The autonomous vehicles market is growing quickly due to technological innovations in AI, machine learning and sensor technologies. Tech giants' and automakers' interest in self-driving cars has driven autonomous vehicle (AV) technologies forward quickly with hopes to improve safety while decreasing congestion and increasing mobility, further strengthening global momentum for driverless car technology and automated driving systems.

Recent events demonstrate an upswing in regulatory support for autonomous vehicle trials and deployments worldwide. Governments around the globe are creating frameworks to test and deploy self-driving cars on public roads, opening up more possibilities for greater integration into urban environments and commercial transport systems.

Consumer interest is driving demand for autonomous vehicles and companies have responded accordingly by developing various AV applications ranging from personal vehicles, delivery services and public transport AV systems that meet evolving consumer expectations while solving last-mile delivery challenges within the broader smart mobility solutions landscape.

Opportunities in this market lie with the rapid innovation of autonomous vehicle software and hardware, along with partnerships among tech firms, automotive manufacturers and mobility providers that create an ecosystem to enhance vehicle autonomy while decreasing costs while expanding into new regions while meeting challenges like cybersecurity, infrastructure provisioning and public acceptance.

In industrial sectors, the rise of

Autonomous Mining Equipment and Unmanned Ground Vehicles has been particularly significant. These autonomous systems are transforming operations by improving safety and productivity in hazardous environments such as mining sites and military zones, reducing the need for human presence in dangerous conditions.

As per research.aimultiple A significant portion of U.S. adults remains cautious about autonomous vehicles, with 16% very likely to ride as a passenger and 28% unlikely to do so. Concerns about safety are prevalent, as 35% believe self-driving cars are less safe than human drivers. Additionally, 57% of Americans are willing to ride in autonomous cars, provided they can take over control if necessary.

Security concerns also top the list of barriers to adoption, with 73% of consumers citing vehicle security against hackers and 72% worried about system vulnerabilities. Furthermore, 71% believe self-driving cars may struggle in unexpected situations, while 57% want clear legal responsibility in the event of an accident. These factors hinder the global acceptance of autonomous vehicles.

