The automatic pill dispenser machines market has recently seen tremendous growth due to increasing healthcare demands for efficient medication administration across a wide variety of health sectors. These machines open the doors for automated solutions for accurate medication dispensing, reduced human error, and patient safety in both hospital pharmacies as well as in-home healthcare environments.

Market expansion can also be attributed to increasing chronic illnesses and an aging population that requires efficient solutions for administering their complicated medication regimes. Automatic medication dispensers have become an increasing part of both hospital and home healthcare settings due to their ability to promote greater medication adherence in elderly patients, especially during

home healthcare services.

They help reduce errors in dosage timing and quantity for chronic conditions like diabetes and cardiovascular diseases, making these machines invaluable tools in relieving symptoms more promptly and safely.

They help reduce errors in dosage timing and quantity for chronic conditions like diabetes and cardiovascular diseases, making these machines invaluable tools in relieving symptoms more promptly and safely. Incorporating modern technologies has enabled more reliable RFID and barcode-based systems which provide user-friendly solutions while speeding up machines even further.

North America holds the highest market share for pill dispenser machines due to its well-developed healthcare infrastructure and greater expenditure on healthcare in that region.

Healthcare IT and modern technologies such as RFID and barcode-based systems have significantly enhanced the market.

Asia Pacific shows strong growth due to increasing healthcare expenditure and patient safety issues; key players like McKesson Corporation, Baxter International Inc., and Cerner Corporation all work towards innovation and developing more advanced systems to meet ever-evolving ecosystem demands.

The global Automatic Pill Dispenser Machine Market has experienced an uptick as healthcare systems increasingly implement automated medication administration solutions. These devices, which help minimize errors and ensure timely doses, have become indispensable tools in both hospitals and home care settings, providing convenience while improving patient outcomes.

An increasing senior population coupled with rising chronic diseases is driving an unprecedented surge in demand for automatic pill dispensers. Elderly patients juggling multiple medications every day require reliable, user-friendly systems that automate dispensing in order to ensure correct doses are dispensed at each dose-taking interval - thus improving medication adherence.

These automated pill dispensers help address missed or incorrect dosing situations and enhance medication adherence, thus creating greater success at improving medication adherence and decreasing risks of missed dosages or missed dosing errors by automatically dispensing.

Technological advances are revolutionizing automatic pill dispensers. Modern innovations include smartphone integration, real-time tracking, and remote patient monitoring features that allow caregivers and healthcare providers to effectively monitor and manage prescriptions efficiently. Furthermore, these innovations make them more appealing to a broader range of consumers from individual patients to large healthcare facilities.

Automatic pill dispenser sales are growing, as both developed and emerging markets strive to improve healthcare efficiency. With increased attention being paid to patient safety, medication administration, and technological solutions these machines are increasingly integral parts of modern healthcare systems. Companies are exploring new markets while developing more advanced features in response to this growing need.

