Market Overview

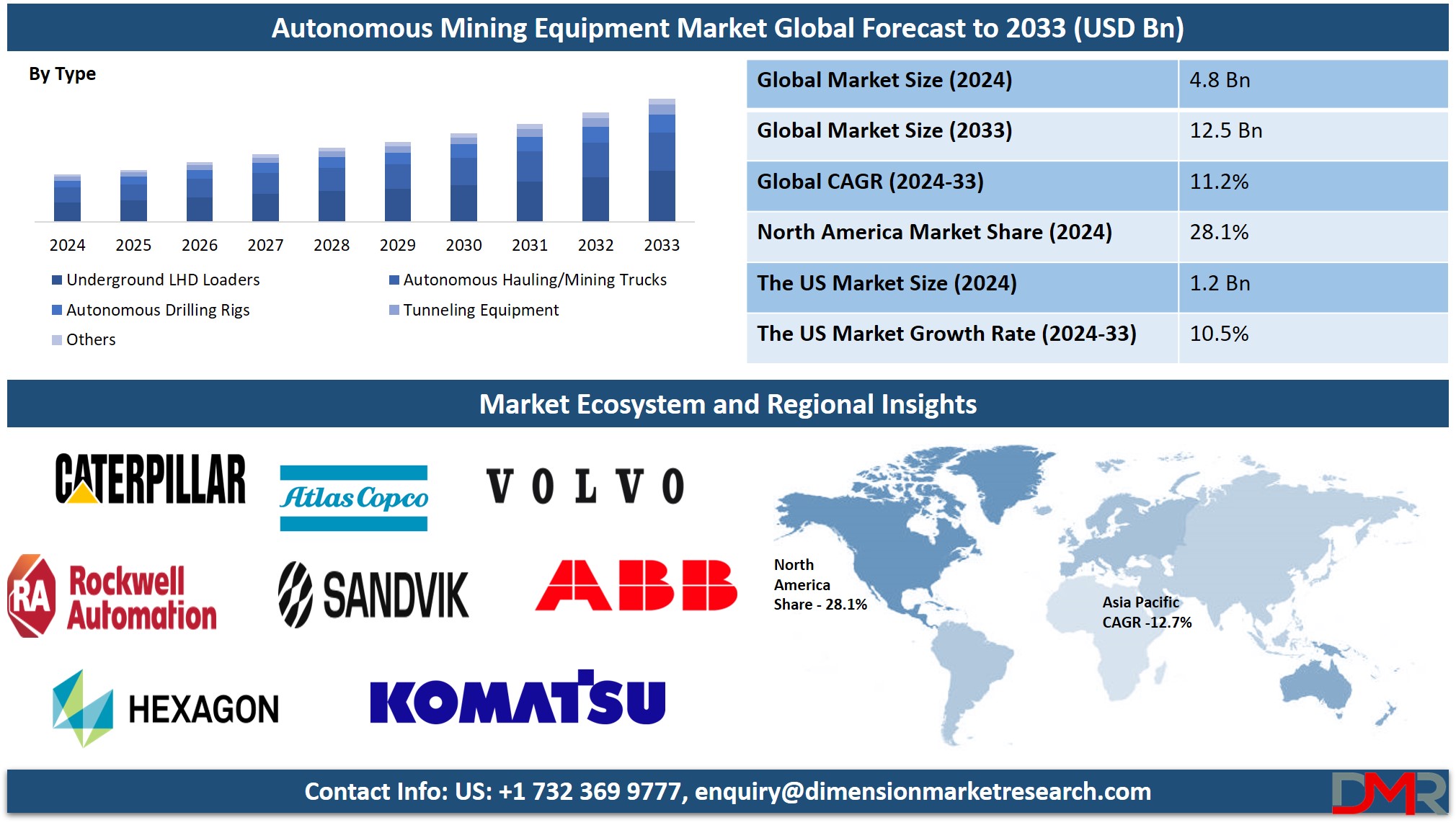

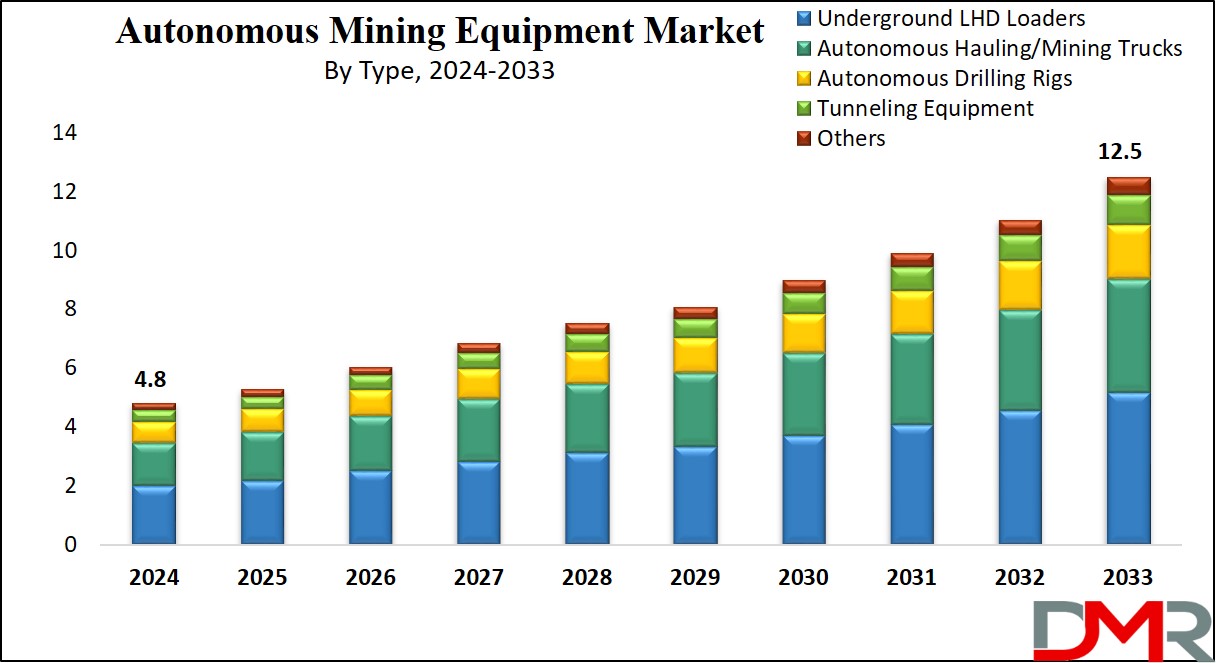

The Global

Autonomous Mining Equipment Market is projected to reach

USD 4.8 billion in 2024 and grow at a compound annual growth rate of

11.2% from there until 2033 to reach a value of

USD 12.5 billion.

Autonomous mining equipment is the machines and vehicles used in mining operations that are capable of performing tasks without human intervention. These include autonomous trucks, loaders, drills, and haulage systems, mostly integrated with advanced technologies like AI, IoT, and GPS for navigation, performance optimization, and safety. They are developed to operate in hazardous and remote environments, highly enhancing operational efficiency, safety, and resource management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, the demand for autonomous mining equipment is driven by the need for increased safety, efficiency, and cost savings. As mining operations grow deeper and in more challenging environments, automation helps reduce risks associated with human labor in dangerous zones. Furthermore, the focus on enhancing productivity and reducing operational costs encourages companies to adopt autonomous systems that work constantly without downtime, thus driving market growth.

Key trends shaping the autonomous mining equipment market include the rising transformation towards electric and hybrid autonomous machines, which lower emissions and operational costs. Another major trend is the higher integration of AI and machine learning into mining operations, allowing for predictive maintenance, real-time data analysis, and optimization of mining activities, which not only enhances the efficiency of mining equipment but also boosts safety and sustainability.