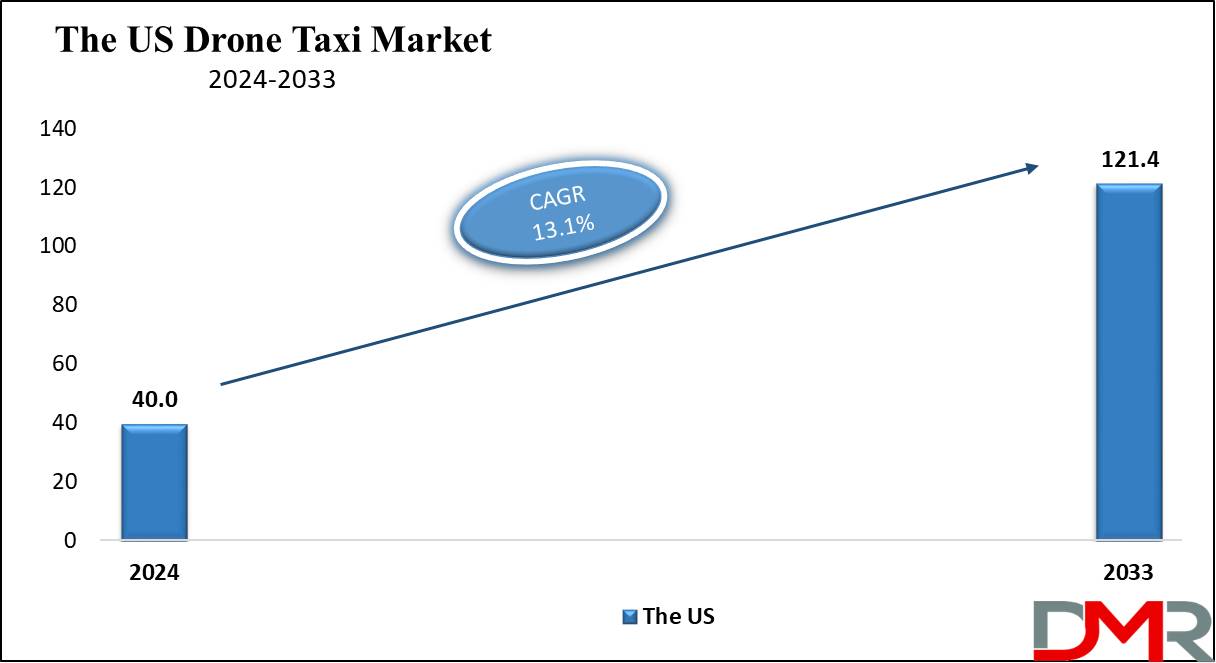

The US Autonomous Vehicles Market

The US Autonomous Vehicles Market is projected to reach USD 21.5 billion in 2024 at a compound annual growth rate of

18.9% over its forecast period.

The US has many growth opportunities in the autonomous vehicles market, driven by developing infrastructure, government support, and a tech-savvy population. Key areas like expanding Mobility-as-a-Service (MaaS), improving smart city projects, and integrating autonomous systems in logistics and public transport. Constant innovation in AI, connectivity, and

electric vehicles will further boost market expansion.

A key growth driver for the U.S. autonomous vehicles market is technological advancements in AI, sensors, and connectivity, supported by government initiatives and consumer demand for safer, more efficient transportation. However, a major challenge is the high cost of development and regulatory challenges, like concerns around safety, liability, and public trust in fully autonomous systems.

Key Takeaways

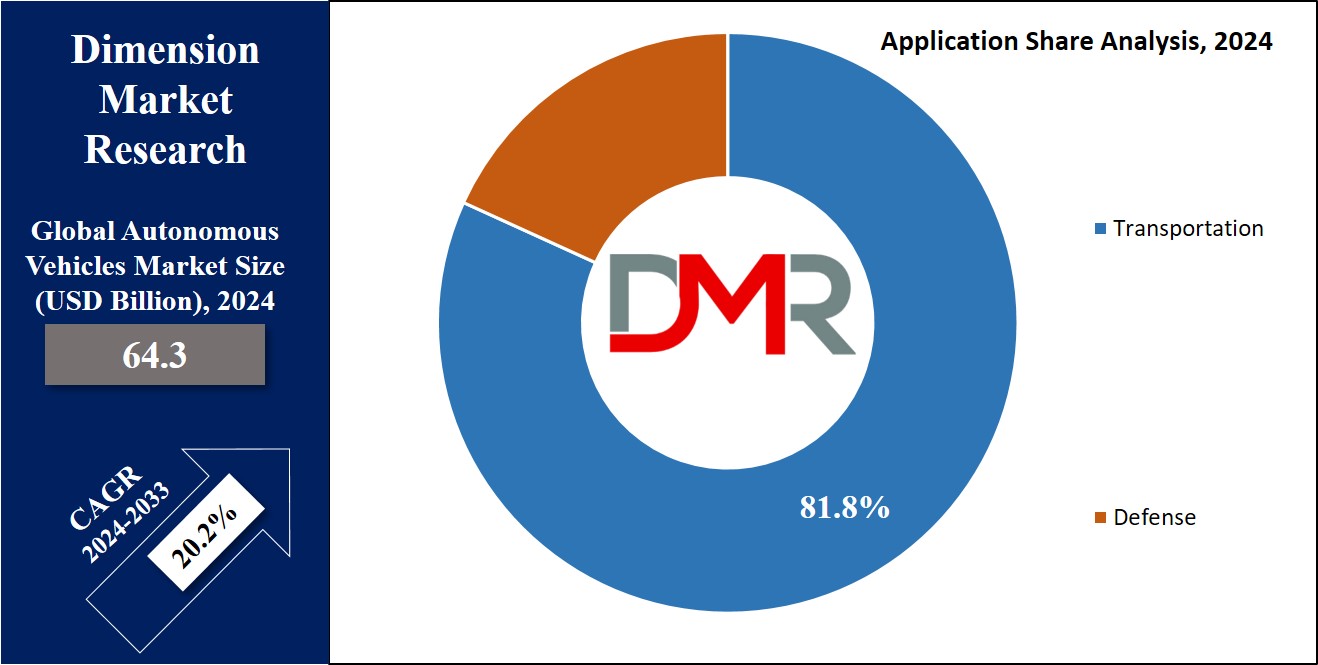

- Market Growth: The Autonomous Vehicles Market size is expected to grow by USD 261.2 billion, at a CAGR of 20.2% during the forecasted period of 2025 to 2033.

