Market Overview

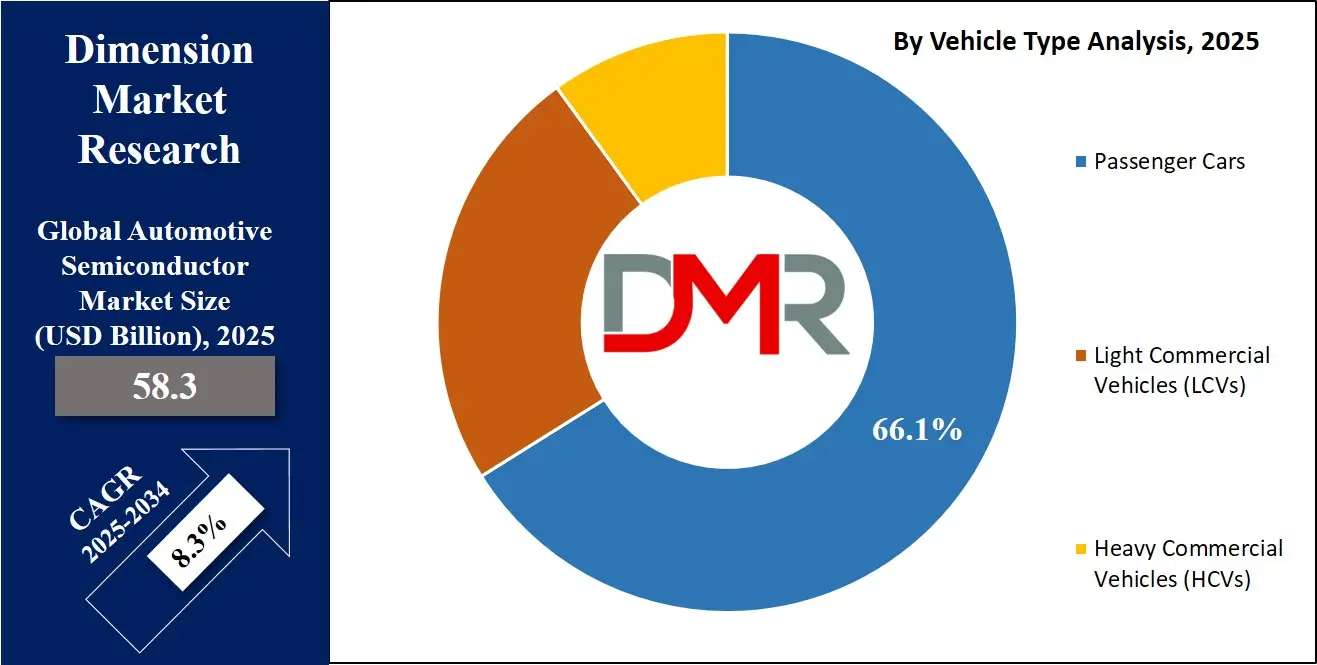

The Global Automotive Semiconductor Market is estimated to be valued at

USD 58.3 billion in 2025 and is further anticipated to reach

USD 119.5 billion by 2034 at a

CAGR of 8.3%.

Automotive semiconductors are specialized microelectronic components designed to perform a wide range of functions in vehicles, from managing power distribution and sensing external conditions to enabling advanced control systems and connectivity. These semiconductors are engineered to operate reliably under the rigorous conditions of the automotive environment, including exposure to heat, cold, moisture, and continuous vibration.

Their roles span critical systems such as engine and transmission control, braking, lighting, electric vehicle propulsion, battery management, and autonomous driving. As vehicles become more reliant on digital technologies, these semiconductors have become central to ensuring performance, safety, efficiency, and driver experience, effectively forming the digital backbone of modern automotive engineering.

The global automotive semiconductor market has witnessed significant evolution, propelled by the ongoing digital transformation within the automotive industry. Where vehicles once relied on mechanical systems for core functionalities, today’s cars are embedded with complex electronics that enhance everything from fuel efficiency to driver safety. This shift has resulted in a growing dependency on high-performance semiconductors, as automakers integrate features such as adaptive cruise control, automatic emergency braking, and real-time navigation. With the proliferation of such technologies, demand for semiconductors has expanded not only in volume but also in technical complexity, requiring chips that can process vast amounts of data at high speed while maintaining energy efficiency.