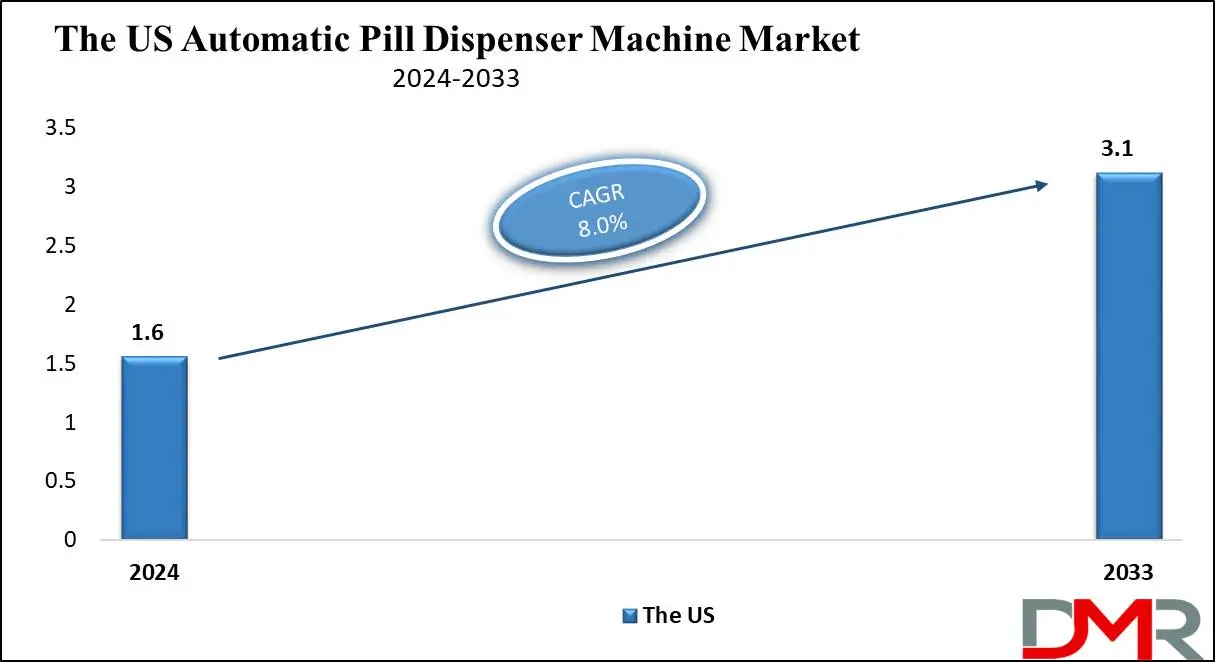

The US Automatic Pill Dispenser Machine Market

The US Automatic Pill Dispenser Machine Market is projected to reach

USD 1.6 billion in 2024 and grow steadily through 2033 at a

CAGR of 8.0%. Some factors contributing to its rapid expansion include increasing chronic disease rates among aging populations as well as rising home healthcare needs resulting from advanced healthcare systems that use automation solutions in an attempt to minimize medication errors while simultaneously improving patient outcomes and cutting healthcare costs.

- RFID and barcode technologies have significantly contributed to this growth by assuring accurate medication dispensing at both hospital pharmacies and retail pharmacies.

- Key players like Cerner Corporation and McKesson Corporation have long led innovation with cutting-edge systems designed to facilitate dispensing.

- Recent market developments indicate an increasing adoption of automated dispensing systems within large healthcare facilities, particularly to manage high-volume medication dispensing with minimum human interaction. Such systems have proven increasingly popular over time.

- As the adoption of home healthcare solutions increases for elderly patient populations who must take multiple prescriptions, the demand for portable automated pill dispensers in the U.S. market grows at an affordable pace supported by various government initiatives on improving healthcare delivery and medication error reduction. This market will experience steady expansion over the coming years.

Key Takeaways

- Global Market Value: This market size is estimated to have a value of USD 4.5 billion in 2024, which is further expected to reach USD 9.3 billion by the end of 2033.

- The US Market Value: The US Automatic Pill Dispenser Machine Market is projected to be valued at USD 3.1 billion in 2033 from the base value of USD 1.6 billion in 2024 at a CAGR of 8.0%.

- Global Growth Rate: The Market is growing at a CAGR of 8.0% over the forecasted period.

- By Type Segment Analysis: Centralized automated dispensing systems are anticipated to dominate the type segment in this market with 61.5% of the market share in 2024.

- By Technology Segment Analysis: RFID-based systems are projected to dominate this segment with the highest market share in 2024.

- By Application Segment Analysis: Hospital pharmacies are projected to dominate the application segment, with the automatic pill dispenser market, as it holds 54.9% of the market share in 2024.

- Regional Analysis: North America is expected to have the highest market share in the global automatic pill dispenser machine market, with a share of about 41.3% in 2024.

Use Cases

- Pharmacies in Hospitals: Automatic pill-dispensing machines, which reduce the handling of medications and help improve patient safety through the automation of medication dispensing in high-volume hospital settings.

- Home Healthcare: Automated pill dispensers in home healthcare remind elderly and chronically ill patients of the complicated regimen of their medicines at the right time and with accuracy without the need for any interference by a caregiver.

