Market Overview

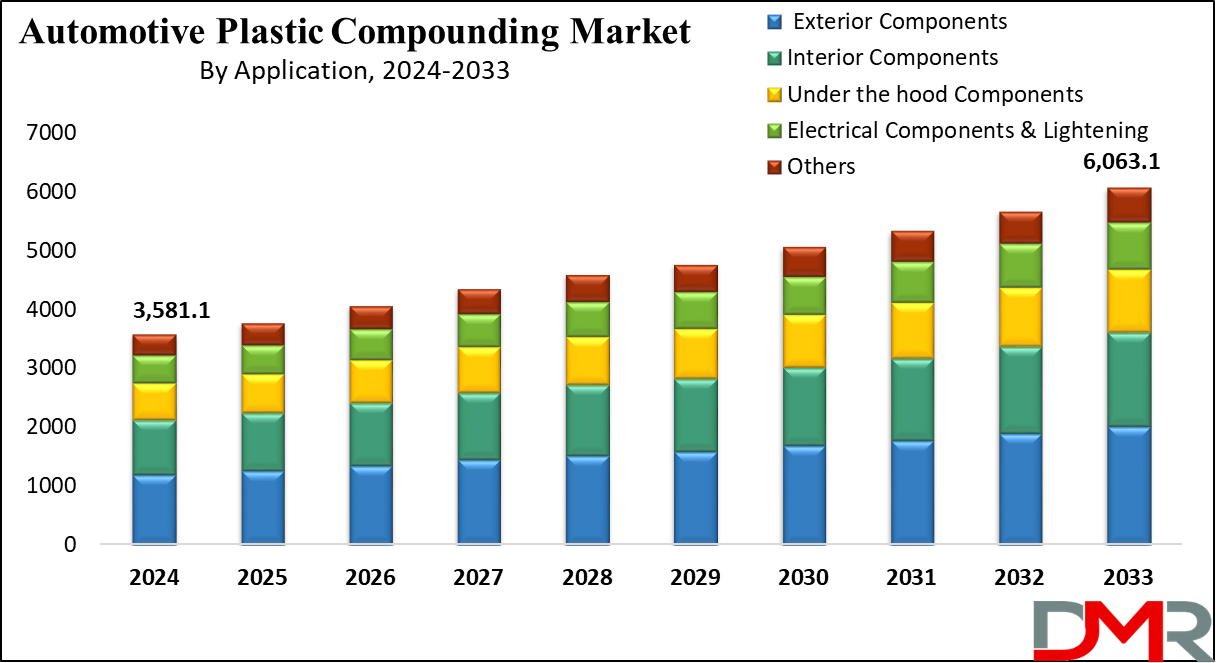

Global Automotive Plastic Compounding Market was estimated at USD 3,372.0 million in 2023, and it is further anticipated to reach a market value of USD 6,063.1 million by 2033 at a CAGR of 6.0 %.

Plastic compounding involves the process of blending different types of plastics

& thermoplastics along with additives to enhance their characteristics. The final product of such compounding exhibits a wide range of needed & required physical properties, like flame retardancy, conductivity, low weight & wear resistance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These high-quality materials have led to increased demand for plastic compounds across many sectors, like, building and construction, automotive, packaging, & electrical, thereby fueling the growth of the global plastic compounding market.

Plastic compounding is critical for producing enhanced materials with properties such as flame retardancy, conductivity, and wear resistance. These materials are increasingly replacing metals in vehicles, contributing to weight reduction, better fuel efficiency, and lower carbon emissions. As the automotive sector undergoes transformation driven by automotive semiconductor and automotive chip integration, the role of compounded plastics in supporting electronic systems and structural integrity continues to expand.

Key Takeaways

- Market Size: The Global Automotive Plastic Compounding Market is expected to grow by 2,288.6 million, at a CAGR of 6.0 % from 2025 to 2033.

- Market Definition: Automotive plastic compounding is the process of manufacturing custom plastic materials specifically tailored for use in automotive applications.

- Product Analysis: In terms of product, PP (Polypropylene) is expected to dominate with a high revenue share of 71.5% in 2024.

- By Application Analysis: Interior Components are anticipated to lead with the largest market share, with 33.2% based on application in 2024.

- Regional Analysis: Asia Pacific is expected to lead the automotive plastic compounding market with a 45.6 % share of revenue in 2024.

Use cases

- Electrical and Electronic Systems: Compounded plastics are used in the manufacturing of electrical connectors and wire insulation, which provide good electrical properties, heat resistance, and dimensional stability.

- Structural Components: Glass fiber-reinforced polyamides and carbon fiber-reinforced composites are some of the compounded materials that are used in structural components such as cross members, subframes, and seat structures.

