Market Overview

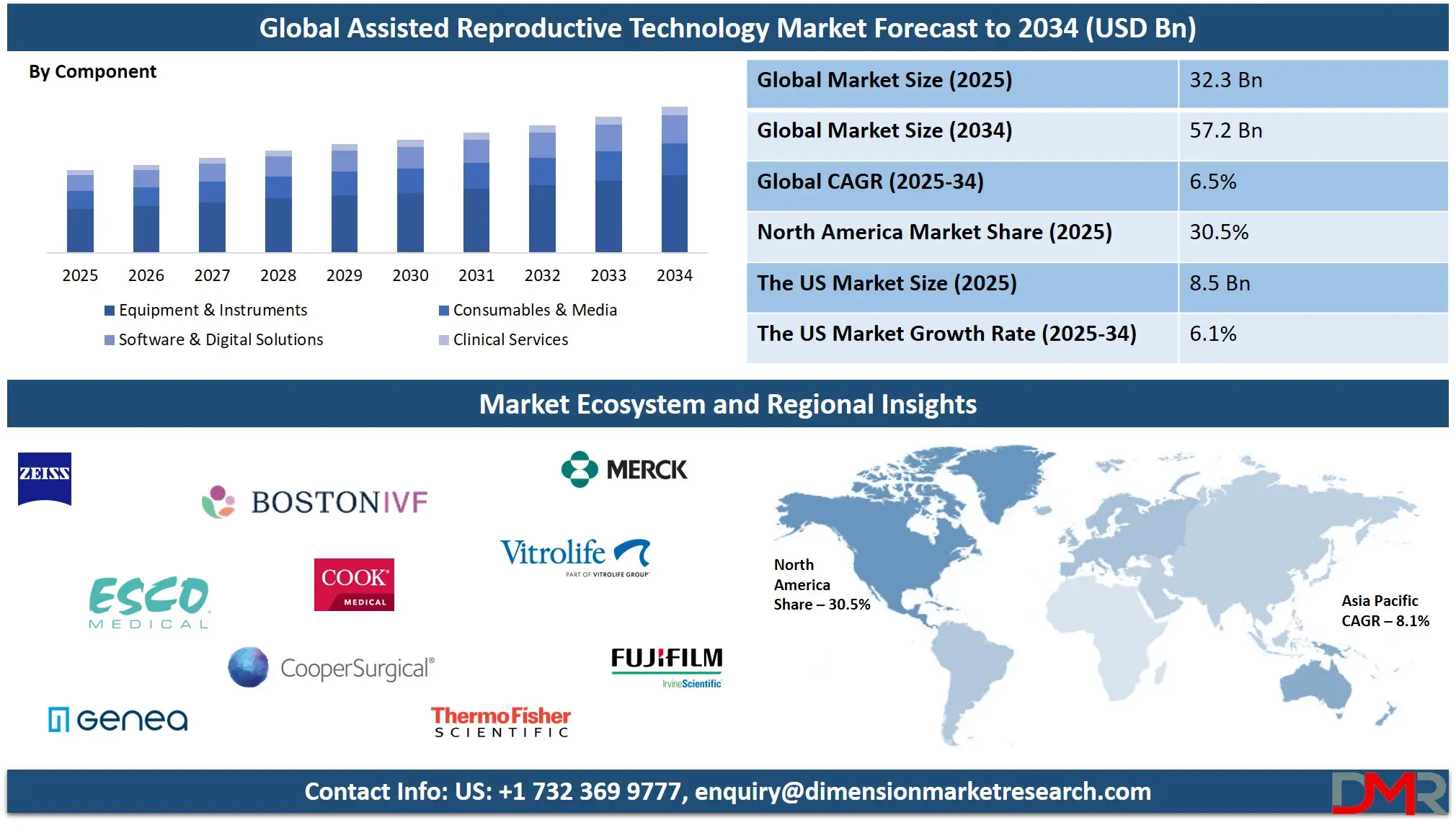

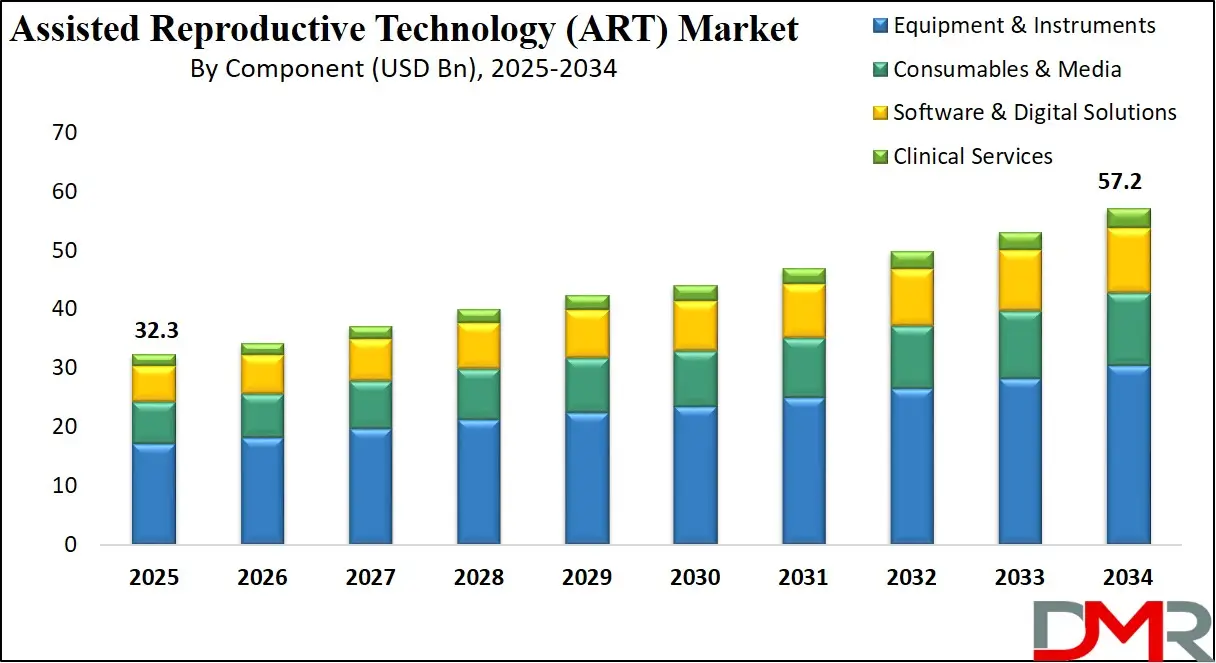

The Global Assisted Reproductive Technology Market size is projected to reach USD 32.3 billion in 2025 and grow at a compound annual growth rate of 6.5% to reach a value of USD 57.2 billion in 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Assisted Reproductive Technology (ART) refers to a group of medical techniques designed to address infertility and help individuals or couples conceive. Core procedures include in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), intrauterine insemination (IUI), egg or sperm donation, surrogacy, and cryopreservation. ART has evolved into a critical segment of modern healthcare, combining reproductive biology, genetics, and advanced medical equipment to improve pregnancy success rates.

Growing lifestyle-related health issues, delayed parenthood, and environmental factors have increased infertility rates worldwide, fueling demand for ART services. Advances in genetic screening, embryo selection, and cryopreservation technologies have significantly improved treatment outcomes, while fertility preservation options such as egg and embryo freezing are gaining acceptance among younger populations planning for future parenthood. Rising social awareness, improved healthcare infrastructure, and supportive government initiatives in many regions are strengthening the adoption of ART solutions.

The market has also seen notable developments in automation and artificial intelligence, such as AI-powered embryo assessment tools and more efficient laboratory systems, which enhance precision and reduce time-to-pregnancy. Additionally, strategic partnerships among fertility clinics, pharmaceutical companies, and equipment manufacturers are fostering innovation and expanding access to treatments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these advancements, challenges persist, including high treatment costs, regulatory differences across countries, and ethical debates surrounding practices like surrogacy and genetic modification. Nevertheless, ART continues to gain global acceptance as a vital healthcare service, with ongoing research, technology integration, and supportive policies expected to sustain its growth trajectory.

