Market Overview

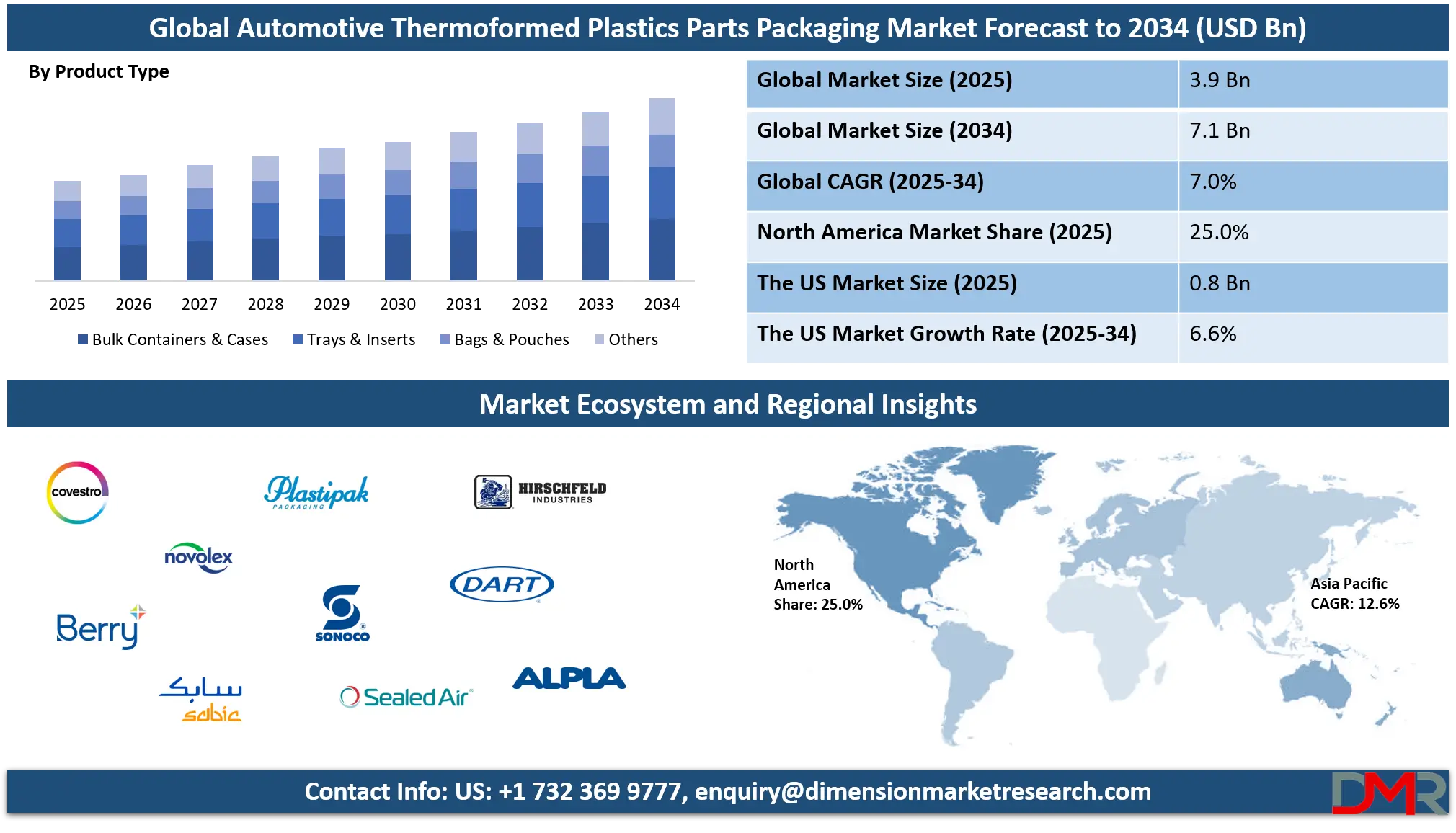

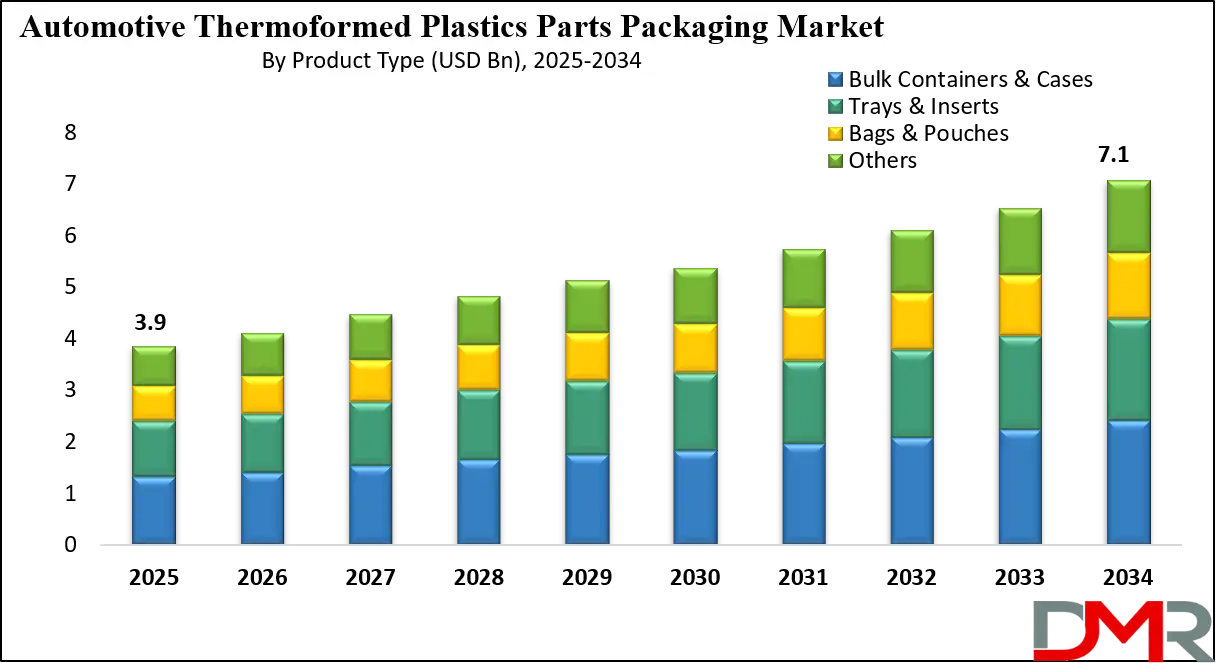

The global automotive thermoformed plastics parts packaging market is projected to reach USD 3.9 billion in 2025 and is expected to grow to USD 7.1 billion by 2034, registering a CAGR of 7.0%. This growth is driven by rising automotive production, demand for lightweight packaging materials, and increasing adoption of reusable thermoformed trays and containers across OEM and aftermarket supply chains.

Automotive thermoformed plastics parts packaging refers to specialized protective packaging solutions made using the thermoforming process, where plastic sheets are heated and molded into custom shapes that securely hold and protect automotive parts during storage, handling, and transportation. This packaging is designed to safeguard components such as bumpers, lighting systems, engine parts, and electrical assemblies from physical damage, dust, and moisture. It ensures product integrity and efficient logistics across the automotive supply chain. Thermoformed plastics packaging offers durability, lightweight structure, design flexibility, and cost efficiency, making it ideal for high-volume automotive component shipments and returnable packaging systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global automotive thermoformed plastics parts packaging market encompasses the production, distribution, and application of thermoformed plastic packaging across automotive manufacturing and aftermarket industries. The market is driven by the rapid growth in automotive production, increasing demand for efficient supply chain logistics, and the shift toward lightweight, recyclable, and reusable packaging solutions.

