Market Overview

Global

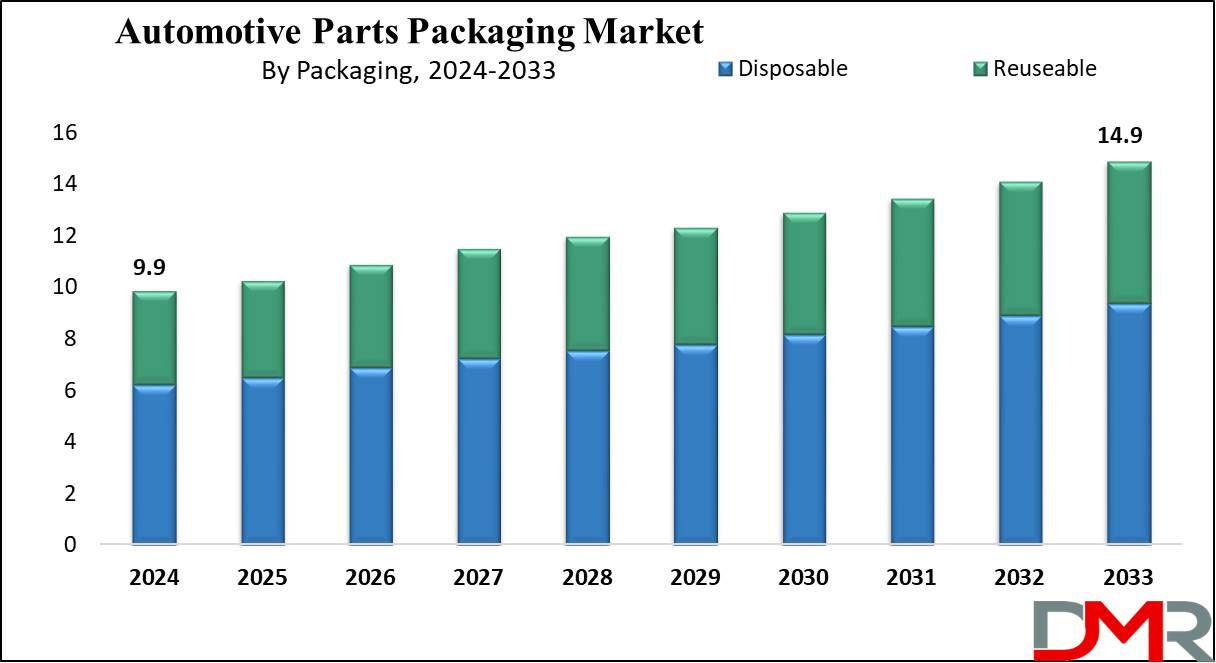

Automotive Parts Packaging Market was

valued at USD 9.9 billion in 2023, and it is further anticipated to reach a market value of

USD 14.9 billion by 2033 at a CAGR of 4.7%.

Automotive parts packaging protects vehicle spare parts during transportation and storage. These packaging solutions are used for service, aftermarket, spare, and automotive parts. There is a requirement for high-quality packaging materials that are employed to pack automotive parts to avoid breakage, water seepage, corrosion, and increase product life.

Packaging includes methods to enclose & protect products during storage & transport. Further, materials like molded pulp, foam, plastic, corrugated, & void fill are used. Returnable

packaging is used for shipping components, while disposable packaging is common. Multiple layers in the packaging protect against corrosion, moisture, & scratches, securing the safety of vehicle parts. Moreover, packaging serves the dual purpose of safeguarding & promoting goods to consumers leading to the expansion of the market.

Key Takeaways

- Market Size: The Global Automotive Parts Packaging Market is expected to grow by 4.6 billion, at a CAGR of 4.7 % from 2025 to 2033.

- Market Definition: Automotive parts packaging is the material or method which is used to pack various components and parts used in the automotive industry.

- By Packaging Analysis: Disposable packaging is expected to lead with revenue share of 63.1% in 2024 & is anticipated to dominate throughout the forecasted period.

- Product Analysis: In terms of product, reusable packaging is expected to dominate with a high revenue share in 2024.