Moreover, the autonomous mining equipment market is witnessing rapid technological development, yet the high initial cost of investment remains a challenge for small-scale operators. As more companies implement automation, there is a major need for skilled labor to manage and maintain these systems. In addition, regions with limited infrastructure and technological expertise may face adoption hurdles. Despite these challenges, the long-term benefits of automation in terms of safety, cost reduction, and productivity continue to drive the market's expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

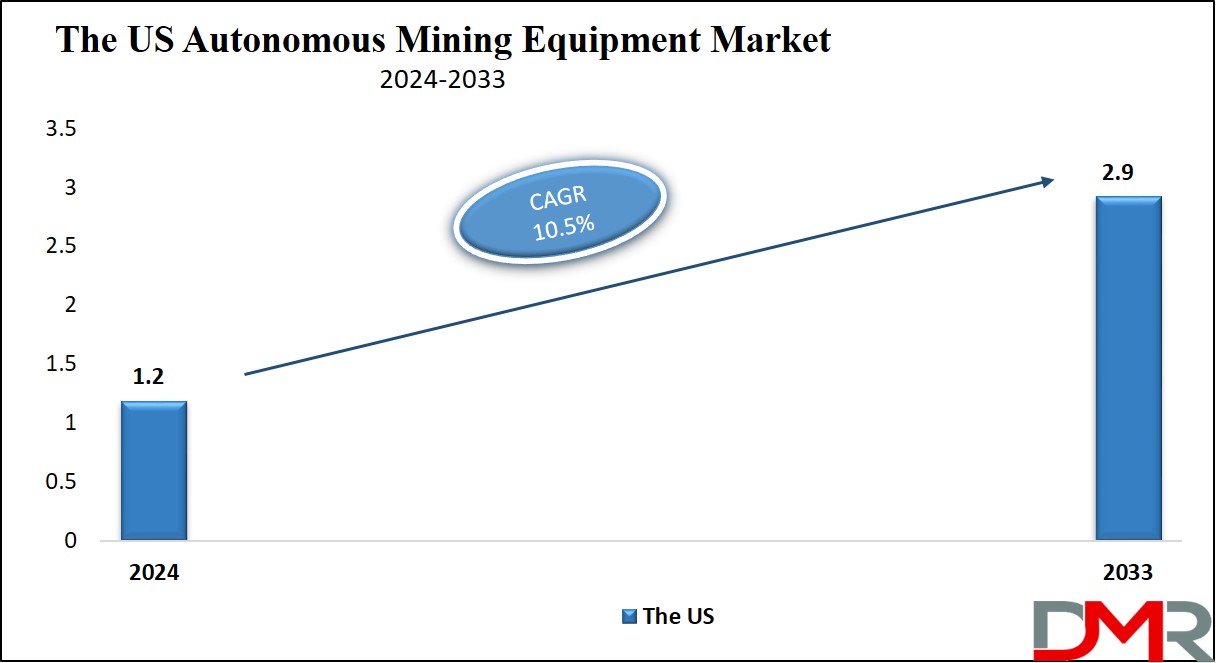

The US Autonomous Mining Equipment Market

The US Autonomous Mining Equipment Market is projected to reach

USD 1.2 billion in 2024 at a compound annual growth rate of

10.5% over its forecast period.

The U.S. provides significant growth opportunities in the autonomous mining equipment market due to its advanced mining sector and strong focus on safety and efficiency. Growing investments in automation, demand for metals vital to renewable energy and technology, and supportive infrastructure drive adoption. In addition, strict safety regulations and environmental goals promoted mining companies to embrace autonomous solutions.

Also, the market is driven by advanced mining technologies, higher demand for efficiency, and strict safety regulations. However, high initial investment costs and the demand for skilled labor to operate and maintain autonomous systems act as restraints, limiting adoption among smaller mining operators and creating challenges in resource-limited regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key Takeaways

- Market Growth: The Autonomous Mining Equipment Market size is expected to grow by USD 7.2 billion, at a CAGR of 11.2% during the forecasted period of 2025 to 2033.

