↵

Market Overview

The Global Baby Products Market is projected to reach USD 357.9 billion in 2024 and grow at a compound annual growth rate of 6.1% from there until 2033 to reach a value of USD 611.4 billion.

Baby products are made for infants and toddlers to ensure their comfort, safety, and well-being. They include diapers, baby food, formula milk, clothing, toys, strollers, car seats, cribs, and hygiene products. Such items are crafted with careful attention to the demands of delicate and developing bodies, mostly adhering to strict safety and health standards. Parents and caregivers depend on these products to provide a nurturing environment during the critical early years of a child's life.

Further, the need for baby products has been majorly growing due to the growth in birth rates in many parts of the world and major awareness of child health and safety. Also, a transformation towards urbanization and dual-income households has created higher spending power, making parents invest more in high-quality and innovative baby items. Convenience-driven products, like disposable diapers and ready-to-use baby foods, have seen mainly strong growth, meeting the needs of busy parents. As a result, these product categories are showing noticeable increases in Baby Product Market Share across global markets.

Moreover, trends like eco-friendly and sustainable products are gaining popularity, with parents mainly choosing reusable diapers, biodegradable toys, and organic baby foods.

Technology incorporation is another notable trend, with smart baby monitors, digital thermometers, and app-connected strollers becoming popular. Moreover, looking for inclusivity and diverse needs has resulted in the availability of hypoallergenic formulas, adaptive clothing, and products catering to children with special needs.

Also, recent years have seen a growth in innovative solutions within the

baby products sector. Making online platforms a preferred shopping choice for parents.

Companies responded by enhancing digital services, providing virtual consultations, and developing subscription models for essentials like diapers and formula. Furthermore, introducing advanced materials, like temperature-regulating fabrics and BPA-free plastics, highlights the industry’s commitment to improving product safety and comfort.

While the baby products market constantly grows, it also experiences challenges. High costs of premium products may limit accessibility for low-income families, developing demand-supply gaps in certain regions. Also, regulatory scrutiny ensures products meet safety standards, but compliance can be costly and time-consuming for manufacturers. However, awareness campaigns and collaborations with healthcare professionals are helping bridge gaps and foster trust among parents.

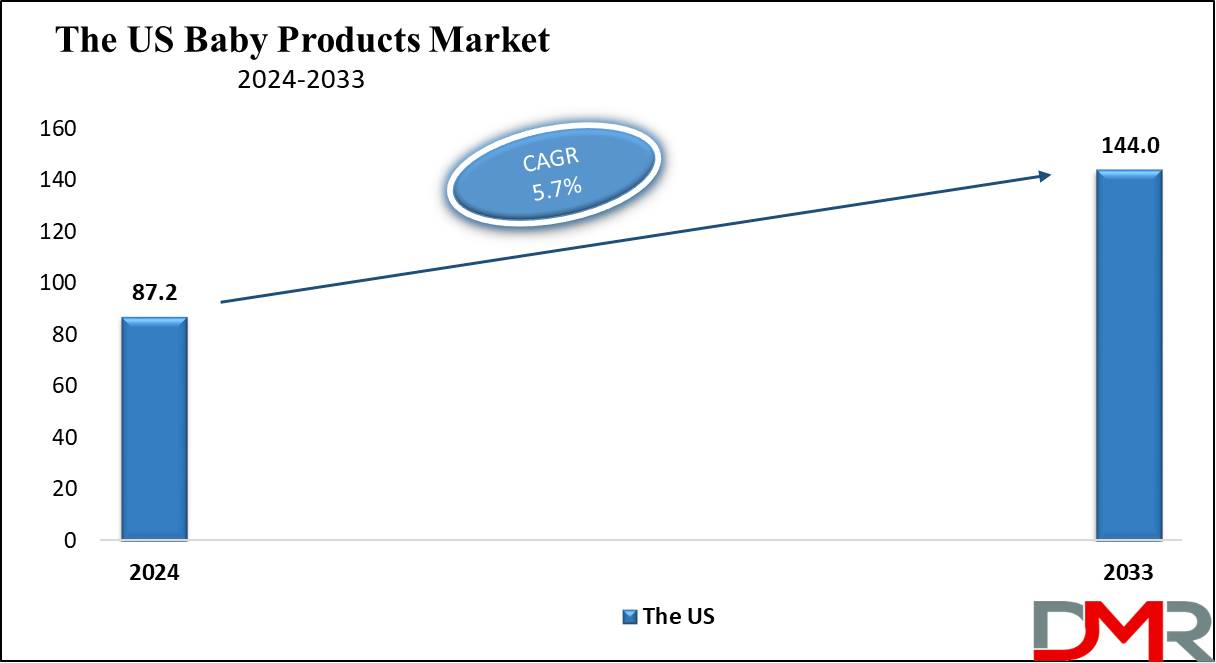

The US Baby Products Market

The US Baby Products Market is projected to reach USD 87.2 billion in 2024 at a compound annual growth rate of 5.7% over its forecast period.

