Market Overview

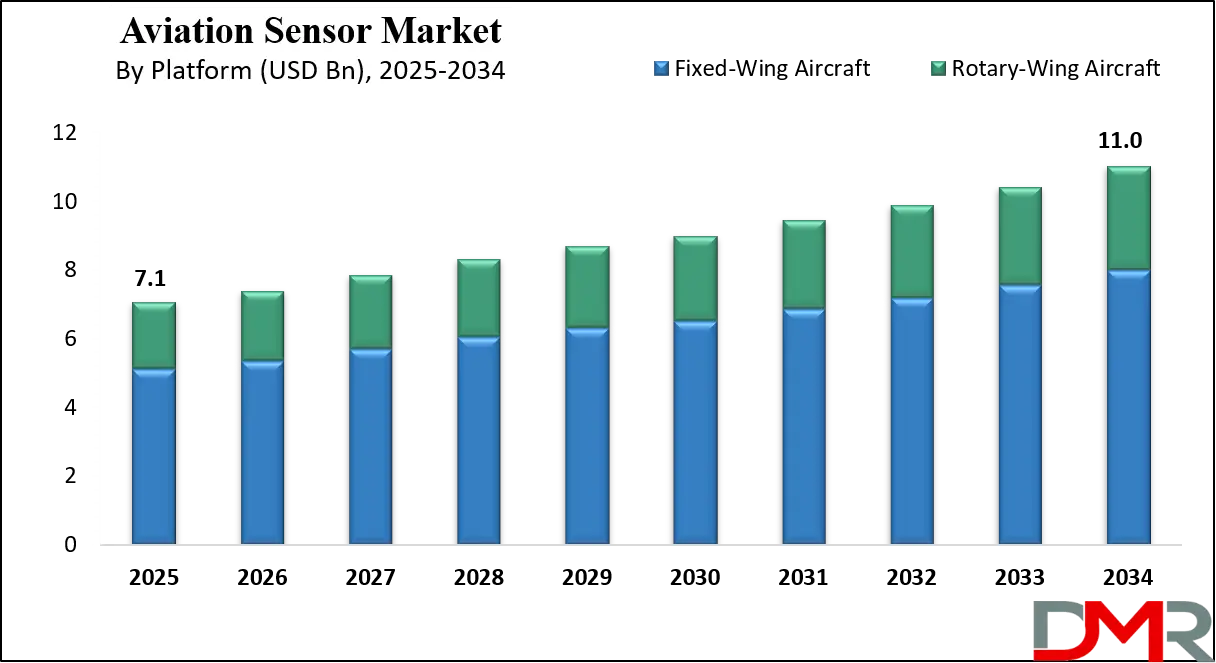

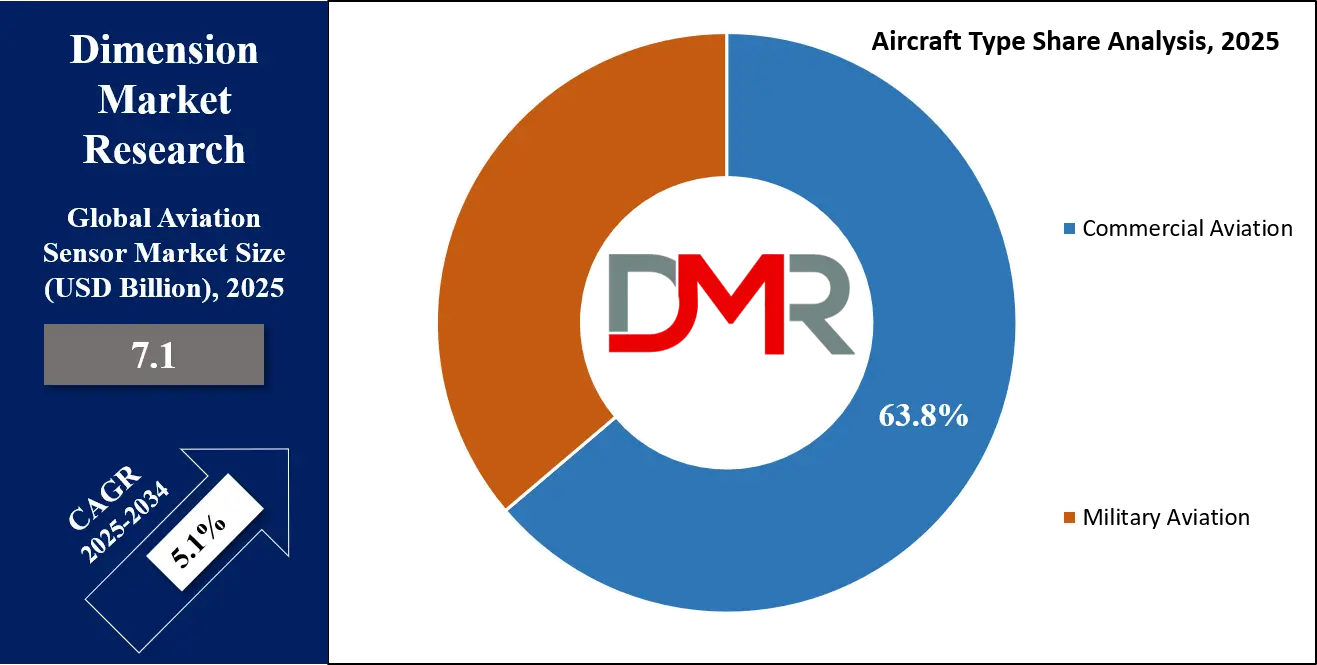

The Global Aviation Sensor Market size is projected to reach USD 7.1 billion in 2025 and grow at a compound annual growth rate of 5.1% to reach a value of USD 11.0 billion in 2034.

The aviation sensor market comprises a broad range of sensor systems embedded in aircraft to monitor, measure, and control critical parameters such as pressure, temperature, position, speed, and vibration. These sensors ensure flight safety, enable predictive maintenance, and support real-time system performance analysis across commercial and military aviation platforms. The demand for more efficient, connected, and data-driven aircraft is driving sensor integration across both fixed-wing and rotary-wing platforms.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Increasing aircraft deliveries, upgrades in legacy fleets, and the shift towards more electric aircraft architectures are accelerating sensor adoption. The growth of unmanned aerial vehicles (UAVs), advanced fighter aircraft, and commercial jets equipped with digital flight systems has pushed requirements for miniaturized, lightweight, and high-precision sensors. Additionally, advancements in sensor technologies such as MEMS, fiber-optic, and wireless systems are enabling more robust sensing capabilities with reduced power consumption and enhanced accuracy.

Aircraft systems like avionics, engine and fuel management, flight control, landing gear, and braking systems increasingly rely on networked sensors for reliable operation. As a result, sensors play a pivotal role in ensuring system redundancy, health diagnostics, and compliance with aviation safety regulations. The convergence of sensors with IoT, AI, and digital twins is further transforming how aircraft data is captured and leveraged across their lifecycle.

While the market outlook is strong, challenges such as sensor certification, harsh environmental requirements, and integration complexity persist. Moreover, aviation's stringent safety and compliance standards extend development cycles for new sensor platforms. Nonetheless, innovation in sensor fusion, edge data processing, and AI integration is pushing the aviation sensor market into a new phase of performance and reliability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

