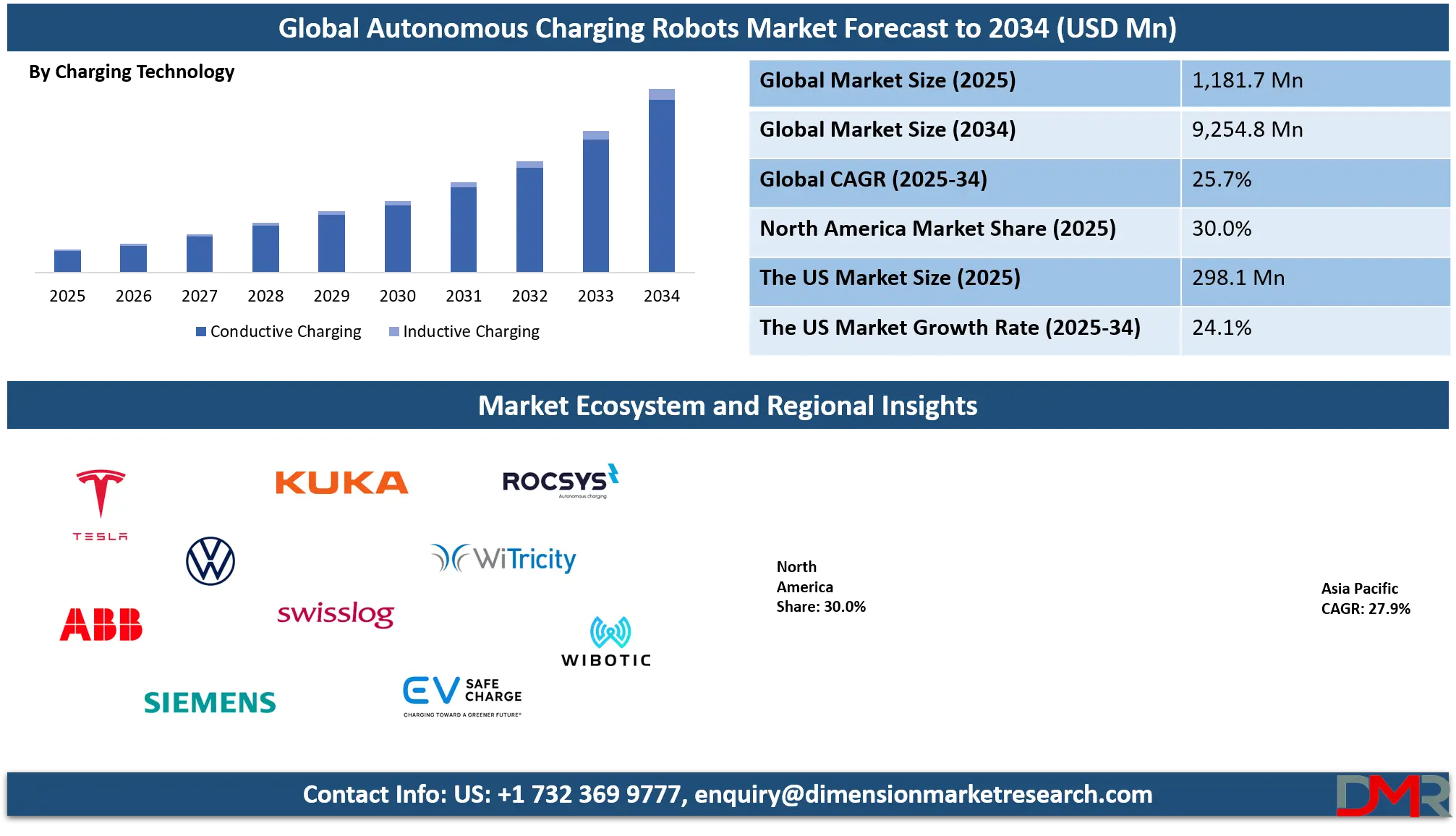

Market Overview

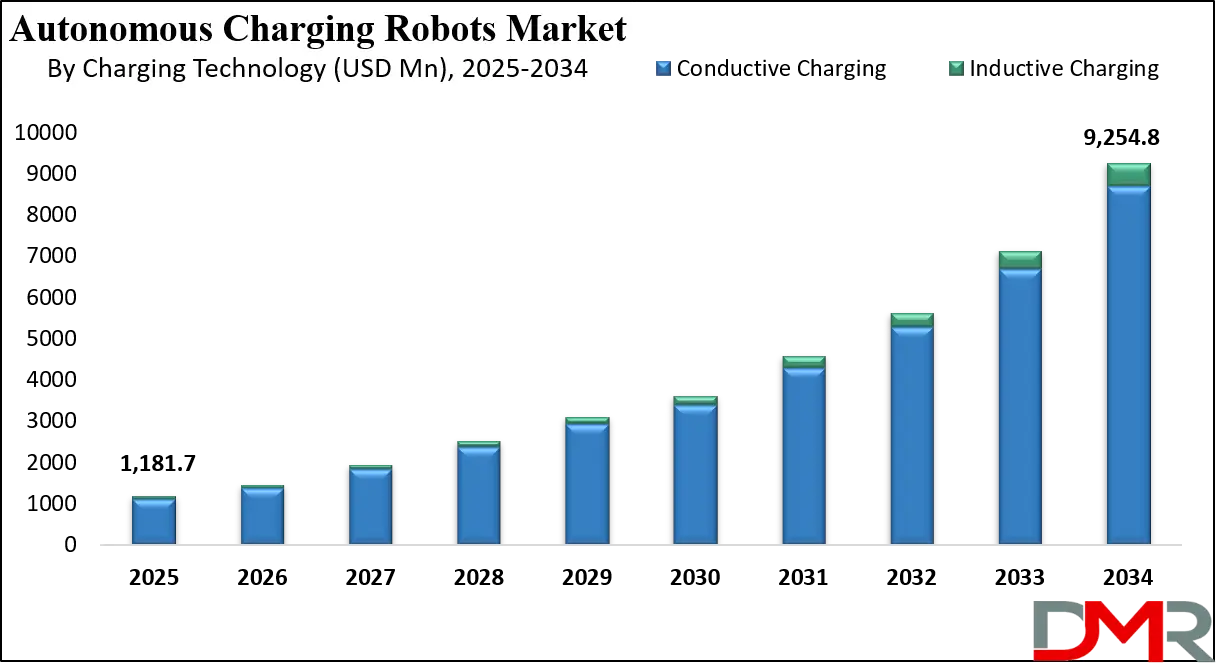

The global autonomous charging robots market was valued at USD 1,181.7 million in 2025 and is expected to expand to USD 9,254.8 million by 2034, growing at a CAGR of 25.7%.

Market growth is supported by rising adoption of automated charging solutions, expansion of electric vehicle infrastructure, increasing deployment of autonomous mobile robots, and growing demand for intelligent energy management across industrial and commercial applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Autonomous charging robots are intelligent robotic systems designed to automatically locate, align with, and charge electric vehicles, mobile robots, or battery powered equipment without human intervention. These robots combine advanced navigation, computer vision,

artificial intelligence, and robotic actuation to identify charging ports or docking points and establish secure energy transfer through conductive or wireless methods. They are widely used in environments where continuous operation is critical, such as automated warehouses, smart factories,

electric vehicle fleets, and service robotics applications, helping reduce downtime, eliminate manual charging labor, and improve operational efficiency.