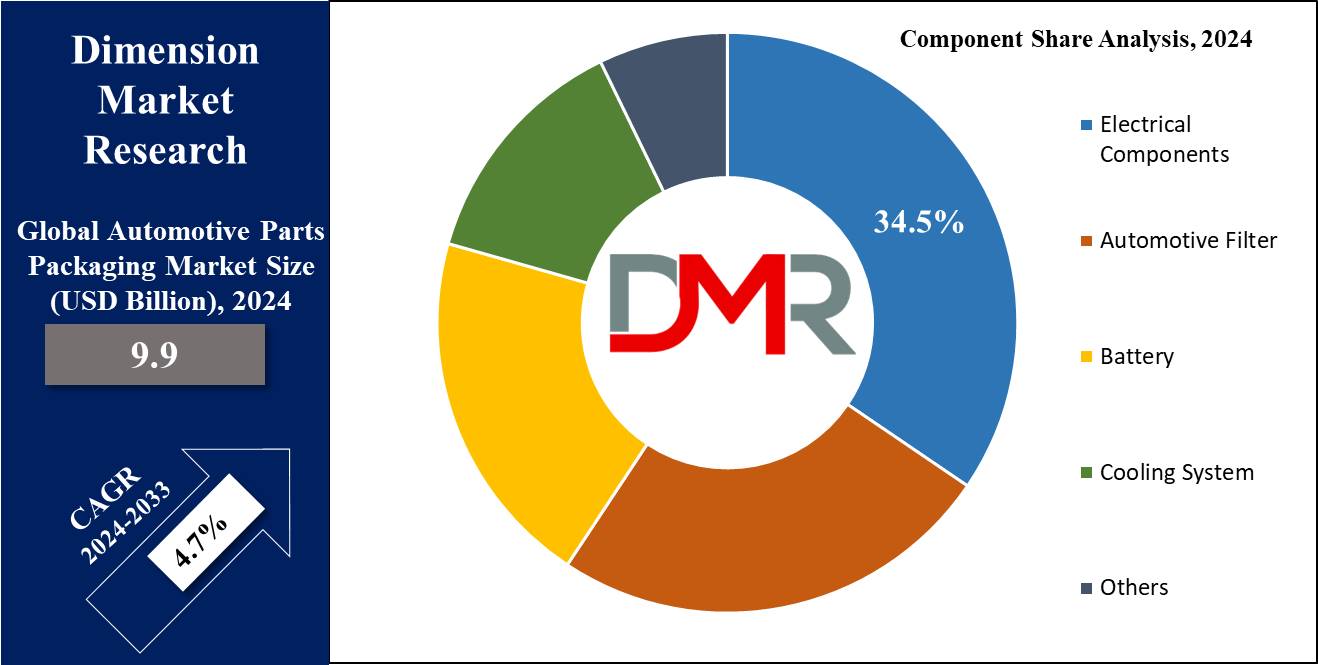

- By Component Analysis: Electric components are anticipated to lead with the largest market share with 34.5% based on components in 2024.

