Market Overview

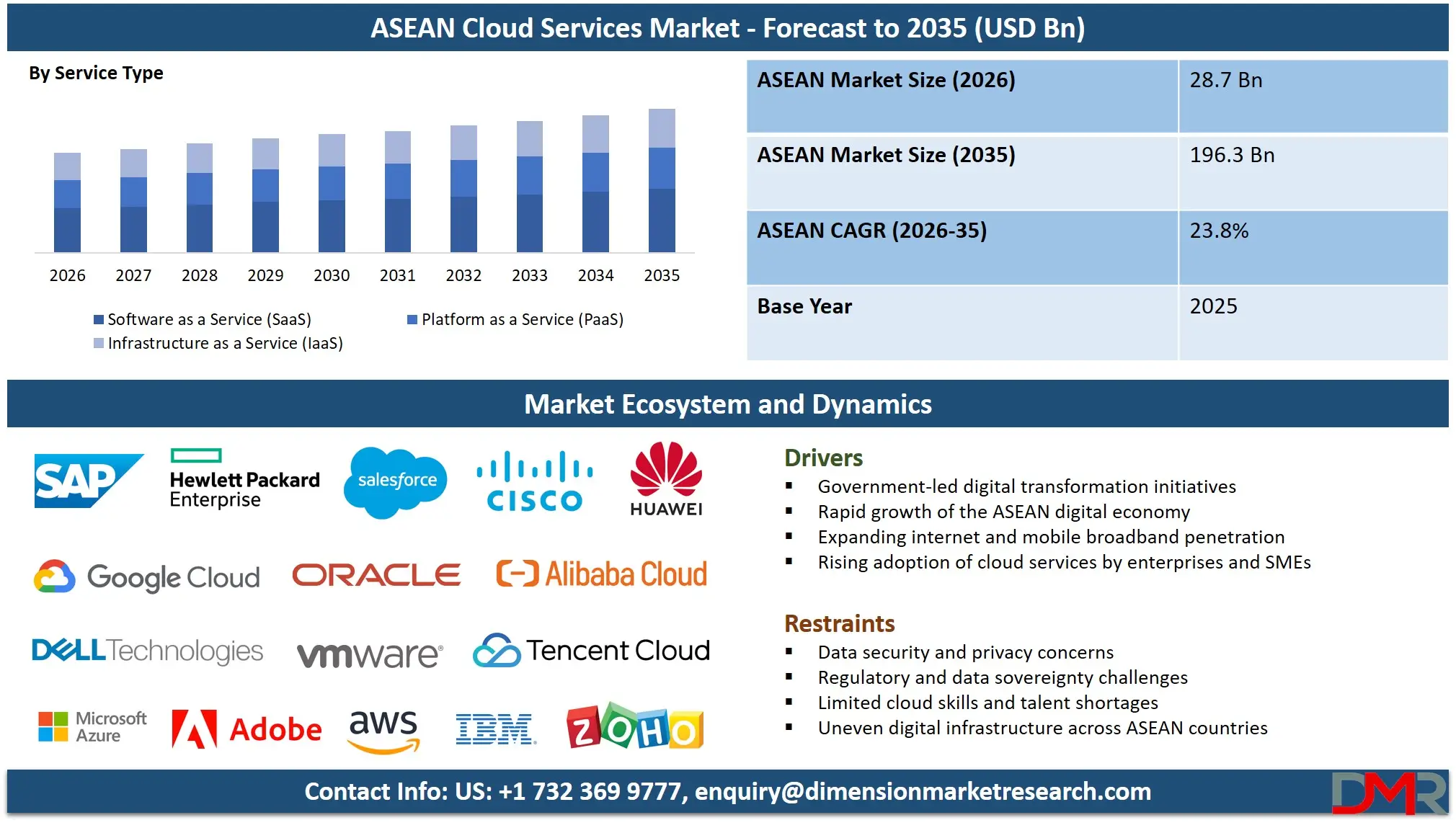

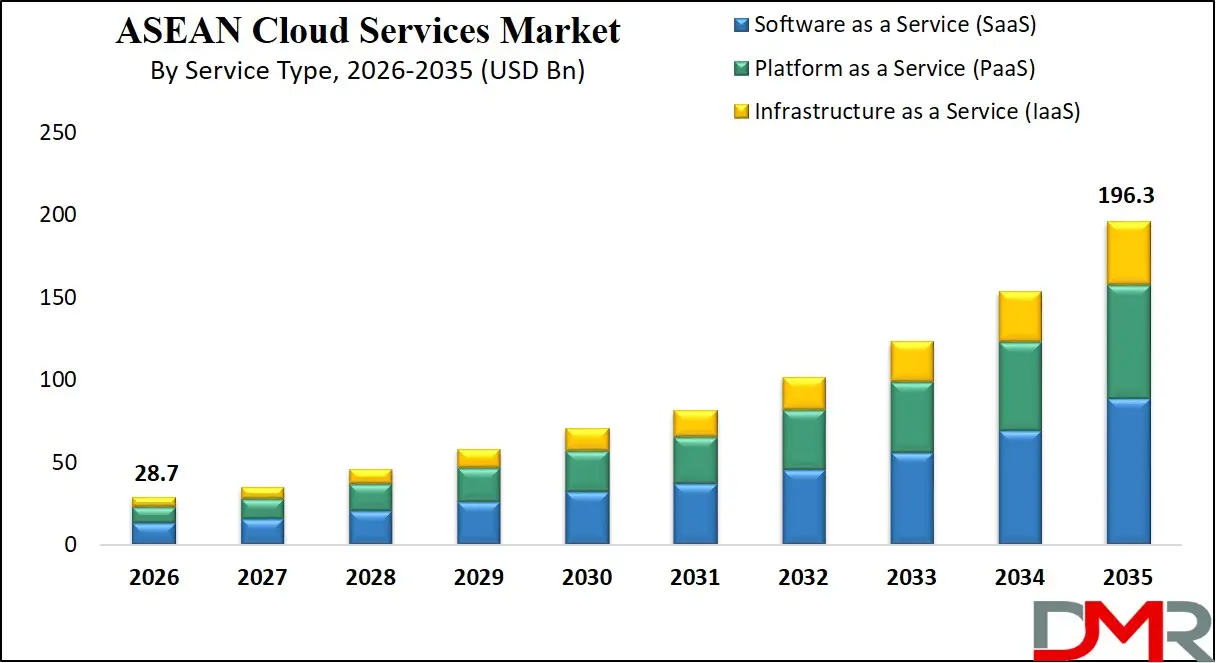

The ASEAN Cloud Services Market is projected to reach USD 28.7 billion in 2026 and is expected to grow at a CAGR of 23.8% from 2026 to 2035, attaining a value of USD 196.3 billion by 2035. This explosive growth is fueled by the region's collective and aggressive pursuit of a digital-first economic future. With a young, tech-savvy population exceeding 670 million and a burgeoning middle class, ASEAN is undergoing a fundamental transformation in how businesses operate and deliver value.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market's expansion is underpinned by several macro-trends like the post-pandemic normalization of hybrid and remote work models, which has permanently shifted enterprise reliance to cloud-based collaboration and productivity suites; the explosive growth of digital commerce and fintech, demanding scalable and secure infrastructure; and significant government-led digital economy masterplans such as Malaysia's MyDigital, Vietnam's National Digital Transformation Program, and the Philippines' Digital Transformation Strategy. These national agendas provide policy certainty and public investment, creating a fertile ground for cloud adoption.

The infrastructure backbone of this growth is being solidified through massive investments from global hyperscale cloud providers. The establishment of new data center regions and Local Zones across key markets like Indonesia, Thailand, and Vietnam is dramatically improving service latency, enabling data residency, and building trust in cloud reliability. Concurrently, the rollout of 5G networks is unlocking next-generation use cases in edge computing, IoT, and real-time analytics, further integrating cloud services into the fabric of industry and society.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

