Market Overview

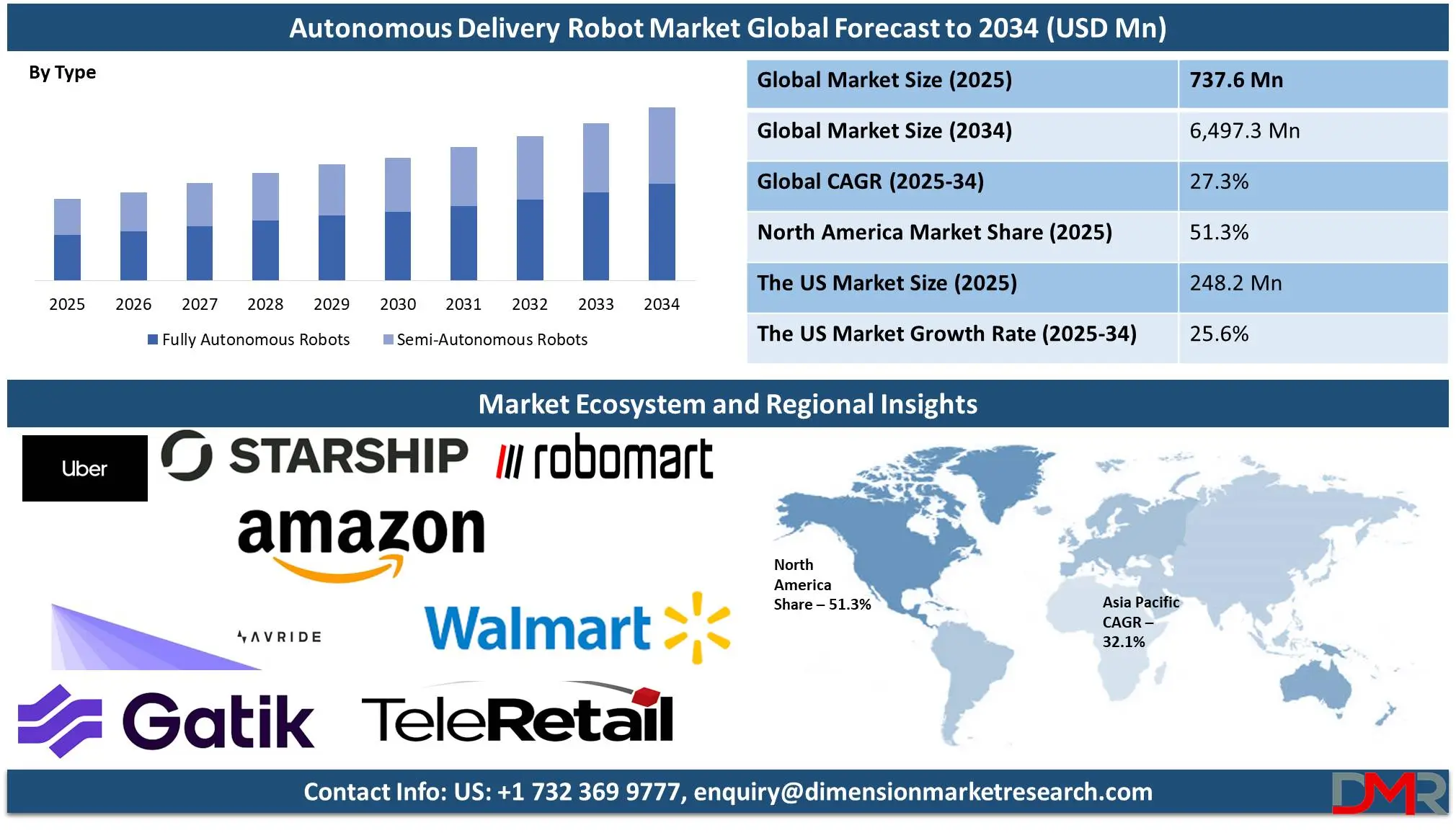

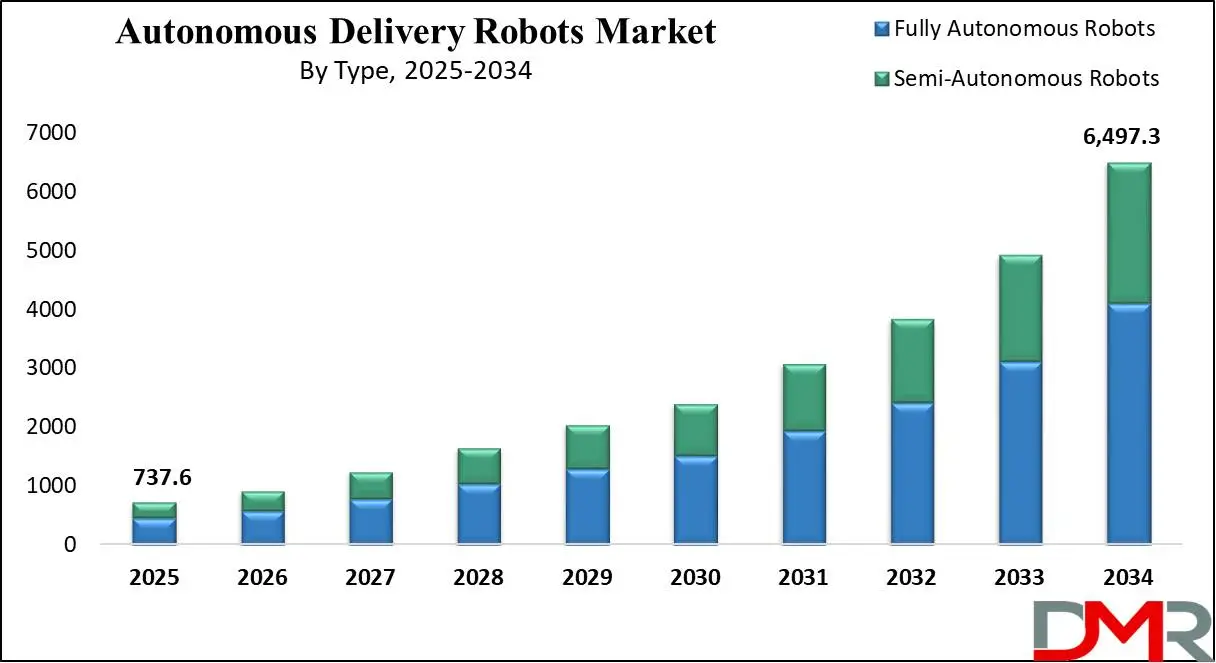

The global

Autonomous Delivery Robots market is expected to be

valued at USD 737.6 million in 2025 and is expected to grow to

USD 6,497.3 million by 2034, registering a compound annual

growth rate (CAGR) of 27.3% from 2025 to 2034.

Autonomous delivery robots are revolutionizing last-mile logistics with their advanced sensors, cameras, and AI-driven navigation systems. By leveraging GPS and LiDAR technologies, these unmanned vehicles efficiently transport goods, minimizing human intervention while reducing operational costs. Their ability to traverse sidewalks, roads, and controlled environments makes them versatile for retail, e-commerce, and supply chain applications.

These robots demonstrate precision obstacle avoidance and adaptability, delivering items swiftly to consumers’ doorsteps and promoting convenience. As they reduce traffic congestion and emissions, manufacturers continue investing in research and development. This innovation is accelerating demand, propelling the global autonomous delivery robot market to new heights.

As consumers demand faster, more cost-efficient deliveries, autonomous delivery robots are rapidly gaining popularity worldwide, encouraging retailers and logistics providers to streamline their operations for improved customer experiences, while healthcare facilities leverage automated transport of medical supplies to enhance patient care and reduce staff burden advanced navigation algorithms enable these machines to excel in diverse environments with reduced margins of error, and governments gradually amend regulatory frameworks to ensure safer public deployment; continued investment in AI research bolsters obstacle detection, facilitating wider adoption and paving the way for fiercer competition and innovation in expanding global markets.