- By Type: The underground LHD loaders segment is anticipated to get the majority share of the Autonomous Mining Equipment Market in 2024.

- By Mines: The surface mines segment is expected to be leading the market in 2024

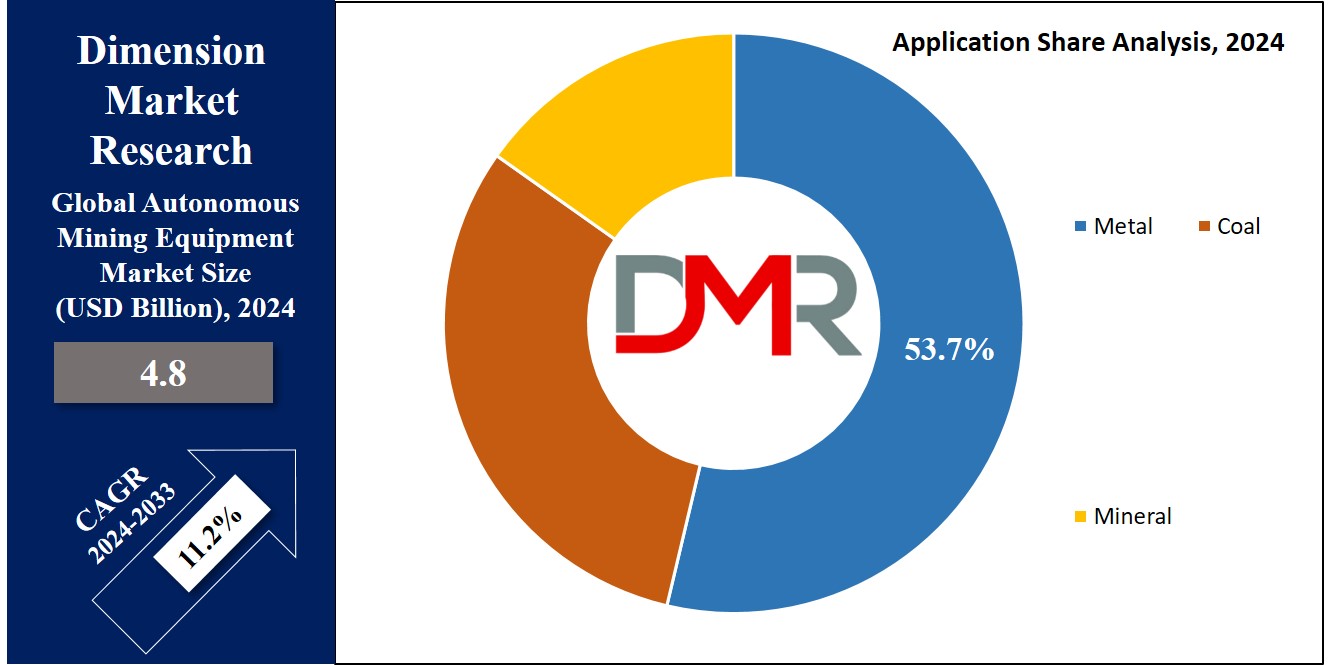

- By Application: The metal segment is expected to get the largest revenue share in 2024 in the Autonomous Mining Equipment Market.

- Regional Insight: Asia Pacific is expected to hold a 39.2% share of revenue in the Global Autonomous Mining Equipment Market in 2024.

- Use Cases: Some of the use cases of Autonomous Mining Equipment include improved safety, cost efficiency, and more.

Use Cases:

- Improved Safety: Autonomous mining vehicles and equipment minimize human involvement in hazardous areas, minimizing the risks from landslides, cave-ins, and toxic exposure in underground and surface mining.

- Increased Productivity: Automated systems work constantly without fatigue, improving operational efficiency and enabling 24/7 operations, which boosts overall productivity.

