Market Overview

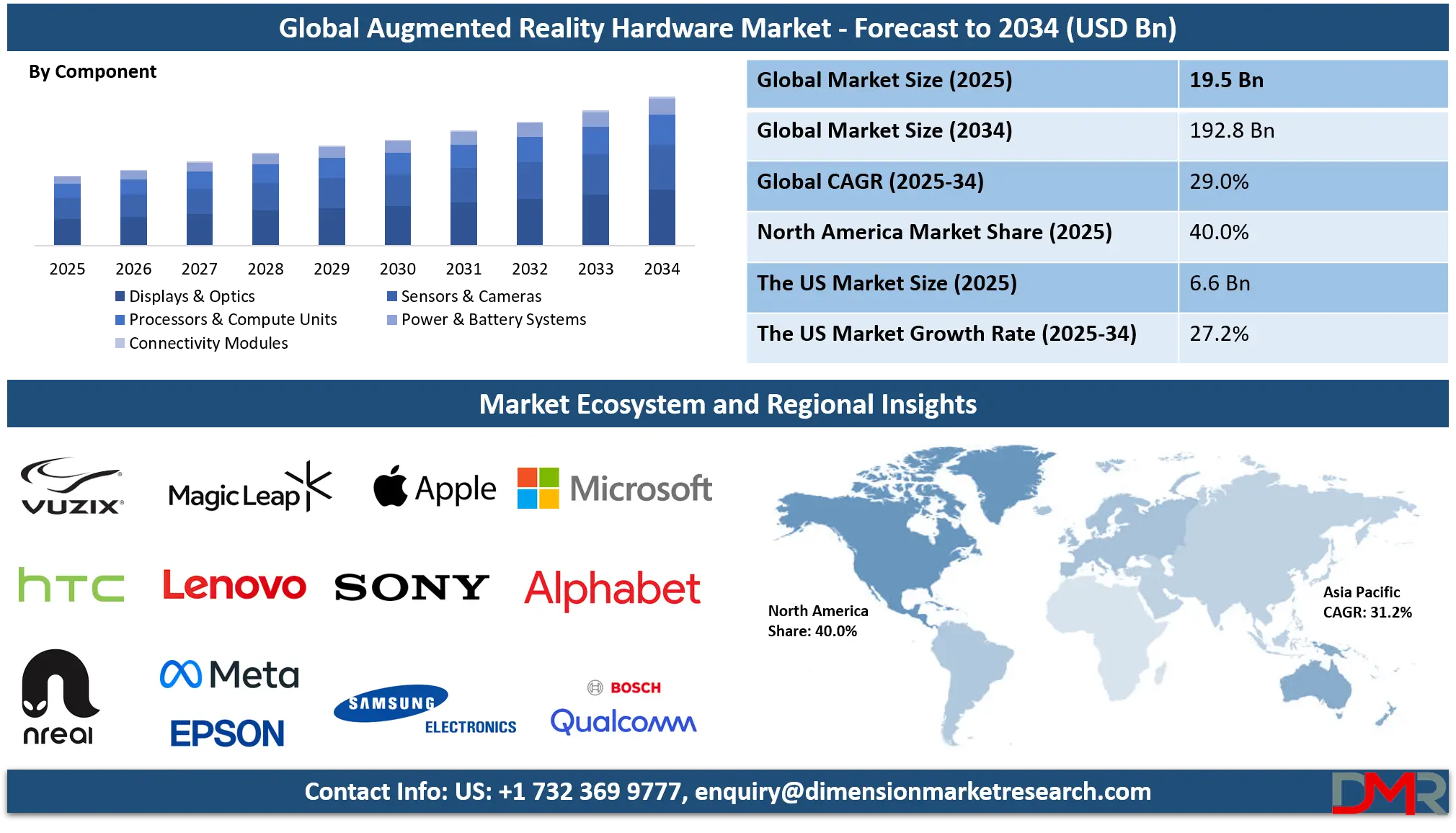

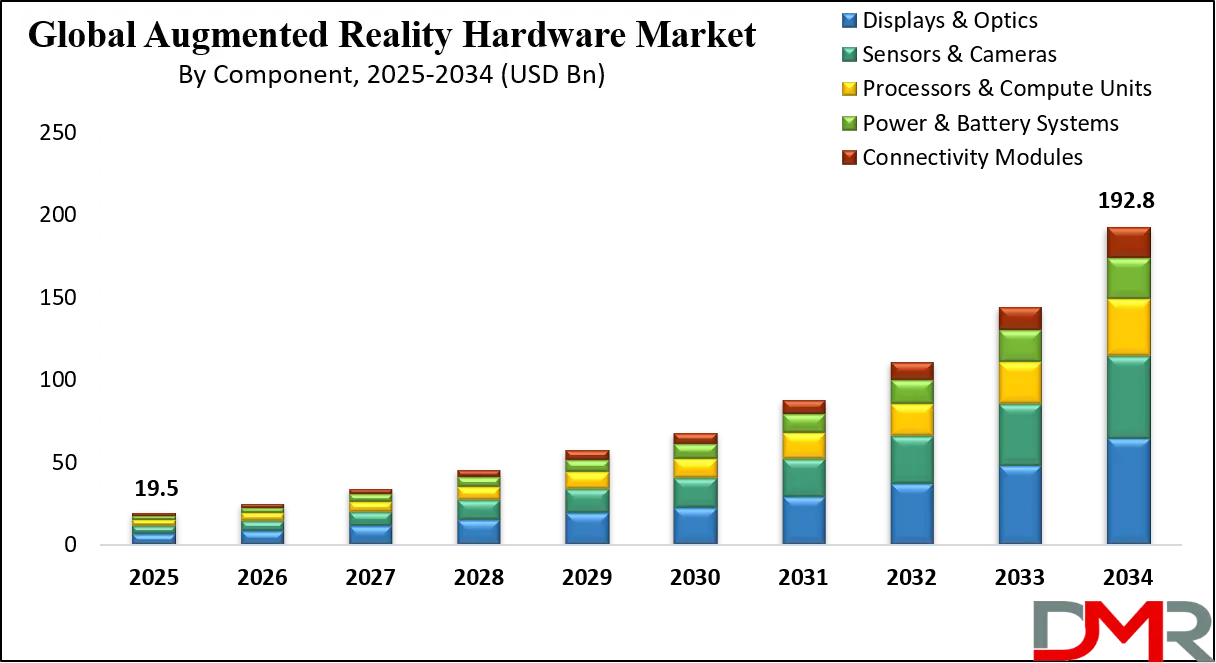

The Global Augmented Reality (AR) Hardware Market is forecast to reach a valuation of USD 19.5 billion in 2025 and is anticipated to expand at a robust compound annual growth rate (CAGR) of 29.0% between 2025 and 2034, driven by accelerating adoption across enterprise, industrial, and consumer applications. This sustained growth trajectory is expected to propel the market to approximately USD 192.8 billion by 2034, supported by advancements in AR displays, sensors, processors, and connectivity technologies, along with increasing integration of AR hardware in manufacturing, healthcare, automotive, defense, retail, and immersive entertainment ecosystems.

Augmented Reality (AR) hardware overlays digital information onto the physical world through optical see-through displays, holographic waveguides, and embedded sensors, enabling transformative applications across enterprise, consumer, and public sectors. The technology addresses critical needs for remote assistance, interactive training, real-time data visualization, and enhanced situational awareness.