In the US, growth opportunities in the baby products market are driven by growth in disposable incomes, a major preference for premium and organic products, and advancements in technology. E-commerce expansion provides parents with easy access to diverse brands and products. In addition, growing awareness of infant safety, government-backed initiatives, and demand for sustainable, eco-friendly baby products further boost market potential.

Further, the market is driven by growing disposable incomes, increased awareness of baby health and safety, and an increase in demand for premium, organic, and eco-friendly products. Technological development and the convenience of e-commerce also boost growth. However, high product costs, mainly for premium items, and strict regulatory standards act as restraints. In addition, declining birth rates in the U.S. pose a challenge to long-term market expansion.

Key Takeaways

- Market Growth: The Baby Products Market size is expected to grow by 233.8 billion, at a CAGR of 6.1% during the forecasted period of 2025 to 2033.

- By Type: The mass segment is anticipated to get the majority share of the Baby Products Market in 2024.

- By Product: Baby food is expected to be leading the market in 2024

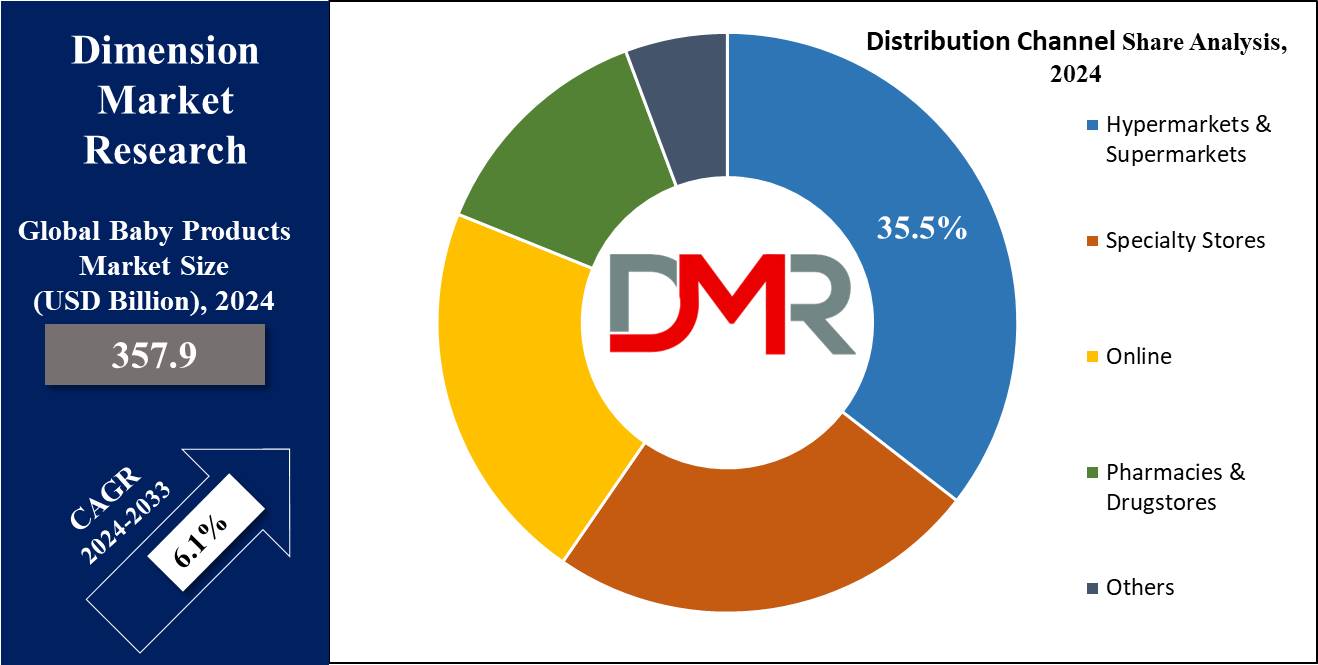

- By Distribution Channel: The hypermarkets & supermarkets segment is expected to get the largest revenue share in 2024 in the Baby Products Market.

