Market Overview

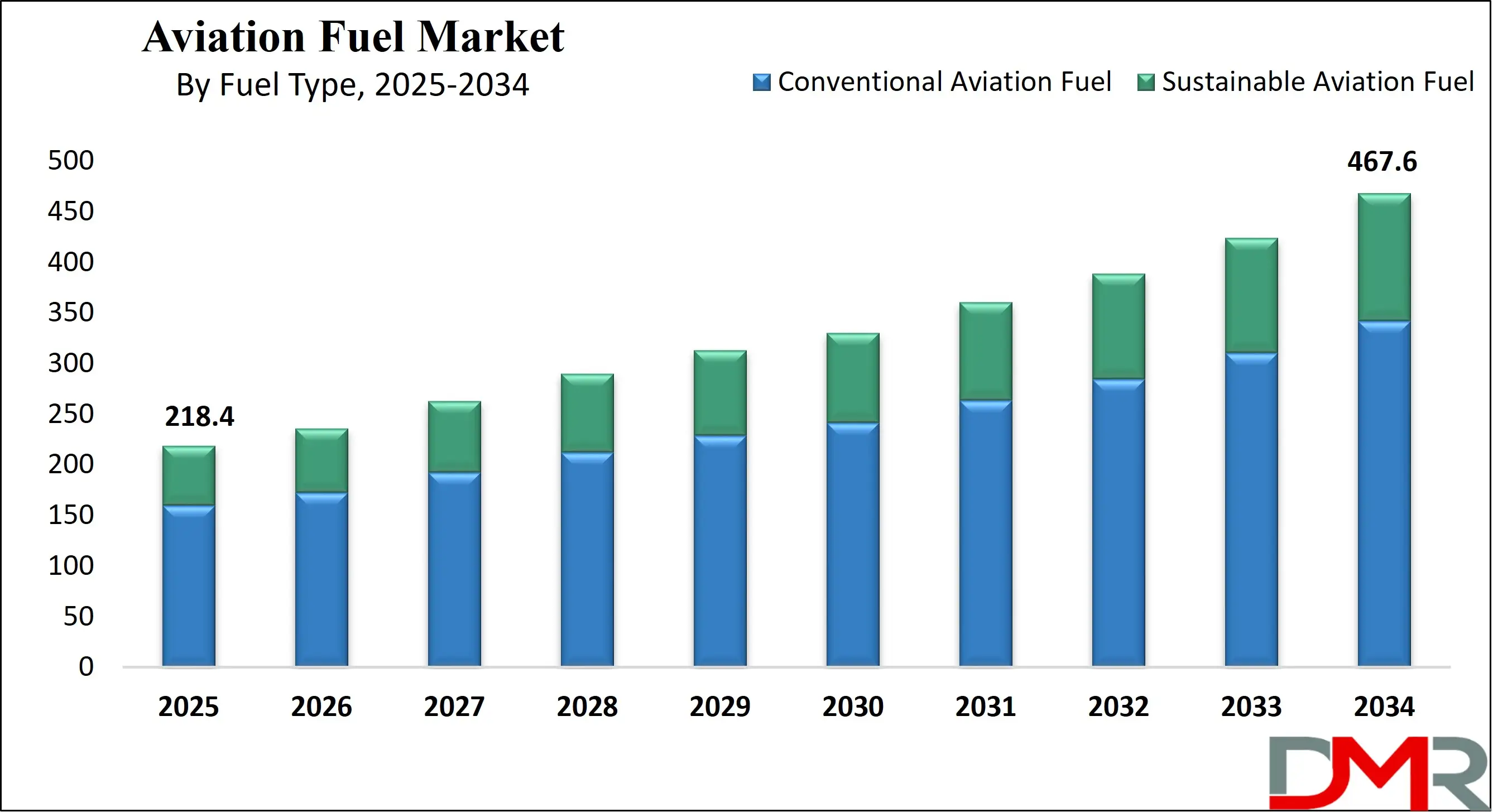

The Global Aviation Fuel Market is projected to reach USD 218.4 billion in 2025 and grow at a compound annual growth rate of 8.8% from there until 2034 to reach a value of USD 467.6 billion.

