Market Overview

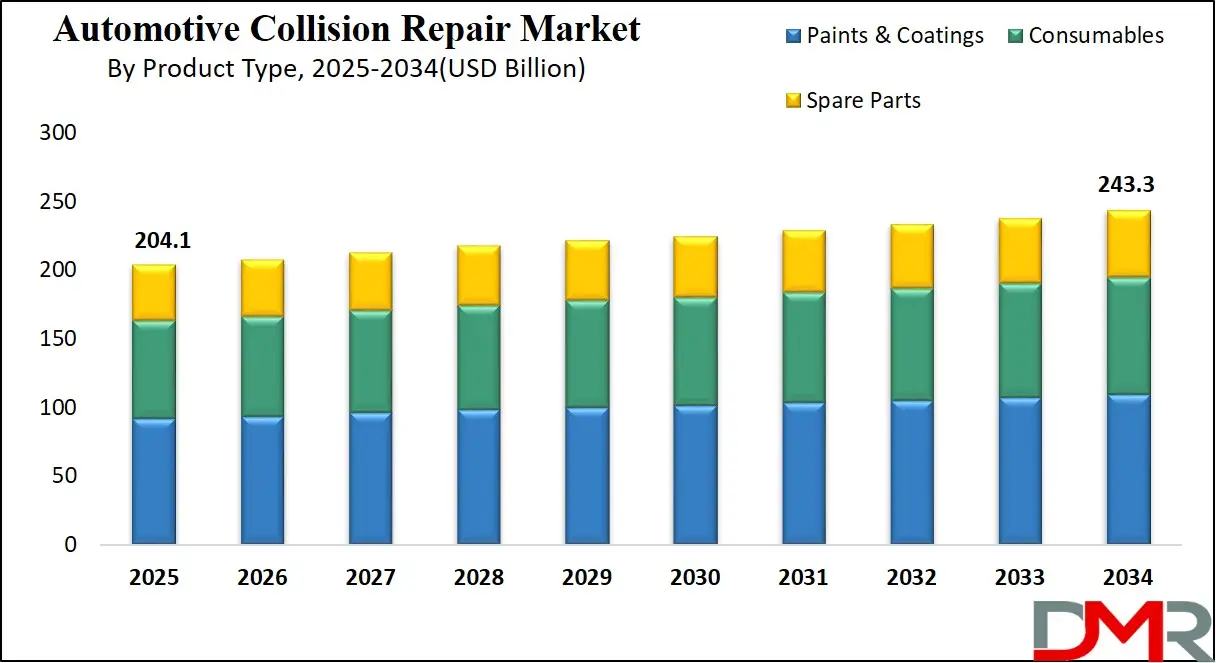

The Global Automotive Collision Repair Market is projected to reach USD 204.1 billion in 2025 and grow at a compound annual growth rate of 2.0% from there until 2034 to reach a value of USD 243.3 billion.

The global automotive collision repair market is experiencing significant growth, driven by the increasing number of vehicles on the road and the rising incidence of traffic accidents. Advancements in vehicle technologies, such as the integration of advanced driver-assistance systems (ADAS) and the proliferation of electric vehicles (EVs), have led to more complex repair processes, necessitating specialized equipment and trained technicians. This complexity has spurred investments in training programs and the adoption of advanced diagnostic tools to ensure efficient and accurate repairs.

Opportunities in the market are abundant, particularly in emerging economies where vehicle ownership is on the rise. The growth of the automotive aftermarket, coupled with the increasing demand for quality repair services, presents a lucrative landscape for service providers. Furthermore, the trend towards vehicle customization and the use of high-quality materials in repairs are opening new avenues for businesses to differentiate themselves and cater to niche markets.

However, the market faces several restraints. The high cost of repairing technologically advanced vehicles, especially those equipped with ADAS and EV components, can be prohibitive for consumers. Additionally, the shortage of skilled labor poses a significant challenge, as the industry requires technicians proficient in handling sophisticated repair tasks. Environmental regulations concerning the use of certain materials and the disposal of hazardous waste also impose operational constraints on repair facilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Automotive Collision Repair Market