While the trajectory is steep, the market's evolution is not without friction. A persistent digital divide exists between major urban centers and rural areas, influencing cloud accessibility. Concerns over data sovereignty, cybersecurity resilience, and a significant regional shortage of advanced cloud talent present ongoing challenges. Despite these headwinds, the strategic imperative for digital agility, innovation, and competitive resilience positions the ASEAN cloud services market as the critical enabler for the region's next decade of economic growth and technological prominence.’

ASEAN Cloud Services Market: Key Takeaways

- Exponential Regional Market Growth: The ASEAN Cloud Services Market is poised for exponential growth, expanding from USD 28.7 billion in 2026 to USD 196.3 billion by 2035, reflecting the region's full-scale digital pivot.

- Unparalleled CAGR Fueled by Multi-Sector Adoption: The 23.8% CAGR is among the highest globally, driven by concurrent adoption across BFSI, telecommunications, government, and a massive, digitally-awakening SME sector.

- Singapore's Hub Dominance and Indonesia's Growth Leadership: Singapore remains the secure, high-value regional hub, while Indonesia's market size and growth rate make it the single most critical growth factor for providers.

- Hybrid Cloud Becomes the De-Facto Enterprise Standard: The Hybrid Cloud model is emerging as the dominant architecture, balancing the agility of public cloud with the security and control needed for sensitive data and legacy systems in regulated industries.

- SMEs as the Mass-Market Accelerator: Small and Medium-sized Enterprises are adopting cloud services at a breakneck pace, utilizing SaaS and packaged cloud solutions to digitalize operations, access markets, and improve competitiveness with minimal capex.

