Market Overview

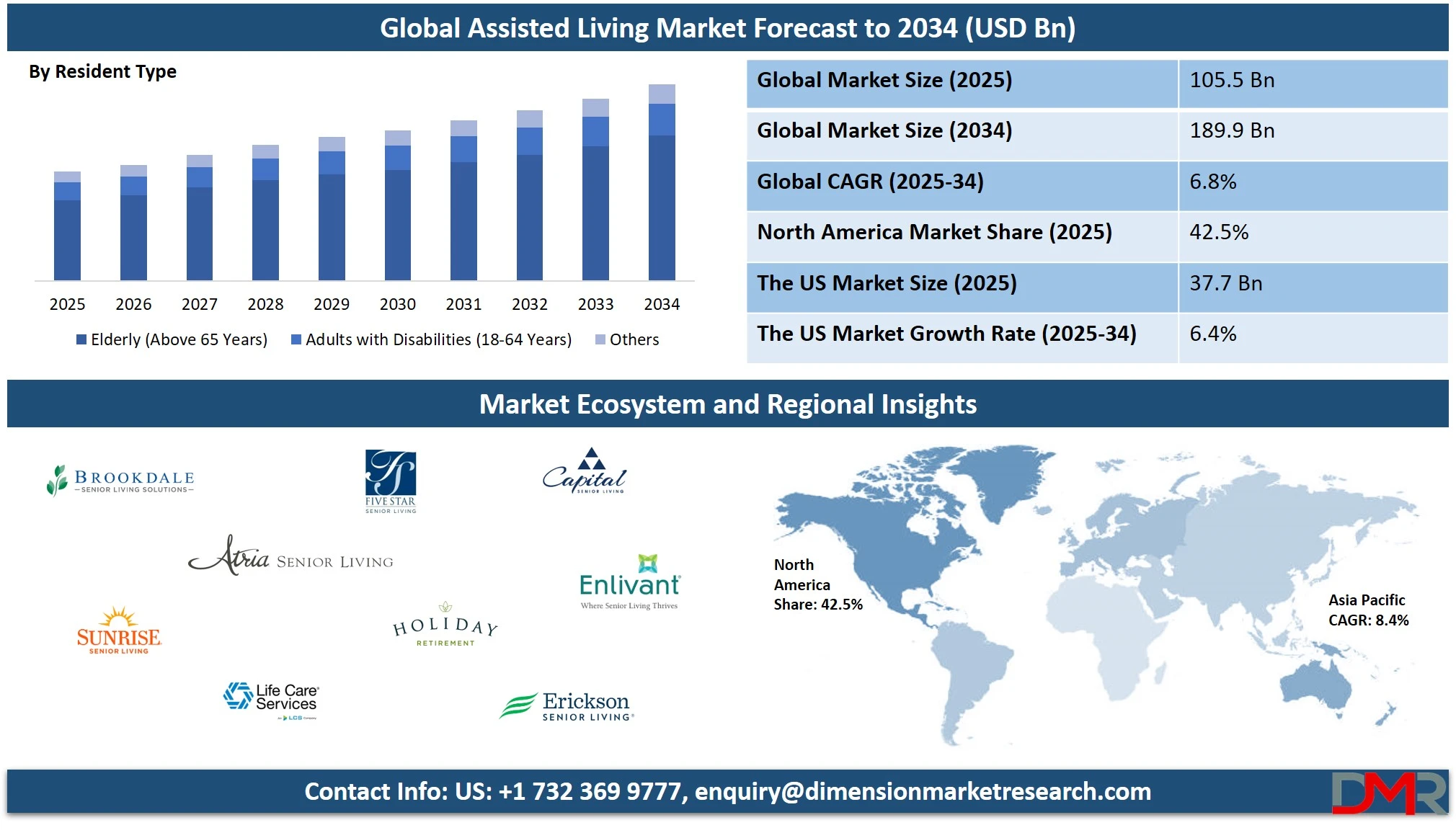

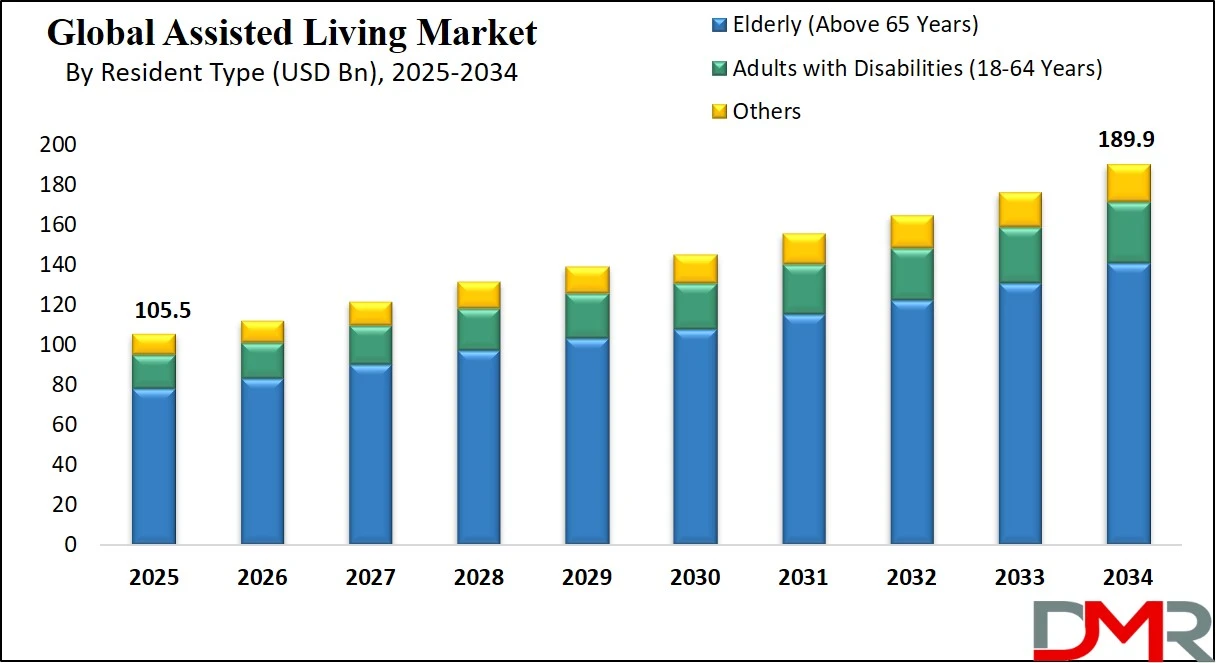

The global Assisted Living Market is projected to grow from USD 105.5 billion in 2025 to USD 189.9 billion by 2034, registering a CAGR of 6.8% during the forecast period. Growth is driven by the rising elderly population, growing demand for senior care services, and the shift toward personalized long-term care solutions. The market reflects strong potential across independent living facilities, memory care units, and technology-enabled eldercare platforms.

