Market Overview

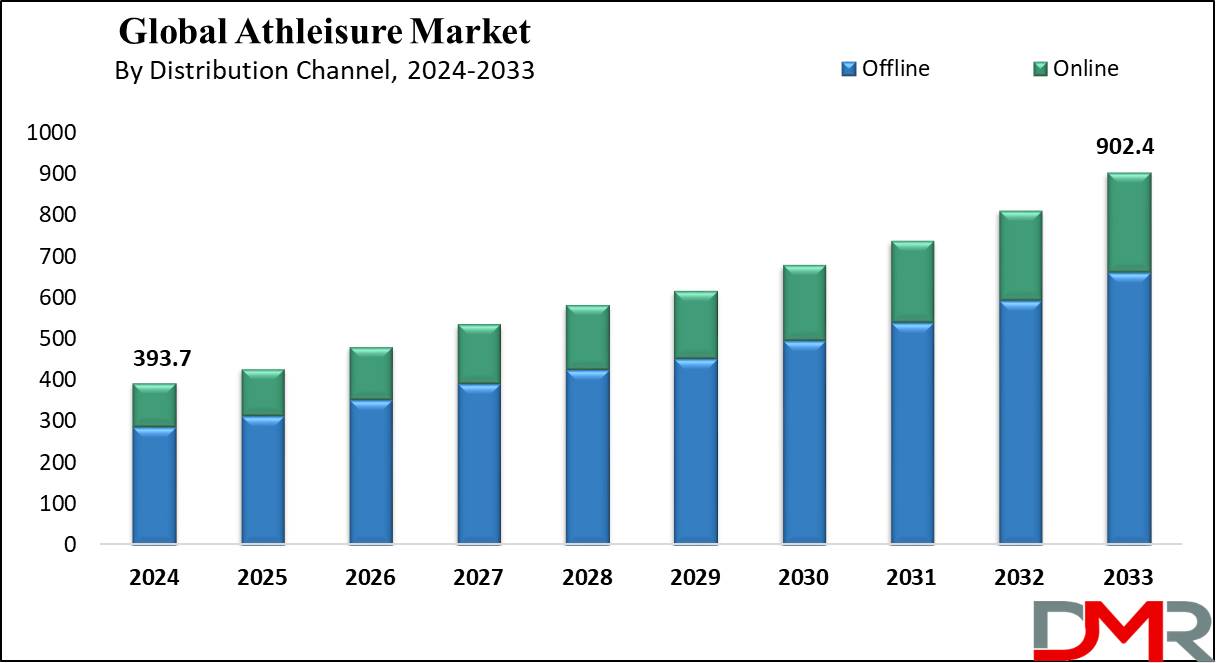

The Global Athleisure Market size is expected to reach a value of USD 393.7 billion in 2024, and it is further anticipated to reach a market value of USD 902.4 billion by 2033 at a CAGR of 9.7%.

The global athleisure market represents a relatively emerging segment of designer fashion meets functionality. It combines activewear with casual, comfortable designs that appeal to a broad demographic. Trends in health and wellness, plus the comfort and versatility of the market, have driven growth in the industry. The rise in active lifestyle apparel has also contributed to this growth, as consumers seek versatile clothing suitable for both workouts and everyday wear.

Today, athleisure is not restricted to workouts alone; it assumes a more fashion-forward category worn daily. Major market players such as Nike, Adidas, and Lululemon Athletica Inc. had taken this as the right opportunity to sell kitted products where performance and style were combined. The growing preference of consumers towards comfortable and functional clothing is the main chain for such a huge rise in the market. Social media and celebrity trends have also made a major contribution by raising demand for athleisure, particularly performance wear that blends fashion and function.

The global size of the athleisure market is poised for robust growth in CAGR, whereby the products offered by the industry will be an intrinsic part of both fashion trends and the growing drive toward an active lifestyle. Adding to that, sustainability has become a crucial factor, in the sense that most consumers prefer wearing clothes for athleisure made from eco-friendly activewear materials.

