Market Overview

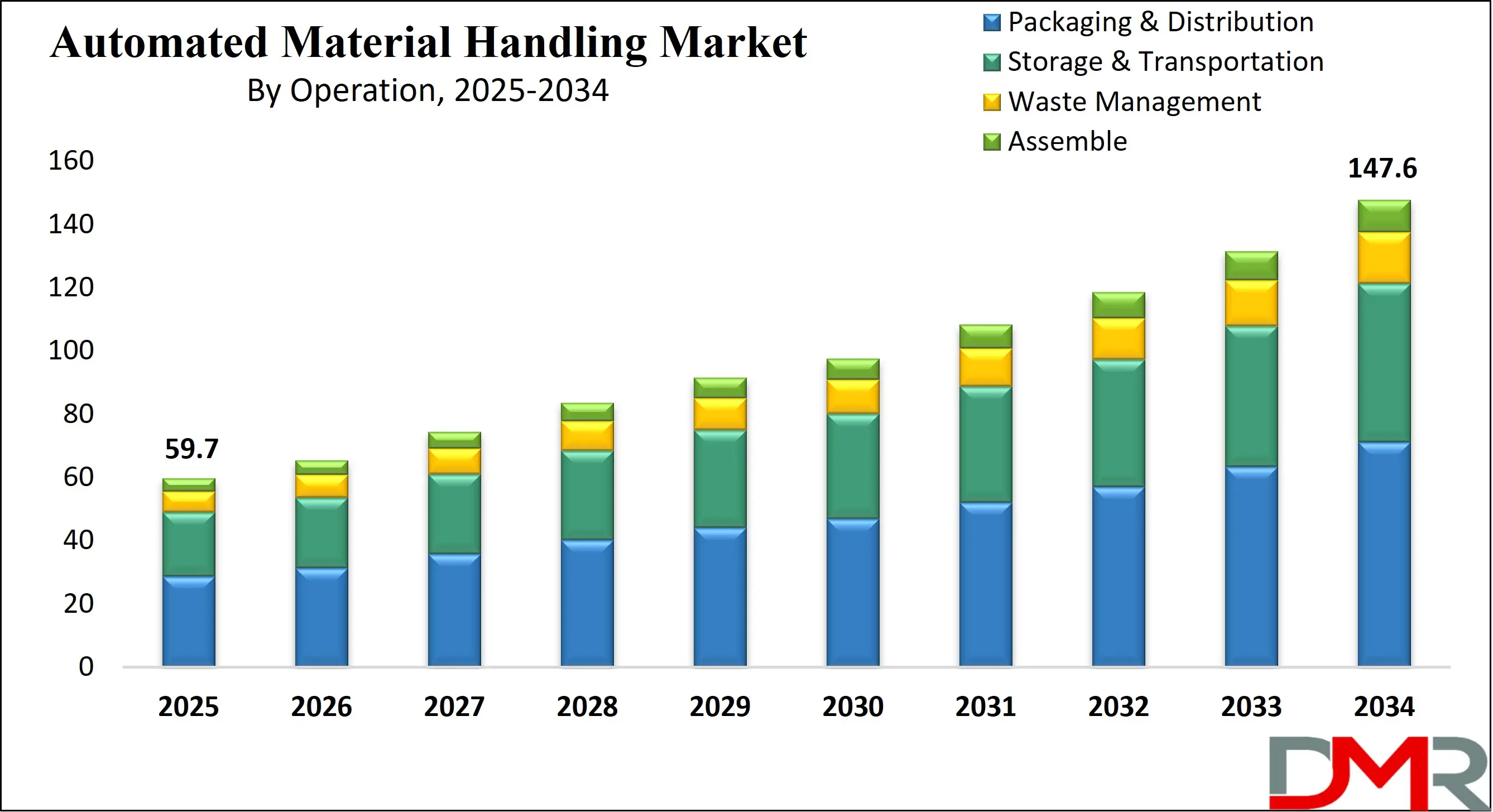

The global automated material handling market is poised for remarkable expansion, with its market size projected to reach

USD 59.7 billion in 2025. Accelerated by the surging demand for smart warehousing, industrial automation, and AI-powered logistics systems, the sector is expected to witness a robust

CAGR of 10.6% over the forecast period. By 2034, the market valuation is anticipated to soar to

USD 147.6 billion, driven by transformative shifts in supply chain automation, robotic material handling, and the adoption of autonomous mobile robots (AMRs) across manufacturing and distribution hubs.

Automated Material Handling refers to the use of advanced technologies, systems, and equipment to automate the movement, storage, control, and protection of materials, goods, and products throughout the manufacturing, warehousing, and distribution processes. This includes a wide range of equipment such as automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), conveyor systems, robotic arms, sortation systems, and palletizing equipment, all integrated with software for warehouse control and management.

These systems are designed to enhance operational efficiency, reduce manual labor, minimize errors, and increase throughput in supply chain and intralogistics environments. Automation in material handling not only supports lean manufacturing principles but also enables real-time inventory tracking, precise order fulfillment, and scalability in response to fluctuating market demands.

The global Automated Material Handling market has been experiencing robust growth, driven primarily by the escalating demand for industrial automation and the evolution of smart factories. Manufacturers and logistics providers are adopting warehouse automation systems to streamline operations and meet the growing consumer expectations for faster deliveries and accurate order processing.

The proliferation of e-commerce platforms, integrated with the need for efficient fulfillment centers, has significantly increased the reliance on robotics and sensor-driven technologies to automate picking, sorting, and packaging processes. Companies are investing in automated logistics systems to gain a competitive edge and reduce dependence on labor-intensive operations, particularly in regions facing skilled labor shortages.

Technological advancements such as machine learning, computer vision, and the Industrial Internet of Things (IIoT) have further accelerated the adoption of material handling automation across industries. Integration of real-time data analytics and cloud-based warehouse management systems has enabled predictive maintenance, process optimization, and smarter decision-making in supply chain management. Automotive, food and beverage, pharmaceuticals, and electronics are among the sectors witnessing increased deployment of automated solutions, given their need for precise handling and timely movement of sensitive or high-volume goods. In addition, governments across various regions are promoting automation as part of their digital transformation initiatives, boosting investments in smart warehouses and distribution centers.