- Interior Components: Polypropylene (PP) and acrylonitrile butadiene styrene (ABS) are used to make dashboards and instrument panels, which offer excellent aesthetic qualities, impact resistance, and can be colored or textured to meet design requirements.

- Exterior Components: Polypropylene polymer compounds with added impact modifiers are used to manufacture bumpers and fascias which offer superior impact resistance, & flexibility, and are lightweight, helping to improve vehicle safety and fuel efficiency.

Market Dynamic

Drivers

Regulatory Impact on Vehicular Weight Reduction

The Global Automotive Plastic Compounding Market is growing due to the increasing implementation of emission norms & regulations related to vehicular weight in the automotive sector, driven by the need to reduce greenhouse gas emissions. As a result, there is a growing demand for plastic compounds as they help enhance & improve the yield of production & improve the performance of automobile products.

Improved Performance of Automotive Components

The automotive sector is expected to be a significant growth driver for the

plastic compounding market, with the increasing desire for several vehicle parts like bumper fascias, instrument panels, & door trims. These plastic compounds play an important role in increasing the efficiency of production & the performance of the components of automobiles.

Restraints

High Costs and Technological Barriers in Plastic Recycling

Re-engineering plastics is hampered by the significant capital and infrastructure investments required. This market is restrained by manufacturers' lack of awareness and knowledge regarding recycling processes and insufficient infrastructure. The Automotive Plastic compounding market is hindered by inadequate technology, deficient infrastructure, and a limited market for recycled materials. These recycling processes require a cutting-edge technological process that needs substantial investments.

Recycling Processes Limitations

Advanced recycling facilities are equipped with plastic separation technologies such as magnetic separation, eddy current separators, float-sink tanks, and laser and infrared systems, which are critical for differentiating and separating plastics based on color and material type. Recycling is a complex process that requires sorting and processing methods to achieve high-quality recyclates, which obstructs the growth of the market.

Opportunities

Technological Revolution in the Automotive Industry

There is a rising adoption of electric vehicles due to technological advancements in the automotive sector. They are known for their efficiency, energy independence, & superiority over gasoline-powered alternatives. They utilize lightweight materials, which enhances the engine's pulling capacity. The growing demand for electric vehicles creates new opportunities for the automotive plastics compounding market, as these materials are essential for reducing vehicle weight.

Trend

Collaboration among automotive manufacturers

Major automotive manufacturers are increasingly collaborating with plastic compounders to develop innovative materials that meet the evolving demands of modern vehicle design and sustainability goals. There is a continuous need for specialized plastics that offer superior electrical and thermal properties due to the integration of advanced features and smart technologies in vehicles.

Research Scope and Analysis

By Product

PP (Polypropylene) is anticipated to dominate with a maximum share of 71.5% in the global automotive plastic compounding market in 2024. The significant market revenue can be attributed to the growing desire for lighter automobiles, including EVs. They offer the advantage of reduced weight & complexity of vehicles, making it a preferred choice for automotive manufacturers. With the automotive sector witnessing growth on a global scale, key manufacturers in the polypropylene market are expected to find lucrative growth opportunities.

Furthermore, Polyethylene is projected to experience significant growth throughout the forecast period. Its popularity is driven by its remarkable resistance against impact, abrasion, and chemicals, along with its durability, flexibility, low weight & strength making it highly favored for automotive production. PE is widely utilized in the automotive sector due to its excellent resistance to break, making it a viable alternative to metals and contributing to the manufacture of vehicles with reduced weight. This makes PE a highly sought-after material for the automotive industry, fueling its growth as a preferred choice for automotive applications.

By Application

Under the application segment, the Interior Components segment is expected to dominate the global automotive plastic compounding market with the largest revenue share of 33.2% in 2024. This strong market share can be accredited to the increasing focus on the reduced weight of automobiles, which is driving the demand for plastic compounding in the automotive sector for the interior components segments like door panels, instrumental panels, & pillars. As the economic conditions economically improve, the desire for such interior automotive components is expected to experience rapid growth.

Moreover, various polymers, like Polypropylene (PP), Polyethylene, and Thermoplastic elastomers, have gained popularity as preferable alternatives to traditional plastics & metals in the automotive sector, particularly for producing several interior parts & components of automobiles. These materials provide exceptional properties like high strength, lightweight, fire resistance, & galvanic corrosion resistance, making PP a perfect polymer for the components of automobiles.

Moreover, recent research and development activities aimed at expanding the application segment to include complex engine parts, outdoor components, & repair parts, are anticipated to further boost the market's growth. Rising production along with the ability to customize intricate products and lightweight designs, are expected to drive the plastic compounded products’ demand in the automotive sector.