This is most likely to be driven further ahead using the increasing use of recycled fabrics and sustainable means of production. With the growth rate being quite great, the athleisure market continues to break down conventional barriers between activewear and fashion, while innovations in

Sustainable Marine Fuel highlight the broader shift toward eco-friendly practices across industries.

The US Athleisure Market

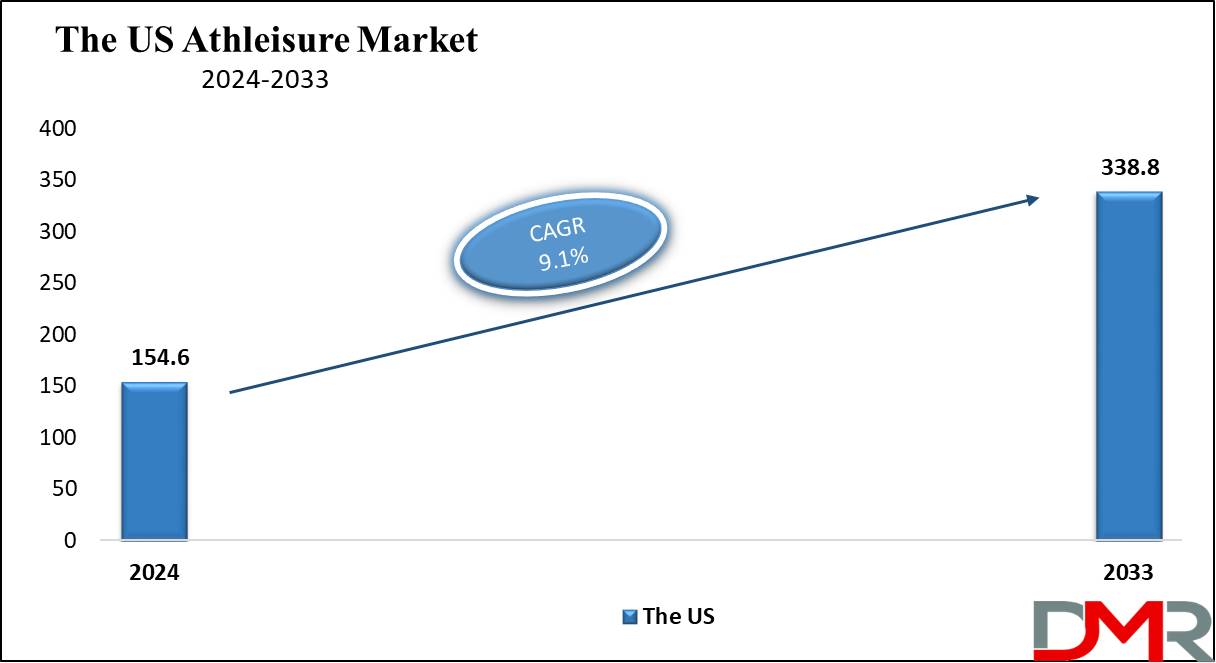

The US

Athleisure Market is projected to be

valued at USD 154.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 338.8 billion in 2033 at a

CAGR of 9.1%. The U.S. accounts for one of the most dominant regions in the global athleisure industry, where the demand for comfortable versatile clothing is constantly rising.

The U.S. is showing a greater market trend toward an inclination where people have a preference for a more fitness-oriented lifestyle and want to wear clothes that would seamlessly transition easily from the gym to wear and about. Major athleisure brands, such as Lululemon Athletica and Nike, remain in the lead of the market, aside from their innovative products, also through strong branding strategies.

Key market trends in the U.S. include an upsurge in sustainable athleisure products, especially with growing eco-consciousness among consumers regarding their choice of apparel. Organic cotton, recycled material, and other sustainable fiber-made athleisure are gaining momentum. This corresponds to the development of the global fashion industry, which contributes to the improvement of environmental sensitivity through eco-friendly manufacturing processes.

The U.S. market trends are also indicative of this powerhouse in high-end athleisure, where an increasing desire for quality fabrics, better fits, and high-class design is influencing demand. Growth in the U.S. shows a growth pace toward durable and multi-potential clothes.