The rise of electric vehicles has further accelerated the growth of the automotive semiconductor market. Unlike internal combustion engine vehicles, EVs depend heavily on semiconductors to manage electric propulsion, battery health, and regenerative braking systems. The transition to electrified powertrains has triggered a fundamental change in semiconductor requirements, prioritizing power electronics capable of handling high voltages and currents efficiently. Additionally, as governments across the globe enforce stricter emissions regulations and incentivize EV adoption, semiconductor manufacturers are investing in innovations that enhance energy management, charging efficiency, and vehicle range, all of which hinge on advanced semiconductor technologies.

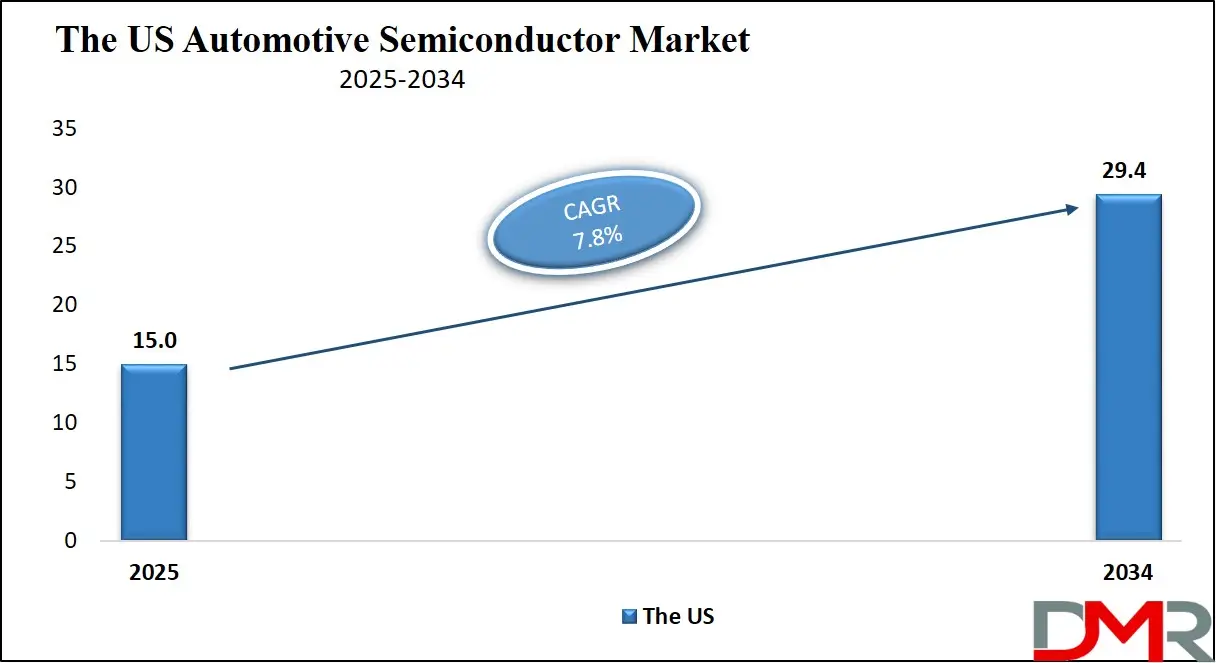

The US Automotive Semiconductor Market

The US Automotive Semiconductor Market is projected to be valued at USD 15.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 29.4 billion in 2034 at a CAGR of 7.8%.

Automotive semiconductors are highly specialized microelectronic components designed to manage and control the growing complexity of vehicle systems, and in the context of the U.S., their role is even more prominent due to the country’s push toward technological advancement, electric mobility, and vehicle automation. These chips are at the heart of modern automotive innovation, responsible for enabling everything from traditional engine control and braking systems to cutting-edge ADAS features, digital infotainment, and battery management in electric vehicles. In the U.S., where regulatory frameworks, consumer preferences, and tech integration are rapidly evolving, automotive semiconductors play a pivotal role in aligning vehicle capabilities with both safety standards and customer expectations.

