Aquaculture involves farming of aquatic organisms such as fish, crustaceans, mollusks, and aquatic plants - an integral sector within global food industries. Market growth is being propelled by rising population numbers and shifting dietary preferences towards high protein diets as well as decreasing wild fish stocks. Freshwater aquaculture dominates this market due to its low operational costs and increased fish production efficiency supported by

IoT semiconductors and sensor-based monitoring for water quality and feed management.

Marine and brackish water aquaculture has seen significant advances, with developments such as Recirculating Aquaculture Systems (RASs) and sustainable aquaculture practices making significant advancements. Government initiatives supporting aquaculture also play a vital role in food security and economic stability for markets worldwide.

Asia Pacific aquaculture market holds the greatest market share globally with China dominating production. Over time, global aquaculture production should see steady increases due to technological innovations, investments, and growing consumer interest in sustainable seafood options.

As demand for sustainable seafood increases, so too does aquaculture as a solution to overfishing and global protein needs. Recirculating aquaculture systems (RAS) are providing new farming technologies which enhance efficiency, water usage and fish health while supporting overfishing reduction efforts.

One of the key trends in aquaculture today is organic and sustainable aquaculture, driven by consumer concern about environmental impacts from their food choices and demand for sustainably-sourced seafood. This demand has resulted in an explosion of certification programs and eco-friendly farming practices worldwide.

Innovations in feed production are also playing a critical role in market expansion. By creating plant-based and alternative protein sources for fish feed, developments such as reduced dependence on fishmeal (a traditional aquaculture ingredient) has helped support sustainability while simultaneously decreasing production costs and increasing food security.

As per worldbank Food price inflation remains elevated in many low- and middle-income countries, with 68.8% of low-income nations experiencing inflation above 5%. This is slightly lower than previous figures, with decreases in lower-middle and upper-middle-income countries. However, high-income nations saw a rise, with inflation increasing by 1.8 percentage points in 10.9% of them.

In real terms, food prices have outpaced overall inflation in nearly 60% of 164 countries. This disparity reflects the continued pressure on consumers in many regions, as food prices rise faster than general price levels, contributing to economic strain in both developing and developed nations alike.

Since the November 15, 2024 update, agricultural, export, and cereal price indices have all shown increases, with the export price index rising sharply by 25%. Cocoa and coffee prices saw notable increases of 28% and 26%, respectively, while cereal prices saw mixed results, with maize and wheat prices rising, but rice prices falling slightly.