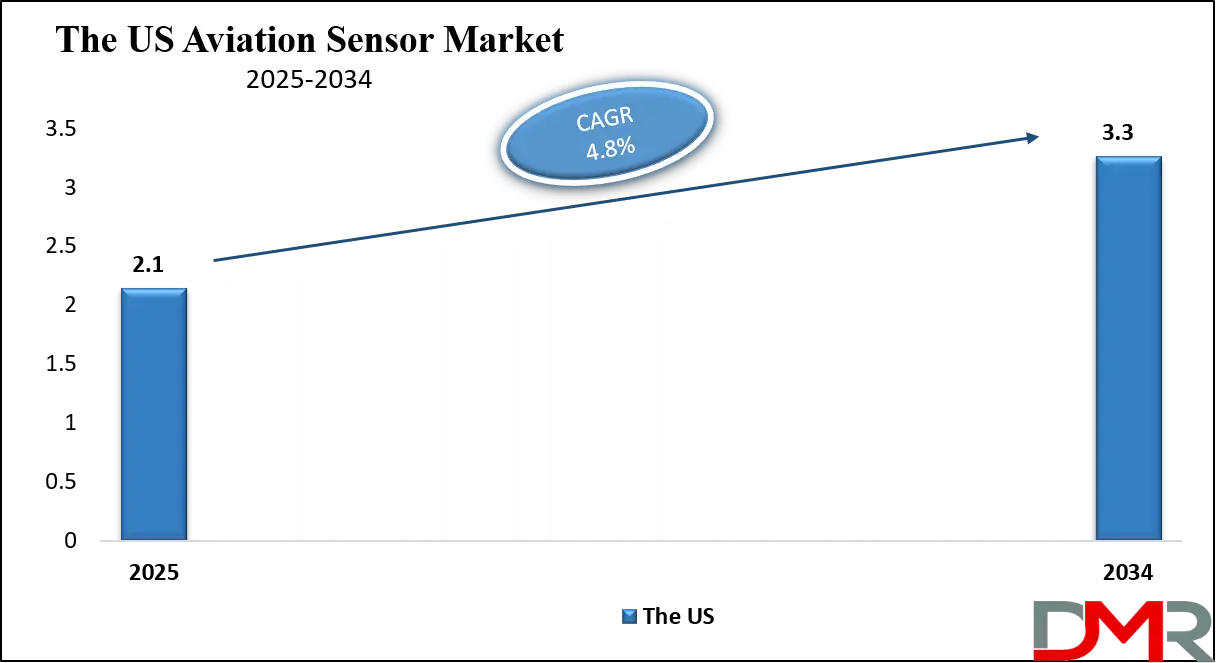

The US Aviation Sensor Market

The US Aviation Sensor Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 4.8% over its forecast period.

In the United States (the heart of the North American region), the aviation‑sensor market benefits from large commercial aircraft production, extensive defense programs, and a highly developed MRO (maintenance‑repair‑overhaul) ecosystem. OEMs and Tier‑1 suppliers are deeply engaged with sensor innovation (MEMS, fiber‑optic, wireless), and regulatory agencies mandate advanced sensor systems for safety, emissions, and performance monitoring.

Retrofit of legacy fleets and growth in unmanned systems also drive demand. However, the U.S. market faces challenges around sensor supply‑chain bottlenecks (especially aerospace‑qualified electronics), increasing certification complexity, and cost pressures from airlines and defense budgets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Aviation Sensor Market

Europe Aviation Sensor Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 4.5% over its forecast period.

Europe’s aviation sensor market is mature, innovation‑led and shaped by regulatory drivers. The presence of major air‑frame and engine manufacturers, strong research infrastructure and stringent aviation safety/environmental standards create demand for advanced sensors for flight control, engine monitoring, landing‑gear systems and avionics. European suppliers often focus on performance, reliability and compliance (EASA standards) rather than cost‑led volumes.

The region benefits from retrofit programs and defense modernization initiatives. On the flip side, growth is slower compared to high‑growth regions, and competition from low‑cost suppliers is increasing. Certification and cross‑border supply‑chain disruptions (e.g., Brexit) pose additional complexity.

Japan Aviation Sensor Market

Japan Aviation Sensor Market size is projected to reach USD 490 million in 2025 at a compound annual growth rate of 5.9% over its forecast period.