- Retail Pharmacies: The automated dispensers thus further streamline processes in retail pharmacies by automating prescription fulfillment, reducing the waiting time for customers, and making operational workflows easier for the pharmacy staff.

- Assisted Living Facilities: These dispensers assist staff at assisted living facilities by automating the administration of medications to residents, minimizing the potential for mistakes, and increasing compliance with medication schedules.

Automatic Pill Dispenser Machine Market Dynamics

Market Trends

Shift Toward Automated Healthcare Solutions

With increasing demand and resources already strained, most of the health systems globally have been considering automation within hospitals, pharmacies, and even in-home healthcare. Automated pill dispensers are part of this trend that can help in smoothing medication management and improving general efficiency since it will reduce human error.

It's a trend driven by the actual need for increased accuracy in the dispensing of medications, mainly by that critical number of prescriptions within a hospital environment, where patient care is the primary priority.

Increasing Integration with Smart Technologies

Artificial intelligence, cloud computing, and IoT are some of the intelligent technologies driving the growth of the automatic pill dispenser machine market. Smart pill dispensers that use a cloud service-based platform to connect are, in particular, being used, thus enabling remote monitoring. This feature is very likely to boost adherence to medication among the elderly and chronic disease patients through real-time alerts and reminders, hence minimizing non-adherence problems.

Rising Demand for Personalized Healthcare Solutions

There is growing interest in personalized health on the part of both providers and patients. Automatic pill dispensers provide personalization about medication schedule, dosage, and time for every individual and are thus highly in demand.

Such personalized systems minimize the chances of medically adverse events in the improvement of better patient outcomes. As a growing amount of emphasis is invested in the industry regarding personalized health, the demand will continue to rise further for more inventive automated dispensing systems that can meet the needs of particular patients.

Growth Drivers

Aging Population and Rise in Geriatric Care

The demand for an automatic pill dispenser machine would consequently go up significantly, owing to the aging population in regions like North America, Europe, and parts of Asia. The rising count of aged patients in dire need of long-term medication management means there is a growing demand for automation that would make things easier. Pill dispensers ensure adherence to intricate medication schedules by the elderly patient, hence mitigating risks of missed doses or wrong administration.

Increasing Focus on Reducing Medication Errors

Medication errors are one of the major challenges for healthcare, these errors have severe consequences on patient safety. Automated pill dispensers present a solution to accurate and timely dispensing of medicines, reducing the chances of human error. Therefore, hospitals, pharmacies, and home healthcare providers are increasingly adopting automated systems to enhance patient safety and reduce liability associated with medication errors, thus driving market growth.

Growth Opportunities

Expansion into Emerging Markets

Huge growth opportunities for the automatic pill dispenser machine market exist in major markets like APAC, Latin America, and the Middle East and Africa. These geographies have been witnessing some improvements in healthcare infrastructure, increased healthcare spending, and growing awareness of the benefits of automated healthcare solutions.

As healthcare infrastructure improves in these geographies, demand for automated dispensing systems will increase, thereby providing opportunities for market participants to grow.

Technological Advancements and Innovation

Continuous technological advancements in the fields of AI, machine learning, and IoT give further scope for innovation in the pill dispenser machine market. For instance, AI-powered automated pill dispensers can offer real-time medication adherence monitoring, predictive analytics of likely patient non-compliance, and medication schedules that can be tailored to one's preference. A company that invests in such advanced technologies immediately captures significant market share, especially in those geographies with well-enhanced healthcare facilities.

Increased Adoption of Home Healthcare Solutions

While the cost of hospitalization is on the rise, the preference is gradually shifting toward home healthcare solutions, hence opening a window of opportunity for home-use automatic pill dispensers. Portable/countertop dispensers will be attractive due to the convenience and relative ease that patients with chronic diseases or those recovering from acute conditions will have in handling them. According to tendencies observed, as more patients and caregivers seek to shift toward home-based care, it follows then that this market will grow in sales.