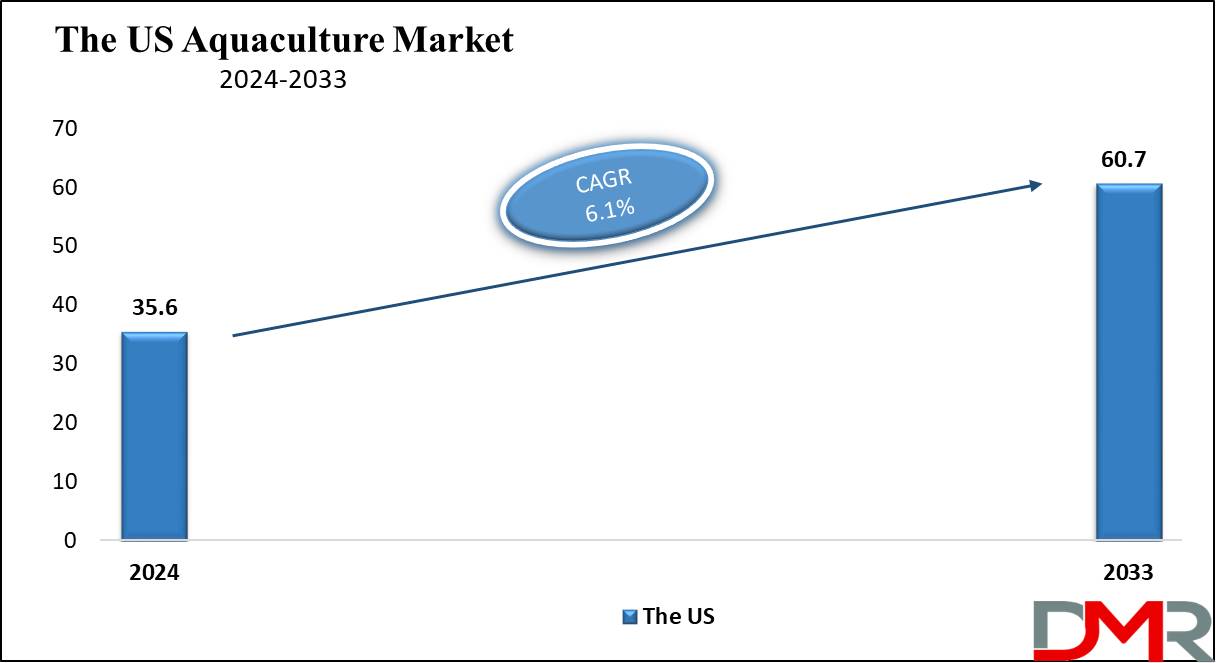

The US Aquaculture Market

The US Aquaculture market is projected to be valued at USD 35.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 60.7 billion in 2033 at a CAGR of 6.1%.

The domestic market for aquaculture in the US is very promising because of the accelerated interest and the rising demand for seafood and sustainable aquaculture. Key trends include the adoption of state-of-the-art aquaculture technologies, such as RAS and freshwater aquaculture, conducted in continental water.

- The US market offers huge opportunities for developing high-value species and integrated biotechnology in aquaculture. Another fast-growing segment of the market involves heavy investments in sustainable aquaculture products and practices to bring down environmental impact and improve fish production efficiency.

- Cooke Aquaculture expanding its operations and new innovative aquaculture equipment to help increase production, another development setting market dynamics is regulatory support. Several initiatives promote domestic aquaculture production to reduce seafood importation in many countries. Driven by these trends and opportunities, US aquaculture is likely to enjoy stable growth during the forecast period.

Key Takeaways

- Market Value: The Global Aquaculture Market size is estimated to have a value of USD 168.6 billion in 2024 and is expected to reach USD 298.0 billion by the end of 2033.

- The US Market Value: The US Aquaculture market is projected to be valued at USD 35.6 billion in 2024 and further expected it hold USD 60.7 billion in 2033 at a CAGR of 6.1%.

- By Environment Segment Analysis: The freshwater aquaculture environment is projected to dominate this segment with the highest market share in 2024.

- By Product Type Segment Analysis: Equipment is projected to dominate this market in terms of product types as it will hold 57.1% of the market share in 2024.

- By Species Segment Analysis: In terms of species, aquatic animals are projected to dominate this segment as they hold 71.1% of the market share in 2024.

- Regional Analysis: Asia Pacific is expected to have the largest market share in the Global Aquaculture Market with a share of about 40.2% in 2024.

- Global Growth Rate: The market is growing at a CAGR of 6.5 percent over the forecasted period.

Use Cases

- Seafood Production: Aquaculture has become a requisite ingredient in the world's demand for seafood, where farming of finfish and shellfish provides a safe sustainable alternative to wild-caught seafood.

- Stock Enhancement: Through aquaculture, it promotes restocking of the wild fish that have declined in number due to various reasons, hence making the conservation and management of marine ecosystems possible.

- Pharmaceuticals: Aquaculture species for the production of bioactive compounds have contributed to several pharmaceutical applications, hence contributing to medical progress.

- Ornamental Fish Trade: The farming of these ornamental fish through aquaculture makes one important contribution to the worldwide pet industry involving diversified species for aquariums.

- Agriculture Integration: Aquaculture, integrated into agriculture in polyculture, enhances the efficient use of land and water resources and increases food production.