The US Assisted Reproductive Technology Market

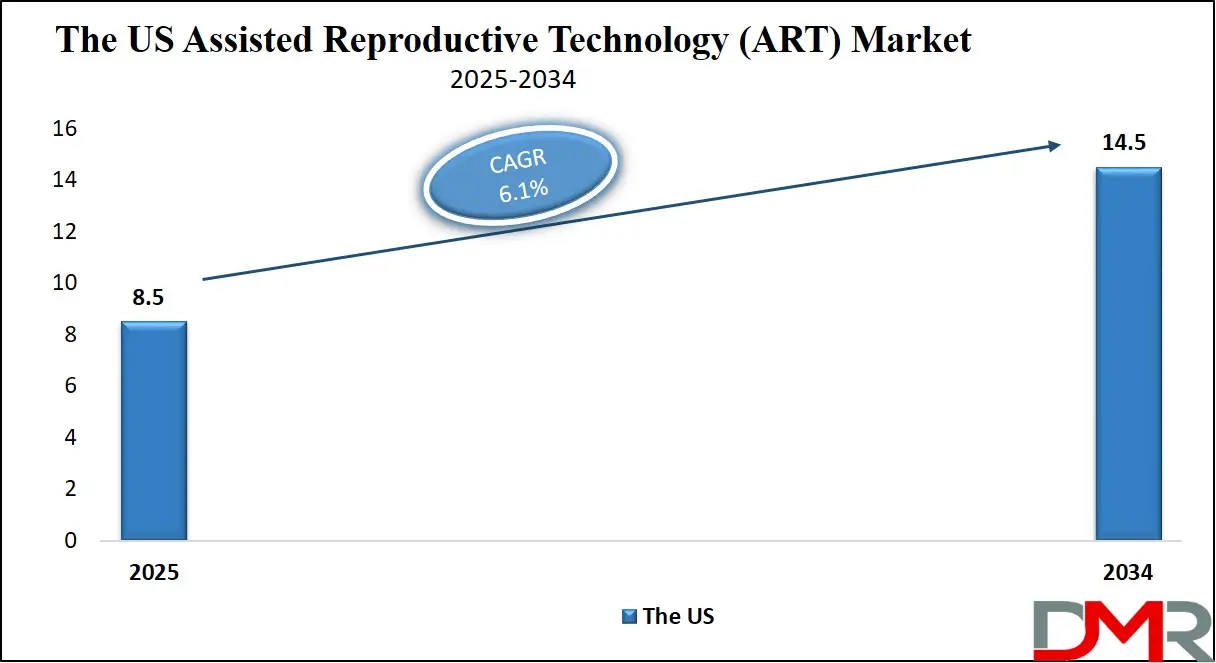

The US Assisted Reproductive Technology Market size is projected to reach USD 8.5 billion in 2025 at a compound annual growth rate of 6.1% over its forecast period.

The US ART market benefits from a well-established healthcare system, a high density of fertility clinics, and strong technological innovation. Growing awareness of fertility preservation and lifestyle factors driving infertility has increased demand for IVF, genetic testing, and cryopreservation services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Insurance coverage for fertility treatments is improving in several states, which is expanding accessibility. While ethical debates and high treatment costs remain challenges, partnerships between research institutions and private providers, along with investments in advanced lab techniques, are reinforcing the U.S. position as a global leader in ART innovation.

Europe Assisted Reproductive Technology Market

Europe Assisted Reproductive Technology Market size is projected to reach USD 12.6 billion in 2025 at a compound annual growth rate of 6.3% over its forecast period.

Europe represents one of the most mature ART markets globally, supported by robust medical infrastructure, experienced practitioners, and relatively high public awareness of reproductive health. Many European countries provide partial or full insurance coverage or public funding for ART procedures, helping to make treatments more accessible. The region is also known for rapid adoption of advanced techniques such as embryo screening and improved cryopreservation. However, differences in national regulations, ethical concerns, and varying cost structures across countries create complexity. Europe’s balanced mix of public support and private innovation positions it as a key driver in the global ART landscape.