The US Automated Material Handling Market

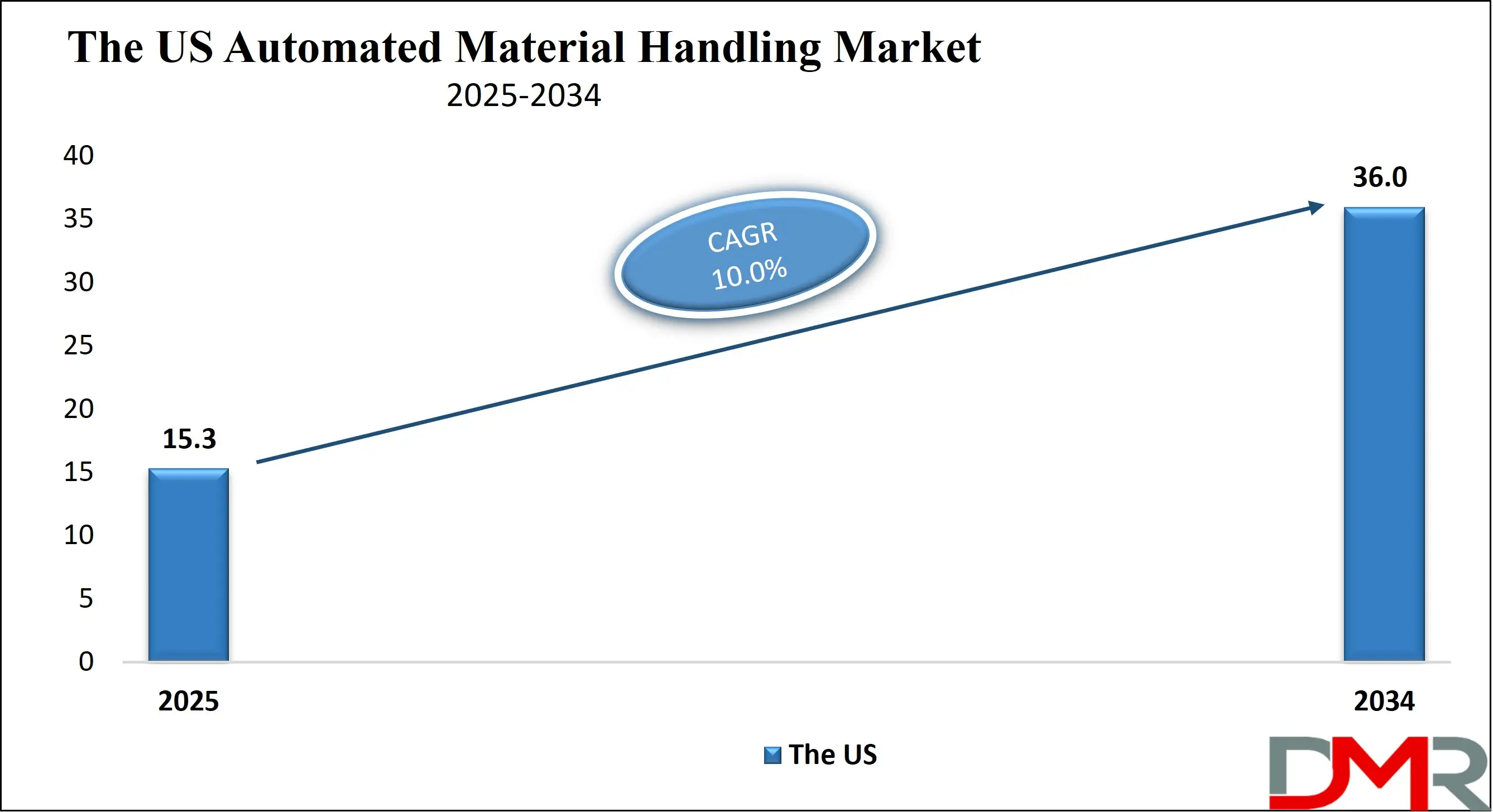

The U.S. Automated Material Handling Market size is projected to be valued at USD 15.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 36.0 billion in 2034 at a CAGR of 10.0%.

The U.S. automated material handling (AMH) market is undergoing rapid transformation, driven by the growing demand for operational efficiency, labor optimization, and real-time logistics visibility across industries. With supply chains growing more complex and customer expectations for fast delivery intensifying, companies are aggressively adopting smart warehouse technologies, automated guided vehicles (AGVs), and robotic picking systems to remain competitive.

The rise of e-commerce giants, along with the shift toward same-day delivery models, has placed immense pressure on warehousing and fulfillment operations to become faster and more agile. As a result, businesses across the U.S. are investing in end-to-end logistics automation, encompassing everything from automated storage and retrieval systems (AS/RS) to intelligent sortation and conveyor solutions. This trend is further bolstered by ongoing labor shortages and growing labor costs, compelling manufacturers and distributors to reduce dependency on manual handling through automation.

Another key growth driver is the accelerating adoption of Industry 4.0 across the U.S. industrial sector. Companies are integrating IoT-enabled sensors, AI-powered analytics, and cloud-based warehouse management systems (WMS) to optimize throughput, track inventory in real time, and enable predictive maintenance of equipment. From automotive manufacturing to pharmaceutical logistics, AMH technologies are playing a pivotal role in reshaping how materials and products move through production and distribution networks.

The European Automated Material Handling Market

In 2025, the European automated material handling (AMH) market is projected to reach a value of USD 41.3 billion, driven by strong adoption across various industries and the region's focus on technological advancements. This growth is expected to be supported by a CAGR of 9% over the forecast period, highlighting the rising demand for automation solutions in manufacturing, logistics, and e-commerce sectors.