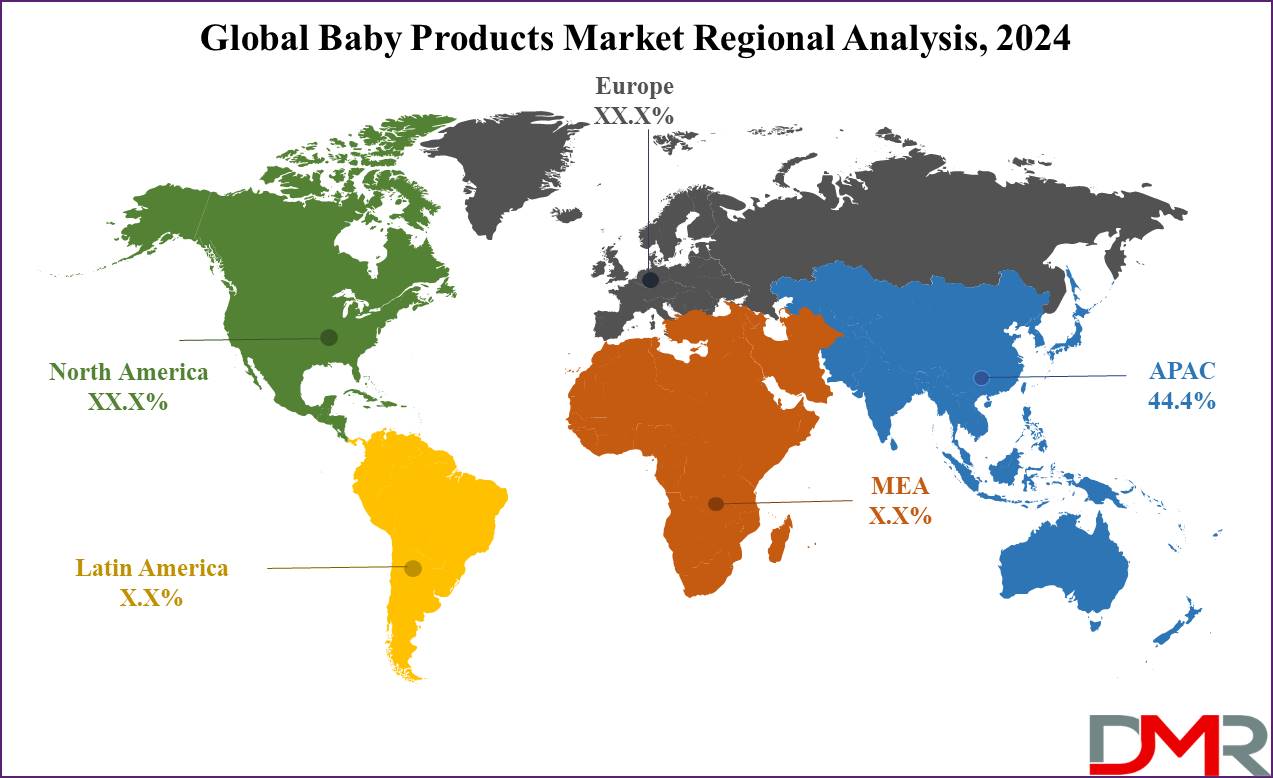

- Regional Insight: Asia Pacific is expected to hold a 44.4% share of revenue in the Global Baby Products Market in 2024.

- Use Cases: Some of the use cases of Baby Products include nutritional support, safety & comfort, and more.

Use Cases

- Nutritional Support: Baby products such as formula milk, baby food, and feeding accessories ensure proper nourishment during important growth stages.

- Safety and Comfort: Products like strollers, car seats, cribs, and baby monitors deliver safety and ease for both babies and parents.

- Hygiene and Health: Diapers, wipes, baby skincare, and bathing are critical to maintaining cleanliness and protecting sensitive skin.

- Development and Engagement: Toys, books, and activity centers stimulate cognitive, motor, and sensory development.