Aviation fuel is the fuel used to power aircraft. It mainly comes in two varieties: jet fuel for commercial and military jets and Avgas used by small piston-engine aircraft. Traditional jet fuel includes petroleum derivatives designed for use at higher altitudes with reduced temperatures; Avgas uses natural gas and can only operate under certain atmospheric conditions. Aviation fuel is essential to global travel, allowing people and goods to move swiftly throughout their travels efficiently across borders, while fossil-based sources contribute carbon emissions that impact climate change negatively.

The need for aviation fuel has steadily increased with increasing air travel. More people are flying for business, tourism, and cargo transportation purposes with e-commerce becoming a driving factor. Aviation fuel consumption was steadily growing before the COVID-19 pandemic occurred; airline airlines consumed large amounts of aviation fuel. Although temporarily reduced due to pandemic symptoms, the industry rebounded quickly, with demand rising again after recovery was complete.

Sustainable Aviation Fuel (SAF) has become one of the major trends in aviation fuel today, featuring renewable sources like cooking oil, agricultural waste, and captured carbon from the atmosphere to significantly lower aviation emissions by up to 80% compared with traditional jet fuel. Many airlines and governments are investing in SAF to minimize environmental impact; at present it can be blended in with regular jet fuel at anywhere between 10% and 50% concentration, but researchers are working toward powering aircraft solely with SAF in the coming years.

Aviation fuel technology continues to advance, yet aviation fuel experiences multiple obstacles. One of the major among them is the rising cost of SAF which is more expensive than regular jet fuel; production capacity also limits supply; therefore, SAF does not meet all aviation industry demand yet. Another problem involves global fuel price fluctuations caused by political and economic events that make airline operations more costly; oil price increases have led to ticket increases for passengers.

Moreover, several events in recent times have affected aviation fuel. In 2020, COVID-19 caused widespread air travel cancellations that contributed to an extreme reduction in demand for aviation fuel; once recovery ensued, however, fuel demand surged once more and caused supply shortages in some regions. Meanwhile, Ukraine's war in 2022 increased oil prices significantly and made aviation fuel more costly; governments and airlines alike are now focusing on increasing efficiency with alternative sources and decreasing reliance on traditional fossil fuels.

Future developments of aviation fuel depend on technological innovations and government policies. Researchers are actively searching for cheaper and wider availability of synthetic aviation fuel (SAF). Hydrogen-powered aircraft and electric planes are being explored as potential future alternatives. Many governments and airlines have set goals to increase SAF usage significantly by 2050 in order to decrease aviation emissions significantly and make air travel more environmentally friendly while meeting global transportation demands. If these efforts succeed, air travel could become more environmentally friendly while still meeting all transportation requirements globally.

The US Aviation Fuel Market

The US Aviation Fuel Market is projected to reach USD 59.4 billion in 2025 at a compound annual growth rate of 8.3% over its forecast period.

The U.S. aviation fuel market has major growth opportunities driven by growing air travel demand, rising investments in Sustainable Aviation Fuel (SAF), and advancements in fuel-efficient technologies. Government incentives and policies supporting cleaner aviation fuels are encouraging innovation. In addition, expanding e-commerce and cargo transportation are boosting fuel consumption, further driving market expansion across the country.

Moreover, the market is driven by strong air travel demand, a well-developed aviation infrastructure, and ongoing development in fuel technology. The push for Sustainable Aviation Fuel (SAF) adoption is further accelerating growth. However, market expansion faces restraints such as fluctuating crude oil prices, high SAF production costs, and regulatory challenges. Balancing fuel affordability with sustainability goals remains a key challenge for the industry.

Aviation Fuel Market: Key Takeaways

- Market Growth: The Aviation Fuel Market size is expected to grow by 231.9 billion, at a CAGR of 8.8% during the forecasted period of 2026 to 2034.

- By Fuel Type: Conventional aviation fuel is anticipated to get the majority share of the Aviation Fuel Market in 2025.