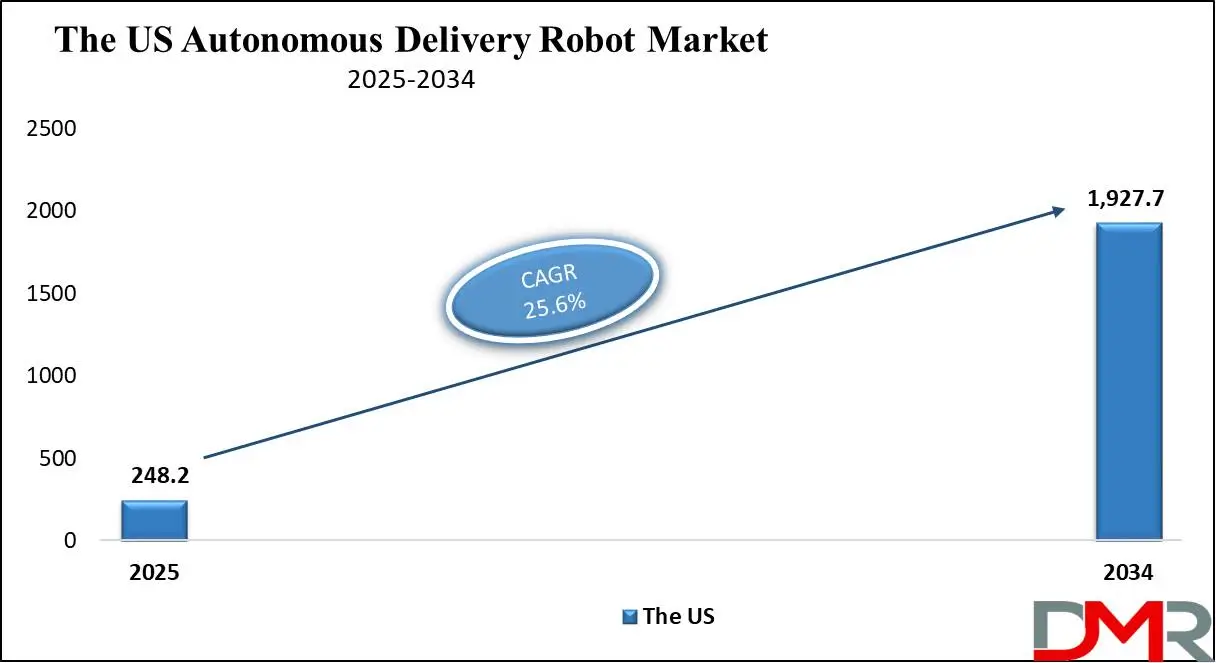

The US Autonomous Delivery Robots Market

The US Autonomous Delivery Robots market is projected to be valued at USD 248.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,927.7 million in 2034 at a CAGR of 25.6%.

Significant investments from prominent technology companies, complemented by the presence of major robotics and automation startups, fuel the U.S. autonomous delivery robot market. Favorable government regulations, which permit testing and limited commercial deployment of autonomous robots on roads and sidewalks, bolster real-world experimentation. Such supportive measures accelerate product development, driving market growth and innovation. This environment positions U.S.-based firms at the forefront of advancements, fostering collaboration, research, and technological breakthroughs.

E-commerce growth and shifting consumer preferences toward contactless services reinforce demand for these robots. Partnerships between established retailers, tech companies, and logistics providers support pilot programs and accelerate deployment. Integration of advanced navigation systems and AI-based decision-making fosters self-sufficiency, creating safer, even more reliable robot operations.