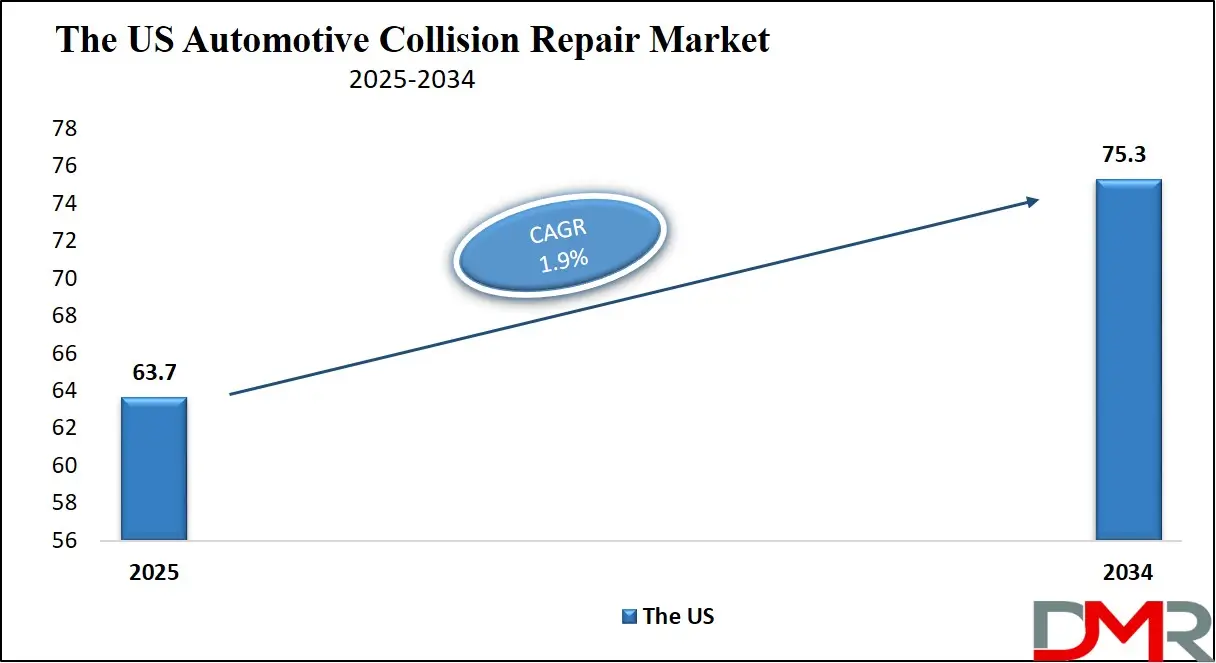

The US Automotive Collision Repair Market is projected to reach

USD 63.7 billion in 2025 at a compound annual growth rate of

1.9% over its forecast period.

The U.S. automotive collision repair market is one of the largest globally, supported by a high vehicle-per-capita ratio and extensive highway networks. The country has over 280 million registered vehicles, contributing to frequent accidents and a steady demand for repair services. With an aging vehicle fleet now averaging over 12 years—repair frequency and complexity have risen sharply.

Urban congestion, inclement weather, and distracted driving contribute to collision rates while maintaining consistent service demand. Government agencies emphasize vehicle safety and emissions regulations, influencing repair material standards and promoting waterborne paints and energy-efficient spray booths. The Environmental Protection Agency encourages greener repair processes to reduce volatile organic compounds in refinishing.

The presence of a skilled labor force and access to technological innovation allow U.S. repair centers to handle advanced repairs such as ADAS recalibration and EV maintenance. States like California and Texas lead in vehicle registrations and accident rates, driving regional service growth.

Technological integration is reshaping the sector with widespread adoption of computerized estimation tools, automated claim processing, and customer-centric portals for service tracking. Many repair networks now partner directly with insurance providers to streamline workflow, cut costs, and reduce cycle time.

Overall, the U.S. market continues to benefit from its demographic scale, mature infrastructure, and government support for safer and more sustainable repair practices. These factors, combined with rising digitalization, are reinforcing the market’s resilience and potential for continued expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Automotive Collision Repair Market

The European Automotive Collision Repair Market is estimated to be valued at

USD 35.90 billion in 2025 and is further anticipated to reach

USD 41.08 billion by 2034 at a CAGR of

1.5%.

Europe’s automotive collision repair market is driven by a dense vehicle population, advanced road infrastructure, and strict vehicle safety regulations. Countries such as Germany, France, and the UK have well-established repair networks catering to both premium and mass-market vehicle segments. High car ownership rates across urban and rural areas, combined with frequent short-distance travel, lead to recurring low-impact collisions.

The European Union enforces stringent safety and emissions standards, pushing repair shops to adopt eco-friendly practices such as water-based paints and sustainable waste management. Additionally, Europe has one of the highest penetration rates of

electric vehicles globally, prompting repair networks to upskill for battery and electronic system repairs.

Demographic advantages such as aging populations and longer vehicle retention periods have led to increased demand for maintenance and repair services. Consumers in Europe also prefer OEM-quality replacement parts and value-certified repair facilities, contributing to a premium service orientation.