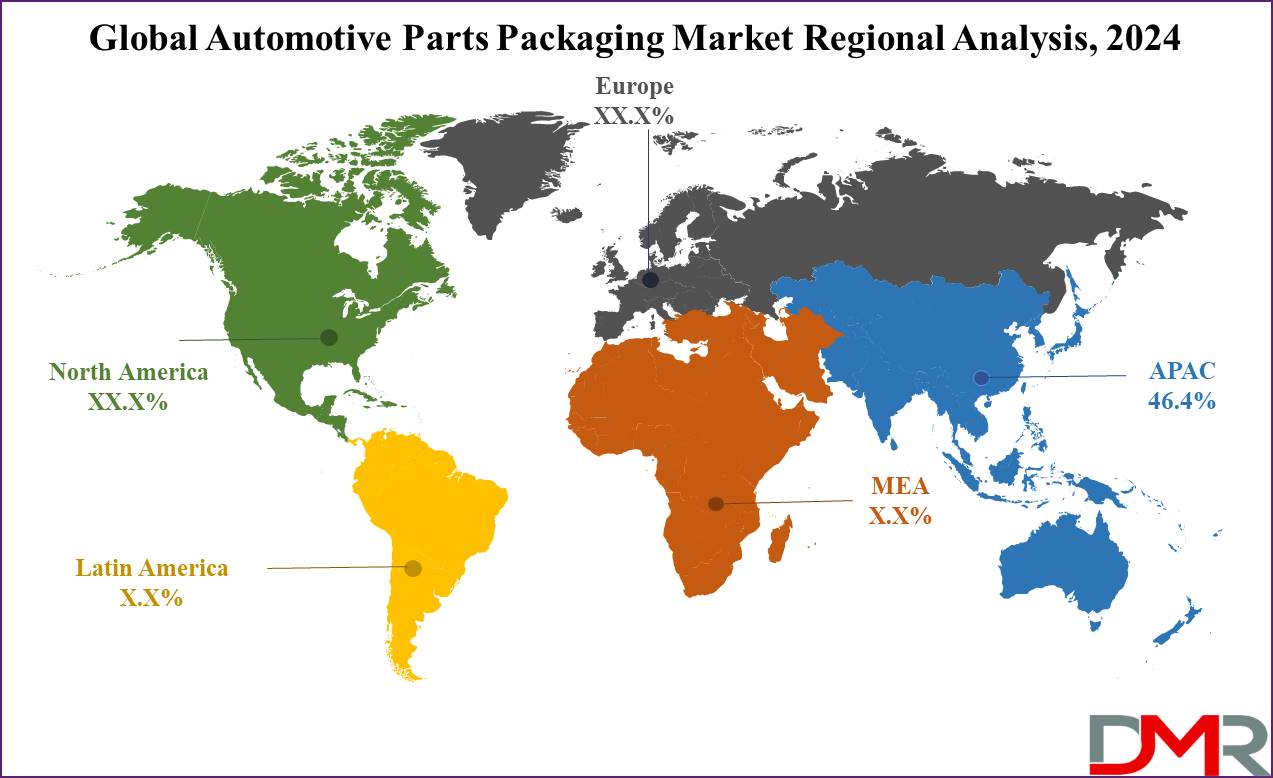

- Regional Analysis: Asia Pacific is expected to lead the automotive parts packaging market with a 46.4% share of revenue in 2024.

Use cases

- Storage and Shelf-Life Extension: Sensitive automotive parts like rubber or plastic, require specific storage conditions to maintain their properties over time. These packaging are designed for long-term storage, such as moisture-resistant containers or anti-static packaging for electronic components, which help to increase the shelf life.

- Protection during Shipping: Packaging is important for protecting automotive parts during transit as engine components, delicate sensors, or electronic module parts are required to secure packaging to prevent damage from shocks, vibrations, and rough handling during transit.

- Preventing Contamination: Automotive parts require protection from environmental factors like dust, moisture, and contaminants. Sealed bags, shrink wrap, or protective coatings help maintain the parts' integrity and functionality until they are ready for installation.

- Inventory Management: Packaging helps in managing and organizing inventory effectively. Different parts of automobiles are packaged in distinct containers or boxes, each labeled with essential information such as part numbers, descriptions, and quantities.

Market Dynamic

Drivers

Increase in global populationThe automotive parts packaging market is experiencing growth in demand, driven by the global population's rapid growth & urbanization, as the increased production & packaging of heavy components like cooling systems & engine parts highly contribute to market expansion in the forecast period, and drive the growth of the market.

Use of environment-friendly materials

Consumer preferences for bio-based packaging materials, driven by environmental concerns, along with the rise in integration of electronic & electrical equipment in automobiles, are anticipated to drive market growth substantially.

The adoption of reusable packaging & the packaging of heavy components have generated significant demand for protective packaging, further boosting the automotive parts packaging market during the forecast period.

Restraints

Fluctuating Demand & High Investment

Fluctuating demand from automotive & spare parts manufacturers may restrain market growth, along with concerns about the large volume of waste produced by protective packaging posing potential challenges to market expansion.