Market Dynamic

Trends

Sustainable Aquaculture Practices

The growing global demand for sustainable seafood has had dramatic changes in attitude towards aquaculture practices. Reduction in the ecological footprint of fish farming received strong impetus, which resulted in adopting eco-friendly methods such as integrated multi-trophic aquaculture and plant-based feed. They reduce waste, improve water quality, and increase biodiversity, hence setting a trend of sustainable aquaculture.

Technological Advancements

The way the aquaculture industry is leveraging sophisticated technologies today, from RAS to automation and AI, is fast changing the face of farming. Operational efficiency can be improved through such measures, improving fish health management while optimizing feed use for higher yields but lower ecological impacts. Digitalization's curve in aquaculture could get steeper due to requirements for farming precision and real-time monitoring.

Growth Drivers

Rising Global Demand for Seafood

The fast-growing global population and increasing awareness about the health benefits of seafood have fueled demand for aquaculture products. Fish and other seafood are recognized as high-protein, low-fat foods that are rich in nutrients. Hence, they remain one of the major priorities among health-conscious consumers. This has been a super thrust to the growth of the global aquaculture market.

Government Support and Investments

Governments of several countries, particularly in the Asia Pacific and Latin America regions, are coming up with several favorable policies and subsidies to support the aquaculture industry, besides the investments made in infrastructure. All this governmental support is concentrated on increasing domestic production not only to establish food security but also to export locally produced sea produce worldwide, thereby providing a stimulus to the growth of the aquaculture market and encouraging innovations in

agriculture biotechnology and biostimulant solutions to enhance production efficiency.

Growth Opportunities

Expansion into Emerging Markets

The real potential for growth in aquaculture lies mainly in emergent markets of Africa, South America, and Southeastern Asia. These regions do guarantee new opportunities, particularly because of their rich natural resource base, favorable climate, and fast-growing middle-class populations. Companies committing to investments made in such markets stand to benefit by capitalizing on the increasing demand for seafood alongside the need for sustainable food production.

Development of Value-Added Products

The trend within the various value-added aquaculture products, ready-to-eat seafood products, nutraceuticals, and bioactive compounds offers numerous new growth avenues. Such innovative products in the field of aquaculture could easily ride on the increasing consumer demand for more convenient and health-oriented food, therefore stimulating market growth, especially for canned seafood,

protein ingredients, and frozen food segments catering to global dietary shifts.

Restraints

Environmental Concerns

Aquaculture industries face numerous environmental sustainability issues that threaten their long-term sustainability, such as water pollution, habitat destruction, and overuse of antibiotics that lead to negative ecological consequences and are cause for consumer and regulatory concern. Addressing these environmental concerns effectively through water and wastewater treatment equipment, water testing equipment, and green technology & sustainability initiatives is of critical importance to safeguard their continued existence within their market.

High Operational Costs

The costs associated with setting up and maintaining aquaculture operations, particularly in terms of feed, energy, and technology, can be substantial. These high operational costs can limit the profitability of aquaculture businesses, especially small and medium-sized enterprises (SMEs), and act as a barrier to entry for new players in the market.

Research Scope and Analysis

By Environment

The freshwater aquaculture environment is projected to dominate this segment with the highest market share in 2024. Freshwater aquaculture leads the global aquaculture market by environment due to lower operational costs and wider accessibility. Together with this, water bodies, such as rivers, lakes, and ponds, offer the perfect setting for rearing a large variety of fish bought in great quantities.

Infrastructure for freshwater aquaculture, however, is usually less complex and expensive compared to those used in marine or brackish water, which makes it much easier to penetrate the industry and become feasible for small-scale producers.

Other advantages of freshwater are its relative tolerance to changes in the environment and less need for expensive resources, like saltwater, or special equipment, all of which minimize real production cost. This has led to its dominance in regions like Asia Pacific, where it is a key contributor not only to the local economy but also to food security. High yield and stable productivity of freshwater support the continued supply in the aquaculture market; hence, it is the main preference of producers during the forecast period.

By Product Type

Equipment is projected to dominate this market in terms of product types as it will hold 57.1% of the market share in 2024. Equipment took the largest market share in the aquaculture market by product type. It forms a very important part in the installation of efficiency and sustainability measures in aquaculture.