- AI and Data Analytics as Primary Value Drivers: Beyond basic infrastructure, the core demand is shifting to cloud platforms that offer integrated AI/ML, data analytics, and industry-specific solutions, transforming data into a strategic asset.

- Data Sovereignty Shapes Market Architecture: Evolving data localization laws across member states are directly influencing cloud infrastructure investments, fostering growth of local data centers and sovereign cloud offerings.

ASEAN Cloud Services Market: Use Cases

- Unified, Scalable Government Services: National and municipal governments deploy sovereign or government cloud platforms to integrate disparate citizen service portals, enable secure inter-agency data sharing, and launch scalable digital identity and benefit distribution systems.

- Next-Generation Digital Banking: Banks and fintech companies leverage cloud-native cores and PaaS to launch new digital-only banking brands, deploy real-time fraud detection AI, perform complex risk simulations, and create personalized customer engagement platforms.

- Agile, Data-Driven Supply Chains: Manufacturing and logistics firms implement cloud-based SCM and IoT platforms to gain end-to-end supply chain visibility, predict disruptions using AI, automate warehouse management, and optimize last-mile delivery in real-time.

- Hyper-Personalized Retail and E-commerce: Retailers use cloud infrastructure to handle massive traffic surges during sales, unify online-offline customer data in cloud CDPs, and run AI engines for dynamic pricing, inventory forecasting, and personalized marketing campaigns.

- Intelligent Telecommunication Networks: Telecom operators utilize cloud and edge computing to virtualize network functions (NFV), manage 5G network slicing, offer low-latency enterprise services, and analyze network data to preemptively resolve issues and improve customer experience.

- Smart Healthcare Ecosystems: Hospitals and health tech firms adopt secure healthcare clouds to host integrated EHR systems, enable telemedicine platforms, store and analyze medical imaging data using AI, and facilitate collaborative research while maintaining compliance.

ASEAN Cloud Services Market: Stats & Facts

ASEAN Secretariat / ASEAN Official Publications

- ASEAN Digital Masterplan 2025 identifies cloud computing as a core enabler for building a leading digital community in ASEAN.

- ASEAN aims to expand cloud-enabled digital public services across all member states as part of regional integration.

- ASEAN governments recognize cloud services as a key foundation for cross-border digital trade and e-government.

- ASEAN established formal Digital Sectoral Cooperation mechanisms to accelerate cloud adoption and interoperability.

- Cloud infrastructure is highlighted as essential for smart cities, digital finance, and e-commerce growth across ASEAN.

ERIA – Economic Research Institute for ASEAN and East Asia

- ERIA reports that cloud computing underpins ASEAN’s digital connectivity and smart services agenda.

- Cloud services are critical for regional data sharing frameworks and cross-border digital platforms.

- ERIA highlights that ASEAN’s digital transformation policies explicitly promote cloud-based public services.

- Regional cooperation supports cloud-enabled innovation ecosystems across ASEAN economies.

Vietnam Government / Ministry of Information and Communications

- Vietnam targets 100% adoption of cloud computing across government agencies by 2025.

- Vietnam has more than 40 licensed cloud service providers, including domestic and global firms.

- Foreign cloud providers currently account for approximately 80% of Vietnam’s cloud services usage.

ASEAN Public Sector Digitalization (Government & Public Institutions)

- 64% of public sector applications in ASEAN run on some form of cloud infrastructure.

- Only 19% of ASEAN public sector workloads are deployed on public cloud platforms.

- 83% of ASEAN public sector organizations remain at early or pilot stages of cloud adoption.

- Cloud usage in the ASEAN public sector includes:

- 27% enterprise private cloud

- 18% hosted private cloud

- 19% public cloud for development and testing

ASEAN Cloud Services Market: Market Dynamics

Driving Factors in the ASEAN Cloud Services Market

Irreversible Digital-First Business Strategies

The collective experience of the pandemic has cemented digital capabilities as a core component of business continuity and competitive strategy. Enterprises are no longer "considering" cloud migration but are executing multi-year digital transformation roadmaps where cloud is the central pillar. This shift is driven by the need for operational resilience, the ability to rapidly innovate and launch new digital products, and the demand for data-driven decision-making. The "cloud-first" or "cloud-native" mandate is now standard in IT strategy across large enterprises and is rapidly permeating the SME consciousness.

Hyperscale Investment and 5G Synergy

Unprecedented capital expenditure from AWS, Microsoft, Google, and Alibaba Cloud is building the physical and service infrastructure required for mass adoption. The opening of new cloud regions in Jakarta, Bangkok, and planned locations directly addresses latency and data sovereignty concerns. This infrastructure build-out synergizes perfectly with the rapid deployment of 5G networks by regional telecom operators. 5G's high bandwidth and low latency enable a new class of edge computing applications from smart factory sensors to autonomous guided vehicles and augmented reality which are inherently dependent on hybrid cloud architectures for data processing and management.