Japan is an important sensor‐manufacturing and aerospace support region, albeit not the largest in demand. The Japanese market leverages high technological capabilities in MEMS, fiber optics and precision sensors for both domestic aircraft, defense programs and export supply‑chains. Domestic initiatives in urban air mobility and unmanned aircraft are also stimulating sensor demand.

However, Japan’s overall aviation sensor market growth is moderated by slower commercial aircraft production compared to Asia’s major growth engines, and by global competition for sensor supply. The supply chain’s localization, skills shortage and stringent certification processes add further hurdles.

Aviation Sensor Market: Key Takeaways

- Market Growth: The Aviation Sensor Market size is expected to grow by USD 3.6 billion, at a CAGR of 5.1%, during the forecasted period of 2026 to 2034.

- By Platform: The fixed-wing aircraft segment is anticipated to get the majority share of the Aviation Sensor Market in 2025.

- By Aircraft Type: The commercial aviation segment is expected to get the largest revenue share in 2025 in the Aviation Sensor Market.

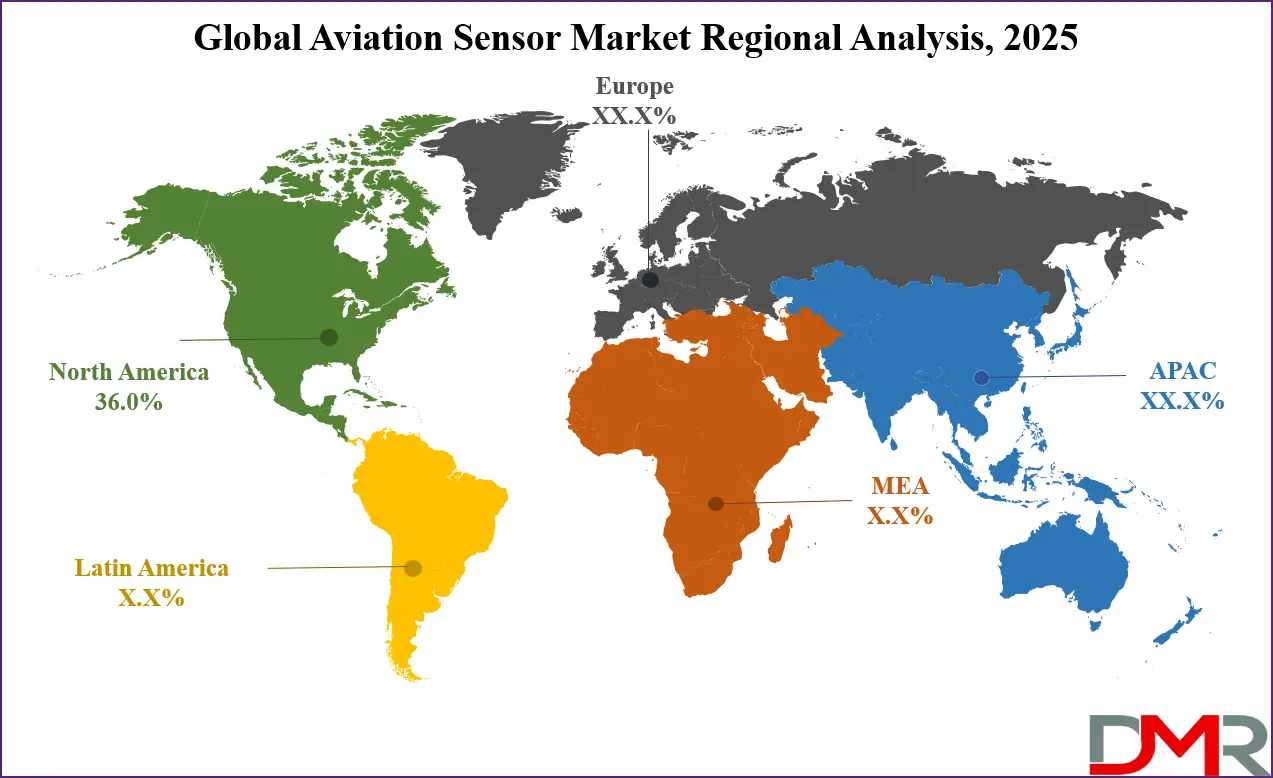

- Regional Insight: North America is expected to hold a 36.0% share of revenue in the Global Aviation Sensor Market in 2025.