Autonomous Delivery Robots Market: Key Takeaways

- Market Growth: The global Autonomous Delivery Robots market is anticipated to expand by USD 5,478.4 million, achieving a CAGR of 27.3% from 2025 to 2034.

- Type Analysis: Full autonomy robots are predicted to lead the market based on operation with the highest revenue share in 2025.

- Load Carrying Capacity Analysis: Light payload robots are anticipated to dominate the market with the highest revenue share of 54.2% by the end of 2025.

- Number of Wheels Analysis: Four-wheeled are anticipated to lead the autonomous delivery robots market with revenue share in 2025.

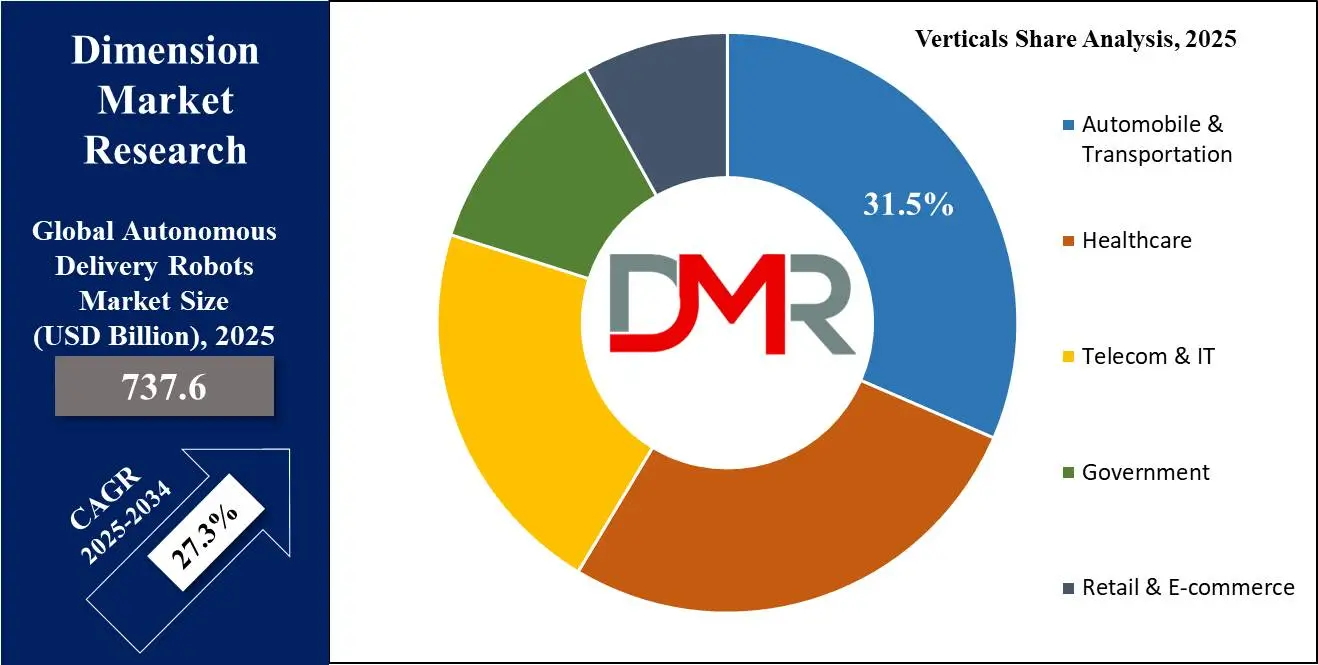

- Verticals Analysis: Retail and logistics are likely to continue to dominate the market with a revenue share of 31.5% by the end of 2025.

- Regional Analysis: North America is projected to dominate the global Autonomous Delivery Robots market, holding a market share of 51.3% by 2025.

Autonomous Delivery Robots Market: Use Cases

- Last-Mile Delivery for E-commerce Orders: Autonomous delivery robots are increasingly used by online retailers to handle last-mile delivery, efficiently transporting packages from local distribution centers directly to customers’ doorsteps.