Assisted living refers to a housing and care solution designed for individuals who need help with daily living activities but do not require the intensive medical care provided in nursing homes. It serves primarily older adults who seek an independent lifestyle while benefiting from support in areas such as bathing, dressing, medication management, and meal preparation.

These facilities offer a balance between personal freedom and assistance, often featuring private apartments, communal dining areas, recreational opportunities, and 24-hour staff availability. The environment is structured to enhance safety, social engagement, and wellness, promoting dignity and autonomy in a secure and community-oriented setting.

The global assisted living market is witnessing significant expansion due to the rising aging population, growing life expectancy, and growing prevalence of chronic conditions that limit independent living. Factors such as urbanization, the breakdown of traditional family support systems, and shifting preferences toward quality eldercare have also accelerated demand.

The market comprises a diverse range of service models, including continuing care retirement communities, standalone facilities, and integrated healthcare solutions that cater to varying levels of physical and cognitive support needs. Favorable government policies, technological innovations like remote monitoring and AI-enabled care, and the emergence of luxury senior housing models further bolster investment in this sector.

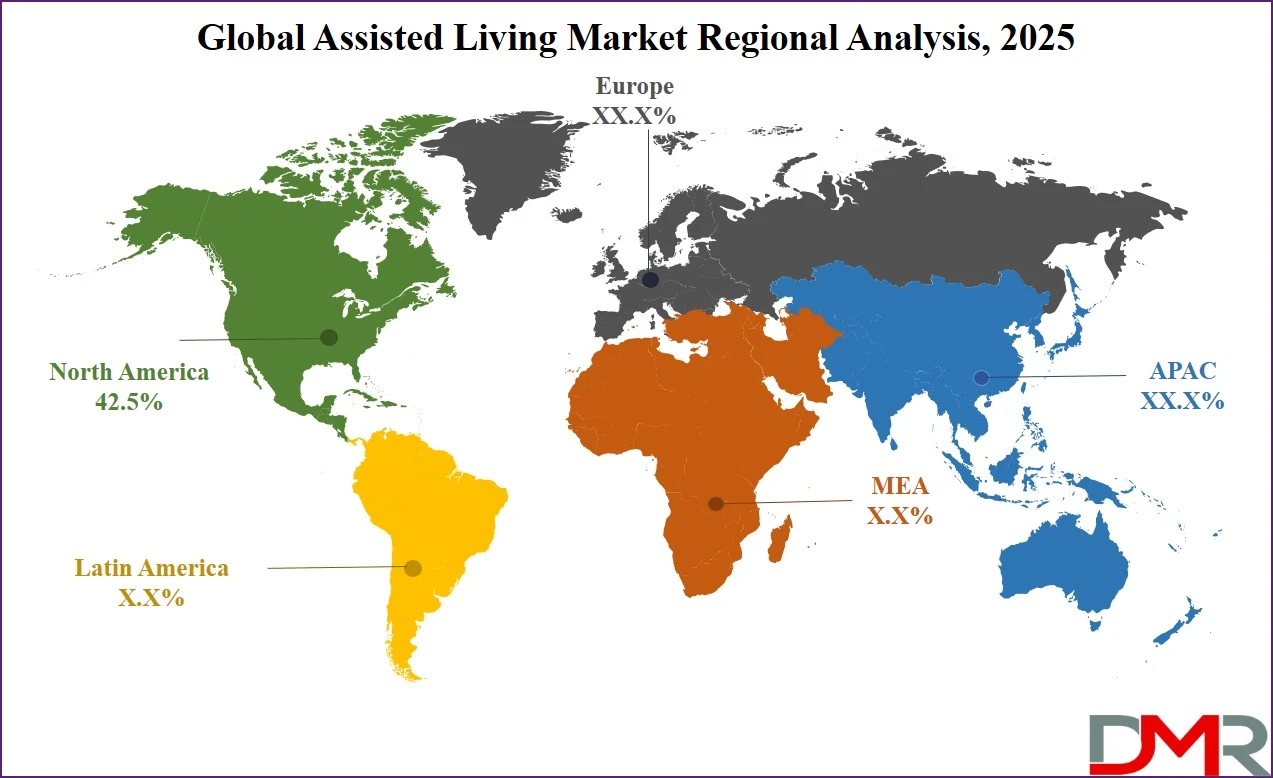

Geographically, North America continues to lead the market, driven by advanced healthcare infrastructure, widespread insurance coverage, and strong awareness of senior living options. However, regions like Asia Pacific and Latin America are rapidly emerging due to growing geriatric populations and growing government focus on long-term care solutions.

The competitive landscape is marked by both large corporate chains and regional providers, each aiming to enhance service quality, operational efficiency, and resident satisfaction. With personalized care models, evolving digital solutions, and rising demand for senior wellness programs, the assisted living market is positioned for steady growth in the coming years.

