Market Overview

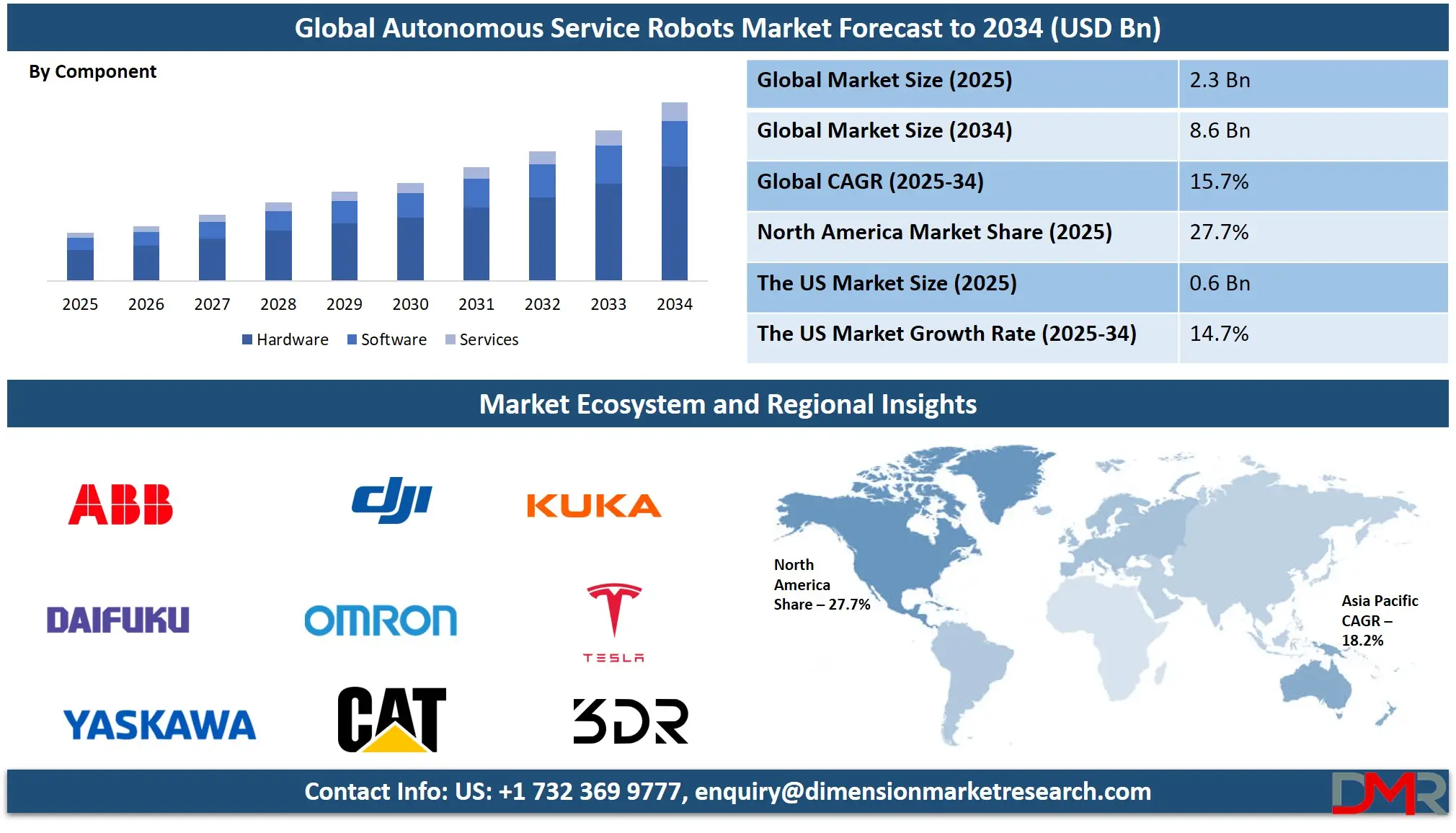

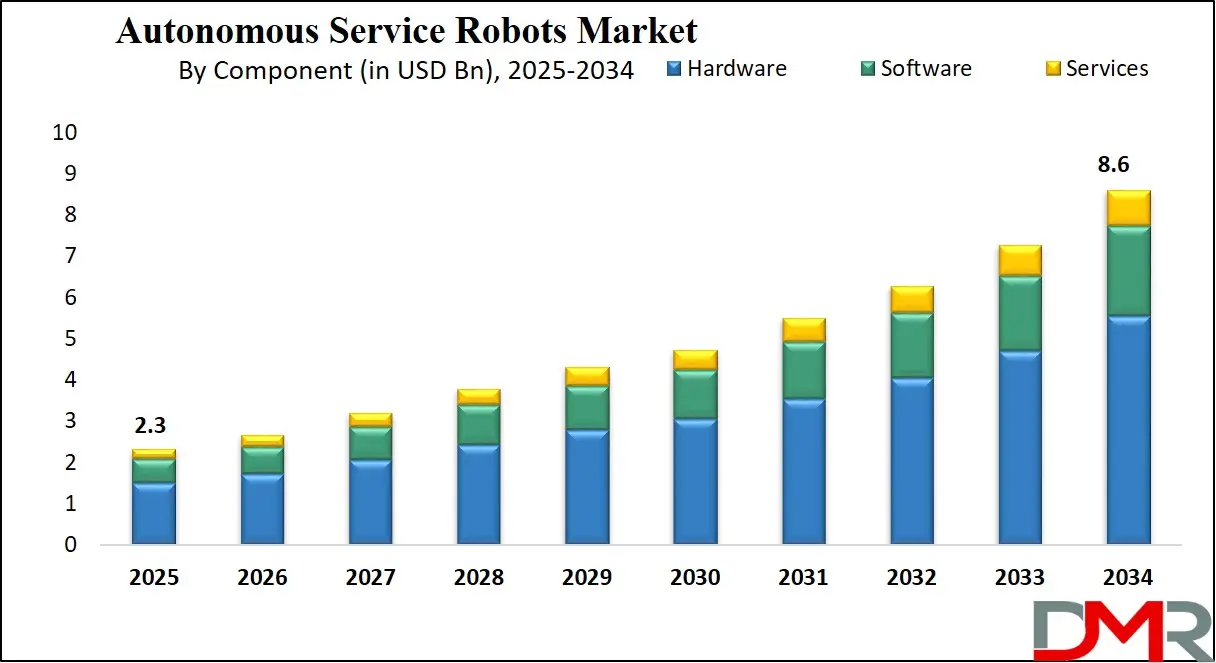

The Global Autonomous Service Robots Market size is projected to reach USD 2.3 billion in 2025 and grow at a compound annual growth rate of 15.7% from there until 2034 to reach a value of USD 8.6 billion.

Autonomous Service Robots are machines that perform useful tasks for humans or equipment without direct human control. These robots are equipped with sensors, artificial intelligence (AI), and software that allow them to navigate, make decisions, and complete tasks independently. One can find them in places like hospitals, hotels, warehouses, and even in homes. Their role is not to replace people but to help make work easier, faster, and safer. They can carry out cleaning, delivery, inspection, and many other services while adapting to changes in their surroundings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In the last few years, the demand for these robots has grown across many sectors. Hospitals have used them for delivering medicine and food to reduce human contact during health crises like the COVID-19 pandemic. In warehouses and logistics, robots are used to move items and manage inventory. Hotels and airports use them to guide guests and answer questions. This rise is driven by the need to improve efficiency, reduce costs, and maintain safe distances in crowded or risky environments. With more businesses adopting automation, the presence of autonomous service robots has become common.