The U.S. automotive semiconductor market has grown steadily, fueled by a mix of domestic innovation, rising demand for electric and autonomous vehicles, and a resurgence in domestic chip manufacturing initiatives. American automakers and technology companies are investing heavily in next-generation mobility solutions, which rely on advanced chips capable of real-time processing, AI computation, and secure connectivity. Companies like Tesla have set benchmarks for EV and ADAS performance, indirectly driving semiconductor demand not just in terms of quantity, but also in terms of performance, reliability, and integration complexity. Additionally, major tech firms like NVIDIA, Qualcomm, and Intel are deeply embedded in the automotive space, supplying advanced chipsets designed for automotive-grade computing, AI processing, and smart cockpit systems.

Global Automotive Semiconductor Market: Key Takeaways

- Market Value: The global automotive semiconductor market size is expected to reach a value of USD 119.5 billion by 2034 from a base value of USD 58.3 billion in 2025 at a CAGR of 8.3%.

- By Vehicle Type Segment Analysis: Passenger Cars are poised to consolidate their dominance in the vehicle type segment, capturing 66.1% of the total market share in 2025.

- By Component Segment Analysis: Discrete Power Components are anticipated to maintain their dominance in the component type segment, capturing 31.9% of the total market share in 2025.

- By Application Segment Analysis: Body Electronic Applications are poised to consolidate their market position in the application type segment, capturing 24.9% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global automotive semiconductor market landscape with 45.5% of total global market revenue in 2025.

- Key Players: Some key players in the global automotive semiconductor market are NXP Semiconductors, Infineon Technologies, Texas Instruments, Renesas Electronics, STMicroelectronics, Robert Bosch GmbH, ON Semiconductor (onsemi), Analog Devices, Toshiba Corporation, ROHM Semiconductor, Intel Corporation, Micron Technology, and Other Key Players.

Global Automotive Semiconductor Market: Use Cases

- Advanced Driver Assistance Systems (ADAS) and Autonomous Driving: One of the most transformative use cases for automotive semiconductors lies in enabling ADAS and autonomous driving technologies. These systems require real-time data collection, processing, and decision-making using a combination of sensors such as radar, LiDAR, ultrasonic sensors, and high-resolution cameras. Semiconductors power every layer of this technology, from the perception and mapping modules to the AI algorithms that control braking, steering, and acceleration.

- Electric Vehicle (EV) Powertrain Management: Electric vehicles have redefined the design priorities of modern cars, placing semiconductors at the center of vehicle propulsion, energy optimization, and battery safety. In EVs, semiconductors are used to manage the electric powertrain, which includes the inverter, onboard charger, battery management system (BMS), and DC-DC converters. Power semiconductors, especially those made from silicon carbide (SiC) or gallium nitride (GaN), are crucial in increasing power density and minimizing energy loss during charging and acceleration.

- In-Vehicle Infotainment and Connected Cockpits: The global push toward more immersive, intelligent, and connected in-car experiences is another compelling use case for automotive semiconductors. Today’s infotainment systems are no longer limited to simple audio or GPS functions, they integrate real-time navigation, voice assistance, wireless connectivity, cloud syncing, personalized UI/UX, and integration with smartphones and IoT devices.

- Vehicle Safety Systems and Cybersecurity Architecture: As vehicles become more digitally integrated and autonomous, the role of semiconductors in safety and cybersecurity becomes paramount. Critical safety systems such as airbag deployment, anti-lock braking systems (ABS), traction control, and electronic stability programs (ESP) are all governed by microcontrollers and sensor arrays designed to respond within milliseconds. These components must meet the highest levels of functional safety (ASIL-D compliance under ISO 26262) to prevent failure in life-critical scenarios.

Global Automotive Semiconductor Market: Stats & Facts

- U.S. International Trade Commission (USITC)

- In 2015, automotive semiconductors accounted for 10.3% of worldwide semiconductor end use, up from 8% in 2005.

- Europe, home to various producers of luxury vehicles, accounted for the largest automotive semiconductor market in 2015.

- U.S. Department of Commerce

- The CHIPS and Science Act of 2022 includes USD 52.7 billion to boost domestic semiconductor research and manufacturing, with USD 39 billion allocated for U.S. chip production and USD 13 billion for semiconductor research and workforce training.