The US Assisted Living Market

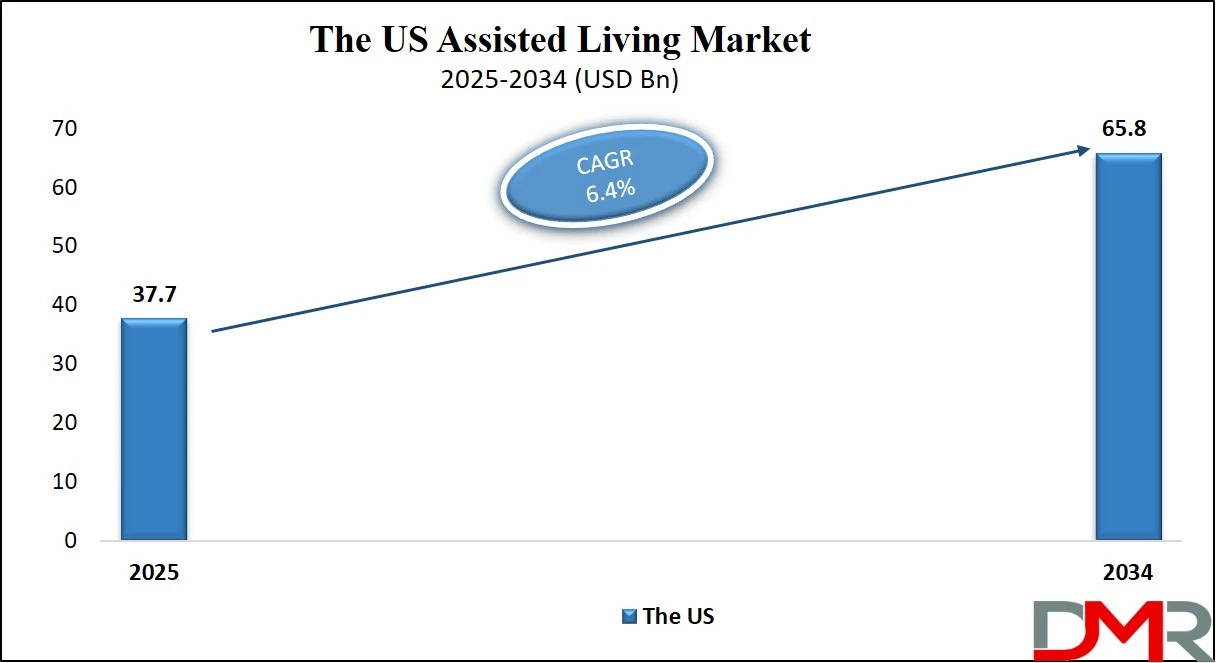

The U.S. Assisted Living Market size is projected to be valued at USD 37.7 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 65.8 billion in 2034 at a CAGR of 6.4%.

The U.S. assisted living market is expanding steadily due to a rapidly aging population, growing life expectancy, and the growing need for supportive yet independent living arrangements. With over 56 million Americans aged 65 and above, there is rising demand for facilities that assist with daily activities like bathing, dressing, and medication while offering a sense of community and security. These facilities are preferred over institutional nursing homes as they provide a more home-like environment.

The market is driven by chronic illnesses such as dementia and arthritis, which require supervised care but not intensive medical attention. In addition, the shift in family structures, with more seniors living alone or far from children, is contributing to demand. Leading operators such as Brookdale Senior Living, Sunrise Senior Living, and Atria Senior Living dominate the market, though many regional and independent facilities remain significant players.

Technology and service innovation are transforming the U.S. assisted living landscape. Facilities are adopting tools such as fall detection systems, remote health monitoring, electronic health records, and AI-based scheduling to improve care efficiency and resident safety. The demand for memory care, rehabilitation, and tiered care models is also rising, allowing residents to age in place without transitioning to more intensive care settings.

Most services are still paid out-of-pocket, though long-term care insurance and veteran assistance help offset costs for some. Regulatory frameworks vary by state, influencing operational models and care standards. Despite staffing shortages and rising operational costs, the market remains highly attractive due to consistent demand, especially with the incoming wave of baby boomers. Providers focused on quality, affordability, and personalized care are best positioned to capture long-term growth.

The Europe Assisted Living Market

In 2025, Europe’s assisted living market is projected to reach a valuation of approximately USD 28.4 billion, representing a significant portion of the global market. This growth is largely fueled by the region’s aging population, where nearly 20% of citizens are aged 65 and above, and many are seeking long-term, structured care outside of traditional family homes. Countries like Germany, France, the UK, and the Netherlands are leading the way in establishing modern assisted living facilities that offer both essential care services and lifestyle-enhancing amenities.

Rising awareness about the benefits of assisted living, such as greater autonomy, social engagement, and safety, is also encouraging more seniors and their families to adopt these care models. Moreover, healthcare reforms and growing investment from both public and private sectors are supporting infrastructure development and service quality.

Europe’s market is anticipated to expand at a steady compound annual growth rate (CAGR) of 6.3% from 2025 to 2034. This growth is underpinned by various factors including government-backed eldercare initiatives, urbanization, and a shift in societal norms regarding aging and independence. The adoption of technology-enabled services like remote health monitoring, AI-driven care systems, and smart facility management tools is also beginning to gain momentum in the region, particularly in Northern and Western Europe.

However, growth may vary across the continent due to regional disparities in funding, regulation, and healthcare integration. As demand continues to rise and expectations for quality, privacy, and personalization increase, the European assisted living market is expected to mature further, with more innovative care models and diversified service offerings emerging over the next decade.

The Japan Assisted Living Market

Japan’s assisted living market is projected to reach approximately USD 4.7 billion in 2025, reflecting the country's urgent and growing need for structured eldercare services. With one of the highest aging populations in the world and over 28 percent of its citizens aged 65 and above, Japan is facing growing pressure to provide sustainable long-term care solutions. Assisted living has emerged as a preferred option for elderly individuals who require daily support but wish to maintain a degree of independence outside of hospital or nursing home settings.

The market is shaped by a unique blend of cultural transition where traditional family-based eldercare is gradually giving way to professional care services due to shrinking family sizes, urban migration, and the rise of dual-income households. Facilities across Japan are focusing not only on basic assistance but also on lifestyle enrichment, wellness programs, and high standards of hygiene and privacy.

The market is expected to grow at a compound annual growth rate of 7.1 percent from 2025 to 2034, driven by a combination of government policy support, advanced healthcare infrastructure, and strong adoption of eldercare technologies. Japan leads globally in integrating robotics, artificial intelligence, and sensor-based monitoring systems within senior care environments which helps address persistent labor shortages in the healthcare sector.