A key development in this field is the rise of adaptive robots. These are robots that can change their behavior based on what’s happening around them. For example, if a delivery robot finds its usual path blocked, it can quickly find a new route, which makes them more useful in real-life situations, where things often don’t go as planned. Adaptive robots are helping autonomous service robots become more reliable, smarter, and more human-like in how they work.

Another interesting area is swarm robotics, which is when many small robots work together like a team, inspired by how ants or bees behave. These robots share information and coordinate their actions to complete large or complex tasks. In cleaning large areas or organizing warehouse stock, swarm robotics adds a new level of flexibility and speed. By working as a group, these robots can do things that one robot alone might find difficult.

Recent years have also seen progress in how these robots interact with humans. They are now designed to understand voice commands, respond to gestures, and even show facial expressions. These features make them easier to work with and more accepted by people. As a result, industries like healthcare and hospitality are welcoming these robots more openly. The trust and comfort level between humans and robots is improving steadily.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Looking ahead, the future of autonomous service robots seems promising. New technologies are making them smarter, smaller, and more affordable. Companies are investing in research to create robots that can do more complicated tasks with better precision. Governments and educational institutions are also supporting this growth by funding robotics programs and encouraging innovation. With these combined efforts, autonomous service robots are expected to play an even bigger role in day to day lives in the future.

