Market Overview

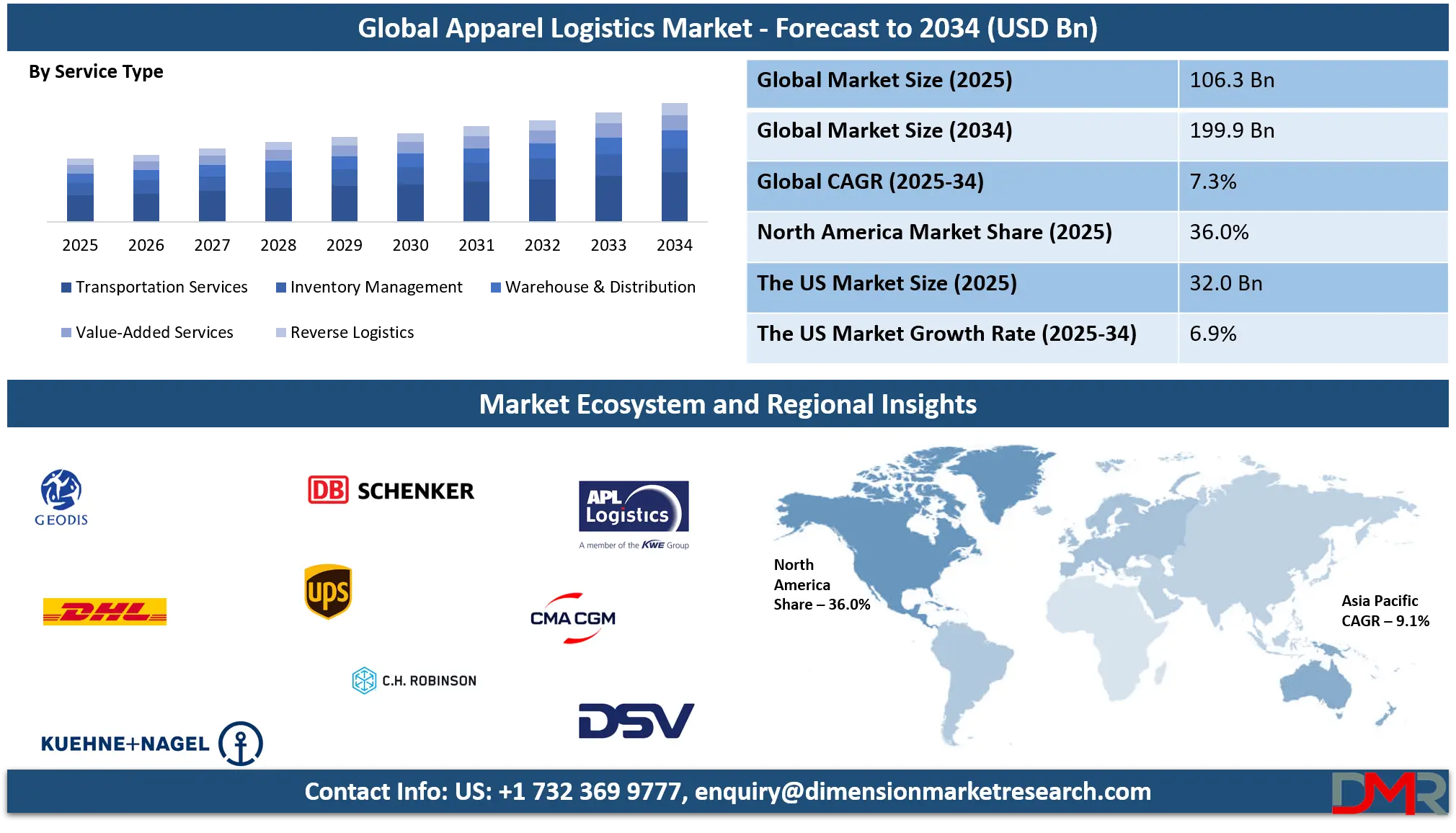

The Global Apparel Logistics Market size is projected to reach USD 106.3 billion in 2025 and grow at a compound annual growth rate of 7.3% to reach a value of USD 199.9 billion in 2034.