The expanded use of advanced containment equipment helps to maintain optimal water quality, in addition to the healthy growth of the aquaculture species, through water pumps, filters, and aerating systems. With increasing industrial expansion, the use of sophisticated equipment has also been increasing in order to enhance productivity and minimize environmental impact.

Containment equipment, such as cages and tanks, is necessary to manage fish inventory and prevent fish escapes. This is aside from the fact that water circulation and aeration systems will ensure that needed oxygen, as well as that aquaculture waste, is likewise being taken out.

The increasing adoption of automated feeding systems adds to the greatness of equipment in this segment, helping in the optimization of feed conversion ratios and minimizing labor costs. With the increasing focus on sustainable aquaculture management and the integration of IoT and AI technologies in aquatic farming supplies, innovation has a premium, hence consolidating the leadership of equipment on the market.

By Species

In terms of species, aquatic animals are projected to dominate this segment as they hold 71.1% of the market share in 2024. The aquatic animals, particularly finfishes, still have a greater share of the global aquaculture market because they opened a sea change opportunity in global aquaculture production.

Some specific finfish species like salmon, tilapia, and catfish had insatiable market demand due to their very high protein content and consumer responsiveness to healthy seafood. Farmed finfish have much higher commercialization and production volume than aquatic plants thus, aquaculture activities target them first.

Due to their well-developed infrastructure, research, and technology established in finfish farming, this is also amply provided for, mass culture and constant supply. In addition, there are relatively good supplies from the mollusk and crustacean sectors, which provide a broad range of consumer tastes and culinary options.

This is further supported by the dominance of aquatic animals in the market because they have a comparatively higher market value, faster growth, and a broader market demand than aquatic plants, such as seaweed and microalgae, making them key drivers contributing to this market's expansion over the forecast period.

By Culture

Net pen culture involves the rearing of fish in big nets, enclosed in the natural aquatic environment of oceans, lakes, or rivers; high-density farming is also enabled by this method. Lower structure costs and operational costs, compared to land-based systems, coupled with scalability, make the technology very preferred among the producers of aquaculture.

Integration with aquaponics and hydroponics systems and equipment and precision farming approaches further improves productivity and sustainability across aquaculture operations.

Net-pen culture is especially ideal for species of rearing that require somewhat special environmental conditions that can be easily provided in any natural water body, for example, salmon culture. Lower structure costs and operational costs, compared to land-based systems, coupled with scalability, make the technology very preferred among the producers of aquaculture.

The net pen culture allows for simple monitoring and managing of the fish stocks by producers, hence reducing the labor intensity and operational complexities per produced ton. The advanced technologies, such as automated systems in feeding and monitoring, are integrated with the net pen systems making it even more productive and efficient.

All these features are driving the market for net pen culture and have enabled it to maintain its dominance and has served as the prominent culture type in the global aquaculture market and is projected to continue serving for the forecast period.

By End User

The seafood industry has maintained leadership in the global aquaculture market as a result of the high demand for its aquaculture output by different markets. The high demand is on account of the seafood industry being the biggest end-user of aquaculture production; that is, the results of aquaculture are in constant demand to supply fish, shellfish, and other seafood types to the global market. This has occasioned the need for the industry to ensure there is a constant, reliable generation of quality seafood and enhance the growth and development of aquaculture practices.

It is in this respect that aquaculture offers a sustainable mode of replacing wild catch, therefore easing the pressure on overfished marine stocks and in turn controlling a steady volume of seafood supply into the global markets. The upsurge in consumer preference for healthy, protein-rich diets that have led to increased consumption of farmed fish and shellfish has further propelled the seafood industry to be dominant.

Moreover, aquaculture has been integrated into the seafood industry supply chain, thus promoting product traceability, better efficiency in product quality control, and further sustainability measures that maintain the leadership position as a major end-use category in the aquaculture market.