- By Vehicle Type: The passenger vehicle segment is expected to lead in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

- By Propulsion Type: The semi-automated segment is expected to be leading the market in 2024

- By Application: The transportation segment is expected to get the largest revenue share in 2024 in the Autonomous Vehicles Market.

- Regional Insight: North America is expected to hold a 39.1% share of revenue in the Global Autonomous Vehicles Market in 2024.

- Use Cases: Some of the use cases of Autonomous Vehicles include public transit, urban mobility, and more.

Use Cases

- Urban Mobility: Autonomous vehicles can navigate city streets, minimizing traffic congestion and providing efficient transportation options. They can also help with ride-sharing and on-demand mobility services.

- Long-Haul Trucking: Self-driving trucks can handle long-distance transportation with better safety and efficiency, reducing human fatigue and optimizing fuel consumption.

- Public Transit: Autonomous buses and shuttles can enhance public transportation systems, providing reliable and consistent service with lower operational costs and potentially integrating with existing transit networks.

- Last-Mile Delivery: Autonomous delivery vehicles can handle short-distance deliveries, like groceries or packages, directly to consumers' homes, enhancing convenience and reducing delivery times. This segment is rapidly expanding with the adoption of Autonomous Delivery Robots and other automated systems that boost efficiency in logistics.

Market Dynamic

Driving Factors

Technological Advancements

Constant development in

Artificial Intelligence,

machine learning, sensor technologies, and vehicle-to-everything (V2X) communication is driving the development and deployment of autonomous vehicles, improving their safety, reliability, and efficiency.

Government Regulations and Incentives

Many governments are introducing supportive policies, like tax incentives, research funding, and regulations promoting the adoption of autonomous vehicles to reduce traffic accidents, lower emissions, and promote smart city infrastructure.

Restraints

High Development Costs

The higher expenses linked with the research, development, and production of autonomous vehicle technology, like advanced sensors, AI systems, and regulatory compliance, can impact the broad adoption and make it difficult for smaller companies to compete.

Regulatory and Legal Challenges

The lack of uniform global regulations and legal concerns around liability in case of accidents involving autonomous vehicles creates uncertainty. It slows down the commercialization and deployment of these vehicles across many regions.

Opportunities

Expansion of Mobility-as-a-Service (MaaS)

Autonomous vehicles can transform transportation by allowing mobility-as-a-service platforms, where users can access on-demand, shared transportation, minimizing the need for personal car ownership and contributing to more sustainable urban mobility.

Integration with Smart City Infrastructure

As cities invest in smart infrastructure, autonomous vehicles can play a major role in developing more efficient, connected transportation ecosystems, optimizing traffic management, lowering congestion, and improving urban planning efforts.

Trends

Collaboration Between Automakers and Tech Companies

Traditional automakers are largely partnering with technology firms, like AI and software development companies, to enhance autonomous vehicle development, which allows for the incorporation of cutting-edge tech into automotive platforms, expediting progress toward fully autonomous driving.

Focus on Autonomous Delivery Solutions

There is higher interest in autonomous vehicles for last-mile delivery services. Companies are investing in self-driving delivery robots & drones to meet the growing demand for fast, contactless delivery, mainly driven by the e-commerce boom.

Research Scope and Analysis

By Vehicle Type

The passenger vehicle segment is expected to lead the autonomous vehicle market in 2024 with a majority share. Consumers are highly interested in transportation options that are more convenient, safe, and efficient. Autonomous vehicles provide a stress-free, hands-free commuting experience, making them appealing to those who want a more relaxed and productive way to travel.