The Apparel Logistics Market refers to the specialized logistics services designed to manage the transportation, warehousing, inventory control, and distribution of apparel products across domestic and international supply chains. This market integrates transportation networks, warehouse management systems, fulfillment centers, and value-added services such as packaging, labeling, and reverse logistics to support fast-moving fashion cycles.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Apparel logistics plays a critical role in ensuring timely product availability, minimizing inventory losses, and supporting omnichannel retail strategies. Its importance has increased as fashion brands respond to shorter product lifecycles, seasonal demand fluctuations, and rising consumer expectations for fast delivery.

The market is undergoing a transformation driven by digital supply chain integration, sustainability initiatives, and the expansion of e-commerce apparel platforms. Automation in warehouses, real-time shipment tracking, and demand-driven inventory planning are reshaping operational efficiency. Additionally, nearshoring and regional manufacturing shifts are influencing logistics routing and warehouse placement strategies, particularly in response to geopolitical risks and supply chain disruptions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key developments in the Apparel Logistics Market include investments in smart warehousing, adoption of AI-enabled demand forecasting, and strategic collaborations between logistics providers and apparel brands. Regulatory focus on emissions reduction and sustainable packaging is also shaping service offerings. As apparel companies prioritize resilience and agility, logistics providers are evolving from cost centers into strategic partners supporting brand competitiveness and customer satisfaction.

The US Apparel Logistics Market

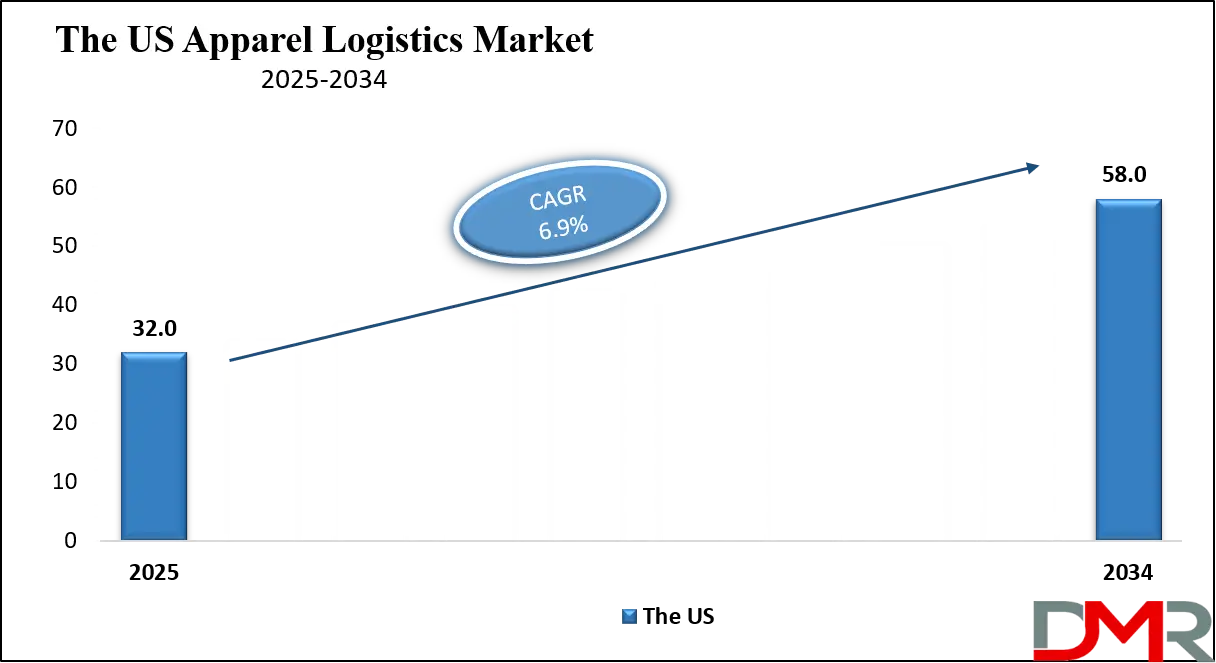

The US Apparel Logistics Market size is projected to reach USD 32.0 billion in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The US Apparel Logistics Market is driven by a mature retail ecosystem, high e-commerce penetration, and advanced logistics infrastructure. Major demand originates from national retail chains and online apparel platforms that require fast fulfillment and efficient returns management. Government investments in transportation infrastructure and port modernization support supply chain efficiency.

Regulatory emphasis on labor standards, emissions reduction, and customs compliance also influences logistics operations. The presence of advanced warehouse automation, AI-based inventory planning, and strong third-party logistics networks positions the US as a key innovation hub within the global apparel logistics landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Apparel Logistics Market

Europe Apparel Logistics Market size is projected to reach USD 26.6 billion in 2025 at a compound annual growth rate of 7.1% over its forecast period.