An emerging trend across the region is the rise of do-it-yourself (DIY) repairs using accessible kits for cosmetic fixes, particularly in countries with high labor costs.

However, complex electronic repairs and ADAS recalibration still require professional services, keeping the professional repair segment robust. Overall, Europe’s market is evolving with a focus on sustainability, advanced repair capabilities, and stringent consumer protection laws. These factors, combined with growing EV adoption and digital transformation in repair services, position the region for continued growth.

The Japan Automotive Collision Repair Market

The Japan Automotive Collision Repair Market is projected to be valued at USD 12.25 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 14.28 billion in 2034 at a CAGR of 1.7%.

Japan's automotive collision repair market is shaped by its dense urban roadways, high vehicle utilization, and strong culture of regular maintenance. With over 75 million registered vehicles, many concentrated in compact urban areas, low-speed collisions and parking-related damage are frequent, driving steady demand for bodywork and cosmetic repairs.

The country’s demographic profile—characterized by an aging population—contributes to accident rates, especially among older drivers. The government supports traffic safety through regulations mandating regular vehicle inspections (shaken), which indirectly sustain demand for repair services. Additionally, high vehicle longevity means more frequent repairs to keep cars roadworthy over extended lifespans.

Japan leads in vehicle technology and electrification, prompting repair facilities to invest in high-end tools for hybrid and EV repairs. Japanese manufacturers also prioritize ADAS technologies, increasing the need for calibration services post-collision. Consumers often favor OEM parts and certified technicians, reinforcing the quality standards of the industry.

Culturally, Japan’s emphasis on vehicle appearance and maintenance makes cosmetic repair services particularly popular. Small dent repairs, panel replacements, and precise repainting are highly sought after, especially in metropolitan areas like Tokyo and Osaka, where vehicle presentation matters socially and professionally.

Environmental consciousness is another key factor, with repair shops using low-VOC paints and energy-efficient equipment. These sustainable practices are supported by national environmental policies and industry-led green certification programs.

In conclusion, Japan’s collision repair market is mature, technologically advanced, and shaped by a unique blend of demographic trends, cultural values, and regulatory frameworks that ensure continued demand and innovation in automotive repair services.

Global Automotive Collision Repair Market: Key Takeaways

- Global Market Size Insights: The Global Automotive Collision Repair Market size is estimated to have a value of USD 204.1 billion in 2025 and is expected to reach USD 243.3 billion by the end of 2034.

- The US Market Size Insights: The US Automotive Collision Repair Market is projected to be valued at USD 63.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 75.3 billion in 2034 at a CAGR of 1.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Automotive Collision Repair Market, with a share of about 37.1% in 2025.

- Key Players: Some of the major key players in the Global Automotive Collision Repair Market are 3M Company, Akzo Nobel N.V., Axalta Coating Systems LLC, BASF SE, Caliber Collision Centers, Continental AG, Denso Corporation, DuPont de Nemours Inc., Faurecia SE, Gerber Collision & Glass Inc., Honeywell International Inc, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 2.0 percent over the forecasted period of 2025.

Global Automotive Collision Repair Market: Use Cases

- ADAS Recalibration After Collision: Post-collision, vehicles equipped with driver-assistance features require sensor recalibration to ensure safety functions like lane assist and emergency braking work correctly.

- EV Structural Repairs: Electric vehicle collisions often involve damage to battery enclosures or wiring. Specialized technicians and insulated tools are required for safe, high-voltage repair procedures.

- Paintless Dent Removal (PDR): PDR techniques allow technicians to fix minor dents and dings without repainting, preserving original paintwork and reducing costs and environmental impact.

- On-Demand Mobile Repair Units: Mobile repair services cater to minor damage such as scratches and bumper repairs at the customer's location, increasing convenience and reducing shop wait times.

- Digital Damage Estimation Platforms: AI-powered tools and mobile apps now allow real-time photo-based damage analysis, providing accurate estimates and speeding up insurance claim approvals.

Global Automotive Collision Repair Market: Stats & Facts

North America

- The United States leads the regional market, driven by a high vehicle population exceeding 280 million registered vehicles and one of the highest vehicle ownership rates globally.

- The National Highway Traffic Safety Administration (NHTSA) reports approximately 6 million vehicle crashes annually in the U.S., sustaining steady demand for collision repair services.

- The growing adoption of advanced driver-assistance systems (ADAS) in new vehicles increases the complexity and cost of repairs, influencing repair shop operations and technological upgrades.

- Insurance frameworks and repair certification programs, such as the Collision Industry Conference (CIC), improve repair quality and standardization.