Developments in autonomous technology, such as smarter AI, better sensors, and enhanced connectivity, have made self-driving passenger vehicles more reliable. These enhancements are increasing consumer confidence in their safety and performance, further growing interest in autonomous vehicles.

Moreover, the commercial vehicle segment is also increasing significantly. Industries like logistics, transportation, and delivery services see the benefits of autonomous technology in enhancing their operations. Self-driving commercial vehicles can support streamlining logistics, optimize supply chains, and meet the growth in demands of customers.

In industrial sectors, the adoption of Autonomous Mining Equipment and

Unmanned Ground Vehicles is accelerating, allowing companies to operate more efficiently and safely in challenging environments such as mining sites and military operations. These technologies reduce human exposure to hazardous conditions while improving productivity.

As a result, more companies are adopting autonomous solutions for their fleets. In addition, a strong network of tech developers, manufacturers, and investors is working to develop autonomous systems for commercial use. Constant innovation and investment will drive the development of even more advanced autonomous commercial vehicles in the coming years.

By Propulsion Type

Semi-autonomous vehicles are currently the top choice for many customers and by propulsion are also expected to lead the market in 2024. Factors like safety and fuel efficiency are driving demand for these vehicles, contributing to the growth of the semi-autonomous segment.

The launch of features like Advanced Driver Assistance Systems (ADAS) has supported reducing accidents across the world, positively influencing the automotive insurance industry. However, insurance rating methods need updating to accurately assess risks. Governments have also implemented strict safety & driving regulations to reduce accidents caused by human error.

These rules are encouraging automakers to integrate semi-autonomous systems into their vehicles, further boosting the growth of this segment in the market.

Moreover, fully autonomous vehicles are also gaining attention from customers. People consider factors like safety & fuel efficiency when choosing fully autonomous vehicles, making them highly popular. Governments have introduced strict regulations to improve road safety, which is pushing manufacturers to adopt fully autonomous technologies.

These vehicles can work entirely without human intervention and are used in services like robo-taxis. With these developments, the complete autonomous vehicle segment is expected to grow rapidly, showing a high growth rate throughout the forecast period.

By Level

The Level 1 segment is expected to hold the largest share in the autonomous vehicle market in 2024. These vehicles include basic driver assistance features like adaptive cruise control and lane-keeping assist. While these systems support the driver, human oversight and input are still necessary. Level 1 automation is considered the most basic form of vehicle automation, unlike higher levels like Level 4 or 5, which provide complete autonomous functionality.

As the first step toward advanced autonomous driving, Level 1 plays a major role in familiarizing both manufacturers and consumers with automated features, and assists in building trust in partially automated driving systems.

Further, the Level 4 and 5 segments are expected to grow the fastest in the coming years. Level 4 autonomous vehicles can operate without human input in most situations, providing higher mobility options for the elderly and disabled.

However, they function only in certain areas or under special conditions, like certain types of roads or favorable weather. While they can manage most driving tasks on their own, some extreme situations may still demand quite human intervention. On the other hand, Level 5 vehicles are designed to handle all driving tasks independently, with no need for human supervision. These completely autonomous vehicles are expected to perform safely in any scenario that a human driver could manage.

By Application

The transportation sector will dominate the global autonomous vehicles market in 2024, holding the largest market share, as it is driven by major revenue growth, assisted by government initiatives focused at increasing the production of hybrid and electric vehicles.

The need for these vehicles, mainly fully autonomous ones with different levels of automation, has risen sharply. Government backing and a rise in public awareness have further fueled the expansion of the transportation sector within the autonomous vehicle market.

Further, the defense sector is anticipated to see rapid growth with a high compound annual growth rate during the forecasted period. Governments across the world are highly adopting autonomous vehicles for military purposes, boosting the sector's growth.

Many companies are collaborating with governments and their agencies to create advanced and innovative vehicle systems for defense use, which is driving the development of advanced autonomous technology customized for defense applications, further accelerating the sector's expansion.

The Autonomous Vehicles Market Report is segmented on the basis of the following

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Propulsion Type

- Semi-autonomous

- Fully Autonomous

By Level

- Level 1

- Level 2

- Level 3

- Level 4 & 5

By Application