Europe's manufacturing sector, particularly in countries like Germany, Italy, and the UK, is a major contributor to this growth. The region’s well-established industrial base is increasingly leveraging automated material handling systems to optimize production lines, reduce labor costs, and enhance overall operational efficiency. Technologies like Automated Guided Vehicles (AGVs), robotics, and automated conveyors are integral to streamlining manufacturing and assembly processes.

The e-commerce boom across Europe is another key factor fueling the market's expansion. As consumer demand for faster deliveries continues to grow, companies are looking for innovative ways to improve warehouse and distribution center operations. Automated material handling solutions are playing a critical role in achieving these goals by optimizing inventory management, increasing throughput, and reducing the time required for order fulfillment.

The Japan Automated Material Handling Market

In 2025, the Japan automated material handling (AMH) market is expected to reach a significant value of USD 1.8 billion, accounting for 10.4% of the global market. This growth is driven by Japan’s leadership in robotics and automation technologies, a key driver for industries looking to streamline their operations and reduce labor costs. With a CAGR of around 9-11%, the market is poised for robust expansion, fueled by the increasing integration of smart automation solutions across various sectors.

Japan's industrial base, particularly in robotics, automotive, and electronics manufacturing, has played a central role in the adoption of automated material handling systems. As one of the leading countries in robotics innovation, Japan has seen widespread implementation of technologies like Automated Guided Vehicles (AGVs), robotics, and advanced conveyor systems to support manufacturing lines, warehouse operations, and logistics networks. These solutions help improve efficiency, reduce downtime, and ensure high precision in operations, making them essential for competitive industries in Japan.

The aging population in Japan, coupled with a shortage of skilled labor, has also driven the need for automation. In response, companies across sectors like automotive, electronics, and consumer goods are increasingly turning to automated systems to meet growing demands and maintain productivity. The government’s initiatives, such as the "Society 5.0" vision, further support the adoption of AI, IoT, and robotics, enabling the development of smart factories and logistics systems.

Global Automated Material Handling: Key Takeaways

- Market Value: The global automated material handling size is expected to reach a value of USD 147.6 billion by 2034 from a base value of USD 59.7 billion in 2025 at a CAGR of 10.6%.

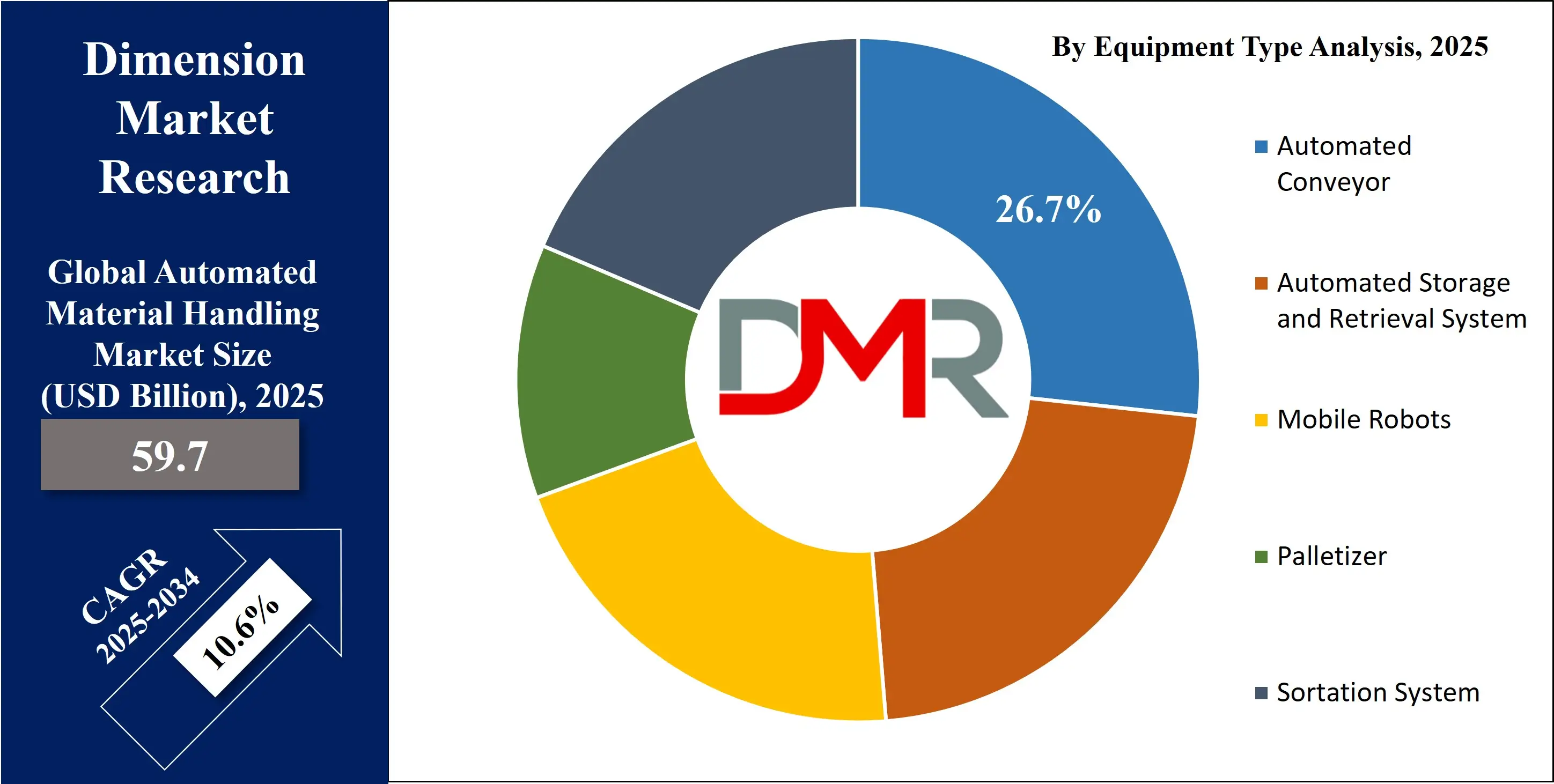

- By Offering Type Segment Analysis: Hardware is poised to consolidate its dominance in the offering type segment, capturing 71.5% of the total market share in 2025.