- European Union

- Aims to double its semiconductor production by 2030 under the European Chips Act, with Germany allocating USD 20 billion to attract semiconductor manufacturers.

- In August 2024, Germany announced a USD 10 billion investment, including USD 5 billion in government aid, to establish a microchip factory in Dresden, aiming to produce chips for the automotive industry by 2027 and create 2,000 jobs.

- Government of India

- In September 2021, the Government of India launched a ₹26,000 crore (approximately USD 3.61 billion) Production Linked Incentive (PLI) scheme to boost the production of electric vehicles and hydrogen fuel vehicles, aiming to generate 750,000 direct jobs in the auto sector.

- China’s Ministry of Industry and Information Technology

- China is encouraging major carmakers to source 20–25% of their automotive chips locally by 2025 to build a self-sufficient semiconductor supply chain.

Global Automotive Semiconductor Market: Market Dynamics

Global Automotive Semiconductor Market: Driving Factors

The Transformation toward Software-Defined Vehicles (SDVs)In an SDV, core functionalities, from powertrain behavior and climate control to user experience and performance upgrades, are managed through software that can be updated, modified, or even monetized after the vehicle leaves the showroom. This transformation fundamentally elevates the role of semiconductors, as these chips are no longer just supporting hardware functions but are actively enabling continuous software integration, edge computing, and real-time decision-making within the vehicle. Unlike traditional vehicles, where mechanical upgrades required physical changes, SDVs rely on high-performance processors, reprogrammable microcontrollers, and advanced system-on-chip (SoC) architectures to dynamically adjust and optimize performance.

Surge in Global Regulations and Standards for Vehicle Safety and Emissions

An equally powerful driver of growth in the automotive semiconductor market is the tightening regulatory environment surrounding vehicle safety, emissions, and environmental impact across major global economies. Governments and international bodies are setting stringent requirements on vehicle emissions, fuel efficiency, and road safety, forcing automakers to integrate advanced electronic systems that rely heavily on semiconductor technology. For instance, mandates around Euro 7 emission standards in the EU, Corporate Average Fuel Economy (CAFE) regulations in the U.S., and China’s NEV credit system all push OEMs to adopt cleaner propulsion technologies, many of which depend on semiconductor-controlled electrified powertrains.

Global Automotive Semiconductor Market: Restraints

Persistent Supply Chain Vulnerabilities and Capacity Constraints

Unlike consumer electronics, automotive semiconductors require long design cycles, rigorous qualification standards, and specialized fabrication processes that often rely on mature nodes rather than cutting-edge technologies. This dependence on legacy fabrication lines, many of which are concentrated in regions like Taiwan and Japan, creates a fragile ecosystem easily disrupted by natural disasters, political tensions, or logistical delays. The 2020–2022 global chip shortage exposed just how inflexible and ill-prepared the automotive industry was to react to such disruptions, leading to widespread production halts, delayed vehicle launches, and billions in lost revenue.

High Development Costs and Long Design-to-Deployment Cycles

Automotive semiconductors are held to the highest standards of reliability, functional safety (such as ISO 26262 compliance), and long-term durability factors that increase design complexity and lengthen time-to-market. Designing a chip that can operate safely and consistently for over a decade in extreme conditions requires extensive testing, validation, and collaboration across multiple tiers of the automotive value chain. This process is both time-consuming and expensive, often involving years of R&D and millions of dollars in investment before a chip is even ready for commercial deployment.

Global Automotive Semiconductor Market: Opportunities

Integration of Edge AI and Machine Learning for Real-Time Vehicle Intelligence

As vehicles become more autonomous and connected, there's a growing need for localized data processing that does not rely on cloud connectivity due to latency, privacy, and reliability concerns. Semiconductors that support real-time AI inferencing at the edge can enable faster decision-making for safety-critical applications such as object recognition, driver behavior monitoring, predictive maintenance, and adaptive cruise control. This opens new markets for specialized AI accelerators, neuromorphic processors, and hybrid chip architectures capable of handling dynamic workloads efficiently.