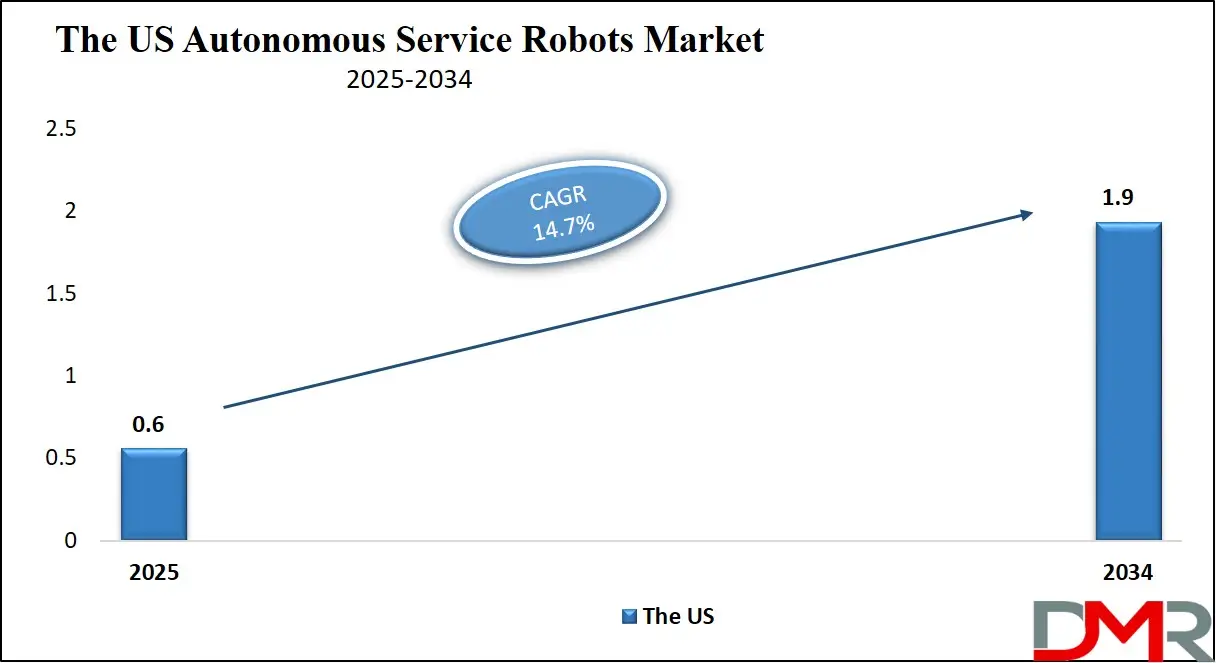

The US Autonomous Service Robots Market

The US Autonomous Service Robots Market size is projected to reach USD 0.6 billion in 2025 at a compound annual growth rate of 14.7% over its forecast period.

The US plays a major role in the autonomous service robots market by driving innovation and adoption across many industries. It has a strong technology ecosystem with leading research institutions and companies focused on developing advanced robotics, AI, and sensor technologies. The US market benefits from significant investments in automation to improve healthcare, logistics, hospitality, and retail services.

Government support and funding for robotics research also help accelerate development. Additionally, the US has a large base of early adopters willing to implement new robotic solutions, which boosts market growth. The country’s focus on smart infrastructure and Industry 4.0 initiatives further encourages the integration of autonomous robots in daily operations. Overall, the US continues to be a key player shaping the future of autonomous service robots globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Autonomous Service Robots Market

Europe Autonomous Service Robots Market size is projected to reach USD 0.5 billion in 2025 at a compound annual growth rate of 15.7% over its forecast period.

Europe is vital to the growth of the autonomous service robots market through strong research, innovation, and adoption across multiple sectors. European countries invest heavily in robotics technology, focusing on safety, efficiency, and sustainability. The region’s healthcare, manufacturing, and logistics industries are adopting robots to improve productivity and reduce labor shortages. Europe also emphasizes ethical and regulatory frameworks to ensure responsible robot use, which helps build trust among users.

Collaboration between universities, research centers, and businesses drives cutting-edge developments in AI, sensors, and adaptive robotics. Additionally, government programs and funding support startups and innovation hubs, accelerating market growth. With its focus on quality and advanced technology, Europe remains a key contributor to the global expansion of autonomous service robots.

Japan Autonomous Service Robots Market

Japan Autonomous Service Robots Market size is projected to reach USD 0.1 billion in 2025 at a compound annual growth rate of 16.6% over its forecast period.

Japan plays an important role in the autonomous service robots market thanks to its long history of robotics innovation and strong government support. The country focuses on developing robots that assist in healthcare, elderly care, hospitality, and manufacturing. Japan faces a rapidly aging population, which drives the demand for service robots to support daily living and reduce the burden on caregivers.

Japanese companies and research institutions are known for creating reliable, high-quality robots with advanced AI and sensor technologies. The government actively funds robotics projects and promotes collaboration between industry and academia. Japan’s strong robotics culture and early adoption help it maintain a competitive edge, making it a key global player in advancing autonomous service robots for both domestic and international markets.

Autonomous Service Robots Market: Key Takeaways

- Market Growth: The Autonomous Service Robots Market size is expected to grow by USD 6.0 billion, at a CAGR of 15.7%, during the forecasted period of 2026 to 2034.

- By Component: The hardware segment is anticipated to get the majority share of the Autonomous Service Robots Market in 2025.