Japan Assisted Reproductive Technology Market

Japan Assisted Reproductive Technology Market size is projected to reach USD 1.6 billion in 2025 at a compound annual growth rate of 7.1% over its forecast period.

Japan’s ART market is shaped by a low fertility rate and an aging population, prompting social and governmental support for fertility treatments. Increasing acceptance of ART procedures, combined with growing awareness of fertility preservation options, is driving adoption. Japanese clinics are integrating advanced technologies and refining protocols to improve success rates. Nonetheless, challenges persist, including high out-of-pocket expenses, regional disparities in access to clinics, and cultural factors that have historically slowed ART adoption. With ongoing investments in technology and gradual policy support, Japan is emerging as an important contributor to the broader ART market.

Assisted Reproductive Technology (ART) Market: Key Takeaways

- Market Growth: The Assisted Reproductive Technology (ART) Market size is expected to grow by USD 23.0 billion, at a CAGR of 6.5%, during the forecasted period of 2026 to 2034.

- By Component: The Equipment & Instruments is anticipated to get the majority share of the Assisted Reproductive Technology (ART) Market in 2025.

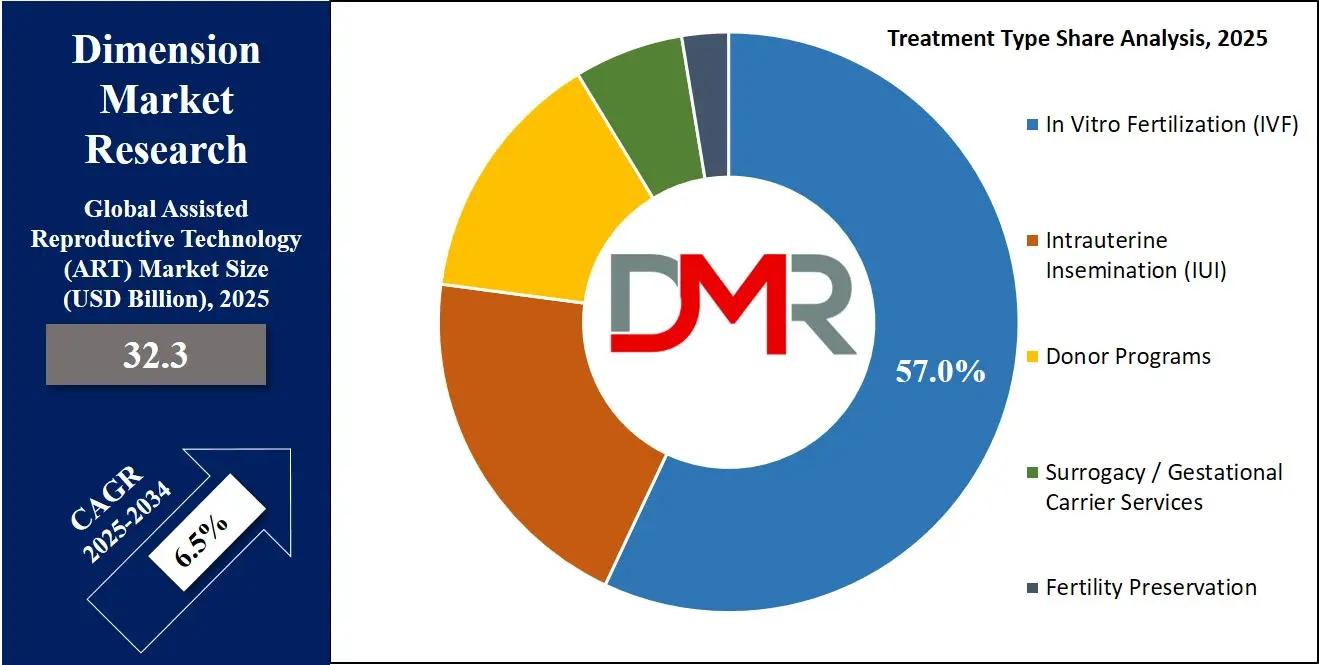

- By Treatment Type: The IVF segment is expected to get the largest revenue share in 2025 in the Assisted Reproductive Technology (ART) Market.