Restraints in the ASEAN Cloud Services Market

Regulatory Complexity and Data Sovereignty Uncertainty

The ASEAN region lacks a unified digital or data governance framework. Each member state is at a different stage of developing and enforcing its own data protection laws (e.g., Indonesia's PDPA, Thailand's PDPA, Vietnam's Law on Cybersecurity). This patchwork of regulations creates significant complexity for businesses operating across borders. The ambiguity and evolving nature of data localization requirements can lead to compliance risks, increased costs for multi-jurisdiction data management, and a cautious approach to cloud migration, particularly for multinationals and in highly regulated sectors like financial services and healthcare.

Acute Shortage of Advanced Cloud and Cybersecurity Skills

The breakneck speed of cloud adoption has far outpaced the development of local talent pools with advanced skills in cloud architecture, DevOps, FinOps, and cloud-native security. This talent gap is a critical bottleneck, limiting organizations' ability to design optimal cloud environments, manage costs effectively, and secure their deployments. It leads to increased reliance on expensive expatriate talent or global system integrators, raising the total cost of ownership and potentially slowing implementation timelines for complex transformations.

Opportunities in the ASEAN Cloud Services Market

Vertical-Specific Cloud Solutions and Sovereign Clouds

One-size-fits-all cloud offerings are giving way to tailored, vertical-specific solutions. There is immense opportunity for providers (both global and local) to develop and offer compliant cloud platforms for specific industries such as Financial Services Cloud with integrated regulatory reporting tools, Healthcare Cloud with HIPAA/GDPR-like compliance for ASEAN, or Government Cloud adhering to strict sovereignty requirements. The demand for sovereign clouds, where data and operations are guaranteed to remain under national jurisdiction, is a particularly high-growth niche driven by public sector and critical infrastructure projects.

AI-as-a-Service and Democratization of Advanced Technologies

The integration of Generative AI, machine learning operations (MLOps) platforms, and sophisticated data analytics tools into cloud service portfolios represents the next major wave of value creation. Cloud providers that can successfully offer these advanced capabilities as easy-to-consume services will capture significant market share. This democratizes access to AI for ASEAN's vast SME sector and startups, enabling them to build intelligent applications, automate processes, and gain insights without massive upfront investment in data science teams and infrastructure.

Trends in the ASEAN Cloud Services Market

The Ascendancy of FinOps and Cloud Cost Optimization

As cloud spend becomes a significant line item in IT budgets, the focus is shifting from simple adoption to intelligent optimization. FinOps the practice of managing cloud financial operations is becoming a critical discipline. Enterprises are increasingly adopting tools and practices for visibility into cloud spending, identifying waste (such as underutilized resources), implementing auto-scaling, and negotiating better commitments with providers. This trend moves cloud management from a technical function to a strategic business one focused on maximizing return on investment.

Sustainability and Green Cloud Initiatives

Environmental, Social, and Governance (ESG) considerations are gaining prominence. Major cloud providers are committing to powering their data centers with renewable energy and are designing more energy-efficient facilities. In parallel, enterprises are beginning to consider the carbon footprint of their cloud workloads as part of their sustainability reporting. This is leading to the development of tools for measuring and optimizing the environmental impact of cloud usage, making "green cloud" a potential differentiator for providers and a consideration for enterprise procurement decisions.

ASEAN Cloud Services Market: Research Scope and Analysis

By Service Type Analysis

Software as a Service (SaaS) maintains its commanding lead in the service type segment, projected to hold over 43.0% of the market share in 2026. Its dominance is attributed to its immediate business value and low barrier to entry. The demand is bifurcated: large enterprises comprehensively adopt integrated Enterprise Application suites like SAP S/4HANA Cloud and Oracle Fusion for ERP and CRM modernization, while SMEs drive massive uptake of focused Collaboration & Productivity Tools (Microsoft 365, Google Workspace) and standalone SaaS for functions like HR (Workday), marketing (HubSpot), and e-commerce (Shopify). The Analytics & Reporting Software sub-segment within SaaS is witnessing explosive growth as businesses of all sizes seek embedded insights.

Platform as a Service (PaaS) is the growth engine, forecast to expand at a CAGR exceeding 28%. This surge is fueled by the region's vibrant developer ecosystem and the enterprise need to build custom, differentiating digital capabilities. AI/ML & Analytics Platforms (such as Google Vertex AI, Azure Machine Learning) are the star performers, as companies rush to embed intelligence into their operations. Application Development Platforms that support containerization and serverless architectures enable the rapid building of cloud-native applications, while Database Management Platforms (like AWS Aurora, Azure SQL Database) provide managed, scalable data backbones.