Stats and Facts

- As per UNICEF, babies should start eating soft, mashed foods like porridge, fruits, and vegetables alongside breastmilk at 6 months to meet growing nutritional needs. Porridge should be thick, not watery, to retain more nutrients.

- Further, solid foods should be given after breastfeeding or between nursing sessions to ensure continued breast milk intake. From 6–8 months, parents should feed half a cup of soft food 2–3 times daily, increasing to 4–5 meals plus snacks by 9–11 months, while avoiding honey until 12 months due to botulism risk.

- In addition, they should wash their hands with soap before preparing food or feeding to protect babies from illnesses as they explore and spread germs.

- Moreover, babies should be fed small portions when they show hunger cues like putting hands to their mouth. If they refuse new foods, try again later or mix them with familiar favorites or breastmilk. Never force-feed and watch for signs of fullness.

- Parents should provide meals rich in energy and nutrients, like grains, vegetables, fruits, legumes, oils, and animal products like dairy, eggs, and meat, to ensure balanced nutrition.

- As per Bady D, baby clothing sizes are typically labeled by age, but matching them to the baby’s weight and height ensures a better fit. Brand size variations make checking specific size charts important.

- In addition, red marks, tightness, or difficulty fastening snaps indicate clothing is too small, and regularly monitor a baby’s growth during rapid spurts to ensure a comfortable fit.

- Further, clothes with adjustable features like snaps or elastic waistbands accommodate growth. Choosing slightly bigger sizes ensures comfort and extended use when babies are between sizes.

- Using lightweight cotton for summer as it is breathable and gentle on the skin. In colder months, layering with cotton-based clothing provides warmth and regulates body temperature without overheating, keeping a mix of sizes and seasonal options to adapt to your baby’s rapid growth and weather changes. Ensure clothes allow free movement for comfort and daily activities.

Market Dynamic

Rising Awareness and Parental Spending

The increase in awareness about child health and safety, along with increasing disposable incomes, drives the need for premium baby products. Parents, mainly in urban areas, are willing to invest in high-quality, innovative products that give importance to comfort, nutrition, and safety, which is why better parenting practices and lifestyle enhancement have been significantly driven by the market's expansion globally.

Emerging Markets and E-commerce Growth

The fast growth of emerging markets in Asia, Africa, and Latin America provides untapped opportunities for baby product manufacturers. In addition, the growth of e-commerce platforms has made baby products more accessible to parents, providing convenience and competitive pricing. Subscription models and

digital innovations in the retail space further boost market demand and consumer reach.

Restraints

High Cost of Premium Products

The growth in the cost of high-quality, branded baby products can be a major barrier for low- and middle-income families. Many parents in developing regions may find it challenging to afford premium items like organic baby food, smart monitors, or developed strollers, limiting market penetration, which creates a demand-supply gap and affects the overall market growth.

Stringent Regulations and Safety Standards

Baby products must comply with strict safety and quality regulations, which can be time-consuming and costly for manufacturers. Non-compliance risks, product recalls, financial losses, and damage to brand reputation. These challenges discourage smaller players from entering the market and can slow down innovation in certain segments.

Opportunities

Sustainability and Eco-Friendly Products

The major demand for eco-friendly and sustainable baby products provides a major opportunity for manufacturers. Parents are majorly opting for

biodegradable diapers, organic baby food, and non-toxic toys to minimize environmental impact. Companies that develop in this space can attract environmentally conscious consumers and carve a niche in the market, driving long-term growth.

Technological Advancements and Smart Products

The incorporation of technology into baby products, like smart monitors, app-connected strollers, and temperature-regulating fabrics, provides a promising growth avenue. These innovations meet tech-savvy parents looking for convenience and better safety for their children. Companies investing in the R&D of smart solutions can capitalize on this trend and differentiate themselves in the competitive market.

Trends

E-commerce and Subscription Models

The fast expansion of e-commerce platforms has transformed the baby products market, providing parents with convenience, competitive pricing, and access to various products. Subscription models for essentials like diapers, baby food, and formula are gaining popularity, providing consistent supply and cost savings, which is particularly appealing to busy parents.

Personalization and Inclusive Products

Brands are majorly focusing on customized and inclusive baby products to meet diverse parental needs. Adaptive clothing for children with special needs, hypoallergenic formulas, and custom-fit diapers are examples of this shift. These customized solutions cater to specific consumer demands, enhancing accessibility and improving brand loyalty in a competitive market.