Additionally, ongoing efforts by both public and private players to expand mid-range and premium assisted living communities especially in urban centers like Tokyo, Osaka, and Yokohama are further boosting market momentum. The rising demand for memory care units, specialized dementia programs, and technology-assisted safety features is also shaping the next generation of assisted living facilities in Japan, positioning the country as a global model for eldercare innovation.

Global Assisted Living Market: Key Takeaways

- Market Value: The global assisted living market size is expected to reach a value of USD 189.9 billion by 2034 from a base value of USD 105.5 billion in 2025 at a CAGR of 6.8%.

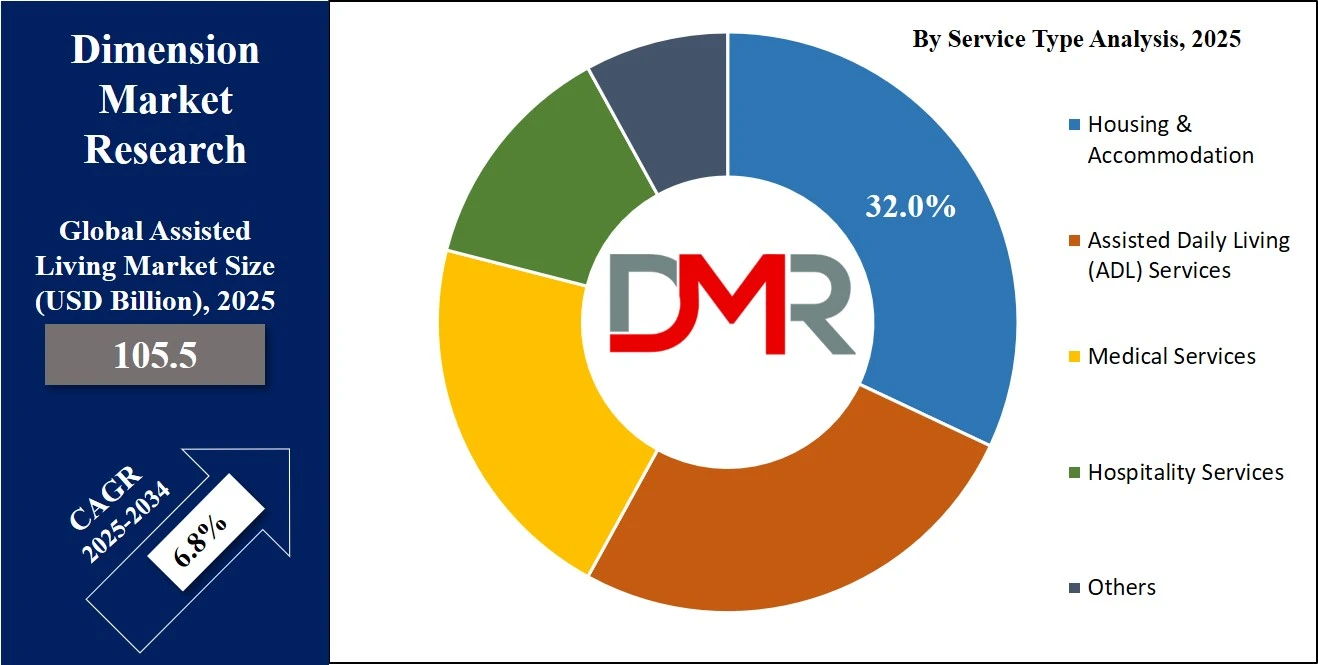

- By Service Type Segment Analysis: Housing & Accommodation services are anticipated to dominate the service type segment, capturing 32.0% of the total market share in 2025.

- By Resident Type Segment Analysis: Elderly (Above 65 Years) residents are poised to consolidate their dominance in the resident type segment, capturing 74.0% of the total market share in 2025.

- By Facility Type Segment Analysis: Standalone Assisted Living Facilities are expected to maintain their dominance in the facility type segment, capturing 41.0% of the total market share in 2025.

- By Payment Model Segment Analysis: Private Pay (Out-of-Pocket) payment model will lead in the payment model segment, capturing 60.0% of the market share in 2025.

- By Technology Integration Segment Analysis: Traditional Facilities will lead the technology integration segment, capturing 52.0% of the market share in 2025.

- By Level of Care Segment Analysis: Basic Care level will dominate the level of care segment, capturing 46.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global assisted living market landscape with 42.5% of total global market revenue in 2025.

- Key Players: Some key players in the global assisted living market are Brookdale Senior Living, Atria Senior Living, Sunrise Senior Living, Life Care Services, Five Star Senior Living, Holiday Retirement, Erickson Senior Living, Capital Senior Living, Enlivant, Senior Lifestyle Corporation, Pacifica Senior Living, Belmont Village Senior Living, and Others.

Global Assisted Living Market: Use Cases

- Memory Care Units for Alzheimer’s and Dementia Patients: One of the most prominent use cases in the assisted living market is the provision of memory care services tailored specifically for seniors with Alzheimer’s disease and other forms of dementia. These specialized units are equipped with secured environments, structured routines, and staff trained in cognitive support. Memory care facilities focus on reducing confusion, preventing wandering, and enhancing residents' quality of life through cognitive therapy, sensory stimulation, and memory-enhancing activities. With the global increase in dementia-related conditions, especially among aging populations in North America, Europe, and parts of Asia, memory care has become a core offering in assisted living communities. This use case highlights the demand for elderly care services, cognitive health management, and 24-hour supervision in a controlled yet comfortable residential setting.

- Post-Acute Recovery and Transitional Care Services: Assisted living facilities are serving as intermediate care settings for seniors recovering from surgeries, strokes, or other acute medical episodes. These transitional care programs support individuals who are not ready to return home but no longer need hospital-level care. Facilities offer physical therapy, medication supervision, daily living assistance, and wellness monitoring in a homelike environment. This use case is especially valuable in reducing hospital readmission rates and improving recovery outcomes. It meets the growing demand for short-term senior care, rehabilitation support, and post-hospitalization care across aging populations globally. In regions where healthcare infrastructure is strained, such as parts of Southeast Asia and Latin America, these services act as a vital bridge between hospital discharge and home-based recovery.