The global autonomous charging robots market represents the commercial ecosystem encompassing the development, manufacturing, deployment, and integration of automated charging solutions across industrial, automotive, commercial, and residential sectors. Market growth is driven by the rapid expansion of electric mobility, rising adoption of autonomous mobile robots in logistics and manufacturing, and the increasing need for unattended and scalable charging infrastructure. Advancements in robotics software, sensor fusion, and intelligent energy management systems are further enabling reliable autonomous charging operations in complex and dynamic environments.

In addition, the market is shaped by the convergence of smart infrastructure, Industry 4.0 initiatives, and fleet electrification strategies across major economies. Growing investments in electric vehicle charging automation, warehouse robotics, and wireless power transfer technologies are expanding the scope of autonomous charging solutions beyond traditional industrial use cases. As organizations focus on reducing operational costs, improving safety, and ensuring uninterrupted asset utilization, autonomous charging robots are emerging as a critical enabler of fully automated and digitally connected ecosystems worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

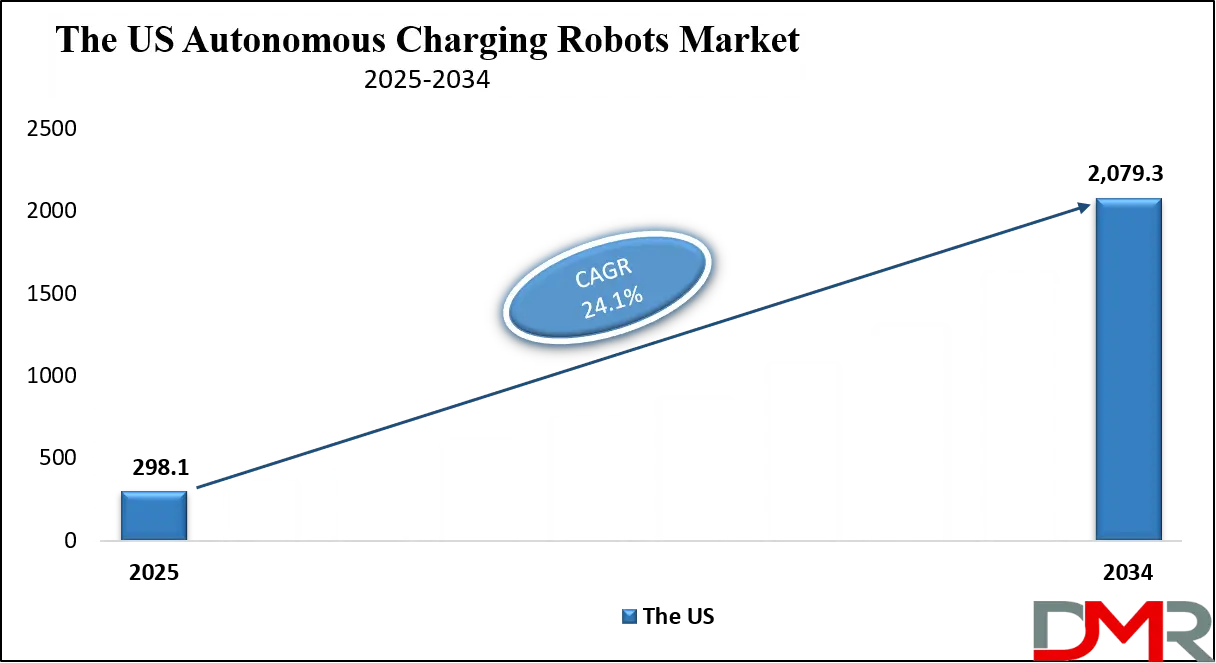

The US Autonomous Charging Robots Market

The U.S. Autonomous Charging Robots market size was valued at USD 298.1 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2,079.3 million in 2034 at a CAGR of 24.1%.

