Market Overview

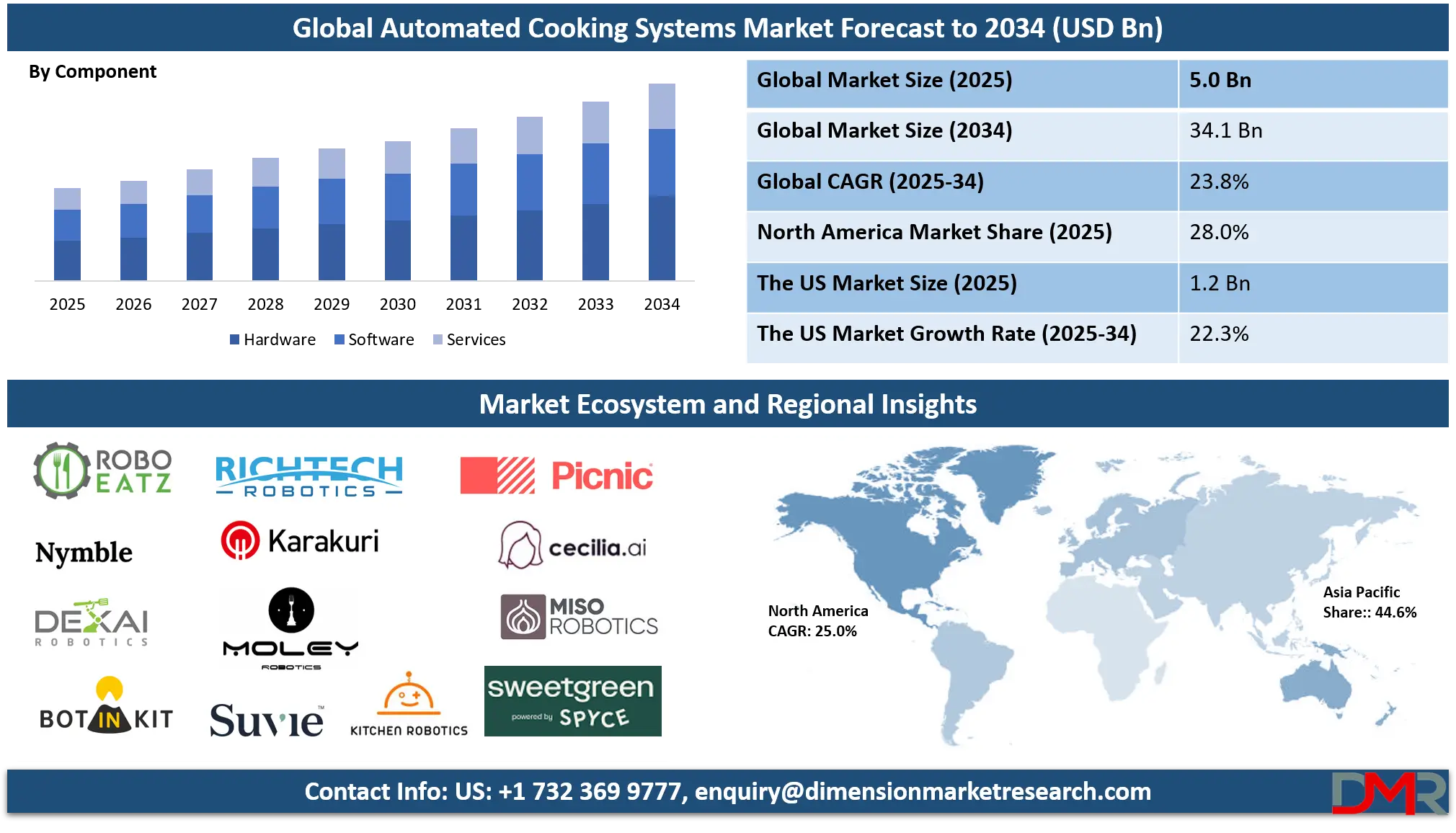

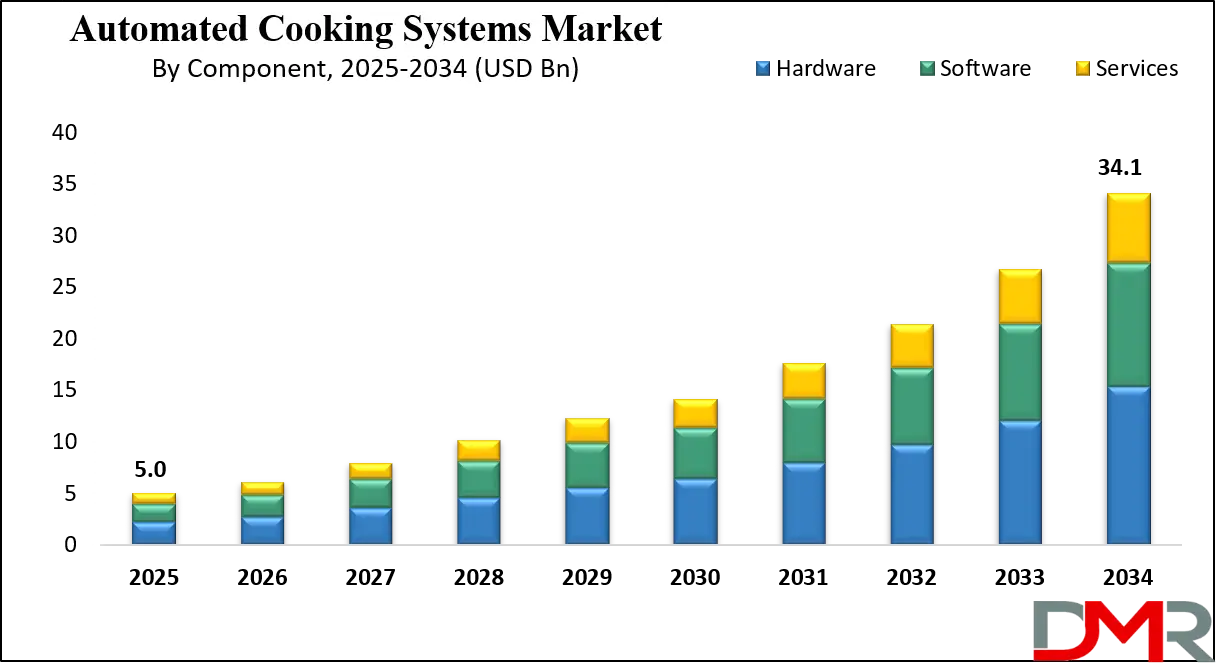

The Global Automated Cooking Systems Market is projected to reach USD 5.0 billion in 2025 and grow at a compound annual growth rate of 23.8% from there until 2034 to reach a value of USD 34.1 billion.

