Market Overview

The Global Artificial Intelligence (AI) in Cybersecurity Market size was valued at USD 22.1 billion in 2023, and it is further anticipated to reach a market value of USD 115.0 billion by 2032 at a CAGR of 20.8%.

The global artificial intelligence in the cybersecurity market is showing a dramatic increase in its development owing to the increasing complexity level and the incidence of cyber threats globally. AI is highly advanced in finding applications across different sectors like technology, healthcare, and pharmaceuticals. It serves as a critical tool in cost reduction for processes, manufacturing, development, automation, & more. Further, cybersecurity and AI analyze & tackle cybercrime using technologies like speech recognition, which enhances cybersecurity capabilities, allowing quick response to cyber-attacks, mainly in anti-fraud measures & security management.

However, the market is experiencing growth in the demand for advanced technologies such as artificial intelligence (AI), and organizations are adopting AI-driven cybersecurity solutions consequently to strengthen their security infrastructures. Leading companies like NVIDIA Corporation are the pioneers in the global market for AI cybersecurity. The market is segmented in terms of security types, including network security, endpoint security, and cloud security, enabling the organization to provide cybersecurity solutions to different security needs.

Cloud-based security solutions are gaining traction due to their scalability and effectiveness in addressing evolving threats. Market dynamics indicate a growing need for AI in cybersecurity to combat rising cyber threats effectively. With a forecast period showing continued expansion, the market is expected to grow at a significant compound annual growth rate (CAGR), providing ample opportunities for innovation and market penetration in the cybersecurity industry.

Key Takeaways

- Market Value: The Global Artificial Intelligence (AI) in Cybersecurity Market is projected to reach USD 147.5 billion by 2033, at a CAGR of 20.8% from the base value of USD 26.9 billion.

- Market Definition: Artificial Intelligence (AI) in cybersecurity utilizes artificial intelligence and machine learning algorithms to analyze data, detect anomalies, and mitigate cyber threats, enhancing security measures against evolving attacks and vulnerabilities.

- By Type Analysis: Network Security is expected to show dominance in this segment with 39.3% of the market share in 2023.