- Regional Insight: Europe is expected to hold a 39.0% share of revenue in the Global Assisted Reproductive Technology (ART) Market in 2025.

- Use Cases: Some of the use cases of Assisted Reproductive Technology (ART) fertility preservation, preimplantation genetic testing, and more.

Assisted Reproductive Technology (ART) Market: Use Cases

- Infertility treatment for heterosexual couples: Helping couples who are unable to conceive naturally via IVF, IUI, or other ART methods.

- Fertility preservation: Freezing eggs, sperm or embryos for future use (e.g., before cancer treatment or for women delaying childbearing).

- Same-sex couples/donor scenarios: Use of donor eggs/sperm or surrogacy so that same-sex couples, single parents, or those with genetic disorders can still have genetically related or partially related children.

- Preimplantation genetic testing/screening: Screening embryos for chromosomal abnormalities or genetic disorders before implantation to increase the likelihood of healthy pregnancy.

Stats & Facts

- (WHO) World Health Organization reports that approximately 1 in 6 people of reproductive age worldwide experience infertility, highlighting ART’s role in global reproductive health.

- (CDC) U.S. Centers for Disease Control and Prevention states that 13.4% of women aged 15–49 in the U.S. experience impaired fecundity, indicating significant domestic demand for ART services.

- (NICHD/NIH) National Institute of Child Health and Human Development notes about 9% of men and 11% of women in the U.S. face fertility challenges, underlining ART’s importance in addressing both male and female infertility.

- (SART/CDC) Society for Assisted Reproductive Technology data show over 95,000 babies born via IVF in 2023 in the U.S., representing about 2.6% of all births, reflecting growing acceptance of ART.

Market Dynamic

Driving Factors in the Assisted Reproductive Technology (ART) Market

Rising Infertility and Changing Lifestyles

Increasing age at first childbirth, obesity, stress, and environmental pollutants are driving infertility rates worldwide. This trend is pushing demand for ART services as individuals and couples seek effective solutions. Expanding awareness campaigns by health organizations and improved access to information are further fueling interest. Social acceptance of ART procedures is also growing, making treatments more mainstream and reducing stigma. Collectively, these factors position ART as a key solution in modern family planning.

Technological Advancements and Clinical Success Rates

Innovations such as AI-driven embryo selection, time-lapse imaging, advanced cryopreservation techniques, and improved stimulation protocols have significantly enhanced ART success rates. These improvements increase patient confidence and attract investments from healthcare providers and fertility centers. Collaborative research between clinics and biotech firms is fostering better tools and methods. Greater efficiency and fewer failed cycles make ART more appealing despite high costs, enhancing its overall market momentum globally.

Restraints in the Assisted Reproductive Technology (ART) Market

High Treatment Costs and Limited Insurance Coverage

ART procedures remain expensive, often requiring multiple cycles to achieve pregnancy. In many countries and U.S. states, insurance coverage is partial or absent, creating financial barriers for prospective parents. This cost burden discourages middle- and lower-income groups from accessing services, thereby restricting overall market growth.

Ethical, Regulatory, and Cultural Challenges

Regulations surrounding donor anonymity, surrogacy, and embryo genetic manipulation vary widely among countries. Ethical debates about embryo handling and genetic testing create uncertainty for providers. Cultural stigma or religious opposition in certain regions can further limit the adoption of ART, resulting in uneven market development across geographies.

Opportunities in the Assisted Reproductive Technology (ART) Market

Emerging Markets and Expanding Infrastructure

Countries in Asia-Pacific, Latin America, and parts of Africa are witnessing growing awareness of fertility options and improving healthcare infrastructure. As governments and private players invest in fertility clinics, untapped populations present significant growth opportunities. International collaborations can bring expertise and technology transfer to these markets.