- Integrated Wellness Programs for Active Seniors: Many modern assisted living communities now focus on proactive, holistic wellness, offering structured programs that promote mental, physical, and social well-being. These include on-site fitness centers, yoga and meditation sessions, nutrition planning, chronic disease prevention workshops, and social clubs. Such programs help residents maintain independence, reduce the risk of isolation, and manage conditions like diabetes, hypertension, and arthritis. Facilities that prioritize personalized wellness, healthy aging, and independent senior living are seeing strong market demand, especially from younger seniors who are lifestyle-conscious and value community engagement. This use case reflects a major shift in consumer expectations where assisted living is seen not just as eldercare but as a lifestyle solution for the aging population.

- Technology-Enabled Remote Monitoring and Safety Systems: The integration of technology in assisted living is enabling smarter, safer, and more efficient care. Facilities are using wearable health monitors, fall detection systems, telemedicine platforms, and AI-powered alert systems to provide continuous, real-time oversight of residents’ health and safety. This is especially useful for individuals with mobility limitations, chronic health conditions, or memory impairments. Remote health tracking allows caregivers to respond faster to emergencies and reduces the burden on limited staff. The adoption of smart eldercare, remote senior monitoring, and IoT in assisted living is expanding globally, particularly in high-tech markets like the U.S., Japan, and Germany. This use case supports higher operational efficiency, improved quality of care, and peace of mind for both residents and their families.

Global Assisted Living Market: Stats & Facts

Global Aging Population and Market Potential

- The global population aged 65 years and older is projected to grow from 830 million in 2024 to over 1.7 billion by 2054. (UN, 2024)

- By 2050, one in six people worldwide will be aged 65 or older, compared to one in eleven in 2019. (UN DESA, 2023)

- People aged 80 years and above will more than triple globally between 2020 and 2050, reaching 426 million. (WHO, 2023)

- In 2020, the number of people aged 60 and older surpassed children under five for the first time in history. (WHO, 2023)

- From 2015 to 2050, the share of people aged 60+ is expected to double from 12% to 22% globally. (WHO, 2023)

- By 2075, the number of people aged 65+ will likely exceed 2.2 billion. (UN, 2024)

- By 2050, over 80% of the world’s elderly population will live in low- and middle-income countries. (WHO, 2023)

Regional Aging Trends

- In Japan, 28.2% of the population was aged 65 or older as of 2020—the highest globally. (PRB, 2020)

- Europe’s dependency ratio is projected to rise from 46.6% in 2010 to 64.7% by 2030. (UN, 2022)

- In Australia, one in six people were aged 65+ in 2016, and this is expected to rise to 25% by 2096. (Australian Government, 2020)

- The number of people aged 65 and over in the U.S. is projected to grow from 58 million in 2022 to 82 million by 2050. (PRB, 2022)

- In Canada, over 46 million older adults preferred to age in place as of 2014, with numbers expected to reach 74 million by 2030. (Canadian Government, 2020)

Assisted Living & Long-Term Care Demand

- Approximately 9 million Americans aged 65+ required long-term care services in 2006, with estimates rising to 27 million by 2050. (U.S. Department of Health, 2020)

- About 70% of long-term care in the U.S. is provided by unpaid caregivers, such as family and friends. (U.S. HHS, 2020)

- Four in ten adults aged 65+ will require nursing home care at some point in their lives. (U.S. CDC, 2020)

- As of 2016, nearly 250,000 Australians used residential or home-based aged care, a 31% rise from the previous decade. (Australian Institute of Health and Welfare, 2016)

- The aged care sector in Australia is expected to account for 6% of the national GDP by 2060. (Australian Government Treasury, 2020)

- In OECD countries, public expenditure on formal long-term care consistently remains around 1% of GDP. (UN DESA, 2023)

- A global deficit of 13.6 million long-term care workers was reported in 2023. (UN DESA, 2023)

Gender, Health, and Life Expectancy

- Globally, women make up 56% of the population aged 65 and above and tend to outlive men by an average of 5.4 years. (UN, 2023)

- As of 2020, global life expectancy was 73.3 years — 70.8 for men and 75.9 for women. (UN Population Division, 2022)

- The global median age is expected to rise from 30.4 years in 2020 to 37.9 years by 2050. (UN, 2022)

Emerging Markets & Future Growth

- Between 1990 and 2010, the global population aged 60+ increased by 56%, from 490 million to 765 million. (UNFPA, 2012)

- By 2050, older people will account for 80% of all residents in low- and middle-income countries. (WHO, 2023)

- China and India are projected to experience the most significant increases in elderly populations, surpassing 300 million and 200 million respectively by 2050. (UN, 2022)

- The global average retirement age is expected to rise by two years in the next two decades due to longer life expectancy. (OECD, 2023)

- Urban elderly populations are growing three times faster than rural ones in most developing nations. (UN-Habitat, 2022)

Memory Care and Special Needs

- One in nine people aged 65+ worldwide is living with Alzheimer’s or a related form of dementia. (WHO, 2022)

- Dementia is currently the seventh leading cause of death globally and one of the major causes of disability in older people. (WHO, 2023)

- The global cost of dementia care is projected to exceed USD 2.8 trillion by 2030. (WHO, 2023)

Global Assisted Living Market: Market Dynamics

Global Assisted Living Market: Driving Factors

Rising Aging Population and Shifting Demographics

The continuous increase in the global elderly population is one of the primary factors fueling the demand for assisted living facilities. According to the United Nations, by 2050, one in six people globally will be aged 65 or older. This surge is creating a significant demand for long-term care services, especially among those who seek assistance with daily activities but wish to avoid institutional nursing care. Additionally, the reduction in traditional family caregiving setups and the rising number of single seniors further elevate the need for structured senior housing options and personal care assistance.

Preference for Independence with Supportive Care

Modern seniors are more active and value their independence, but many still require help with tasks such as medication management, meal preparation, and mobility. Assisted living bridges this gap by offering supportive services within a private, home-like environment. The growing demand for independent retirement living that includes access to emergency response systems, health checkups, and wellness activities supports the expansion of this market. This balance between freedom and care is a major driver behind the growing occupancy in assisted living facilities across developed regions.