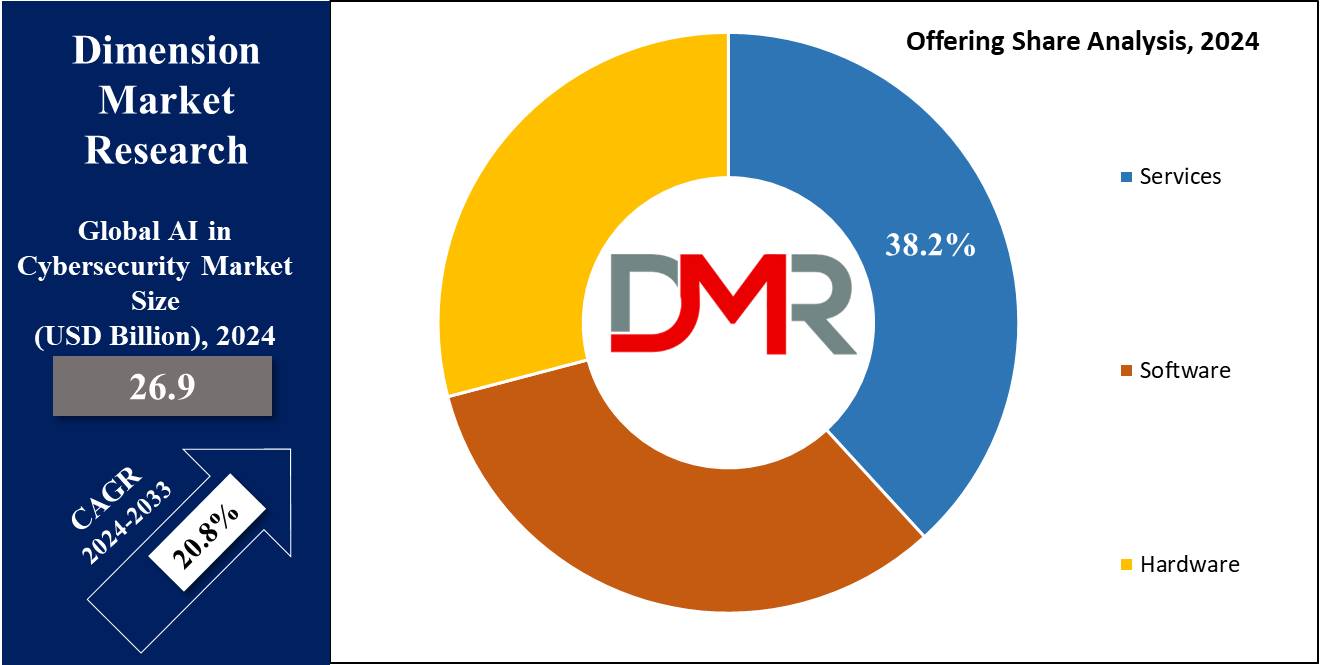

- By Offering Segment Analysis: Services are projected to show their dominance in the type segment in this market with 38.2% of the market share in 2023.

- Application Segment Analysis: Fraud Detection/Anti-Fraud is expected to dominate the application segment in this market with the highest market share in 2023.

- By Technology Segment Analysis: Machine learning is expected to show its dominance in the technology segment in this market with the highest market share in 2023.

- End User Segment Analysis: BFSI is projected to dominate this market in the context of end users with the highest market share in 2023.