The global automated cooking systems market is evolving rapidly, driven by a combination of artificial intelligence (AI), robotics, and changing consumer lifestyles. As demand rises for energy-efficient, time-saving, and hygienic cooking methods, automated cooking solutions ranging from robotic chefs and smart ovens to integrated kitchen platforms are transforming how food is prepared in both commercial and residential settings. These systems use real-time sensors, computer vision, and connected software to automate complex culinary processes, ensuring consistency and precision.

The market is witnessing major opportunities in the commercial foodservice sector, especially quick-service restaurants (QSRs), food chains, and institutional kitchens, which are embracing automation to counter labor shortages and increase productivity. Residential adoption is also increasing as more consumers invest in smart home ecosystems and cooking appliances with AI-enabled recipe management, portion control, and nutritional optimization. This shift is further fueled by rising disposable incomes and greater interest in personalized and health-focused meal preparation.

However, high installation and maintenance costs remain significant barriers, particularly for small and mid-sized enterprises. Technical challenges in retrofitting traditional kitchens and concerns about workforce displacement also slow down adoption rates. Moreover, cybersecurity vulnerabilities in IoT-connected appliances raise concerns regarding data privacy and system integrity.

Despite these challenges, the long-term outlook for the automated cooking systems market is highly promising. Continued innovation in machine learning, real-time analytics, and food automation software is expected to widen adoption across sectors. As digital transformation reshapes food preparation, the global market is poised for exponential growth, aligning with evolving consumer expectations and industry efficiency standards.

The US Automated Cooking Systems Market

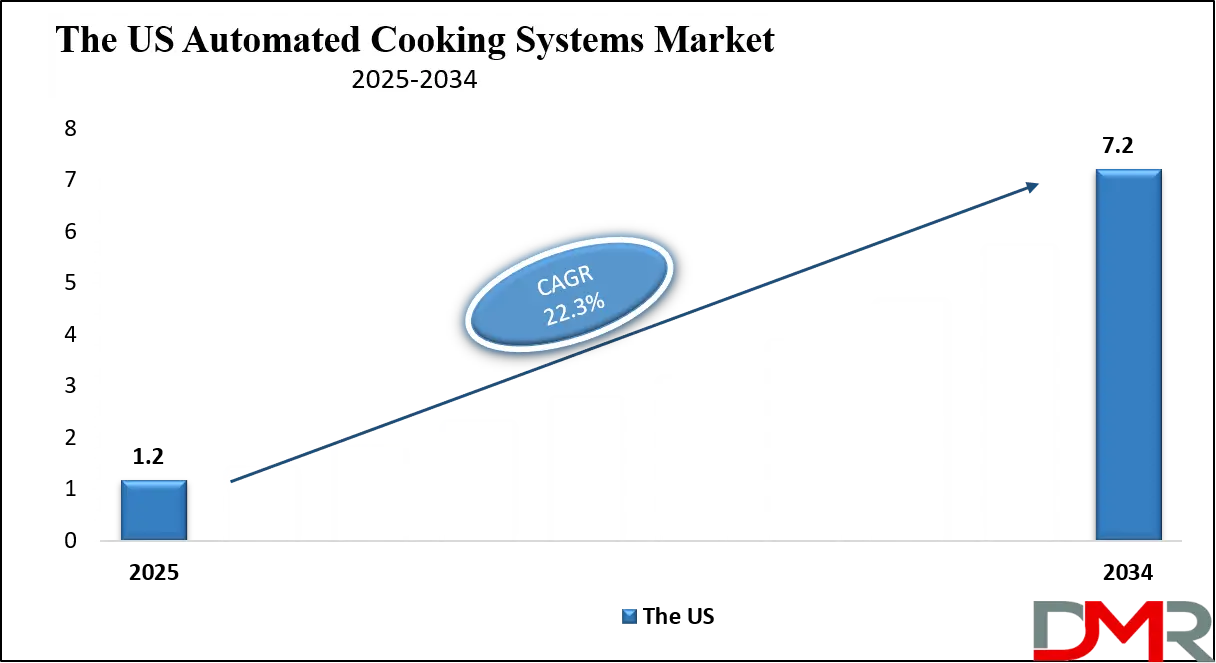

The US Automated Cooking Systems Market is projected to reach USD 1.2 billion in 2025 at a compound annual growth rate of 22.3% over its forecast period.

The United States' automated cooking systems market is advancing rapidly, reflecting the country's leadership in AI innovation, digital connectivity, and foodservice modernization. The U.S. Census Bureau reports that over 85% of households have broadband internet, providing fertile ground for smart appliance adoption. With a high prevalence of dual-income households and growing urbanization, American consumers are increasingly prioritizing convenience, safety, and precision in their daily cooking routines.

Demographically, the U.S. population is diverse and tech-savvy, fostering demand for cooking systems that support customized dietary needs, ethnic cuisines, and health-focused recipes. According to the Bureau of Labor Statistics, employment in food preparation continues to face constraints, driving restaurants, schools, and cafeterias to explore automated alternatives to mitigate staffing issues and enhance operational throughput.