- By Equipment Type Segment Analysis: Automated Conveyor equipment is anticipated to maintain its dominance in the equipment type segment, capturing 26.7% of the total market share in 2025.

- By Operation Type Segment Analysis: Packaging & Distribution operations are expected to maintain their dominance in the operation type segment, capturing 48.1% of the total market share in 2025.

- By End-User Type Segment Analysis: The retail, warehouse, and logistics centers are poised to consolidate their market position in the end-user type segment, capturing 22.7% of the total market share in 2025.

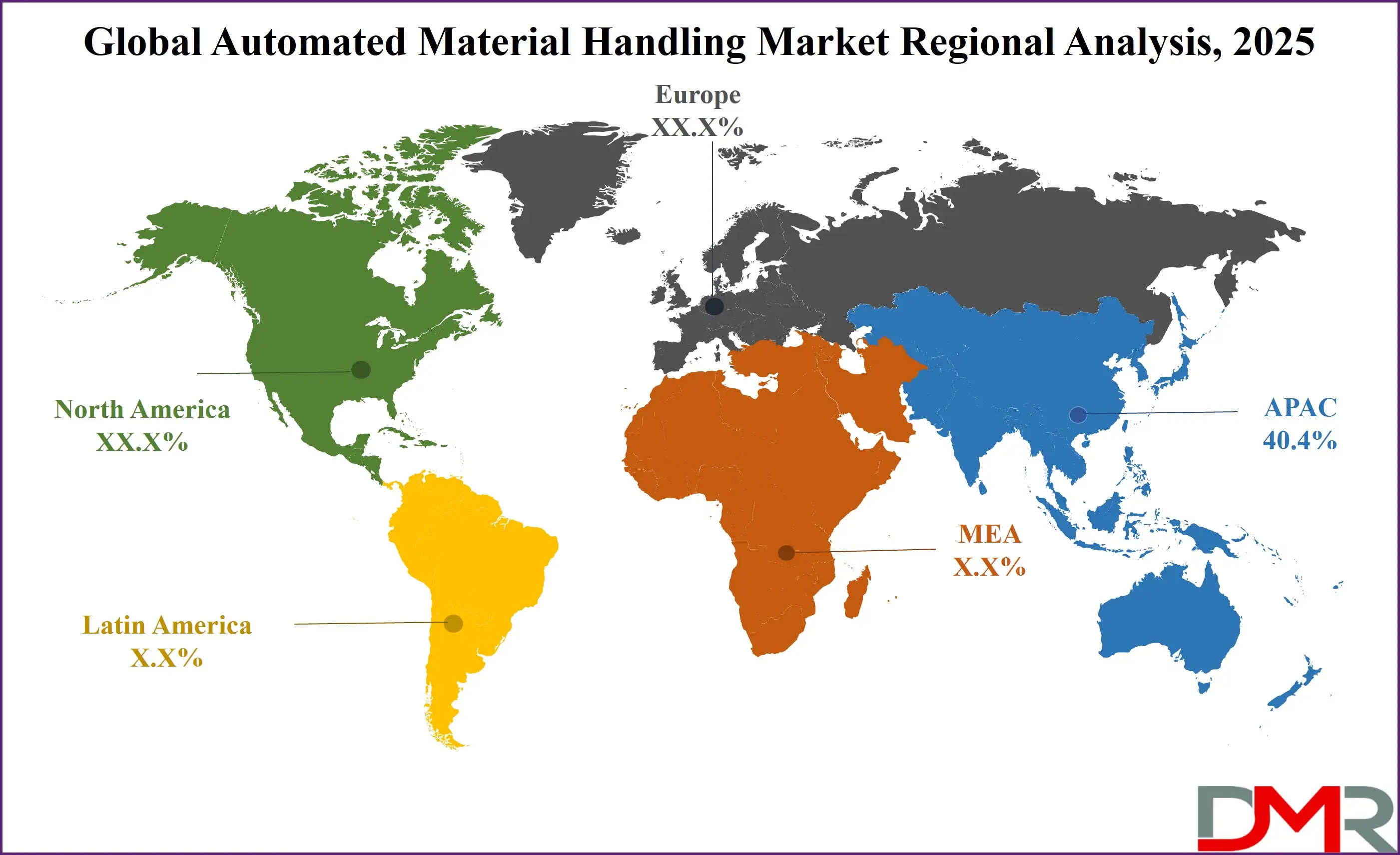

- Regional Analysis: Asia Pacific is anticipated to lead the global automated material handling market landscape with 40.4% of total global market revenue in 2025.

- Key Players: Some key players in the global automated material handling market are Daifuku Co., Ltd., SSI Schäfer, Dematic (a KION Group company), Honeywell Intelligrated, Murata Machinery, Ltd., BEUMER Group, TGW Logistics Group, Vanderlande Industries, Swisslog (a KUKA company), Bastian Solutions (a Toyota Advanced Logistics company), Interroll Holding AG, KNAPP AG, Mecalux, S.A., Hyster-Yale Materials Handling, Inc., Toyota Material Handling, Schaefer Systems International, JBT Corporation, Egemin Automation, SICK AG, Rockwell Automation, and Other Key Players.

Global Automated Material Handling: Use Cases

- Smart Manufacturing in the Automotive Industry: The automotive sector has become one of the most significant adopters of automated material handling solutions. With the rising complexity in vehicle assembly and growing model variants, manufacturers are leveraging automated guided vehicles (AGVs), robotic arms, and conveyor automation to streamline production lines and improve material flow. These systems ensure the just-in-time (JIT) delivery of components such as engines, dashboards, and wiring systems, enabling lean manufacturing practices and reducing production downtime. The integration of warehouse execution systems (WES) and industrial IoT sensors also allows real-time monitoring of part availability and predictive maintenance of AMH equipment, enhancing operational efficiency. As Industry 4.0 and smart factory initiatives expand globally, automotive players are investing in end-to-end intralogistics automation to boost throughput and maintain competitive advantage.