- Cost Efficiency: Autonomous mining equipment substantially lowers operational costs by optimizing routes, minimizing fuel consumption, and reducing equipment downtime through predictive maintenance.

- Precise Resource Management: Advanced sensors and AI-driven analytics enhances excavation and material handling precision, minimizing waste and enhancing resource utilization.

Market Dynamic

Driving Factors

Rising Focus on Worker Safety

Mining companies are highly prioritizing worker safety due to strict regulations and the high costs of workplace accidents. Autonomous mining equipment minimizes the need for human presence in hazardous zones, ensuring safer operations while maintaining productivity and driving market adoption.

Technological Advancements and AI Integration

The integration of AI, IoT, and advanced sensors allows precise navigation, predictive maintenance, and on-the-spot data analysis. These technologies improve equipment efficiency and operational optimization, encouraging mining firms to invest in autonomous systems to stay competitive and reduce costs.

Restraints

High Initial Investment Costs

Autonomous mining equipment includes higher upfront costs for procurement, installation, and system integration. Small and midsized mining companies may struggle to afford these technologies, slowing adoption rates and restraining market growth in cost-sensitive regions.

Limited Infrastructure and Technical Expertise

Installing autonomous equipment needs robust digital infrastructure, including high-speed connectivity and skilled personnel to manage and maintain the systems. Many mining regions, mainly in developing economies, lack these resources, creating a significant barrier to implementation.

Opportunities

Expansion in Developing Markets

As mining operations grow in emerging economies, there is a major opportunity to introduce autonomous equipment. These regions are largely adopting new technologies to boost efficiency, safety, and productivity, creating a growing demand for autonomous mining solutions.

Integration of Sustainable Practices

Autonomous mining equipment provides opportunities for more sustainable mining practices, like reducing energy consumption and minimizing environmental impact. With growing pressure for eco-friendly operations, mining companies can use automation to meet environmental regulations and enhance their sustainability profile.

Trends

Increased Adoption of Electric and Hybrid Autonomous Equipment

There is a major trend toward the adoption of electric and hybrid-powered autonomous mining equipment. These systems not only minimize emissions and fuel consumption but also lower operational costs, aligning with the mining industry's sustainability goals while improving efficiency.

Integration of Advanced AI and Machine Learning

The use of AI and machine learning is advancing rapidly in autonomous mining, allowing for smarter decision-making, predictive maintenance, and real-time optimization. These technologies enhance the accuracy, efficiency, and safety of mining operations, leading to the broad adoption of autonomous systems across the industry.

Research Scope and Analysis

By Type

Underground LHD (Load-Haul-Dump) loaders play a key role in the growth of the autonomous mining equipment market and are expected to lead the overall market in 2024 by improving efficiency and safety in underground operations. These loaders are vital for transporting mined materials from underground tunnels to surface conveyors or trucks. When equipped with autonomous technology, LHD loaders can operate without human intervention, reducing risks linked with underground mining, such as accidents or exposure to hazardous conditions.

Their ability to work constantly without fatigue higher productivity and reduces downtime. As the mining industry aims to improve safety and cost-efficiency, autonomous LHD loaders offer a reliable solution for handling complex underground tasks, driving the need for automation in this sector. Their adoption is expected to grow, mainly in challenging underground environments, contributing to the overall expansion of autonomous mining equipment.

Further, autonomous hauling/mining trucks are set to significantly grow in the coming years as these trucks transport large quantities of mined materials between different points in a mining site, operating without human drivers. By utilizing advanced technologies like GPS, AI, and sensors, they can navigate rough terrain safely and efficiently.

Autonomous trucks can work around the clock, increasing productivity while reducing fuel costs and labor expenses. Their ability to minimize human error and improve safety in hazardous environments makes them a vital component of modern mining operations, significantly contributing to the expansion of the autonomous mining equipment market.