Expansion of Vehicle-to-Everything (V2X) Ecosystems and Smart Infrastructure Integration

V2X allows vehicles to communicate with other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and the cloud (V2N), creating a data-rich environment for safer and more efficient driving. Semiconductors are central to enabling these low-latency, high-reliability communication protocols, especially with the rollout of 5G and dedicated short-range communications (DSRC) or C-V2X (cellular-based) technologies. As global cities invest in smart traffic systems, connected intersections, and intelligent tolling, vehicles equipped with V2X capabilities will become essential components of a broader mobility ecosystem.

Global Automotive Semiconductor Market: Trends

Shift toward Centralized Vehicle Computing Architectures

Traditionally, vehicles relied on dozens of independent ECUs scattered throughout the car, each handling specific tasks like braking, lighting, infotainment, or steering. However, this fragmented approach has become highly inefficient and difficult to scale, especially with the rise of software-defined vehicles and complex, data-intensive applications like autonomous driving. Automakers are now moving toward zonal and centralized architectures, where fewer, more powerful domain or central computing units manage multiple vehicle functions simultaneously. This shift demands high-performance semiconductors capable of supporting virtualization, multi-core processing, and scalable software stacks.

Growing Adoption of GaN and SiC Power Semiconductors in EV Platforms

As EVs continue to proliferate globally, the demand for higher energy efficiency, faster charging, and compact power electronics is growing exponentially. GaN and SiC offer significant advantages over traditional silicon-based power devices, including higher voltage tolerance, lower switching losses, and superior thermal conductivity. These properties translate into lighter, smaller, and more efficient powertrain components such as inverters, DC-DC converters, and onboard chargers, which are essential for extending EV range and reducing battery size.

Global Automotive Semiconductor Market: Research Scope and Analysis

By Vehicle Type Analysis

Passenger cars are set to maintain their dominant position in the global automotive semiconductor market, projected to capture a commanding 66.1% share in 2025. This dominance is largely driven by the rapid integration of advanced electronics and digital features in personal vehicles, particularly in mid-range and luxury models. Consumers expect vehicles to be equipped with sophisticated infotainment systems, advanced driver assistance systems (ADAS), seamless connectivity, and enhanced safety features, all of which require complex semiconductor solutions.

The rise of electric passenger vehicles (EVs) further amplifies semiconductor demand, as these vehicles depend heavily on chips for battery management, motor control, power conversion, and real-time system monitoring. With global OEMs prioritizing passenger car innovations and rolling out tech-forward models at a faster pace, semiconductors have become foundational to maintaining competitiveness and meeting evolving consumer preferences.

Light Commercial Vehicles (LCVs), which include vans, pickup trucks, and small delivery vehicles, play a vital role in the automotive semiconductor landscape, yet they represent a rising opportunity as industries modernize fleet operations. Traditionally slower in adopting cutting-edge electronics compared to passenger cars, LCVs are now rapidly evolving due to shifts in last-mile delivery logistics, e-commerce growth, and increasing fleet electrification. Modern LCVs are being equipped with telematics systems, GPS-based route optimization, fleet management software, and safety enhancements such as lane departure warnings and collision avoidance systems, all powered by semiconductors.

By Component Analysis

Discrete power components are anticipated to maintain their leading position in the global automotive semiconductor market, expected to account for

31.9% of the total market share in 2025. These components, which include diodes, transistors, thyristors, and power MOSFETs, are fundamental to managing and regulating electrical energy throughout a vehicle’s systems. Their dominance is largely driven by the ongoing electrification of vehicles, both hybrid and fully electric, which require robust power control mechanisms to ensure efficient energy distribution, battery protection, and thermal stability. Discrete power components are crucial for key vehicle functions such as powertrain control, DC-DC conversion, inverter systems, lighting management, and regenerative braking. Their reliability, high voltage handling, and thermal efficiency make them indispensable in high-stress environments where performance and safety cannot be compromised.