- Canada’s automotive repair sector benefits from government safety regulations and increasing vehicle parc, with over 24 million registered vehicles requiring ongoing maintenance and repair.

Europe

- Europe has a mature automotive collision repair market with an estimated vehicle population of over 300 million vehicles across EU member states.

- The European Environment Agency (EEA) enforces strict environmental regulations promoting eco-friendly repair technologies and sustainable shop practices.

- EU policies on vehicle safety, including mandatory advanced safety features, contribute to evolving repair techniques and higher demand for specialized collision repairs.

- Countries such as Germany, France, and the UK lead the market due to their large vehicle fleets and high insurance penetration rates.

- The European Commission emphasizes circular economy principles, promoting reuse and recycling in collision repair parts and materials.

Asia-Pacific

- Japan stands out with a dense vehicle population of approximately 80 million registered vehicles, backed by efficient transport infrastructure and stringent vehicle safety laws.

- The Japanese Ministry of Land, Infrastructure, Transport and Tourism (MLIT) mandates rigorous vehicle inspection and maintenance protocols, indirectly boosting collision repair market demand.

- Urbanization and increasing motorization in Japan and neighboring countries expand the market.

- The rising use of lightweight materials and hybrid vehicles in Japan challenges repair providers to adopt advanced repair methodologies.

- Other APAC nations, such as South Korea and Australia, are investing in automotive safety and repair infrastructure, fueling regional market growth.

Latin America

- Latin American countries experience growing vehicle ownership, with Brazil and Mexico accounting for the largest shares.

- Road safety initiatives by local governments aim to reduce traffic accidents, but vehicle fleet growth sustains demand for collision repair.

- Limited availability of certified repair centers poses challenges, but increased government focus on automotive standards is helping improve service quality.

Middle East & Africa

- Vehicle fleets are growing steadily in the Gulf Cooperation Council (GCC) countries due to rising disposable incomes.

- Governments in this region emphasize road safety and vehicular compliance, indirectly supporting the collision repair industry.

- The adoption of modern automotive technologies is slower compared to other regions, but increasing urbanization is driving demand.

Global Automotive Collision Repair Market: Market Dynamics

Driving Factors in the Global Automotive Collision Repair Market

Increasing Vehicle Parc and Rising Traffic Congestion Worldwide

One of the primary drivers of growth in the automotive collision repair market is the steady increase in the global vehicle parc. With economic development and rising incomes in emerging economies, vehicle ownership is growing rapidly, particularly in Asia-Pacific, Latin America, and parts of Africa. More vehicles on the road naturally lead to increased traffic congestion and a higher frequency of road accidents. Urbanization and expansion of transportation infrastructure further intensify vehicular interactions, contributing to more frequent collisions.

This expanding vehicle fleet increases the demand for collision repair services, as vehicles sustain damage requiring professional repair to meet safety and regulatory standards. Moreover, as vehicles age, repair rather than replacement becomes a cost-effective solution, further expanding the repair market. Government initiatives aimed at improving road safety, including stricter traffic laws and enhanced enforcement, also indirectly stimulate demand by encouraging timely and certified repairs after collisions.

Growing Insurance Penetration and Expanding Direct Repair Programs

Insurance penetration, especially in developed regions such as North America and Europe, is a critical growth driver for the automotive collision repair market. A large proportion of collision repairs are funded through insurance claims, incentivizing vehicle owners to seek professional repair services. Insurers increasingly collaborate with certified repair shops through direct repair programs (DRPs), streamlining claims and repair processes. These partnerships help repair shops maintain consistent business, improve quality standards, and reduce turnaround times.

The increasing availability of automotive insurance in emerging markets is also expanding the customer base for collision repair services. Additionally, insurance companies promote the use of aftermarket and recycled parts to reduce claim costs, driving changes in repair methods. Enhanced data analytics and telematics integrated into insurance policies are helping insurers better manage collision claims, further solidifying the relationship between insurance services and the collision repair industry’s growth.

Restraints in the Global Automotive Collision Repair Market

High Repair Costs Due to Advanced Vehicle Technologies

One of the significant restraints in the global automotive collision repair market is the increasing cost of repairs linked to sophisticated vehicle technologies. Modern vehicles are equipped with complex electronics, ADAS, lightweight materials such as aluminum and

carbon fiber, and hybrid or electric powertrains, all of which require specialized repair techniques and equipment. These technologies increase the skill level and training requirements for technicians, as well as the capital investment in diagnostic and calibration tools.