Global Assisted Living Market: Restraints

High Cost of Assisted Living Services

The cost of assisted living remains a key barrier, especially in regions without substantial insurance coverage or government support. In countries like the United States, monthly expenses can range from USD 4,000 to USD 6,000, making it unaffordable for a large segment of the elderly population. Limited reimbursement from Medicaid and lack of widespread long-term care insurance further restrict access. This financial burden can lead families to delay or avoid placing loved ones in retirement care facilities, thereby impacting overall market growth.

Regulatory Variability and Licensing Challenges

Unlike acute care settings, assisted living is regulated differently across countries and even within states in federal systems. This lack of uniformity in licensing, staffing standards, and safety protocols leads to inconsistent service quality. In emerging markets, the absence of clear legal frameworks creates operational risks for new entrants. These regulatory barriers hinder international expansion and reduce investor confidence in the eldercare solutions segment, limiting the full potential of global market growth.

Global Assisted Living Market: Opportunities

Expansion in Middle-Income and Emerging Economies

While developed markets are currently leading in assisted living infrastructure, significant opportunity lies in middle-income countries where the elderly population is growing fast, but services are still underdeveloped. Countries such as China, India, Brazil, and South Africa are experiencing demographic shifts and urbanization, leading to a rising need for senior living communities and supportive housing models. Establishing affordable, culturally aligned care models in these regions presents a lucrative growth path for global and regional providers.

Rise of Specialized and Niche Facilities

Demand is growing for facilities that cater to specific needs such as memory care units, LGBTQ+ senior housing, or pet-friendly assisted living. These niche offerings allow operators to differentiate themselves and meet the personalized expectations of modern seniors. Facilities that offer integrated services like spiritual wellness, dietary customization, and holistic therapies are capturing more attention. The trend supports the creation of personalized eldercare environments tailored to diverse lifestyles and preferences, opening new avenues for market innovation.

Global Assisted Living Market: Trends

Integration of Smart Technology and Remote Health Monitoring

Technology is rapidly transforming assisted living environments. Facilities are incorporating IoT devices, remote patient monitoring, and AI-powered analytics to improve care delivery and safety. Wearable health trackers, automated lighting, fall detectors, and virtual care platforms enhance resident well-being while reducing staff workload. This trend reflects the move toward tech-enabled senior care, where digital tools complement human caregiving and allow real-time health insights and emergency response.

Shift toward Wellness-Focused Living Environments

Assisted living is evolving beyond basic care into a more lifestyle-oriented model. Facilities are offering wellness-focused amenities like fitness centers, meditation rooms, organic meal options, art therapy, and social clubs. The trend reflects the growing interest in healthy aging, with an emphasis on mental and physical well-being rather than just medical support. This transformation positions assisted living as a desirable choice for proactive seniors, not just those with declining health.

Global Assisted Living Market: Research Scope and Analysis

By Service Type Analysis

In the global assisted living market, housing and accommodation services are projected to hold the dominant position within the service type segment, accounting for approximately 32.0% of the total market share in 2025. This dominance is primarily due to the foundational nature of residential offerings in assisted living facilities, where seniors are provided with secure, accessible, and private living spaces that ensure safety, comfort, and independence.

These facilities typically offer various living arrangements, including private rooms, shared apartments, or studio setups, equipped with essential amenities tailored for elderly residents. The demand for such accommodation is growing as more seniors, especially in urban settings, seek structured environments that reduce their dependency on family while still offering a sense of autonomy and community living. The built environment often includes safety features like handrails, emergency call systems, and barrier-free access, which are critical for the aging population.

Alongside housing, Assisted Daily Living (ADL) services play a central role in the value proposition of assisted living facilities. These services encompass support with essential day-to-day activities that residents can no longer manage independently. ADLs include help with bathing, grooming, dressing, toileting, mobility assistance, and eating. As individuals’ age or deal with chronic conditions, their ability to perform these tasks can decline, making ADL support one of the most critical components of care.

Facilities offering efficient and compassionate ADL services not only enhance residents’ quality of life but also reduce health risks such as falls, infections, and malnutrition. The importance of ADL services is expected to rise in the coming years, especially with the growing number of elderly individuals requiring personalized and dignified care that bridges the gap between full independence and medical supervision.

By Resident Type Analysis

In the resident type segment of the global assisted living market, individuals aged above 65 years are expected to maintain a dominant position, accounting for approximately 74.0% of the total market share in 2025. This strong presence is primarily driven by the steady growth in the global aging population and the growing need for structured support among seniors who face challenges with mobility, chronic conditions, and cognitive decline.

Many older adults prefer assisted living facilities because they offer a balance between independent living and access to essential care services. The appeal lies in the availability of personal care assistance, health monitoring, social interaction, and secure living environments that enhance both quality of life and peace of mind. As life expectancy continues to rise and traditional family caregiving structures decline, especially in urban and developed regions, the demand for senior-focused assisted living arrangements is expected to remain high.

While elderly residents dominate the market, adults with disabilities aged between 18 and 64 years also represent a notable segment within assisted living facilities. This group includes individuals with physical, intellectual, or developmental disabilities who require daily support but do not need hospitalization or intensive medical care. These residents often benefit from tailored programs that focus on life skills development, vocational training, social engagement, and mobility assistance.

Assisted living facilities catering to this demographic provide an inclusive environment that encourages independence while ensuring safety and consistent support. Though this segment holds a smaller share compared to elderly residents, it is gaining attention as more families seek long-term residential options for younger adults with lifelong care needs, particularly in countries with improved disability rights frameworks and support funding.

By Facility Type Analysis

Standalone assisted living facilities are projected to continue leading the facility type segment of the global assisted living market, holding around 41.0% of the total market share in 2025. These facilities operate independently and are solely focused on providing assisted living services, without being integrated into a broader healthcare system or offering multiple levels of care. Their popularity stems from their ability to provide a specialized, cost-effective, and easily accessible care environment tailored to seniors who require help with daily living activities but do not need intensive medical supervision.