On the other hand, processors represent another vital segment within the automotive semiconductor ecosystem, playing an entirely different yet equally critical role. These include central processing units (CPUs), graphics processing units (GPUs), system-on-chip (SoCs), and microcontrollers (MCUs), all of which serve as the digital brains of the vehicle. As vehicles become more software-defined and data-intensive, processors are responsible for executing complex tasks such as real-time sensor fusion, decision-making in ADAS systems, navigation, infotainment, cybersecurity protocols, and user interface responsiveness. Unlike discrete components, which handle the flow and conversion of electrical energy, processors deal with data, logic, and control instructions that drive vehicle intelligence.

By Application Analysis

Body electronic applications are poised to consolidate their market leadership in the application segment of the automotive semiconductor industry, expected to account for 24.9% of the total market share in 2025. This dominance reflects the rising consumer demand for comfort, customization, safety, and in-vehicle connectivity, all of which rely heavily on a complex network of electronic systems integrated into the vehicle body. Body electronics encompass a wide range of subsystems such as lighting controls, HVAC (heating, ventilation, and air conditioning), power windows, seat adjustment systems, wiper controls, and central locking.

As vehicles become more feature-rich across both premium and mid-range segments, semiconductor content in these non-powertrain systems continues to grow. The push toward smart interiors enabled by gesture control, ambient lighting, and climate automation requires microcontrollers, sensors, motor drivers, and communication ICs to work in unison. Moreover, the growing integration of digital cockpits and human-machine interface (HMI) elements has further expanded the semiconductor footprint in body electronics.

In contrast, the chassis application segment, though traditionally more mechanical, has evolved into a critical arena for semiconductor integration, particularly as vehicle dynamics become electronically controlled. The chassis forms the structural and operational foundation of a vehicle, and modern vehicles are embedding more electronic control units (ECUs) into the chassis to manage systems such as anti-lock braking (ABS), electronic stability control (ESC), active suspension, torque vectoring, and steering-by-wire.

These systems not only enhance ride quality and handling precision but also contribute directly to safety and regulatory compliance. The role of semiconductors here is centered on real-time data processing, sensor input fusion, and actuation control, often under highly dynamic and demanding physical conditions.

The Automotive Semiconductor Market Report is segmented on the basis of the following

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Component

- Discrete Power

- Processor

- Sensor

- Memory

- Others

By Application

- Body Electronics

- Chassis

- Powertrain

- Safety

- Telematics & Infotainment

Global Automotive Semiconductor Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global automotive semiconductor market in 2025, commanding a significant

45.5% share of total market revenue, a dominance rooted in a blend of manufacturing scale, evolving consumer demand, and accelerating technological innovation. The region’s supremacy is anchored by key economies like China, Japan, South Korea, and India, each playing distinct roles in shaping the semiconductor value chain.

China, for instance, not only stands as the world’s largest automobile producer and consumer but is also aggressively advancing its domestic semiconductor capabilities to reduce import reliance, especially in critical applications like EVs and autonomous systems. The government’s backing of “Made in China 2025” and NEV (New Energy Vehicle) policies has further stimulated the integration of semiconductors in everything from battery management systems to intelligent cockpits.

Region with the Highest CAGR

North America is expected to register the highest compound annual growth rate (CAGR) in the global automotive semiconductor market, driven by a unique convergence of innovation leadership, strong investment momentum, and a rapidly evolving mobility landscape. Unlike regions where volume manufacturing drives market value, North America’s growth is being fueled by its strategic pivot toward next-generation vehicle technologies, particularly in electric vehicles (EVs), autonomous systems, and software-defined architectures. The U.S., as the region’s dominant player, is home to a robust ecosystem of technology firms, EV disruptors like Tesla, Rivian, and Lucid Motors, and a growing wave of traditional automakers aggressively retooling for electrification and digital mobility. This shift demands high volumes of sophisticated semiconductors for applications such as AI-enabled driver assistance, high-voltage power management, in-vehicle connectivity, and real-time data processing.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Automotive Semiconductor Market: Competitive Landscape

The global competitive landscape of the automotive semiconductor market is marked by a dynamic mix of legacy semiconductor giants, specialized chipmakers, and emerging innovators, each leveraging distinct strategic strengths to capture market share in a complex and high-demand ecosystem. As the automotive industry transitions toward electrification, automation, and software-defined architectures, semiconductor suppliers are being pushed to evolve from component manufacturers to integrated technology partners capable of delivering complete system-level solutions.