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological breakthroughs, including micro-OLED displays, lightweight ergonomic designs, eye-tracking systems, haptic feedback modules, and onboard AI processors, are accelerating the transition from bulky prototypes to all-day wearable devices. Integration of simultaneous localization and mapping (SLAM), spatial audio, and environment understanding is redefining immersive interaction and user adoption.

Growing investments from tech giants, defense contractors, automotive OEMs, and healthcare innovators are catalyzing ecosystem development. However, barriers such as high device costs, limited field of view (FOV), battery life constraints, content fragmentation, and user privacy concerns remain. Despite these challenges, the synergy of advanced optics, AI at the edge, and enterprise digital transformation positions AR hardware as a foundational platform for the future of work, learning, and entertainment through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

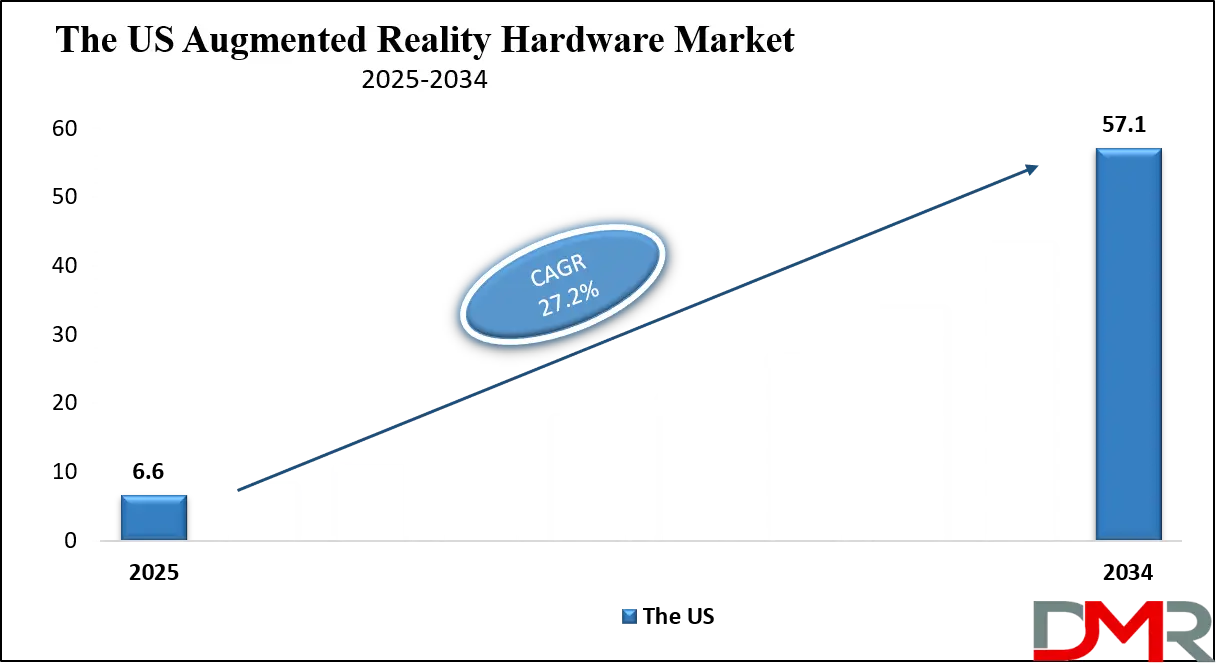

The US Augmented Reality Hardware Market

The U.S. Augmented Reality Hardware Market is projected to reach USD 6.6 billion in 2025 and grow at a CAGR of 27.2%, reaching USD 57.1 billion by 2034. The U.S. leads global innovation and adoption due to its concentration of technology leaders, strong venture capital funding, and early enterprise integration across defense, manufacturing, and healthcare.