- E -commerce Fulfillment and Last-Mile Logistics: The explosive growth of e-commerce has significantly driven the need for faster, more accurate order fulfillment. Leading retailers and logistics providers are implementing automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), and intelligent sortation systems to optimize picking, packing, and shipping processes. These systems help manage high-order volumes with speed and precision, especially during peak seasons and flash sales. Advanced warehouse management systems (WMS) and real-time inventory tracking tools are also being deployed to enhance visibility and streamline operations across distribution centers. With growing consumer demand for same-day or next-day delivery, logistics automation has become critical for maintaining customer satisfaction and operational scalability in the global supply chain.

- Cold Chain and Pharmaceutical Logistics: The pharmaceutical and healthcare industries require stringent control over the storage, handling, and transportation of sensitive products such as vaccines, biologics, and temperature-controlled medications. AMH systems play a pivotal role in ensuring compliance with safety regulations and minimizing human contact to reduce contamination risks. Technologies like automated climate-controlled warehouses, robotic picking systems, and RFID-enabled inventory tracking are being widely adopted to ensure traceability and product integrity. In pharmaceutical manufacturing facilities and hospitals, AMH solutions also help automate material transfer, reduce human error, and maintain workflow efficiency in sterile environments.

- Food & Beverage Production and Packaging: In the highly competitive food and beverage industry, automation is vital for handling high throughput, ensuring hygiene, and minimizing waste. Companies are implementing high-speed conveyor systems, automated palletizers, and robotic case packers to manage a continuous flow of perishable goods and reduce reliance on manual labor. Moreover, automated warehouse solutions with temperature and humidity controls ensure compliance with food safety standards. Integration of data analytics platforms and machine learning algorithms enables producers to predict maintenance needs, track expiration dates, and optimize packaging workflows. These advancements are driving higher efficiency and product quality across the global food supply chain.

Global Automated Material Handling: Stats & Facts

China (Sources: IFR, China’s Smart Manufacturing Initiatives)

- China is the largest industrial robot market, with 154,032 units sold in 2018, and had the largest operational stock of industrial robots, with 649,447 at the end of 2018. (IFR)

- The Chinese government has set a target to automate 40% of all manufacturing processes by 2030, with the automotive and electronics industries being the primary sectors for automation integration. (China’s Smart Manufacturing Initiatives)

- China’s market share for industrial robots and automation solutions is expected to grow rapidly, as they push for increased usage across sectors like automotive, electronics, and logistics. (IFR)

Germany (Sources: IFR, Germany Trade & Invest, EU Reports)

- Germany has the highest robot density in Europe, with 294 units per 10,000 workers, trailing only Japan and South Korea globally. (IFR)

- Germany’s manufacturing sector contributes 23% of the nation’s GDP, and the country is pushing for increased adoption of automated material handling systems, especially in the automotive and consumer goods sectors. (Germany Trade & Invest)

- Europe accounts for over one-third of worldwide Industry 4.0 investments, with Germany being a primary leader. (EU Reports)

South Korea (Sources: Smart Factory Initiative, Korea’s Manufacturing & Logistics Industry)

- South Korea aimed to establish 30,000 smart factories by 2023, with plans to create 20 smart industrial zones by 2030, demonstrating a strong governmental push towards industrial automation and smart manufacturing capabilities. (Smart Factory Initiative)

- South Korea’s logistics industry has experienced a significant transformation due to automation, with investments in AI-powered robotic systems expected to improve operational efficiency by 40% over the next 5 years. (Korea’s Manufacturing & Logistics Industry)

- By 2025, South Korea plans to implement 50,000 smart factories nationwide, with significant investment focused on robotic automation in logistics and manufacturing. (Smart Factory Initiative)

United States (Sources: U.S. International Trade Administration, U.S. Department of Energy)

- The U.S. is projected to lead the global automated material handling equipment market in terms of revenue by 2030, driven by advancements in robotics and automation. (U.S. International Trade Administration)

- The U.S. Department of Energy reports an annual increase of 8% in industrial automation adoption across manufacturing sectors, driven by energy savings and productivity improvements. (U.S. Department of Energy)

- The U.S. government’s manufacturing initiative, 'Advanced Manufacturing National Program Office (AMNPO)', is driving investments into automation and smart manufacturing technologies with a focus on industrial robots. (U.S. International Trade Administration)

Japan (Sources: IFR, Japan’s Industry 4.0 Roadmap)

- Japan is focusing on increasing automation in logistics and manufacturing as part of its Industry 4.0 roadmap, particularly for automotive and electronics sectors, expected to grow by 9% annually by 2025. (Japan’s Industry 4.0 Roadmap)

- Japan maintains a high robot density, with over 1,200 robots per 10,000 workers in the manufacturing sector, the highest globally. (IFR)

India (Sources: SAMARTH Udyog Bharat 4.0, India’s Manufacturing Growth Plans)

- India’s Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to increase manufacturing output contribution to 25% of GDP by 2025, up from 16%, driving awareness and implementation of Industry 4.0 technologies across the manufacturing sector. (SAMARTH Udyog Bharat 4.0)

- India’s adoption of automated systems is expected to grow by 13% annually, as part of the 'Make in India' initiative focusing on robotics and automation in manufacturing. (India’s Manufacturing Growth Plans)

France (Source: France’s Industrial Automation Plans)

- France aims to increase the automation of its manufacturing processes by 15% by 2025, focusing on the automotive and aerospace sectors, to improve efficiency and reduce labor costs. (France’s Industrial Automation Plans)

United Kingdom (Source: UK Government’s Strategy for Automation)

- The UK government has committed to investing in the development of automated material handling systems for logistics as part of its broader strategy to improve its supply chain resilience. (UK Government’s Strategy for Automation)

European Union (Sources: EU Reports, Germany Trade & Invest)

- Europe accounts for over one-third of worldwide Industry 4.0 investments, with Northern and Western Europe, particularly Germany, being the primary markets. (EU Reports)

- The EU’s automation market in manufacturing is expected to grow by 7% annually over the next decade, with an emphasis on sustainability and reducing carbon emissions in industrial operations. (EU Reports)

Global Automated Material Handling: Market Dynamics

Global Automated Material Handling: Driving Factors

Surge in Demand for Warehouse Automation Across E-commerce and Retail

The exponential growth of e-commerce has fundamentally reshaped warehouse operations, prompting businesses to invest in scalable, automated systems to meet high-volume, high-speed order fulfillment requirements. Automated material handling technologies like robotic picking systems, automated storage and retrieval systems (AS/RS), and intelligent sortation units are now essential to support fast-moving inventory and fluctuating demand. As global consumers continue to expect faster delivery times and real-time order tracking, warehouse automation has become a critical pillar of modern logistics infrastructure.