Research Scope and Analysis

By Product

Baby food is expected to dominate the baby product market in 2024, with strong growth continuing in the coming years. Baby food is mainly developed to be easily consumed and digested by infants and toddlers, making it a key component of early childhood nutrition, which is available in various forms, like mashed table foods and pre-packaged options from manufacturers. The increase in demand for baby food is mainly driven by urbanization, busy work schedules, and changing lifestyles, all of which make packaged baby food a convenient choice for many parents.

In addition, there has been a growth in parental concerns about proper baby nutrition, which is prompting more parents to look for high-quality food options for their children. Developments in food technology have allowed manufacturers to make products that are not only nutritious but also meet the specific needs of growing babies. The demand for infant formula, in particular, has been growing rapidly, further contributing to the expansion of this segment in the market.

In addition, baby cosmetics and toiletries, including diapers and wipes, will also hold a significant share of the market in the coming years. Diapers and wipes play a major role in ensuring babies stay clean and dry, which is vital for their hygiene and health. As parents become more aware of the importance of maintaining proper hygiene for their babies, the need for these products is steadily increasing. In the U.S., for example, babies use between 6 and 12 diapers daily during their first year, as reported by the National Diaper Bank Network in September 2022.

The baby safety and convenience market is also on the rise, driven by the increase in the number of nuclear families and a greater focus on child protection. Government initiatives focused on reducing child mortality rates, along with stricter safety regulations, are also driving the growth of this segment. These safety measures are designed to ensure that infants are better protected, contributing to a safer environment for babies and boosting market demand.

By Type

In the baby products market, mass baby products are expected to hold the largest share of the market in 2024. These products are affordable and value-oriented, making them accessible to a variety of consumers. The affordability of mass baby products is a major factor driving their popularity, as they are priced highly to appeal to price-conscious parents. Many parents look for products that provide a good balance between quality and cost, and mass baby products meet this demand. In addition, these products are easily available in supermarkets, discount stores, and online retail platforms, making them convenient choices for busy parents.

The broad availability and reasonable prices of mass baby products ensure they remain the preferred option for many families. Further, the demand for premium baby products is anticipated to grow significantly in the coming years. With the growing disposable incomes, more parents are willing to invest in high-quality baby products that offer advanced features and superior materials. These parents look for safety, comfort, and innovation over cost, looking for the best products available for their children.

Premium baby products mostly include eco-friendly materials, specialized designs, and better functionality, making them highly appealing to consumers who value quality and sustainability, which transforms towards higher-end baby products, which is expected to drive growth in the premium segment as more parents look out for products that offer long-term benefits and a higher standard of care for their babies.

By Distribution Channel

Hypermarkets & supermarkets are expected to hold a major share of the baby products market in 2024, as they provide numerous selections of baby products, making them an easy one-stop shopping destination for parents. Whether it's diapers, baby food, or toys, parents can find everything they require in one place. Also, for convenience, these stores mostly provide competitive pricing, making baby products more affordable for consumers. Owing to their large-scale operations, hypermarkets and supermarkets benefit from economies of scale, which enables them to negotiate better deals with suppliers and pass those savings on to customers.

Further, online sales of baby products are expected to grow at the fastest rate in the coming years. Online shopping provides parents the convenience of browsing and purchasing products from the comfort of their homes, removing the need for trips to physical stores. In addition, online platforms provide various products, allowing parents to choose from numerous brands, styles, and price points.

They can easily compare products, read customer reviews, and make well-informed decisions before buying. With these advantages, online shopping is expected to continue expanding, providing a major growth opportunity for the baby products market in the coming years.

The Baby Products Market Report is segmented on the basis of the following

By Product

- Baby Food

- Baby Cosmetics & Toiletries

- Baby Toys & Play Equipment

- Baby Safety & Convenience

- Baby Clothing

- Baby Nursery & Furniture

- Baby Feeding & Nursing

By Type

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

- Pharmacies & Drugstores

- Others

Regional Analysis

The Asia Pacific region is expected to hold a substantial market

share of 44.4% in 2024 and is expected to grow significantly in the coming years, owing to an increasing number of working mothers and high birth rates in countries like India and China. India alone contributes nearly one-fifth of the world’s annual births, with about 25 million children born each year, according to UNICEF. The growing population of young parents in India has driven demand for baby products as they highly prioritize nutrition, health, and safety.