Rising investments in electric vehicles and the growing complexity of automotive components have further increased the need for precision-fit thermoformed packaging that minimizes material waste and enhances protection standards. Manufacturers are increasingly adopting polypropylene, polyethylene, and PVC materials due to their cost-effectiveness and structural integrity in harsh conditions.

Globally, the market is experiencing steady expansion as automakers and suppliers emphasize sustainable packaging aligned with circular economy initiatives. Asia Pacific dominates due to its vast automotive manufacturing base in China, India, and Japan, while North America and Europe are witnessing advancements in returnable and smart packaging systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological innovations such as 3D modeling and automated thermoforming processes are helping producers develop customized trays, inserts, and containers that reduce shipping costs and improve part handling efficiency. The ongoing emphasis on sustainability and production optimization positions this market as a critical segment within the broader automotive packaging ecosystem.

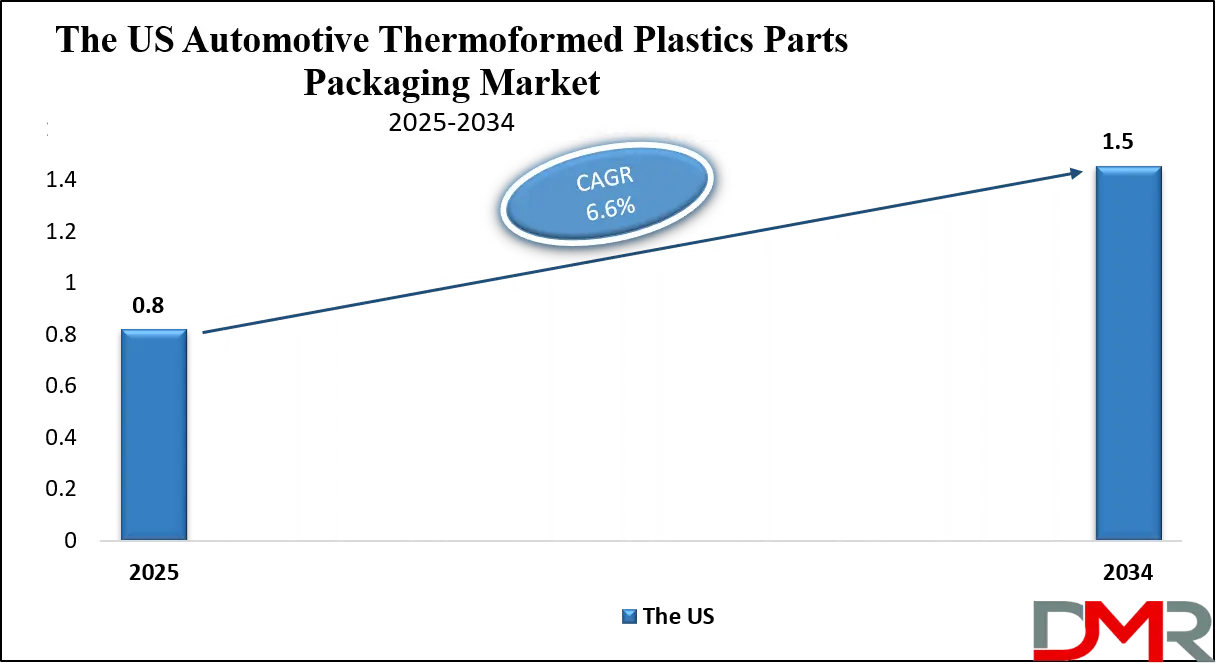

The US Automotive Thermoformed Plastics Parts Packaging Market

The US Automotive Thermoformed Plastics Parts Packaging Market is projected to be valued at USD 0.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.5 billion in 2034 at a CAGR of 6.6%.