The second major reason contributing to the development of the U.S. athleisure market is e-commerce, where it is quite convenient for customers to scan through different types of athleisure merchandise and purchase them from the comfort of their own homes. The distribution channel segment continues to be dominated by brand websites and online retailers such as Amazon. These insights clearly show not only a surge in demand but also a preference for athleisure by the U.S. consumer, for whom the market is expanding incessantly.

Key Takeaways

- Global Market Value: The Global Athleisure Market size is estimated to have a value of USD 393.7 billion in 2024 and is expected to reach USD 902.4 billion by the end of 2033.

- The US Market Value: The US Athleisure Market is projected to be valued at USD 338.8 billion in 2033 from a base value of USD 154.6 billion in at a CAGR of 9.1%.

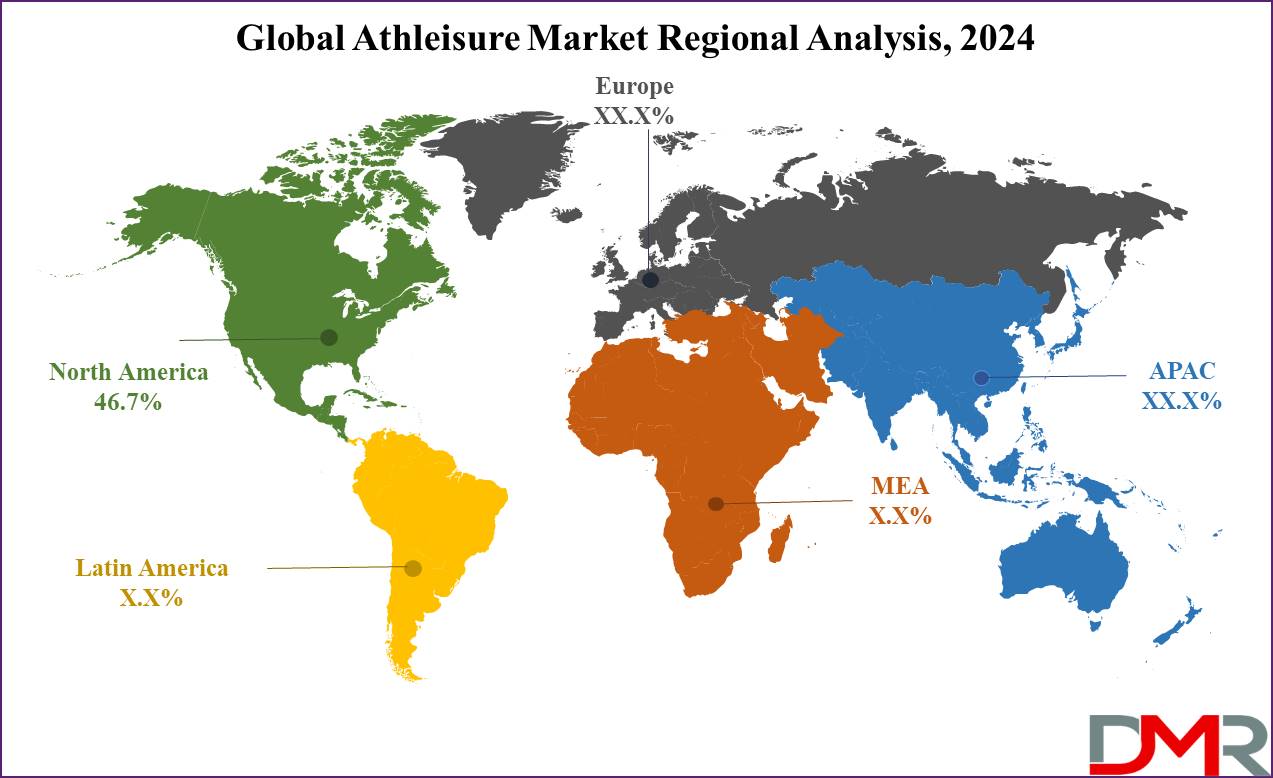

- Regional Analysis: North America is expected to have the largest market share in the Global Athleisure Market with a share of about 46.7% in 2024.