Leading the charge are established players such as NXP Semiconductors, Infineon Technologies, and Renesas Electronics, who have deep-rooted expertise in automotive-grade chip design, compliance with stringent safety standards (like ISO 26262), and longstanding relationships with top-tier OEMs and Tier-1 suppliers. These companies are strengthening their portfolios through targeted acquisitions and co-development projects, aiming to provide end-to-end semiconductor platforms that cover everything from powertrain control to cybersecurity and advanced driver-assistance systems (ADAS).

Some of the prominent players in the Global Automotive Semiconductor market are

- NXP Semiconductors

- Infineon Technologies

- Texas Instruments

- Renesas Electronics

- STMicroelectronics

- Robert Bosch GmbH

- ON Semiconductor (onsemi)

- Analog Devices

- Toshiba Corporation

- ROHM Semiconductor

- Intel Corporation

- Micron Technology

- NVIDIA Corporation

- Qualcomm

- Broadcom Inc.

- Samsung Electronics

- Skyworks Solutions

- Marvell Technology

- MediaTek Inc.

- Diodes Incorporated

- Other Key Players

Global Automotive Semiconductor Market: Recent Developments

- March 2025: NXP Semiconductors merged with PowerDrive Systems, a cutting-edge software platform provider specializing in electric vehicle powertrain optimization and connected mobility solutions. This strategic union combines NXP’s robust hardware expertise with PowerDrive’s innovative software algorithms, resulting in enhanced power distribution and vehicle control systems.

- November 2024: Qualcomm acquired SiC Innovations, a Silicon Carbide technology firm known for its high-efficiency power management components. Silicon Carbide offers superior performance for power conversion in high-voltage systems, enabling faster charging and reduced energy losses in electric vehicles. With this acquisition, Qualcomm strengthens its portfolio in the next-generation EV space by incorporating SiC Innovations’ power modules, a critical step toward developing more efficient and reliable electric powertrains.

- August 2024: Infineon Technologies finalized a strategic deal with SafeDrive AI, an innovative autonomous driving software startup focused on sensor integration and real-time hazard detection. SafeDrive AI’s advanced algorithms complement Infineon’s automotive-grade semiconductors, resulting in improved sensor fusion and rapid identification of potential road hazards.

- June 2023: Renesas Electronics merged with VisionAI Systems, an AI-based image processing company committed to advancing advanced driver assistance systems (ADAS). The integration of VisionAI’s sophisticated algorithms into Renesas’ chipsets promises more reliable image analysis and quicker response times for detecting road conditions, pedestrians, and other vehicles.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 58.3 Bn |

| Forecast Value (2034) |

USD 119.5 Bn |

| CAGR (2025–2034) |

8.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 15.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Component (Discrete Power, Processor, Sensor, and Memory), and By Application (Chassis, Powertrain, Safety, Telematics & Infotainment, and Body Electronics) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

NXP Semiconductors, Infineon Technologies, Texas Instruments, Renesas Electronics, STMicroelectronics, Robert Bosch GmbH, ON Semiconductor (onsemi), Analog Devices, Toshiba Corporation, ROHM Semiconductor, Intel Corporation, Micron Technology, NVIDIA Corporation, Qualcomm, Broadcom Inc., Samsung Electronics, Skyworks Solutions, Marvell Technology, MediaTek Inc., Diodes Incorporated, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global automotive semiconductor market size is estimated to have a value of USD 58.3 billion in 2025 and is expected to reach USD 119.5 billion by the end of 2034.

The US automotive semiconductor market is projected to be valued at USD 15.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 29.4 billion in 2034 at a CAGR of 7.8%.

Asia Pacific is expected to have the largest market share in the global automotive semiconductor market, with a share of about 45.5% in 2025.

Some of the major key players in the global automotive semiconductor market are NXP Semiconductors, Infineon Technologies, Texas Instruments, Renesas Electronics, STMicroelectronics, Robert Bosch GmbH, ON Semiconductor (onsemi), Analog Devices, Toshiba Corporation, ROHM Semiconductor, Intel Corporation, Micron Technology, and Other Key Players.

The market is growing at a CAGR of 8.3 percent over the forecasted period.