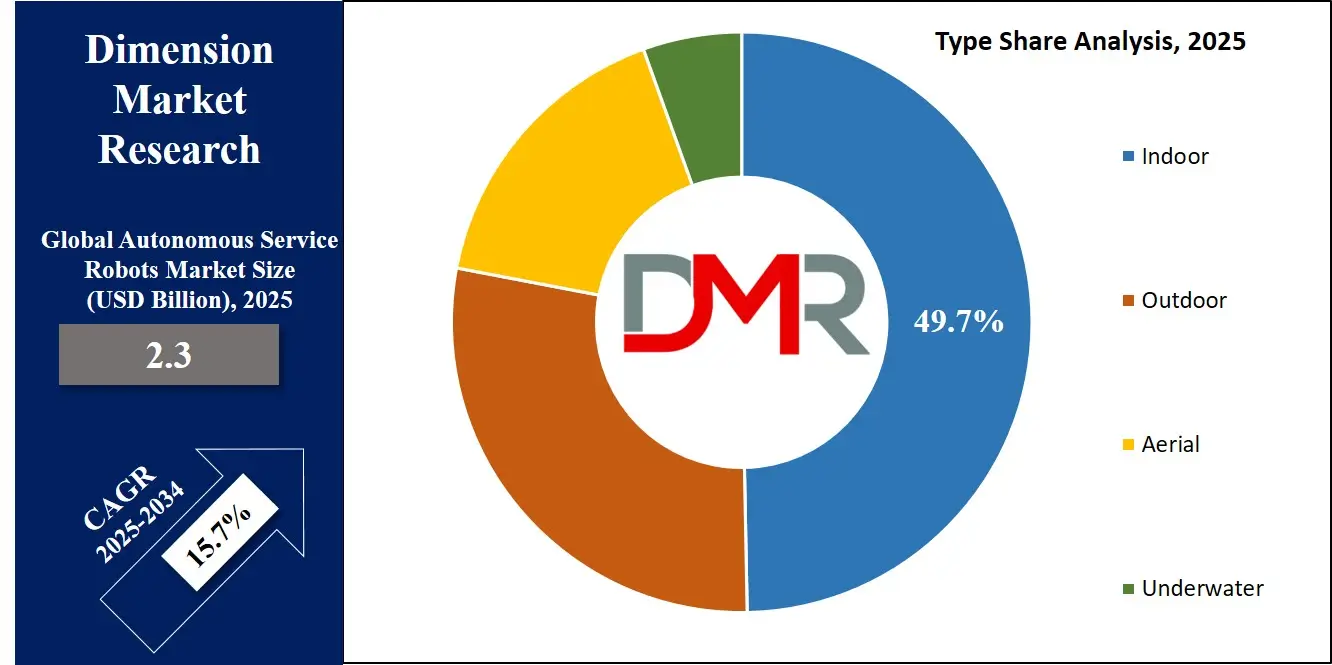

- By Type: The indoor segment is expected to get the largest revenue share in 2025 in the Autonomous Service Robots Market.

- Regional Insight: Asia Pacific is expected to hold a 29.1% share of revenue in the Global Autonomous Service Robots Market in 2025.

- Use Cases: Some of the use cases of Autonomous Service Robots include healthcare assistance, warehouse & inventory management, and more.

Autonomous Service Robots Market: Use Cases

- Healthcare Assistance: Autonomous service robots are used in hospitals to deliver medications, transport medical supplies, and help with routine tasks. They also assist in reducing the workload of medical staff and minimizing human contact, mainly in infectious zones. Their ability to navigate crowded spaces and adapt to changing hospital environments makes them highly effective.

- Hospitality and Customer Service: In hotels and restaurants, robots assist guests by delivering room service, providing information, and guiding them to different areas. They enhance the guest experience by offering quick, contactless, and around-the-clock service. Their presence also helps businesses manage staff shortages and improve efficiency.

- Warehouse and Inventory Management: Autonomous robots help move goods, sort packages, and manage stock levels in warehouses and fulfillment centers. They reduce human labor for repetitive and physically demanding tasks. Their ability to work non-stop boosts productivity and speeds up order processing.

- Cleaning and Disinfection: These robots are widely used for cleaning floors in malls, airports, and offices, as well as for disinfecting surfaces in healthcare facilities. They follow pre-set routes or adjust paths in real-time, ensuring thorough coverage. Their consistent performance helps maintain hygiene and safety in public spaces.

Stats & Facts

- According to the International Federation of Robotics, China installed 276,288 industrial robots in 2023, accounting for 51% of global installations and bringing its operational stock to nearly 1.8 million units, making it the only country with such a vast robotic presence on the factory floor.

- As per the World Intellectual Property Organization (WIPO), industrial robot installations globally grew at an average annual rate of 13.3% between 2012 and 2022, effectively doubling since 2015, with forecasts estimating up to 700,000 new installations annually by 2026.

- According to the International Federation of Robotics, India recorded the fastest global growth in industrial robot installations in 2023, with a 59% year-on-year increase reaching 8,510 units; the automotive sector alone saw a 139% surge to 3,551 units.

- As stated by the International Federation of Robotics, Japan remained the second-largest global robot market in 2023, though installations fell by 9% to 46,106 units following strong years in 2021 and 2022, with medium- to high-single-digit growth expected from 2025 onwards.