Europe’s Apparel Logistics Market is shaped by sustainability regulations, cross-border trade complexity, and the European Green Deal. Apparel logistics providers focus heavily on carbon reduction strategies, including rail freight usage and eco-friendly packaging. Strict customs regulations and VAT compliance drive demand for specialized logistics expertise. Leading markets such as Germany, France, and Italy benefit from integrated transport networks and proximity to luxury apparel manufacturing hubs. The region shows steady adoption of digital logistics platforms, with increasing investment in circular logistics to support recycling and returns processing.

Japan Apparel Logistics Market

Japan Apparel Logistics Market size is projected to reach USD 7.4 billion in 2025 at a compound annual growth rate of 7.8% over its forecast period.

Japan’s Apparel Logistics Market is characterized by high urban density, advanced automation, and strong demand for precision-driven logistics services. Fast-growing sectors include sportswear, functional apparel, and premium fashion, which require temperature-controlled storage and rapid distribution. Government initiatives supporting smart logistics and robotics adoption are accelerating warehouse automation. Japan’s aging population and labor shortages further push investments in AI-driven inventory management and autonomous material handling. While high operating costs pose challenges, the market benefits from strong domestic demand and technologically advanced logistics infrastructure.

Apparel Logistics Market: Key Takeaways

- Market Growth: The Apparel Logistics Market size is expected to grow by USD 86.7 billion, at a CAGR of 7.3%, during the forecasted period of 2026 to 2034.

- By Service Type: The transportation services segment is anticipated to get the majority share of the Apparel Logistics Market in 2025.

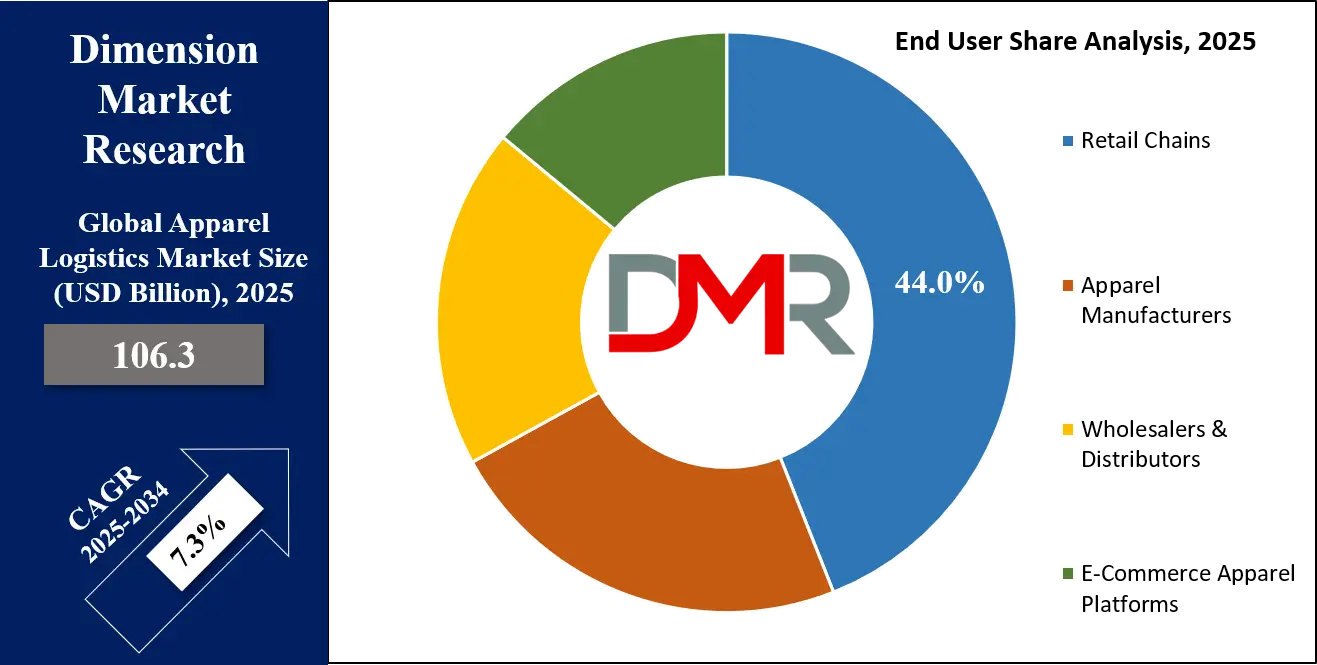

- By End User: The Retail Chains segment is expected to get the largest revenue share in 2025 in the Apparel Logistics Market.