Additionally, OEM parts for these advanced vehicles often come at a premium, raising repair costs further. High repair expenses can deter vehicle owners from opting for professional collision repair, especially in markets where insurance coverage is limited or absent. This cost barrier can also lead to increased use of substandard repairs or the decision to replace vehicles rather than repair them, impacting the market’s growth potential.

Shortage of Skilled Technicians and Workforce Challenges

The automotive collision repair market faces a persistent shortage of skilled technicians and a trained workforce, which limits the industry’s capacity to meet growing demand. The rapid evolution of vehicle technologies demands continuous education and certification, but the industry struggles to attract younger workers due to the perception of repair jobs as physically demanding and less desirable.

Training programs and vocational schools have not scaled sufficiently to fill the skill gaps created by the introduction of new materials, electronics, and ADAS recalibration. This shortage impacts repair quality, turnaround time, and the ability of shops to expand service offerings. Moreover, labor costs rise as shops compete to retain qualified personnel, contributing to increased repair prices. Without addressing workforce challenges through enhanced training initiatives and career development incentives, the market’s growth and innovation potential may be constrained.

Opportunities in the Global Automotive Collision Repair Market

Expansion of Mobile Collision Repair Services

Mobile collision repair represents a significant growth opportunity, driven by consumer demand for convenience and time-saving services. Mobile technicians equipped with tools for minor dent repairs, paint touch-ups, and scratch removals can provide on-site services at customers’ homes or workplaces. This business model appeals to busy consumers and fleet operators seeking to minimize downtime. Advances in mobile repair technologies, such as portable paint systems and mobile calibration units for ADAS, are enhancing the scope and quality of services that can be provided remotely.

The COVID-19 pandemic accelerated the adoption of contactless and on-demand services, making mobile collision repair an attractive growth area. Companies investing in mobile service capabilities can access new customer segments and geographic areas, including rural and underserved urban locations. This model also enables more flexible service delivery, reducing overhead costs for repair shops while maintaining high service standards.

Adoption of Artificial Intelligence and Automation in Collision Repair

The integration of

artificial intelligence (AI) and automation into collision repair processes offers substantial growth potential. AI-powered damage assessment tools utilize image recognition and

machine learning algorithms to quickly and accurately estimate repair costs and timelines, improving efficiency and transparency for both repair shops and insurance companies. Automation technologies such as robotic painting, welding, and frame alignment increase precision and reduce labor time, enhancing productivity and consistency.

Digital platforms connecting vehicle owners, insurers, and repair shops streamline the claims process, reduce paperwork, and accelerate vehicle return times. AI-driven predictive analytics enable better inventory management for spare parts and consumables, minimizing downtime and improving service quality. Investment in these technologies positions repair providers to meet increasing complexity in vehicle design and regulatory requirements, driving competitive advantage and market expansion.

Trends in the Global Automotive Collision Repair Market

Integration of Advanced Driver-Assistance Systems (ADAS) in Vehicles

The proliferation of Advanced Driver-Assistance Systems (ADAS) such as lane departure warning, adaptive cruise control, and automatic emergency braking is reshaping the automotive collision repair landscape. These systems utilize an array of sensors, cameras, and radar technology, requiring specialized calibration and repair post-collision. Collision repair shops are increasingly investing in sophisticated diagnostic equipment and technician training to accommodate ADAS recalibration, which is crucial to maintaining vehicle safety standards after repairs.

The complexity of repairing vehicles equipped with ADAS has elevated the repair costs and time, influencing customer expectations and insurance claims. This trend is accelerating the consolidation of repair shops into networks certified to handle high-tech vehicle repairs, often through insurer partnerships. Moreover, repair centers offering ADAS recalibration services gain a competitive advantage, expanding their market share. The integration of these technologies also shifts repair strategies from conventional bodywork to include electronics and software updates, prompting continuous innovation in the collision repair market.

Rising Adoption of Eco-Friendly and Sustainable Repair Practices

Sustainability has become a significant trend in the global automotive collision repair market. Increasing regulatory pressure and consumer demand for environmentally responsible practices are driving shops to adopt eco-friendly paints, coatings, and recycling programs. Waterborne paints, which reduce volatile organic compound (VOC) emissions, are becoming standard in many repair centers, supported by policies from environmental agencies worldwide.

Additionally, many repair shops have integrated recycling programs for damaged parts and scrap materials, promoting circular economy principles. This shift towards sustainable practices also includes energy-efficient equipment and waste reduction initiatives. Adoption of eco-friendly materials and processes not only helps shops comply with stringent environmental regulations but also appeals to eco-conscious consumers, enhancing brand reputation and customer loyalty. As sustainability trends continue to influence automotive repair, businesses adapting early are likely to capture emerging market segments, fostering long-term growth.