- According to the International Federation of Robotics, Europe reached an all-time high of 92,393 industrial robot installations in 2023—up 9% from the previous year—largely due to demand from the automotive sector, nearshoring trends, and the clearing of project backlogs.

- According to the World Intellectual Property Organization, global sales of professional service robots jumped 48% in 2022 to nearly 158,000 units, with the Robotics as a Service (RaaS) segment growing by 50% to surpass 21,000 units.

- As per the International Federation of Robotics, Germany, Europe’s largest industrial robot market and the only one in the global top five, increased its installations by 7% in 2023 to 28,355 units, while Italy and France experienced respective declines of 9% and 13%.

- According to the International Federation of Robotics and the World Intellectual Property Organization, the Republic of Korea installed 31,444 industrial robots in 2023 (down just 1%) and remains the global leader in robots relative to GDP.

- As per the World Intellectual Property Organization, hospitality robots saw a 125% spike in global sales in 2022, making them one of the fastest-growing segments of the service robot market, whereas medical robot sales declined by 4% during the same year.

- As reported by the International Federation of Robotics, EU countries accounted for 80% of Europe’s total 92,393 industrial robot installations in 2023, with robust growth in countries like Spain (+31%), Slovakia (+48%), and Hungary (+31%).

Market Dynamic

Driving Factors in the Autonomous Service Robots Market

Rising Demand for Automation Across Industries

One of the main drivers of growth in the autonomous service robots market is the increasing need for automation in various industries. Businesses are under pressure to improve efficiency, cut costs, and reduce human errors in routine tasks. Service robots offer consistent performance, operate around the clock, and require minimal supervision, making them an attractive solution.

In sectors like healthcare, logistics, and hospitality, these robots are used for delivery, monitoring, and customer service roles. The shift toward contactless services, especially after global health concerns, has further pushed companies to adopt automation. As more industries recognize the benefits, the demand for advanced, reliable robots continues to grow. This is creating a strong market base and fueling innovation in robot design and function.

Advancements in Artificial Intelligence and Sensor Technology

Another key growth factor is the rapid improvement in AI and sensor technologies, which has made autonomous service robots smarter and more capable. Modern robots can now understand their surroundings, learn from experiences, and make decisions in real-time. This progress allows them to adapt to changing environments, interact with humans more naturally, and handle complex tasks more effectively.

Sensors help them detect obstacles, follow specific routes, and respond to voice commands or gestures. These advancements not only improve robot performance but also boost user trust and acceptance. As technology continues to evolve, robots are becoming more affordable and easier to integrate into existing systems. This makes it easier for businesses of all sizes to adopt them, contributing to steady market expansion.

Restraints in the Autonomous Service Robots Market

High Initial Costs and Integration Challenges

One of the major restraints in the autonomous service robots market is the high initial cost of purchasing and setting up these systems. Many businesses, especially small and medium-sized ones, find it difficult to invest in expensive robots and the necessary infrastructure to support them. Beyond the cost of the robot itself, there are expenses related to software, maintenance, training, and system integration.

Some existing environments may require structural changes or technical upgrades to accommodate robotic operations. This can lead to long implementation times and slow return on investment. For industries with tight budgets or limited technical resources, this becomes a significant barrier to adoption. These factors can delay decision-making and limit the market’s growth in less developed regions.

Limited Flexibility in Complex or Unstructured Environments

While autonomous service robots are becoming more advanced, they still face challenges in complex or unpredictable environments. These robots often struggle in places that lack clear navigation paths or where frequent changes occur, such as outdoor areas or busy public spaces. Their decision-making depends on data from sensors and AI, which may not always be accurate or quick enough in highly dynamic situations.

This limits their effectiveness in certain use cases that require human-level adaptability and critical thinking. Errors in navigation or interaction can lead to service disruptions or safety concerns. As a result, some industries remain cautious about fully relying on robots, preferring human involvement in complex or sensitive tasks. This limits broader usage in diverse settings.

Opportunities in the Autonomous Service Robots Market

Expansion into Healthcare and Medical Applications

The healthcare sector offers a promising opportunity for the swarm robotics market as demand for efficient, precise, and scalable solutions grows. Swarm robots can assist in tasks like disinfecting hospitals, delivering medicines, or even performing coordinated micro-surgeries in the future.

Their ability to work together in tight spaces and adapt to dynamic environments makes them ideal for crowded medical settings. With the rise of telemedicine and remote healthcare, swarm robotics could provide automated support that reduces the workload on medical staff. As healthcare providers seek safer and faster ways to deliver services, integrating swarm robotics presents a chance for significant growth and innovation.

Integration with Internet of Things (IoT) and Smart Cities

Swarm robotics holds great potential in the development of smart cities, where robots can work together to manage urban infrastructure more efficiently. Connected through IoT networks, swarm robots can monitor traffic, maintain public spaces, and assist in waste management with minimal human supervision.