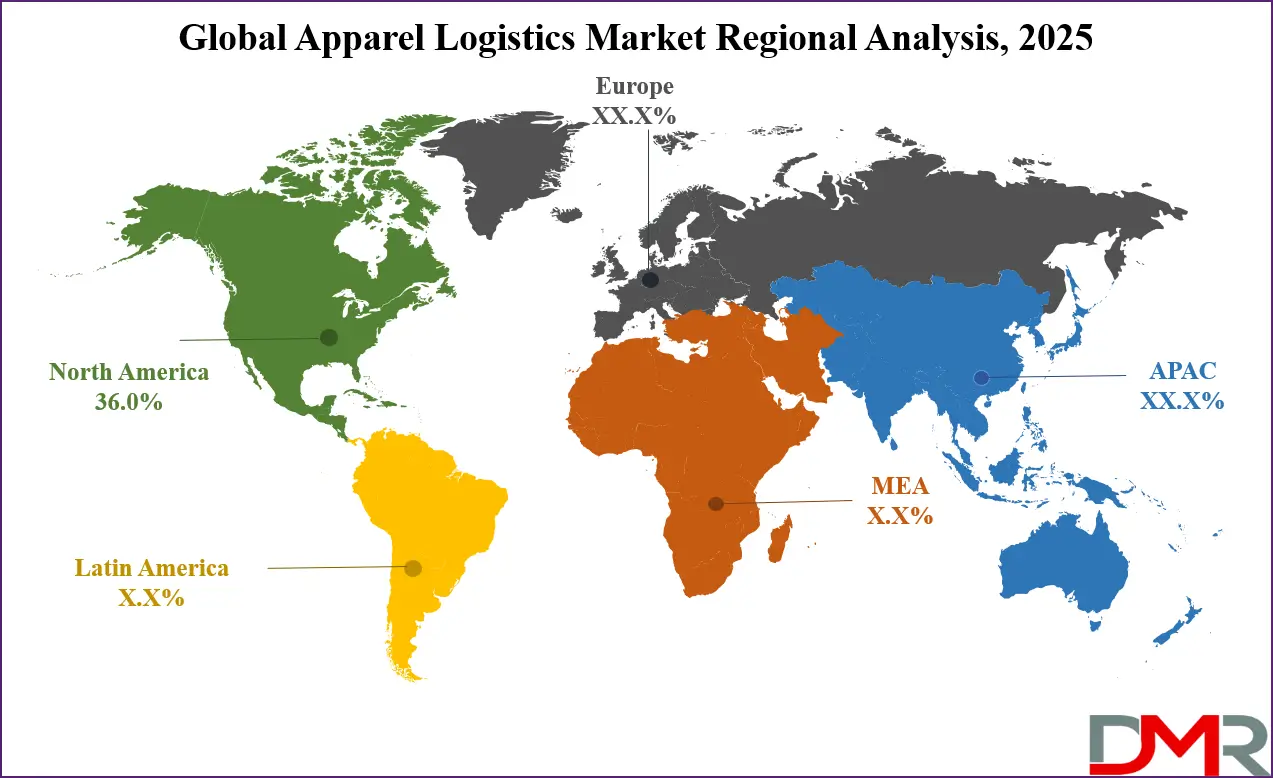

- Regional Insight: North America is expected to hold a 36.0% share of revenue in the Global Apparel Logistics Market in 2025.

- Use Cases: Some of the use cases of Apparel Logistics include reverse logistic handling, omnichannel fulfillment, and more.

Apparel Logistics Market: Use Cases

- Omni-channel Fulfillment: Integrated logistics systems support seamless order fulfillment across online and offline apparel sales channels.

- Seasonal Inventory Management: Logistics providers manage peak-season inventory surges and rapid replenishment cycles for fashion retailers.

- Reverse Logistics Handling: Efficient processing of apparel returns, exchanges, and recycling improves sustainability and cost control.

- Cross-Border Apparel Distribution: Specialized logistics services manage customs clearance, labeling, and compliance for international apparel trade.

Stats & Facts

- European Commission stated that apparel and textile logistics account for over 6% of total intra-EU freight movements in 2024.