Global Automotive Collision Repair Market: Research Scope and Analysis

By Product Analysis

The paints and coatings segment is projected to dominate the global automotive collision repair market due to its critical role in restoring the vehicle’s aesthetics and structural integrity after a collision. Following any collision damage, repairing the vehicle’s body panels involves refinishing with paints and coatings to protect the metal surfaces from corrosion and environmental damage. Paints not only restore the original look but also ensure durability, weather resistance, and safety compliance, making them indispensable in the repair process.

Advanced developments in automotive paints, such as waterborne and low-VOC (volatile organic compounds) formulations, have boosted their demand by offering environmentally friendly alternatives that comply with increasingly stringent global regulations on emissions and workplace safety. The adoption of eco-friendly coatings aligns with sustainability trends, appealing to repair shops and consumers who prioritize green practices.

Moreover, the paints and coatings segment covers a broad spectrum of products, including primers, base coats, clear coats, and sealants, each serving a specialized function within the repair workflow. The use of high-performance coatings enhances vehicle resale value by ensuring repairs are nearly invisible, which is crucial in maintaining consumer confidence.

Technological advancements, including the introduction of UV-curable coatings and nanotechnology-based paints, have improved repair speed and finish quality, thereby reducing turnaround time and operational costs. Repair shops invest heavily in sophisticated spray booths, drying ovens, and color-matching software to deliver flawless finishes.

Given the large volume of minor and major repairs that require refinishing, paints and coatings consistently account for a significant portion of repair expenditure, solidifying their dominance within the product segment of the collision repair market.

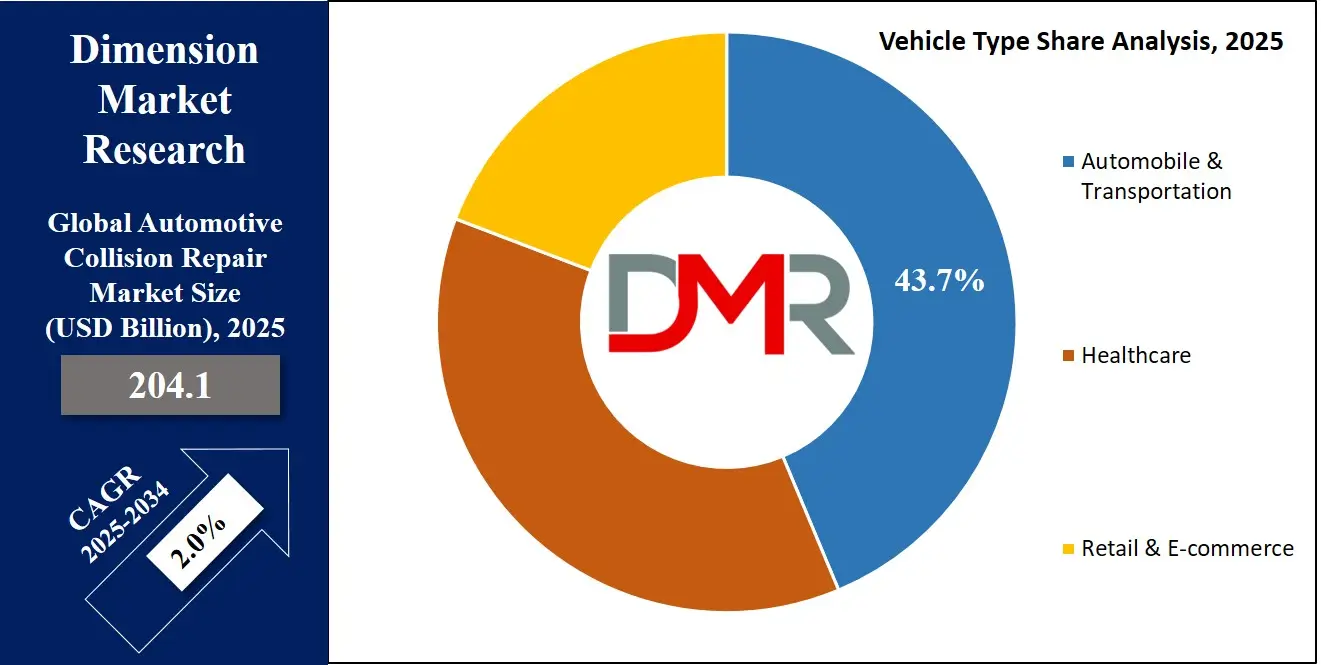

By Vehicle Type Analysis

Passenger vehicles are expected to dominate the global automotive collision repair market due to their sheer volume on roads worldwide and frequent involvement in traffic accidents, making them the primary focus for repair services. Globally, passenger cars account for the majority of the registered vehicle fleet, reflecting their central role in personal and commercial transportation. This large base naturally translates into a higher incidence of collisions, driving demand for collision repair services tailored to this segment.