- Food and Grocery Deliveries in Urban Settings: Restaurants and grocery chains employ autonomous delivery robots to fulfill customer orders in densely populated areas.

- Healthcare and Pharmaceutical Deliveries: Hospitals and medical facilities use autonomous robots to transport medications, lab samples, and medical supplies within and between buildings.

- Campus and Industrial Complex Applications: Large corporate campuses, universities, and industrial complexes implement autonomous delivery robots to move documents, tools, and equipment across sprawling sites.

Autonomous Delivery Robots Market: Stats & Facts

- Starship Technologies projects that its operational costs could be reduced to around USD 1–2 per delivery. Since 2018, the company reports having prevented 137 tons of CO2 emissions and replaced 280,000 car trips.

- Approximately 23 U.S. states now allow delivery robots to operate, signaling a growing trend toward regulatory support for this technology.

- Depending on a device’s features, the typical cost for an autonomous delivery robot ranges from USD 2500 to USD 5500.

- Amazon, has increasingly integrated robotics into its supply chain to boost delivery efficiency. In 2024, the company announced new AI and robotics innovations aimed at cutting delivery times and expenses by 25%. Their advanced fulfillment center in Shreveport, Louisiana, deploys ten times more robots than standard warehouses, underscoring Amazon’s drive toward automation.

- As of October 2024, Starship Technologies’ fleet—exceeding 2,000 robots—had completed 7 million deliveries, traveled more than 8.5 million miles, and carried out 150,000 daily street crossings.

- In April 2024, Kiwibot launched 200 autonomous delivery robots in collaboration with the city of Detroit, focusing on food deliveries and small parcel transport to residential areas.

Autonomous Delivery Robots Market: Market Dynamic

Driving Factors in the Autonomous Delivery Robots Market

Increase Adoption in the Food Service IndustryAutonomous delivery robots have revolutionized the food service industry with fast, cost-effective, contactless solutions that benefit employees and customers. Their popularity accelerated during pandemic events as businesses sought ways to safeguard employees and customers. Companies such as Avride and Uber Eats invest in compact sidewalk navigating robots equipped with sophisticated sensors and LiDAR technology that efficiently maneuvers around traffic congestion. These robots detect obstacles along their routes, plan optimal routes accordingly, and ensure on-time deliveries. As consumer preferences shift toward on-demand services and contactless payments, food service firms increasingly rely on autonomous delivery robots to meet market needs.

Rising Demand in E-commerce and Retail

As consumer expectations for convenient deliveries grow, the adoption of autonomous delivery robots in both retail and e-commerce industries also increases. By automating last-mile logistics and operating continuously around the clock, these robots reduce delivery times while simultaneously cutting labor costs. Advanced mapping and obstacle detection technologies enable them to navigate dense urban areas with minimal disruptions and greater efficiency.

Major retail players have begun testing or deploying autonomous solutions to enhance customer experiences and gain competitive advantages. Moreover, as online shopping continues to surge, demand will only accelerate for cost-effective yet environmentally friendly delivery methods, ultimately redefining both retail and e-commerce landscapes.

Restraints in the Autonomous Delivery Robots Market

High Development and Implementation CostsEstablishing and deploying autonomous delivery robots requires substantial capital outlays from companies. Investments are needed in research, testing, and advanced hardware components such as sensors and navigation systems. Integrating

artificial intelligence software further raises costs, while maintenance, updates, and training obligations create additional financial pressures over time.

Emerging firms often struggle to secure financing, hindering their ability to launch pilot programs or expand services. Complying with safety and operational regulations adds another expense, as meeting required standards typically involves lengthy approval processes. These hurdles can create barriers for new market entrants, inhibiting widespread adoption and profitability.