- Japan Ministry of Economy, Trade and Industry recorded logistics automation investments in apparel supply chains growing by 14% in 2025.

- U.S. Census Bureau indicated that e-commerce apparel sales represented 38% of total apparel retail sales in 2024.

- Eurostat reported that cross-border apparel trade volumes increased by 9% across EU member states in 2025.

Market Dynamic

Driving Factors in the Apparel Logistics Market

Expansion of E-Commerce Apparel Retail

The rapid expansion of e-commerce apparel platforms is a primary driver of the Apparel Logistics Market. Online fashion retailers require fast, flexible, and scalable logistics solutions to meet consumer expectations for quick delivery and easy returns. Same-day and next-day delivery models are pushing logistics providers to invest in urban fulfillment centers and advanced route optimization technologies. Additionally, increased order volumes and fragmented shipment sizes are accelerating demand for third-party logistics services capable of handling high-frequency, low-volume deliveries efficiently.

Supply Chain Digitalization

Digital transformation across apparel supply chains is significantly driving market growth. Technologies such as warehouse management systems, RFID tracking, and AI-driven demand forecasting improve inventory accuracy and reduce stockouts. Apparel brands increasingly rely on real-time logistics visibility to respond quickly to fashion trends and demand shifts. Digital integration also supports predictive maintenance, automated sorting, and data-driven decision-making, enhancing overall logistics efficiency and reliability.

Restraints in the Apparel Logistics Market

High Operational and Infrastructure Costs

High capital investment requirements remain a major restraint in the Apparel Logistics Market. Advanced warehouse automation, temperature-controlled storage, and digital platforms require substantial upfront spending. Smaller apparel brands often struggle to absorb these costs, limiting their access to premium logistics services. Rising fuel prices, labor costs, and warehouse leasing expenses further strain profitability for logistics providers operating in competitive markets.

Regulatory and Compliance Complexity

Apparel logistics operations face complex regulatory environments related to customs, labor laws, sustainability standards, and product labeling. Cross-border apparel shipments require compliance with varying import regulations and trade policies, increasing administrative burdens. Frequent regulatory updates also demand continuous system upgrades and staff training, slowing market expansion and increasing operational risks.

Opportunities in the Apparel Logistics Market

Sustainable and Circular Logistics Solutions

Growing emphasis on sustainability presents major opportunities in the Apparel Logistics Market. Demand for eco-friendly transportation, recyclable packaging, and carbon-neutral warehousing is rising among apparel brands. Circular logistics models supporting apparel recycling, resale, and refurbishment are gaining traction. Logistics providers that invest in green technologies and emissions tracking systems can capture new revenue streams and strengthen long-term partnerships.

Emerging Markets and Nearshoring

Emerging economies and nearshoring trends offer significant growth opportunities. Apparel brands are relocating manufacturing closer to consumer markets to reduce lead times and supply chain risks. This shift increases demand for regional logistics hubs, multimodal transport solutions, and flexible warehousing services, particularly in Asia-Pacific and Latin America.

Trends in the Apparel Logistics Market

Automation and Robotics in Warehousing

Automation is reshaping apparel logistics operations through robotic picking, automated storage systems, and AI-based sorting. These technologies reduce dependency on manual labor, improve accuracy, and enhance throughput during peak seasons. Automation adoption is particularly strong in high-volume apparel fulfillment centers.

Data-Driven Inventory Optimization

Data analytics and AI-driven forecasting tools are transforming inventory management strategies. Apparel logistics providers leverage predictive analytics to align stock levels with demand patterns, reducing overstock and markdown risks. This trend supports agile fashion cycles and improves supply chain responsiveness.

Impact of Artificial Intelligence in Apparel Logistics Market

- AI enables predictive demand forecasting to optimize apparel inventory levels.

- Machine learning improves route optimization and last-mile delivery efficiency.

- AI-powered vision systems enhance quality inspection and sorting accuracy.

- Chatbots and AI platforms improve customer service and shipment visibility.

- AI-driven analytics support sustainability tracking and emissions reduction.

Research Scope and Analysis

By Service Type Analysis

Transportation services account for the largest share of the Apparel Logistics Market, holding approximately 42% of the total market share in 2025, due to the continuous movement of raw materials, semi-finished goods, finished apparel, and returned products across domestic and international supply chains. Apparel manufacturing and retail operations rely heavily on efficient transportation to manage short fashion cycles, seasonal launches, and promotional campaigns.