Passenger vehicles encompass a wide range of models, including sedans, hatchbacks, SUVs, and crossovers, each with diverse body styles and repair requirements. The high diversity and volume of passenger vehicles sustain continuous demand for specialized repair services, parts, and consumables.

Urbanization, growing middle-class populations, and increased affordability of cars in emerging economies have led to significant growth in passenger vehicle ownership, intensifying the need for collision repair. Additionally, the average lifespan of passenger vehicles has increased due to improvements in vehicle quality and maintenance, meaning owners opt for repairs to extend vehicle usability rather than replacing vehicles outright.

Insurance penetration in passenger vehicles is higher compared to commercial or two-wheeler segments, facilitating quicker and more frequent repairs. Furthermore, stricter safety and emission regulations often mandate certified repairs to maintain vehicle compliance, boosting repair shop activity focused on passenger cars.

Advanced safety features, luxury finishes, and electronic components in modern passenger vehicles require skilled repair services, promoting investment in technology and training among repair providers. The dominance of passenger vehicles in the collision repair market stems from their widespread use, regulatory factors, and the economic logic of maintaining and restoring these vehicles efficiently.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Automotive Collision Repair Market Report is segmented on the basis of the following:

By Product Type

- Paints & Coatings

- Consumables

- Spare Parts

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

Global Automotive Collision Repair Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to hold a dominant position in the global automotive collision repair market as it commands over

37.1% of market share by the end of 2025, due to several key factors. The region boasts one of the largest vehicle fleets globally, with high vehicle ownership per capita driven by a well-established automotive culture. This extensive vehicle parc leads to increased collision incidents, fueling demand for repair services. Moreover, North America has a mature insurance ecosystem, with high insurance penetration encouraging professional and timely repairs after accidents. Regulatory frameworks in the region enforce stringent safety and environmental standards that mandate certified repair processes, promoting the use of quality products and skilled technicians.

Advanced technological adoption also supports market dominance, with repair shops equipped to handle complex repairs involving ADAS and electric vehicles. The presence of well-organized direct repair programs (DRPs) between insurers and certified repair centers streamlines the claims and repair process, enhancing service efficiency and customer trust. Additionally, North America’s strong focus on sustainability drives the adoption of eco-friendly paints and repair techniques, aligning with consumer preferences and regulations. Together, these factors create a robust ecosystem favoring growth and leadership in the automotive collision repair market.

Region with the Highest CAGR

Asia-Pacific is experiencing the highest compound annual growth rate (CAGR) in the automotive collision repair market, propelled by rapid urbanization, economic expansion, and increasing vehicle ownership. Emerging economies like China, India, and Southeast Asian countries are witnessing a surge in middle-class populations with rising disposable incomes, leading to greater demand for passenger and commercial vehicles. The expanding vehicle fleet naturally results in more collisions, which drives the need for repair services.

Infrastructure development and increasing traffic density in urban centers further contribute to collision risks. While insurance penetration is still developing, growing awareness and government initiatives to improve road safety are expected to boost professional repair services. Additionally, the region is gradually adopting advanced automotive technologies and repair equipment, enhancing service quality.

The combination of these demographic and economic factors, along with improving regulatory standards and investments in collision repair infrastructure, positions Asia-Pacific as the fastest-growing regional market in the automotive collision repair sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Automotive Collision Repair Market: Competitive Landscape

The global automotive collision repair market is highly competitive, featuring a mix of multinational corporations, regional players, and independent repair shops. Leading companies differentiate themselves through advanced technological capabilities, extensive service networks, and strong collaborations with insurers and automotive OEMs. Major players invest heavily in research and development to innovate repair techniques, especially in handling sophisticated materials and ADAS recalibration.

Companies such as Akzo Nobel N.V., PPG Industries, Axalta Coating Systems, and BASF SE dominate the paints and coatings segment by offering eco-friendly, high-performance products that meet evolving environmental regulations. In parallel, repair service providers are increasingly focusing on integrating digital tools, such as AI-driven damage assessment and automated workflows, to enhance repair accuracy and customer experience.

The rise of direct repair programs (DRPs) has intensified competition, as insurers prefer certified repair networks that ensure quality and reduce claim costs. Smaller regional players compete by offering localized expertise and cost-effective services, particularly in emerging markets.