This integration allows for real-time data sharing and quicker responses to city needs like road repairs or emergencies. As urban populations grow, the demand for automated, scalable solutions to maintain city services will increase. Swarm robotics, combined with Internet of Things (IoT), offers a valuable opportunity to create safer, cleaner, and more responsive urban environments.

Trends in the Autonomous Service Robots Market

Rise of Collaborative and Mobile Manipulator Robots

A prominent trend in the autonomous service robots market is the increasing adoption of collaborative robots, or cobots, designed to work safely alongside humans. Advancements in sensors, vision technologies, and smart grippers have enabled these robots to respond in real-time to environmental changes, making them suitable for tasks requiring heavy lifting, repetitive motions, or operations in hazardous environments.

Furthermore, the development of mobile manipulators, robots that combine mobility with robotic arms, has expanded their applications in industries such as automotive, logistics, and aerospace. These mobile manipulators can navigate complex environments and perform tasks like inspections and maintenance, addressing labor shortages and enhancing productivity.

Integration of AI and Advanced Sensor Technologies

Another major trend is the integration of artificial intelligence (AI) and advanced sensor technologies into service robots. AI allows robots to learn from data, adapt to new situations, and improve their performance over time, facilitating enhanced decision-making and personalized interactions with users.

Modern service robots are equipped with high-resolution cameras, LiDAR systems, and advanced tactile sensors, allowing for precise movements and better environmental perception. These technological advancements have expanded the capabilities of service robots, allowing them to perform complex tasks with minimal human intervention in dynamic environments.

Research Scope and Analysis

By Component Analysis

Hardware as a component in the autonomous service robots market will be a major driver of growth in 2025, with an estimated share of 64.4%, which includes key physical parts like sensors, cameras, processors, motors, and batteries that allow robots to move, sense their environment, and perform tasks independently. Improvements in hardware technology are making robots more efficient, durable, and capable of working in different conditions.

Better sensors and processors help robots navigate complex spaces and respond quickly to changes. As the demand for reliable and versatile service robots grows across industries like healthcare, logistics, and hospitality, investment in hardware development will continue to rise. This hardware progress is essential for making autonomous service robots smarter and more adaptable, which supports the overall expansion of the market.

Software as a component plays a vital role in the growth of the autonomous service robots market, which includes robots designed to perform tasks without human control using AI and programming. The software controls how these robots understand their environment, make decisions, and interact with people.

Advances in software, such as machine learning, navigation algorithms, and voice recognition, allow robots to perform complex jobs more accurately and safely. Software updates can improve robot performance without changing the physical parts, making robots more flexible for different uses. With significant growth expected over the forecast period, improvements in software will continue to enhance the capabilities of autonomous service robots, driving wider adoption across industries like healthcare, retail, and logistics.

By Type Analysis

As a type, the indoor type will be a major growth driver of the autonomous service robots market in 2025, with an estimated share of 49.7%. These robots are designed to operate inside buildings such as hospitals, hotels, offices, and warehouses. They help with tasks like cleaning, delivery, security, and customer assistance. Indoor robots are growing in demand because they can navigate controlled environments efficiently and safely.

Their ability to work alongside humans in busy indoor spaces without causing disruptions adds to their appeal. With advances in navigation, sensors, and AI, indoor autonomous service robots are becoming more reliable and versatile. As more industries look to improve productivity and reduce manual labor indoors, this segment is expected to see steady growth.

Aerial as a type, will also contribute to the growth of the autonomous service robots market, referring to robots that operate in the air, such as drones. Autonomous service robots are machines that perform tasks without direct human control, and aerial robots specialize in tasks like inspection, surveillance, delivery, and mapping.

These flying robots are useful in places that are hard to reach or dangerous for people. With improvements in flight control, sensors, and battery life, aerial robots are becoming more efficient and widely used. Over the forecast period, significant growth is expected as industries like agriculture, construction, and logistics adopt aerial robots to increase safety and save time. Their flexibility and speed make them a valuable part of the autonomous service robots market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Navigation Technology Analysis

LiDAR-based navigation technology will hold a key position in the growth of the autonomous service robots market in 2025, with an expected share of 36.6%. LiDAR uses laser beams to create detailed maps of the robot’s surroundings, allowing precise detection of obstacles and accurate movement in complex environments. This technology helps robots navigate smoothly indoors and outdoors, avoiding collisions and adjusting routes in real time.

LiDAR improves the safety and efficiency of autonomous service robots used in hospitals, warehouses, and public spaces. As industries demand higher accuracy and reliability from service robots, the adoption of LiDAR navigation systems is set to rise. Continuous advancements in LiDAR technology, such as smaller size and lower costs, will further support the expansion of autonomous service robots in various sectors.

Also, hybrid systems as a navigation technology will contribute to the growth of the autonomous service robots market, combining different methods like LiDAR, vision, GPS, and ultrasonic sensors. Autonomous service robots perform tasks independently, and hybrid navigation helps them operate in diverse and challenging environments by using multiple sensors to improve accuracy and reliability.