- Use Cases: Some of the use cases of Aviation Sensor include engine health monitoring, avionics data fusion, and more.

Aviation Sensor Market: Use Cases

- Engine Health Monitoring: Sensors track temperature, pressure, and vibration in engines for real-time performance data and predictive maintenance.

- Flight Control Assistance: Position and proximity sensors support actuators and control surfaces for smooth and precise flight operations.

- Landing Gear Operations: Speed, position, and pressure sensors enable safe extension/retraction of landing gear and braking systems.

- Avionics Data Fusion: MEMS and inertial sensors deliver critical motion data to onboard avionics for enhanced situational awareness.

Stats & Facts

- The Directorate General of Civil Aviation (DGCA) India has mandated advanced flight data monitoring systems on certain categories of aircraft to improve safety and predictive diagnostics.

- The Federal Aviation Administration (FAA) includes sensor validation in its aircraft certification processes to ensure performance under high-vibration, pressure, and temperature conditions.

- The European Union Aviation Safety Agency (EASA) supports integration of wireless sensor networks in retrofit programs for fuel and landing gear systems.

- Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has initiated modernization schemes for domestic aircraft sensors in both civil and defense aviation.

Market Dynamic

Driving Factors in the Aviation Sensor Market

Rise of More-Electric Aircraft Architectures

The shift toward more electric and hybrid-electric aircraft is increasing the need for advanced sensors to replace mechanical and hydraulic systems. These aircraft demand accurate and compact sensors for power management, control, and thermal monitoring, particularly in next-generation propulsion and actuation systems.

Growing Emphasis on Predictive Maintenance and Health Monitoring

Airlines and defense operators are increasingly deploying sensors to monitor aircraft systems in real time for proactive maintenance. Sensor data enables condition-based servicing, reducing unscheduled downtime and extending aircraft lifespan a key driver in both commercial and military segments.

Restraints in the Aviation Sensor Market

Stringent Certification and Safety Standards

Sensors used in aviation must meet highly rigorous certification standards across regions, which lengthens development cycles and adds compliance costs. Even minor sensor upgrades must be validated for electromagnetic interference, vibration, and thermal limits, slowing innovation timelines.

Harsh Environmental Requirements

Aviation sensors operate under extreme conditions rapid altitude changes, temperature swings, pressure variation, and vibration which demand highly durable and expensive designs. This restricts low-cost mass deployment and raises entry barriers for new players in the market.

Opportunities in the Aviation Sensor Market

Integration of Wireless Sensor Networks

Wireless sensor systems are emerging as a promising area for reducing aircraft wiring weight, enabling easier installation, and supporting real-time monitoring. These are particularly suited for retrofitting older aircraft and for future digital-twin-based monitoring frameworks.

Expansion of UAVs and eVTOL Platforms

The proliferation of drones, unmanned combat air systems (UCAVs), and electric vertical takeoff and landing aircraft is creating new avenues for compact, lightweight, multi-functional sensors with modular configurations suited for autonomous and remotely piloted operations.

Trends in the Aviation Sensor Market

Sensor Fusion and Integrated Health Monitoring

Modern aircraft increasingly use sensor fusion to combine input from multiple sensors into a unified view for onboard systems and diagnostics. This trend supports advanced flight automation and predictive analytics for mission readiness and fleet reliability.

Development of AI-Enabled Smart Sensors

AI-integrated sensors capable of local processing, anomaly detection, and communication with digital twins are gaining traction. These sensors reduce processing loads on aircraft computers and enable more efficient data use for maintenance, safety, and system optimization.