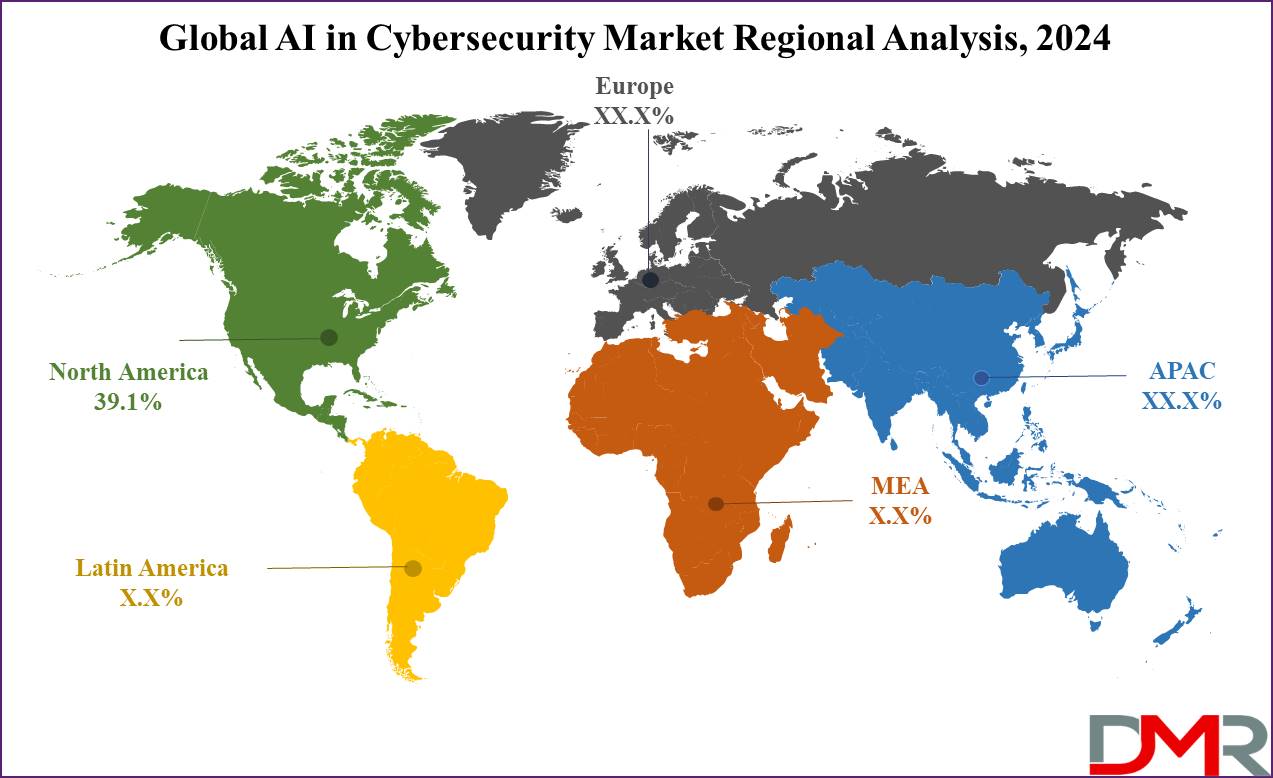

- Regional Analysis: North America is predicted to dominate the global AI in cybersecurity market with 39.1% of the market share in 2023.

Use Cases

- Threat Detection: Artificial Intelligence (AI) analyzes massive datasets to identify of suspicious activities, permitting early detection of capacity threats along with malware, phishing attacks, and insider threats within networks.

- Behavioral Analysis: Utilizing machine learning, AI monitors consumer behavior patterns to detect deviations indicative of unauthorized access or malicious activity, enhancing anomaly detection abilities.

- Vulnerability Assessment: AI-powered tools conduct complete scans of systems and applications, figuring out weaknesses and potential entry points for cyber threats, facilitating proactive security measures and patch control.

- Fraud Prevention: Artificial Intelligence (AI) algorithms analyze transactional data and user behaviors to detect fraudulent activity, permitting real-time identification and prevention of financial fraud, such as credit score card fraud and account takeovers.

Market Dynamic

Trends

Rapid Evolution of Cyber Threats

The proliferation of cybercriminal activities in the form of ransomware, phishing, and software supply chain attacks calls for continuous and ongoing development of AI-based cybersecurity solutions in line with the fast evolution of the environment so they can combat the growing threats effectively.

Increasing Adoption of AI Applications

Major companies in this market are rapidly installing artificial intelligence applications for detecting and preventing security breaches using artificial and deep learning technologies that automate the process and allow cybersecurity systems to recognize potential threats more effectively and timely.

Growth Drivers

Escalating Frequency of Cyberattacks

The concerning surge of cyber-attacks internationally, particularly against individuals, enterprises, and government institutions, fuels the need for efficient cyber security, which in turn delivers ever-evolving threat intelligence to AI-driven solutions that can deal with growing cyber threats.

Demand for Comprehensive Security Solutions

With the growth in internal cyber threats, in addition to the cybersecurity dilemma in many sectors, including SMEs, banking and financial services, and healthcare, there are prevalent growth opportunities out there in AI and cybersecurity, which in turn generate the need for cloud-based data protection solutions and AI threat intelligence.

Growth Opportunities

Expansion in SME Security Solutions

Small and medium-sized businesses which are highly exposed to cyber-attacks as compared to large ones due to insufficient security mechanisms offer a lucrative market prospect for providers of cloud-based cybersecurity services. Cloud deployment as a viable option gives SMEs flexibility in scaling and cost-saving, it also offers cost-effectiveness in the improvement of their cybersecurity stance.

Advancements in Antivirus/Anti-malware Solutions

Malware is still so dynamic that it requires automated smart systems like AI and machine learning to be incorporated into the next-generation anti-virus and anti-malware programs. As cyber attackers become more sophisticated in their techniques, a trend is emerging for AI-powered security solutions to address the issue of evolving cyber threats.

Restraints

Interoperability Challenges

Enterprises struggle with information systems interoperability, which impedes the process of information exchange as well as smooth communication between the various IT systems, and the endpoint solutions. The absence of a uniform communication medium spanning across all information security systems is one of the main problems preventing their interoperability.