Infrastructure as a Service (IaaS) forms the essential foundation, experiencing steady, high growth primarily driven by large-scale migration projects, disaster recovery solutions, and the raw compute/storage needs of data-intensive industries like media and gaming. The Compute Services sub-segment is particularly active due to the rise of GPU-intensive workloads for AI training and rendering.

By Deployment Model Analysis

The Hybrid Cloud model is decisively becoming the enterprise standard, expected to capture the largest market share by 2026. This model perfectly aligns with the "bimodal IT" reality of many ASEAN organizations, where legacy, mission-critical systems (often with data residency requirements) remain in a private cloud or on-premises data center, while customer-facing, innovative, and scalable applications are built in the public cloud. The need for seamless integration, data mobility, and unified security across these environments is driving massive investment in hybrid cloud management platforms.

Public Cloud remains the largest segment in terms of raw spend, particularly dominating among digital-native businesses, startups, and for specific workloads like development/testing, big data analytics, and content delivery. Its economic model of shifting capex to opex is irresistibly attractive for growth-focused companies.

Private Cloud maintains a vital, steady role, especially within the BFSI sector, government agencies, and large national conglomerates where control, security, and regulatory compliance are non-negotiable. These organizations often build private clouds using vendor technologies (like VMware on AWS) or leverage sovereign cloud offerings from local providers.

By Organization Size Analysis

Small and Medium-sized Enterprises (SMEs) are the transformative force in the ASEAN cloud narrative, representing the fastest-growing segment with a CAGR of over 27%. For SMEs, cloud services are not just an IT upgrade but an existential enabler. They provide access to enterprise-grade software (via SaaS), global marketplaces (via e-commerce platforms on IaaS), and advanced tools (like AI-powered marketing) that were previously inaccessible due to cost and complexity. This democratization of technology is leveling the playing field and fueling the region's entrepreneurial spirit.

Large Enterprises continue to account for the bulk of market revenue, driven by multi-million-dollar, multi-year digital transformation programs. Their cloud journeys are complex, involving legacy system migration, application refactoring, and the establishment of centralized cloud centers of excellence. They are major consumers of all service types IaaS for infrastructure modernization, PaaS for building new digital channels, and SaaS for standardizing global business processes.