Impact of Artificial Intelligence in Aviation Sensor Market

- AI enhances predictive maintenance: Sensor data combined with AI models allows real-time fault detection and failure prediction, improving safety and reducing operational costs.

- Smarter flight control systems: AI helps interpret sensor inputs more efficiently, enabling smoother flight handling, especially in adverse conditions or automated operations.

- Real-time decision support: Artificial Intelligence algorithms use live sensor data to support pilots and automated systems in making faster, more accurate flight decisions.

- Sensor calibration and error correction: AI enables adaptive calibration of sensors, correcting drift and improving long-term accuracy in critical flight systems.

- AI in avionics and autopilot: Sensors integrated with AI improve responsiveness in avionics, supporting smoother transitions between manual and automated modes.

Research Scope and Analysis

By Sensor Type Analysis

In 2025, pressure sensors dominate the aviation sensor market, commanding approximately 29.6% of the total share. These sensors are crucial across nearly every aircraft subsystem from cabin pressurization and fuel systems to hydraulics and flight data measurements. Their robustness, high accuracy, and role in maintaining operational safety under varying altitudes and environmental conditions contribute to their widespread deployment.

Additionally, the redundancy and fail-safe architecture required by aviation standards make pressure sensors a top-priority component for both OEM installations and retrofits. Their ability to function reliably in high-pressure, high-vibration environments ensures long-term adoption across both commercial and military platforms.

Temperature sensors represent the fastest-growing category within aviation sensors. Their demand is rapidly increasing in applications involving engine performance, avionics thermal control, battery safety systems, and power electronics—particularly in hybrid-electric and all-electric aircraft platforms.

As thermal regulation becomes more critical in newer airframe architectures and propulsion systems, temperature sensors are increasingly required to support safe, efficient operations in both manned and unmanned platforms. The shift toward advanced propulsion and compact avionics systems makes precise, real-time temperature sensing essential.

By Technology Analysis

MEMS (Micro-Electro-Mechanical Systems) sensors account for 41.2% of the aviation sensor market in 2025, making them the leading technology segment. Their miniaturization, integration capability, and cost-effectiveness have positioned MEMS-based sensors such as gyroscopes, accelerometers, and pressure sensors as a go-to solution across fixed-wing and rotary-wing aircraft. These sensors support applications from flight control and navigation to engine monitoring and structural health diagnostics. Their high durability and low power consumption are especially advantageous in aerospace environments where space, weight, and energy efficiency are mission-critical.

Wireless sensors are the fastest-growing technology due to their ability to reduce wiring weight and complexity while improving maintenance access. As aviation platforms evolve toward digital twin and predictive maintenance ecosystems, wireless sensor integration enables faster retrofitting and scalability in data collection. Particularly in aftermarket and MRO applications, wireless sensors are key enablers for transforming conventional systems into smart, connected aviation architectures without requiring structural overhaul.

By Application Analysis

In 2025, Engine & Fuel Systems represent the leading application for aviation sensors, capturing around 35.5% of total demand. These systems rely heavily on pressure, temperature, vibration, and flow sensors for optimal engine health monitoring, performance management, and safety regulation compliance. Given the centrality of engines to aircraft performance and the strict monitoring required to meet emission and safety norms, these sensors play a pivotal role in both commercial and defense aircraft. They are embedded throughout propulsion systems to ensure continuous, real-time diagnostics and control.

Avionics Systems are the fastest-growing application segment as aircraft become more digitized and autonomous. From navigation and communication to surveillance and system health monitoring, avionics require a wide array of sensors—including inertial, optical, and MEMS devices. The adoption of fly-by-wire systems, AI-assisted piloting technologies, and enhanced situational awareness tools is significantly boosting sensor content in next-generation avionics suites, especially for advanced commercial jets and military aircraft.