Major corporations such as Microsoft (HoloLens), Meta (Ray-Ban Meta), Apple (Apple Vision Pro), and Google are driving R&D and commercial deployment. The U.S. Department of Defense's significant contracts for AR headsets for soldier situational awareness and training represent a major demand driver. In enterprise, sectors like automotive (design & assembly), aerospace (maintenance), and logistics (warehouse picking) are integrating AR glasses to improve efficiency and reduce errors.

The consumer segment is gaining momentum through gaming, social AR, and live event experiences, supported by advanced smartphone AR and dedicated wearables. Regulatory support for AR in medical device guidance and surgical planning further expands the market. With a robust ecosystem of developers, content creators, and network infrastructure, the U.S. is poised to maintain its leadership in shaping the global AR hardware landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Augmented Reality Hardware Market

In Europe, the augmented reality hardware market was valued at approximately USD 4.9 billion in 2025 and is projected to reach nearly USD 48.2 billion by 2034, growing at a CAGR of about 29.0% during the forecast period. Europe's strength lies in its advanced manufacturing base, strong automotive and industrial sectors, and supportive EU digital innovation policies.

Countries such as Germany, France, the U.K., and the Nordic region are at the forefront, deploying AR for precision engineering, factory floor operations, and professional training. European automotive giants like Volkswagen, BMW, and Airbus utilize AR for assembly, quality control, and remote expert support. The region's strict data privacy regulations (GDPR) drive the development of secure, enterprise-grade AR solutions.

Public funding through Horizon Europe and Digital Europe Programme supports R&D in lightweight optics, battery technology, and industrial metaverse applications. With a focus on worker safety, skilled labor augmentation, and sustainable production, Europe is a key market for high-performance, reliable AR hardware in business-to-business (B2B) environments.

The Japan Augmented Reality Hardware Market

In Japan, the augmented reality hardware market accounted for around USD 1.76 billion in 2025 and is expected to expand to approximately USD 17.35 billion by 2034, registering a CAGR of roughly 29.0% from 2025 to 2034. Japan's leadership in precision electronics, optics, and robotics, combined with societal challenges like an aging workforce and labor shortages, drives innovative AR adoption.

Japanese electronics leaders such as Sony, Panasonic, and Epson are pioneers in micro-display technology and compact wearable design. AR is being deployed to augment skilled workers in manufacturing, support elderly care through remote assistance, and enhance tourism and cultural experiences. The concept of "Society 5.0", promoted by the Japanese government, explicitly integrates AR and IoT to create a human-centered smart society.

Strategic partnerships between tech companies, automotive manufacturers (Toyota, Honda), and healthcare providers are creating vertically integrated AR solutions. Japan's focus on high-fidelity visual quality, reliability, and user comfort positions it as a critical innovation hub for next-generation AR hardware.

Global Augmented Reality Hardware Market: Key Takeaways

- Exponential Global Market Growth: The Global Augmented Reality Hardware Market is expected to be valued at USD 19.5 billion in 2025 and is projected to reach USD 192.8 billion by 2034, showcasing transformative growth driven by enterprise digitization and consumer metaverse exploration.

- Remarkable CAGR Fueled by Technological Maturation: The market is expected to grow at a stellar CAGR of 29.0% from 2025 to 2034, fueled by breakthroughs in display technology, miniaturization of components, AI integration, and expanding 5G/6G connectivity.

- Strong Growth Trajectory in the United States: The U.S. Augmented Reality Hardware Market stands at USD 6.6 billion in 2025 and is projected to reach USD 57.1 billion by 2034, expanding at a CAGR of 27.2%, supported by dominant tech ecosystems and deep enterprise penetration.

- Asia-Pacific Exhibits Highest Growth Potential: Asia-Pacific is projected to register the highest CAGR during the forecast period, driven by massive consumer electronics production, government investments in industrial AR, and a booming gaming and entertainment sector in China, South Korea, and Southeast Asia.

- Rapid Advancement in Core Hardware Technologies: Innovations including waveguide optics, micro-LED displays, varifocal lenses, on-device AI chips, and gesture recognition systems are significantly improving performance, comfort, and affordability, accelerating mainstream adoption.

- Enterprise Adoption is the Primary Growth Engine: The urgent need for remote collaboration, workforce training, complex assembly guidance, and digital twin interaction in industries like manufacturing, logistics, and healthcare is the dominant driver for AR hardware investment.

Global Augmented Reality Hardware Market: Use Cases

- Industrial Maintenance & Repair: Field technicians use AR glasses to view interactive manuals, schematics, and receive remote expert guidance overlaid on machinery, reducing downtime and errors.

- Surgical Navigation & Medical Training: Surgeons utilize AR headsets to visualize patient anatomy (CT/MRI scans) superimposed on the surgical field, while medical students engage in immersive procedural training.