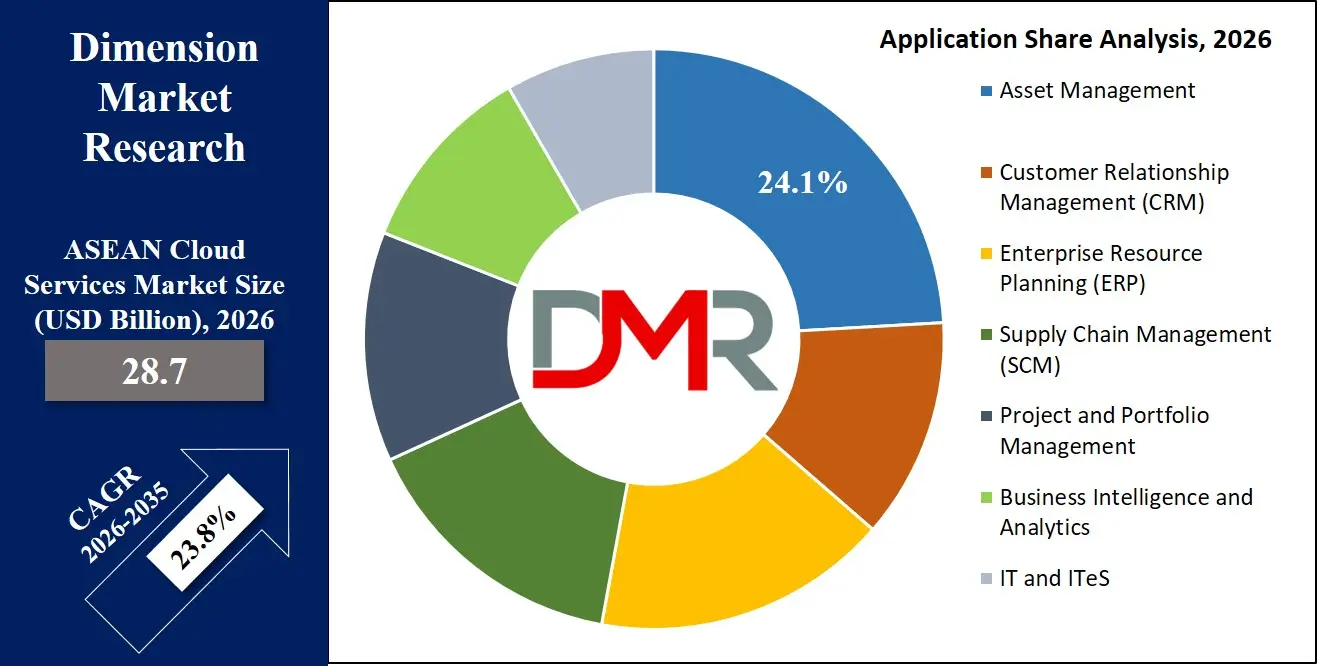

By Application Analysis

Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) collectively form the bedrock of enterprise cloud application spend. Modern, cloud-based ERP suites are unifying finance, supply chain, and human resources on a single, real-time platform, providing the operational backbone for digital transformation. Cloud CRM is the engine of customer-centricity, driving revenue growth through sales force automation, personalized marketing campaigns, and omnichannel customer service.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Business Intelligence and Analytics (BI&A) is the most dynamic and strategic application segment. As data volumes explode, organizations are moving their data warehouses to the cloud (e.g., Snowflake, Google BigQuery) and adopting cloud-based Data Visualization and Dashboards (Tableau Online, Power BI service) and Predictive Analytics tools. This shift enables them to derive actionable insights at speed and scale, informing everything from supply chain decisions to customer lifetime value optimization.

Supply Chain Management (SCM) has gained unprecedented importance post-pandemic. Cloud SCM applications provide the visibility, agility, and predictive capability needed to navigate global disruptions, optimize inventory, and manage complex supplier networks, making them critical for the region's export-oriented manufacturing economies.

By Industry Vertical Analysis

Banking, Financial Services, and Insurance (BFSI) is the most mature and demanding vertical, a leader in both spend and innovation. Cloud adoption is moving beyond peripheral applications to core banking systems, enabled by regulatory clarity in markets like Singapore and the Philippines. Use cases include cloud-native mobile banking, AI-powered wealth management robo-advisors, fraud detection engines, and scalable platforms for insurance claim processing. Compliance and security are paramount, driving demand for specialized financial services cloud offerings.

Telecommunications is undergoing its own radical transformation, becoming both a major cloud user and a cloud provider. Telcos are using cloud to virtualize their network cores (NFV/SDN), deploy 5G standalone networks, and create new enterprise services like SD-WAN and unified communications. Simultaneously, they are leveraging their extensive infrastructure to offer colocation, managed cloud, and edge computing services, competing directly with hyperscalers in the local market.

Government and Public Sector is a high-growth vertical fueled by national digitalization agendas. Cloud enables smarter cities, digital citizen ID platforms, efficient e-procurement systems, and data-driven policy-making. The key trend here is the strong preference for sovereign cloud or government-dedicated regions to meet strict data sovereignty and security requirements.

The ASEAN Cloud Services Market Report is segmented on the basis of the following:

By Service Type

- Software as a Service (SaaS)

- Enterprise Applications

- Collaboration And Productivity Tools

- Analytics And Reporting Software

- Platform as a Service (PaaS)

- Application Development Platforms

- AI/ML And Analytics Platforms

- Database Management Platforms

- Integration And Middleware Services

- Infrastructure as a Service (IaaS)

- Compute Services

- Storage Services

- Networking Services

By Application

- Asset Management

- IT Asset Tracking

- Digital Asset Management

- Predictive Maintenance Systems

- Customer Relationship Management (CRM)

- Sales Automation

- Marketing Automation

- Customer Support And Service

- Enterprise Resource Planning (ERP)

- Financial Management

- Human Resource Management

- Procurement And Inventory Management

- Supply Chain Management (SCM)

- Logistics and Transportation Management

- Demand Planning And Forecasting

- Supplier Relationship Management

- Project and Portfolio Management

- Project Planning And Scheduling

- Resource Management

- Performance And Risk Analytics

- Business Intelligence and Analytics

- Data Visualization And Dashboards

- Predictive And Prescriptive Analytics

- Data Warehousing

- IT and ITeS

- IT Service Management (ITSM)

- Application Hosting And Management

- Other Applications

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Other Industry Verticals

Impact of Artificial Intelligence in the ASEAN Cloud Services Market

- AI-Driven Cloud Operations and FinOps: AI is revolutionizing cloud management through AIOps (Artificial Intelligence for IT Operations), which predicts and auto-remediates performance issues, and AI-powered FinOps tools that provide intelligent cost anomaly detection, right-sizing recommendations, and automated spending optimizations, crucial for managing complex multi-cloud estates.

- Democratized AI Development via Cloud PaaS: Cloud-based AI/ML platforms (e.g., Azure ML, Amazon SageMaker) are removing the barriers to entry for AI development. They provide pre-built algorithms, automated machine learning (AutoML) capabilities, and managed infrastructure, allowing ASEAN enterprises and startups to rapidly build, train, and deploy models for local language processing, fraud detection, and predictive maintenance.