Industrial Shift toward Smart Manufacturing and Industry 4.0 Integration

Manufacturing industries are rapidly embracing digital transformation strategies that involve the integration of cyber-physical systems, industrial IoT devices, and AI-driven process automation. Automated material handling solutions are a core component of this shift, enabling seamless communication between machines, inventory systems, and production lines. By reducing human intervention, these technologies enhance operational safety, reduce lead times, and support lean production principles across industries such as automotive, aerospace, and electronics.

Global Automated Material Handling: Restraints

High Initial Capital Investment and Integration Complexity

Despite the long-term efficiency gains, the high upfront cost of implementing advanced AMH systems remains a significant barrier for small to mid-sized enterprises. Capital expenditures for robotic systems, smart sensors, and software platforms, along with the costs of retrofitting existing infrastructure, can be substantial. Moreover, integrating these systems into legacy environments requires skilled labor, time-intensive planning, and ongoing system maintenance, often limiting adoption to larger organizations with ample resources.

Cybersecurity and Data Privacy Concerns in Connected Systems

As AMH solutions become more interconnected via cloud-based warehouse management systems and IoT-enabled devices, they also become more vulnerable to cyber threats and data breaches. Unauthorized access to operational data, disruptions to automated control systems, or manipulation of inventory software can have serious implications for business continuity. These risks are particularly relevant for sectors like pharmaceuticals and defense logistics, where data security is non-negotiable, making cybersecurity resilience a crucial limitation to broader deployment.

Global Automated Material Handling: Opportunities

Rise of Autonomous Mobile Robots (AMRs) in Flexible Warehousing

One of the most promising developments in material handling automation is the rapid adoption of autonomous mobile robots (AMRs), which provide flexible, scalable solutions for intra-warehouse movement. Unlike fixed conveyor systems, AMRs offer dynamic routing, quick deployment, and real-time responsiveness to changing workloads. As demand for modular and cost-effective solutions grows, AMRs are becoming attractive for businesses looking to optimize material flow without extensive structural changes.

Expansion in Emerging Markets with Infrastructure Modernization

Developing regions in Southeast Asia, Latin America, and the Middle East are witnessing increased investments in industrial automation and logistics infrastructure. Governments and private sector players are prioritizing smart warehouse development to enhance supply chain resilience and attract global manufacturing contracts. This creates fertile ground for automated material handling vendors to penetrate new markets, especially in sectors like food processing, textiles, and consumer electronics, where manual operations still dominate.

Global Automated Material Handling: Trends

Integration of AI and Predictive Analytics in Material Handling Systems

AI-powered algorithms are being used to forecast demand patterns, optimize route planning, and perform predictive maintenance on AMH equipment. By leveraging data from sensors, RFID tags, and enterprise resource planning (ERP) systems, companies can improve uptime, reduce energy consumption, and minimize operational bottlenecks. This evolution is driving the shift from reactive to proactive logistics strategies, particularly in high-volume sectors like retail and manufacturing.

Growth in Sustainable and Energy-efficient Automation Solutions

Sustainability has emerged as a major focus area for logistics and manufacturing companies. Automated material handling vendors are responding by designing energy-efficient systems that minimize waste and reduce the environmental footprint. Electric-powered conveyors, regenerative braking systems in AGVs, and recyclable packaging technologies are gaining traction. The integration of green practices not only supports corporate ESG goals but also helps reduce long-term operational costs in energy-intensive facilities.

Global Automated Material Handling: Research Scope and Analysis

By Offering Analysis

In the offering type segmentation of the global automated material handling market, hardware is projected to remain the dominant category, accounting for approximately 71.5% of the total market share in 2025. This stronghold is primarily due to the heavy reliance of industries on physical automation infrastructure, such as automated storage and retrieval systems (AS/RS), conveyor belts, robotic arms, sortation systems, and autonomous guided vehicles (AGVs).

These solutions form the backbone of warehouse automation, manufacturing floor efficiency, and material transport systems, enabling high-throughput operations and reducing manual labor dependency. With the ongoing trend of industrial digitization and the rise in smart factory investments, the demand for high-performance material handling hardware continues to surge, particularly in logistics-intensive sectors like e-commerce, automotive manufacturing, food and beverage processing, and consumer electronics.

However, the software segment is emerging as a strategic enabler within the automated material handling ecosystem. Although smaller in market share, its role is rapidly gaining importance due to the growing complexity of logistics networks and the need for intelligent orchestration of equipment and workflows. Software offerings in this space include warehouse control systems (WCS), warehouse execution systems (WES), and advanced warehouse management systems (WMS), which provide real-time visibility, decision automation, and dynamic task allocation across material handling assets. These platforms often leverage AI and machine learning algorithms to optimize storage allocation, minimize travel time, and enhance order accuracy.

By Equipment Type Analysis

Automated conveyor equipment is expected to maintain its leadership in the equipment type segment, capturing an estimated 26.7% of the total market share in 2025. This dominance is largely driven by the widespread adoption of conveyor systems across industries that require efficient, continuous material transport. From large-scale distribution centers to manufacturing facilities, conveyors provide a flexible, scalable solution for moving materials seamlessly through production lines, warehouses, and fulfillment hubs.

