Market Overview

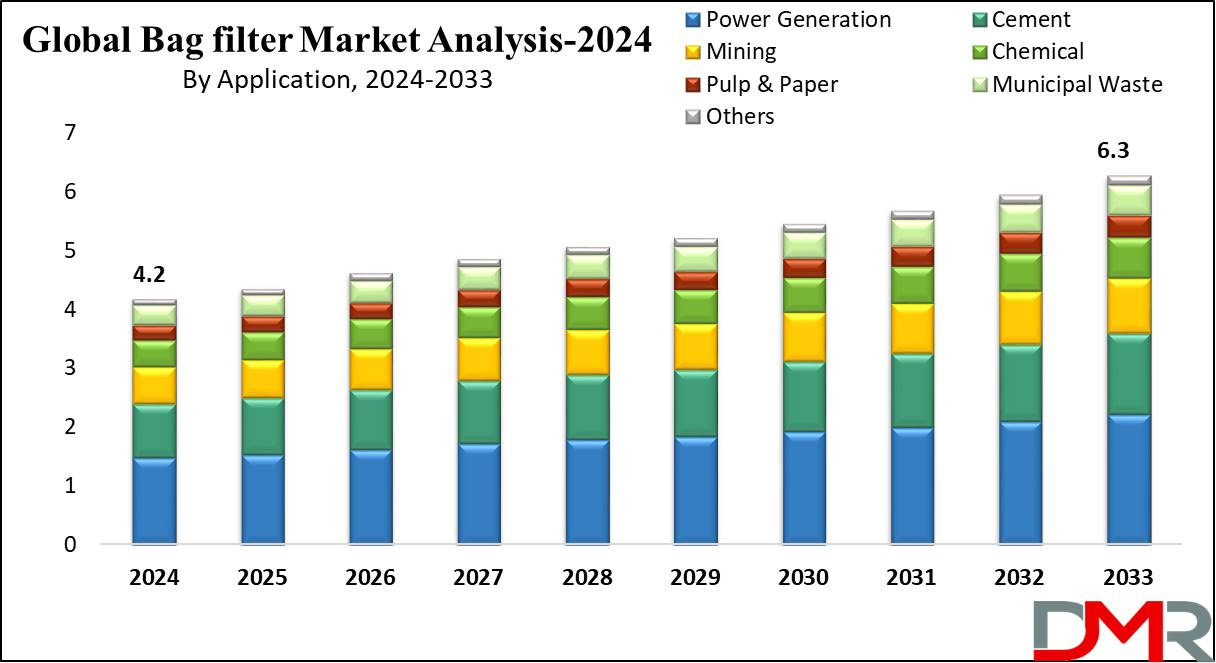

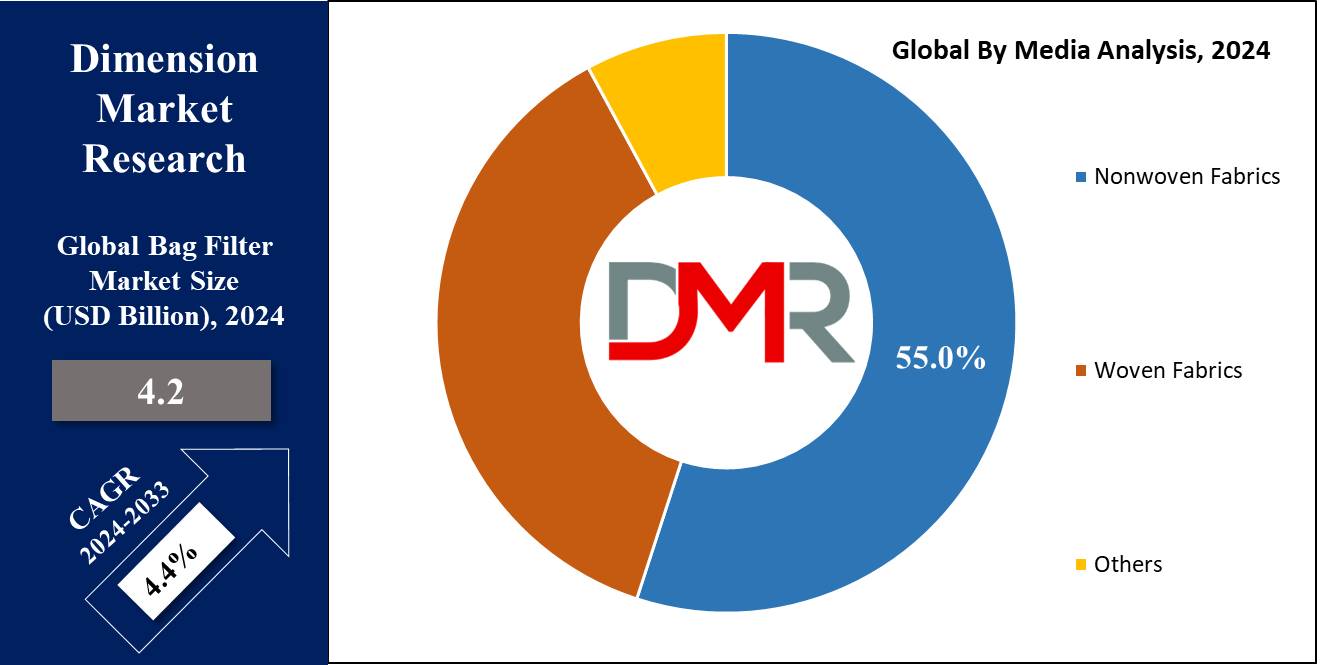

Global Bag Filter Market size is projected to reach a value of USD 4.2 Billion in 2024 and it is further anticipated to reach a market value of USD 6.3 billion in 2033 at CAGR of 4.4%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Bag Filter Market encompasses the sector that produces and distributes fabric bag-based filtration systems designed to capture airborne particulate matter. Filters play an essential role in maintaining air quality and operational efficiency across industries such as manufacturing, energy, and pharmaceuticals; meeting regulatory standards while improving workplace safety and prolonging equipment lifespan by preventing particulate emissions is possible with the effective use of filters.

In the Pharmaceutical Intermediates Market, stringent purity requirements further amplify the demand for advanced filtration solutions to ensure contamination-free production environments. The market for air filters is driven by rising environmental regulations, technological innovations in filter materials, and an upsurge in industrial activity; key players in this market focus on providing innovative high-efficiency solutions that support industry needs and sustainable goals.

The Bag Filter Market is poised for robust expansion, driven by rising environmental regulations and expanding industrial activities. As global regulations tighten on air quality and emissions issues, industries invest more heavily in advanced filtration systems to meet compliance standards and enhance operational efficiencies. Filter technology innovations like HEPA filters and nanofiber materials have propelled market evolution by offering superior performance with extended service lives.

The market is driven by industrial sectors spanning manufacturing, pharmaceuticals, and energy seeking effective solutions for particulate control and emission reduction. This trend is further encouraged by global initiatives emphasizing sustainability with stricter environmental mandates. Unfortunately, however, the sector still faces challenges, including high upfront costs and maintenance requirements that may delay adoption rates; competitive dynamics influence pricing strategies as well as foster rapid technological advances.

Key Takeaways

- Market Growth: The Global Bag Filter Market is expected to grow from USD 4.0 billion in 2024 to USD 5.9 billion by 2033, at a CAGR of 4.4%. Dominating Segment by Type: Pulse Jet filters lead the market, holding approximately 45% of the market share in 2024, due to their efficiency and adaptability.