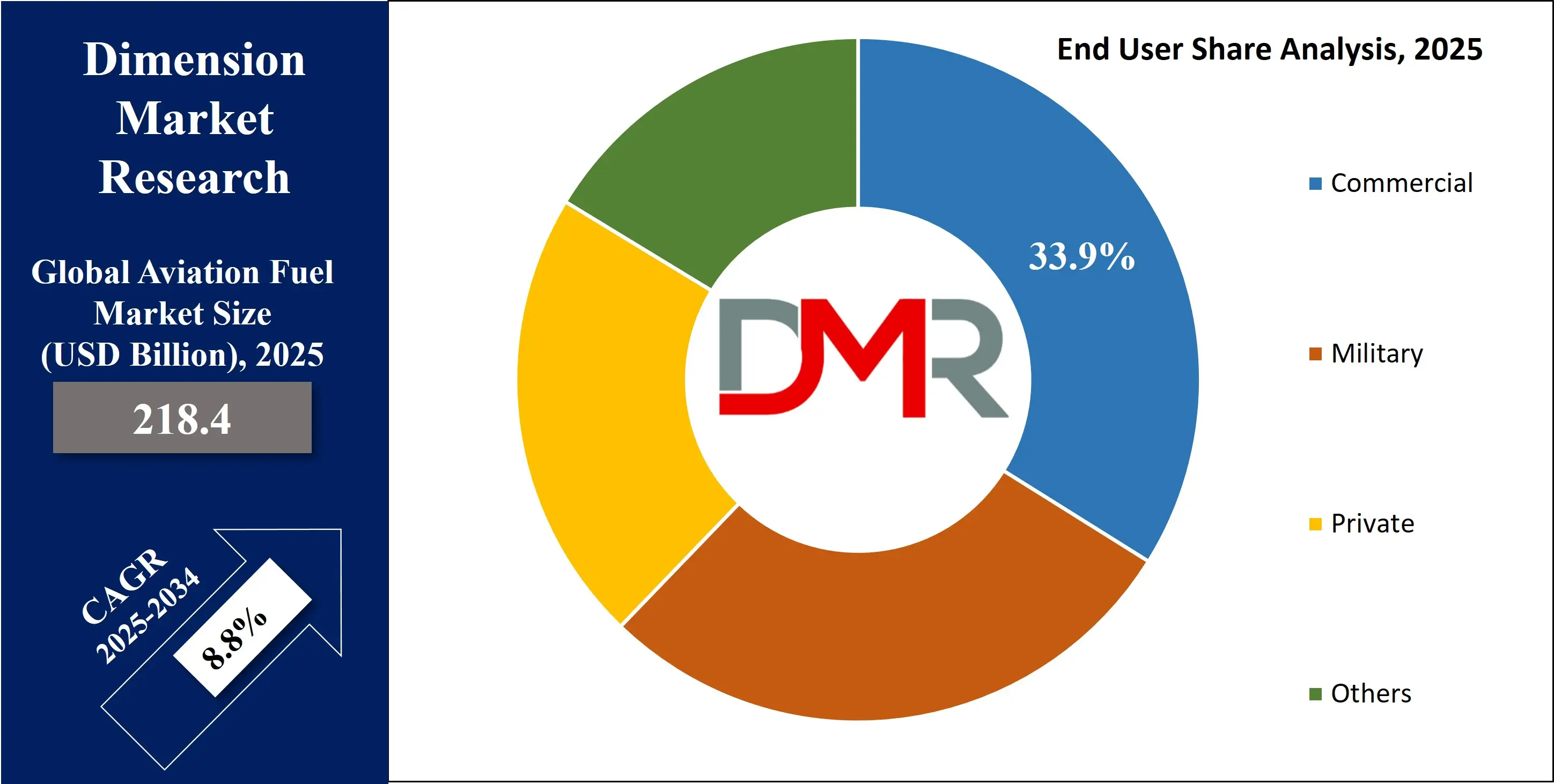

- By End User: The commercial sector is expected to get the largest revenue share in 2025 in the Aviation Fuel Market.