The US automotive thermoformed plastics parts packaging market is witnessing strong growth driven by expanding vehicle production, increasing demand for lightweight and cost-effective packaging, and the adoption of sustainable logistics solutions across OEM and Tier 1 automotive suppliers. Thermoformed plastics packaging solutions such as trays, inserts, clamshells, and bulk containers are increasingly being used for the safe transportation and storage of critical components including engine parts, electrical systems, bumpers, and lighting assemblies.

The market is supported by the strong presence of established packaging manufacturers and advanced thermoforming technology providers offering customized designs, enhanced durability, and high load-bearing capacity. Moreover, the shift toward electric and hybrid vehicles in the US automotive industry is creating new opportunities for thermoformed packaging in battery modules and sensitive electronic components that require superior protection and precision-fit packaging.

In addition, the US market benefits from the growing adoption of returnable and recyclable plastic packaging systems aimed at reducing waste and operational costs in the automotive supply chain. Rising emphasis on automation, efficient part handling, and supply chain optimization has led to increased integration of smart thermoformed packaging solutions with RFID tagging and part traceability features. Companies are focusing on materials such as polypropylene and high-density polyethylene due to their superior strength, chemical resistance, and sustainability credentials.

Furthermore, stringent environmental regulations and the push toward circular economy practices are encouraging manufacturers to incorporate post-consumer recycled plastics and bio-based polymers into packaging production. With continued investment in manufacturing automation and logistics efficiency, the US automotive thermoformed plastics parts packaging market is expected to maintain steady growth through the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Automotive Thermoformed Plastics Parts Packaging Market

The Europe automotive thermoformed plastics parts packaging market, valued at approximately USD 700 million in 2025, is positioned as one of the key regional contributors to the global market. This growth is driven by the strong presence of leading automotive manufacturers and component suppliers in countries such as Germany, France, Italy, and the United Kingdom. The region’s advanced automotive production ecosystem demands high-quality, precision-engineered packaging solutions to ensure the safe transportation of critical components like powertrains, electronic modules, and under-body parts.

The growing adoption of electric vehicles and hybrid technologies across Europe has also increased the need for durable, reusable, and recyclable thermoformed packaging solutions that can support the safe handling of high-voltage batteries and sensitive electronic systems. Additionally, the implementation of strict environmental regulations by the European Union is pushing manufacturers toward sustainable packaging innovations made from recycled and bio-based polymers.

The market is also benefiting from the widespread digital transformation of automotive supply chains, where automation and smart packaging technologies are being integrated to enhance efficiency and traceability. Companies across Europe are increasingly focusing on closed-loop packaging systems to reduce waste, lower carbon emissions, and meet corporate sustainability goals.

Moreover, collaborations between automotive OEMs, packaging material suppliers, and logistics providers are resulting in the development of cost-effective, lightweight, and space-optimized thermoformed packaging designs. With continuous investments in research and development and the growing emphasis on green manufacturing practices, the Europe market is expected to maintain steady growth at a CAGR of 6.2%, solidifying its position as a mature yet innovation-driven segment within the global automotive thermoformed plastics parts packaging industry.

Japan Automotive Thermoformed Plastics Parts Packaging Market

The Japan automotive thermoformed plastics parts packaging market is estimated to be valued at around USD 300 million in 2025, reflecting the nation’s strong foundation in precision automotive manufacturing and advanced materials engineering. Japan’s automotive sector, led by major OEMs and component suppliers, places a high emphasis on quality, efficiency, and environmental compliance, which drives the demand for specialized thermoformed packaging solutions. These packaging formats—such as trays, clamshells, and reusable containers—are widely adopted for transporting delicate engine parts, electrical assemblies, and EV batteries.

The shift toward electric and hybrid vehicle production in Japan is further accelerating the need for durable, lightweight, and heat-resistant thermoformed plastics that can ensure product integrity during complex logistics operations. Additionally, Japan’s focus on automation and lean manufacturing has encouraged the use of standardized and stackable thermoformed packaging that optimizes warehouse space and streamlines assembly line efficiency.

The country’s commitment to sustainability and circular economy principles is also influencing material innovation within the market. Packaging manufacturers in Japan are increasingly using recyclable and bio-based polymers, such as recycled PET and PP blends, to align with government-led environmental goals and corporate ESG commitments.

Furthermore, the integration of smart tracking and RFID-enabled packaging solutions is enhancing supply chain visibility and reducing handling errors in high-precision automotive operations. As domestic automotive production stabilizes and electric mobility expands, Japan’s thermoformed plastics parts packaging market is expected to grow steadily at a CAGR of 5.8%. Continuous advancements in materials science, automation, and sustainable packaging technologies are expected to keep Japan at the forefront of innovation within the Asia-Pacific packaging landscape.

Global Automotive Thermoformed Plastics Parts Packaging Market: Key Takeaways

- Market Value: The global Automotive Thermoformed Plastics Parts Packaging market size is expected to reach a value of USD 7.1 billion by 2034 from a base value of USD 3.9 billion in 2025 at a CAGR of 7.0%.

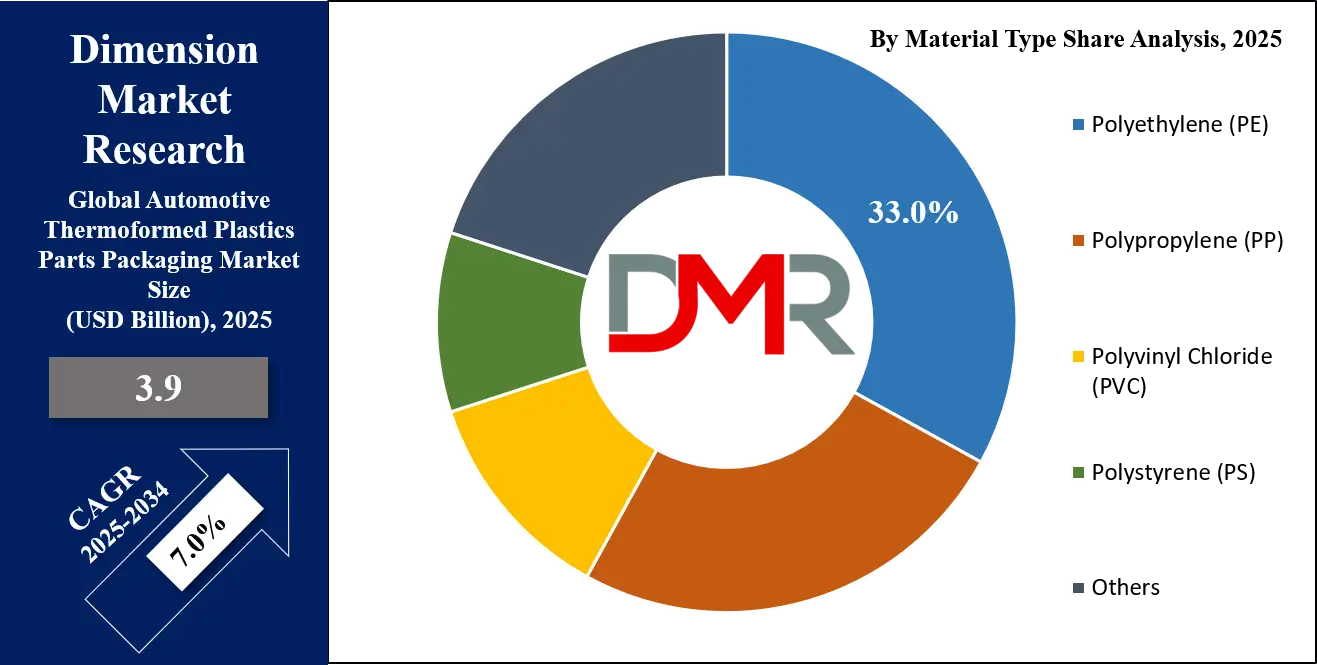

- By Material Type Segment Analysis: Polyethylene (PE) materials are expected to maintain their dominance in the material type segment, capturing 33.0% of the total market share in 2025.

- By Product Type Segment Analysis: Bulk Containers & Cases will dominate the product type segment, capturing 34.0% of the market share in 2025.

- By Automotive Component Type Segment Analysis: Under-body Components are anticipated to dominate the automotive component type segment, capturing 23.0% of the total market share in 2025.

- By Vehicle Type Segment Analysis: Passenger Vehicles will dominate the vehicle type segment, capturing 60.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Automotive Thermoformed Plastics Parts Packaging market landscape with 45.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Automotive Thermoformed Plastics Parts Packaging market include Covestro AG, Novolex Holdings, Berry Global Inc., SABIC, Plastipak Holdings, Sonoco Products Company, Hirschfeld Industries, Dart Container Corporation, Sealed Air Corporation, ALPLA Werke Alwin Lehner GmbH, Multimatic Inc., Jabil Inc., and Others.

Global Automotive Thermoformed Plastics Parts Packaging Market: Use Cases

- Packaging for Engine and Powertrain Components: Thermoformed plastics packaging is extensively used for engine blocks, transmission parts, and powertrain assemblies that require high impact resistance and dimensional accuracy during storage and transport. Custom thermoformed trays and inserts provide precise part alignment, preventing scratches, dents, and contamination. In the global automotive thermoformed plastics parts packaging market, this use case ensures safe logistics for heavy mechanical components across OEM and Tier 1 suppliers while optimizing space utilization and reducing packaging weight compared to metal or wooden alternatives.

- Packaging for Electrical and Electronic Automotive Parts: As vehicles become more connected and electrified, the need for protective packaging for sensors, connectors, batteries, and wiring harnesses has grown rapidly. Thermoformed plastic trays and clamshells offer electrostatic discharge (ESD) protection and cushioning for delicate electrical assemblies. This use case supports the expansion of electric vehicle manufacturing, ensuring that sensitive electronic components remain damage-free during global distribution, thereby maintaining product quality and reducing warranty costs.

- Returnable and Reusable Packaging Systems: Automotive manufacturers increasingly adopt returnable thermoformed packaging solutions such as stackable pallets, bulk containers, and reusable trays. These systems enhance supply chain efficiency by allowing repeated use over multiple transport cycles, reducing material waste and overall packaging costs. Within the global automotive thermoformed plastics parts packaging market, this application is gaining prominence due to sustainability initiatives and regulatory pressures encouraging circular economy practices and eco-efficient manufacturing.

- Aftermarket and Spare Parts Packaging: Thermoformed plastics packaging also plays a vital role in the automotive aftermarket, where spare parts and replacement components require durable, easy-to-handle packaging for retail and logistics purposes. Clear blister packs, clamshells, and inserts improve product visibility while protecting items from dust, oil, and vibration. This use case drives consistent demand across distributors and retailers, supporting brand presentation, customer convenience, and long-term component protection throughout the aftermarket supply chain.

Impact of Artificial Intelligence on the global Automotive Thermoformed Plastics Parts Packaging market

Artificial intelligence (AI) is transforming the global automotive thermoformed plastics parts packaging market by optimizing design, production, and supply chain processes. AI-driven simulation tools enable packaging manufacturers to create lightweight yet durable thermoformed solutions with precise dimensions tailored for complex automotive components. Machine learning algorithms analyze part geometry, load distribution, and material properties to minimize waste and enhance product performance. This results in improved packaging strength-to-weight ratios, reduced tooling time, and faster prototyping cycles, allowing manufacturers to respond quickly to changing automotive component requirements.

AI also plays a crucial role in automating production lines through real-time monitoring, predictive maintenance, and quality control. Smart sensors and AI-based vision systems detect defects in thermoformed trays or containers, ensuring consistent quality and minimizing rework. In logistics, AI-powered demand forecasting and inventory management systems help optimize the use of returnable and reusable packaging, reducing excess stock and transportation costs.

Additionally, integration of AI with digital twins and robotics supports just-in-time manufacturing, aligning packaging operations with automotive assembly schedules. Overall, AI enhances efficiency, sustainability, and customization in the automotive thermoformed plastics parts packaging market, positioning it as a key enabler of the next-generation automotive supply chain.

Global Automotive Thermoformed Plastics Parts Packaging Market: Stats & Facts

Eurostat (European Union)

- In 2023, the EU generated 35.3 kg of plastic packaging waste per person, of which 14.8 kg were recycled.

- In 2023, the EU’s municipal waste generation was 511 kg per person, down from 515 kg in 2022 and 534 kg in 2021, with a recycling rate of 48.0% in 2023.

- In 2023, the EU exported 8.5 million tonnes of recyclable products including paper, plastic, and glass to non-EU countries, a 34% increase from 2022. Plastic represented about 1.3 million tonnes of these exports.

- In 2023, the circular material use rate in the EU reached 11.8%, indicating that roughly one-ninth of materials used originated from recycled sources.

European Environment Agency (EEA)

- In Western Europe, average annual plastic consumption is around 150 kg per person, more than twice the global average of 60 kg.

- Plastics consumption by end-users in the EU27+3 decreased from 58.3 million tonnes in 2018 to 55.2 million tonnes in 2022, equivalent to about 105 kg per capita in 2022.

Verband der Automobilindustrie (VDA – Germany)

- Total German passenger car production declined from 14.1 million units in 2023 to 13.6 million units in 2024, marking a 4% decrease.

- German car production in 2024 stood at approximately 4.1 million units, reflecting a 1.0% decline compared with the previous year.

Japan Containers and Packaging Recycling Association

- Japan reported a plastics recycling rate of around 23.8 % to 24.4 % when comparing collected post-consumer plastic waste with total demand.

- Japan remains one of the global leaders in PET bottle recycling, with recovery rates exceeding 80 %.

Organisation Internationale des Constructeurs d’Automobiles (OICA)

- In 2024, global car manufacturing reached about 75.5 million units, with production in the European Union decreasing by 6.2% compared with the previous year.

Global Automotive Thermoformed Plastics Parts Packaging Market: Market Dynamics

Global Automotive Thermoformed Plastics Parts Packaging Market: Driving Factors

Rising Demand for Lightweight and Sustainable Packaging Solutions

The increasing emphasis on fuel efficiency and cost reduction across the automotive industry is driving the demand for lightweight packaging solutions made from thermoformed plastics. These materials, such as polypropylene and polyethylene, offer high strength, corrosion resistance, and reduced weight compared to traditional wooden or metal packaging. Automakers and Tier 1 suppliers are increasingly opting for recyclable and reusable thermoformed trays, inserts, and containers to minimize waste and comply with global sustainability regulations. This shift toward eco-friendly and efficient packaging is a major driver of the global automotive thermoformed plastics parts packaging market.

Expansion of Electric Vehicle Manufacturing and Complex Component Logistics

The rapid growth of electric vehicle (EV) production has created new packaging requirements for delicate components such as lithium-ion batteries, sensors, and electronic control units. Thermoformed plastics packaging provides precision-fit protection, ESD resistance, and superior handling efficiency for these high-value parts. As EV production expands in the US, Europe, and Asia-Pacific, the demand for advanced thermoformed packaging solutions tailored to sensitive automotive electronics continues to accelerate, fueling overall market growth.

Global Automotive Thermoformed Plastics Parts Packaging Market: Restraints

Fluctuating Raw Material Prices and Supply Chain Disruptions

The automotive thermoformed plastics parts packaging market faces challenges from volatility in the prices of raw materials such as polypropylene, polyethylene, and PVC. Supply chain disruptions caused by geopolitical tensions and transportation bottlenecks further impact material availability and cost stability. These fluctuations increase production expenses and reduce profit margins for packaging manufacturers, limiting their ability to offer competitively priced solutions to OEMs and component suppliers.

Environmental Concerns Related to Plastic Waste Management

Despite growing adoption of recyclable and reusable packaging, the market still faces environmental scrutiny over plastic waste generation. Improper disposal and limited recycling infrastructure in developing economies pose challenges for sustainability. Stringent environmental regulations in regions like Europe and North America are compelling packaging manufacturers to invest heavily in eco-friendly materials and waste reduction technologies, adding to overall operational costs.

Global Automotive Thermoformed Plastics Parts Packaging Market: Opportunities

Integration of Smart Packaging and IoT Technologies

The integration of smart packaging technologies such as RFID tags, QR codes, and sensors presents a significant opportunity for the automotive thermoformed plastics parts packaging market. These technologies enable real-time tracking, inventory management, and predictive logistics, reducing part losses and improving supply chain transparency. Manufacturers adopting AI and IoT-enabled thermoformed packaging are expected to gain a competitive advantage through enhanced efficiency and customer service.

Growing Adoption of Circular Economy Practices

Global emphasis on sustainable manufacturing and circular economy principles is encouraging the development of closed-loop packaging systems. Automotive OEMs are increasingly partnering with packaging suppliers to design returnable, multi-use thermoformed solutions that reduce material consumption and carbon footprint. This trend is opening new avenues for innovation in recycled content usage and bio-based plastic packaging, driving long-term growth in the global market.

Global Automotive Thermoformed Plastics Parts Packaging Market: Trends

Automation and Digitalization of Thermoforming Processes

Automation in thermoforming machinery, combined with AI-driven quality inspection systems, is reshaping production efficiency and product consistency. The use of digital twins and 3D design software enables precise customization of trays and containers, reducing time-to-market and improving overall packaging accuracy. This trend toward smart manufacturing enhances scalability and supports high-volume automotive part packaging requirements globally.

Rising Focus on Reusable and Returnable Packaging Systems

Automotive manufacturers are increasingly shifting from single-use packaging toward returnable and reusable thermoformed systems to align with sustainability goals. These durable packaging solutions help reduce waste, optimize logistics costs, and support green manufacturing standards. The growing preference for closed-loop supply chains across automotive production hubs in Asia-Pacific, North America, and Europe is reinforcing this long-term market trend.

Global Automotive Thermoformed Plastics Parts Packaging Market: Research Scope and Analysis

By Material Type Analysis

Polyethylene (PE) materials are projected to retain their leading position in the material type segment of the global automotive thermoformed plastics parts packaging market, accounting for approximately 33.0% of the total market share in 2025. The dominance of PE is primarily attributed to its exceptional durability, chemical resistance, and lightweight nature, which make it highly suitable for manufacturing trays, inserts, and bulk containers used in packaging automotive components. Its flexibility allows for easy thermoforming into complex shapes, ensuring precise part fitting and superior protection during transit.

Moreover, the growing focus on recyclable materials has boosted the adoption of high-density and low-density polyethylene, as these grades can be reused and repurposed in closed-loop packaging systems, supporting sustainability goals across automotive supply chains. PE’s ability to withstand harsh environmental conditions and mechanical stress further strengthens its position as the preferred material for both OEM and aftermarket packaging applications.

Polypropylene (PP) is emerging as the fastest-growing material segment in the automotive thermoformed plastics parts packaging market due to its excellent balance of stiffness, impact strength, and heat resistance. PP offers higher rigidity compared to PE, making it ideal for returnable packaging systems and heavy-duty applications such as engine parts and electrical component packaging. Its low density helps reduce overall packaging weight, contributing to lower logistics costs and improved fuel efficiency in automotive transport operations.

Additionally, PP’s superior recyclability and compatibility with sustainable manufacturing practices align with the industry’s shift toward eco-efficient solutions. Continuous innovation in polypropylene formulations, including the use of copolymers and reinforced blends, is further enhancing its performance, driving its adoption among leading automotive packaging manufacturers globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Product Type Analysis

Bulk containers and cases are expected to dominate the product type segment of the global automotive thermoformed plastics parts packaging market, accounting for around 34.0% of the total market share in 2025. Their dominance is driven by the increasing need for durable, large-capacity packaging solutions capable of securely transporting heavy and bulky automotive components such as bumpers, engines, and drivetrain parts. These containers provide superior impact resistance, stacking strength, and reusability, making them ideal for high-volume supply chain operations between Tier 1 suppliers and OEM assembly plants.

The adoption of bulk containers is also supported by the growing trend toward returnable packaging systems that reduce waste and long-term operational costs. With advances in thermoforming technology, manufacturers are now producing customized, lightweight, and ergonomically designed cases that enhance space efficiency and ease of handling, further strengthening their position in the automotive packaging landscape.

Trays and inserts represent another key product type gaining significant traction in the market due to their versatility and precision-fit design. They are widely used for packaging smaller and more delicate automotive components such as sensors, filters, switches, and lighting elements that require high protection against vibration, abrasion, and contamination during transit. Thermoformed trays offer excellent compartmentalization, ensuring that each part remains securely positioned, thereby minimizing the risk of damage.

Their lightweight structure and cost efficiency make them an attractive choice for both disposable and returnable packaging applications. Furthermore, the increasing adoption of electric vehicles has expanded the demand for specialized trays and inserts designed for battery modules and electronic assemblies, positioning this segment as one of the fastest-growing areas within the automotive thermoformed plastics parts packaging market.

By Automotive Component Type Analysis

Under-body components are projected to lead the automotive component type segment of the global automotive thermoformed plastics parts packaging market, accounting for nearly 23.0% of the total market share in 2025. The dominance of this segment is primarily due to the wide range of large, heavy, and high-value parts located beneath the vehicle’s chassis, such as suspension systems, exhaust assemblies, bumpers, and brake components. These parts require robust packaging solutions capable of withstanding heavy loads, impacts, and vibration during shipping.

Thermoformed plastic packaging, particularly bulk containers and customized trays, offers high durability, structural integrity, and protection against corrosion and contamination. With growing vehicle production and increasing complexity of under-body designs, manufacturers are focusing on reusable and returnable thermoformed packaging to improve supply chain efficiency and reduce packaging waste. The shift toward electric and hybrid vehicles, which also include complex under-body assemblies like battery enclosures and cooling systems, is further driving the need for advanced, precision-fit thermoformed packaging in this segment.

Engine components also represent a vital application area within the automotive thermoformed plastics parts packaging market due to the need for secure, clean, and durable packaging during transportation and storage. Engine-related parts such as pistons, valves, filters, and cylinder heads are often sensitive to moisture, dust, and mechanical damage, requiring protective thermoformed trays and inserts that ensure component stability and separation. The use of high-strength polymers like polypropylene and polyethylene in these packaging solutions provides superior chemical resistance and heat tolerance, which are essential for engine parts handling.

As automotive manufacturers emphasize lean logistics and just-in-time delivery systems, thermoformed packaging offers standardized, stackable, and reusable designs that optimize warehouse space and reduce handling errors. The increasing use of lightweight and customized packaging for internal combustion and hybrid engine components continues to reinforce the importance of this segment in the overall market landscape.

By Vehicle Type Analysis

Passenger vehicles are expected to dominate the vehicle type segment of the global automotive thermoformed plastics parts packaging market, accounting for nearly 60.0% of the total market share in 2025. The dominance of this segment is largely driven by the high production volume of passenger cars globally and the rising demand for efficient, lightweight, and reusable packaging solutions to protect delicate automotive components during logistics and assembly.

Thermoformed plastic packaging offers superior part protection, space optimization, and ease of handling, making it a preferred choice for passenger vehicle component transportation. The increasing adoption of electric passenger cars has further elevated the need for precision-fit thermoformed packaging for batteries, electrical modules, and other sensitive parts. Moreover, automakers are shifting toward sustainable packaging materials such as recycled PET and PP to align with circular economy goals, thereby expanding the demand for eco-friendly thermoformed plastic packaging across the passenger vehicle manufacturing and aftermarket supply chains.

Commercial vehicles, particularly light and medium-duty types, also hold a significant share in the automotive thermoformed plastics parts packaging market due to the growing logistics, construction, and e-commerce sectors. These vehicles often require durable and reusable packaging solutions to transport heavy-duty and large-sized components such as drivetrain assemblies, chassis modules, and engine parts. Thermoformed plastics provide the necessary rigidity, impact resistance, and flexibility for repeated use in rugged industrial conditions, reducing damage and operational costs.

Additionally, fleet modernization programs and the rising adoption of electric commercial vehicles are increasing the use of specialized thermoformed trays and containers designed for battery modules and high-voltage components. The demand for standardized, stackable, and sustainable packaging solutions in commercial vehicle manufacturing and service networks continues to support the steady expansion of this segment.

The Automotive Thermoformed Plastics Parts Packaging Market Report is segmented on the basis of the following:

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

By Product Type

- Bulk Containers & Cases

- Trays & Inserts

- Bags & Pouches

- Others

By Automotive Component Type

- Under-body Components

- Engine Components

- Electrical Components / Lighting / Battery

- Cooling Systems / Filters / Other Sub-systems

- Vehicle Component Kits / Aftermarket Parts

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles (Light & Medium)

- Heavy-duty / Off-road Vehicles

- Two-wheelers

- Electric Vehicles

Global Automotive Thermoformed Plastics Parts Packaging Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global automotive thermoformed plastics parts packaging market, accounting for around 45.0% of the total market revenue in 2025. The region’s dominance is primarily attributed to the strong automotive manufacturing base in countries such as China, Japan, India, and South Korea, which serve as key production and export hubs for both passenger and commercial vehicles. Growing industrialization, increasing vehicle production, and the rapid expansion of electric vehicle manufacturing are driving the demand for durable, lightweight, and cost-efficient thermoformed plastic packaging solutions.

Additionally, the shift toward sustainable packaging and the rising adoption of reusable and recyclable materials are further enhancing market growth in the region. With major global automakers establishing production facilities across Asia Pacific, the demand for thermoformed trays, containers, and pallets for component protection, logistics, and assembly operations is expected to continue rising steadily throughout the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

North America is expected to witness significant growth in the global automotive thermoformed plastics parts packaging market during the forecast period. The region’s expansion is driven by the strong presence of major automotive OEMs and Tier-1 suppliers in the United States and Mexico, integrated with the growing focus on lightweight and sustainable packaging solutions. Increasing adoption of electric and hybrid vehicles is creating demand for specialized thermoformed packaging for batteries, electronic modules, and precision parts.

Moreover, advancements in packaging automation and the integration of smart tracking technologies are improving logistics efficiency across the automotive supply chain. The region’s commitment to circular economy practices and the use of recycled materials in packaging production further support market growth, making North America one of the fastest-evolving markets in this industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Automotive Thermoformed Plastics Parts Packaging Market: Competitive Landscape

The global automotive thermoformed plastics parts packaging market is characterized by a moderately consolidated competitive landscape, with several established manufacturers focusing on innovation, material sustainability, and customized packaging solutions. Companies are investing in advanced thermoforming technologies to develop lightweight, durable, and reusable packaging that enhances component protection and logistics efficiency across automotive supply chains. Strategic partnerships with OEMs and Tier-1 suppliers are common, enabling tailored packaging designs for electric vehicle components, under-body systems, and engine parts.

The growing emphasis on recyclable and bio-based polymers is reshaping competitive strategies, with players expanding their product portfolios to align with global sustainability goals. Additionally, mergers, acquisitions, and regional expansions are being pursued to strengthen production capabilities and market reach, particularly in high-growth regions such as Asia Pacific and North America.

Some of the prominent players in the global Automotive Thermoformed Plastics Parts Packaging market are:

- Covestro AG

- Novolex Holdings

- Berry Global Inc.

- SABIC

- Plastipak Holdings

- Sonoco Products Company

- Hirschfeld Industries

- Dart Container Corporation

- Sealed Air Corporation

- ALPLA Werke Alwin Lehner GmbH

- Multimatic Inc.

- Jabil Inc.

- Reynolds Consumer Products

- Gentex Corporation

- Dow Inc.

- NEFAB Group

- Placon Corporation

- Tray‑Pak Corporation

- Schoeller Allibert

- Kiva Container

- Other Key Players

Global Automotive Thermoformed Plastics Parts Packaging Market: Recent Developments

- September 2025: A UK-based green materials company raised about USD 14 million in funding from sustainability-focused investors to scale its biodegradable packaging technologies, including plant-protein films that can replace single-use plastics in packaging applications.

- August 2025: A manufacturing supply-chain startup connecting packaging material suppliers with consumer goods companies secured USD 30 million in venture capital to expand its platform and better service packaging supply networks.

- August 2025: A plastics manufacturer specializing in thermoforming and extrusion acquired another plastics firm to expand its capabilities in thermoforming, targeting automotive and industrial packaging segments.

- March 2025: A packaging-equipment manufacturer unveiled a new high-performance range of thermoforming machines built for efficiency, automation and sustainability, enabling advanced thermoformed trays and containers for packaging applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.9 Bn |

| Forecast Value (2034) |

USD 7.1 Bn |

| CAGR (2025–2034) |

7.0% |

| The US Market Size (2025) |

USD 0.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Others), By Product Type (Bulk Containers & Cases, Trays & Inserts, Bags & Pouches, Others), By Automotive Component Type (Under-body Components, Engine Components, Electrical Components / Lighting / Battery, Cooling Systems / Filters / Other Sub-systems, Vehicle Component Kits / Aftermarket Parts), and By Vehicle Type (Passenger Vehicles, Commercial Vehicles (Light & Medium), Heavy-duty / Off-road Vehicles, Two-wheelers, Electric Vehicles) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Covestro AG, Novolex Holdings, Berry Global Inc., SABIC, Plastipak Holdings, Sonoco Products Company, Hirschfeld Industries, Dart Container Corporation, Sealed Air Corporation, ALPLA Werke Alwin Lehner GmbH, Multimatic Inc., Jabil Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Automotive Thermoformed Plastics Parts Packaging market?

▾ The global Automotive Thermoformed Plastics Parts Packaging market size is estimated to have a value of USD 3.9 billion in 2025 and is expected to reach USD 7.1 billion by the end of 2034.

What is the size of the US Automotive Thermoformed Plastics Parts Packaging market?

▾ The US Automotive Thermoformed Plastics Parts Packaging market is projected to be valued at USD 0.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.5 billion in 2034 at a CAGR of 6.6%.

Which region accounted for the largest global Automotive Thermoformed Plastics Parts Packaging market?

▾ Asia Pacific is expected to have the largest market share in the global Automotive Thermoformed Plastics Parts Packaging market, with a share of about 45.0% in 2025.

Who are the key players in the global Automotive Thermoformed Plastics Parts Packaging market?

▾ Some of the major key players in the global Automotive Thermoformed Plastics Parts Packaging market are Covestro AG, Novolex Holdings, Berry Global Inc., SABIC, Plastipak Holdings, Sonoco Products Company, Hirschfeld Industries, Dart Container Corporation, Sealed Air Corporation, ALPLA Werke Alwin Lehner GmbH, Multimatic Inc., Jabil Inc., and Others.

What is the growth rate of the global Automotive Thermoformed Plastics Parts Packaging market?

▾ The market is growing at a CAGR of 7.0 percent over the forecasted period.