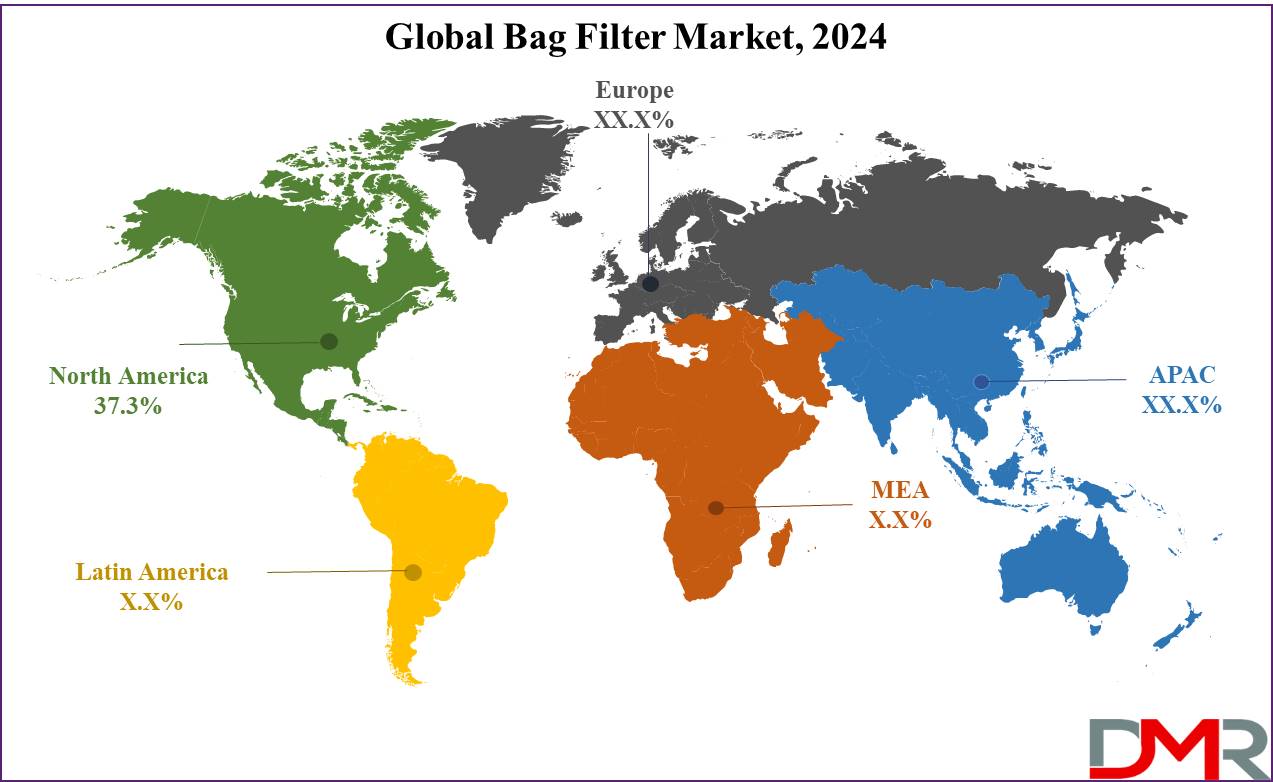

- Leading Region: North America dominates the market with a 37.3% share, driven by stringent environmental regulations and a robust industrial base.

- Key Application: Power Generation holds the largest share at around 40% of the market, reflecting this sector's need for effective emission control.

- Media Segment: Nonwoven fabrics are the most dominant media type, accounting for approximately 55% of the market in 2024, due to their efficiency and cost-effectiveness.

Use Cases

- Industrial Dust Control: Bag filters capture airborne dust to increase safety, minimize equipment damage, and ensure regulatory compliance.

- HVAC System Efficiency: Bag filters enhance energy efficiency while prolonging equipment lifespan and improving indoor air quality.

- Automotive Paint Quality: Bag filters help prevent paint overspray and dust contamination, leading to better paint finishes and reduced rework in automotive manufacturing.

- Pharmaceutical Clean Rooms: Bag filters maintain sterility in pharmaceutical clean rooms by filtering out particulates that could contaminate product purity and meet regulatory standards.

- Food & Beverage Processing: Bag filters provide an essential service in preserving product safety, minimizing maintenance requirements, and adhering to industry standards.

Market Dynamics

Driving Factors

Focus on Energy Efficiency

Bag Filter Market trends have been strongly affected by an increasing emphasis on energy efficiency across various industries. Modern bag filters are designed to offer reduced operating costs by optimizing energy use during filtration processes. Filter designs with improved airflow dynamics have proven highly cost-effective solutions in air handling systems. This is especially appealing in industries with significant energy expenditures, such as manufacturing and chemical processing. By adopting energy-efficient bag filters, companies can experience significant cost reductions in operational expenses, further encouraging adoption and driving market expansion.

Technological Advancements

Technological developments play a pivotal role in driving the expansion of bag filter markets. Constant improvements to filter media and filtration technologies continue to enhance the effectiveness and efficiency of bag filters. Nanofibers and advanced membrane technologies have enabled filters with superior dust-holding capacities and longer service lives, thanks to their inclusion. These breakthroughs not only increase particulate removal efficiency but also decrease filter replacement frequency for lasting cost savings for users. Their incorporation into bag filter systems has propelled market expansion by meeting industry demand for reliable and efficient filtration solutions.