Standalone facilities typically offer private living units, dining services, social and recreational activities, and basic health monitoring. Their relatively lower operational complexity and more flexible service models make them a preferred choice in both urban and suburban areas, especially for middle-income seniors seeking affordable care with a strong sense of community and independence.

On the other hand, Continuing Care Retirement Communities, or CCRCs, represent a more comprehensive model that combines multiple levels of senior care within a single campus, including independent living, assisted living, and skilled nursing care. These communities are designed to allow residents to transition smoothly from one level of care to another as their health needs change, without the need to relocate. This continuity of care appeals to seniors and families looking for long-term stability and peace of mind.

CCRCs typically operate on a larger scale, offering a wide range of amenities such as wellness centers, rehabilitation services, social clubs, and sometimes even on-site clinics or physician offices. While they require higher initial entry fees and monthly costs, CCRCs are gaining popularity, particularly among wealthier retirees who value aging in place with guaranteed access to higher levels of care as needed. Their share in the assisted living market is growing steadily as the demand for flexible and future-ready senior care models continues to rise.

By Payment Model Analysis

The private pay or out-of-pocket payment model is anticipated to dominate the payment model segment of the global assisted living market, accounting for approximately 60.0% of the total market share in 2025. This model relies primarily on personal savings, pensions, or financial contributions from family members to cover the cost of assisted living services. It is the most common form of payment, especially in countries where government support or insurance coverage for assisted living is limited or non-existent.

Many seniors choose private pay options to gain access to higher-quality amenities, greater flexibility in care, and faster admission into preferred facilities without waiting for public approval or subsidies. While this model provides freedom of choice, it often restricts access for lower-income individuals due to the substantial monthly expenses associated with housing, care, meals, and wellness services. As life expectancy increases and more seniors live longer with chronic conditions, affordability under the private pay model is becoming a growing concern in many regions.

In contrast, government funding plays a critical but smaller role in supporting access to assisted living services, particularly for low-income seniors or those with specific health conditions. In several developed countries, such as the United States, Canada, and parts of Europe, public assistance programs like Medicaid, social security benefits, or state-funded eldercare schemes help subsidize costs for eligible individuals. These programs often come with strict eligibility criteria and may only cover limited services or basic levels of care within certified facilities.

In countries with universal healthcare or stronger public welfare systems, government funding may play a more significant role, though assisted living is still generally considered outside the scope of full medical care. While this payment model increases inclusivity and access to essential services, it is often constrained by budget limitations, inconsistent regional policies, and a lack of standardization in service coverage. As demand grows, many governments are under pressure to expand funding options and create more sustainable long-term care financing models.

By Technology Integration Analysis

Traditional facilities are expected to lead the technology integration segment in the global assisted living market, accounting for around 52.0% of the total market share in 2025. These facilities typically rely on conventional care models and manual processes, with limited use of digital systems or smart devices. Their focus remains on delivering basic assisted living services such as housing, meals, and help with daily activities, without significant incorporation of remote monitoring, automation, or health data analytics.

Traditional facilities continue to dominate because they cater to a large base of middle- and low-income seniors, particularly in regions where the adoption of digital health technologies is still in its early stages. Additionally, many smaller operators lack the infrastructure or financial resources to implement advanced technological systems. For residents and families seeking affordable care and human-centered support, traditional facilities often remain the most accessible and familiar option.

Moderate tech-enabled facilities, on the other hand, are steadily gaining market share by integrating select digital tools that improve care efficiency and resident experience. These facilities may utilize electronic medical records, nurse call systems, basic telehealth services, digital medication management platforms, and resident engagement apps. Such technology allows staff to monitor health indicators more efficiently, reduce administrative burdens, and respond to resident needs more quickly.

While not as advanced as high-tech or smart-assisted living centers, these moderately equipped facilities strike a balance between affordability and innovation. They are popular in urban and semi-urban areas where there is greater awareness of the benefits of technology in elder care. Residents and families who value real-time updates, improved safety, and streamlined communication are driving demand for these services, making moderate tech-enabled facilities a crucial transitional phase in the sector’s broader digital transformation.

By Level of Care Analysis

Basic care is expected to dominate the level of care segment in the global assisted living market, capturing approximately 46.0% of the total market share in 2025. This level of care primarily includes support with routine daily living activities such as bathing, dressing, meal preparation, housekeeping, and mobility assistance. It caters to seniors who are generally in stable health but require assistance with non-medical tasks to maintain their independence and quality of life.

Basic care services are widely available, cost-effective, and form the foundation of most assisted living offerings. The high demand for this care level is driven by the growing number of aging adults who wish to avoid institutional care settings but still need regular help to manage everyday activities safely and comfortably. Facilities offering basic care appeal to a broad demographic, especially middle-income seniors seeking affordable and less medically intensive living arrangements.

Intermediate care represents a more advanced level of support within the assisted living continuum, positioned between basic care and skilled nursing. It includes all elements of basic care but adds more involved supervision such as regular health assessments, chronic disease management, medication administration, mobility rehabilitation, and access to on-site medical professionals or nursing staff.

This level of care is essential for residents who have multiple chronic conditions, mild cognitive impairments, or are recovering from surgeries or hospital stays but do not yet require full-time medical or nursing care. The demand for intermediate care is growing as more seniors develop age-related health issues that require closer attention without needing hospitalization. Facilities that offer intermediate care provide a safety net for residents with progressing health needs, ensuring a smoother transition between care levels and promoting aging in place.

The Assisted Living Market Report is segmented on the basis of the following:

By Service Type

- Housing & Accommodation

- Assisted Daily Living (ADL) Services

- Medical Services

- Hospitality Services

- Others

By Resident Type

- Elderly (Above 65 Years)

- Adults with Disabilities (18-64 Years)

- Others

By Facility Type

- Standalone Assisted Living Facilities

- Continuing Care Retirement Communities (CCRCs)

- Integrated Facilities with Hospitals or Clinics

- Home Care/Remote Assisted Living Units

By Payment Model

- Private Pay (Out-of-Pocket)

- Government Funding

- Long-Term Care Insurance

- Others

By Technology Integration

- Traditional Facilities

- Moderate Tech-Enabled

- High-Tech Facilities

By Level of Care

- Basic Care

- Intermediate Care

- Advanced Care

Global Assisted Living Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global assisted living market in 2025, accounting for approximately 42.5% of the total market revenue. This strong regional presence is driven by the region's rapidly aging population, high awareness of senior care options, and a well-established infrastructure of assisted living facilities. The United States, in particular, has a mature market with large-scale operators, private equity investments, and a wide range of care models catering to diverse senior needs.