- Generative AI Integration as a Core Service: Hyperscalers are aggressively integrating Generative AI services (large language models, code generators, image creators) directly into their cloud portfolios. This allows businesses to experiment with and deploy GenAI for customer service chatbots, content creation, software development acceleration, and personalized marketing at an unprecedented pace, creating a new frontier of cloud consumption.

- Intelligent Security and Compliance Automation: AI is embedded into cloud security services, offering advanced threat intelligence, user and entity behavior analytics (UEBA), and automated compliance scanning for frameworks like Indonesia's PDPA or Singapore's MAS guidelines. This provides a proactive security posture essential for building trust in cloud environments.

- AI-Enhanced SaaS Applications: AI is becoming a table-stakes feature within SaaS offerings. ERP systems use AI for predictive forecasting and automated financial closes; CRM platforms leverage AI for lead scoring and sentiment analysis; and collaboration tools integrate AI for meeting summaries and content generation, continuously increasing the intrinsic value of SaaS subscriptions.

ASEAN Cloud Services Market: Regional Analysis

Country with the Largest Revenue Share

Singapore is projected to dominate the ASEAN Cloud Services Market with over 35.0% of the regional revenue share in 2026. Its pre-eminence is structural and self-reinforcing. As the region's most advanced financial and business hub, it hosts the regional headquarters of countless multinationals whose digital transformations are centralized and managed from Singapore. The city-state's pro-business environment, coupled with its world-class infrastructure exemplified by its massive data center ecosystem and multiple submarine cable landings makes it the default choice for latency-sensitive and mission-critical workloads.

The government's role cannot be overstated. The Smart Nation initiative has not only digitized the public sector but has also created a sophisticated ecosystem of tech partners, startups, and talent. Regulatory bodies like the MAS have provided clear, progressive guidelines for cloud use in finance, turning perceived risk into a competitive advantage. Singapore's market is characterized by high-value, advanced cloud consumption, with a significant focus on PaaS for innovation, hybrid cloud architectures, and a mature understanding of cloud security and governance.

Country with the Highest CAGR

Indonesia is forecast to exhibit the highest CAGR poised to challenge Singapore for overall market size by the end of the forecast period. This growth is a function of sheer scale and pent-up demand. With a population nearly 50 times that of Singapore and a digital economy booming, the absolute growth in cloud users and workloads is staggering. The enforcement of data localization laws, while a restraint in some aspects, has been a catalyst, forcing global providers to build local infrastructure, which in turn has improved service quality and trust.

The growth is highly democratized. It is driven from the top by large banks and telcos modernizing their IT, from the middle by a dynamic startup scene building everything from super-apps to agritech on cloud-native principles, and from the ground up by millions of SMEs adopting SaaS for the first time to get online and compete. The primary challenge and opportunity lies in extending reliable digital infrastructure beyond Java and major cities, a gap that is being addressed through edge computing and partnerships with local telecom providers.

By Region

ASEAN

- Singapore

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Philippines

- Rest of ASEAN (Brunei, Cambodia, Laos, Myanmar)

ASEAN Cloud Services Market: Competitive Landscape

The ASEAN Cloud Services Market is a fiercely contested arena characterized by a multi-layered competitive ecosystem. At the apex, the Global Hyperscale Cloud Providers (AWS, Microsoft Azure, Google Cloud Platform) engage in a relentless battle for market leadership. Their competition revolves around continuously expanding their service portfolios (especially in AI), building local infrastructure to ensure compliance and performance, and forging deep partnerships with local system integrators, telecom companies, and government agencies. They compete on global scale and innovation but are increasingly required to localize their offerings and go-to-market strategies.

The Regional Telecom and Technology Giants form a powerful second tier. Companies like Singtel (Nxera data center platform), Telkom Indonesia (TelkomCloud), Viettel (Viettel IDC), and PLDT (ePLDT) leverage their extensive domestic network infrastructure, deep customer relationships, and understanding of local regulations. They often compete by offering hybrid solutions, managed services, colocation, and sovereign cloud offerings, positioning themselves as trusted local partners. Strategic alliances, where telcos resell or co-brand hyperscaler services (e.g., Singtel-AWS, Telekom Malaysia-Microsoft), are common and blur competitive lines.