Supply Chain Disruptions

Global trade conflicts, natural calamities, and geopolitical tensions are instances of disruptions in the global supply chain. These disruptions have the potential to impact the availability and costs of packaging materials, which restrains the stability and growth of the automotive parts packaging market.

Opportunities

Growth of E-commerce Retail

The increasing use of e-commerce in the automotive retail sector is due to the rising demand for specialized packaging solutions. They are important for ensuring the safe and secure delivery of automotive parts to end users, thereby driving the growth opportunities of the market. There is a constant need for effective packaging that protects parts during transit as online automotive sales continue to rise.

Customized Packaging SolutionsThe automotive parts packaging market is seeing innovative packaging solutions due to the increased demand for customized packaging solutions. They are specifically designed to meet the requirements of diverse automotive components, considering factors like their size, shape, and susceptibility to damage. This customization reflects the market's commitment to improving product protection and optimizing

logistics efficiency.

Trend

Sustainable Packaging SolutionsSustainable and eco-friendly packaging is gaining momentum due to consumer preferences for environmentally responsible solutions. Packaging materials like biodegradable plastics, recycled cardboard, and reusable containers are sustainable. Companies are focusing on reducing packaging waste by optimizing design to minimize material usage.

Interactive Packaging for Customer Engagement

This market is continuously designing interactive experiences for customers, including QR codes linking to instructional videos or product information. Augmented reality allows customers to visualize how parts are installed or perform maintenance tasks through digital overlays.

Research Scope and Analysis

By Packaging

The major market share in automotive parts packaging is expected to belong to disposable packaging with largest market share of 63.1% in 2024, mainly comprising single-use options designed for recycling or proper disposal once a vehicle part fulfills its intended purpose. These packaging solutions focus on the importance of integrating a routine material disposal procedure into the entire production & packaging lifecycle.

Further, there has been a growth in the advancement of returnable packaging alternatives customized for reuse within manufacturing & distribution systems, which eliminates the necessity for constantly purchasing disposable packaging, reducing the environmental impact associated with landfill disposal or recycling. The switch towards returnable packaging not only aligns with sustainable practices but also addresses the growing need for effective, eco-friendly solutions in the automotive parts packaging sector.

By Product

Protective Packaging is predicted to lead the Automotive Parts Packaging Market in terms of product type in 2024, which is attributed to the increasing complexity of supply networks & the expanding transportation of goods, increasing the risk of damage or spoilage.

Further, it addresses these challenges by providing features like cushioning, shock absorption, temperature regulation, & moisture resistance. These protective qualities play a vital role in reducing the potential dangers associated with the complicated journey of automotive parts.

As supply chains become more complex & goods traverse longer distances, the importance of protective packaging becomes noticeable, ensuring the preservation & safe delivery of automotive components by minimizing the risks posed by various environmental factors & handling conditions.

By Component

The global automotive parts packaging market is segmented into electrical components, automotive filters, batteries, cooling systems, and others based on components. The electrical Components segment is anticipated to lead the market with the largest market share of 34.5% in 2024, which is highlighted by the rise in consumer demand for electrical & electronic equipment used in the automotive sector, along with growing concerns regarding the safety & quality of such components.

Further, modern vehicles integrate advanced electronic systems, there is a growing emphasis on packaging solutions to ensure the secure

transportation of electrical components. Also, growth in the need for electric vehicles & the proliferation of advanced automotive technologies contributes to the prominence of the Electrical Components segment, signifying a market trend aligning with the changing landscape of the automotive industry.

The Automotive Parts Packaging Market Report is segmented based on the following

By Packaging

By Product

- Protective Packaging

- Crates

- Pallets

- Bags & Pouches

- Bulk Containers & Cases

- Folding Carton

- Trays

- Corrugated Products

By Component

- Electrical Components

- Automotive Filter

- Battery

- Cooling System

- Others

Regional Analysis

Asia Pacific region is expected to dominate the automotive parts packaging market, claiming a significant

46.4% share in 2024, and is expected to persist throughout the forecast period. Further, China stands out as the leading & rapidly growing automotive industry globally, providing a lucrative opportunity for global packaging leaders to venture into the Chinese market with advanced packaging solutions. Further, established packaging providers in the region provide affordable solutions, global leaders have the potential to leverage their expertise for a competitive edge.