The U.S. Department of Energy actively promotes energy-efficient appliances under programs like ENERGY STAR, which further drives innovation in automated cooking systems. Meanwhile, the U.S. Department of Agriculture emphasizes food hygiene and safety protocols that align with the benefits of automation, namely, contactless cooking, real-time temperature monitoring, and reduced cross-contamination risks.

In educational institutions and healthcare facilities, robotic cooking units are gaining traction for their ability to prepare large volumes of meals quickly and uniformly. Commercial foodservice operators are integrating AI-powered kitchen platforms for predictive cooking, ingredient tracking, and automated cleaning. As AI, IoT, and robotics become increasingly embedded in consumer and institutional kitchens, the U.S. market is positioned to lead global adoption, supported by a large base of early tech adopters and a well-developed infrastructure for innovation.

The European Automated Cooking Systems Market

The European Automated Cooking Systems Market is estimated to be valued at USD 750.0 million in 2025 and is further anticipated to reach USD 3,870.0 million by 2034 at a CAGR of 20.0%.

The European automated cooking systems market is expanding, underpinned by digital transformation, demographic aging, and policy-driven sustainability goals. According to Eurostat, internet penetration in EU households exceeds 90%, enabling the adoption of smart kitchen systems that offer hands-free operation, multi-language recipe support, and energy-efficient cooking processes. These capabilities appeal to time-constrained households, working professionals, and older adults seeking accessible food preparation.

Europe’s aging population, with over 20% aged 65 or above according to the European Commission, is a key demographic segment benefiting from automated appliances designed for safety and ease-of-use. Additionally, the market aligns with the European Green Deal, which promotes energy-efficient technologies and low-waste systems across all sectors, including domestic and commercial kitchens.

Commercial kitchens in Europe are increasingly turning to AI-enabled systems to optimize labor costs, maintain hygiene standards, and manage inventory efficiently. In cities like Berlin, Paris, and Amsterdam, cloud kitchens and robotic QSRs are experimenting with full-cycle automation from ingredient loading to meal dispatch. Educational institutions and long-term care facilities are adopting batch cooking robots and smart ovens to improve consistency and reduce waste.

The region’s strong regulatory oversight from food safety authorities enhances demand for automation in maintaining precise cooking temperatures, allergen control, and clean handling. Local appliance manufacturers in Germany, Italy, and the Nordic region are also advancing the field with modular robotics and AI-powered culinary assistants. As Europe's digital economy matures, the automated cooking systems market will grow steadily, bolstered by consumer demand for sustainable, health-conscious, and tech-integrated kitchen solutions.

The Japan Automated Cooking Systems Market

The Japan Automated Cooking Systems Market is projected to be valued at USD 300.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,596.0 million in 2034 at a CAGR of 23.0%.

Japan is at the forefront of the automated cooking systems market, leveraging its technological sophistication and unique demographic profile. With nearly 30% of its population aged 65 or older (according to Japan's Statistics Bureau), Japan faces labor shortages in sectors like foodservice, making automation not just desirable but essential. The country's dense urban centers, limited kitchen space, and fast-paced lifestyles also create ideal conditions for compact, efficient, and autonomous cooking systems.

Government initiatives such as “Society 5.0” promote seamless integration of digital infrastructure and robotics in daily life, including the kitchen. Supported by the Ministry of Economy, Trade and Industry (METI), the country is incentivizing smart appliances that use artificial intelligence, real-time data, and machine vision to improve quality of life. Japan's high internet penetration, exceeding 93%, further facilitates the uptake of app-controlled and voice-activated kitchen technologies.

Japanese consumers prioritize precision, hygiene, and culinary tradition. Automated systems equipped with sensors, heat control, and built-in recipe libraries enable the preparation of classic dishes such as tempura, miso soup, or sushi rice with consistency and minimal supervision. Tech companies like Panasonic, Zojirushi, and Mitsubishi are pioneers in developing AI-enhanced rice cookers, robotic stir-fry machines, and modular systems tailored to traditional cooking styles.

Hospitals, school cafeterias, and company kitchens are adopting commercial-grade robotic cookers to improve efficiency and reduce errors. With its fusion of robotics expertise, demographic imperatives, and cultural openness to technology, Japan’s automated cooking systems market is poised for sustained growth, both domestically and as a benchmark for global innovation.

Global Automated Cooking Systems Market: Key Takeaways

- Global Market Size Insights: The Global Automated Cooking Systems Market size is estimated to have a value of USD 5.0 billion in 2025 and is expected to reach USD 34.1 billion by the end of 2034.

- The US Market Size Insights: The US Automated Cooking Systems Market is projected to be valued at USD 1.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.2 billion in 2034 at a CAGR of 22.3%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Automated Cooking Systems Market with a share of about 44.6% in 2025.

- Key Players: Some of the major key players in the Global Automated Cooking Systems Market are Moley Robotics, Chowbotics (DoorDash), Spyce (Sweetgreen), Miso Robotics, Cecilia.ai, Picnic Works, Karakuri, Suvie, Botinkit, Kitchen Robotics, Richtech Robotics, Dexai Robotics, Cooksy, Nymble (Julia), and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 23.8 percent over the forecasted period of 2025.

Global Automated Cooking Systems Market: Use Cases

- Quick-Service Restaurants (QSRs): Robotic cooking arms, automated fryers, and conveyor ovens in QSRs ensure uniformity, faster throughput, and food safety. These systems reduce dependency on manual labor while maintaining consistent quality during peak hours, improving both customer satisfaction and operational efficiency.

- Smart Home Kitchens: Smart kitchen hubs equipped with voice-controlled assistants and programmable cooking sequences allow users to schedule meals, monitor food temperature, and control appliances remotely. This enhances daily convenience for working individuals, elderly populations, and health-conscious families seeking reliable and personalized meal options.