Both domestic transportation and international freight play a vital role in supporting fast fashion and global sourcing strategies. Investments in multimodal transportation networks, including road, rail, sea, and air connectivity, have enhanced reliability and reduced transit times.

Additionally, real-time shipment tracking, GPS-enabled fleet management, and route optimization technologies have improved delivery accuracy. Apparel brands prioritize transportation efficiency to reduce lead times, avoid stockouts, and maintain speed-to-market, making this segment a cornerstone of overall logistics operations.

Warehousing and distribution represent the fastest-growing service segment within the Apparel Logistics Market, driven by the rapid expansion of e-commerce and omnichannel retail models. Apparel companies increasingly require strategically located fulfillment centers to enable faster order processing, same-day delivery, and seamless returns handling. The growth of cross-docking facilities has reduced storage time while improving inventory turnover.

Automated storage and retrieval systems, robotic picking, and AI-powered warehouse management solutions are being widely adopted to handle high SKU complexity and fluctuating demand patterns. Regional distribution hubs are gaining importance as brands decentralize inventory to remain closer to consumers. Additionally, demand for value-added services such as labeling, quality inspection, and packaging customization is rising within warehouses. These factors collectively contribute to accelerated growth in warehousing and distribution services across the apparel logistics ecosystem.

By Mode of Transportation Analysis

Road freight dominates the Apparel Logistics Market by mode of transportation, accounting for approximately 46% of the total market share in 2025, due to its unmatched flexibility, accessibility, and cost efficiency. It plays a critical role in regional distribution, last-mile delivery, and store replenishment operations. Apparel logistics relies heavily on road freight for short- and medium-distance transportation, particularly between warehouses, distribution centers, and retail outlets.

The segment benefits from well-developed road infrastructure in key markets and the ability to support just-in-time delivery models. Technological advancements such as fleet telematics, fuel-efficient vehicles, and route optimization software have further enhanced operational efficiency. Road freight also supports rapid response to changing demand patterns, making it indispensable for fashion retailers managing frequent inventory updates and promotional cycles.

Air freight is the fastest-growing transportation mode in the Apparel Logistics Market, driven by the increasing demand for rapid delivery of high-value, time-sensitive apparel products. Fashion brands utilize air freight for premium collections, limited-edition launches, and urgent replenishment needs to minimize delays.

The growth of cross-border e-commerce has further accelerated demand for air cargo services, particularly for international shipments with strict delivery timelines. Although air freight involves higher costs compared to other modes, apparel companies prioritize speed and reliability for specific product categories. Enhanced cargo handling facilities, digital air cargo tracking, and improved customs clearance processes are supporting the expansion of this segment. As consumer expectations for faster delivery continue to rise, air freight adoption is expected to grow steadily.

By Logistics Function Analysis

Outbound logistics holds a significant position in the Apparel Logistics Market, capturing approximately 39% of the market share in 2025, as apparel brands increasingly focus on order fulfillment speed and delivery accuracy. This function encompasses the movement of finished garments from warehouses or manufacturing units to retail stores, distribution centers, and end consumers. The rise of omnichannel retailing has intensified the importance of outbound logistics, requiring seamless coordination across online and offline channels.

Apparel companies invest heavily in fulfillment optimization, last-mile delivery solutions, and real-time order tracking to enhance customer satisfaction. The need for rapid dispatch during seasonal peaks and promotional periods further strengthens demand for efficient outbound logistics. As delivery performance directly influences brand perception, outbound logistics remains a strategic priority for apparel businesses.

Returns management is experiencing rapid growth due to high return rates associated with online apparel shopping. Factors such as size mismatches, style preferences, and impulse buying contribute to frequent returns. Efficient reverse logistics systems are essential for handling inspection, restocking, refurbishment, or disposal of returned apparel.

Apparel brands increasingly partner with logistics providers offering specialized returns processing, automated sorting, and resale or recycling solutions. Sustainability concerns are also driving demand for optimized returns management to reduce waste and recover value from returned products. As e-commerce penetration continues to increase, returns management is becoming a critical function within the apparel logistics value chain.

By Apparel Type Analysis

Casual wear dominates the Apparel Logistics Market by apparel type, accounting for approximately 34% of the total market share in 2025, due to consistently high consumer demand and frequent purchase cycles. Casual apparel includes everyday clothing such as t-shirts, jeans, and casual tops, which require continuous replenishment across retail and online channels. The segment benefits from high sales volumes, fast inventory turnover, and broad consumer appeal across age groups.