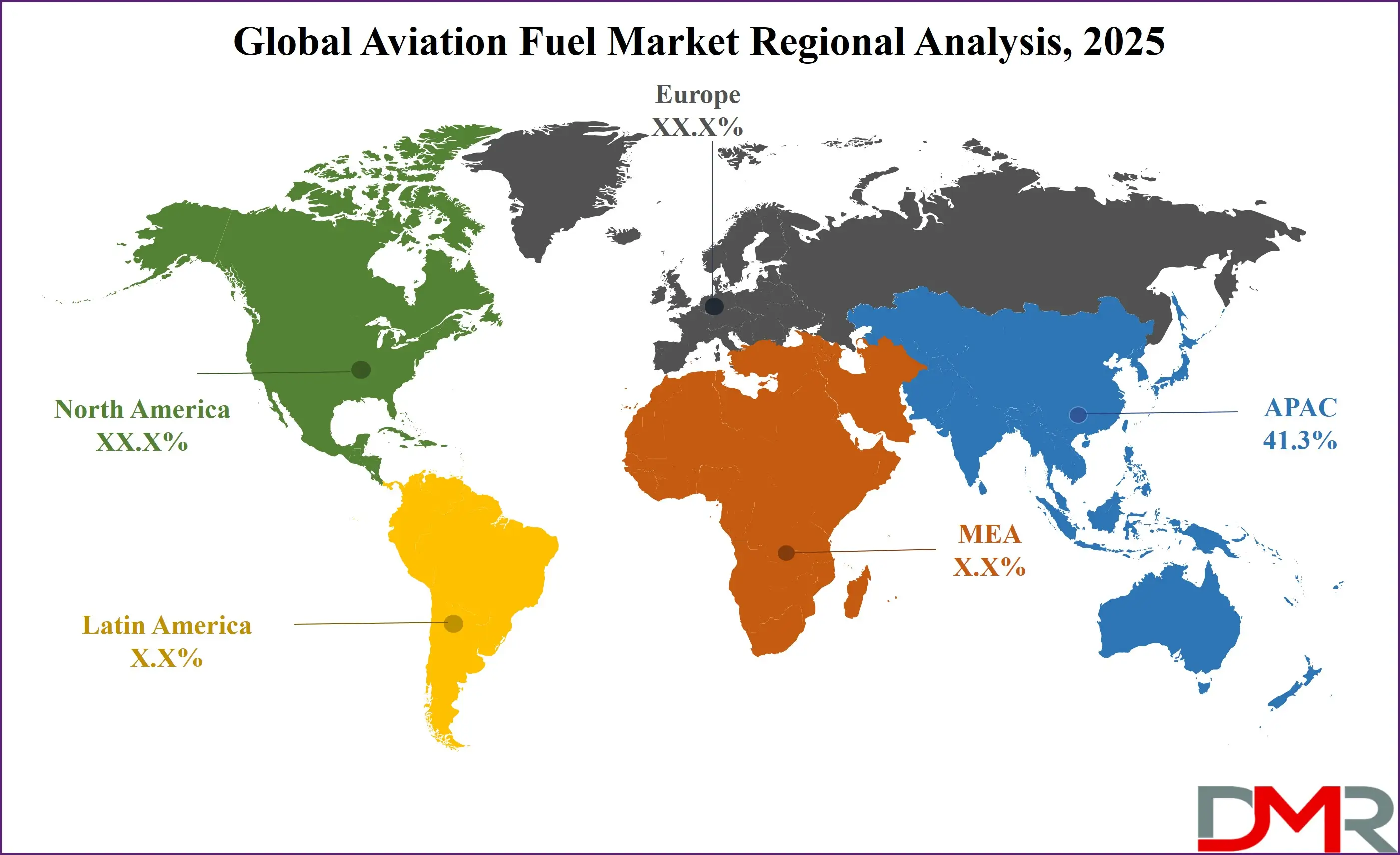

- Regional Insight: Asia Pacific is expected to hold a 41.3% share of revenue in the Global Aviation Fuel Market in 2025.

- Use Cases: Some of the use cases of Aviation Fuel include commercial aviation, military & defense, and more.

Aviation Fuel Market: Use Cases

- Commercial Aviation: Aviation fuel is mainly used to power commercial aircraft, allowing passenger travel and global connectivity for business, tourism, and trade. Airlines rely on jet fuel for long-haul and short-haul flights, ensuring efficient and reliable air transport.