- By Product Segment Analysis: Shirts and T-shirts are projected to dominate this segment with 46.7% of the market share in 2024.

- By Distribution Channel Segment Analysis: The offline distribution channel is anticipated to dominate the global athleisure market with 73.1% of the market share in 2024

- Key Players: Some of the major key players in the Global Athleisure Market are Nike Inc., Adidas AG, Lululemon Athletica Inc., Puma SE, Under Armour Inc., Reebok International Ltd., Gymshark, and many others.

- Global Growth Rate: The market is growing at a CAGR of 9.7 percent over the forecasted period.

Use Cases

- Work-from-Home Wear: The shift to remote working has driven the demand for comfortable and stylish athleisure clothing. Consumers prefer casual apparel that is professional enough for virtual meetings but comfortable enough for home settings.

- Fitness & Sports: Athleisure is worn for gym workouts, yoga sessions, and running. As people show more interest in health and fitness, it has become an essential part of activewear.

- Casual Daily Wear: Athleisure is worn daily as casual wear. Consumers love it because it provides sufficient comfort and fashionable designs that easily fit into their daily schedules.

- Travel Wear: Athleisure, offers comfort for traveling is availed and because of this it has gained much appeal for any long-distance flights or road trips. These lightweight full-stretch fabrics are flexible through long journeys.

Market Dynamic

Trends

Sustainability in Athleisure

There is a considerable trend toward eco-friendly and sustainable materials in the athleisure market. Several brands are using more recycled material and organic products for their makeup so that consumers can answer the consistent demand for 'green' garments. Using manufacturing materials like these meets the expectations of customers and may also create brand loyalists, thus enabling the growth of the market. Then again, sustainable athleisure emerges from the perspective of international social movements that insist on environmental protection, thus influencing future product lines.

Influence of Social Media

Social networking sites give the required impetus to trends related to the athleisure market. The social media marketing of brands reaches their audiences effectively to strive and showcase new collections, showing how they fit into one's life. It influences their lifestyles while creating a community over athleisure with influencer partnerships and user-generated content, cautiously encouraging consumer participation. This type of trend increases brand awareness and contributes to shaping consumer preference, hence improving sales and market share.

Growth Drivers

Health and Wellness Awareness

The rising awareness among people regarding health and wellness has proved to be one of the major catalysts for growth in the athleisure market. Comfortable and versatile attire required for increasingly active lifestyles fuels demand. In addition, athleisure wear is the perfect blend of style and functionality, making it perfect not only for workouts but also whenever casual wear is desired. Such shifts in consumer attitude go a long way in increasing sales within the industry.

E-commerce Expansion

The rapid growth in e-commerce has reshaped the distribution channel for athleisure products. Online shopping combines convenience and accessibility by providing an opportunity to browse and purchase products from the comfort of a home. This has mainly helped the premium brands, as people are more likely to shift toward purchasing better quality athleisure products online. E-commerce platforms offer greater market reach and superior customer interaction, therefore driving overall growth in the market.

Growth Opportunities

Emerging Markets

New emerging economies have tremendous prospects for the athleisure market. With improving disposable incomes and urbanization, active lifestyles of fitness and wellness are increasingly becoming a part of more consumers. Companies can leverage this by building regionally designed marketing strategies along with product offerings to win new customers in these economies.

Product Innovation

More athleisure products include continuous innovation, offering immense growth opportunities. Companies can invest in research and development to invent advanced fabrics, designs, and features that enhance product performance and comfort. Innovations such as moisture-wicking, anti-odor, and temperature-regulation technologies can serve to differentiate products and make them more interesting for a wider customer base, contributing to further market growth.

Restraints

Price Sensitivity

While the increased demand for Athleisure products is on the rise, it is not out of the clutches of price sensitivity in price-sensitive markets, as customers would prefer cheap merchandise over a high-end product. This could be a restraining factor for growth in the premium segment. The price sensitivity will clearly change the market positioning of athleisure and hence needs to be balanced with quality and affordability.