Integration of Precision Medicine and AI

Personalized stimulation protocols, genetic screening, and AI-assisted embryo grading can improve outcomes and patient satisfaction. These technologies can reduce treatment cycles, lower costs over time, and provide competitive advantages to clinics adopting advanced solutions. Continuous innovation in diagnostics and lab automation further amplifies growth potential.

Trends in the Assisted Reproductive Technology (ART) Market

AI and Automation in Fertility Clinics

Fertility centers are increasingly adopting AI tools for embryo viability prediction, workflow optimization, and decision support. These solutions reduce subjectivity, enhance efficiency, and can lead to higher pregnancy success rates. The trend reflects the broader digitization of healthcare services.

Rising Demand for Fertility Preservation

Social egg freezing and embryo preservation are becoming common among individuals delaying parenthood for career or personal reasons. This trend is also driven by increased cancer survival rates, where fertility preservation before treatment has become standard practice. Growing awareness is expanding ART’s reach beyond immediate infertility treatment.

Impact of Artificial Intelligence in Assisted Reproductive Technology (ART) Market

- Enhanced Embryo Selection: AI algorithms analyze time-lapse images and morphological data to predict embryo viability more accurately than manual grading, improving implantation and live birth rates.

- Personalized Treatment Protocols: Machine learning models optimize ovarian stimulation dosages and cycle planning, tailoring treatments to individual patient profiles for higher efficiency and fewer failed cycles.

- Workflow Automation and Efficiency: AI-driven lab systems automate repetitive tasks such as image analysis and record-keeping, reducing human error, saving time, and improving consistency across clinics.

- Predictive Analytics for Outcomes: Advanced predictive models forecast pregnancy success probabilities and guide decision-making, enabling clinics and patients to make informed choices about procedures.

- Non-Invasive Diagnostics and Screening: AI-powered imaging and genetic analysis tools enable less invasive embryo assessment and genetic screening, minimizing the need for intrusive testing while maintaining accuracy.

Research Scope and Analysis

By Treatment Type Analysis

In 2025, In Vitro Fertilization (IVF) continues to dominate the ART market, accounting for roughly 57% of total treatments. Its leadership stems from its broad applicability across multiple infertility causes and its established clinical track record. Conventional IVF, ICSI, and minimal/natural cycle variants are widely adopted across clinics, benefiting from advancements such as improved culture media, cryopreservation techniques, and preimplantation genetic testing, which collectively enhance success rates and patient confidence. The integration of AI for embryo assessment and workflow optimization further strengthens IVF’s position as the preferred treatment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Meanwhile, fertility preservation, including egg, sperm, and embryo freezing, is the fastest-growing segment. Social trends, such as delaying parenthood, and medical considerations, like oncofertility, have expanded adoption. Improved vitrification methods and increased awareness of preservation options are driving uptake, especially in younger populations and urban centers, creating a strong growth trajectory despite its smaller share relative to IVF.

By Component Analysis

Equipment and instruments dominate the ART component landscape in 2025, representing approximately 53% of market share. Incubators, micromanipulators, and cryo systems remain essential to clinic operations, with many facilities upgrading to incorporate time-lapse embryo monitoring and automated lab solutions. Capital-intensive nature and recurring maintenance contracts contribute to their leading share, while adoption of advanced technologies enhances procedural success rates and clinic reputation.

The software and digital solutions segment, including AI-based embryo selection and clinic management platforms, is the fastest-growing component. Low-cost scalability, rapid deployment, and measurable clinical value drive adoption, especially in smaller clinics seeking efficiency improvements. AI-powered decision support tools and workflow automation reduce errors and improve embryo assessment consistency, supporting faster market expansion even as absolute revenue remains below that of equipment.

By Indication Type Analysis

Female-factor infertility continues as the largest indication segment in 2025, representing around 34% of ART cases. Causes such as ovulatory disorders, tubal disease, endometriosis, and age-related ovarian decline account for a substantial portion of clinic visits. Women typically undergo multiple monitoring sessions and interventions per cycle, which concentrate clinical resources and revenue in this segment. Advanced diagnostics, preimplantation genetic testing, and personalized stimulation protocols reinforce its dominance in both treatment volume and revenue.