- Military and Defense: Aviation fuel is important for military jets, transport aircraft, and helicopters used in defense operations, surveillance, and emergency response. High-performance fuels are needed to meet the extreme demands of military aviation.

- Cargo and Logistics: Air freight services use aviation fuel to transport goods quickly across the world, which is vital for industries like e-commerce, pharmaceuticals, and perishable goods, where speed and reliability are key.

- Emergency and Rescue Operations: Aviation fuel powers helicopters and aircraft used in medical evacuations, disaster relief, firefighting, and search-and-rescue missions, ensuring quick response times in critical situations.

Stats & Facts

- According to Earth.org, a single long-haul flight can generate more carbon emissions in a few hours than the average person in 56 countries produces in a year, making aviation a major contributor to global emissions.

- Transitioning from petroleum-based fuels to sustainable aviation fuel (SAF), made from non-petroleum feedstocks like cooking oil, animal waste fat, agricultural and forestry waste, and municipal waste, can significantly cut airlines' carbon dioxide emissions.

- As per Earth.org, SAF can be blended with conventional aviation fuel at levels ranging from 10% to 50%, depending on the feedstock and production method, and could potentially be used at 100% by 2030 without requiring modifications to aircraft engines.

- In addition, SAF can also be produced synthetically by capturing carbon directly from the atmosphere, making it a renewable alternative to fossil-based fuels while reducing net carbon dioxide emissions.

- The Alcohol-to-Jet (ATJ) pathway, as mentioned by Earth.org, involves converting biomass-derived alcohols into SAF by breaking down sugars into ethanol or isobutanol and refining them into jet fuel, which meets industry standards.

- According to the International Air Transport Association (IATA), SAF could contribute around 65% of the emissions reductions needed for aviation to achieve net-zero CO2 emissions by 2050, but this will require a massive scale-up of production, supported by global policy initiatives.

- The International Energy Agency (IEA) reports that in 2023, aviation accounted for 2.5% of global energy-related carbon dioxide emissions, growing faster than rail, road, or shipping between 2000 and 2019 and rebounding to 90% of pre-pandemic levels.

- In addition, aviation emissions in 2023 reached approximately 950 million metric tons of CO2, and to reduce emissions in line with the Net Zero by 2050 scenario, stakeholders must increase low-carbon fuel use, improve aircraft efficiency, optimize flight operations, and manage demand.

- The National Renewable Energy Laboratory (NREL) reports that total domestic available seat miles in 2022 were 839 billion, while total domestic revenue passenger miles were 707 billion, increasing to 930 billion and 780 billion respectively, from April 2023 to March 2024, reflecting growing air travel demand.

- According to the Bureau of Transportation Statistics (BTS), U.S. airlines used 1.594 billion gallons of fuel in December 2024, a 6.8% increase from November 2024 and 2.7% higher than in December 2019, surpassing pre-pandemic levels.

- Further, BTS data reveals that the cost per gallon of airline fuel in December 2024 was USD 2.32, a 16.0% increase from December 2019, while total fuel expenditure for U.S. airlines reached USD 3.71 billion, up 7.6% from November 2024 and 19.1% higher than in December 2019.

- According to BTS, domestic airline fuel consumption in December 2024 increased by 0.5% year-over-year compared to December 2023 and rose 5.8% from November 2024, aligning with increased airline passenger travel.

Market Dynamic

Driving Factors in the Aviation Fuel Market

Rising Air Travel Demand

The market expansion is driven mainly by growth in passenger and cargo flights around the world. As economies develop and middle-class populations expand, more people can afford air travel, leading to major fuel consumption. Budget airlines with affordable ticket prices have further contributed to an increase in travel demand. Tourism and business travel have recovered strongly post-pandemic, prompting airlines to expand their fleets and increase flight frequencies; furthermore, high e-commerce activity has increased air cargo demand, necessitating more fuel for freight operations, ultimately contributing directly to an expanding aviation fuel market.