- Cloud Kitchens & Virtual Restaurants: In delivery-only kitchens, automation helps meet high-volume demand with limited staff. Robotic chefs prepare orders around the clock, reducing human errors, minimizing waste, and optimizing inventory essential for scaling food delivery operations profitably in urban centers.

- Healthcare & Hospital Kitchens: Automated systems in healthcare environments precisely manage patient diets, allergens, and calorie content. By ensuring regulatory compliance, standardizing recipes, and reducing contamination risks, hospitals use automation to deliver safe, nutritious meals consistently across large patient volumes.

- Catering & Institutional Food Services: Automated batch cooking and recipe replication help large institutions such as schools, defense messes, and corporate cafeterias serve high volumes of meals efficiently. These systems increase throughput, standardize flavor profiles, and allow catering businesses to manage food costs and preparation times effectively.t

Global Automated Cooking Systems Market: Stats & Facts

U.S. Census Bureau

- According to the U.S. Census Bureau, automation is increasingly transforming labor across sectors. In manufacturing, 52% of workers are now exposed to advanced automation technologies, compared to just 28% in other industries. This shift supports the growth of automated cooking systems as part of broader industrial automation in food production and preparation.

National Restaurant Association (U.S.)

- The association highlights that automation is becoming a key factor in foodservice operations:

- Robotic kitchen equipment and smart cooking systems are being adopted by 62% of quick-service restaurants to reduce human labor dependency.

- Automated fryers and grill stations have become part of kitchen automation pilot projects across major U.S. cities due to labor shortages.

- More than 50% of restaurant owners expect automation to be a major operational investment by 2026.

U.S. Bureau of Labor Statistics

- Food preparation and serving jobs are projected to be among the hardest to fill by 2028 due to low wages and high turnover.

- Automation, including robotic cooking systems, is seen as a strategic labor substitution in the sector.

Japan Ministry of Economy, Trade and Industry (METI)

- Japan has invested heavily in cooking robotics through its Society 5.0 strategy:

- Over $100 million allocated to smart kitchen innovation since 2020.

- Cooking robots are deployed in eldercare facilities to address labor shortages and dietary consistency.

European Commission – Digital Europe Programme

- The EU has funded over €75 million toward AI and automation in hospitality and catering under Horizon Europe.

- Initiatives include automated sous chefs, autonomous oven control systems, and modular cooking bots for cafeterias and institutional kitchens.

Smart Kitchen Summit (SKS) Data

- Over 600 new kitchen automation startups have been launched globally between 2020–2023.

- More than 35% of VC funding in the foodtech space since 2021 has gone to automated kitchen and smart appliance ventures.

Global Automated Cooking Systems Market: Market Dynamics

Driving Factors in the Global Automated Cooking Systems Market

Labor Shortages and Rising Operational Costs in the Foodservice Industry

A critical driver propelling the automated cooking systems market is the acute labor shortage and escalating operational costs within the global foodservice industry. According to the U.S. Bureau of Labor Statistics, the hospitality sector is one of the hardest-hit industries in terms of labor retention, with a high attrition rate due to long hours and low wages.

Post-pandemic workforce shortages have intensified these challenges, compelling restaurant operators, hotel kitchens, and cloud kitchens to invest in cooking automation to ensure uninterrupted service delivery. Robotic arms that handle repetitive cooking tasks such as flipping, frying, stirring, and portioning have emerged as reliable substitutes for human labor, ensuring speed, consistency, and hygiene. By automating meal preparation, businesses can reduce dependence on unpredictable human availability while optimizing staffing budgets.

Moreover, automation reduces human error, enhances food safety, and enables kitchens to scale up operations during peak hours without proportionately increasing labor costs. This driver is becoming foundational in reshaping foodservice workflows globally.

Technological Advancements in Machine Vision, Sensors, and IoT Integration

The rapid advancement in enabling technologies such as machine vision, sensor fusion, and Internet of Things (IoT) integration is significantly driving the adoption of automated cooking systems. These technologies allow real-time monitoring of food temperature, moisture levels, doneness, and ingredient quality, thereby ensuring precision cooking. For example, smart ovens with embedded thermal sensors can automatically switch cooking modes based on internal food temperature.

Likewise, robotic kitchen arms are now equipped with 3D vision systems and AI-based object recognition, enabling them to handle delicate tasks such as cutting vegetables or plating meals without human intervention. IoT connectivity further enhances these systems by providing remote diagnostics, firmware updates, and integration with broader restaurant management software.

This convergence of intelligent sensors and wireless connectivity reduces maintenance downtime, enhances energy efficiency, and boosts the reliability of robotic systems. These technological innovations have made automated cooking solutions more scalable, adaptable, and suitable for various culinary environments, from small cafés to large institutional kitchens.

Restraints in the Global Automated Cooking Systems Market

High Initial Investment and Long-Term Cost of Ownership

One of the major restraints hindering the widespread adoption of automated cooking systems is the significant initial investment required for deployment. Commercial-grade robotic kitchen setups featuring robotic arms, AI-enabled cooking modules, and integrated software can cost tens or even hundreds of thousands of dollars. For small- and medium-sized restaurants or household consumers, this cost remains a major barrier.

Beyond the purchase cost, there are additional long-term ownership expenses including maintenance, software licensing, staff training, and infrastructure upgrades. Smaller establishments, especially in developing economies, often lack the capital or risk appetite to invest in such systems.

In residential settings, high-end automated kitchen appliances also face limited penetration due to affordability concerns. While financing options and rental models are emerging, cost sensitivity continues to restrict mass-market access. For widespread adoption to occur, manufacturers must work toward offering scalable, modular, and cost-efficient solutions that deliver ROI within realistic timelines, especially for emerging market segments.

Integration Challenges with Existing Kitchen Infrastructure and Human Workforce

Another significant restraint is the complexity involved in integrating automated cooking systems into existing kitchen layouts and workflows. Most traditional kitchens are not designed to accommodate robotic equipment, requiring retrofitting or redesign of workspaces to ensure smooth installation and operation.