This approach allows robots to adapt to changes and work efficiently both indoors and outdoors. Over the forecast period, hybrid systems will see significant growth due to their ability to overcome the limitations of single navigation technologies. As industries seek robots that can perform complex tasks with greater precision, hybrid navigation technology will become increasingly important in driving market expansion.

By Application Analysis

As an application, domestic will play a significant role in the growth of the autonomous service robots market in 2025, with an estimated share of 34.7%. These robots are designed to assist with everyday household tasks such as cleaning, lawn mowing, and security monitoring. The convenience of having robots that can perform routine chores helps users save time and effort. Advances in user-friendly designs, smart sensors, and AI make domestic robots more efficient and adaptable to different home environments.

As more people look for automated solutions to simplify their daily lives, demand for domestic autonomous service robots is set to increase. Growing awareness of smart home technologies and rising disposable incomes will further drive the adoption of these robots, supporting steady market growth.

Further, healthcare as an application will also contribute significantly to the autonomous service robots market, involving robots that assist medical staff and patients in hospitals and clinics. Autonomous service robots in healthcare perform tasks such as delivering medicines, disinfecting rooms, and supporting patient care. These robots help reduce the risk of infections and ease the workload on healthcare workers. With a growing focus on improving patient outcomes and managing labor shortages, healthcare facilities are adopting robots more widely.

Over the forecast period, the demand for healthcare robots will see significant growth due to technological advancements and the need for efficient, contactless services. This will play a key role in expanding the market for autonomous service robots.

By End User Analysis

Residential as an end user will play an important role in the growth of the autonomous service robots market in 2025, with an estimated share of 30.8%. These robots are designed to assist homeowners with daily chores like cleaning, security, and even companionship. As people increasingly adopt smart home technologies, autonomous robots become valuable tools that make life easier and more convenient. Rising awareness about home automation and improvements in robot affordability and usability are driving demand.

Additionally, busy lifestyles and the desire for more free time encourage the use of residential service robots. Over the forecast period, the residential segment is set to grow steadily as more households seek efficient solutions to manage routine tasks, contributing significantly to the overall expansion of the autonomous service robots market.

Healthcare as an end user will also be a major contributor to the autonomous service robots market, involving robots that assist medical professionals and patients in hospitals, clinics, and care facilities. Autonomous service robots in healthcare perform tasks such as medicine delivery, patient monitoring, sanitation, and assistance with mobility.

These robots help reduce human error, increase efficiency, and minimize infection risks, which is especially important in busy healthcare environments. With the growing demand for better patient care and workforce support, the healthcare segment is expected to see significant growth over the forecast period. This rising adoption of service robots in healthcare will play a crucial role in driving the market forward.

The Autonomous Service Robots Market Report is segmented on the basis of the following:

By Component

- Hardware

- Sensors

- Actuators

- Power Supply

- Control Systems

- Software

- Navigation & Mapping

- AI & Machine Learning Algorithms

- Fleet Management

- Services

- Maintenance

- Integration

- Training

By Type

- Indoor

- Outdoor

- Aerial

- Underwater

By Navigation Technology

- LiDAR-based

- Vision-based

- GPS-based

- Ultrasonic/Infrared-based

- Hybrid Navigation

By Application

- Domestic

- Cleaning Robots

- Lawn-Mowing Robots

- Entertainment Robots

- Commercial

- Delivery Robots

- Security & Surveillance Robots

- Hospitality Robots

- Retail Robots

- Industrial

- Inventory & Warehouse Robots

- Inspection Robots

- Healthcare

- Medical Assistance Robots

- Disinfection Robots

- Elderly Care Robots

By End User

- Residential

- Commercial

- Industrial

- Healthcare

- Defense & Security

- Agriculture

- Logistics

Regional Analysis

Leading Region in the Autonomous Service Robots Market

Asia Pacific will be leading the autonomous service robots market in 2025, with an estimated share of 29.1%. This region is growing rapidly due to several factors, including expanding industries like healthcare, logistics, and hospitality that increasingly rely on automation. Countries here are investing heavily in robotics technology to improve efficiency and meet the needs of growing populations and urbanization.

The increase in labor costs and shortage of skilled workers also encourage businesses to adopt autonomous service robots. In addition, governments are supporting innovation through funding and policies that promote smart manufacturing and digital infrastructure. The presence of major technology hubs and manufacturing centers further boosts the development and deployment of these robots. Overall, Asia Pacific’s dynamic economy and focus on modernization make it a key driver in the global growth of autonomous service robots.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Autonomous Service Robots Market

Latin America is showing significant growth in the autonomous service robots market over the forecast period, driven by increasing automation in industries such as healthcare, retail, and logistics. The region is gradually adopting robotics to improve productivity and address labor shortages. Rising awareness about the benefits of service robots and growing investments in technology infrastructure are helping expand their use.