Logistics operations supporting casual wear must handle large assortments of SKUs and frequent restocking. Efficient transportation and warehousing solutions are crucial for maintaining availability and minimizing lead times. The growing popularity of affordable fashion and comfort-oriented clothing continues to support the dominance of casual wear within apparel logistics operations.

Sportswear and active-wear represent the fastest-growing apparel type segment, driven by increasing health awareness, fitness trends, and athleisure fashion. Consumers increasingly seek functional, performance-oriented apparel suitable for both exercise and everyday use. This segment often requires specialized logistics solutions, including quality inspection and careful handling of technical fabrics. Rising participation in sports and outdoor activities, combined with premium pricing, makes this segment attractive for logistics providers. Growth is further supported by endorsements, lifestyle branding, and expanding online sales channels.

By Supply Chain Model Analysis

Third-party logistics providers dominate the Apparel Logistics Market, holding approximately 51% of the market share in 2025, as apparel companies increasingly outsource logistics operations to improve efficiency and scalability. 3PL providers offer integrated services including transportation, warehousing, fulfillment, and returns management, allowing apparel brands to focus on core competencies such as design and marketing.

The flexibility of 3PL models enables companies to scale operations during peak seasons without heavy capital investment. Advanced technology adoption, global network coverage, and cost optimization capabilities further strengthen the dominance of 3PL providers. As supply chains become more complex, reliance on experienced third-party logistics partners continues to grow.

Fourth-party logistics is expanding rapidly as apparel companies seek end-to-end supply chain orchestration. 4PL providers act as strategic integrators, managing multiple logistics partners and leveraging advanced analytics to optimize supply chain performance. Demand is driven by the need for transparency, coordination, and data-driven decision-making across global apparel networks.

By End User Analysis

Retail chains represent the largest end-user segment in the Apparel Logistics Market, accounting for approximately 44% of the total market share in 2025. Large retail chains operate extensive store networks and require efficient logistics systems to manage inventory replenishment, seasonal launches, and promotional campaigns. Omni-channel strategies further increase logistics complexity, as retailers integrate physical stores with online fulfillment models. Retail chains rely on centralized distribution centers, regional hubs, and reliable transportation networks to ensure consistent product availability. Their scale and volume requirements drive strong demand for comprehensive logistics solutions.

E-commerce apparel platforms are the fastest-growing end-user segment due to rapid digital retail adoption and cross-border online sales. These platforms require agile logistics solutions capable of handling high order volumes, rapid delivery, and efficient returns processing. Growth in mobile commerce and social media-driven sales further supports expansion in this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Apparel Logistics Market Report is segmented on the basis of the following:

By Service Type

- Transportation Services

- Domestic Transportation

- International Transportation

- Warehousing and Distribution

- Storage and Fulfillment

- Cross-Docking

- Inventory Management

- Stock Planning

- Demand Forecasting

- Value-Added Services

- Packaging and Labeling

- Quality Inspection

- Reverse Logistics

- Returns Handling

- Recycling and Disposal

By Mode of Transportation

- Road Freight

- Rail Freight

- Air Freight

- Sea Freight

By Logistics Function

- Inbound Logistics

- Outbound Logistics

- In-Store Replenishment

- Returns Management

By Apparel Type

- Casual Wear

- Formal Wear

- Sportswear and Activewear

- Luxury and Designer Apparel

- Children’s Wear

By Supply Chain Model

- Third-Party Logistics

- Fourth-Party Logistics

- In-House Logistics

By End User

- Apparel Manufacturers

- Wholesalers and Distributors

- Retail Chains

- E-Commerce Apparel Platforms

Regional Analysis

Leading Region in the Apparel Logistics Market

North America holds the leading position in the global Apparel Logistics Market, accounting for approximately 36% of the total market share in 2025, driven by its advanced logistics infrastructure and high penetration of e-commerce apparel retail. The region benefits from well-developed road, rail, air, and port networks that enable efficient domestic and cross-border apparel distribution. Strong demand from large retail chains and e-commerce platforms requires fast, reliable, and scalable logistics solutions, particularly for order fulfillment and returns management.