Limited Range and Security Concerns

Autonomous delivery robots also face constraints related to limited range and security. Their travel distance and battery capacity make longer deliveries impractical. Theft is another concern, prompting companies to invest in locking compartments, GPS tracking, and remote monitoring systems which are measures that reduce but do not eliminate risk. Technical challenges, including navigating complex terrain and adverse weather conditions, further impede operations and limit both the range and profitability of these autonomous delivery solutions.

Opportunities in the Autonomous Delivery Robots Market

Partnership Agreements between Retailers and Logistics Providers

Autonomous delivery robots present an opportunity for retailers and logistics providers to form partnerships that streamline operations. Integrating robotic fleets into existing supply chains allows companies to improve last-mile efficiency, lower operational costs, and meet the growing consumer demand for quick deliveries. Such collaborations enable retailers to leverage their extensive customer reach while using robust logistics networks to optimize routes and ensure timely deliveries.

An example is the collaboration between U.S. postal providers like the USPS and autonomous delivery robot companies, demonstrating how industry stakeholders are testing next-generation solutions in select urban settings. This approach signals an exciting future where robots offer cost-effective and customer-friendly delivery services.

Infrastructure and Environmental Adaptation Strategies

The large-scale implementation of autonomous delivery robots requires modifications to urban infrastructure, which presents an invaluable opportunity for governments, city planners, and private stakeholders. Upgrading pedestrian pathways, enhancing road conditions, and creating dedicated robot lanes can improve operational efficiency while promoting safer coexistence among robots, vehicles, and pedestrians. These improvements can significantly reduce traffic congestion, lower carbon emissions, and support more sustainable urban environments.

Public-private partnerships that invest in sensor networks, advanced signage systems, and real-time data analytics also contribute to seamless navigation. Addressing infrastructure requirements is crucial for fostering an environment where autonomous delivery innovations can thrive.

Trends in the Autonomous Delivery Robots Market

Integration of Advanced AI and Machine Learning SystemsOne of the key trends in the autonomous delivery robots market is the adoption of advanced AI and

machine learning solutions, which provide improved navigation, obstacle avoidance, and real-time decision-making capabilities. These technologies help robots operate smoothly in dynamic environments, while data-driven algorithms adapt to changing route conditions.

According to data from the National Science Foundation, federal funding for AI research in the United States increased by 30% between 2020 and 2023, and reaching 1.9 million dollars. This significant investment drives innovation that benefits delivery robots by enabling robust AI models. As a result, delivery times and operational costs are reduced, contributing to more efficient logistics overall.

Expansion in Urban and Residential Areas

Another emerging trend is the deployment of autonomous delivery robots in congested urban settings and residential neighborhoods to address last-mile delivery challenges. As populations grow, efficient logistics solutions are essential to meet increased demands while reducing traffic congestion and environmental impact. Autonomous robots equipped with sophisticated mapping and sensor technologies can navigate crowded sidewalks, narrow streets, and complex residential layouts.

Real-world environments require robust obstacle detection and adaptation systems to ensure the safety of pedestrians and property. Effective integration in these areas streamlines operations, lowers costs, and enhances customer satisfaction through faster deliveries. This also helps reduce customer support expenses, ultimately improving the overall delivery experience.

Autonomous Delivery Robots Market: Research Scope and Analysis

By Type

Full autonomy robots are projected to lead the market of Autonomous Delivery Robots with the highest revenue share in 2025 as their ability to function without human interaction will likely make them the market leaders. These robots utilize sophisticated machine learning algorithms and real-time data processing to navigate unpredictable environments, avoid obstacles, and make intelligent decisions while on the move. As urban congestion and labor costs escalate, fully autonomous robots offer an efficient last-mile delivery option by cutting costs associated with drivers or additional personnel.

Additionally, advancements in sensor technology, AI-powered route optimization, and robust safety features help these robots meet local regulations while decreasing delivery times. Furthermore, their capacity for 24/7 operation under various environmental conditions makes them cost-efficient, especially for tasks requiring frequent or timed responses.