By Platform Analysis

Fixed-wing aircraft dominate the aviation sensor market in 2025, accounting for approximately 72.5% of total sensor demand. These platforms ranging from commercial airliners and business jets to military transports and fighter aircraft feature extensive sensor integration across propulsion, flight control, avionics, and structural monitoring systems. The sheer scale of fixed-wing aircraft deliveries globally, coupled with higher sensor content per aircraft, ensures their continued market leadership. The trend of increasing fleet modernization and sensor upgrades also supports this dominance.

Rotary-wing aircraft including helicopters, tilt-rotors, and emerging eVTOLs—are the fastest-growing platform category. These platforms demand specialized sensors to monitor rotor dynamics, vibration, proximity, and environmental conditions unique to vertical take-off and landing operations. The growth of urban air mobility (UAM), helicopter-based EMS, surveillance, and military rotorcraft programs is accelerating adoption, particularly as reliability and precision become more critical in congested and low-altitude flight zones.

By Aircraft Type Analysis

Commercial aviation holds the largest share of the aviation sensor market in 2025 with an estimated 63.8%. This includes narrow-body, wide-body, and regional aircraft operated by global airlines. The high-volume production and delivery of commercial aircraft, combined with increasingly strict safety, fuel efficiency, and emissions standards, drive the use of advanced sensors across nearly every aircraft subsystem. Additionally, airlines’ focus on predictive maintenance and digital fleet management enhances sensor content per aircraft.

Military aviation is the fastest-growing segment, underpinned by rising global defense budgets, new fighter programs, UAV expansions, and electronic warfare advancements. Sensors in military platforms must operate in extreme environments with high resilience. Increased demand for rugged, encrypted, and real-time capable sensor solutions especially in combat aircraft and surveillance drones is driving rapid growth. The adoption of autonomous technologies and integrated avionics also contributes to higher sensor complexity and density in defense platforms.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Aviation Sensor Market Report is segmented on the basis of the following:

By Sensor Type

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Proximity Sensors

- Speed Sensors

- Vibration Sensors

- Others

By Technology

- MEMS (Micro-Electro-Mechanical Systems)

- Fiber Optic Sensors

- Wireless Sensors

By Application

- Engine & Fuel Systems

- Flight Control Systems

- Avionics Systems

- Landing Gear & Braking Systems

- Others

By Platform

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

By Aircraft Type

- Commercial Aviation

- Military Aviation

Regional Analysis

Leading Region in the Aviation Sensor Market

In 2025, North America stands as the leading region in the global aviation sensor market, accounting for approximately 36% of the total market share. This dominance is driven by the presence of major aerospace OEMs, well-established supply chains, and robust defense and commercial aviation sectors. The U.S. leads regional demand due to its high-volume aircraft production, strong focus on avionics and flight-control innovation, and substantial investment in military aircraft and unmanned systems.

Additionally, a mature MRO (maintenance, repair, and overhaul) industry supports steady demand for retrofit and replacement of sensor systems in aging fleets. Federal mandates on aircraft safety and performance monitoring further fuel the adoption of advanced sensing technologies, including MEMS and fiber-optic sensors. The region also benefits from close collaboration between industry and regulatory bodies, promoting sensor certification and innovation. Overall, North America’s ecosystem fosters sustained sensor demand across both commercial and defense aviation platforms.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Aviation Sensor Market

The Asia-Pacific region is emerging as the fastest-growing market for aviation sensors in 2025, driven by a surge in commercial aircraft deliveries, especially in China and India. Expanding airline networks, rising air passenger traffic, and the increasing presence of regional aircraft manufacturers are fuelling demand for onboard sensor systems. Governments across the region are modernising defense fleets, investing in advanced aircraft platforms that require sophisticated sensor technologies for engine monitoring, flight control, and avionics.