Market Restraints

High Initial Costs and Maintenance

One of the major constraints to the automatic pill dispenser machine market is the high initial cost of buying and installing these systems, notably in the field of hospital pharmacies. In a central automated dispensing system, large infrastructure investment is required in technology and training for staff operating the systems.

This often acts as a barrier to entry for smaller players in the healthcare market. Again, over and above this, there are continuing charges for maintenance that may resist highly widespread diffusion in low-budget facilities and limit market penetration.

Lack of Awareness in Emerging Regions

Though the demand for medication management solutions is on the rise, automated pill dispensers have not gained much popularity in some underdeveloped regions. Poor healthcare infrastructural facilities keep the normal mode of medication dispensing in these places manual. Full benefits from automated systems are therefore not realized in such regions. This general unawareness coupled with limited access to the latest healthcare technologies restrains market growth in those regions.

Challenges in Integration with Existing Systems:

Another challenge lies in the integration of automated dispensing systems with existing healthcare IT infrastructure such as EHRs. Several hospitals and pharmacies face compatibility issues with the implementation of such systems.

As such, the integration between the new technologies and legacies is at a good prospect of slowing adoption in most instances-especially within larger healthcare organizations. This is one of the significant restraints to the automatic pill dispenser machines market that calls for more seamless and interoperable solutions.

Automatic Pill Dispenser Machine Market Research Scope and Analysis

By Type

Centralized Automated Dispensing Systems are projected to dominate the type segment of this market as they hold 61.5% of the market share in 2024. Centralized dispensing systems, for the reason that they operate in a more integrated manner toward handling medication in health facilities with the ability to handle large volumes.

The efficiency offered by these systems is high because the process of storing, dispensing, and tracking medications is well centralized, therefore beneficial for pharmacies involved in different hospital operations dealing with large volumes of prescriptions.

Automating the process and controlling medication dispensing from one centralized place minimizes errors, optimizes workflow, improves the navigator's role, and enhances patient safety, therefore leading to improved outcomes. One of the key reasons for their dominance is that they offer enhanced inventory control, which is very necessary at hospitals, maintaining optimal quantity levels to reduce wastage and ensuring the right medicines are available at all times.

An integrated automated centralized system also seamlessly unites with Electronic Health Records and Hospital Information Systems for real-time tracking of patients and medication on time for enhancing efficiency in healthcare settings. These systems also facilitate compliance with regulations since they provide automation of documentation and record-keeping, an important concern in large healthcare organizations that fall under strict health and safety regulations.

The healthcare sector demonstrates a high emphasis on minimizing medication errors and ensuring patients' outcomes, which is one of the main growth drivers for centralized automated dispensing systems and thus shows a usage impact on the global automatic pill dispenser machine market.

By Technology

RFID-based systems are anticipated to projected to dominate the technology segment as they hold the highest market share in 2024. The technology segment of automatic pill dispenser machines can be dominated by RFID-based systems, considering their higher efficiency and accuracy in managing medication dispensing.

Radio Frequency Identification (RFID) provides real-time tracking of medication, enabling the healthcare provider to track the location and status of every pill or dosage within the healthcare facility. This level of accuracy surpasses that of any barcode-based system, which, though efficient, requires manual scanning and is more prone to human error.

Some major advantages that RFID systems can promise include automatic inventory management for maintaining accurate stock levels and reducing wastes by the healthcare provider; the ability to integrate into centralized automated dispensing systems further ensures medication errors are reduced, patient safety guaranteed, and workflows improved both at the hospital and retail pharmacies.

In addition, RFID systems find applications, especially in high-volume settings where several medications have to be dispensed daily. They are recommended for large healthcare facilities because they allow faster and more efficient tracking than barcode systems.

Due to better scalability, higher data accuracy, and reduced operation costs, RFID-based solutions are increasingly adopted in the global automatic pill dispenser machine market. Major share dominance and contribution to the overall growth in the forecast period is expected by the RFID-based systems, as healthcare providers give more importance to patient safety and efficiency.