The US autonomous charging robots market is witnessing strong momentum driven by rapid electrification of transportation, widespread adoption of warehouse automation, and increasing deployment of autonomous mobile robots across logistics and manufacturing facilities. The presence of advanced robotics manufacturers, electric vehicle innovators, and smart infrastructure providers is accelerating the commercialization of automated charging solutions.

Growing demand for unattended charging, reduced labor dependency, and continuous equipment uptime is pushing industries to integrate robotic charging systems into EV fleets, fulfillment centers, and smart factories. Federal and state level investments in electric vehicle charging infrastructure and automation friendly policies are further supporting market expansion.

Additionally, the market benefits from advancements in artificial intelligence, machine vision, and intelligent navigation systems that enable precise alignment and safe energy transfer in dynamic environments. Rising use of autonomous charging robots in commercial fleets, airports, hospitals, and large scale distribution hubs is strengthening adoption beyond traditional industrial settings. As US enterprises prioritize operational efficiency, energy optimization, and scalable automation, autonomous charging solutions are becoming a critical component of connected ecosystems. The increasing convergence of robotics, EV charging automation, and Industry 4.0 technologies continues to shape long term growth prospects for the US autonomous charging robots market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Autonomous Charging Robots Market

The European autonomous charging robots market was valued at approximately USD 496.4 million in 2025, reflecting the region’s strong leadership in electric mobility, industrial automation, and smart infrastructure development. Europe’s dominance is driven by widespread adoption of electric vehicles, robust warehouse and manufacturing automation, and favorable government policies supporting sustainability and Industry 4.0 initiatives. The presence of advanced robotics companies, EV charging network providers, and technology integrators further strengthens the deployment of autonomous charging solutions across both commercial and industrial sectors, ensuring high reliability, efficiency, and scalability in operations.

The market’s growth trajectory, with a CAGR of 27.0%, is supported by continuous innovation in autonomous charging technologies, including mobile charging robots, conductive charging systems, and AI‑enabled energy management platforms. European countries are investing heavily in smart grid integration, connected infrastructure, and fleet electrification, which creates additional opportunities for autonomous charging robots to operate seamlessly in dynamic environments.

Furthermore, increasing demand for unattended charging solutions in logistics, manufacturing, and public transport fleets is reinforcing the adoption of these systems, positioning Europe as the leading and most technologically advanced market for autonomous charging robots globally.

Japan Autonomous Charging Robots Market

The Japanese autonomous charging robots market was projected to reach approximately USD 94.5 million in 2025, driven by the country’s strong focus on industrial automation, robotics innovation, and smart mobility solutions. Japan’s manufacturing and logistics sectors are early adopters of autonomous mobile robots and automated guided vehicles, creating a high demand for reliable and efficient charging systems. The government’s push for electric vehicle adoption, smart factory initiatives, and sustainable transportation infrastructure further supports the deployment of autonomous charging robots, enabling uninterrupted operations and enhanced productivity across industrial and commercial environments.

The market is expected to grow at a CAGR of 24.0%, supported by advancements in AI, machine vision, and autonomous navigation technologies that allow charging robots to operate safely and efficiently in dynamic and complex environments. Increasing integration with fleet management systems, energy optimization platforms, and predictive maintenance tools enhances operational efficiency and reduces downtime for both industrial and electric vehicle applications. As Japanese enterprises continue to invest in connected infrastructure and smart automation, autonomous charging robots are becoming a critical component of the country’s advanced robotics and electrification ecosystem.

Global Autonomous Charging Robots Market: Key Takeaways

- Rapid Market Expansion: The global autonomous charging robots market is projected to grow from USD 1,181.7 million in 2025 to USD 9,254.8 million by 2034, reflecting strong adoption driven by EV infrastructure growth, industrial automation, and smart energy management solutions.

- Dominance of Mobile Solutions: Mobile autonomous charging robots are leading the market due to their flexibility, adaptability in dynamic environments, and compatibility with EV fleets, industrial robots, and automated guided vehicles.

- Technology Shift towards Conductive Charging: Conductive charging solutions dominate, accounting for the majority of market adoption, while inductive and wireless technologies are emerging for niche applications requiring low maintenance and contactless charging.

- Industrial and Automotive Users Drive Adoption: Industrial facilities, logistics hubs, and automotive EV infrastructure are primary end users, emphasizing the importance of uninterrupted operations, labor efficiency, and scalable charging solutions.

- AI and Smart Integration as Growth Enablers: Artificial intelligence, predictive analytics, and smart energy management are increasingly embedded in charging robots, enhancing operational efficiency, safety, fleet integration, and autonomous decision-making across applications.