Competition from Fast Fashion

Fast fashion segregates an effect that is quite contrary to the predictive elements of the athleisure market. When fast-fashion brands can provide trend-driven, affordable options, then budget-friendly customers turn toward them. The competition is likely to saturate the market and drive established brands to reconsider their adjusted pricing strategies, impacting their profitability and market position.

Research Scope and Analysis

By Product

Shirts and T-shirts are projected to dominate the product segment in the global athleisure market as it holds 46.7% of market share in 2024. It is due to this versatility, comfort, and general appeal that shirts and T-shirts continue to rule the roost in the global market segment pertaining to athleisure. These garments seamlessly combine athletic functionality and everyday fashion, making them perfect to wear from workouts to casual events.

As comfort increasingly plays a bigger role in consumers' choices, T-shirts strike just the right balance of performance and style, meeting the demand for athleisure wear. Moreover, shirts and T-shirts are highly versatile: they are worn by different men and women in various age brackets. They are also affordable and easy to customize; hence, they are leading in the market because new designs, fabrics, and features introduced by various brands have met changing consumer preferences.

Fast fashion and e-commerce definitely gave them a boost, with all varieties of athleisure products available on the Web, from fashionable to functional T-shirts. Overall, shirts and T-shirts are the go-to choice of consumer because they are versatile and comfortable, along with being fashion-forward. This would easily place them as a dominant product segment within the athleisure industry.

By Material

Cotton is anticipated to dominate the material segment in the global athleisure market in 2024 Because of the comfort, breathability features, and naturally skin-friendly properties, cotton is the leading material in the global athleisure market. Cotton has emerged as one of the favorite materials in clothing for wearers of athleisure wear since consumers are giving considerable emphasis to soft skin-friendly fabrics in their choice of garments.

It offers a natural fiber alternative that is strong yet comfortable enough to be worn in casual settings or low-intensity activities such as yoga or just lounging. Cotton-based athleisure products are gaining momentum in the market due to their stylish outlook combined with functionality. Most customers would prefer cotton because it can control temperature and therefore can be used in most types of climates around the world.

Its absorbent properties also make it attractive for use in athleisure wear meant for daily usage. Another factor contributing to making cotton dominate this market is its description as an eco-friendly product. With the rise in environmental awareness, the majority of customers would say that athleisure should be made from organic or recycled cotton. This goes in line with the greater fashion trend toward eco-friendly materials, which gives cotton a standing lead in comparison with synthetic alternatives.

The versatility of cotton puts it as a material at the heart of athleisure apparel, from T-shirts and hoodies down to joggers and sweatpants. Its versatility for diverse lines of wear and consumer demand for sustainable and comfortable fabrics will continue to keep the segment dominant in the athleisure market during the forecast period.

By Category

Several reasons for the dominance of the premium category in the global athleisure market align with the shifting preference for high-quality, tasteful, functional wear. Consumers do not mind investing in premium athleisure wear considering their advanced materials, innovative designs, and brand prestige. A trend is being pushed by an increasing user awareness of the wholesome benefits of high-quality athletic wear including durability, comfort, and performance-enhancing features.

Specialized fabric and technology have helped these premium fashion athletic brands position themselves as category leaders. Examples of brands in this category include Lululemon Athletica, Nike, and Adidas. Overall, these products generally offer moisture-wicking properties, breathability, and fashionable designs for workouts and fashion sense. Moreover, the health and wellness movement is on the rise and encouraging customers to spend more on

fitness apparel.

With the rise in focus on people's physical and mental health, the demand for high-end athleisure to support an active lifestyle also increased. Besides, most high-end athleisure brands have tended to run successful marketing campaigns and teamed up with influencers who have helped them establish the brand value proposition further, making such brands more memorable and desirable to consumers.

This kind of branding is based more on quality and lifestyle than functionality; hence, these premium athleisure products land in the hands of people across a wide range of consumers. Consequently, the premium segment is expected to keep leading the marketplace in the forecast period, further deepening its penetrations in both athletic and everyday contexts.

By Distribution Channel

The offline distribution channel is anticipated to dominate the global athleisure market with 73.1% of the market share in 2024, as offline distribution presents certain compelling factors that improve the consumer shopping experience. Physical retail stores, besides hypermarkets, sporting goods retailers, and brand-owned stores, advocate for an interactive shopping experience that cannot be fully presented through online mediums.