Technological Advancements and Sustainable Aviation Fuel Adoption

Development in fuel efficiency and the adoption of Sustainable Aviation Fuel (SAF) are shaping the aviation fuel market. Airlines & governments alike have become avid investors in SAF, which minimizes carbon emissions while still meeting performance needs similar to conventional jet fuel. With stricter environmental regulations & commitments toward reaching net-zero emissions by 2050 expected, demand is expected to surge for SAF products. Aircraft manufacturers have developed fuel-efficient engines and hybrid propulsion systems to reduce fuel consumption; research into alternative fuels such as hydrogen or biofuels is further fueling industry expansion while creating a more sustainable future for aviation.

Restraints in the Aviation Fuel Market

High Fuel Prices and Cost Volatility

The aviation fuel market is highly affected by fluctuating crude oil prices, which can develop unpredictable fuel costs for airlines. Geopolitical tensions, supply chain disruptions, and economic instability mostly cause sharp price increases, making operations more expensive. Higher fuel costs force airlines to raise ticket prices, potentially minimizing passenger demand. The financial burden of fuel expenses also limits airline profitability and investment in new technologies, which makes long-term planning difficult for airlines, impacting the overall aviation fuel market growth.

Limited Production and High Costs of SAF

While Sustainable Aviation Fuel (SAF) is a promising alternative, its production remains limited and expensive in comparison to conventional jet fuel. The infrastructure for large-scale SAF production is still under development, making it difficult for airlines to transition fully. High production costs make SAF less competitive, preventing broad adoption across the industry. In addition, the availability of raw materials, like biomass and waste oils, poses challenges for consistent supply. Without major policy support and investment, SAF adoption will remain slow, restraining the market's shift toward sustainable fuel solutions.

Opportunities in the Aviation Fuel Market

Expansion of Sustainable Aviation Fuel (SAF) Market

The growth in the focus on reducing carbon emissions provides a major opportunity for the aviation fuel market. Governments and aviation authorities around the world are setting SAF blending mandates and offering incentives to boost production. Investments in new SAF production technologies, like biofuels and synthetic fuels, can help lower costs and increase availability. Airlines are actively looking for partnerships with SAF producers to achieve sustainability goals. As SAF adoption grows, it will create new business opportunities for fuel suppliers and refiners. The long-term transformation to SAF can drive significant market expansion while meeting environmental regulations.

Advancements in Fuel-Efficient Technologies

The development of next-generation aircraft with better fuel efficiency is opening new opportunities in the aviation fuel market. Aircraft manufacturers are investing in hybrid-electric propulsion, hydrogen-powered planes, and aerodynamic designs to minimize fuel consumption. Engine improvements, lightweight materials, and better flight route optimization can significantly lower fuel usage. Airlines adopting these technologies will need specialized fuel blends, creating demand for innovative fuel solutions. Research and development in alternative fuels, such as hydrogen and synthetic aviation fuels, offer potential breakthroughs. These developments can enhance market growth while supporting the transition to sustainable aviation.

Trends in the Aviation Fuel Market

Increased Adoption of Sustainable Aviation Fuel (SAF)

As part of its effort to minimize carbon emissions and meet sustainability targets, the aviation industry is rapidly adopting Sustainable Aviation Fuel (SAF). Airlines are teaming up with fuel producers & governments alike to secure supplies of SAF. Production facilities have opened, increasing output; major airlines have begun mixing SAF into conventional jet fuel for commercial flights; research into alternative feedstocks like algae or carbon capture is also gaining traction; this trend should accelerate as we head toward zero-emission goals.

Aviation Fuel Market Players Are Investing in Alternative Fuels and Technologies

The players in the market have highly invested in alternative sources like hydrogen and synthetic fuels, with hydrogen-powered aircraft being tested as potential long-term solutions for zero-emission flights. Aircraft manufacturers are developing more efficient engines and hybrid-electric propulsion systems. Governments & private companies alike are funding research into new production methods like power-to-liquid technologies for aviation fuel production, while airlines focus on optimizing flight operations to minimize consumption. All these advancements are shaping the future of aviation fuel and pushing the industry towards greener solutions.