Limited Adoption for Insider Threat Detection

Insider cyber threats are spreading more and more, although there is not much employment of AI for identifying insider threats, which serves as a constraint to the use of AI in cybersecurity. The change from the outsider to the insider attacks pushes forward the necessity of artificial intelligence-driven solutions for identifying and mitigating internal threats correctly.

Research Scope and Analysis

By Type

Network security dominates the type segment in this market with 39.3% of the market share in 2023, driven by the growing popularity of machine learning algorithms & artificial intelligence in cybersecurity, as businesses are highly utilizing these technologies to safeguard against & prevent cyber-attacks, marking an important role for network security.

Further, AI-based endpoint security is gaining momentum across organizations, showcasing continuous monitoring, risk-based application control, & automated classification. Endpoint security solutions are automating allow & deny lists based on known goodware & malware, respectively, in response to the number of endpoint attacks, which in connected devices has further encouraged the integration of AI-powered endpoint security technologies to discover suspicious activities & protect sensitive information. The pursuit of live authentication & behavioral analytics showcasing security solutions in the changing landscape of cybersecurity.

By Offering

The services sector leads the offering segment in the AI in cybersecurity market with 38.2% of the market share in 2023, driving rapid growth in the AI cybersecurity market, which is attributed to the rise in demand for covering machine learning, application program interfaces, speech, sensor data, and vision, with the market's expansion is driven by advanced programs adept at reliably detecting anomalous activities. As hardware operations gain popularity, the software platform is changing to improve security capabilities, with industry participants showcasing anticipated to prioritize open system architecture, open-source software, & open standards to advance hidden computing.

Further, the growth in global prominence of networking solutions, processors, & memory solutions is driving the development of hardware-based AI in cybersecurity, with the rise in popularity of neural networks & processors expanding hardware applications, mainly in fraud detection in the middle of the global rise in cyberattacks, with the deep learning approach gaining traction in anticipated credit card fraud detection, promising further industry expansion.

By Technology

In terms of technology, the machine learning segment leads this market with highest market share in 2023, driven by the larger adoption of deep learning across different industries, as major players like Google & IBM are integrating machine learning into threat detection & email filtering, improving cybersecurity measures, as businesses recognize the importance of deep learning & ML in fortifying security protocols. Machine learning platforms are gaining traction for their ability to automate monitoring, identify anomalies, and sift through vast volumes of data generated by security technologies.

Moreover, the global AI in the cybersecurity market is anticipated to experience further growth, driven by the NPL segment., as the rising popularity of text summarization, sentiment analysis, question-answering systems, & natural language inference contributes to this trend, as it finds its application in uncovering data overlaps, identifying framework & standard gaps, and pinpointing security infrastructure vulnerabilities. The future also holds potential developments in the automation & customization of NLP, promising significant steps in the application of AI in cybersecurity.

By Application

The fraud detection/anti-fraud segment claimed a significant share of global revenue, as AI in cybersecurity is gaining momentum as a proactive measure against fraud, making it a leading preventive control. Machine learning has emerged as an important tool, supporting governments & end-users to battle the growth in the number of fraudulent activities. Further, the use of AI tools is expected to grow, aiming at fraud prevention, countering email phishing, & identifying fake records.

Further, enterprises are highly switching towards unified threat management (UTM) to safeguard digital assets from a spectrum of threats, like phishing attacks, spyware, unauthorized website access, & trojans.

Also, the UTM approach is expected to rise in number, providing a range of security functions like intrusion detection and prevention, business VPN, gateway anti-virus, network firewalls, & web content filtering. Moreover, organizations are likely to emphasize UTM software for quick and precise detection of advanced threats, imposing scalable hardware-based monitoring to prevent attacks before entering the network.

By End User

The enterprise category leads the end-user segment in this market with the highest market share in 2023, and the BFSI sector is expected to become a major market for cyber-AI. The emphasis is on security measures to restrict data leaks & battle cyber threats, as the BFSI sector is adapting to technological advancements, experiencing a shift in how consumers engage in financial activities like purchases, payments, borrowing, & crowdfunding, to further improve operations & secure sensitive information, banks are inspecting the implementation of the zero-trust concept in their hardware, depending on threat intelligence.