By Application

Hospitals are projected to dominate the global automatic pill dispenser market as they hold 54.9% of the market share in 2024. The main contributors to the global automatic pill dispenser machine market application segment include hospitals and pharmacies since these are the two crucial places in health facilities that deal with bulk medication being dispensed.

Hospitals fill a large number of prescriptions daily and even monitor complex medication programs for patients suffering from chronic diseases or those patients who are undergoing intensive treatments. The machines will not only simplify the work but also eliminate medication errors, thus boosting patient safety and streamlining workflow.

Among the major reasons these systems are more in use by a hospital pharmacy is due to the fact that these systems have interoperability with EHRs and HIS. It can be continuously monitored in real-time so that the patients are getting their medication at the right time and the right dose. This kind of automation bears prominence for the improvement of patient outcomes, especially in high-risk settings such as hospitals, where erroneous medication may result in serious consequences for the patients.

Also, the increase in the prevalence rate of chronic disease and the rise in the geriatric population has enhanced the demand for more effective and spontaneous administration of medication in hospitals. The hospital pharmacy acts as a center point of medication supply in many healthcare environments and, hence considered the largest utilizer of centralized automated dispensing systems.

As long as medication error reduction and operational efficiency continue to be at the top of the agendas in hospitals, automatic pill dispensers will remain an important part of each healthcare strategy and thus see more continued growth within this market segment.

The Global Automatic Pill Dispenser Machine Market Report is segmented on the basis of the following

By Type

- Centralized Automated Dispensing Systems

- Decentralized Automated Dispensing Systems

- Hybrid Automated Dispensing Systems

- Portable/Countertop Automated Pill Dispensers

- Other Types

By Technology

- RFID-Based Systems

- Barcode-Based Systems

By Application

- Hospital Pharmacy

- Retail Pharmacies

- Home Healthcare

Automatic Pill Dispenser Machine Market Regional Analysis

North America is projected to dominate the global automatic pill dispenser market as it will

hold 41.3% of the market share in 2024. North America leads the global automatic pill dispenser machine market due to several key factors, including advanced healthcare infrastructure, high levels of healthcare spending, and focus on adopting innovative healthcare technologies.

The United States leads this trend by prioritizing patient safety through reduced medication errors, as a result, hospital pharmacies and home healthcare settings alike are rapidly adopting automated dispensing systems as part of patient safety programs. One reason North America remains so dominant is due to the region's growing geriatric population, creating greater demand for automatic pill dispensers in home healthcare and assisted living facilities where elderly patients require assistance managing complex medication regimens.

Furthermore, chronic illnesses like diabetes and cardiovascular conditions further fuel demand for automated medication management solutions. Technological developments such as RFID systems and their integration into Electronic Health Records (EHR) have driven market expansion across North America.

Furthermore, regulatory requirements reinforce the adoption of such systems healthcare providers are now required to abide by more stringent standards regarding medication safety and efficiency than ever. North America remains a dominant pill dispenser machine market due to the region's impressive investments in healthcare IT and the presence of key market players like McKesson Corporation, Cerner Corporation, and Baxter International Inc.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Automatic Pill Dispenser Machine Market Competitive Landscape

The global automatic pill dispenser machine market is highly competitive, with several key players such as McKesson Corporation, Baxter International Inc., and Cerner Corporation dominating it globally. They do this by creating innovative solutions to address rising demands for automated medication administration while using modern technologies like RFID and barcode-based systems to increase efficiency while decreasing medication errors.

ScriptPro LLC and Talyst have both invested extensively in research and development to bring innovative new solutions that target hospitals, retail pharmacies, home healthcare services providers, and homecare patients to market. Together with healthcare providers, they collaborated in expanding their reach and strengthening their market presence.

Additionally, an increasing focus on decentralized automated dispensing systems and portable pill dispensers is driving smaller players into the market and intensifying competition. Market trends indicate that companies are seeking opportunities to expand into emerging markets such as Asia-Pacific and Latin America where demand for automated medication systems continues to expand rapidly. As competition within this space intensifies over time, encouraging continued innovation and growth within this market.