Research Scope and Analysis

By Fuel Type

Conventional fuel and sustainable fuel are two primary categories in the aviation fuel market, respectively. Conventional jet fuel derived from petroleum remains dominant and is expected to account for most of its sales by 2025 due to its wide availability, established infrastructure, and relative cost advantages over alternative options. Even as concerns about carbon emissions arise in aviation, conventional jet fuel remains vital in powering commercial, military, and cargo aircraft fleets worldwide. As global air travel increases & airlines expand their fleets, conventional jet fuel demand should continue growing over time.

Sustainable Aviation Fuel (SAF) has also become an attractive cleaner alternative to conventional jet fuel, and is growing in popularity as an aviation fuel option. SAF, with its relatively smaller market share, is projected to experience the fastest rate of expansion over the study period due to environmental regulations, government incentives, and commitments by airlines to limit carbon emissions. SAF is produced from renewable sources like used cooking oil, agricultural waste, and captured carbon emissions - making it more eco-friendly than its fossil counterpart. Unfortunately, however, its higher production costs and limited supply remain barriers to widespread adoption. As technology improves and production capacity expands, SAF could play an increasingly vital role in shaping the aviation fuel market and aiding its transition toward more eco-friendly solutions.

By Aircraft Type

Fixed-wing aircraft will dominate the aviation fuel market in 2025 due to their ability to travel long distances efficiently and carry passengers and cargo all around the globe. These aircraft form the backbone of commercial aviation. With growing air travel demand and online commerce soaring, airlines and freight companies are turning more heavily towards fixed-wing aircraft, leading to greater fuel usage. Although developments in aircraft design have better fuel efficiency, an increase in air traffic continues to push up fuel demand. Furthermore, fixed-wing aircraft play a vital role in military operations by being used for surveillance, transport, and combat missions, further reinforcing their importance within the aviation fuel market.

In addition, rotorcraft such as helicopters make an invaluable contribution to aviation fuel production and use. Helicopters can be seen being deployed for emergency medical services, search-and-rescue missions, law enforcement purposes, and military purposes. Helicopters provide vertical takeoff and landing capabilities, making them the ideal solution for operations in remote or congested locations where fixed-wing aircraft cannot land. Commercially speaking, helicopters are frequently utilized for offshore oil and gas transportation, tourism, and executive travel purposes. Helicopters consume less fuel than fixed-wing aircraft; however, due to their specialized applications, they continue to drive a steady demand for aviation fuel. With technology constantly improving fuel efficiency and emissions reduction being designed into newer helicopter models, further solidifying rotary-wing aircraft's place within the aviation fuel market.

By End User

The aviation fuel market can be divided into three end-use segments, including commercial aircraft, private aircraft and military aircraft. Of these three subsets, commercial aircraft is anticipated to produce the highest revenue by 2025. Due to rising passenger and cargo travel demands worldwide, airlines are expanding their fleets and increasing flight frequencies, leading to higher fuel usage. Subsequent to the pandemic, international travel has rebounded substantially and created further fuel demand surge. E-commerce growth also contributed significantly, as cargo planes relied heavily on aviation fuel for fast delivery services across multiple regions. Since commercial airlines operate many flights daily, their fuel needs were considerably greater - further cementing their market dominance.

Also, the commercial aircraft segment is projected to experience the highest compounded annual growth rate during this forecast period, driven by factors like global tourism growth, business travel trends and advancements in airline operations. Many airlines are investing in more fuel-efficient aircraft to lower operational costs and comply with environmental regulations. Furthermore, commercial aviation's increasing adoption of sustainable aviation fuel (SAF) is driving market trends as airlines strive to reduce carbon emissions while increasing efficiency. Military and private aircraft also contribute to aviation fuel demand; however, their consumption levels remain relatively lower compared to commercial airlines. With air travel demand continuing to surge forward, commercial airlines will remain the key force driving market growth.