Strategic mergers and acquisitions are common, enabling companies to expand geographic reach and broaden service portfolios. The competitive landscape is thus characterized by continuous innovation, partnerships, and service diversification, with a strong emphasis on sustainability and technological advancement to capture market share.

Some of the prominent players in the Global Automotive Collision Repair Market are

- 3M Company

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE

- Caliber Collision

- Continental AG

- Denso Corporation

- DuPont de Nemours Inc.

- Faurecia SE

- Gerber Collision & Glass

- Honeywell International Inc.

- Magna International Inc.

- Maaco Collision Repair & Auto Painting

- Mitchell International

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- Robert Bosch GmbH

- Service King Collision Repair Centers

- Tenneco Inc.

- Valeo SA

- Other Key Players

Recent Developments in the Global Automotive Collision Repair Market

- April 2025: Akzo Nobel N.V. announced a strategic investment in expanding its automotive coatings production capacity in North America to meet rising demand for eco-friendly, low-VOC paints. This investment aligns with increasing regulatory pressures on emissions and supports the shift towards sustainable collision repair solutions.

- March 2025: BASF SE entered into a collaboration agreement with a leading automotive OEM to develop next-generation paint systems compatible with electric and autonomous vehicles. This partnership focuses on enhancing durability and repairability while reducing application time and environmental impact.

- February 2025: The Automotive Aftermarket Suppliers Association (AASA) hosted its annual Collision Repair Expo in Las Vegas, showcasing the latest innovations in repair technologies, including AI-driven damage assessment tools and advanced coating systems. The event attracted over 1,500 industry professionals and facilitated critical networking among OEMs, insurers, and repair centers.

- January 2025: Axalta Coating Systems completed the acquisition of a regional automotive refinish business in Asia-Pacific, expanding its footprint in fast-growing emerging markets. The merger enhances Axalta’s product portfolio with localized coatings optimized for diverse climatic conditions and vehicle types.

- November 2024: PPG Industries launched a cloud-based color-matching software platform designed to improve accuracy and reduce waste in collision repair shops. The digital innovation supports faster repair cycles and superior finish quality, driving operational efficiency across the value chain.

- October 2024: A global consortium of collision repair stakeholders, including insurers, OEMs, and aftermarket suppliers, initiated a multi-year research project focused on standardizing repair protocols for ADAS-equipped vehicles. This collaboration aims to mitigate repair complexity and ensure post-repair safety compliance.

- September 2024: The National Institute for Automotive Service Excellence (ASE) conducted a specialized conference on advanced collision repair training, emphasizing techniques for hybrid and electric vehicles. The event highlighted skill gaps and promoted certification programs to improve workforce readiness.

- July 2024: LKQ Corporation announced a joint venture with a technology firm to develop AI-powered damage estimation software integrated with real-time parts inventory management. This initiative targets enhanced accuracy in insurance claims and faster turnaround for collision repair services.

- June 2024: Sherwin-Williams Automotive Finishes unveiled a new line of waterborne coatings with superior corrosion resistance, targeting both commercial and passenger vehicle segments. The product launch supports industry trends towards sustainable, high-performance refinishing materials.

- April 2024: Car-O-Liner, a global leader in collision repair equipment, expanded its R&D center focused on automated frame alignment technologies, improving repair precision for complex structural damages. The investment underscores the growing importance of technology in reducing repair cycle times.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 204.1 Bn |

| Forecast Value (2034) |

USD 243.3 Bn |

| CAGR (2025–2034) |

2.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 63.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Paints & Coatings, Consumables, Spare Parts), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M Company, Akzo Nobel N.V., Axalta Coating Systems LLC, BASF SE, Caliber Collision Centers, Continental AG, Denso Corporation, DuPont de Nemours Inc., Faurecia SE, Gerber Collision & Glass Inc., Honeywell International Inc., Magna International Inc., Maaco Collision Repair & Auto Painting, Mitchell International Inc., Nippon Paint Holdings Co. Ltd., PPG Industries Inc., Robert Bosch GmbH, Service King Collision Repair Centers Inc., Tenneco Inc., Valeo SA., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Automotive Collision Repair Market?

▾ The Global Automotive Collision Repair Market size is estimated to have a value of USD 204.1 billion in 2025 and is expected to reach USD 243.3 billion by the end of 2034.

What is the size of the US Automotive Collision Repair Market?

▾ The US Automotive Collision Repair Market is projected to be valued at USD 63.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 75.3 billion in 2034 at a CAGR of 1.9%.

Which region accounted for the largest Global Automotive Collision Repair Market?

▾ North America is expected to have the largest market share in the Global Automotive Collision Repair Market, with a share of about 37.1% in 2025.