The Global Automotive Plastic Compounding Market Report is segmented based on the following

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Polycarbonate (PC)

- Polybutylene Terephthalate (PBT)

- Thermoplastic Elastomers (TPE)

- Acrylonitrile Butadiene Systems (ABS)

- Others

By Application

- Exterior Components

- Interior Components

- Under the hood Components

- Electrical Components & Lightening

- Others

Regional Analysis

Asia Pacific is predicted to dominate the global automotive plastic compounding market,

holding a significant share of over 45.6% of the revenue in 2024. The region's strong position is fueled by the increasing desire for automobiles, supported by supportive foreign direct investment norms implemented by governments in the area.

Additionally, the low costs of production in countries like India & China are anticipated to drive the adoption of plastic compounding in the automotive industry in the region. Moreover, North America presents favorable conditions for the market, with growing production capabilities, a thriving automotive industry, and a positive demographic dividend. The demand for cars and several other vehicle products, such as heavy & medium trucks & buses, remains robust.

Furthermore, In Europe, factors such as an increase in automotive manufacturing, rising disposable income, and a population with old age, contribute significantly to the growth of the global automotive plastic compounding market. The presence of properly developed infrastructure & major key players like BMW, Fiat, & Volkswagen further propels the advancement of the automotive market in Europe. Overall, the global market for plastic compounding in the automotive sector is observing substantial growth in different regions, driven by various factors unique to each area.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The automotive plastic compounding market offers detailed insights into key competitors which includes overviews of companies, their financials, revenue generation, market potential, and R&D investments. Market vendors are actively engaged in expanding plastic compounding within the automotive industry and exploring new applications for their products. Simultaneously, automobile manufacturers are prioritizing the optimization of pre- and post-production processes due to the rapid advancements in technology.

Some of the prominent players in the Global Automotive Plastic Compounding Market are

- Asahi Kasei Corporation

- LyondellBasell Industries Holdings B.V

- SABIC

- BASF SE

- Dow

- Ferro Corporation

- Washington Pen

- Ravago

- KRATON Corporation

- Covestro AG

- DuPont

- Others

Recent development

- In February 2024, Modern Dispersions finalized and put into operation the initial stage of a multifaceted manufacturing expansion at its new 168-acre location in Fitzgerald, Georgia which is driven by robust demand in injection molding and extrusion applications across various sectors such as automotive, electronics packaging, and construction, with notable uses including pipe manufacturing and wire and cable production.

- In December 2023, Sirmax, an Italian plastic processing company, revealed to expand its plastic compounding operations in India, aiming for a production capacity of 20 kilotons per year.

- In November 2023, Borealis AG announced an expansion in the production of mechanically recycled plastic compounds, boosting its compounding capacity to more than 50 kilotons per year facilitated by ac4wq7quiring Rialti S.p.A., an Italian company specializing in polypropylene (PP) compounding from recycled materials.

- In May 2023, Lear, a leading automotive technology company, announced plans to establish a connection systems facility in Morocco which is dedicated to manufacturing components for automakers, suppliers, as well as Lear's E-systems and seating units.

- In November 2022, Covestro AG and HASCO Vision partnered to recycle post-industrial plastics and transform them into high-quality post-industrial recycled polycarbonates and polycarbonate blends, and then provide them to HASCO to manufacture new automotive components.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3,581.1 Mn |

| Forecast Value (2033) |

USD 6,063.1 Mn |

| CAGR (2024–2033) |

6.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Products (Polyethylene (PE), Polypropylene (PP), Polycarbonate (PC), Polybutylene Terephthalate (PBT), Thermoplastic Elastomers (TPE), Acrylonitrile Butadiene Systems (ABS), and Others), By Application (Exterior Components, Interior Components, Under the hood, Electrical Components & Lightening, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Asahi Kasei Corporation, LyondellBasell Industries Holdings B.V, SABIC, BASF SE, Dow, Ferro Corporation, Washington Pen, Ravago, KRATON Corporation, Covestro AG, DuPont, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

What is the value of the Global Automotive Plastic Compounding Market?

▾ Global Automotive Plastic Compounding Market was valued at USD 3,372 million in 2023, and it is further anticipated to reach a market value of USD 6,063.1 million by 2033 at a CAGR of 5.8%.

What is the expected CAGR for the Global Automotive Plastic Compounding Market?

▾ The Global Automotive Plastic Compounding Market is expected to grow at 6.0 % (CAGR) from 2024 to 2033.

Which region dominates the Global Automotive Plastic Compounding Market?

▾ Asia Pacific region is predicted to dominate the global market, holding a significant share of over 45.3% of the global revenue in 2024.

Who are the prominent players in the Global Automotive Plastic Compounding Market?

▾ Some of the prominent players in the Global Automotive Plastic Compounding Market include Asahi Kasei Corporation, LyondellBasell Industries holdings B.V, SABIC, BASF SE, etc.