The Global Aquaculture Market Report is segmented on the basis of the following

By Environment

- Fresh Water

- Inland Ponds

- Rivers and Lakes

- Recirculating Aquaculture Systems (RAS)

- Marine Water

- Coastal Waters

- Offshore Aquaculture

- Brackish Water

- Estuaries

- Coastal Lagoons

- Mangrove Areas

By Product Type

- Equipment

- Containment Equipment

- Water Pump & Filters

- Mechanical Filters

- Biofilters

- Sump Pumps

- Water Circulating and Aerating Equipment

- Cleaning Equipment

- Feeders

- Automatic Feeders

- Manual Feeders

- Monitoring Equipment

- Water Quality Monitors

- Temperature Sensors

- Fish Behavior Sensors

- Chemicals

- Water Treatment Chemicals

- Disinfectants and Sanitizers

- Algae Control Agents

- Pharmaceuticals

- Antibiotics

- Vaccines

- Probiotics

- Fertilizers

- Organic Fertilizers

- Inorganic Fertilizers

By Species

- Aquatic Animal

- Finfishes

- Salmon

- Tilapia

- Catfish

- Carp

- Trout

- Mollusks

- Oysters

- Clams

- Mussels

- Scallops

- Crustaceans

- Other Aquatic Animals

- Aquatic Plants

- Seaweed

- Brown Algae (Kelp)

- Red Algae

- Green Algae

- Microalgae

- Spirulina

- Chlorella

- Diatoms

By Culture

- Net Pen Culture

- Offshore Net Pens

- Nearshore Net Pens

- Floating Cage Culture

- Pond Culture

- Earthen Ponds

- Concrete Ponds

- Lined Ponds

- Rice Field Culture

- Integrated Multi-Trophic Aquaculture (IMTA)

By End-User

- Seafood industry

- Pharmaceuticals

- Others

Regional Analysis

Asia Pacific is projected to dominate the global aquaculture market as it holds

40.2% of the market share by the end of 2024 which is further anticipated to show subsequent growth in the upcoming period of 2033.

The Asia Pacific dominates the global aquaculture market, driven by its ideal climate, ample water resources, and well-established practices in aquaculture. Major producers in the Asia Pacific region include China, India, Vietnam, and Indonesia, all large contributors to global aquaculture production.

This region's dominance is driven by its large population, high per capita seafood consumption, and culture that views fish as an important source of protein. The government in this region offers subsidies, favorable regulations, and well-funded infrastructure providing a nurturing environment that has fostered the rapid growth of the aquaculture sector within the Asia Pacific region. The area has a suitable climate tropical and subtropical which allows for year-round aquaculture production in both freshwater systems of the region.

Additionally, low-cost labor coupled with technological advances in aquaculture further strengthens the competitive advantage of this region. The Asia Pacific market is expected to stay ahead until the end of the period, thanks to continuous investments in sustainable aquaculture practices and increasing global seafood demand.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global aquaculture market remains highly competitive in nature due to the presence of various key contenders in the competitive landscape operating in the diversified market segments. In this connection, companies such as Mowi ASA, Cooke Aquaculture Inc., and Thai Union Group PCL have been leading the markets through their huge production capacity, vast distribution network, and sustainability. The key players are actively involved in the expansion of operations, investment in advanced technologies of aquaculture production, and sustainable practices in order to improve market positions.

Further, the competitive landscape is also marked by strategic partnerships, mergers and acquisition, in the bid to penetrate the market, raise their market share, and diversify products. The presence of numerous small and medium-sized enterprises (SMEs) across various regions also contributes to the dynamic nature of the market.

The competitive landscape is expected to evolve further during the forecast period, with increased investment in research and development, technological innovation, and expansion into emerging markets.

Some of the prominent players in the Global Aquaculture Market are

- Mowi ASA

- Cooke Aquaculture Inc.

- Thai Union Group PCL

- Mitsubishi Corporation

- Grieg Seafood ASA

- Austevoll Seafood ASA

- Cermaq Group AS

- Nireus Aquaculture S.A.