Global Autonomous Charging Robots Market: Use Cases

- Electric Vehicle Fleet Charging Automation: Autonomous charging robots are increasingly used for electric vehicle fleets operating in logistics, ride hailing, public transport, and corporate mobility services. These robots enable automated EV charging without manual cable handling, allowing vehicles to recharge during idle periods with minimal human involvement. Fleet operators benefit from reduced labor costs, optimized charging schedules, and improved vehicle availability. Integration with fleet management systems and intelligent energy management platforms further enhances charging efficiency, making autonomous charging robots a key enabler for scalable electric mobility and smart transportation ecosystems.

- Warehouse and Logistics Robot Charging: In automated warehouses and distribution centers, autonomous charging robots support continuous operation of autonomous mobile robots and automated guided vehicles. By autonomously locating and charging mobile robots, these systems eliminate downtime caused by manual battery swaps or scheduled charging breaks. This use case is critical in high throughput e commerce fulfillment centers where operational continuity and productivity are essential. The adoption of robotic charging solutions also aligns with Industry 4.0 initiatives, enabling fully automated material handling environments supported by intelligent robotics and smart infrastructure.

- Manufacturing and Smart Factory Applications: Autonomous charging robots are deployed in smart factories to maintain uninterrupted operation of industrial robots, mobile platforms, and inspection systems. These solutions support flexible production lines by allowing robots to charge autonomously based on real time energy requirements. Manufacturers benefit from improved asset utilization, reduced maintenance intervention, and enhanced safety by eliminating manual charging processes. As factories increasingly adopt digital twins, predictive maintenance, and connected automation, autonomous charging robots play a vital role in supporting advanced manufacturing and intelligent production ecosystems.

- Service Robotics and Public Infrastructure: Autonomous charging robots are gaining adoption in service robotics applications such as hospitals, airports, campuses, and smart cities. Service robots used for cleaning, security, delivery, and inspection rely on automated charging to operate continuously in public environments. Robotic charging systems enable safe and precise energy transfer while reducing human interaction and operational disruptions. This use case supports the expansion of service robotics, smart buildings, and intelligent public infrastructure by ensuring reliable power availability and efficient autonomous operations across large and complex facilities.

Impact of Artificial Intelligence on the global Autonomous Charging Robots market

The impact of artificial intelligence on the global autonomous charging robots market has been profound and transformative, reshaping how robotic charging systems operate, optimize energy use, and interact within complex environments. AI technologies such as machine learning, computer vision, sensor fusion, and advanced navigation algorithms empower charging robots to autonomously locate charging ports, identify optimal docking paths, and adapt in real time to dynamic surroundings.

This intelligence reduces reliance on pre-defined infrastructure and human supervision, enabling charging solutions to function reliably in busy industrial floors, automated warehouses, logistics hubs, and EV charging stations. The integration of AI enhances precision and efficiency, ensuring that robots can make decisions based on contextual data, predict energy demand patterns, and manage charging schedules with minimal manual intervention.

Beyond operational autonomy, artificial intelligence significantly boosts performance through predictive analytics and smart energy management. AI-enabled systems analyze historical usage and sensor data to forecast charging needs, prevent downtime, and optimize battery health, ultimately increasing equipment uptime and prolonging asset life. In electric mobility, AI allows autonomous charging robots to integrate seamlessly with fleet management platforms, dynamically prioritizing vehicles based on route schedules, battery levels, and grid constraints.

Moreover, AI contributes to enhanced safety and reliability by enabling robots to detect obstacles, avoid collisions, and self-correct in varied indoor and outdoor conditions. As Industry 4.0, smart infrastructure, and autonomous systems converge, the role of AI in the autonomous charging robots market continues to expand, driving innovation, scalability, and adoption across industrial, commercial, and public charging ecosystems.

Global Autonomous Charging Robots Market: Stats & Facts

U.S. Department of Energy – EV Charging Port Growth

- In Q3 2023 the number of EV charging ports grew by 7.7%, and in Q4 2023 by 5.0%, indicating consistent infrastructure expansion toward 2030 goals.

- In Q1 2024 EV charging ports increased 4.6% and in Q2 2024 by 6.3%, with DC fast charging growing fastest.

U.S. Alternative Fuels Data Center – Public & Private Charging Growth

- U.S. EV charging ports grew from 128,894 in 2022 to 151,273 in 2023 and then 184,098 in 2023–24 showing steady national infrastructure scaling.

- Charging station locations increased from 57,482 in 2022 to 68,475 in 2023, supporting more accessible EV charging.

U.S. Bipartisan Infrastructure Law – NEVI & EV Funding

- The NEVI Formula Program allocates USD 5 billion (2022–2026) for EV charging deployment, with an additional USD 2.5 billion in the Charging & Fueling Infrastructure Grant Program.

- Federal investment across all government levels includes USD 3.0 billion in public funding beyond NEVI to expand EV infrastructure.

National Charging Network – NREL / DOE (2023)

- As of April 1, 2023, USD 11.2 billion in private sector EV charging infrastructure investments were announced, complementing public efforts.

South Korean Government EV Adoption Stats

- Battery electric vehicle registrations increased from 612,531 in 2023 to 683,696 in 2024 (about 12% growth).

- EV charging outlets in South Korea reached 398,989 total, with 82.9% slow chargers and 9.6% rapid chargers by 2024.

IEA / International EV Trends (Government Partner Data)

- China accounted for >70% of global EV production and 67% of global EV sales in 2024.