Semi-autonomous robots represent another dominant segment that depends on human oversight for certain functions or complex decision-making, their use entails remote monitoring or manual intervention during critical situations requiring direct human input. While semi-autonomous solutions still require staffing, their advantages lie in harnessing both human intuition and machine precision. Many businesses adopt semi-autonomous solutions as lower-risk entry points until technology improves and regulatory frameworks change further.

By Load Carrying Capacity

Light payload robots, with capacities of up to 5 kg, are predicted to dominate the global autonomous delivery robot with a revenue share of 54.2% by the end of 2025 due to their cost efficiency, smaller footprint, and ability to adapt seamlessly in urban environments. As online retail continues to expand exponentially, the demand for on-demand delivery of small parcels and consumer goods has surged. This requires maneuverable delivery robots that can bypass traffic jams and navigate crowd-filled sidewalks with minimal disturbance. These robots also tend to face fewer regulatory hurdles and have lower operating costs, which further solidifies their market dominance in 2025.

Medium payload robots (5 kg to 20 kg) are also expected to be highly influential, driven by the increasing consumer demand for heavier items that exceed the capacity of light payload robots. As retailers and logistics providers handle heavier products such as electronics or mid-sized packages, medium payload robots become vital for efficient and cost-effective deliveries.

By Number of Wheels

Four-wheeled are anticipated to lead the autonomous delivery robots market with revenue share by the end of 2025 due to their superior maneuverability, stable quadricycle design, and better cornering capabilities. They handle sidewalks, stairs, and uneven terrains more effectively compared to three-wheeled or six-wheeled variants. The arrangement of four wheels lowers the center of gravity for enhanced balance, enabling navigation in crowded areas with minimal disruptions. With bidirectional drive systems, these robots pivot swiftly, reducing frequent stops or direction changes. Furthermore, their mechanical simplicity and single motor per axle design ensure cost-effectiveness and ease of maintenance, driving broad adoption.

The second dominating segment comprises six-wheeled robots, valued for their higher payload capacity and increased stability over uneven terrains. This additional wheel support accommodates heavier deliveries, making them popular among logistics and e-commerce companies. Their reliability and adaptability foster robust demand and market expansion. As technology advances, four- and six-wheeled models are expected to coexist, addressing diverse delivery needs.

By Verticals

Retail and Logistics are expected to lead the Autonomous Delivery Robots Market by the end of 2025 with a revenue share of 31.5% because of the growth of online shopping coupled with consumer demands for efficient last-mile delivery services which has fueled the widespread adoption of autonomous robots within this sector. Autonomous delivery robots help retailers and logistics providers navigate congested urban areas while simultaneously cutting operational costs without impacting delivery speed. Their real-time route optimization, contactless delivery features, and improved payload capacities make them well-suited to modern retail operations with their logistics-intensive requirements.

Food Service will likely become the second most dominant vertical because of the increasing consumer preference for on-demand restaurant delivery and meal kit services. Autonomous delivery robots present cost-effective and hygienic methods of providing fresh meals directly to customers while maintaining rigorous hygiene standards. As more consumers embrace convenient on-demand deliveries of fresh meals from restaurants or food aggregators, robotic solutions help streamline operations while remaining cost-competitive in an increasingly dynamic market.

The Autonomous Delivery Robots Market Report is segmented based on the following

By Type

- Fully Autonomous Robots

- Semi-Autonomous Robots

By Load Carrying Capacity

- Light Payload (up to 5 kg)

- Medium Payload (5 kg – 20 kg)

- Heavy Payload (more than 20 kg)

By Number of Wheels

- 3 Wheels

- 4 Wheels

- 6 Wheels

By Verticals

- Food Service

- Retail & Logistics

- Healthcare

- Building & Construction

- Others

Regional Analysis

North America is projected to lead the Autonomous Delivery Robots Market with a

revenue share of 51.3% in 2025 due to its superior technological infrastructure, favorable investment climate, and presence of leading technology firms driving innovation. This region's impressive network of research institutions, venture capital firms, and industrial partnerships foster growth in AI technologies like robotics and sensor devices. North America's advanced e-commerce sector, led by online retailers, fuels demand for cost-effective last-mile delivery solutions.