Health and Safety Concerns

Increased public awareness of air pollutants' health hazards has become a driving factor behind the bag filter market. As more industries and governments recognize the dangers posed by airborne particulate matter to human health and safety, demand has skyrocketed for advanced filtration solutions. Bag filters play an essential role in protecting people against these risks by effectively trapping harmful particles and improving air quality. As regulations and public health initiatives increase their pressures for businesses to adopt superior filtration technologies to comply with compliance mandates while protecting employee health, the adoption of high-efficiency bag filters is increasing exponentially and stimulating overall market growth.

Growth Opportunities

Eco-Friendly Filter Materials

Bag Filter Market is set to see an increasing global trend towards eco-friendly filter materials driven by rising environmental awareness in 2024. Biodegradable and recycled filter media development is meeting growing customer demands for green solutions while meeting stricter environmental regulations; manufacturers who integrate eco-friendly options into their portfolio can stand out in competitive landscapes by differentiating themselves from rival manufacturers while potentially taking advantage of government incentive programs aimed at encouraging sustainability. Nanotech

Innovations

Nanotechnology is revolutionizing the bag filter industry through advancements in nanofiber technology. These innovations greatly increase filtration efficiency while simultaneously decreasing energy use; offering exceptional particulate capture at minimal pressure drop with reduced energy requirements and operational costs, opening new market segments such as pharmaceuticals, electronics, and advanced manufacturing industries where high-performance filtration is vitally important. Companies investing in nanotech can position themselves at the forefront of the market by offering state-of-the-art solutions tailored specifically to these demanding applications.

Expansion into Emerging Markets

Asia-Pacific and Africa present significant growth opportunities for the bag filter market, thanks to rapid industrialization and urbanization in these regions. As these areas build upon their industrial foundations, there is an increased demand for effective air pollution control solutions to manage increasing levels of particulate matter and emissions. By expanding into emerging markets with tailored solutions and local support packages, market players can capitalize on high growth potential while building a strong market presence and driving overall expansion.

Key Trends

Growing Food and Beverage Sector with Increased Demand for Filtration Solutions

2024 has seen huge momentum for the global Bag Filter Market, driven by the expansion of the food and beverage sectors and the growing Food Coating Market, where precision in texture, flavor retention, and hygiene are critical. A special emphasis has been placed on upholding high standards of cleanliness and product quality as these sectors expand globally. Bag filters play an integral part in maintaining product integrity—whether in preventing particulate contamination during food processing or ensuring uniform coatings in the Food Coating Market—while adhering to stringent health regulations. Rising consumer demand for packaged foods, coated snacks, and beverages, combined with increasing awareness of contamination risks, has spurred an upsurge in the adoption of advanced bag filter systems. Food-grade filtration companies stand to gain by tailoring solutions to meet the specific requirements of these industries, from dust control in seasoning applications to maintaining purity in liquid coating systems.

Global Trade and Export Opportunities

Global trade and export opportunities will play a critical role in 2024. As industries worldwide seek to expand operations and tap new international markets, demand is on the rise for effective filtration systems that comply with different regulatory standards. Bag filter manufacturers are taking advantage of global trade agreements and incentives to reach new markets while strengthening their competitive standing; by adapting products according to international standards and creating robust distribution networks, they can capitalize on this rising global need for effective air and liquid filtration solutions which drive market expansion.

Emergence of Novel Filtration Technologies

The emergence of new filtration technologies has presented both opportunities and challenges to the Bag Filter Market. Innovations like electrostatic precipitators, cyclones, and advanced catalytic converters offer competitive advantages in certain applications - such as higher efficiency and reduced operational costs. While these technologies could reduce the market share for traditional bag filters, they also foster innovation within the industry. Bag filter manufacturers are responding by expanding their product offerings with enhanced performance features and cost-effective solutions to ensure they remain market-relevant. Their focus on developing alternative technologies ensures continual advancements in bag filter design and use.