- Plug‑in EV (BEV + PHEV) sales comprised 47.9% of China’s auto market in 2024, up significantly from previous years.

National EV Adoption / Charging Deployment Needs

- IEA projects that global public electric vehicle supply equipment (EVSE) will exceed 15 million ports by 2030 to support EV adoption goals.

- In the U.S., 900,000 public EVCS ports are needed by 2030, rising to 1.7 million by 2035 under government planning.

U.S. EV Sales Share Growth

- EVs reached 18.8% of new light‑duty vehicle sales in the U.S. by 2023, up from single‑digit percentages prior to 2020.

U.S. DOE Alternative Fuels EV Charging Trends

- In Q2 2023, public EV charging ports increased 8.4%, and Level 1 EV chargers increased 15.5% quarter‑over‑quarter.

Industrial Robotics (Government‑Referenced Density)

- China’s industrial robot density reached 322 robots per 10,000 manufacturing employees by 2021, exceeding U.S. density (~274 robots per 10,000).

Global Autonomous Charging Robots Market: Market Dynamics

Global Autonomous Charging Robots Market: Driving Factors

Rapid Expansion of Electric Vehicle Infrastructure

The accelerated deployment of electric vehicles worldwide is a key driver for the autonomous charging robots market. As governments and private enterprises invest in extensive EV charging networks, there is a growing need for intelligent charging solutions that can operate without direct human involvement. Autonomous charging robots facilitate efficient power delivery to electric cars, commercial fleets, and shared mobility solutions, helping reduce charging time, increase turnaround, and support continuous operation. The adoption of smart charging automation aligns with the increasing focus on sustainable transport and decarbonization initiatives, making robotic charging systems a strategic asset for future energy ecosystems.

Adoption of Automation in Industrial and Warehouse Operations

Industry 4.0 and digital transformation strategies are pushing manufacturers and logistics operators to adopt autonomous mobile robots across production and distribution floors. These environments require constant uptime, and frequent battery recharges can disrupt workflow and reduce productivity. Autonomous charging robots enable unattended battery replenishment for AMRs and AGVs, eliminating manual intervention and ensuring seamless operations. The integration of intelligent navigation, machine vision, and autonomous energy management supports adaptive charging workflows, which enhance throughput, lower operational costs, and strengthen end-to-end automation.

Global Autonomous Charging Robots Market: Restraints

High Initial Investment and Integration Complexity

One of the primary challenges restricting the widespread adoption of autonomous charging robots is the substantial upfront cost involved in purchasing and integrating these systems into existing infrastructure. Small and medium enterprises often lack the capital to deploy advanced robotic charging platforms, and retrofitting legacy facilities with compatible charging stations can be both time-consuming and costly. Additionally, complexity in integration with enterprise resource planning (ERP) systems and fleet management software may slow deployment, particularly in environments without standardized automation protocols.

Technology Limitations and Safety Concerns

Despite advancements in navigation and sensor technologies, autonomous charging robots still face limitations related to real-world environment variability. Adverse conditions such as uneven surfaces, obstructed charging ports, or unpredictable obstacles can hinder precise alignment and safe energy transfer. Safety concerns around high-power charging, especially in public spaces and mixed-use environments, demand robust fail-safe mechanisms and compliance with strict electrical and robotics safety standards. These technological constraints may delay adoption in certain sectors where reliability and human safety are paramount.

Global Autonomous Charging Robots Market: Opportunities

Integration with Smart Grids and Energy Management Platforms

As smart grid technologies evolve, there is a significant opportunity for autonomous charging robots to become integrated components of intelligent energy ecosystems. By interfacing with real-time grid data, robotic charging systems can optimize energy usage, reduce peak load stress, and participate in demand response programs. This integration enables dynamic charging schedules based on electricity cost fluctuations, renewable power availability, and vehicle or equipment priority, creating value for utilities, fleet operators, and facility managers looking to enhance sustainability and operational efficiency.

Growth in Service Robotics and Public Infrastructure

Beyond industrial and automotive settings, service robotics adoption is expanding rapidly in sectors such as healthcare, airports, hospitality, and urban logistics. Autonomous charging robots can support continuous operation of delivery robots, cleaning robots, and inspection drones, making them essential for smart building and smart city initiatives. As public infrastructure becomes more connected and automated, the demand for intelligent charging stations that seamlessly support a diverse range of autonomous systems presents a lucrative opportunity for vendors and solution providers to diversify their offerings and capture new market segments.

Global Autonomous Charging Robots Market: Trends

Emergence of Wireless and Contactless Charging Solutions

A notable trend in the autonomous charging robots market is the development of wireless and contactless charging technologies. These solutions reduce mechanical wear and simplify alignment requirements, enabling robots to charge without physical connectors. Such advancements enhance user convenience, extend equipment longevity, and support future modular automation architectures. Wireless charging compatibility with autonomous systems also aligns with broader trends in smart device power delivery and urban mobility ecosystems.

AI-Driven Predictive Charging and Analytics

Artificial intelligence and machine learning are increasingly embedded into autonomous charging platforms to deliver predictive insights and self-optimizing performance. By analyzing operational data, battery health metrics, and utilization patterns, AI-enabled systems can forecast charging requirements, recommend optimal scheduling, and adapt to variable workloads. This trend toward intelligent energy management not only improves uptime and efficiency but also contributes to lower lifecycle costs and extended battery performance, reinforcing the strategic value of autonomous charging robots in modern automation and electrification initiatives.