Government policies in North America have long supported autonomous technologies by offering incentives such as pilot programs and commercializing delivery robots, leading to them becoming market leaders in innovation, efficiency, and safety standards. All these factors combine to create North America as a region known for being at the forefront of market leadership.

Asia Pacific stands as one of the fastest-growing regions for autonomous delivery robot market growth, driven by rapid urbanization and consumer demand for efficient delivery solutions. Major economies including China, Japan, and South Korea have made significant investments in AI/robotics technology; providing them an edge against rival nations.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global autonomous delivery robots (ADR) market is characterized by rapid innovation, strategic collaborations, and intense rivalry among key players. Companies are actively forming partnerships and acquiring startups to enhance their technological capabilities and expand their market share. For example, Nuro's 2021 partnership with Walmart to test grocery delivery using autonomous robots exemplifies the collaborative strategies employed in the industry.

Major players are entering into partnerships with retailers, logistics providers, and technology companies to expand their reach and capabilities. These collaborations enable companies to refine their last-mile delivery solutions, a critical aspect of the ADR market. Market leaders are acquiring startups to access specialized technology and expertise. This helps them stay ahead in developing efficient and reliable delivery solutions while simultaneously reducing competition.

Some of the prominent players in the global Autonomous Delivery Robots are

- Uber Technologies

- Starship Technologies

- Postmates Serve Robotics

- Walmart Amazon

- TeleRetail

- Avride

- Gatik

- Robomart

- Refraction AI

- Nuro

- Savioke

- Other Key Players

Recent Developments

- In October 2024, US-based companies Serve Robotics and Wing announced a breakthrough partnership. Serve Robotics is a sidewalk bot delivery expert, while Wing is a drone delivery provider. The companies have partnered to offer a new solution that is expected to revolutionize the last-mile delivery sector. The novel robot-to-drone service will first launch in the Dallas region. Users will be able to order food which will initially be picked up by a Serve bot followed by final delivery within 6 miles by Wing drone AutoLoader.

- In October 2023, Starship Technologies expanded its fleet with a new generation of delivery robots featuring enhanced navigation and obstacle avoidance systems for improved efficiency in urban environments.

- In November 2023, Nuro secured a major partnership with a leading grocery chain to deploy its autonomous delivery vehicles for last-mile grocery delivery, marking a significant step in commercializing autonomous delivery services.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 737.6 Mn |

| Forecast Value (2033) |

USD 6,497.3 Mn |

| CAGR (2024-2033) |

27.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 248.2 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Fully Autonomous Robots, and Semi-Autonomous Robots), By Load Carrying Capacity (Light Payload (up to 5 kg), Medium Payload (5 kg – 20 kg), and Heavy Payload (more than 20 kg)), By Number of Wheels (3 Wheels, 4 Wheels, and 6 Wheels, By Verticals (Food Service, Retail & Logistics, Healthcare, Building & Construction, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Uber Technologies, Starship Technologies, Postmates Serve Robotics, Walmart, Amazon, TeleRetail, Avride, Gatik, Robomart, Refraction AI, Nuro, Savioke, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Autonomous Delivery Robots Market size is estimated to have a value of USD 737.6 million in 2024 and is expected to reach USD 6,497.3 million by the end of 2033.

North America is expected to be the largest market share for the Global Autonomous Delivery Robots Market with a share of about 51.3% in 2024.

Some of the major key players in the Global Autonomous Delivery Robots Market are Starship Technologies, Nuro, Amazon, and many others.

The market is growing at a CAGR of 27.3 percent over the forecasted period.

The US Autonomous Delivery Robots Market size is estimated to have a value of USD 248.2 million in 2024 and is expected to reach USD 1,927.7 million by the end of 2033.