Moreover, automation often necessitates new electrical, plumbing, and ventilation systems, which can be logistically and financially burdensome. Beyond infrastructure, human resource integration poses additional challenges. Kitchen staff often need to be retrained to operate, maintain, and collaborate with these machines. Resistance to change, fear of job displacement, and technical knowledge gaps can further slow adoption, especially in traditional restaurants or family-run eateries.

There’s also the concern of systems malfunctioning during peak hours, leading to service disruption. Unless seamless human-machine collaboration and infrastructure compatibility are addressed, automation adoption may be limited to newly built or tech-forward kitchens. Overcoming this constraint will require ecosystem-wide planning, from architecture to workforce upskilling.

Opportunities in the Global Automated Cooking Systems Market

Expansion of Automated Cloud Kitchens and Delivery-First Restaurants

The rising trend of cloud kitchens and delivery-first restaurants presents a vast growth opportunity for automated cooking systems. Cloud kitchens, or ghost kitchens, operate without dine-in facilities and cater exclusively to online food delivery platforms. These establishments prioritize speed, consistency, and scalability, making them ideal candidates for kitchen automation. With rising demand for food delivery across metro cities in North America, Europe, India, and Southeast Asia, operators are increasingly looking to reduce cooking time and ensure consistent output across multiple locations.

Automated cooking solutions like robotic fryers, automated woks, and modular cooking bots allow cloud kitchens to centralize operations and expand quickly without depending on large culinary teams. The integration of real-time order management systems and robotic workflows enables seamless coordination from kitchen to doorstep. Investors are already funding cloud kitchen startups that embed robotic automation as a core competency. This growing model of centralized, tech-enabled food production offers a substantial runway for market expansion.

Growing Demand for Personalized and Health-Conscious Meal Preparation

The global shift toward personalized nutrition and health-focused eating habits is opening up new avenues for automated cooking systems. Consumers are increasingly seeking meals tailored to specific dietary preferences, such as low-carb, vegan, keto, or allergen-free options. Automated cooking systems equipped with customizable modules and AI-based meal planning engines are emerging as a solution to address this need. Smart appliances now allow users to input their dietary restrictions and taste preferences, enabling machines to recommend suitable recipes and automate their preparation accordingly.

Moreover, health-conscious meal delivery services are exploring automated kitchen lines to meet growing subscription demands without compromising nutritional accuracy. These systems are also being introduced in wellness resorts, fitness centers, and corporate cafeterias to cater to diverse nutritional goals at scale. As awareness around lifestyle diseases increases, the demand for diet-specific, automated meal preparation is expected to rise, particularly among urban millennials, aging populations, and healthcare institutions, driving robust market growth.

Trends in the Global Automated Cooking Systems Market

Rise of AI-Integrated Robotic Kitchens in Commercial Settings

A prominent trend in the automated cooking systems market is the integration of artificial intelligence (AI) and machine vision into robotic kitchen systems, particularly within commercial restaurants, quick-service outlets, and institutional kitchens. These AI-enabled platforms are equipped to analyze cooking times, detect ingredients, adjust seasoning levels, and adapt to various recipes using deep learning algorithms.

In fast-food chains such as White Castle and CaliBurger, robotic fry stations and burger-flipping bots have shown increased operational efficiency, reduced human error, and enhanced food consistency.

Additionally, AI-driven systems are now capable of learning consumer preferences over time, offering hyper-personalized menu items in automated vending kiosks and smart cafés. This trend is driven by the rising demand for contactless food preparation, labor shortage challenges, and the need for consistent food quality in high-volume environments. As a result, AI-integrated robotic kitchens are no longer futuristic concepts but a growing reality shaping the commercial culinary industry.

Adoption of Smart Kitchen Appliances in Urban Residential Markets

Another significant trend is the growing adoption of automated cooking systems within urban households, driven by smart kitchen appliances that cater to time-constrained, tech-savvy consumers. Devices like intelligent pressure cookers, robotic arms, and automated stirrers are gaining traction, particularly in Tier-1 cities across Asia, Europe, and North America.

These devices offer benefits such as voice control integration via Alexa or Google Assistant, recipe-guided cooking, automatic ingredient dispensing, and remote operation via mobile apps. The increasing penetration of high-speed internet, rising disposable incomes, and growing urbanization are catalyzing the trend. Consumers now demand kitchen solutions that reduce meal preparation time without compromising quality or nutrition.

This home automation wave, aligned with the broader smart home ecosystem, is expanding rapidly among millennials and Gen Z households who prioritize convenience, connected living, and energy efficiency. In this context, automated residential cooking solutions are transforming domestic culinary habits and influencing new product development by major appliance brands.

Global Automated Cooking Systems Market: Research Scope and Analysis

By Component Analysis

The hardware segment is projected to dominate the Automated Cooking Systems Market due to its essential role in enabling the physical execution of automated culinary processes. Hardware components such as robotic arms, intelligent grills, fryers, induction-based cooktops, conveyor systems, temperature sensors, and smart ovens are the backbone of any automated cooking solution.

These physical systems perform critical tasks like cutting, stirring, flipping, steaming, boiling, and frying, often in real time and with high consistency. Unlike software and services, which act as enablers or support layers, hardware is indispensable and irreplaceable in delivering tangible cooking functions.

The high upfront demand for robust, precision-engineered equipment in both commercial and semi-commercial kitchens drives large-scale procurement and installations. Automated cooking systems are seeing increased adoption in quick-service restaurants (QSRs), cloud kitchens, and food chains globally, all of which depend on reliable hardware to maintain food quality, safety, and efficiency. Moreover, advanced hardware integrates seamlessly with machine vision and AI-driven controls, making it vital for applications requiring high customization and precision.

As new innovations like multi-functional robotic chefs and modular cooktops become commercially available, the hardware market continues to expand. These platforms often require expensive capital expenditure, further boosting the revenue share of the hardware segment compared to software and services.