Government investments in transportation infrastructure, port modernization, and digital logistics systems further enhance operational efficiency. Additionally, North America has a highly mature third-party logistics ecosystem offering integrated services such as warehousing, inventory optimization, and last-mile delivery. Technological innovation, including warehouse automation, AI-driven demand forecasting, and real-time shipment tracking, strengthens the region’s dominance. High consumer expectations for rapid delivery and flexible returns continue to reinforce North America’s leadership in apparel logistics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Apparel Logistics Market

Asia-Pacific is the fastest-growing region in the Apparel Logistics Market, supported by rapid economic growth, expanding apparel manufacturing, and rising consumer demand across both developed and emerging economies. The region serves as a global apparel production hub, with countries such as China, India, Vietnam, and Bangladesh playing critical roles in textile and garment manufacturing. Increasing domestic consumption, combined with export-oriented production, has significantly increased demand for efficient logistics services.

The rapid expansion of e-commerce platforms and mobile shopping has further intensified the need for advanced warehousing, fulfillment, and last-mile delivery solutions. Governments across the region are actively investing in logistics modernization, smart ports, and digital infrastructure to improve supply chain efficiency. Regional trade agreements and cross-border connectivity initiatives are also accelerating market expansion, positioning Asia-Pacific as a key growth engine for apparel logistics globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Apparel Logistics Market is highly competitive, characterized by high entry barriers due to capital-intensive infrastructure and technology requirements. Market participants focus on automation, digital platforms, sustainability initiatives, and strategic partnerships to strengthen their market position. Continuous investment in R&D, expansion of fulfillment networks, and service differentiation through value-added offerings are key strategies used to maintain competitiveness.

Some of the prominent players in the global Apparel Logistics are:

- DHL Supply Chain

- Kuehne + Nagel

- DSV

- CEVA Logistics

- DB Schenker

- Nippon Express

- Expeditors International

- Hellmann Worldwide Logistics

- GEODIS

- Bolloré Logistics

- XPO Logistics

- GXO Logistics

- FedEx Supply Chain

- UPS Supply Chain Solutions

- C.H. Robinson

- Agility Logistics

- Kintetsu World Express

- Yusen Logistics

- CMA CGM Logistics

- APL Logistics

- Other Key Players

Recent Developments

- In March 2025, DHL Supply Chain expanded its automated apparel fulfillment centers in North America, integrating AI-driven sorting and inventory optimization to support e-commerce fashion brands and improve delivery speed during peak seasons.

- In July 2024, Kuehne+Nagel invested significantly in sustainable apparel logistics solutions across Europe, introducing low-emission transportation routes and circular logistics services to support apparel recycling and returns management.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 106.3 Bn |

| Forecast Value (2034) |

USD 199.9 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 32.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Transportation Services, Warehousing and Distribution, Inventory Management, and Value-Added Services, and Reverse Logistics), By Mode of Transportation (Road Freight, Rail Freight, Air Freight, and Sea Freight), By Logistics Function (Inbound Logistics, Outbound Logistics, In-Store Replenishment, and Returns Management), By Apparel Type (Casual Wear, Formal Wear, Sportswear and Activewear, Luxury and Designer Apparel, and Children’s Wear), By Supply Chain Model (Third-Party Logistics, Fourth-Party Logistics, and In-House Logistics), By End User (Apparel Manufacturers, Wholesalers and Distributors, Retail Chains, and E-Commerce Apparel Platforms) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

DHL Supply Chain, Kuehne + Nagel, DSV, CEVA Logistics, DB Schenker, Nippon Express, Expeditors International, Hellmann Worldwide Logistics, GEODIS, Bolloré Logistics, XPO Logistics, GXO Logistics, FedEx Supply Chain, UPS Supply Chain Solutions, C.H. Robinson, Agility Logistics, Kintetsu World Express, Yusen Logistics, CMA CGM Logistics, APL Logistics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Apparel Logistics Market?

▾ The Global Apparel Logistics Market size is expected to reach a value of USD 106.3 billion in 2025 and is expected to reach USD 199.9 billion by the end of 2034.

Which region accounted for the largest Global Apparel Logistics Market?

▾ North America is expected to have the largest market share in the Global Apparel Logistics Market, with a share of about 36.0% in 2025.

How big is the Apparel Logistics Market in the US?

▾ The Apparel Logistics Market in the US is expected to reach USD 32.0 billion in 2025

Who are the key players in the Apparel Logistics Market?

▾ Some of the major key players in the Global Apparel Logistics Market include DHL, UPS, DSV and others

What is the growth rate in the Global Apparel Logistics Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period.