- Tassal Group Limited

- Bakkafrost

- Marine Harvest Canada Inc.

- Huon Aquaculture Group Limited

- Invesco Ltd.

- Ridley Corporation Limited

- Alltech Inc.

- Other Key Players

Recent Developments

- July 2024: Cooke Aquaculture Inc. expanded its salmon farming operations in Scotland. This expansion aims to increase production capacity to meet the growing global demand for sustainably farmed salmon. The move is part of Cooke's broader strategy to enhance its market presence in Europe and strengthen its supply chain to ensure consistent quality and availability of its products.

- June 2024: Mowi ASA launched a new range of sustainable aquaculture products, including plant-based feed options. This initiative is aligned with the company's commitment to reducing the environmental impact of its operations. By introducing plant-based alternatives to traditional fish feeds, Mowi aims to lower its reliance on wild fish stocks, contributing to marine conservation efforts.

- May 2024: Thai Union Group PCL acquired a controlling stake in an aquaculture technology company specializing in recirculating aquaculture systems (RAS). This acquisition enhances Thai Union's technological capabilities, allowing the company to adopt more sustainable and efficient farming methods. The integration of RAS technology is expected to improve production efficiency, reduce water usage, and minimize environmental impact, supporting the Thai Union's sustainability goals.

- April 2024: Mitsubishi Corporation invested in a new aquaculture facility in Southeast Asia, focusing on high-value species like tuna and shrimp. This investment is part of Mitsubishi's strategy to diversify its aquaculture portfolio and strengthen its position in the Asian market. The facility is designed to incorporate advanced aquaculture technologies, ensuring high productivity and sustainability standards.

- March 2024: Grieg Seafood ASA initiated a collaboration with a biotechnology firm to develop innovative solutions for disease management in aquaculture. The partnership aims to create advanced vaccines and diagnostic tools to address common diseases in farmed fish, thereby improving fish health and reducing the need for antibiotics.

- February 2024: Austevoll Seafood ASA expanded its operations in South America by establishing new aquaculture sites for salmon and trout farming. This expansion is driven by the growing demand for premium seafood in international markets, particularly in North America and Europe.

- January 2024: Cermaq Group AS launched a sustainability initiative aimed at reducing the carbon footprint of its global aquaculture operations. The initiative includes the adoption of renewable energy sources, the optimization of feed conversion ratios, and the implementation of carbon offset projects.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 168.6 Bn |

| Forecast Value (2033) |

USD 298.0 Bn |

| CAGR (2024-2033) |

6.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 35.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Environment (Fresh Water, Marine Water, and Brackish Water), By Product Type (Equipment, Chemicals, Pharmaceuticals, and Fertilizers), By Species (Aquatic Animals, and Aquatic Plants), By Culture (Net Pen Culture, Floating Cage Culture, Pond culture, and Rice Field Culture), By End-User (Seafood industry, Pharmaceuticals, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Mowi ASA, Cooke Aquaculture Inc., Thai Union Group PCL, Mitsubishi Corporation, Grieg Seafood ASA, Austevoll Seafood ASA, Cermaq Group AS, Nireus Aquaculture S.A., Tassal Group Limited, Bakkafrost, Marine Harvest Canada Inc., Huon Aquaculture Group Limited, Invesco Ltd. Ridley Corporation Limited, Alltech Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Aquaculture Market size is estimated to have a value of USD 168.6 billion in 2024 and is expected to reach USD 298.0 billion by the end of 2033.

The US Aquaculture market is projected to be valued at USD 35.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 60.7 billion in 2033 at a CAGR of 6.1%.

Asia Pacific is expected to have the largest market share in the Global Aquaculture Market with a share of about 40.2% in 2024.

Some of the major key players in the Global Aquaculture Market are Mowi ASA, Cooke Aquaculture Inc., Thai Union Group PCL, Mitsubishi Corporation, Grieg Seafood ASA, Austevoll Seafood ASA, and many others.

The market is growing at a CAGR of 6.5 percent over the forecasted period.