Global Autonomous Charging Robots Market: Research Scope and Analysis

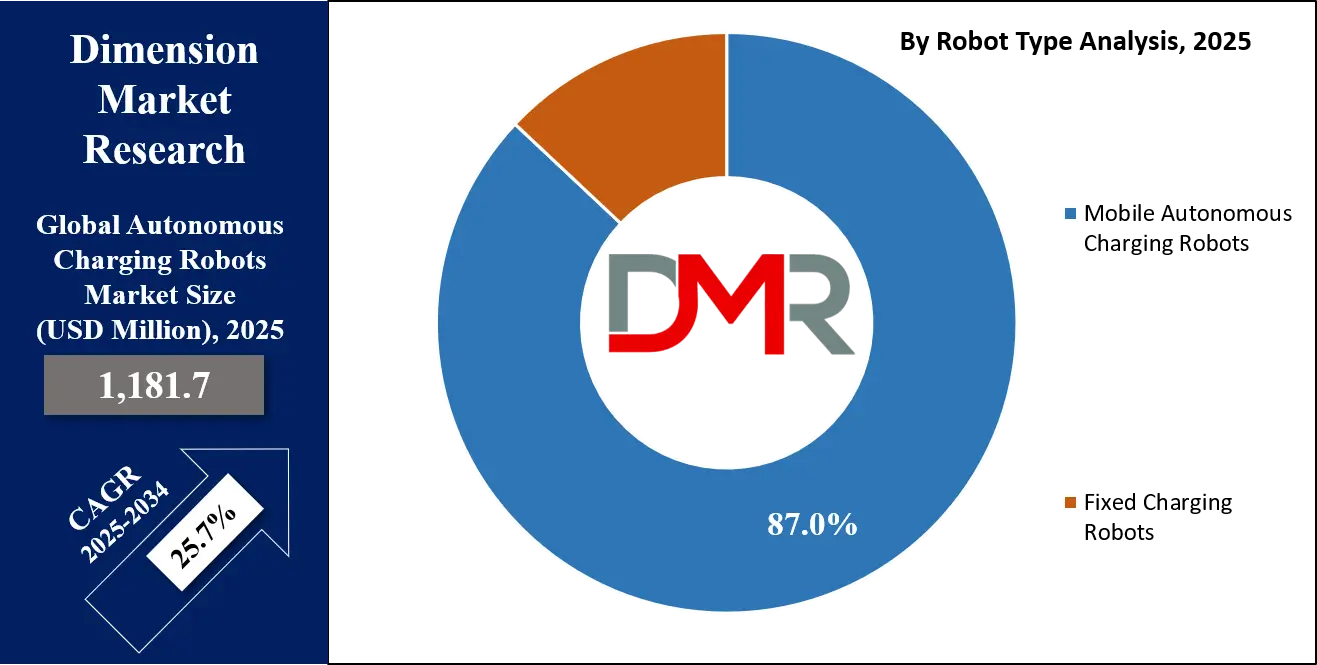

By Robot Type Analysis

Mobile autonomous charging robots are anticipated to dominate the robot type segment, capturing 87.0% of the total market share in 2025, primarily due to their flexibility and ability to operate in dynamic environments without requiring fixed infrastructure. These robots can navigate warehouses, factories, parking facilities, and fleet depots to locate vehicles or equipment that require charging, significantly reducing downtime and manual labor. Their compatibility with electric vehicles, autonomous mobile robots, and automated guided vehicles makes them highly suitable for logistics, manufacturing, and commercial fleet operations. The growing focus on uninterrupted operations, smart factories, and scalable EV charging solutions further supports the strong adoption of mobile autonomous charging robots across global industrial and commercial applications.

In comparison, fixed charging robots represent a smaller but important portion of this market segment, serving use cases where charging locations and equipment positions remain largely constant. These systems are commonly deployed in structured environments such as production lines, dedicated EV parking bays, and robotic workstations, where predictable movement patterns allow efficient automated plug in or docking based charging. Fixed charging robots offer high reliability and precision, particularly for high power charging and repetitive industrial operations. While their lack of mobility limits flexibility, they remain relevant in controlled settings that prioritize consistency, safety, and integration with existing automation infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Charging Technology Analysis

Mobile autonomous conductive charging is anticipated to dominate the charging technology segment, capturing 94.0% of the total market share in 2025, largely due to its high efficiency, reliability, and compatibility with existing charging infrastructure. Conductive charging systems enable autonomous charging robots to establish direct physical contact with vehicles or equipment through automated connectors or docking interfaces, ensuring fast energy transfer and minimal power loss.

This technology is widely adopted across electric vehicle fleets, industrial robots, and autonomous mobile robots because it supports high power charging requirements and delivers consistent performance in demanding operational environments such as warehouses, factories, and logistics hubs. The maturity of conductive charging standards and lower implementation costs further reinforce its dominance across global applications.

Inductive charging, while representing a smaller share of the market, is gaining attention for its contactless and low maintenance advantages. This technology uses electromagnetic fields to transfer energy wirelessly, reducing mechanical wear and eliminating the need for precise physical connectors.