- Warehouse Logistics & Picking: Workers wear AR smart glasses that display optimal pick paths, item locations, and inventory data, dramatically increasing picking speed and accuracy.

- Immersive Design & Engineering: Automotive and aerospace engineers use AR to visualize and interact with 3D CAD models at full scale in real-world contexts, facilitating design reviews and prototyping.

- Retail & Try-Before-You-Buy: Consumers use AR in stores or via apps to virtually try on clothing, visualize furniture in their home, or see makeup applied, enhancing confidence and reducing returns.

Global Augmented Reality Hardware Market: Stats & Facts

OECD – Immersive & Emerging Technologies Policy Papers

- Global XR (AR/VR/MR) head-mounted display shipments peaked at 11.2 million units in 2021.

- Global XR headset shipments declined to 8.8 million units in 2022.

- Global XR headset shipments further fell to 6.7 million units in 2023.

- OECD member countries reported over 30 national pilot programs using AR hardware in education, manufacturing, or public services.

- More than 60% of OECD countries classify AR hardware as a “strategic emerging technology.”

- AR head-mounted displays are formally categorized under human–computer interaction hardware in OECD technology taxonomies.

United States Department of Defense (DoD)

- The U.S. Army signed a 10-year AR headset procurement framework for soldier augmentation systems.

- Initial AR headset deployment programs covered over 120,000 soldiers.

- AR hardware systems are used across 6 major U.S. Army training commands.

- The DoD lists AR as part of Tier-1 digital battlefield technologies.

- U.S. defense AR hardware programs span training, navigation, and battlefield visualization domains.

U.S. Congressional Research Service (CRS)

- U.S. government agencies identified “hundreds of thousands” of AR head-mounted displays in circulation by the late 2010s.

- CRS reports classify AR hardware as a dual-use technology (civilian and defense).

- AR hardware is included in federal emerging technology risk assessments.

- CRS documents note AR hardware integration across defense, healthcare, and industrial training sectors.

European Commission – Digital Europe & Industry 5.0 Programs

- AR hardware is officially included in the EU Industry 5.0 technology framework.

- The European Union funds over 100 XR testbeds, many involving AR headsets and smart glasses.

- AR hardware is deployed in more than 20 EU cross-border industrial pilot projects.

- Public funding programs recognize AR hardware as part of advanced manufacturing infrastructure.

- AR is included in EU human-centric digital workplace initiatives.

International Telecommunication Union (ITU)

- AR is formally recognized within ITU digital skills and ICT taxonomy frameworks.

- AR hardware is classified under advanced user-interface equipment.

- ITU includes AR hardware in future network and edge-computing use-case planning.

- AR devices are referenced in ITU smart city technology architectures.

ISO / IEC (International Standards Organizations)

- ISO/IEC maintains multiple active standards committees covering AR hardware ergonomics and safety.

- AR head-mounted displays are standardized under wearable electronic device classifications.

- AR hardware performance metrics include latency, field-of-view, and optical safety parameters.

- International standards apply to optical see-through and video see-through AR devices.

UNESCO & UN System Bodies

- AR hardware is recognized as a digital learning infrastructure tool in technical education.

- AR devices are cited in vocational and skills-training modernization programs.

- AR hardware is included in UN creative economy and digital content classifications.

National Manufacturing & Industry Agencies (US, EU, Japan)

- AR hardware adoption is reported across a majority of advanced manufacturing pilot factories.

- Public manufacturing programs identify AR smart glasses as productivity-enhancing hardware.

- AR hardware is used in real-time assembly guidance and quality inspection in government-supported plants.

Global Augmented Reality Hardware Market: Market Dynamic

Driving Factors in the Global Augmented Reality Hardware Market

Enterprise Digital Transformation and Industry 4.0

The relentless push towards smart factories, digital twins, and connected workers is the primary driver for AR hardware. Industries seek to boost productivity, enhance quality control, and enable remote expert support for a distributed workforce. AR glasses provide hands-free access to information, diagrams, and data, reducing cognitive load and minimizing errors in complex tasks like assembly, maintenance, and inspection.

Advancements in Enabling Technologies

Rapid progress in optical engineering (waveguides, holographic lenses), display systems (micro-OLED, Laser Beam Scanning), and miniaturized sensors (IMUs, depth cameras) directly enables lighter, more powerful, and more affordable AR devices. Breakthroughs in battery technology, thermal management, and edge AI processing are solving critical barriers to all-day wearability and immersive, responsive experiences.

Restraints in the Global Augmented Reality Hardware Market

High Cost and ROI Uncertainty

The significant upfront investment for enterprise-grade AR headsets (often thousands of dollars per unit) and the perceived complexity of integration deter widespread adoption, especially among SMEs. While ROI is proven in specific use cases, quantifying broad benefits and achieving organizational buy-in remains a challenge, slowing procurement cycles.

Technical Limitations and User Experience Hurdles

Current generation devices often face trade-offs between field of view, display resolution, brightness, and device weight. Battery life constraints limit extended use, and interaction models (gesture, voice, controller) are still evolving. User discomfort (eyestrain, ergonomics) and a lack of compelling, scalable content for some verticals further restrain mass adoption.