Genetic disorders and oncofertility represent the fastest-growing indication. Rising demand for preimplantation genetic testing and fertility preservation before gonadotoxic treatments has expanded this patient segment. Increased awareness and referral integration from oncology clinics, coupled with improved non-invasive testing methods, contribute to higher growth rates even as total share remains smaller than female-factor infertility.

By End User Analysis

Fertility clinics and specialized ART centers are the leading end-user segment in 2025, holding nearly 79% of the market. These clinics concentrate advanced lab facilities, embryology expertise, and full-service treatment offerings, making them the primary point of care for most ART patients. Multi-location networks, consolidation, and investment in cutting-edge technologies like AI-assisted labs strengthen their market share and enable clinics to serve both domestic and international patients efficiently.

The hospital and surgical center segment is the fastest-growing end-user class. Integration of ART services into broader women’s health care and oncology programs allows hospitals to offer one-stop care, combining fertility, obstetrics, and other medical services. Improved financing options, employer benefits, and adoption of hybrid lab models accelerate uptake, supporting rapid expansion even though their share is still below specialized clinics.

The Assisted Reproductive Technology (ART) Market Report is segmented on the basis of the following:

By Treatment Type

- In Vitro Fertilization (IVF)

- Conventional IVF

- Intracytoplasmic Sperm Injection (ICSI)

- Minimal / Natural Cycle IVF

- Intrauterine Insemination (IUI)

- Donor Programs

- Egg Donation

- Sperm Donation

- Embryo Donation

- Surrogacy / Gestational Carrier Services

- Fertility Preservation

- Oocyte Cryopreservation

- Sperm Cryopreservation

- Embryo Cryopreservation

By Component

- Equipment & Instruments

- Incubators

- Micromanipulators

- Cryo Systems

- Consumables & Media

- Software & Digital Solutions

- Clinic Management

- AI for Embryo Selection

- Clinical Services

- Fertility Clinics

- Cryobanks

By Indication Type

- Female-Factor Infertility

- Male-Factor Infertility

- Unexplained Infertility

- Genetic Disorders / Oncofertility

- Elective Fertility Preservation

By End User

- Fertility Clinics / Specialized ART Centers

- Hospitals & Surgical Centers

- Cryobanks & Donor Banks

- Research & Academic Institutes

Regional Analysis

Leading Region in the Assisted Reproductive Technology (ART) Market

Europe is the largest regional market in 2025, holding roughly 39% of ART revenues. This leading position reflects long-standing public and private investment in reproductive health, relatively broad insurance or public funding for ART in several countries, and advanced clinical infrastructure across Western Europe.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Countries such as Spain, the UK, France and Germany have high clinic density, established regulatory frameworks, and sizeable medical tourism flows (Spain is a notable hub for cross-border fertility services). Europe’s clinical expertise in embryo genetics, cryopreservation, and regulated donor programs attracts both domestic and international patients. Additionally, consolidated clinic networks and active OEM vendor presence support rapid technology diffusion (time-lapse, PGT, cryo systems).

Fastest Growing Region in the Assisted Reproductive Technology (ART) Market

Asia-Pacific is the fastest-growing region for the Assisted Reproductive Technology during the forecasted period, driven by rising infertility incidence, improving healthcare infrastructure, expanding clinic networks, increased private financing, and rising social acceptance. Large population bases in China and India, combined with growing middle-class healthcare spending and government initiatives to support fertility services, have prompted rapid clinic expansion and inward investment.

Medical tourism, competitive pricing, and technology transfer (European and U.S. clinic networks entering APAC) further accelerate growth. Additionally, employer benefits and fertility-financing products are gaining traction in urban centres, lowering access barriers. While absolute revenue still lags Europe in 2025, APAC’s clinic counts, procedure growth rates, and private investment dynamics mark it as the region to watch for fastest CAGR.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Assisted Reproductive Technology (ART) (ART) market is highly competitive, driven by a mix of established global players and emerging specialized companies. Leading providers such as CooperSurgical, FUJIFILM Irvine Scientific, Vitrolife, Hamilton Thorne, Cook Medical, and Thermo Fisher Scientific dominate through comprehensive solutions spanning equipment, consumables, and clinical services.