Inductive charging is particularly attractive in environments where dust, moisture, or frequent human interaction may affect connector durability, such as public spaces, healthcare facilities, and service robotics applications. However, limitations related to charging efficiency, power transfer rates, and higher system costs currently restrict widespread adoption, positioning inductive charging as an emerging but evolving alternative within the autonomous charging robots market.

By Power Output Capacity Analysis

Medium power autonomous charging robots in the 10–50 kW range are anticipated to dominate the power output capacity segment, capturing 47.0% of the total market share in 2025, as they offer an optimal balance between charging speed, energy efficiency, and infrastructure requirements. This power range is well suited for charging autonomous mobile robots, automated guided vehicles, light commercial electric vehicles, and industrial equipment operating in warehouses, manufacturing plants, and logistics centers.

Medium power systems support frequent opportunity charging without placing excessive load on electrical infrastructure, making them highly attractive for facilities focused on continuous operations, cost control, and scalable automation. Their broad applicability across industrial and commercial use cases reinforces their leading position in the global market.

High power autonomous charging robots with output capacities above 50 kW account for a significant and growing portion of the market, driven by increasing demand from passenger electric vehicles and heavy commercial fleets. These systems enable faster charging cycles, which is critical for applications requiring quick vehicle turnaround, such as public transport depots, delivery fleets, and high utilization EV operations.

High power charging robots are typically deployed in structured environments with robust electrical infrastructure to manage higher energy loads and safety requirements. Although higher costs and complex installation limit adoption in some settings, the rising focus on rapid charging and fleet electrification continues to strengthen the role of high power solutions within the autonomous charging robots market.

By Application Analysis

Electric vehicle charging is anticipated to dominate the application segment, capturing 71.0% of the total market share in 2025, due to the rapid global adoption of electric mobility and the increasing need for automated, scalable charging solutions. Autonomous charging robots in this application can efficiently manage passenger cars, commercial EVs, and fleet vehicles by automatically navigating to charging stations and connecting to the power source without human intervention. This not only reduces operational downtime but also enhances fleet utilization and energy management. The integration of intelligent scheduling, real‑time monitoring, and connectivity with fleet management systems further drives efficiency, making autonomous charging robots essential for supporting the expanding EV infrastructure and sustainable transportation initiatives worldwide.

Industrial equipment and automated guided vehicles represent another important application segment, providing automated charging solutions for robots and mobile machinery used in warehouses, factories, and logistics centers. In these environments, maintaining continuous operation is critical, and autonomous charging robots ensure that AGVs, autonomous mobile robots, and other battery‑powered industrial equipment can recharge without disrupting workflow. By enabling opportunity charging, real‑time battery monitoring, and optimized energy allocation, these systems improve operational efficiency, reduce labor requirements, and support fully automated industrial processes. The adoption of such solutions aligns with Industry 4.0 objectives, smart manufacturing practices, and the push for cost-effective, uninterrupted automation in industrial facilities.

By End-User Analysis

Industrial users are anticipated to dominate the end-user segment, capturing 45.0% of the total market share in 2025, driven by the widespread adoption of autonomous mobile robots, automated guided vehicles, and other battery-powered equipment in manufacturing, logistics, and warehouse operations. Autonomous charging robots help industrial facilities maintain uninterrupted operations by enabling automated battery replenishment without manual intervention.

This reduces labor dependency, optimizes workflow efficiency, and ensures consistent productivity across high-throughput environments. The integration of intelligent navigation, real-time battery monitoring, and predictive charging scheduling allows industrial operators to maximize asset utilization while aligning with Industry 4.0 initiatives and smart factory implementations.

Automotive and EV infrastructure users represent another key segment, comprising charging solutions for electric vehicle fleets, public charging stations, and OEM-managed depots. Autonomous charging robots in this segment enable unattended, efficient energy transfer to passenger vehicles, commercial EVs, and fleet transport systems, improving vehicle availability and operational efficiency.

These systems support scalable EV deployment by reducing manual labor, optimizing charging schedules, and integrating with fleet management and energy monitoring platforms. As governments and private operators invest heavily in expanding EV infrastructure and public charging networks, autonomous charging robots play a crucial role in enhancing the reliability, speed, and convenience of electric mobility solutions.

The Autonomous Charging Robots Market Report is segmented on the basis of the following:

By Robot Type

- Mobile Autonomous Charging Robots

- Wheeled Mobile Charging Robots

- Rail-Guided / Track-Based Mobile Robots

- Fixed Charging Robots

- Robotic Arm-Based Charging Systems

- Automated Docking & Plug-In Stations

By Charging Technology

- Conductive Charging

- Automated Plug-In (Robotic Connector)

- Inductive Charging

- Static Wireless Pads

- Position-Adaptive Wireless Charging

By Power Output Capacity

- Low Power (Up to 10 kW)

- Consumer Devices & Small Robots

- Medium Power (10–50 kW)

- Industrial Robots & AGVs

- Light Commercial EVs

- High Power (Above 50 kW)