Further, the growth in cyber events has spurred interest in AI within the government & defense industries, as a DDoS attack on a major Israeli telecommunications provider in March 2022, as reported by the Center for Strategic & International Studies, led to the disconnections of several Israeli government websites, highlighting the urgency for advanced AI solutions in cybersecurity.

The Artificial Intelligence (AI) in Cybersecurity Market Report is segmented on the basis of the following

By Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

By Offering

- Services

- Consulting Services

- Deployment and Integration

- Support and Maintenance

- Software

By Type

- Software

- Standalone

- Integrated

- Platform

- Application Program Interface (API)

- Machine Learning Framework

o By Deployment

- Cloud

- On-Premises

- Hardware

o Accelerators

o Processors

- Microprocessing Unit (MPU)

- Graphics Processing Unit (GPU)

- Field Programmable Gate Arrays (FPGA)

- Application Specific Integrated Circuit (ASIC)

- Tensor Processing Unit (TPU)\Other Processors

o Storage

o Network

By Technology

- Machine Learning

- Convolutional Neural Networks (CNN)

- Recurrent Neural Networks (RNN)

- Generative AI

- Generative Adversarial Networks

- Variational Autoencoders

- Transformative AI

- Others

- Supervised Learning

- Unsupervised Learning

- Reinforcement Learning

- Neural Networks

- Natural Language Processing

- Text Analysis

- Chatbot Security

- Sentiment Analysis

- Natural Language Generation (NLG)

- Named Entity Recognition (NER)

- Natural Language Understanding (NLU)

- Context-Aware Computing

- Automated Threat Intelligence

- Threat Hunting

- Automation and Orchestration

- Security Orchestration, Automation, and Response (SOAR)

- Robotic Process Automation (RPA)

- Computer Vision

- Image Recognition

- Object Detection

- Anomaly Detection

- Video Analysis

- Facial Recognition

- Security Surveillance Optimization

By Application

- Identity And Access Management

- Risk And Compliance Management

- Data Loss Prevention

- Unified Threat Management

- Fraud Detection/Anti-Fraud

- Threat Intelligence

- Others

By End User

- BFSI

- Retail

- Government & Defense

- Manufacturing

- Enterprise

- Healthcare

- Automotive & Transportation

- Others

Regional Analysis

North America dominates the global AI in cybersecurity market with a

39.1% revenue share in 2023, largely driven by the proliferation of network-connected devices driven by IoT, 5G, & Wi-Fi 6. Industries like healthcare, automotive, energy, government, and mining spurred 5G expansion, creating potential vulnerabilities for hackers. To bolster security, leading organizations plan to invest in machine learning, advanced analytics, and real-time assessment tools. North America is set to lead in adopting natural language processing, machine learning, & neural networks to detect and counter cyber threats, mainly with the rise in the use of mobile devices. Nearly 60% of mobile threats grow from browsing activities, allowing stakeholders to turn to AI algorithms for cybersecurity in the region.

Moreover, Europe provides growth prospects with strong government policies & rising cyber incidents, mainly in healthcare, automotive, government, and IT & telecommunication. Further, governments in France, the UK, Germany, & Russia plan a rise in investments in detecting anomalies & threats, allowing cybersecurity providers to improve their AI offerings to address changing cyber challenges.

By Region

North America

Europe

- Germany

- The U.K.

- France

- • Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Artificial Intelligence (AI) in the cybersecurity market's competitive environment is dynamic and involves both existing players and startups looking to push boundaries and expand their market presence. Key players such as NVIDIA Corp, IBM Corp, Intel Corp, McAfee Inc, Samsung Electronics, Micron Technology, Cylance Inc, Cisco System, Darktrace, and LogRhythm entirely occupy the market with their highly developed artificial intelligence-based cybersecurity solutions.