Additionally, the development of domestic aerospace industries and local supply chains is pushing regional adoption of sensors aligned with international aviation standards. Emerging smart airport and urban air mobility initiatives, particularly in South Korea, Japan, and Southeast Asia, are also expanding the use of wireless and real-time sensors. Despite regulatory and certification hurdles, Asia-Pacific’s focus on fleet expansion, technology indigenisation, and infrastructure growth positions it as a key driver of long-term aviation sensor market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The aviation sensor market is moderately concentrated, with large global aero‑sensor OEMs and component suppliers dominating, alongside emerging specialist players and regional vendors. Leading firms design, certify, manufacture and supply aerospace‑qualified sensors for engine, flight‑control, landing‑gear, and avionics applications. Many incumbents are extending into digital/connected sensor suites and wireless sensor networks for predictive maintenance.

Newer entrants focus on niche innovations (wireless sensor nodes, fiber‑optic sensing, structural‑health monitoring) and retrofit modules for older aircraft. Supply‑chain complexity, long certification cycles, high reliability standards and defence export controls all raise the barrier to entry.

Some of the prominent players in the global Aviation Sensor are:

- Honeywell International Inc.

- TE Connectivity Ltd.

- Safran SA

- Meggitt PLC

- METEK Inc.

- Thales Group

- Curtiss-Wright Corporation

- General Electric Company

- Raytheon Technologies Corporation

- Woodward Inc.

- Amphenol Corporation

- Bosch Group

- L3Harris Technologies Inc.

- Crane Aerospace & Electronics

- Trimble Inc.

- Eaton Corporation plc

- Kongsberg Gruppen ASA

- TDK Corporation

- Ultra Electronics Holdings plc

- VectorNav Technologies LLC

- Other Key Players

Recent Developments

- In June 2025, TransDigm Group revealed plans to acquire Simmonds Precision Products for USD 765 million. The acquisition strengthens TransDigm’s portfolio in proximity sensors and health-monitoring solutions for aerospace systems.

- In May 2025, Aeva Technologies announced it is supplying lidar sensors to Airbus UpNext for autonomous taxi operations on the A350-1000. The sensors support precise gate-to-runway movement without pilot input, enhancing ground autonomy.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.1 Bn |

| Forecast Value (2034) |

USD 11.0 Bn |

| CAGR (2025–2034) |

5.1% |

| The US Market Size (2025) |

USD 2.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Sensor Type (Pressure Sensors, Temperature Sensors, Position Sensors, Proximity Sensors, Speed Sensors, Vibration Sensors, and Others), By Technology (MEMS (Micro-Electro-Mechanical Systems), Fiber Optic Sensors, and Wireless Sensors), By Application (Engine & Fuel Systems, Flight Control Systems, Avionics Systems, Landing Gear & Braking Systems, and Others), By Platform (Fixed-Wing Aircraft and Rotary-Wing Aircraft), By Aircraft Type (Commercial Aviation and Military Aviation) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Honeywell International Inc., TE Connectivity Ltd., Safran SA, Meggitt PLC, METEK Inc., Thales Group, Curtiss-Wright Corporation, General Electric Company, Raytheon Technologies Corporation, Woodward Inc., Amphenol Corporation, Bosch Group, L3Harris Technologies Inc., Crane Aerospace & Electronics, Trimble Inc., Eaton Corporation plc, Kongsberg Gruppen ASA, TDK Corporation, Ultra Electronics Holdings plc, VectorNav Technologies LLC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Aviation Sensor Market?

▾ The Global Aviation Sensor Market size is expected to reach a value of USD 7.1 billion in 2025 and is expected to reach USD 11.0 billion by the end of 2034.

Which region accounted for the largest Global Aviation Sensor Market?

▾ North America is expected to have the largest market share in the Global Aviation Sensor Market, with a share of about 36.0% in 2025.

How big is the Aviation Sensor Market in the US?

▾ The Aviation Sensor Market in the US is expected to reach USD 2.1 billion in 2025.

Who are the key Aviation Sensor Market?

▾ Some of the major key players in the Global Aviation Sensor Market are Thales, Bosch, Honeywell, and others

What is the growth rate in the Global Aviation Sensor Market?

▾ The market is growing at a CAGR of 5.1 percent over the forecasted period.