By Mine

Surface mines play a major role in the growth of the autonomous mining equipment market and are expected to dominate the market in 2024 due to their large-scale operations and the need for efficient, safe, and affordable methods of extraction. In surface mining, the utilization of autonomous equipment like haul trucks, drills, and excavators supports streamlined operations by minimizing the dependency on human labor, enhancing safety, and increasing productivity.

These machines can work constantly, even in harsh weather conditions, minimizing downtime and operational costs. As surface mining operations expand, mainly in remote or challenging environments, the adoption of autonomous equipment becomes highly essential for improving efficiency and meeting safety standards, driving the need for automation technologies in this sector.

In addition, underground mines play a major role in the growth of the autonomous mining equipment market and are also expected to have a significant portion of the market in 2024 by driving the demand for safer and more efficient operations. Autonomous equipment, like LHD loaders and drills, helps reduce the risks linked with underground work, like accidents and exposure to harmful conditions.

These machines can operate constantly, improving productivity while minimizing the need for human presence in hazardous environments. As underground mining becomes more complex, the demand for automation in these mines continues to grow.

By Application

Metal mining is projected to drive the growth of the autonomous mining equipment market as it needs efficient, precise, and continuous operations to extract valuable resources like gold, copper, and iron. Autonomous equipment, like haul trucks, drills, and excavators, helps enhance productivity and safety in metal mining by minimizing human involvement in hazardous tasks and enabling 24/7 operations. These machines can navigate through challenging terrains, optimize extraction processes, and provide real-time data to improve decision-making.

As metal demand increases globally, mainly for industries like electronics, renewable energy, and construction, the demand for advanced, affordable mining solutions grows. Autonomous equipment not only boosts productivity but also reduces operational costs, making it an attractive option for metal mining companies looking to stay competitive and meet sustainability goals, which is contributing to the rapid adoption of automation in the metal mining sector.

Further, coal mining is a significant application driving the growth of the autonomous mining equipment market. With the growing demand for coal, autonomous trucks, drills, and loaders help enhance efficiency and safety in coal extraction. These machines can operate constantly without fatigue, reducing costs and increasing productivity. By minimizing human involvement in dangerous underground or surface operations, autonomous equipment imptoves worker safety, meets regulatory standards, and helps coal mining companies boost their operational performance, fueling market growth in the process.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Autonomous Mining Equipment Market Report is segmented on the basis of the following:

By Type

- Autonomous Hauling / Mining Trucks

- Autonomous Drilling Rigs

- Underground LHD Loaders

- Tunneling Equipment

- Others

By Mine

- Surface Mines

- Underground Mines

By Application

Regional Analysis

Asia Pacific is set to lead the autonomous mining equipment market in 2024 by having a share of

39.2% in 2024 due to its rapidly expanding mining industry. Countries like China, India, Australia, and Indonesia are major regions in coal, metal, and mineral production, driving the requirements for advanced mining technologies. The region’s aims of increasing productivity, enhancing safety, and reducing labor costs have led to a higher adoption of autonomous equipment.

Also, Asia Pacific is investing heavily in technological developments and infrastructure development, which further allows the implementation of automation in mining operations. As the region continues to modernize its mining practices, the adoption of autonomous mining equipment is expected to grow, making it a key contributor to the overall market expansion.

Further, North America will play a key role in the growth of the autonomous mining equipment market, driven by countries like the U.S. and Canada, which are major players in mining, mainly in coal, metals, and precious minerals. The region's focus on enhancing safety, reducing costs, and increasing productivity has led to the adoption of autonomous technology. With developments in AI, automation, and infrastructure, North American mining companies are highly investing in autonomous equipment to optimize operations. In addition, strict safety regulations and environmental concerns are pushing the market toward more automated and efficient solutions, further boosting the region's contribution to market growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the autonomous mining equipment market is characterized by the presence of both established players and emerging startups. Key industry participant’s aim for technological innovation, offering equipment equipped with advanced features like AI, GPS, and real-time data analytics for better efficiency, safety, and productivity.