Favorable reimbursement policies, widespread adoption of healthcare technologies, and a cultural preference for independent living in later life further support market growth. Additionally, the presence of advanced regulatory frameworks and growing demand for memory care, chronic disease support, and lifestyle-oriented senior housing continues to strengthen North America's leadership position in the global landscape.

Region with significant growth

The Asia Pacific region is projected to experience significant growth in the global assisted living market over the coming years, driven by rapid population aging, rising life expectancy, and shifting family dynamics in countries such as China, Japan, India, and South Korea. As traditional multigenerational living arrangements decline due to urbanization and changing social structures, the demand for formal eldercare services is growing sharply.

Additionally, growing middle-class income levels and increased healthcare awareness are encouraging investment in senior living infrastructure and services. Governments in the region are also beginning to implement supportive policies and public-private partnerships to address the needs of their aging populations. Though currently less mature than Western markets, Asia Pacific region represents a high-growth area with strong long-term potential for assisted living providers and investors alike.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Assisted Living Market: Competitive Landscape

The global competitive landscape of the assisted living market is characterized by a mix of large-scale multinational operators, regional providers, and niche players, all striving to capture market share in a rapidly growing and evolving sector. Leading companies such as Brookdale Senior Living, Sunrise Senior Living, and Atria Senior Living dominate in developed markets like the United States through expansive networks, premium service offerings, and strong brand recognition. At the same time, regional operators in Europe, Asia Pacific, and Latin America are expanding their presence by adapting to local cultural expectations and offering more affordable or specialized care models.

Competition is intensifying as players invest in technology integration, memory care services, and lifestyle-based senior housing to differentiate themselves. Mergers, acquisitions, and strategic partnerships are also common as companies seek to scale operations, diversify services, and enter emerging markets. This dynamic competitive environment is driving continuous innovation in care delivery, pricing models, and facility design across the global assisted living landscape.

Some of the prominent players in the global assisted living market are:

- Brookdale Senior Living

- Atria Senior Living

- Sunrise Senior Living

- Life Care Services

- Five Star Senior Living

- Holiday Retirement

- Erickson Senior Living

- Capital Senior Living

- Enlivant

- Senior Lifestyle Corporation

- Pacifica Senior Living

- Belmont Village Senior Living

- Merrill Gardens

- Affinity Living Group

- Gardant Management Solutions

- Frontier Management

- Genesis HealthCare

- Prestige Care

- Benchmark Senior Living

- Watermark Retirement Communities

- Other Key Players

Global Assisted Living Market: Recent Developments

Product Launches

- June 2025: Pegasus Senior Living reopened its Pegasus Landing of Tanglewood community in Houston with a new NASA‑themed assisted living and memory care concept, featuring space-inspired environments like the Gemini Bistro Cafe and Launch Pad Courtyard.

- June 2025: Aspenwood launched pilot deployments of AI-based fall-detection and remote monitoring tools across its 20 communities, marking a step forward in technology-enabled eldercare.

Mergers & Acquisitions

- March 2025: Welltower Inc. completed the acquisition of Oakmonte Village at Davie, a 199-unit assisted living and memory care community, adding a significant senior housing asset in South Florida.

- January 2025: Masonicare merged with United Methodist Homes and acquired Atria Greenridge Place, expanding its service capacity from 4,500 to 7,500 daily patients in Connecticut.

Funding & Investment

- April 2025: Inspiren, an AI-driven senior living care platform, secured USD 35 million in Series A funding to expand its integrated care ecosystem and scale across more facilities.

- April 2025: Equitage Ventures announced a new USD 47.3 million tech-focused investment fund aimed at backing AgeTech and senior living innovations globally.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 105.5 Bn |

| Forecast Value (2034) |

USD 189.9 Bn |

| CAGR (2025–2034) |

6.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 37.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Housing & Accommodation, Assisted Daily Living Services, Medical Services, Hospitality Services, Others), By Resident Type (Elderly Above 65 Years, Adults with Disabilities 18–64 Years, Others), By Facility Type (Standalone Assisted Living Facilities, Continuing Care Retirement Communities, Integrated Facilities with Hospitals or Clinics, Home Care or Remote Assisted Living Units), By Payment Model (Private Pay Out-of-Pocket, Government Funding, Long-Term Care Insurance, Others), By Technology Integration (Traditional Facilities, Moderate Tech-Enabled, High-Tech Facilities), and By Level of Care (Basic Care, Intermediate Care, Advanced Care) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Brookdale Senior Living, Atria Senior Living, Sunrise Senior Living, Life Care Services, Five Star Senior Living, Holiday Retirement, Erickson Senior Living, Capital Senior Living, Enlivant, Senior Lifestyle Corporation, Pacifica Senior Living, Belmont Village Senior Living, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global assisted living market size is estimated to have a value of USD 105.5 billion in 2025 and is

expected to reach USD 189.9 billion by the end of 2034.

The US assisted living market is projected to be valued at USD 37.7 billion in 2025. It is expected to

witness subsequent growth in the upcoming period as it holds USD 65.8 billion in 2034 at a CAGR of

6.4%.

North America is expected to have the largest market share in the global assisted living market, with a

share of about 42.5% in 2025.

Some of the major key players in the global assisted living market are Brookdale Senior Living, Atria

Senior Living, Sunrise Senior Living, Life Care Services, Five Star Senior Living, Holiday Retirement,

Erickson Senior Living, Capital Senior Living, Enlivant, Senior Lifestyle Corporation, Pacifica Senior Living,

Belmont Village Senior Living, and Others.

The market is growing at a CAGR of 6.8 percent over the forecasted period.