The Aviation Fuel Market Report is segmented on the basis of the following

By Fuel Type

- Conventional Aviation Fuel

- Aviation Turbine Fuel

- AVGAS

- Sustainable Aviation Fuel

- Biofuel

- Hydrogen Fuel

- Power-to-Liquid

- Gas-to-Liquid

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicle

By End User

- Commercial

- Military

- Private

- Others

Regional Analysis

Leading Region in the Aviation Fuel Market

The Asia Pacific region is expected to lead the global aviation fuel market, holding a 41.3% share in 2025. The region’s growing dominance is driven by a strong recovery in tourism and international travel, as many countries have eased or lifted travel restrictions. Despite global economic uncertainties, demand for air travel in Asia Pacific continues to rise steadily. This growth is closely linked to the presence of rapidly developing economies, where increasing business activity and rising middle-class populations are fueling airline travel. As more people in the region can afford to fly, both domestic and international air traffic are expanding, boosting aviation fuel consumption.

Region with steady growth in the Aviation Fuel Market

North America is expected to experience a significant growth rate in the aviation fuel market during the forecast period. The region's strong recovery is driven by growing air travel demand, particularly as most travel restrictions have been lifted. According to the International Air Transport Association (IATA), airline traffic in North America surged by 203.4% in May 2022 compared to the previous year, which reflects a strong willingness to travel, fueled by both tourism and business activities. With a well-established aviation infrastructure and a high number of domestic and international flights, North America remains a key player in the global aviation fuel market’s expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The aviation fuel market is highly competitive, with many players involved in fuel production, refining, distribution, and supply. Companies compete based on factors like fuel quality, pricing, sustainability initiatives, and global supply chain networks. The push for Sustainable Aviation Fuel (SAF) has intensified competition as market participants invest in R&D to create eco-friendly alternatives. Strategic partnerships between fuel providers and airlines are becoming more common to ensure a stable supply. Government regulations and policies also play a key role, in influencing market dynamics and encouraging innovation in fuel efficiency and sustainability.

Some of the prominent players in the Global Aviation Fuel are

- Exxon Mobil

- Shell Plc

- BP

- Valero Energy

- ADNOC

- LUKOIL

- Chevron Corp

- VITOL

- ESSAR

- GEVO

- Other Key Players

Recent Developments

- In February 2025, Boeing and Hindustan Petroleum Corporation Ltd unveiled a partnership to support and advance India’s sustainable aviation fuel (SAF) ecosystem and support the Indian Government’s environmental goals. SAF minimizes carbon emissions over the fuel’s life cycle by up to 84%, depending on the feedstock, and it has the potential to reduce even more in the future.

- In January 2025, Lydian unveiled the successful pilot demonstration of its technology for producing sustainable aviation fuel (SAF) for commercial and defense applications, which can produce up to 25 gallons of fuel per day, located at RTI International in North Carolina. Lydian's new process uses captured CO2, water, and renewable electricity to produce a drop-in alternative for today's fossil-based jet fuel, with up to 95% lower emissions.

- In April 2024, Honeywell launched technology for producing low-cost sustainable aviation fuel. The new technology will expand the feedstock options available in the industry to more plentiful sources.

- In February 2023, KBR launched Sustainable Aviation Fuel (SAF) technology in alliance with Swedish Biofuels AB, a technology developer and pioneer in cutting-edge research on biofuels. The alliance expands KBR's decarbonization and energy transition portfolio into the aviation sector with a differentiated SAF offering. Also, this technology can convert carbon dioxide and synthesis gas to SAF, thereby expanding opportunities for KBR's clients using captured carbon toward a cleaner, greener future.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 218.4 Bn |

| Forecast Value (2034) |

USD 467.6 Bn |

| CAGR (2025-2034) |

8.8% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 59.4 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Fuel Type (Conventional Aviation Fuel and Sustainable Aviation Fuel), By Aircraft Type (Fixed Wing, Rotary Wing, and Unmanned Aerial Vehicle), By End User (Commercial, Military, Private, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Exxon Mobil, Shell Plc, BP, Valero Energy, ADNOC, LUKOIL, Chevron Corp, VITOL, ESSAR, GEVO, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Aviation Fuel Market size is expected to reach a value of USD 218.4 billion in 2025 and is expected to reach USD 467.6 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Aviation Fuel Market with a share of about 41.3% in 2025.

The Aviation Fuel Market in the US is expected to reach USD 59.4 billion in 2025.

Some of the major key players in the Global Aviation Fuel Market are Exxon Mobil, Shell Plc, BP, and others.

The market is growing at a CAGR of 8.8 percent over the forecasted period.