Several countries are focusing on modernizing their manufacturing and service sectors, which supports market growth. Despite some challenges like high costs and limited technical expertise, Latin America is making steady progress in integrating autonomous service robots, contributing to the broader global development of this technology in 2025 and beyond.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market for autonomous service robots is highly active and growing, with many players competing to develop smarter, more reliable, and cost-effective solutions. Companies are focusing on making robots that can handle different tasks, from cleaning and delivery to security and customer service. Innovation is a key focus, with teams working on better navigation, obstacle detection, and user-friendly designs. New ideas like adaptive behavior and team-based robot coordination are also shaping the competition.

As more industries see the benefits of using these robots, businesses are racing to offer specialized features for different needs. Partnerships, research programs, and global expansion are common strategies. Overall, the market is fast-paced, full of ideas, and open to newcomers with strong technology and fresh thinking.

Some of the prominent players in the global Autonomous Service Robots are:

- ABB

- Tesla

- Kuka AG

- Yaskawa Electric Corporation

- DJI

- Omron Corp

- Daifuku

- Mitsubishi Electric

- Kawasaki Robotics

- Caterpillar Inc

- Panasonic Corp

- Husqvarna AB

- SSI Schaefer

- Smith & Nephew Plc

- JBT Corp

- Inovance Technology

- 3DR

- Built Robotics

- Other Key Players

Recent Developments

- In March 2025, Hexagon launched a new Robotics division, building on its strengths in measurement technologies, AI, and autonomous systems to advance humanoid robotics and support true autonomy for its customers. With breakthroughs in AI, simulation, and reinforcement learning, robotic systems are becoming more capable of navigating complex environments and performing sophisticated tasks. As a leader in measurement and sensor technology, Hexagon is well-positioned to drive this progress by offering spatial intelligence and digital twins that help robots learn, adapt, and act effectively in real-world settings.

- In October 2024, Zetes, a supply chain execution expert and part of the Panasonic Group, increased its investment in Danish robotics firm Robotize to a 50% stake, joining the company's founding shareholders. Robotize is known for its advanced Autonomous Mobile Robots (AMRs), which allow Zetes to create more integrated and efficient logistics solutions. By combining expertise, the move addresses key industry challenges, such as labor shortages, and supports the growing demand for automation in supply chain operations.

- In August 2024, Serve Robotics Inc., a leading autonomous sidewalk delivery company, has partnered with Shake Shack Inc. to deliver orders using Serve’s robots through Uber Eats in select Los Angeles locations, which highlights a new milestone in expanding robotic deliveries on the Uber Eats platform, which has featured Serve’s services in LA since 2022. The partnership reflects Serve’s ongoing growth, with plans for broader U.S. expansion, and highlights its strong relationship with Uber Eats and national merchants like Shake Shack.

- In June 2024, Rockwell Automation, Inc. has expanded its collaboration with NVIDIA to advance safer, smarter industrial AI mobile robots. Building on earlier efforts to scale AI in manufacturing, the partnership will include robotics, focusing on boosting the performance of autonomous mobile robots (AMRs). By integrating the NVIDIA Isaac robotics platform, Rockwell aims to deliver enhanced AMR and automation solutions, helping industrial customers improve factory efficiency and tap into untapped potential.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.3 Bn |

| Forecast Value (2034) |

USD 8.6 Bn |

| CAGR (2025–2034) |

15.7% |

| The US Market Size (2025) |

USD 0.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Type (Indoor, Outdoor, Aerial, and Underwater), By Navigation Technology (LiDAR-based, Vision-based, GPS-based, Ultrasonic/Infrared-based, and Hybrid Navigation), By Application (Domestic, Commercial, Industrial, and Healthcare), By End User (Residential, Commercial, Industrial, Healthcare, Defense & Security, Agriculture, and Logistics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABB, Tesla, Kuka AG, Yaskawa Electric Corporation, DJI, Omron Corp, Daifuku, Mitsubishi Electric, Kawasaki Robotics, Caterpillar Inc, Panasonic Corp, Husqvarna AB, SSI Schaefer, Smith & Nephew Plc, JBT Corp, Inovance Technology, 3DR, Built Robotics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Autonomous Service Robots Market?

▾ The Global Autonomous Service Robots Market size is expected to reach a value of USD 2.3 billion in 2025 and is expected to reach USD 8.6 billion by the end of 2034.

Which region accounted for the largest Global Autonomous Service Robots Market?

▾ Asia Pacific is expected to have the largest market share in the Global Autonomous Service Robots Market, with a share of about 29.1% in 2025.

How big is the Autonomous Service Robots Market in the US?

▾ The Autonomous Service Robots Market in the US is expected to reach USD 0.6 billion in 2025.

Who are the key players in the Global Autonomous Service Robots Market?

▾ Some of the major key players in the Global Autonomous Service Robots Market are ABB, Omron, Kuka AG, and others

What is the growth rate in the Global Autonomous Service Robots Market?

▾ The market is growing at a CAGR of 15.7 percent over the forecasted period.