Opportunities in the Global Augmented Reality Hardware Market

Expansion into Mainstream Consumer Applications

Beyond enterprise, the emerging consumer metaverse, social AR, gaming, and fitness represent a colossal opportunity. The success of smartphone AR paves the way for dedicated eyewear. The development of fashion-forward, affordable smart glasses focused on notifications, navigation, and content capture could create a market akin to wireless headphones.

Healthcare and Medical Training Revolution

AR hardware offers transformative potential in surgical planning, intraoperative navigation, medical education, and patient rehabilitation. The ability to visualize complex 3D anatomy in situ improves precision and outcomes. This high-value application segment commands premium pricing and drives innovation in hygienic design, clinical accuracy, and regulatory-compliant hardware.

Trends in the Global Augmented Reality Hardware Market

Shift Towards All-Day Wearable "Smart Glasses"

The market is evolving from task-specific headsets to general-purpose smart glasses designed for continuous wear. This trend emphasizes sunglass aesthetics, passive transparency, audio integration, and core smartphone companion features (calls, messages, navigation). Companies like Meta, Ray-Ban, and Snap are leading this charge to blend digital utility with everyday style.

Integration of AI and Spatial Computing

On-device AI processors are becoming standard, enabling real-time object recognition, scene understanding, and predictive information display without cloud latency. This trend powers context-aware AR, where the hardware intelligently adapts digital content based on the user's environment, task, and history, moving from simple overlays to truly assistive experiences.

Global Augmented Reality Hardware Market: Research Scope and Analysis

By Component Analysis

Within the AR hardware ecosystem, Displays and Optics represent the most dominant component sub-segment by value. This dominance is driven by the demand for high-resolution near-eye displays, advanced waveguides, and micro-OLED technologies that enable realistic visuals, wide fields of view, and compact device form factors. Display performance is a critical differentiator in AR hardware, making this component central to overall device cost and performance.

Sensors and Cameras form a critical enabling sub-segment and dominate in terms of functional importance. Depth sensors, motion tracking sensors, and eye-tracking components are essential for spatial mapping, environment understanding, gesture recognition, and user interaction. Their dominance is driven by increasing demand for accurate tracking, real-time responsiveness, and immersive AR experiences across both enterprise and consumer applications.

In Processors and Compute Units, integrated AR system-on-chips (SoCs) and edge-AI processors dominate due to their ability to handle real-time graphics rendering, AI inference, and low-latency processing directly on the device. These processors are essential for reducing reliance on cloud computing, improving performance, and extending battery life.

Power and Battery Systems are dominated by compact, high-density battery solutions, optimized for wearable and mobile AR devices where weight, size, and heat management are critical constraints. Battery efficiency directly impacts user comfort and session duration.

Connectivity Modules are dominated by Wi-Fi, Bluetooth, and 5G-enabled solutions, which support cloud-based content streaming, real-time collaboration, and multi-user AR experiences. Overall, component dominance favors sub-segments that enable performance, immersion, and portability.