It is very common for buyers to prefer trying out athleisure wear and accordingly assess the fit, comfort, and style that tends to drive purchasing decisions. It is also important to note that with this hands-on experience in stores, the touch of high-quality fabric and the overall construction of the high-end merchandise instill confidence in these brands.

Furthermore, the personalized service provided by retailers, along with expert advice, allows consumers to make choices based on their needs and preferences; this reinstates the value of customized shopping experiences within a marketplace characterized by special consumer demands for products bearing various performance or attractive features.

Moreover, the dawn of omnichannel retail also supports the fact that the offline channel will prevail. Many consumers still research products online but make their purchases in-store. This therefore then shows when retailers continue to enhance their physical presence through the introduction of technology, such as mobile apps and in-store kiosks that facilitate seamless transitions between online and offline shopping.

Further, experiential retail has ensured more people enter the shops, whereby brands create interactive spaces and hold events. These experiences foster brand loyalty and increase sales. Thus, the offline segment will keep dominating the athleisure market in the forecast period since it adjusts to changing trends in consumer behavior and preference.

By End-User

Women dominate the end-user segment in the global athleisure market is a resultant factor interconnected with transformative lifestyle choices and increasing propensity for fitness and wellness activities. As interest in the healthy lifestyle and fitness movement has grown, there has been an endogenous growth in the involvement of women in exercises, yoga, and outdoor activities. Demands for fashionable and functional athleisure wear, developed exclusively for their use, are high on the other side.

Brands have equally risen to the occasion by producing all sorts of women's athleisure gear, including but not limited to leggings, sports bras, and yoga pants, in a plethora of colors, patterns, and design variations that only women can appreciate. Added attention to fashion-forward designs ups appeal and helps align the garment for seamless transitioning from the gym to casual outings desired by women.

Besides, social media platforms have proved to be a boon regarding the popularity of women's athleisure among the young generation. Influencers and fitness personalities are often showcasing how they can wear athleisure products in normal daily life. The success of women-centric athleisure campaigns triggered brand loyalty for female consumers.

The Athleisure Market Report is segmented on the basis of the following

By Product

- Shirts & T-Shirts

- Yoga Apparel

- Tops

- Pants

- Shorts

- Unitards

- Capris

- Others

- Leggings

- Hoodies & Sweatshirts

- Joggers & Sweatpants

- Shorts

- Others

By Material

- Cotton

- Polyester

- Nylon

- Spandex

- Others

By Category

By Distribution Channel

- Offline

- Hypermarkets & Supermarkets

- Sporting Goods Retailers

- Brand-Owned Stores

- Department Stores

- Online

- E-commerce Platforms

- Brand Websites

By End-user

Regional Analysis

North America is projected to dominate the global athleisure market as it is anticipated to command over

46.7% of total revenue share by the end of 2024. The combined impact of cultural and economic factors makes North America the largest market in the world for athleisurewear. In particular, the United States has a majority population that embraces fitness and wellness as tenets of leading life as a whole.

In line with such a cultural trend, more and more users are engaging in sports, yoga, and fitness activities, thereby driving demands for versatile yet stylish athleisure wear. Besides, economic factors also determine the dominance of North America in the athleisure industry: with a considerable amount of disposable income and effective retail infrastructure, people are more open to investing in high-end athleisure products.

Key players in the market, such as Lululemon, Nike, and Adidas, have their headquarters in the region and hence give North America its strong presence and influence in the market. E-commerce, too, has experienced a steep rise in this region, further enhancing the availability of athleisure products. The comfort of online convenience and an extension of omnichannel retail methods translate to mean that consumers can readily avail a wide array of athleisure apparel.

In addition, social media has driven the athleisure fashion trend, driving consumer purchasing behavior to a large extent. Several celebrities and fitness influencers flaunt athleisure fashion, thus rendering such products more visible and desirable to end-consumers. Considering all these factors, during the forecast period, North America is expected to continue with its dominance in the athleisure market, offering enormous opportunities for growth, while retaining its position as an important player in the athleisure market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive scenario of the global athleisure market includes several players that set up the key dynamics of the industry. Some of the popular brands dominating the market competition include Nike, Adidas, Lululemon Athletica, and Puma. The innovation provided by them in their products, along with successful marketing, has helped them to gain significant positions in the industry.