Additionally, hardware longevity and upgradeability contribute to lifecycle cost advantages, making them the core investment focus for end-users, especially in high-throughput food environments. Given these factors, hardware remains the dominant component in the automated cooking systems landscape.

By Type Analysis

Semi-automated cooking systems are anticipated to lead the market due to their balanced blend of automation efficiency and human flexibility, making them more practical and accessible for widespread adoption. These systems assist human chefs in repetitive or high-risk tasks such as stirring, frying, or portioning while still allowing manual oversight and culinary creativity. This hybrid approach significantly reduces labor fatigue, ensures food consistency, and minimizes errors without completely displacing human staff, thus easing the transition for businesses hesitant to adopt full automation.

Semi-automated systems require lower capital investment than fully automated setups, which makes them attractive to small and mid-sized restaurants, hotels, and institutional kitchens. They are also more adaptable to existing infrastructure, requiring fewer design modifications and workforce retraining. For example, intelligent frying stations that automate oil temperature control or robotic arms that assist with ingredient dispensing can be integrated easily into traditional kitchens.

Furthermore, semi-automated cooking systems allow businesses to scale automation at their own pace. They provide operational flexibility to handle both fixed recipes and dynamic culinary environments. Many players opt for semi-automation to test market readiness and consumer acceptance before moving to more complex systems. These setups also offer the advantage of maintaining the artisanal or handmade touch that full automation often lacks, especially important in gourmet or culturally sensitive cuisines.

Given the cost-efficiency, ease of implementation, and operational balance between man and machine, semi-automated cooking systems dominate the market, especially in regions where full automation is not yet economically viable or culturally accepted.

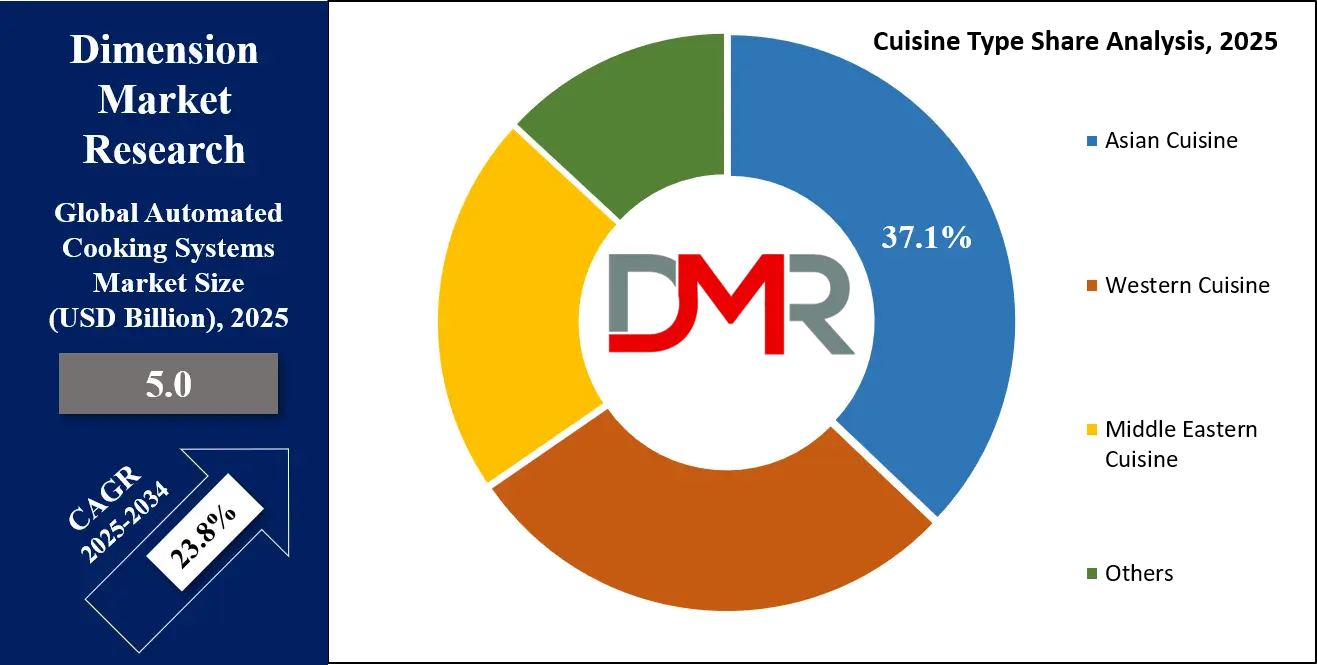

By Cuisine Type Analysis

Asian cuisine is expected to lead the global automated cooking systems market by cuisine type, primarily due to its strong global demand, highly repeatable cooking techniques, and compatibility with automation technologies. Stir-frying, steaming, boiling, and sautéing are core methods in Chinese, Japanese, Thai, and Indian cooking that are particularly suited to robotic operations. These processes often involve quick, high-heat cooking that benefits significantly from machine precision and consistency. Automation helps overcome the challenges of manual labor in replicating intricate techniques such as wok tossing or temperature-sensitive boiling, especially in high-volume kitchens.

In commercial settings, such as Asian QSR chains, food courts, and ghost kitchens, automated systems have been widely adopted to replicate traditional dishes like fried rice, noodles, curries, and dumplings at scale. For instance, robotic stir-fry stations have gained popularity in Singapore, South Korea, and China for their ability to prepare complex dishes within minutes without sacrificing flavor or texture. Additionally, with the global proliferation of Asian food spurred by urbanization, migration, and growing cultural curiosity, demand for scalable, automated preparation methods is rising in Western countries.

Moreover, Asian cuisine’s diverse ingredient base, ranging from vegetables and spices to meat and seafood, aligns well with modular cooking systems capable of automated ingredient dispensing and sequencing. From sushi-making robots in Japan to automatic dosa machines in India, innovations targeting specific sub-cuisines also enhance the segment’s dominance. The frequency of consumption, quick preparation requirements, and strong regional manufacturing ecosystem ensure Asian cuisine maintains a leadership position within the automated cooking systems market.