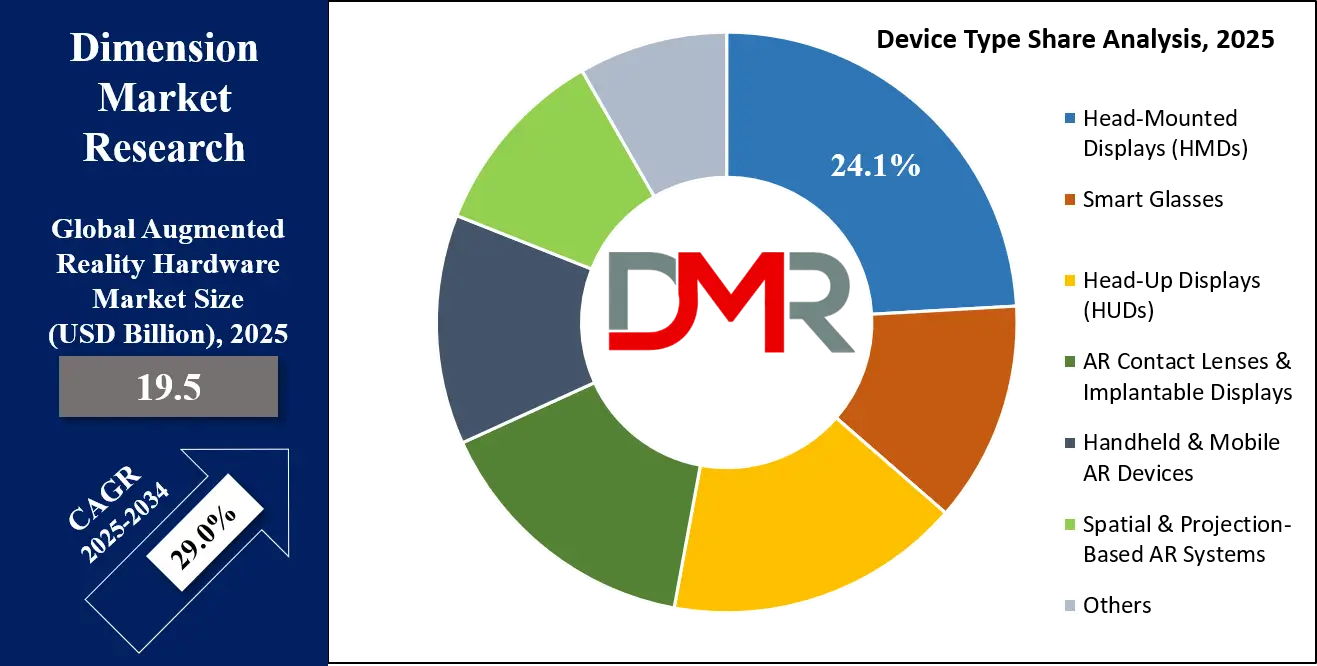

By Device Type Analysis

The Head-Mounted Displays (HMDs) segment dominates the AR hardware market in terms of revenue generation and enterprise adoption. Within this segment, optical see-through and mixed reality HMDs represent the most dominant sub-segments, driven by their ability to overlay digital information onto real-world environments while maintaining situational awareness. These HMDs are widely adopted in industrial operations, defense training, healthcare visualization, and enterprise collaboration. Their dominance is reinforced by high device pricing, customized deployments, long replacement cycles, and mission-critical use cases where accuracy and reliability are essential.

In Smart Glasses, consumer-oriented monocular and binocular smart glasses dominate shipment volumes due to their lightweight design, hands-free operation, and affordability compared to full HMDs. Monocular smart glasses lead adoption in logistics, field service, and basic information display, while binocular smart glasses dominate enterprise-assisted workflows requiring higher immersion and contextual visualization. Cost-effective smart glasses drive adoption in emerging markets, while advanced binocular models see stronger uptake in enterprise environments.

The Head-Up Displays (HUDs) segment is primarily dominated by automotive HUDs, supported by rising demand for driver assistance systems, navigation overlays, and enhanced safety visualization. Aviation and industrial HUDs remain important but account for a smaller share due to limited deployment volumes.

AR Contact Lenses and Implantable Displays remain the least dominant device segment, with activity concentrated in research, prototyping, and pilot-scale deployments rather than commercial use.

Handheld and Mobile AR Devices dominate overall user reach due to mass smartphone penetration, low entry barriers, and broad consumer accessibility. Spatial and projection-based AR systems dominate applications requiring large-scale shared visualization, particularly in retail environments, live events, and architectural walkthroughs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Industrial and manufacturing is the most dominant AR application segment, driven by widespread adoption of assembly guidance, maintenance support, and quality inspection use cases. These applications deliver measurable productivity gains, error reduction, and cost savings, making them central to enterprise AR deployments.

In Healthcare and Medical, surgical navigation, medical training, and simulation dominate adoption. These sub-segments benefit from AR’s ability to enhance visualization, improve procedural accuracy, and support skill development. Strict regulatory requirements and the need for precision reinforce the dominance of these applications over more experimental use cases.

Aerospace and Defense applications are dominated by training, simulation, and battlefield visualization. These use cases require ruggedized hardware, high accuracy, and long-term deployment programs, resulting in high per-unit investment and sustained demand.

Within the Automotive sector, navigation and safety-focused AR HUDs dominate implementation. These applications enhance driver awareness, reduce distraction, and support advanced driver assistance systems, making them a priority for vehicle integration.

Retail and E-commerce adoption is led by virtual try-on and interactive product visualization, which improve customer engagement and conversion rates. Tourism, Media, and Marketing are dominated by immersive brand experiences and interactive storytelling, using AR to create memorable consumer interactions.

Gaming and Entertainment dominates consumer engagement through immersive, social, and location-based AR experiences, while Education and Training adoption is driven by technical, vocational, and professional learning, where AR improves comprehension and retention.

By End User Analysis

Enterprise and Industrial Users dominate overall AR hardware revenue due to high device prices, customized solutions, and recurring deployments. Manufacturing, utilities, construction, and energy sectors lead adoption, driven by productivity optimization, workforce training, and operational efficiency.

Consumer Users dominate shipment volume rather than revenue, fueled by widespread use of mobile AR devices and smart glasses. Entertainment, social interaction, navigation, and lifestyle applications drive consumer adoption, supported by low-cost entry points and familiarity with smartphones.

Government and Defense users dominate high-budget AR procurement, characterized by long procurement cycles, strict technical requirements, and mission-critical applications. Training, simulation, and situational awareness use cases reinforce this segment’s importance despite lower unit volumes.

Healthcare Providers, including hospitals and medical training institutes, dominate clinical AR adoption. Precision, reliability, compliance, and patient safety are key priorities, making healthcare one of the most specialized and regulation-driven end-user segments.

Educational Institutions increasingly adopt AR at scale, particularly universities and vocational training centers. Engineering, healthcare, and technical disciplines drive adoption due to AR’s ability to enhance experiential learning and skill development.

Commercial and Retail Organizations dominate customer-facing AR use cases, focusing on engagement, personalization, and conversion optimization. AR enables immersive shopping experiences, in-store navigation, and interactive marketing, strengthening brand differentiation.

Across all end-user segments, dominance consistently favors those with scale, funding capacity, operational complexity, and long-term deployment strategies, shaping the evolution of the global AR hardware market.