Some of the prominent players in the Global Automatic Pill Dispenser Machine Market are:

- Becton, Dickinson and Company (BD)

- Omnicell, Inc.

- Cerner Corporation

- Capsa Healthcare

- MedMinder

- ScriptPro LLC

- Swisslog Healthcare

- Parata Systems

- Accu-Chart Plus Healthcare Systems, Inc.

- Philips Healthcare

- McKesson Corporation

- Talyst Systems, LLC

- Hero Health, Inc.

- Yuyama Co., Ltd.

- Other Key Players

Recent Developments

- August 2024: McKesson Corporation Launches AI-Driven Dispenser Machine Solutions

- McKesson Corporation, a leading player in the global automatic pill dispenser machine market, introduced an AI-driven pill dispenser solution. This system enhances real-time tracking, reduces medication errors, and optimizes inventory management through advanced RFID-based systems.

- July 2024: Yuyama Co. Expands Product Line with Hybrid Dispensers

- Yuyama Co. announced the launch of a hybrid automated dispensing system that combines features of both centralized and decentralized dispensing systems. This innovation allows healthcare providers greater flexibility in managing medication dispensing processes in hospitals, pharmacies, and home care settings.

- June 2024: Becton, Dickinson, and Company (BD) Introduces Portable Dispensers for Home Healthcare

- BD unveiled a new line of portable automated pill dispensers targeted specifically at the home healthcare sector. These dispensers are designed to help elderly and chronically ill patients manage their medications more effectively.

- April 2024: Baxter International Inc. Expands Manufacturing Facilities for Automated Dispensers

- Baxter International Inc. announced an expansion of its manufacturing facilities in the U.S. to meet the increasing demand for automated pill dispensers. The expansion is expected to significantly increase production capacity for centralized and decentralized automated dispensing systems.

- March 2024: Talyst and ScriptPro LLC Collaborate for Integrated Pharmacy Solutions

- Talyst collaborated with ScriptPro LLC to create an integrated solution for hospital and retail pharmacies. The solution combines ScriptPro’s automated dispensing systems with Talyst’s inventory management platform, improving the efficiency and accuracy of medication distribution.

- February 2024: Cerner Corporation Implements Cloud-Based Pill Dispensing Solutions

- Cerner Corporation launched a cloud-based pill dispenser machine management system that allows hospitals and home healthcare providers to monitor and control medication dispensing remotely.

- December 2023: Omnicell Acquires Swisslog Healthcare

- Omnicell acquired Swisslog Healthcare, a global provider of medication management and automated dispensing solutions. This acquisition is expected to expand Omnicell’s capabilities in developing advanced automated pill dispensers for hospitals and home healthcare settings.

- November 2023: Parata Systems Rolls Out Enhanced RFID-Based Dispensers

- Parata Systems introduced an updated version of its RFID-based automated pill dispensers. This new model offers improved medication tracking and security features, making it ideal for hospital pharmacies and retail pharmacies.

- September 2023: Yuyama Co. Increases Global Reach with New Distributors

- Yuyama Co. expanded its global presence by partnering with distributors in the Asia-Pacific and Middle East regions.

Automatic Pill Dispenser Machine Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 4.5 Bn |

| Forecast Value (2033) |

USD 9.3 Bn |

| CAGR (2024-2033) |

8.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Centralized Automated Dispensing Systems, Decentralized Automated Dispensing Systems, Hybrid Automated Dispensing Systems, Portable/Countertop Automated Pill Dispensers, and Other Types), By Technology (RFID-Based Systems, and Barcode-Based Systems), By Application (Hospital Pharmacy, Retail Pharmacies, and Home Healthcare) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Becton, Dickinson and Company (BD), Omnicell Inc., Cerner Corporation, Capsa Healthcare, MedMinder, ScriptPro LLC, Swisslog Healthcare, Parata Systems, Accu-Chart Plus Healthcare Systems Inc., Philips Healthcare, McKesson Corporation, Talyst Systems LLC, Hero Health Inc., Yuyama Co. Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |