Market Overview

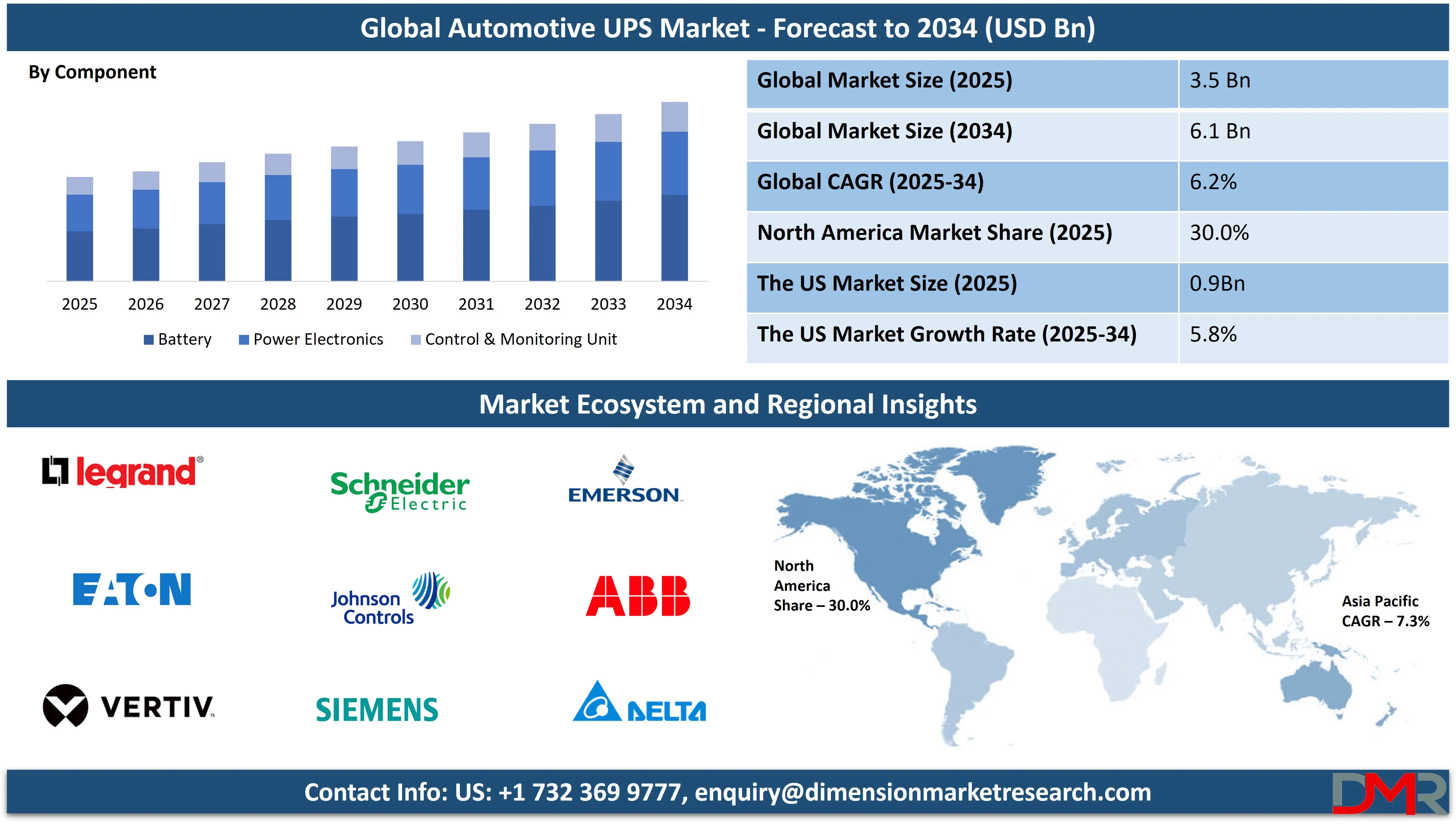

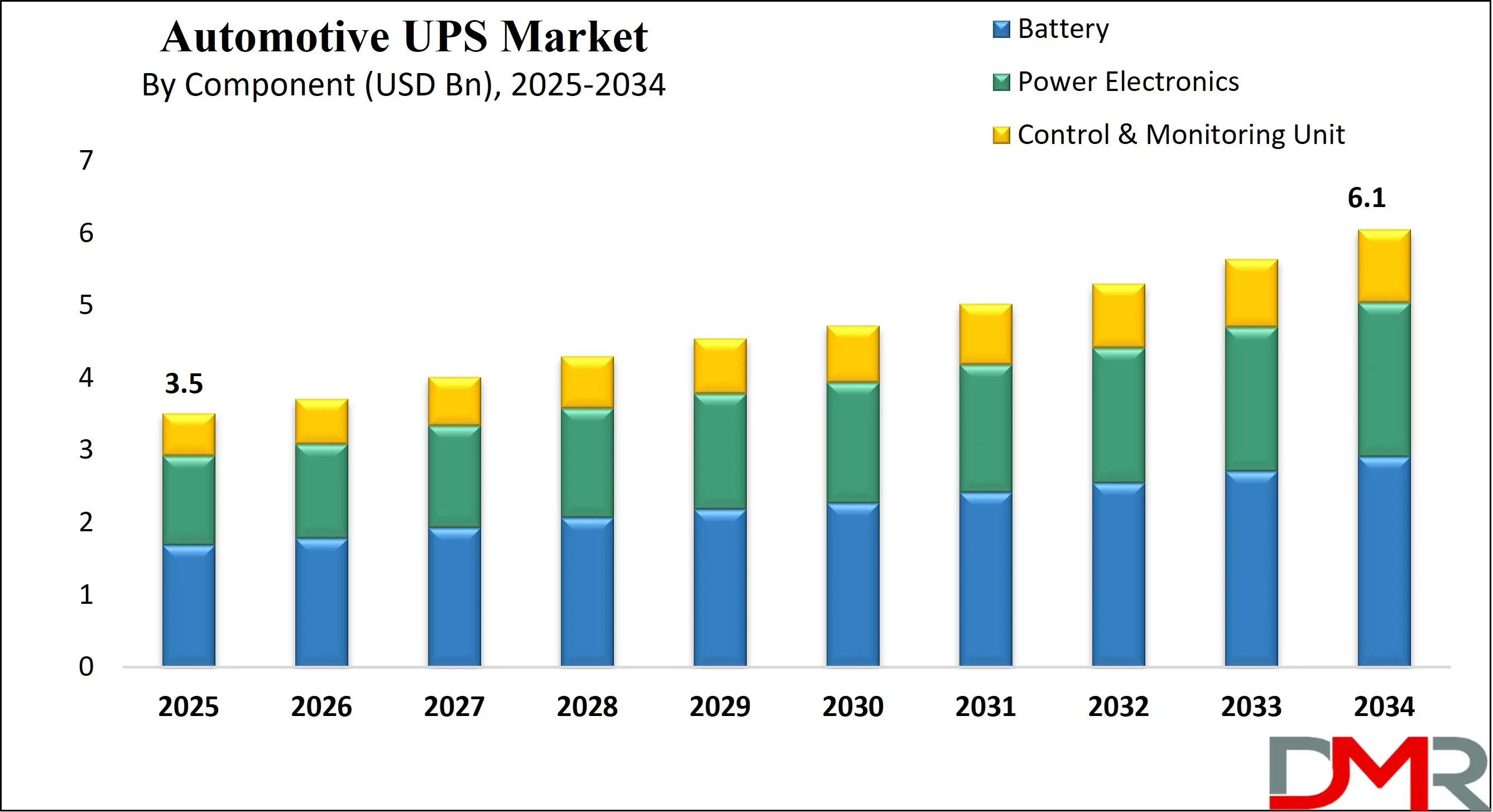

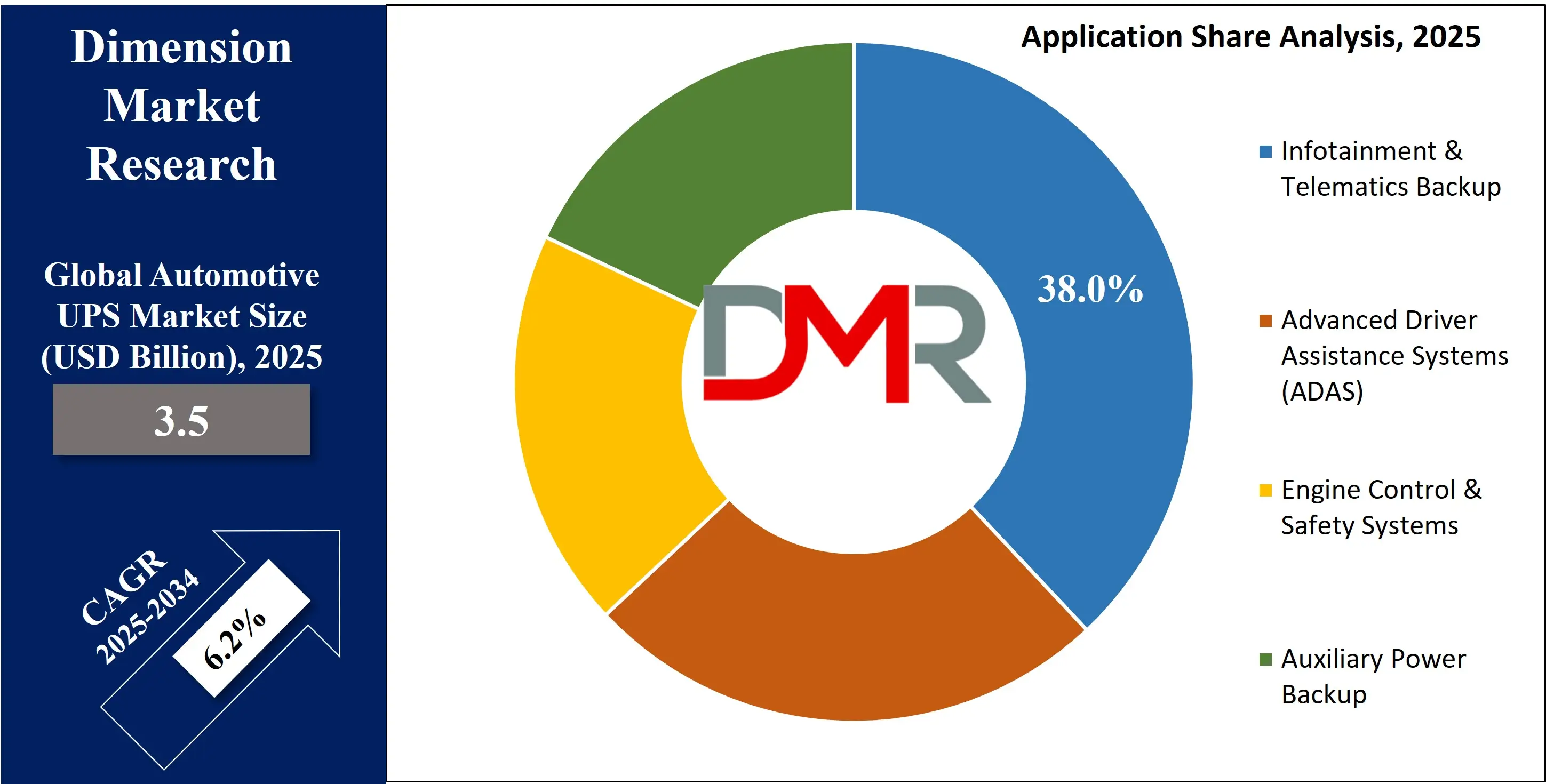

The Global Automotive UPS Market size is projected to reach USD 3.5 billion in 2025 and grow at a compound annual growth rate of 6.2% to reach a value of USD 6.1 billion in 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Automotive UPS refers to uninterruptible power supply system’s specifically engineered for vehicles to ensure continuous power delivery to critical electronic components. These systems comprise batteries, power electronics, and control units that stabilize voltage and prevent power loss during engine start-stop events, battery fluctuations, or system faults. Automotive UPS solutions are increasingly embedded in passenger cars, commercial vehicles, and electric vehicles to support safety systems, infotainment modules, telematics, and control electronics. Their importance has grown significantly as modern vehicles rely heavily on electronics, making power continuity a core requirement within the broader automotive and mobility ecosystem.

The expansion of vehicle electrification, rising integration of advanced driver assistance systems, and increasing adoption of connected vehicle platforms are reshaping demand patterns. Automotive architectures are transitioning from mechanical dominance to software- and electronics-centric systems, requiring reliable backup power. Improvements in lithium-ion batteries, compact power electronics, and intelligent monitoring have improved efficiency and reduced system weight. Regulatory focus on functional safety and energy efficiency further reinforces the role of automotive UPS as a standard component rather than an optional add-on.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Industry evolution is also marked by strategic collaborations between automakers and electronics suppliers, increasing investments in R&D, and a shift toward modular and scalable UPS designs. Regulatory alignment with automotive safety standards, combined with innovation in fast-response power systems, is shaping long-term adoption. As vehicles become smarter and more autonomous, uninterrupted power is emerging as a foundational requirement across all vehicle categories.

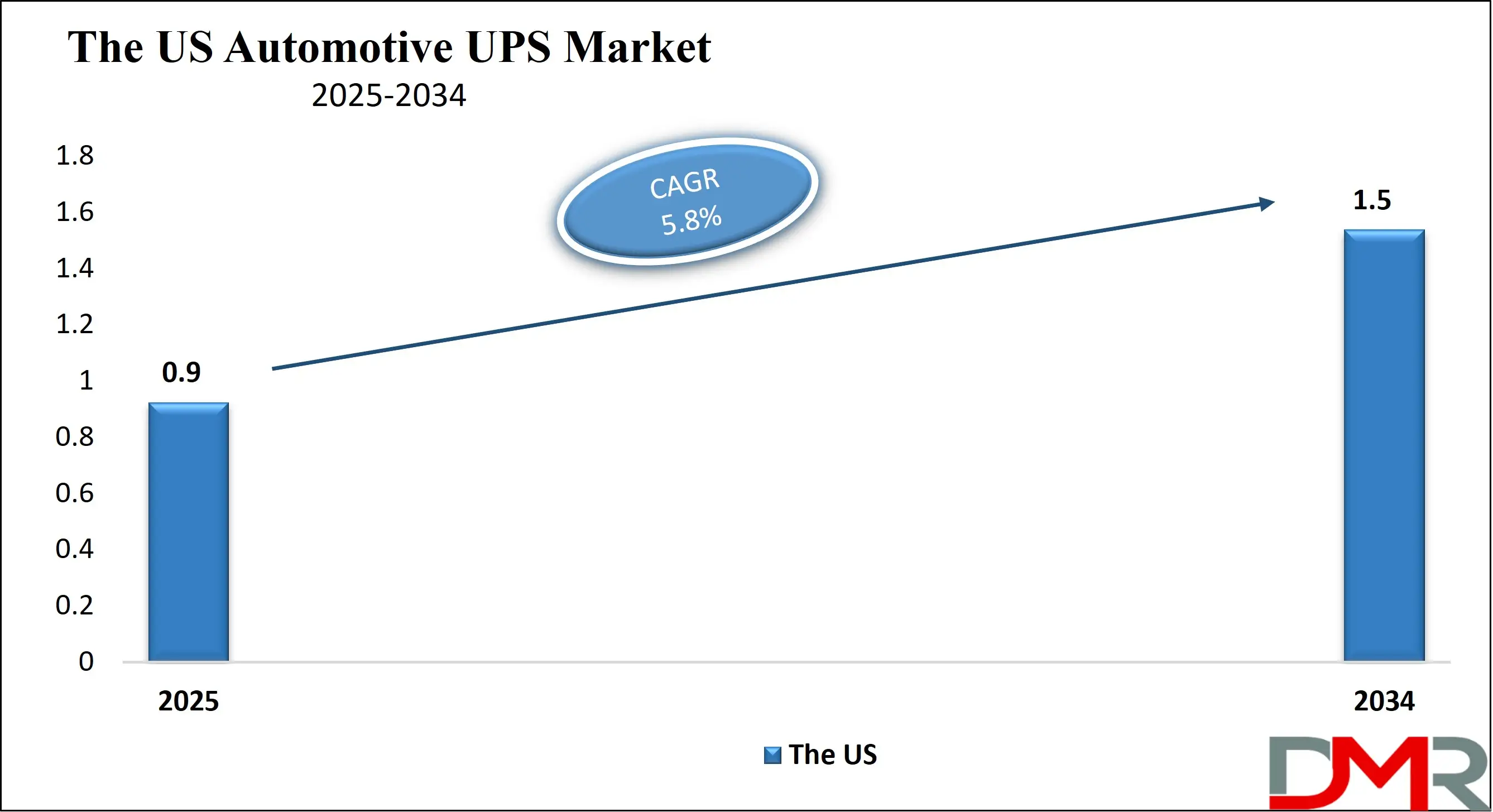

The US Automotive UPS Market

The US Automotive UPS Market size is projected to reach USD 900 million in 2025 at a compound annual growth rate of 5.8% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US automotive UPS market is driven by high adoption of advanced vehicle electronics, strong penetration of electric and hybrid vehicles, and a well-established automotive manufacturing ecosystem. OEMs increasingly integrate UPS systems to support ADAS, infotainment, and telematics functions, particularly in passenger cars and fleet vehicles. Government incentives for electric mobility, combined with safety regulations emphasizing system redundancy, are encouraging UPS adoption. The presence of major technology developers and strong aftermarket demand further contribute to market expansion, positioning the US as a mature and innovation-driven market.

Europe Automotive UPS Market

Europe Automotive UPS Market size is projected to reach USD 770 million in 2025 at a compound annual growth rate of 6.0% over its forecast period.

Europe’s automotive UPS market is shaped by strict emissions regulations, functional safety requirements, and sustainability-focused policies such as the European Green Deal. The region emphasizes energy efficiency and vehicle electrification, driving demand for advanced power management solutions. Automotive UPS systems are increasingly adopted in electric and hybrid vehicles to ensure reliability of safety-critical electronics. Strong collaboration between OEMs and component suppliers, along with a rapid pace of innovation in automotive electronics, supports steady adoption. Europe remains a key hub for regulatory-driven technological advancement.

Japan Automotive UPS Market

Japan Automotive UPS Market size is projected to reach USD 245 million in 2025 at a compound annual growth rate of 5.7% over its forecast period.

Japan’s automotive UPS market benefits from strong technological expertise, high vehicle quality standards, and significant investment in hybrid and electric vehicles. The market emphasizes compact, high-efficiency UPS systems suited for space-constrained vehicle architectures. Urbanization and advanced manufacturing capabilities drive demand for reliable backup power in connected and intelligent vehicles. Government initiatives supporting smart mobility, combined with consumer expectations for reliability and safety, create favorable conditions for UPS integration. However, cost optimization and system miniaturization remain key challenges and innovation areas.

Automotive UPS Market: Key Takeaways

- Market Growth: The Automotive UPS Market size is expected to grow by USD 2.4 billion, at a CAGR of 6.2%, during the forecasted period of 2026 to 2034.

- By Component: The battery segment is anticipated to get the majority share of the Automotive UPS Market in 2025.

- By Application: The infotainment & Telematics backup segment is expected to get the largest revenue share in 2025 in the Automotive UPS Market.

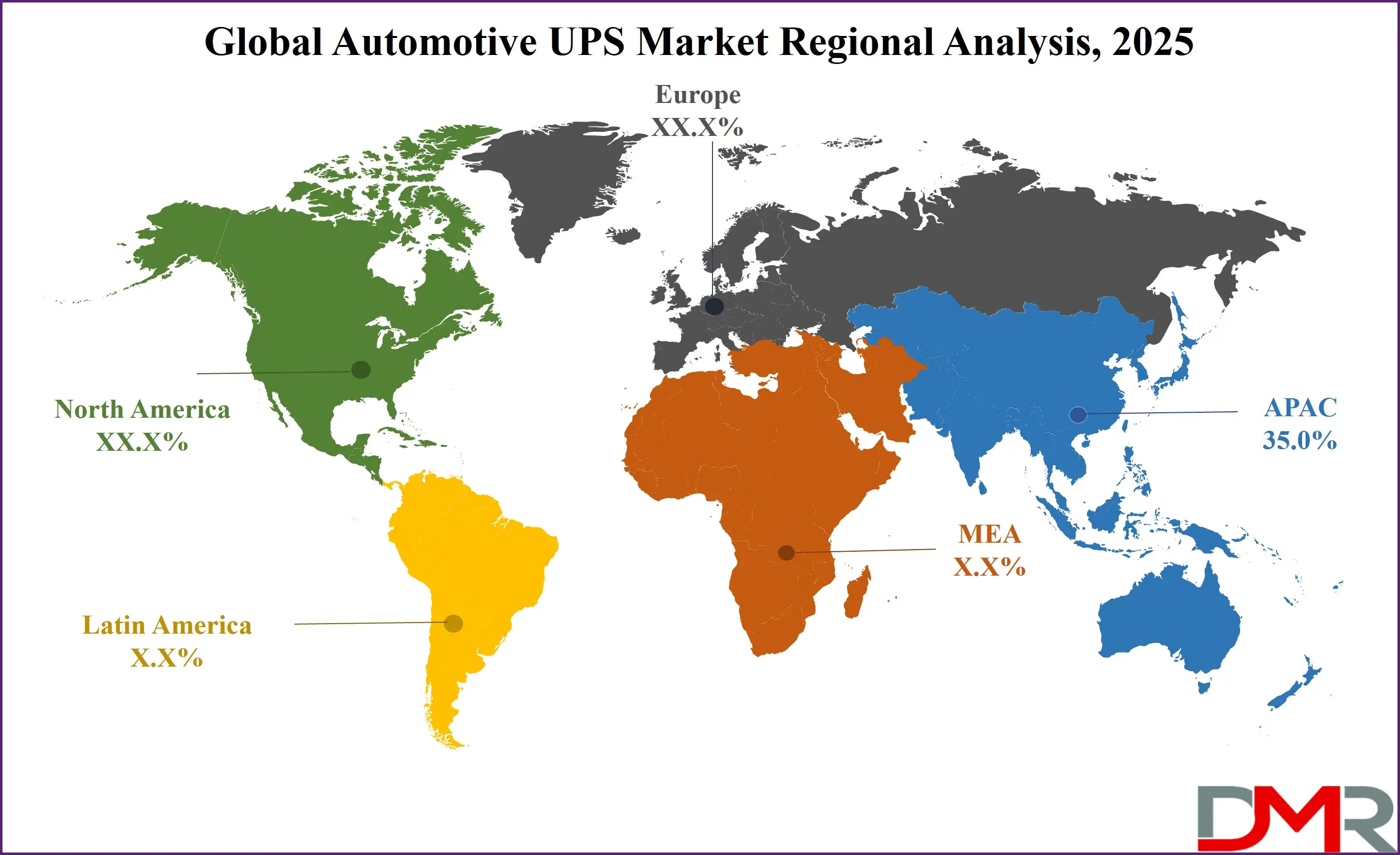

- Regional Insight: Asia Pacific is expected to hold a 35.0% share of revenue in the Global Automotive UPS Market in 2025.

- Use Cases: Some of the use cases of Automotive UPS include ADAS Power Backup, Telematics & Fleet Management, and more.

Automotive UPS Market: Use Cases

- ADAS Power Backup: Provides uninterrupted power to braking, collision avoidance, and driver assistance systems during voltage instability.

- Infotainment & Connectivity Support: Ensures continuous operation of infotainment and navigation systems during transient power losses.

- Telematics & Fleet Management: Maintains tracking, diagnostics, and communication systems in commercial and fleet vehicles.

- Emergency Auxiliary Power: Supplies backup power in electric and hybrid vehicles during battery or system faults.

Stats & Facts

- International Energy Agency reported global electric vehicle sales exceeding 14 million units in 2024, reflecting strong growth in power-dependent vehicle electronics.

- U.S. Department of Transportation noted increasing integration of electronic safety systems across new vehicle models in 2024.

- European Commission highlighted that over 40% of new vehicles sold in Europe in 2025 include advanced electronic safety features requiring power redundancy.

- Ministry of Economy, Trade and Industry of Japan reported rising adoption of power management systems in hybrid vehicles in 2024.

- International Organization of Motor Vehicle Manufacturers indicated that electronic components account for over 35% of total vehicle value in 2025.

Market Dynamic

Driving Factors in the Automotive UPS Market

Rising Vehicle Electrification

The rapid transition toward electric and hybrid vehicles is a primary force driving the automotive UPS market. Electrified powertrains rely heavily on stable electrical systems to manage batteries, motors, and electronic control units. Any power interruption can compromise vehicle safety and performance, making UPS systems essential. Governments worldwide are promoting EV adoption through incentives and infrastructure development, further accelerating demand. As EV architectures become more complex, the need for reliable backup power solutions becomes integral to vehicle design and operational safety.

Growth of Advanced Vehicle Electronics

Modern vehicles incorporate numerous electronic systems such as ADAS, infotainment, digital dashboards, and connectivity modules. These systems require consistent power quality to function correctly. Automotive UPS solutions protect sensitive electronics from voltage fluctuations and sudden power loss. As consumers demand enhanced safety and connectivity features, OEMs increasingly embed UPS systems to ensure reliability. This trend is particularly strong in premium passenger vehicles and technologically advanced commercial fleets.

Restraints in the Automotive UPS Market

High Initial Integration Costs

Automotive UPS systems involve advanced batteries, power electronics, and control software, which increase vehicle manufacturing costs. For cost-sensitive markets and entry-level vehicles, OEMs may hesitate to integrate UPS solutions due to pricing pressures. Additional costs related to system testing, certification, and integration complexity further limit widespread adoption. These cost challenges are especially pronounced in developing markets where affordability remains a critical factor.

Design and Space Constraints

Vehicles have limited space for additional components, making UPS integration challenging. Compact design requirements, thermal management issues, and weight constraints complicate system deployment. Engineering trade-offs between performance, size, and cost can delay adoption. Ensuring compatibility with existing vehicle architectures also adds complexity, particularly for retrofitting applications in the aftermarket.

Opportunities in the Automotive UPS Market

Expansion of Electric Commercial Fleets

The growing adoption of electric buses, delivery vans, and logistics fleets presents a major opportunity for automotive UPS providers. These vehicles require high reliability for safety, tracking, and operational continuity. UPS systems support uninterrupted telematics, battery management, and safety controls, making them critical for fleet efficiency. Government-backed electrification programs further enhance this growth potential.

Technological Advancements in Battery Systems

Advances in lithium-ion and solid-state battery technologies enable smaller, lighter, and more efficient UPS solutions. Improved energy density and faster response times enhance system performance while reducing space requirements. These innovations allow UPS integration across a wider range of vehicle segments, including compact passenger cars and two-wheelers, expanding addressable market potential.

Trends in the Automotive UPS Market

Shift Toward Intelligent Power Management

Automotive UPS systems are evolving from passive backup units to intelligent power management solutions. Integration with vehicle software allows predictive diagnostics, real-time monitoring, and adaptive power distribution. This trend supports improved safety, reduced downtime, and enhanced vehicle reliability, aligning with the broader digital transformation of the automotive sector.

Adoption of Modular UPS Architectures

Manufacturers are increasingly adopting modular UPS designs that can be scaled across different vehicle platforms. Modular systems reduce development costs, simplify integration, and support customization. This trend enables OEMs to deploy UPS solutions efficiently across passenger cars, commercial vehicles, and electric models, accelerating market penetration.

Impact of Artificial Intelligence in Automotive UPS Market

- Predictive Diagnostics: AI enables early detection of battery and power failures, improving system reliability.

- Adaptive Power Management: AI optimizes energy distribution based on driving conditions and system demand.

- Battery Health Monitoring: Machine learning models extend battery life through usage pattern analysis.

- Fault Detection & Safety: AI enhances real-time fault detection to prevent system failures.

- Design Optimization: AI supports simulation-based UPS design for improved efficiency and compactness.

Research Scope and Analysis

By Vehicle Type Analysis

Passenger cars represent the leading vehicle type segment in the Automotive UPS market, accounting for approximately 67.3% share in 2025. This dominance is primarily driven by high global production volumes and the rapid increase in electronic content per vehicle. Modern passenger cars integrate multiple power-dependent systems, including infotainment units, digital instrument clusters, telematics modules, and safety electronics, all of which require uninterrupted power to ensure reliability and performance. Automotive UPS solutions help protect these sensitive components from voltage fluctuations, power interruptions, and transient electrical faults. Rising consumer demand for connected, feature-rich vehicles further strengthens the adoption of UPS systems across the passenger car segment.

Electric vehicles, including battery electric vehicles and hybrid electric vehicles, constitute the fastest-growing vehicle type segment in the Automotive UPS market. Growth is driven by increasing electrification of vehicle platforms and the high dependency of EV architectures on electronic control systems. UPS solutions play a critical role in supporting battery management systems, power electronics, auxiliary loads, and safety-critical functions during power transitions. As EV adoption accelerates globally and automakers shift toward fully electric platforms, demand for advanced, high-reliability UPS systems continues to rise rapidly within this segment.

By UPS Type Analysis

Standby or offline UPS systems lead the UPS type segmentation, holding an estimated 41% market share in 2025. Their leadership is attributed to cost-effectiveness, compact design, and suitability for basic backup power requirements in conventional passenger and commercial vehicles. These systems are widely used to support infotainment, telematics, and non-critical electronics during brief power interruptions or voltage drops. Standby UPS solutions are easy to integrate with existing automotive electrical architectures, making them a preferred choice for mass-market vehicles where affordability and simplicity are key considerations.

Online or double conversion UPS systems are the fastest-growing UPS type segment due to their ability to provide continuous, high-quality power with zero transfer time. These systems are increasingly adopted in electric vehicles and advanced automotive platforms where uninterrupted power is essential for ADAS, safety systems, and complex electronic control units. Their capability to isolate sensitive electronics from power disturbances makes them suitable for next-generation vehicles with higher safety and performance requirements, driving rapid growth across premium and electrified vehicle categories.

By Power Rating Analysis

UPS systems with a power rating below 1 kVA dominate the Automotive UPS market, accounting for approximately 46% share in 2025. These systems are extensively used in passenger cars and light commercial vehicles, where power requirements for infotainment, telematics, and basic safety systems fall within this range. Their compact size, lower cost, and compatibility with standard vehicle electrical systems support widespread adoption. Below-1 kVA UPS units effectively provide reliable backup power without adding significant weight or complexity, making them ideal for high-volume automotive applications.

UPS systems rated above 5 kVA represent the fastest-growing power rating segment, driven by increasing adoption in electric buses, heavy commercial vehicles, and premium electric vehicles. These applications demand robust backup power to support high-load electronics, advanced safety systems, and redundant control architectures. As vehicle electrification expands into commercial and public transportation segments, higher-capacity UPS systems are gaining traction to ensure operational reliability under demanding conditions.

By Component Analysis

The battery segment holds the leading position in the Automotive UPS market, with an estimated 48% share in 2025. Batteries form the core energy storage component of UPS systems, enabling uninterrupted power delivery during electrical disruptions. Lead-acid batteries continue to be used in cost-sensitive applications, while lithium-ion batteries are increasingly adopted due to higher energy density, longer lifespan, and reduced weight. The growing shift toward electric and hybrid vehicles further reinforces the importance of advanced battery technologies in automotive UPS systems.

Power electronics is the fastest-growing component segment, supported by advancements in semiconductor technologies and increasing demand for efficient power conversion and voltage regulation. Innovations in silicon carbide and advanced control circuits enable higher efficiency, reduced energy losses, and improved thermal performance. As vehicles incorporate more electronic systems and higher power loads, demand for sophisticated power electronics within UPS solutions continues to expand rapidly.

By Application Analysis

Infotainment and telematics backup represents the leading application segment, accounting for approximately 38% of the Automotive UPS market in 2025. Rising consumer expectations for uninterrupted connectivity, navigation, and digital entertainment drive demand for reliable backup power. UPS systems ensure continuous operation of communication and infotainment systems during power fluctuations, enhancing user experience and system reliability. The widespread integration of connected features across passenger vehicles supports sustained dominance of this application.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

ADAS applications are the fastest-growing segment as vehicles increasingly rely on electronic safety features such as collision avoidance, lane assistance, and adaptive cruise control. These systems require uninterrupted and stable power to function accurately. Growing regulatory emphasis on vehicle safety and the gradual transition toward autonomous driving technologies are accelerating UPS adoption within ADAS applications.

By Sales Channel Analysis

OEMs dominate the Automotive UPS market through the sales channel segment, holding approximately 70% share in 2025. Most UPS systems are integrated during vehicle manufacturing to ensure compatibility with vehicle architectures and compliance with safety standards. OEM integration allows optimized system design, testing, and quality assurance, making it the preferred approach for large-scale deployment across passenger, commercial, and electric vehicles.

The aftermarket channel is the fastest-growing sales segment as fleet operators and vehicle owners increasingly seek retrofit UPS solutions. Demand is driven by longer vehicle lifecycles, rising electronic content in existing vehicles, and the need to enhance reliability in commercial and specialty vehicles. Growing awareness of power continuity benefits further supports aftermarket expansion.

By End Use Analysis

Personal mobility accounts for the largest share of the Automotive UPS market, contributing approximately 55% in 2025. This segment benefits from widespread use of UPS systems in passenger cars to support safety, infotainment, and connectivity features. Increasing consumer reliance on electronic vehicle functions reinforces the importance of uninterrupted power in personal mobility applications.

Fleet and logistics represent the fastest-growing end-use segment, driven by increasing adoption of connected fleet management, telematics, and tracking systems. Commercial operators prioritize power reliability to ensure continuous monitoring, compliance, and operational efficiency, accelerating UPS adoption across logistics and delivery fleets.

The Automotive UPS Market Report is segmented on the basis of the following

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

- Electric Vehicles

- Battery Electric Vehicles

- Hybrid Electric Vehicles

By UPS Type

- Standby (Offline) UPS

- Line-Interactive UPS

- Online (Double Conversion) UPS

By Power Rating

- Below 1 kVA

- 1–5 kVA

- Above 5 kVA

By Component

- Battery

- Power Electronics

- Control & Monitoring Unit

By Application

- Infotainment & Telematics Backup

- Advanced Driver Assistance Systems (ADAS)

- Engine Control & Safety Systems

- Auxiliary Power Backup

By Sales Channel

By End Use

- Personal Mobility

- Fleet & Logistics

- Public Transportation

Regional Analysis

Leading Region in the Automotive UPS Market

Asia Pacific is the leading region in the global Automotive UPS market, accounting for around 35% of market share in 2025. This dominance is driven by the region’s significant position as the largest automotive manufacturing hub and the rapid adoption of electric and hybrid vehicles. Governments in key markets have supported EV infrastructure development and stringent emissions regulations that accelerate electrified mobility, increasing demand for resilient power solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, the high volume of passenger car production, expanding commercial fleet investments, and strong component supply chains contribute to robust regional performance. Automotive UPS suppliers are strategically expanding local partnerships and production footprints to address diverse vehicle platforms and regulatory environments, maintaining leadership in a highly competitive landscape.

Fastest Growing Region in the Automotive UPS Market

Latin America is emerging as one of the fastest-growing regions in the Automotive UPS market, driven by increasing adoption of advanced vehicle technologies and a growing focus on electrification. Several countries in the region are expanding investments in EV infrastructure and smart mobility initiatives, which is accelerating demand for reliable power backup systems in both passenger and commercial vehicles. Urbanization and rising consumer expectations for connected features have boosted the integration of electronic systems that rely on uninterrupted power. Additionally, government incentives aimed at reducing emissions and promoting sustainable transportation are encouraging OEMs and fleet operators to adopt automotive UPS solutions. Expansion of local automotive manufacturing, combined with improvements in supply chain capabilities, is enabling faster deployment of modern electrical components, further contributing to rapid market growth outside traditional hubs.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive dynamics in the Automotive UPS market center on strategic investments in innovation, integration partnerships, and differentiation through advanced power management capabilities. Companies prioritize in-vehicle UPS designs that reduce weight and size while improving efficiency and reliability. Collaboration with major automotive OEMs to secure long-term supply agreements is common, supporting seamless integration into new vehicle platforms. Innovation strategies include developing intelligent diagnostics, predictive maintenance functions, and modular architectures that adapt across segments. Competitive advantages stem from proprietary power electronics technologies, strong IP portfolios, and the ability to meet stringent automotive safety and quality standards. Barriers to entry include high R&D costs and certification complexities, reinforcing the position of established suppliers who continue to invest in next-generation UPS solutions.

Some of the prominent players in the global Automotive UPS are

- Schneider Electric

- Eaton Corporation

- ABB Ltd.

- Siemens AG

- Delta Electronics

- Vertiv Holdings

- Emerson Electric

- Legrand

- Riello Elettronica

- CyberPower Systems

- Toshiba Corporation

- Mitsubishi Electric

- AEG Power Solutions

- Fujitsu Limited

- Phoenix Contact

- Socomec Group

- Johnson Controls

- Clore Automotive

- Exide Technologies

- Sensata Technologies

- Other Key Players

Recent Developments

- In October 2025, Honda announced to invest in OMC Power Private Limited, which conducts distributed power supply and mini-grid business in India. The investment focuses to contribute to a stable power supply utilising batteries, which is expected to expand in line with the accelerating electrification of mobility products in India.

- In September 2025, Huawei Technologies released new brands and the deepening of existing collaborations. The Shangjie H5, the first model under electric vehicle brand Shangjie, co-developed by SAIC Motor and Huawei’s full-set solutions partnership Harmony Intelligent Mobility Alliance. Equipped with Huawei’s advanced driver-assistance system ADS 4, the Shangjie H5 is priced at USD 22,600 to USD 28,300, targeting the mainstream consumer market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.5 Bn |

| Forecast Value (2034) |

USD 6.1 Bn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.9 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Vehicle Type (Passenger Cars, Commercial Vehicles, and Electric Vehicles), By UPS Type (Standby (Offline) UPS, Line-Interactive UPS, Online (Double Conversion) UPS), By Power Rating (Below 1 kVA, 1–5 kVA, and Above 5 kVA), By Component (Battery, Power Electronics, Control & Monitoring Unit), By Application (Infotainment & Telematics Backup, Advanced Driver Assistance Systems (ADAS), Engine Control & Safety Systems, and Auxiliary Power Backup), By Sales Channel (OEM and Aftermarket), By End Use (Personal Mobility, Fleet & Logistics, and Public Transportation) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Delta Electronics, Vertiv Holdings, Emerson Electric, Legrand, Riello Elettronica, CyberPower Systems, Toshiba Corporation, Mitsubishi Electric, AEG Power Solutions, Fujitsu Limited, Phoenix Contact, Socomec Group, Johnson Controls, Clore Automotive, Exide Technologies, Sensata Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Automotive UPS Market?

▾ The Global Automotive UPS Market size is expected to reach USD 3.5 billion by 2025 and is projected to reach USD 6.1 billion by the end of 2034.

Which region accounted for the largest Global Automotive UPS Market?

▾ Asia Pacific is expected to have the largest market share in the Global Automotive UPS Market, with a share of about 35.0% in 2025.

How big is the Automotive UPS Market in the US?

▾ The US Automotive UPS market is expected to reach USD 0.9 billion by 2025.

Who are the key players in the Automotive UPS Market?

▾ Some of the major key players in the Global Automotive UPS Market include Eaton, ABB, Siemens and others

What is the growth rate in the Global Automotive UPS Market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period.