By Application Analysis

Stir-frying and sautéing are expected to dominate the automated cooking systems market by application, due to their prevalence across global cuisines and high suitability for robotic execution. These cooking techniques involve continuous movement, high-temperature control, and precise timing elements that lend themselves well to automation using rotating pans, temperature sensors, and robotic stirrers. In commercial settings, stir-frying is frequently used to prepare a variety of menu items quickly, such as noodles, rice dishes, vegetables, and proteins, making it ideal for integration with high-speed robotic cooking stations.

Automation ensures uniform heat distribution and consistent texture, which are difficult to maintain manually during peak service hours. Stir-fry robots equipped with programmable controls can mimic the wok-tossing motion traditionally used in Asian kitchens, while also reducing oil usage and minimizing overcooking. These advantages help restaurants ensure consistent food quality while optimizing energy use and reducing labor dependency.

Furthermore, robotic sautéing systems can reduce health and safety risks by preventing burns and injuries commonly associated with hot oil or high flames. They also enable strict control of seasoning and ingredient addition timing, essential for flavor retention in complex dishes. With the popularity of dishes that require stir-frying or sautéing rising globally, especially in fast-casual and delivery-first dining models, this application is among the first to receive significant investment in automation technologies.

Given its versatility, operational repeatability, and global culinary relevance, stir-frying and sautéing continue to dominate the application landscape in the automated cooking systems market.

By End User Analysis

The commercial segment is anticipated to dominate the automated cooking systems market due to its scale, consistency requirements, and constant drive for operational efficiency. Restaurants, quick-service chains, food courts, ghost kitchens, and hospitality groups are under increasing pressure to deliver standardized, high-quality meals at a rapid pace, often across multiple locations. Automation plays a pivotal role in ensuring that food preparation remains consistent regardless of outlet or staff availability.

Commercial foodservice environments face persistent challenges such as labor shortages, high employee turnover, rising wage costs, and growing demand for hygienic and contactless food handling. Automated cooking systems help mitigate these issues by executing repetitive and precision-based tasks such as flipping burgers, frying items, or stirring sauces. These systems operate tirelessly and with high accuracy, significantly reducing order errors, cooking inconsistencies, and training requirements for kitchen staff.

Additionally, commercial kitchens often have the capital and infrastructure necessary to invest in large-scale robotic installations and are willing to do so when the return on investment is clear, typically through labor cost savings, reduced waste, and increased throughput. Large franchises also benefit from the scalability and standardization automation provides, making it easier to roll out new locations with uniform culinary outcomes.

Cloud kitchens and automated food trucks have further reinforced the segment's dominance, with cooking robots becoming central to fast, efficient, and hygienic food preparation. As foodservice businesses continue to prioritize speed, scalability, and sustainability, the commercial segment will remain the primary growth driver in the global automated cooking systems market.

The Global Automated Cooking Systems Market Report is segmented on the basis of the following:

By Component

- Hardware

- Robotic Arms

- Sensors

- Motors

- Actuators

- Induction Heaters

- Frying Modules

- Dispensing Units

- Software

- AI Algorithms

- Recipe Databases

- Control Systems

- UI/UX Platforms

- Real-Time Monitoring Tools

- Services

- Installation & Integration

- Maintenance

- Remote Monitoring

- Training And Support

By Type

- Semi-Automated Cooking Systems

- Fully Automated Cooking Systems

By Cuisine Type

- Asian Cuisine

- Indian

- Chinese

- Japanese

- Korean

- Western Cuisine

- American

- European

- Italian

- French

- Middle Eastern Cuisine

- Others

By Application

- Stir-Frying and Sauteing

- Grilling and Roasting

- Steaming and Boiling

- Deep Frying

- Blending and Mixing

- Baking

By End User

- Commercial

- Quick Service Restaurants (QSRs)

- Casual Dining Restaurants

- Institutional Canteens (corporate, schools, universities)

- Hotels & Resorts

- Food Trucks & Cloud Kitchens

- Residential

- Smart homes

- Urban households

- High-income kitchens

Global Automated Cooking Systems Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to lead the global automated cooking systems market as it commands over 44.6% of the total revenue by the end of 2025, owing to its high population density, rapid urbanization, and deep-rooted culinary traditions that are well-suited for automation. Countries like China, Japan, South Korea, and India are home to large foodservice industries with soaring demand for fast, consistent, and hygienic food preparation.

The region has been at the forefront of robotics innovation, with Japan and South Korea pioneering cooking robots for tasks like sushi rolling, ramen serving, and wok-based stir-frying. Moreover, labor shortages and rising operational costs in urban centers like Tokyo, Seoul, Shanghai, and Singapore have accelerated the deployment of smart kitchen automation to reduce reliance on human workers.

Government initiatives promoting AI and robotics (such as Japan’s "Society 5.0" and China’s "Made in China 2025") further support the integration of automated culinary systems across restaurants, hotels, and institutional kitchens. Additionally, the thriving quick-service restaurant culture and growing middle-class consumer base demand convenience, speed, and consistency, driving adoption among commercial kitchens. With strong local manufacturing capabilities and early adoption of robotics, Asia-Pacific remains the dominant regional force in this market.

Region with the Highest CAGR

North America is projected to register the highest CAGR in the automated cooking systems market due to growing demand for labor-efficient kitchen operations, rising foodservice digitalization, and the surge in contactless, robotic cooking post-COVID-19. In the U.S. and Canada, chronic staff shortages and increasing wages in the hospitality sector have pushed businesses toward intelligent cooking automation. The region’s strong ecosystem of food-tech startups, advanced robotics research, and venture capital funding fosters rapid innovation and commercialization of semi- and fully-automated cooking systems.