These companies focus on innovation, including AI-assisted embryo selection, advanced culture media, and automated laboratory instruments, to enhance success rates and streamline operations. Regional players like Genea Biomedx and Esco Micro contribute to growth in APAC and emerging markets, while fertility benefits managers such as Progyny integrate clinical access with personalized patient programs.

The market has also seen significant consolidation and investment, exemplified by acquisitions like IVI-RMA’s purchase of ART Fertility Clinics in India and Vitrolife’s acquisition of eFertility, reflecting strategic expansion and technology integration. Overall, competitive dynamics revolve around technological leadership, geographic expansion, and comprehensive service offerings.

Some of the prominent players in the global Assisted Reproductive Technology (ART) are:

- CooperSurgical

- Vitrolife AB

- FUJIFILM Irvine Scientific

- Merck KGaA (EMD Serono)

- Thermo Fisher Scientific

- Genea Biomedx

- Cook Medical

- Esco Micro Pte. Ltd.

- IVFtech ApS

- Hamilton Thorne Ltd.

- Boston IVF

- Ferring Pharmaceuticals

- IKS International

- Nidacon International AB

- Zeiss Group

- Origio

- Cryoport, Inc.

- Kitazato Corporation

- Gynemed GmbH

- Other Key Players

Recent Developments

- In June 2025, KKR-backed IVI RMA moved to acquire ART Fertility Clinics (reported deal value USD 400–450 million), marking a major consolidation and signaling increased private equity interest in high-growth ART markets such as India and the Middle East. The transaction expands IVI’s footprint, brings scale to regional operations, and accelerates technology and protocol standardization across acquired centers.

- In February 2025, Integral Capital completed the acquisition of a majority stake in Embryos, a leading Romanian IVF clinic, reflecting investor appetite for regional clinic platforms. The deal supports clinic expansion, capital improvements in lab infrastructure, and talent development; it also highlights a trend where PE and strategic investors target specialist providers in under-penetrated European and Eastern European markets to scale standards of care and prepare for later consolidation or international partnerships.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 32.3 Bn |

| Forecast Value (2034) |

USD 57.2 Bn |

| CAGR (2025–2034) |

6.5% |

| The US Market Size (2025) |

USD 8.5 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Treatment Type (In Vitro Fertilization (IVF), Intrauterine Insemination (IUI), Donor Programs, Surrogacy / Gestational Carrier Services, and Fertility Preservation), By Component (Equipment & Instruments, Consumables & Media, Software & Digital Solutions, and Clinical Services), By Indication Type (Female-Factor Infertility, Male-Factor Infertility, Unexplained Infertility, Genetic Disorders / Oncofertility, and Elective Fertility Preservation), By End User (Fertility Clinics / Specialized ART Centers, Hospitals & Surgical Centers, Cryobanks & Donor Banks, and Research & Academic Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Assisted Reproductive Technology Market?

▾ The Global Assisted Reproductive Technology (ART) Market size is expected to reach a value of USD 32.3 billion in 2025 and is expected to reach USD 57.2 billion by the end of 2034.

Which region accounted for the largest Global Assisted Reproductive Technology Market?

▾ Europe is expected to have the largest market share in the Global Assisted Reproductive Technology (ART) Market, with a share of about 39.0% in 2025.

Who are the key players in the Global Assisted Reproductive Technology Market?

▾ Some of the major key players in the Global Assisted Reproductive Technology (ART) Market are Vitrolife AB, FUJIFILM Irvine Scientific, Merck, and others

What is the growth rate in the Global Assisted Reproductive Technology Market?

▾ The market is growing at a CAGR of 6.5 percent over the forecasted period.

How big is the Assisted Reproductive Technology (ART) Market in the US?

▾ The Assisted Reproductive Technology (ART) Market in the US is expected to reach USD 8.5 billion in 2025.