Companies are investing in R&D to develop more reliable, energy-efficient, and affordable autonomous solutions. Collaboration with mining operators and the integration of automation with existing infrastructure are common strategies. As demand for automation in mining grows, competition intensifies, with players striving to differentiate based on technology, service offerings, and geographic reach.

Some of the prominent players in the Global Autonomous Mining Equipment are

- Caterpillar Inc

- Atlas Copco

- Volvo Group

- ABB Ltd

- Sandvik AB

- Komatsu Ltd

- Rockwell Automation Inc

- Hitachi Construction Machinery Co Ltd

- Hexagon AB

- Autonomous Solution Inc

- Other Key Players

Recent Developments

- In November 2024, Hexagon unveiled the acquisition of Indurad, which highlights Hexagon's commitment to advancing mine productivity, safety, and autonomy through cutting-edge tech, which represents another step towards realizing our vision of fully connected and integrated mine workflows.

- In November 2024, Caterpillar Inc. successfully demonstrated the fully autonomous operation of its Cat® 777 off-highway truck, which is a major milestone in Caterpillar’s objective to deliver an autonomous hauling solution for the quarry and aggregates sector, as it also highlights the progress being made between Caterpillar and Luck Stone, the largest family-owned and operated producer of crushed stone, sand, and gravel in the United States.

- In October 2024, Scania announced a partnership with Australian mining services provider Regroup to launch its first fleet of autonomous in-pit mining trucks in commercial operations. These autonomous rigid G 560 8x4 tippers will begin operations at Element 25’s Butcherbird Mine in Western Australia’s Pilbara region by late 2025.

- In September 2024, Bell unveiled a technology collaboration with MacLean to enhance support for the transforming needs of mining customers. The innovations being introduced will enhance equipment interoperability, how machines exchange and make use of information, enhance safety for workers, drive sustainable practices, and reduce vehicle emissions.

- In September 2024, Liebherr and Fortescue announced a partnership and launched the jointly developed autonomous battery-electric T 264 truck, as it will develop and validate a range of zero-emission mining solutions, which will result in the supply of 475 new Liebherr machines with Fortescue’s innovative green technology to Fortescue’s operations in Western Australia. Further, Fortescue's mining fleet consumed approximately 400 million liters of diesel in FY24 and accounted for 51 percent of its Scope 1 emissions.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.8 Bn |

| Forecast Value (2033) |

USD 4.8 Bn |

| CAGR (2024-2033) |

11.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Autonomous Hauling / Mining Trucks, Autonomous Drilling Rigs, Underground LHD Loaders, Tunneling Equipment, and Others), By Mine (Surface Mines and Underground Mines), By Application (Metal, Coal, and Mineral) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Caterpillar Inc, Atlas Copco, Volvo Group, ABB Ltd, Sandvik AB, Komatsu Ltd, Rockwell Automation Inc, Hitachi Construction Machinery Co Ltd, Hexagon AB, Autonomous Solution Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Autonomous Mining Equipment Market?

▾ The Global Autonomous Mining Equipment Market size is expected to reach a value of USD 4.8 billion in 2024 and is expected to reach USD 12.5 billion by the end of 2033.

Which region accounted for the largest Global Autonomous Mining Equipment Market?

▾ Asia Pacific is expected to have the largest market share in the Global Autonomous Mining Equipment Market with a share of about 39.2% in 2024.

How big is the Autonomous Mining Equipment Market in the US?

▾ The Autonomous Mining Equipment Market in the US is expected to reach USD 1.2 billion in 2024.

Who are the key players in the Global Autonomous Mining Equipment Market?

▾ Some of the major key players in the Global Autonomous Mining Equipment Market are Caterpillar Inc, Atlas Copco, Volvo Group, and others

What is the growth rate in the Global Autonomous Mining Equipment Market?

▾ The market is growing at a CAGR of 11.2 percent over the forecasted period.