Major awareness about the benefits of breastfeeding and organic or natural baby products has also boosted market growth. Majorly, economic development in ASEAN countries has led to higher disposable incomes, enabling parents to invest more in quality baby products. Urbanization and changing lifestyles have increased awareness of baby care needs, with parents looking for safe, non-toxic, and eco-friendly products, which is particularly strong in urban areas, where health and safety are top priorities for young families.

Further, in North America, the baby products market is thriving due to advanced technology, working parents, and strong government initiatives supporting infant safety. Parents in the U.S. and Canada are willing to spend more on premium products that ensure their baby’s health and well-being. Early adoption of advanced baby care products further drives this market.

Meanwhile, in the Middle East and Africa, awareness about baby care is growing due to better access to information, more healthcare professionals trained in infant care, and significant efforts from government to promote good baby care practices. These factors, combined with an increasing demand for safe and high-quality baby products, are expected to boost sales in the region throughout the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The baby products market is highly competitive, with various global and regional players competing for market share. Companies focus on product innovation, safety, and quality to meet the changing needs of parents. Major brands like Johnson & Johnson, Procter & Gamble, and Nestlé dominate through strong brand recognition and extensive distribution networks. Smaller and regional brands compete by providing affordable, niche, or eco-friendly products. The rise of e-commerce has intensified competition, allowing new entrants to reach a broader audience. Strategic partnerships and marketing efforts are key tactics in this dynamic market.

Some of the prominent players in the Global Baby Products are

- Johnson & Johnson

- Unilever

- Nestlé

- The Procter & Gamble Company

- Fujian Hengan Group

- Britax

- Chicco

- Beiersdorf AG

- Dorel Industries

- Kimberly Clark Corp

- Other Key Players

Recent Developments

- In October 2024, Dynarex Corporation announced an expansion to a recall initiated on September 2024 including an additional 373 cases of item number 4875, Dynacare Baby Powder, 14 oz., along with 647 cases of item number 4874, Dynacare Baby Powder, 4 oz., owing to having the potential to be contaminated with asbestos, which is a naturally occurring mineral that is often found near talc, an ingredient in many cosmetic products.

- In October 2024, Nestlé India launched its baby food with no refined sugar, introducing ‘Cerelac’ variants with no refined sugar, which was initiated three years ago and has culminated this year with the introduction of new Cerelac variants with no refined sugar, as the expanded Cerelac range in India will consist of 21 variants, of which 14 variants will have no refined sugar. Of these 14 variants, seven will be available by the end of November.

- In April 2024, ELSE NUTRITION HOLDINGS INC. unveiled the official commercial launch of its first-in-class ‘Follow-On’ formula for infants ages 6-12 months in Australia, which is a significant milestone as it marks the first country, along with New Zealand, in which the company’s new infant formula is eligible for sale. Also, it launched its Toddler Drink for toddlers ages 12-36 months in Australia.

- In January 2024, Baby Jogger launched the City Turn™ Convertible Car Seat in Canada, an innovation with a secure rotating mechanism that provides a one-hand 180-degree rotation in rear-facing mode and brings a child 25.4 cm (10 inches) closer to the parent when getting them in and out of the car. The distinctive technology allows parents and caregivers, mainly those who are recently post-partum or older like grandparents, a simple way to get a child in and out of the car while maintaining a more upright posture.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 357.9 Bn |

| Forecast Value (2033) |

USD 611.4 Bn |

| CAGR (2024-2033) |

6.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 87.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Baby Food, Baby Cosmetics & Toiletries, Baby Toys & Play Equipment, Baby Safety & Convenience, Baby Clothing, Baby Nursery & Furniture, and Baby Feeding & Nursing), By Type (Mass and Premium), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online, Pharmacies & Drugstores, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Johnson & Johnson, Unilever, Nestlé, The Procter & Gamble Company, Fujian Hengan Group, Britax, Chicco, Beiersdorf AG, Dorel Industries, Kimberly Clark Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Baby Products Market size is expected to reach a value of USD 357.9 billion in 2024 and is expected to reach USD 611.4 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Baby Products Market with a share of about 44.4% in 2024.

The Baby Products Market in the US is expected to reach USD 87.2 billion in 2024.

Some of the major key players in the Global Baby Products Market are Johnson & Johnson, Unilever, Nestlé, and others.

The market is growing at a CAGR of 6.1 percent over the forecasted period.