The most impactful manifestation of strategic countermeasures by cybersecurity firms is their considerable investment in research and development aiming to improve the quality of offered products and to remain a step ahead as far as cyber threat evolution is concerned. Established & new players are investing highly in ML, neural networks, and NLP to support users with AI-driven insights. However, cybercriminals are increasingly using AI to improve the potency of their attacks. Key companies are gearing up to support their cybersecurity defenses using AI. Industry participants may channel funds into both organic & inorganic strategies to advance their proficiency in AI-based cybersecurity.

Some of the prominent players in the Global Artificial Intelligence (AI) in Cybersecurity Market are

- NVIDIA Corp

- IBM Corp

- Intel Corp

- McAfee

- Samsung Electronics

- Micron Technology

- Cylance Inc

- Cisco System

- Darktrace

- LogRhythm

- Other Key Players

Recent Development

- In November 2023, the Department of Homeland Security's Cybersecurity and Infrastructure Security Agency (CISA) unveiled its initial Roadmap for AI, contributing to broader government initiatives for secure AI development. With a main role in national AI safety & security, DHS, following President Biden's Executive Order, aims to promote global AI safety standards, safeguarding U.S. networks, reducing AI-related risks, combating intellectual property theft, and attracting skilled talent. Further, CISA's roadmap outlines 5 strategic efforts, guiding responsible AI implementation in cybersecurity.

- In November 2023, cybersecurity firm Trellix introduced its new generative artificial intelligence (GenAI) capabilities, powered by Amazon Bedrock & backed by Trellix Advanced Research Center, using Amazon Bedrock, a completely managed service by AWS, Trellix taps into foundation models (FMs) from top AI companies via an API, improving the development & scalability of generative AI applications.

- In November 2023, the US Cybersecurity & Infrastructure Security Agency (CISA) & the UK National Cyber Security Centre (NCSC) together released the Guidelines for Secure AI System Development. Co-endorsed by 23 cybersecurity organizations worldwide, which addresses the convergence of artificial intelligence (AI), cybersecurity, & critical infrastructure. Aligned with the US Voluntary Commitments on Safe AI, the Guidelines offer critical recommendations, focusing on adherence to Secure by Design principles, which highlight customer-centric security, advocate transparency, & support organizational structures prioritizing secure design.

- In October 2023, IBM introduced an upgraded version of its managed detection & response services, incorporating advanced AI technologies, which enable automatic escalation or closure of up to 85% of security alerts, accelerating response times. Further, the new Threat Detection & Response Services (TDR) allow constant monitoring, investigation, & automated resolution of security alerts across hybrid cloud environments.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 26.9 Bn |

| Forecast Value (2033) |

USD 147.5 Bn |

| CAGR (2024-2033) |

20.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Network Security, Endpoint Security, Application Security, and Cloud Security), By Offering (Software, Hardware, and Services), By Application (Identity And Access Management, Risk And Compliance Management, Data Loss Prevention, Unified Threat Management, Fraud Detection/Anti-Fraud, Threat Intelligence, and Others), By Technology (Machine Learning, Natural Language Processing (NLP), Context-aware Computing, and Computer Vision), By End User (BFSI, Retail, Government & Defense, Manufacturing, Enterprise, Healthcare, Automotive & Transportation, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

NVIDIA Corp, IBM Corp, Intel Corp, McAfee, Samsung Electronics, Micron Technology, Cylance Inc, Cisco System, Darktrace, LogRhythm, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global AI in Cybersecurity Market size was valued at USD 22.1 billion in 2023 and is expected to reach USD 115.0 billion by the end of 2032.

North America has the largest market share for the Global AI in Cybersecurity Market with a share of about 39.1% in 2023.

Some of the major key players in the Global AI in Cybersecurity Market are NVIDIA Corp, IBM Corp, Intel Corp, and many others.

The market is growing at a CAGR of 20.8 percent over the forecasted period.