Many of these companies are focusing on increasing investments in research and development to advance their product portfolios by catering to the changing preferences of consumers. Nike stays at the top because of higher brand equity, wider distribution networks, and more products across a wide array of consumer segments. Adidas comes up with innovative designs in collaboration with high-profile designers or celebrities to catch the attention of consumers and build brand loyalty.

New emerging brands including Gymshark and Alo Yoga are targeting more niche market segments and building online communities. This, combined with their direct-to-consumer business models and social media marketing methods, helps them break through the noise with younger consumers, which has been one of the factors going for them as they take on more established players.

Today, companies are pushing forward with sustainability advantages by infusing eco-friendly materials and ethical manufacturing ways into their products. It also reflects increasing consumer demand for environment-friendly products across the wider industrial shift toward sustainability.

Some of the prominent players in the Global Athleisure Market are

- Nike, Inc.

- Adidas AG

- Lululemon Athletica Inc.

- Puma SE

- Under Armour, Inc.

- Reebok International Ltd.

- Gymshark

- Alo Yoga

- Fabletics

- Athleta (Gap Inc.)

- ASICS Corporation

- New Balance Athletics, Inc.

- Other Key Players

Recent Developments

- October 2023: Adidas launched its new 'Infinite Play' initiative, focusing on sustainable practices by promoting the recycling of old athletic wear into new products. This initiative aims to reduce waste and appeal to eco-conscious consumers.

- September 2023: Lululemon introduced a new line of ultra-lightweight yoga gear designed specifically for high-performance activities. This line emphasizes breathability and comfort, targeting the growing number of women participating in yoga and fitness classes.

- August 2023: Nike expanded its 'Move to Zero' campaign, pledging to use 100% recycled polyester in its products by 2025. This initiative underlines the brand’s commitment to sustainability and addresses consumer demand for environmentally friendly products.

- July 2023: Puma announced a partnership with several fitness influencers to launch a new athleisure collection targeting the Gen Z demographic. The collection features trendy styles and vibrant colors designed to resonate with younger consumers.

- June 2023: The Global Athleisure Conference was held in New York, showcasing innovative products and discussing trends in the athleisure market, emphasizing the importance of sustainability and consumer engagement strategies.

- May 2023: Under Armour reported a 15% increase in athleisure sales in the first quarter of 2023, driven by rising consumer interest in fitness and wellness apparel. The brand continues to focus on product innovation to meet market demands.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 393.7 Bn |

| Forecast Value (2033) |

USD 902.4 Bn |

| CAGR (2024-2033) |

9.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 154.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Shirts & T-Shirts, Yoga Apparel, Leggings, Hoodies & Sweatshirts, Joggers & Sweatpants, Shorts, and Others), By Material (Cotton, Polyester, Nylon, Spandex, and Others), By Category (Mass, and Premium), By Distribution Channel (Offline, and Online), By End-user (Men, Women, and Children) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Nike Inc., Adidas AG, Lululemon Athletica Inc., Puma SE, Under Armour Inc., Reebok International Ltd., Gymshark, Alo Yoga, Fabletics, Athleta (Gap Inc.), ASICS Corporation, New Balance Athletics, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Athleisure Market size is estimated to have a value of USD 393.7 billion in 2024 and is expected to reach USD 902.4 billion by the end of 2033.

The US Athleisure Market is projected to be valued at USD 154.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 338.8 billion in 2033 at a CAGR of 9.1%.

North America is expected to have the largest market share in the Global Athleisure Market with a share of about 46.7% in 2024.

Some of the major key players in the Global Athleisure Market are Nike Inc., Adidas AG, Lululemon Athletica Inc., Puma SE, Under Armour Inc., Reebok International Ltd., Gymshark, and many others.

The market is growing at a CAGR of 9.7 percent over the forecasted period.