These systems are integral to the automation of supply chains, particularly in sectors like automotive, retail, and e-commerce, where rapid, high-volume handling of goods is critical to meeting consumer demand. Innovations such as intelligent conveyor networks, modular systems, and energy-efficient designs are further solidifying the role of conveyors in the modern logistics landscape.

Alongside conveyors, the automated storage and retrieval system (AS/RS) is emerging as a key player in the equipment type segment, contributing to the growth of the global automated material handling market. AS/RS solutions are particularly beneficial in environments that require high-density storage and quick retrieval of products or materials. These systems rely on automated cranes, shuttles, and robotic arms to efficiently store and retrieve items from shelves in a highly organized, systematic manner, reducing manual labor and improving overall storage capacity. They are commonly used in sectors such as pharmaceuticals, electronics, and food production, where precision and space optimization are critical.

By Operation Analysis

Packaging and distribution operations are projected to retain their dominance in the operation type segment, capturing an estimated 48.1% of the total market share in 2025. This growth is largely fueled by the growing demand for faster and more accurate order fulfillment, particularly within the e-commerce and retail sectors. Automated material handling technologies such as robotic arms, intelligent sortation systems, and automated conveyors play a central role in streamlining packaging processes and improving the efficiency of product distribution.

As consumer expectations continue to rise, the integration of automation in these operations enables businesses to scale, improve throughput, and reduce human errors, particularly in environments that deal with large volumes of SKUs and complex order structures. The widespread adoption of warehouse management systems (WMS) and warehouse control systems (WCS) is also optimizing packaging lines by ensuring that the right products are selected, packed, and dispatched with minimal delay.

In addition to packaging and distribution, the storage and distribution segment is also experiencing significant growth within the automated material handling market. Automated storage systems, including automated storage and retrieval systems (AS/RS) and shuttle systems, are being deployed to maximize storage density and streamline product retrieval processes. These systems are particularly valuable in environments with limited space or in industries like pharmaceuticals, automotive, and consumer goods, where both space optimization and quick access to inventory are essential.

By End-User Analysis

Retail, warehouse, and logistics centers are set to solidify their position in the end-user type segment of the automated material handling market, expected to account for 22.7% of the total share in 2025. This sustained dominance is being driven by the rising demand for seamless inventory flow, faster order fulfillment, and efficient last-mile delivery solutions. As omnichannel retail strategies become more prevalent, these sectors are deploying advanced automation technologies such as autonomous mobile robots (AMRs), automated sortation systems, and real-time tracking software to improve throughput and manage high SKU volumes.

The widespread shift toward dark stores, micro-fulfillment centers, and urban warehousing has accelerated the integration of intelligent warehouse automation to meet the expectations of same-day or next-day delivery. Additionally, logistics service providers are investing heavily in scalable and adaptive solutions that allow for rapid reconfiguration of workflows, a necessity in handling seasonal surges and evolving customer behavior.

In parallel, the automotive industry continues to be a major end-user in the automated material handling ecosystem, leveraging automation to enhance efficiency, safety, and production precision. Automotive manufacturers rely on automated guided vehicles (AGVs), robotic part handling systems, and conveyor-integrated assembly lines to support high-volume production with minimal manual intervention.

These systems enable just-in-time (JIT) delivery of components, optimize space utilization, and reduce lead times across manufacturing plants. The integration of industrial IoT and predictive maintenance platforms ensures continuous system availability, critical in automotive environments where unplanned downtime can have significant cost implications.

The Automated Material Handling Market Report is segmented on the basis of the following:

By Offering

- Hardware

- Software

- Warehouse Management System (WMS)

- Transport Management System (TMS)

- Services

- Maintenance & Repairs

- Training & Software Upgradation

By Equipment Type

- Mobile Robots

- Automated Guided Vehicle (AGV)

- Autonomous Mobile Robot (AMR)

- Automated Storage and Retrieval System

- Fixed Aisle

- Carousel

- Vertical Lift Module

- Automated Conveyor

- Belt

- Roller

- Pallet

- Overhead

- Palletizer

- Sortation System

By Operation

- Packaging & Distribution

- Storage & Transportation

- Waste Management

- Assembly

By End-User

- Airport

- Automotive

- Food and Beverages

- Retail/Warehousing/Distribution Centers/Logistics Centers

- General Manufacturing

- Pharmaceuticals

- Post and Parcel

- Others

Global Automated Material Handling: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global automated material handling (AMH) market by capturing approximately

40.4% of total market revenue in 2025. This dominance is fueled by a combination of rapid industrialization, technological adoption, and the expansion of manufacturing and logistics infrastructure across key economies such as China, Japan, South Korea, and India. The region has emerged as a global manufacturing hub, particularly in sectors like automotive, electronics, and consumer goods, which are integrating automation to enhance operational efficiency, reduce labor costs, and meet the growing complexity of modern supply chains.

China, in particular, continues to drive demand with large-scale investments in smart factories and high-tech logistics parks, aligning with national strategies like "Made in China 2025." The country is witnessing widespread deployment of robotic handling systems, AGVs, and intelligent warehousing solutions to support both domestic consumption and export-driven manufacturing. Meanwhile, Japan and South Korea are leveraging their expertise in robotics and industrial automation to implement next-generation AMH systems across both manufacturing and distribution networks.

Region with significant growth

Asia Pacific is anticipated to register the highest compound annual growth rate (CAGR) in the global automated material handling (AMH) market over the forecast period, driven by a convergence of economic, industrial, and technological dynamics unique to the region. This accelerated growth is underpinned by rapid industrialization, booming e-commerce activity, strategic government initiatives, and growing investments in smart manufacturing across key countries like China, India, South Korea, Japan, and several Southeast Asian nations.