Some of the prominent players in the ASEAN Cloud Services Market are:

- Amazon Web Services (AWS)

- Microsoft

- Google (Google Cloud)

- IBM

- Oracle

- Alibaba Cloud

- Salesforce

- SAP

- VMware

- Tencent Cloud

- Huawei Cloud

- Adobe

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Rackspace Technology

- ServiceNow

- Workday

- Dropbox

- Zoho

- Other Key Players

Recent Developments in the ASEAN Cloud Services Market

November 2025: Microsoft launches its second cloud region in Indonesia, located in Surabaya

- Microsoft announced the launch of a second cloud region in East Java, Indonesia, to provide additional capacity, disaster recovery options, and lower latency for businesses in the eastern part of the archipelago, further committing to the Indonesian market's growth and data sovereignty needs.

October 2025: Google Cloud and Thailand's Digital Economy Promotion Agency announce AI skilling initiative

- Google Cloud partnered with Thailand's DEPA to train over 10,000 developers and IT professionals in AI/ML and cloud technologies over two years, directly addressing the critical skills gap and fostering local innovation capacity.

September 2025: Singtel and Gulf Energy announce joint venture for a new hyperscale data center park in Thailand

- Singtel's digital infrastructure arm, Nxera, partnered with Thailand's Gulf Energy to develop a state-of-the-art, sustainable data center campus near Bangkok, aiming to capture growing demand from hyperscalers and enterprises in the Indochina region.

August 2025: Bank of the Philippines Islands (BPI) completes full core banking migration to a hybrid cloud platform

- One of the Philippines' largest banks, BPI, successfully migrated its core banking system to a hybrid cloud architecture in partnership with a global hyperscaler and system integrator, setting a new benchmark for core system modernization in ASEAN BFSI.

July 2025: Vietnam's Ministry of Information and Communications issues detailed guidance on in-country data storage

- The MIC released clarified technical guidelines for data localization under the Cybersecurity Law, providing clearer rules for cloud providers and enterprises and accelerating planning for local data center expansion in Vietnam.

June 2025: AWS announces general availability of its Local Zone in Kuala Lumpur, Malaysia

- AWS launched its Local Zone in Kuala Lumpur, delivering single-digit millisecond latency for applications like media rendering, online gaming, and real-time analytics to users in Malaysia, enhancing performance for latency-sensitive workloads.

April 2025: SAP expands its "RISE with SAP" program with tailored packages for ASEAN SMEs

- SAP introduced localized, streamlined, and cost-effective versions of its RISE with SAP cloud ERP solution specifically for small and medium enterprises in key ASEAN markets like Indonesia, Thailand, and Vietnam, targeting the massive SME digitization opportunity.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 28.7 Bn |

| Forecast Value (2035) |

USD 196.3 Bn |

| CAGR (2026–2035) |

23.8% |

| Historical Data |

2021 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Service Type (Software as a Service [SaaS], Platform as a Service [PaaS], Infrastructure as a Service [IaaS]); By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud); By Organization Size (Large Enterprises, Small and Medium-sized Enterprises [SMEs]); By Application (Asset Management, Customer Relationship Management [CRM], Enterprise Resource Planning [ERP], Supply Chain Management [SCM], Project and Portfolio Management, Business Intelligence and Analytics, IT and ITeS, Other Applications); By Industry Vertical (Banking, Financial Services, and Insurance [BFSI], Telecommunications, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, Other Industry Verticals) |

| Regional Coverage |

Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Rest of ASEAN (Brunei, Cambodia, Laos, Myanmar) |

| Prominent Players |

Amazon Web Services (AWS), Microsoft, Google Cloud, IBM, Oracle, Alibaba Cloud, Salesforce, SAP, VMware, Tencent Cloud, Huawei Cloud, Adobe, Cisco Systems, Dell Technologies, Hewlett Packard Enterprise (HPE), Rackspace Technology, ServiceNow, Workday, Dropbox, Zoho, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the ASEAN Cloud Services Market?

▾ The ASEAN Cloud Services Market size is estimated to have a value of USD 28.7 billion in 2026 and is expected to reach USD 196.3 billion by the end of 2035.

What is the growth rate in the ASEAN Cloud Services Market?

▾ The market is growing at a compound annual growth rate (CAGR) of 23.8 percent over the forecasted period from 2026 to 2035.

Which service type segment leads the ASEAN cloud market?

▾ Software as a Service (SaaS) is the leading service type segment, driven by widespread, immediate-value adoption of enterprise applications and collaboration tools across both large enterprises and SMEs.

Which deployment model is growing the fastest?

▾ The Hybrid Cloud deployment model is experiencing the fastest adoption growth, as it becomes the preferred architecture for enterprises seeking to balance innovation, security, control, and compliance across their IT estate.

Who are the key players in the ASEAN Cloud Services Market?

▾ The market is led by global hyperscalers like Amazon Web Services, Microsoft Corporation, and Google LLC. Key regional players include telecommunications giants such as Singtel, Telkom Indonesia, and Viettel Group, along with global software leaders like SAP, Oracle, and Salesforce.