The Global Augmented Reality Hardware Market Report is segmented on the basis of the following:

By Component

- Displays & Optics

- Waveguides

- Micro-LED / OLED displays

- Sensors & Cameras

- Depth sensors

- Motion sensors

- Eye-tracking sensors

- Processors & Compute Units

- Power & Battery Systems

- Connectivity Modules

By Device Type

- Head-Mounted Displays (HMDs)

- Optical see-through HMDs

- Video see-through HMDs

- Mixed Reality headsets

- Smart Glasses

- Monocular smart glasses

- Binocular smart glasses

- Head-Up Displays (HUDs)

- Automotive HUDs

- Aviation HUDs

- Industrial HUDs

- AR Contact Lenses & Implantable Displays

- Smart contact lenses

- Retinal projection implants

- Handheld & Mobile AR Devices

- Spatial & Projection-Based AR Systems

- Spatial projectors

- Holographic display systems

- Others

By Application

- Industrial & Manufacturing

- Assembly & production guidance

- Maintenance & repair

- Quality inspection

- Healthcare & Medical

- Surgical navigation

- Medical training & simulation

- Diagnostics & visualization

- Aerospace & Defense

- Pilot assistance

- Battlefield visualization

- Training & simulation

- Automotive

- Advanced driver assistance displays

- In-vehicle infotainment AR

- Navigation & safety HUDs

- Retail & E-commerce

- Virtual try-on

- In-store AR navigation

- Education & Training

- Technical skill training

- Remote learning & visualization

- Gaming & Entertainment

- Immersive gaming

- Location-based entertainment

- Architecture, Construction & Real Estate

- Design visualization

- On-site planning

- Tourism, Media & Marketing

- Interactive experiences

- Advertising & brand engagement

- Others

By End User

- Enterprise & Industrial Users

- Manufacturing companies

- Utilities & energy firms

- Consumer Users

- Individual consumers

- Gamers & content creators

- Government & Defense

- Military

- Law enforcement

- Public safety agencies

- Healthcare Providers

- Hospitals

- Clinics

- Medical training institutes

- Educational Institutions

- Schools

- Universities

- Vocational training centers

- Commercial & Retail Organizations

- Retail chains

- E-commerce platforms

- Others

Impact of Artificial Intelligence in the Global Augmented Reality Hardware Market

- On-Device AI for Real-Time Object & Scene Recognition: AI processors within AR hardware enable instant identification of objects, people, and environments, allowing the system to anchor relevant information and instructions contextually without cloud dependency.

- AI-Powered Gesture & Gaze Interaction: Advanced AI models interpret natural hand gestures, eye movements, and voice commands as primary inputs, creating more intuitive and hands-free user interfaces essential for industrial and consumer applications.

- AI-Driven Content Adaptation & Personalization: AI algorithms learn user preferences, behavior, and environmental context to dynamically adjust the type, density, and presentation of AR content, reducing information overload and enhancing relevance.

- Predictive Maintenance & Assistance: In industrial settings, AI analyzes sensor data from machinery via AR view and predicts failures, proactively guiding maintenance procedures and overlaying step-by-step repair instructions.

- Enhanced Visual SLAM & Spatial Mapping: AI improves the speed and accuracy of Simultaneous Localization and Mapping, allowing AR devices to better understand and persist digital content in complex, dynamic physical spaces.

Global Augmented Reality Hardware Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Augmented Reality Hardware Market, capturing over 40.0% of the global market share by the end of 2025. This commanding leadership is anchored by a unique convergence of innovation density, capital fluidity, and strategic early adoption. The region is home to the global headquarters of technology titans driving the AR revolution, including Microsoft (HoloLens), Meta (Ray-Ban Meta & Quest Pro), Apple (Vision Pro), and Google (ARCore & ongoing hardware ventures). This concentration fosters an unparalleled ecosystem of talent, R&D, and competitive advancement.

Massive venture capital and private equity investment continuously fuels a vibrant pipeline of AR hardware startups and component innovators, accelerating the pace of technological iteration. Beyond the private sector, deep and early adoption by enterprise and defense sectors provides a stable, high-value demand base. The United States Department of Defense's Integrated Visual Augmentation System (IVAS) program, a multi-billion-dollar contract based on modified Microsoft technology, exemplifies the strategic significance and scale of government-led deployment.

Furthermore, North American enterprises across automotive (Ford, GM), aerospace (Boeing, Lockheed Martin), and healthcare (Johnson & Johnson, Medtronic) are aggressively piloting and scaling AR solutions to enhance design visualization, complex assembly, remote expert guidance, and surgical planning.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia-Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period and is strategically poised to become the largest market by volume in the coming decade. This explosive growth trajectory is fueled by a powerful synergy of manufacturing supremacy, demographic forces, and proactive government policy.

APAC's undisputed dominance in consumer electronics manufacturing and supply chains is a primary accelerant. The region, led by China, South Korea, Japan, and Taiwan, is the global hub for producing the core components of AR hardware: advanced micro-OLED and micro-LED displays, compact optics, sensors, and batteries. This proximity to the supply base drives down component costs, enables rapid hardware iteration, and reduces time-to-market for both local and global brands, making AR devices more affordable and accessible faster than anywhere else.

Demand is further supercharged by the region's massive, digitally-native population and booming gaming, entertainment, and social media ecosystems. Countries like China and South Korea have thriving metaverse and immersive content industries that create a natural pull for consumer AR hardware. Concurrently, acute structural challenges such as aging populations, rising labor costs, and skilled worker shortages in manufacturing hubs like Japan, South Korea, and China are forcing enterprises to adopt AR for worker augmentation, remote assistance, and training, creating robust B2B demand.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Augmented Reality Hardware Market: Competitive Landscape

The Global Augmented Reality Hardware Market is highly dynamic and competitive, characterized by the presence of tech titans, specialized AR companies, and consumer electronics giants. Microsoft, Meta, and Apple currently shape the high-end and consumer narratives with HoloLens, Ray-Ban Meta, and Vision Pro, respectively. Google remains a wildcard with its ongoing investments in AR OS and potential hardware.