The popularity of fast-casual dining, ghost kitchens, and smart food trucks is also fueling the deployment of robotic fryers, grilling machines, and automatic food assembly stations. In cities like San Francisco, Austin, and Toronto, automated kitchens are already piloting AI-powered platforms for burger flipping, pizza baking, and ingredient dispensing. The region also benefits from tech-savvy consumers and regulatory support for robotics and AI, enhancing its potential for future growth. These combined factors drive North America’s position as the fastest-growing regional market for automated cooking systems.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Automated Cooking Systems Market: Competitive Landscape

The global automated cooking systems market is highly competitive and innovation-driven, with a mix of established industrial automation firms, emerging food-tech startups, and commercial kitchen solution providers. Key players are focusing on developing modular, intelligent, and scalable cooking robots capable of automating specific tasks such as frying, stirring, mixing, and grilling.

Leading companies like Miso Robotics, Chowbotics (acquired by DoorDash), and Suzumo Machinery have introduced advanced robotic cooking systems targeting quick-service and institutional kitchens. Asian players such as Karakuri (UK-Japan), Keenon Robotics (China), and Panasonic are expanding their smart kitchen portfolios, leveraging AI, IoT, and real-time vision systems for meal precision and consistency. Partnerships between kitchen equipment manufacturers and AI companies are on the rise, with firms like Middleby Corporation and Welbilt integrating robotics into traditional appliances.

In addition, startups such as Spyce (acquired by Sweetgreen), Remy Robotics, and Cooksy are reshaping the space with compact, cloud-integrated, and consumer-friendly cooking bots. Investment flows are robust, with venture capitalists backing scalable food automation ventures for cloud kitchens and delivery platforms. With M&A activity intensifying and a global push for contactless cooking, the competitive landscape is poised for aggressive growth and technological breakthroughs.

Some of the prominent players in the Global Automated Cooking Systems Market are:

- Moley Robotics

- Chowbotics (DoorDash)

- Spyce (Sweetgreen)

- Miso Robotics

- Cecilia.ai

- Picnic Works

- Karakuri

- Suvie

- Botinkit

- Kitchen Robotics

- Richtech Robotics

- Dexai Robotics

- Cooksy

- Nymble (Julia)

- Yo-Kai Express

- RoboEatz

- Samsung Bot Chef

- Sony AI (Chef Assisting Systems)

- Sony Global Kitchen Lab

- LG CLOi ChefBot

- Other Key Players

Recent Developments in the Global Automated Cooking Systems Market

June 2024

- Wonderchef launched ‘Chef Magic’, a multifunctional kitchen robot capable of cooking over 200 automated recipes, during the Consumer Electronics World Expo in Delhi, targeting the Indian urban and semi-urban household market.

May 2024

- Expo FoodTech 2025 was announced, scheduled for May 13–15 in Bilbao, Spain. It will focus on innovations in food industry automation, robotics, and smart cooking technologies, expecting 8,000+ professionals and 250+ exhibitors.

December 2023

- At CES 2024, 74 food tech companies, including Samsung and LG, confirmed participation to showcase AI-powered cooking robots, smart ovens, and intelligent kitchen assistants, reflecting the growing fusion of consumer electronics and culinary robotics.

November 2023

- Cuisinart entered into a collaboration with a kitchen automation startup to develop a new line of AI-powered automatic cooking machines tailored for precision cooking and time efficiency in home kitchens.

October 2023

- Moley Robotics unveiled a new version of its robotic chef with enhanced capabilities in preparing global cuisine using AI-based personalization and gesture-mimicking arms.

- LG Electronics launched an AI-driven automatic cooking system capable of suggesting and cooking recipes using deep learning models based on pantry inputs and past preferences.

September 2023

- Samsung Electronics partnered with an AI culinary tech firm to embed machine learning algorithms into its kitchen appliances for better recipe adaptation and user-friendly controls.

- Philips introduced a smart range of automatic cooking machines with Wi-Fi and app connectivity for remote control and step-by-step guidance.

August 2023

- Panasonic acquired a robotics startup focused on domestic AI cooking systems, integrating advanced automation features into its product line.

- Tefal expanded its automated cooking appliance line into India and Southeast Asia, targeting growing urban markets seeking convenience and hands-free cooking.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.0 Bn |

| Forecast Value (2034) |

USD 25.7 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By ACaaS Deployment (Hosted, Managed, Hybrid), By Authentication Method (Single-Factor, Multi-Factor, Mobile Credential/Bluetooth LE), By Connectivity Technology (RFID/NFC, Smart Cards, Bluetooth Low Energy, Ultra-Wideband), By Technology (Authentication Systems, Detection Systems, Alarm Panels, Communication Devices, Perimeter Security Systems), By End-Use Vertical (Commercial Buildings, Industrial & Manufacturing, Government & Public Sector, Military & Defense, Transport & Logistics, Healthcare, Residential & Smart Homes, Education & Research, Energy & Utilities, Hospitality & Entertainment, Retail & Customer-Facing, Financial Institutions, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, Thales Group, AMAG Technology, Axis Communications, NEC Corporation, Gallagher Group, Brivo Systems, SALTO Systems, Genetec Inc., HID Global, Siemens, Cansec Systems., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Automated Cooking Systems Market size is estimated to have a value of USD 5.0 billion in 2025 and is expected to reach USD 34.1 billion by the end of 2034.

The US Automated Cooking Systems Market is projected to be valued at USD 1.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.2 billion in 2034 at a CAGR of 22.3%.

Asia Pacific is expected to have the largest market share in the Global Automated Cooking Systems Market with a share of about 44.6% in 2025.

Some of the major key players in the Global Automated Cooking Systems Market are Moley Robotics, Chowbotics (DoorDash), Spyce (Sweetgreen), Miso Robotics, Cecilia.ai, Picnic Works, Karakuri, Suvie, Botinkit, Kitchen Robotics, Richtech Robotics, Dexai Robotics, Cooksy, Nymble (Julia), and many others.

The market is growing at a CAGR of 23.8 percent over the forecasted period of 2025.