- Passenger EVs

- Heavy Commercial EVs

By Application

- Electric Vehicle (EV) Charging

- Industrial Equipment & AGVs

- Consumer Electronics & Smart Devices

- Robotics & Drone Charging

- Others

By End-User

- Industrial

- Automotive & EV Infrastructure

- Commercial

- Residential

- Others

Global Autonomous Charging Robots Market: Regional Analysis

Region with the Largest Revenue Share

Europe is anticipated to lead the global autonomous charging robots market, capturing 42.0% of total market revenue in 2025, driven by strong government support for electric mobility, well-established industrial automation infrastructure, and widespread adoption of smart manufacturing and logistics solutions. The region benefits from advanced EV charging networks, robust regulatory frameworks promoting sustainability, and high penetration of autonomous mobile robots in warehouses, factories, and commercial facilities. Additionally, growing investments in smart grids, connected infrastructure, and innovative robotics technologies are accelerating the deployment of autonomous charging solutions, making Europe the most prominent and technologically advanced market for these systems worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness the most significant growth in the autonomous charging robots market over the forecast period, driven by rapid electrification of transportation, increasing adoption of warehouse automation, and expansion of industrial robotics across China, Japan, South Korea, and Southeast Asia. Rising investments in electric vehicle infrastructure, government initiatives supporting Industry 4.0, and the growing need for uninterrupted operations in logistics and manufacturing facilities are fueling demand for autonomous charging solutions. Additionally, the region’s focus on smart city development, connected infrastructure, and advanced robotics technologies is creating strong opportunities for market expansion and higher adoption rates compared to other regions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Autonomous Charging Robots Market: Competitive Landscape

The competitive landscape of the global autonomous charging robots market is marked by rapid innovation, strategic partnerships, and continuous advancements in robotics, artificial intelligence, and energy management technologies. Key players are focusing on enhancing autonomous navigation, improving charging efficiency, and integrating smart connectivity features to differentiate their solutions and address diverse industry needs across electric mobility, industrial automation, and service robotics.

The market is witnessing increased collaboration between technology developers, EV infrastructure providers, and automation integrators to deliver scalable, reliable, and interoperable charging systems. Additionally, competition is driving investments in research and development to improve safety, reduce operational costs, and expand use cases, leading to accelerated adoption across global regions and end‑user segments.

Some of the prominent players in the global Autonomous Charging Robots market are:

- Tesla, Inc.

- Volkswagen AG

- ABB Ltd.

- Siemens AG

- KUKA AG

- Swisslog

- Rocsys

- WiTricity Corporation

- Wiferion GmbH

- EV Safe Charge

- WiBotic

- Fetch Robotics (Zebra Technologies)

- Clearpath Robotics

- Mobile Industrial Robots (MiR)

- Locus Robotics

- Vecna Robotics

- SMP Robotics

- Cimcorp Automation

- Aethon

- Evatran Group

- Other Key Players

Global Autonomous Charging Robots Market: Recent Developments

- May 2025: Hyundai Motor Group and Incheon International Airport began trials of AI‑powered electric vehicle automatic charging robots, demonstrating a fully autonomous EV charging system that can locate and charge vehicles without human intervention as part of a smart airport mobility infrastructure initiative.

- May 2025: A definitive agreement was announced for a robotics and medical technology company to acquire an autonomous systems developer to expand its robotics suite and integrate autonomous solutions, signaling consolidation in the robotics and automation space.

- December 2024: An autonomous EV charging robot concept known as FlashBot, designed to bring power to off‑grid locations via a mobile robot EV charger, was highlighted for its ability to provide autonomous charging capabilities that support roaming electric vehicles in underserved areas.

- February 2024: An autonomous delivery robotics firm raised USD 90 million in funding to expand its global autonomous robot operations, including technologies that support self‑charging and wireless power for last‑mile delivery robots.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,181.7 Mn |

| Forecast Value (2034) |

USD 9,254.8 Mn |

| CAGR (2025–2034) |

25.7% |

| The US Market Size (2025) |

USD 298.1 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

Robot Type (Mobile Autonomous Charging Robots, Fixed Charging Robots), Charging Technology (Conductive Charging, Inductive Charging), Power Output Capacity (Low Power up to 10 kW, Medium Power 10–50 kW, High Power above 50 kW), Application (Electric Vehicle Charging, Industrial Equipment & AGVs, Consumer Electronics & Smart Devices, Robotics & Drone Charging, Others), and End-User (Industrial, Automotive & EV Infrastructure, Commercial, Residential, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Tesla, Inc., Volkswagen AG, ABB Ltd., Siemens AG, KUKA AG, Swisslog, Rocsys, WiTricity Corporation, Wiferion GmbH, EV Safe Charge, WiBotic, Fetch Robotics (Zebra Technologies), Clearpath Robotics, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Autonomous Charging Robots market?

▾ The global Autonomous Charging Robots market size was valued at USD 1,181.7 million in 2025 and is expected to reach USD 9,254.8 million by the end of 2034.

What is the size of the US Autonomous Charging Robots market?

▾ The US Autonomous Charging Robots market is projected to be valued at USD 298.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,079.3 million in 2034 at a CAGR of 24.1%.

Which region accounted for the largest global Autonomous Charging Robots market?

▾ Europe is expected to have the largest market share in the global Autonomous Charging Robots market, with a share of about 42.0% in 2025.

Who are the key players in the global Autonomous Charging Robots market?

▾ Some of the major key players in the global Autonomous Charging Robots market are Tesla, Inc., Volkswagen AG, ABB Ltd., Siemens AG, KUKA AG, Swisslog, Rocsys, WiTricity Corporation, Wiferion GmbH, EV Safe Charge, WiBotic, Fetch Robotics (Zebra Technologies), Clearpath Robotics, and Others.