Established optical and display specialists like Sony, Epson, and Vuzix provide critical components and own significant segments of the enterprise smart glasses market. A vibrant ecosystem of startups and innovators such as Magic Leap, Nreal/Lynx (consumer-focused), and specialized industrial players push boundaries in specific niches.

The competitive landscape is further defined by strategic partnerships between hardware makers, software/platform developers (Unity, Unreal Engine), and vertical-specific solution providers. Success depends on technological superiority, a strong developer ecosystem, effective enterprise sales channels, and the ability to achieve compelling form factors and price points.

Some of the prominent players in the Global Augmented Reality Hardware Market are:

- Microsoft Corporation

- Meta Platforms, Inc.

- Apple Inc.

- Google LLC (Alphabet)

- Sony Corporation

- Magic Leap, Inc.

- Vuzix Corporation

- Epson

- Nreal (Now Lynx)

- Lenovo

- HTC Corporation

- Samsung Electronics

- Bosch

- Qualcomm

- Intel Corporation

- Other Key Players

Recent Developments in the Global Augmented Reality Hardware Market

- November 2025: Apple released advanced developer kits for the next-generation Vision Pro, featuring improved field of view, lighter design, and enhanced hand-tracking APIs, accelerating the creation of enterprise and consumer spatial applications.

- October 2025: Microsoft partnered with a global automotive OEM to deploy HoloLens 2 across its worldwide design and production facilities for collaborative design reviews and assembly line worker guidance, marking one of the largest industrial AR deals.

- October 2025: Meta launched its third-generation Ray-Ban Meta smart glasses with a full-color always-on display, advanced AI assistant via multimodal interaction, and significantly improved battery life, targeting mainstream consumer adoption.

- September 2025: Qualcomm introduced its latest AR-focused chipset, offering 50% better AI performance and 30% power reduction, enabling OEMs to build thinner, cooler, and more capable AR glasses.

- August 2025: A NATO-aligned defense consortium awarded a contract to a leading AR hardware firm for next-generation soldier systems, emphasizing situational awareness, navigation, and targeting, valued at over USD 2.0 billion.

- July 2025: Sony and Siemens expanded their collaboration, integrating Sony's AR glasses with Siemens' Xcelerator digital twin platform to create seamless "see-what-I-see" remote expert and factory floor visualization solutions.

- June 2025: Baidu launched its self-developed enterprise AR glasses, focusing on the Chinese industrial market with integrated Baidu AI cloud services and competitive pricing, challenging international players in APAC.

- March 2025: Logitech launched a line of certified controllers and input devices specifically designed for major AR platforms, signaling the maturation of the AR accessory ecosystem for professional use.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.5 Bn |

| Forecast Value (2034) |

USD 192.8 Bn |

| CAGR (2025–2034) |

29.0% |

| The US Market Size (2025) |

USD 6.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Displays & Optics, Sensors & Cameras, Processors & Compute Units, Power & Battery Systems, Connectivity Modules), By Device Type (Head-Mounted Displays (HMDs), Smart Glasses, Head-Up Displays (HUDs), AR Contact Lenses & Implantable Displays, Handheld & Mobile AR Devices, Spatial & Projection-Based AR Systems, Others), By Application (Industrial & Manufacturing, Healthcare & Medical, Aerospace & Defense, Automotive, Retail & E-commerce, Education & Training, Gaming & Entertainment, Architecture, Construction & Real Estate, Tourism, Media & Marketing, Others), By End User (Enterprise & Industrial Users, Consumer Users, Government & Defense, Healthcare Providers, Educational Institutions, Commercial & Retail Organizations, Others)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft Corporation, Meta Platforms, Inc., Apple Inc., Google LLC (Alphabet), Sony Corporation, Magic Leap, Inc., Vuzix Corporation, Epson, Nreal (now Lynx), Lenovo, HTC Corporation, Samsung Electronics, Bosch, Qualcomm, Intel Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Augmented Reality Hardware Market?

▾ The Global Augmented Reality Hardware Market size is estimated to have a value of USD 19.5 billion in 2025 and is expected to reach USD 192.8 billion by the end of 2034.

What is the growth rate in the Global Augmented Reality Hardware Market?

▾ The market is growing at a CAGR of 29.0 percent over the forecasted period of 2025 to 2034.

What is the size of the US Augmented Reality Hardware Market?

▾ The US Augmented Reality Hardware Market is projected to be valued at USD 6.6 billion in 2025. It is expected to reach USD 57.1 billion in 2034, growing at a CAGR of 27.2%.

Which region accounted for the largest Global Augmented Reality Hardware Market?

▾ North America is expected to have the largest market share in the Global Augmented Reality Hardware Market with a share of over 40.0% in 2025.

Who are the key players in the Global Augmented Reality Hardware Market?

▾ Some of the major key players in the Global Augmented Reality Hardware Market are Microsoft Corporation, Meta Platforms, Inc., Apple Inc., Google LLC, Sony Corporation, Magic Leap, Inc., and many others.