Moreover, in China, a noteworthy aspect is the comparatively less investment in R&D by packaging companies in comparison to North America & Europe. Also, the competition in China's packaging sector addresses traditional packaging products rather than cutting-edge solutions.

Furthermore, advancements in material science have led to the development of affordable biodegradable plastics, revolutionizing disposable packaging for automotive parts. The automotive industry's growing inclination towards disposable packaging, driven by its advantages over reusable alternatives, provides enticing global opportunities in the automotive parts packaging market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global automotive parts packaging market experiences intense competition as companies compete for market share. With a major focus on innovation, sustainable practices, & affordability to gain a competitive edge. Packaging solutions that meet changing industry trends, like e-commerce growth & environmental concerns, are major. Further strategic partnerships & technological developments contribute to the dynamic competitive landscape, shaping the industry's future trajectory.

Market players are also introducing new auto parts packing solutions by using eco-friendly packaging materials. An increase in investments in research and development would allow companies to introduce customized packaging solutions in the automotive sector.

Automotive parts packaging providers offer a range of services and solutions including design, manufacturing, testing, and logistics management to ensure that automotive components are properly packaged for transportation and storage.

Some of the prominent players in the Global Automotive Parts Packaging Market are

- Nefab AB

- Mondi Plc

- Knauf Industries

- Smurfit Kappa Group

- WestRock Company

- Sonoco Products

- DS Smith

- Signode India

- Schoeller Allibert Services

- Sealed Air Corp

- Other Key Players

Recent Development

- In March 2023, Pregis introduced its AirSpeed Ascent air cushioning system in Europe. Using patented square-designed hybrid cushioning (HC) developed with high-pressure air improves shock absorption for enhanced product protection. Further, the AirSpeed HC Renew film meets Circular Economy Flexible Packaging standards, having over 30% recycled material. Also, the compact design conserves space and its 30 minutes per second speed benefits users.

- In November 2022, Onsemi introduced a new line of MOSFET devices with innovative top-side cooling, particularly designed for challenging automotive applications like motor control & DC/DC conversion, these devices were highlighted at Electronica, the premier electronics trade show. Further, the Automotive Power Solutions at Onsemi, solving cooling challenges is critical for reducing size & weight in modern car design, offering an efficient & compact solution.

- In August 2022, ORBIS Corporation, a global leader in reusable packaging, showcased solutions for the battery supply chain & electric vehicles at the North American Battery Show, including protective dunnage, hand-held containers, bulk containers, & metal racks. These options focus on enhancing sustainability, efficiency, and affordability in the automotive supply chain, addressing challenges expected by the complexities of Li-ion batteries in electric vehicles.

- In February 2022, Smurfit Kappa made a significant investment in its new Design2Market Factory, which facilitates quick & smooth progress from designing a package to launching it in the market. Further, the company's significant financial commitment highlights its dedication to effectively bringing new products from the drawing board to the consumer market.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 9.9 Bn |

| Forecast Value (2033) |

USD 14.9 Bn |

| CAGR (2024-2033) |

4.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Packaging (Reusable and Disposable), By Product (Crates, Pallets, Bags & Pouches, Bulk Containers & Cases, Folding Carton, Trays, Corrugated Products, and Protective Packaging), By Component (Electrical Components, Automotive Filter, Battery, Cooling System, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Nefab AB, Mondi Plc, Knauf Industries, Smurfit Kappa Group, WestRock Company, Sonoco Products, DS Smith, Signode India, Schoeller Allibert Services, Sealed Air Corp, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global Automotive Parts Packaging Market size was valued at USD 9.9 billion in 2023 and is expected to reach USD 14.9 billion by the end of 2033.

Asia Pacific is expected to be the largest market share for the Global Automotive Parts Packaging Market with a share of about 46.4% in 2024.

Some of the major key players in the Global Automotive Parts Packaging Market are Nefab AB, Mondi Plc, Knauf Industries, and many others.

The market is growing at a CAGR of 4.7 percent over the forecasted period.