India, meanwhile, is seeing rapid digital transformation in its logistics and warehousing sectors, driven by the growth of e-commerce, the implementation of the Goods and Services Tax (GST), and the growing development of organized retail. Companies are adopting automation to manage large SKU volumes, improve inventory accuracy, and meet customer expectations for faster deliveries. This is further reinforced by foreign direct investments and public-private partnerships supporting infrastructure development in industrial corridors and logistics parks. Japan and South Korea contribute to the region’s high CAGR through their technological leadership in robotics and smart automation systems. These countries are home to some of the world’s leading manufacturers of automation equipment and are deploying these technologies domestically to maintain production efficiency in the face of aging workforces and high labor costs.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Automated Material Handling: Competitive Landscape

The global automated material handling market is defined by a highly competitive and innovation-driven environment, featuring a mix of longstanding industrial giants and specialized automation firms. Leading players across North America, Europe, and Asia are actively investing in technological advancements to maintain a competitive edge and meet the evolving needs of industries such as e-commerce, automotive, manufacturing, and logistics.

Key companies such as Daifuku Co., Ltd., SSI Schäfer, Dematic, Honeywell Intelligrated, and Vanderlande are recognized for their strong portfolios in robotics, material flow optimization, and warehouse automation solutions. These firms continuously evolve their offerings with AI-driven logistics, IoT-enabled equipment, and intelligent control systems designed to improve throughput and reduce operational bottlenecks.

Meanwhile, players like Swisslog (a KUKA company), Murata Machinery, BEUMER Group, and TGW Logistics are gaining prominence for their integrated automation solutions tailored to specific end-user needs, including pharmaceutical, food & beverage, and cold chain logistics. Their strategic focus often lies in end-to-end system integration, combining software, robotics, and equipment under unified platforms.

Some of the prominent players in the Global Automated Material Handling industry are:

- Daifuku Co., Ltd.

- Dematic (a KION Group company)

- SSI Schaefer

- Vanderlande Industries

- Honeywell Intelligrated

- Murata Machinery

- TGW Logistics Group

- Swisslog (part of KUKA AG)

- Toyota Material Handling

- BEUMER Group

- Bastian Solutions

- Knapp AG

- Hyster-Yale Materials Handling

- KION Group AG

- Elettric 80

- Mecalux

- JBT Corporation

- Schaefer Systems International

- Interroll Group

- Siemens AG

- Other Key Players

Global Automated Material Handling: Recent Developments

- March 2025: Wabtec Corporation announced the acquisition of Dellner Couplers, a manufacturer specializing in railway coupler systems. This strategic move aims to enhance Wabtec's capabilities in rail automation and material handling solutions.

- October 2024: Terex Corporation completed the acquisition of the Environmental Solutions Group (ESG) from Dover Corporation. ESG is known for its integrated equipment serving the solid waste and recycling industries, which complements Terex's material handling portfolio.

- September 2024: The Timken Company acquired CGI, Inc., a manufacturer of precision drive systems for various automation markets, including medical robotics. This acquisition expands Timken's presence in the automated material handling sector.

- August 2024: Symbotic Inc., a leader in AI-driven robotics for supply chains, acquired key assets from Veo Robotics, including the FreeMove® 3D depth-sensing system. This acquisition enhances Symbotic's warehouse automation capabilities.

- February 2024: Coesia, through its company FlexLink, acquired Automation & Modular Components, LLC, a manufacturer of material handling automation systems and conveyors. This acquisition strengthens Coesia's position in the AMH market.

- March 2023: Regal Rexnord Corporation completed the acquisition of Altra Industrial Motion Corp., a manufacturer of mechanical power transmission products. This acquisition broadens Regal Rexnord's offerings in the material handling industry.

- January 2023: Hy-Tek Holdings acquired Winchester Industrial Controls LLC, a provider of control systems for automated material handling systems. This acquisition enhances Hy-Tek's product line and customer base.

- July 2022: Alta Equipment Group Inc. acquired Yale Industrial Trucks, a Canadian company offering automated material handling products. This acquisition aligns with Alta's strategy to expand into new markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 59.7 Bn |

| Forecast Value (2034) |

USD 147.6 Bn |

| CAGR (2025–2034) |

10.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 15.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Hardware, Software, and Services), By Equipment Type (Mobile Robots, Automated Storage and Retrieval System, Automated Conveyor, Palletizer, and Sortation System), By Operation (Packaging & Distribution, Storage & Transportation, Waste Management, and Assembly), and By End-User (Airport, Automotive, Food and Beverages, Retail, logistics, and Warehousing, General Manufacturing, Pharmaceuticals, Post and Parcel, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Daifuku Co., Ltd., SSI Schäfer, Dematic (a KION Group company), Honeywell Intelligrated, Murata Machinery, Ltd., BEUMER Group, TGW Logistics Group, Vanderlande Industries, Swisslog (a KUKA company), Bastian Solutions (a Toyota Advanced Logistics company), Interroll Holding AG, KNAPP AG, Mecalux, S.A., Hyster-Yale Materials Handling, Inc., Toyota Material Handling, Schaefer Systems International, JBT Corporation, Egemin Automation, SICK AG, Rockwell Automation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global automated material handling market size is estimated to have a value of USD 59.7 billion in 2025 and is expected to reach USD 147.6 billion by the end of 2034.

The US automated material handling market is projected to be valued at USD 15.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 36.0 billion in 2034 at a CAGR of 10.0%.

Asia Pacific is expected to have the largest market share in the global automated material handling market, with a share of about 40.4% in 2025.

Some of the major key players in the global automated material handling market are Daifuku Co., Ltd., SSI Schäfer, Dematic (a KION Group company), Honeywell Intelligrated, Murata Machinery, Ltd., BEUMER Group, TGW Logistics Group, Vanderlande Industries, Swisslog (a KUKA company), Bastian Solutions (a Toyota Advanced Logistics company), Interroll Holding AG, KNAPP AG, Mecalux, S.A., Hyster-Yale Materials Handling, Inc., Toyota Material Handling, Schaefer Systems International, JBT Corporation, Egemin Automation, SICK AG, Rockwell Automation, and Other Key Players.

The market is growing at a CAGR of 10.6 percent over the forecasted period.