Restraining Factors

Competition from Alternative Technologies

The Bag Filter Market faces substantial headwinds from alternative filtration technologies such as electrostatic precipitators, cyclones, and catalytic converters which offer alternative means for particulate and pollutant control. These technologies often offer greater efficiency or lower operational costs in certain conditions, which may change market attitudes toward traditional bag filters. Electrostatic precipitators, for instance, are capable of managing larger air volumes with lower maintenance requirements than bag filters while cyclones excel in environments with high-temperature and dust applications. Their growing adoption could erode bag filters' market share while challenging their dominance within filtration landscapes.

Complex Installation Requirements

Installation complexity is one of the biggest impediments to market growth for bag filter systems. Bag filters often require complex setup procedures, including precise alignment, special housing requirements, and integration with existing ventilation systems - these complex setup requirements can incur increased labor costs, downtime delays, and potential disruptions of operations; industries with limited technical skills or budget restrictions may find these obstacles prohibitive, leading to slower adoption rates or delays altogether. Furthermore, professional installation and ongoing maintenance services could deter users further inhibiting market development overall.

Dependence on Raw Material Prices

Raw material prices play a substantial role in shaping the bag filter market. Bag filters are composed of synthetic fabrics, metals, and other specialized compounds; prices for raw materials may fluctuate due to factors like supply chain disruptions, geopolitical considerations, or market demand. Increases in polyester or other filter media material costs directly impact production costs for bag filters - potentially raising end-user prices due to increased manufacturing costs resulting from raw material price dependence; such pressure could reduce bag filter affordability and accessibility as well as adoption rates overall.

By Type

Pulse Jet filters are set to the clear market leaders, accounting for approximately 45% of total market value by 2024. Their popularity can be attributed to their efficiency and adaptability across various industrial applications - manufacturing, energy production, and pharmaceuticals - such as manufacturing. Pulse Jet filters utilize rapid bursts of air to clean filter media continuously with reduced maintenance downtime allowing continuous operation while handling high dust loads consistently and maintaining consistent performance under various operational conditions - making them the preferred choice of many industries.

Reverse Air Filters will be expected at approximately 30% market share in 2024. Reverse airflow filters utilize this innovative filtration method to clean filter media efficiently in applications processing large air volumes, making it particularly suitable for cement and mining industries with moderate-to-high dust loads. Their relatively low energy consumption and operating costs also contributed to their strong market position.

Shaker filters will make up approximately 20% of the global bag filter market in 2024, using mechanical shaking or vibration to collect and remove dust from their filter media. Though less advanced compared to Pulse Jet and Reverse Air filters, shaker filters still serve several applications, particularly where dust levels are relatively low to moderate. Their simplicity and lower upfront cost keep these filter systems relevant within industrial settings even though their market share remains significantly smaller compared to more advanced filter technologies.

By Media

Nonwoven filter media will be the top segment in the Bag Filter Market in 2024, accounting for around 55% of the total market share. Nonwoven filters are favored for their excellent dust-holding capacity, efficiency, and cost-effectiveness; their fibers can be bound together through needle punching or thermal bonding to enhance their filtration performance and operational durability; growing preferences are driven by nonwovens' ability to provide high filtration efficiency with reduced resistance to airflow; making them suitable for manufacturing, pharmaceuticals, energy sectors, etc.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Woven filter media will account for approximately 25% of the Bag Filter Market in 2024, as these filters made from fibers woven together into fabric offer effective filtration and durability. Woven filters proved particularly successful at handling high temperature/pressure environments in chemical processing industries as well as metal fabrication industries due to their durability. Their large market share may also be attributable to their long lifespan; however, they often present greater resistance to airflow compared with nonwoven filters, which may reduce efficiency for certain applications.

The "Others" segment, comprising specialty and composite filter media, made up approximately 20% of the market in 2024. This category included materials like fiberglass, PTFE membranes, and advanced composites which offered specific advantages for niche applications - for instance, chemical resistance for highly specific industrial processes using PTFE membranes for chemical resistance applications. Furthermore, "Others" was notable for its wide array of applications that met needs not met by standard nonwoven or woven materials.

By Fluid

Air filters are projected approximately 65% of the Bag Filter Market share in 2024. Their dominance can be attributed to their widespread application across numerous industries such as manufacturing, energy, pharmaceuticals, and automotive. Air filters play an essential role in maintaining air quality while controlling dust emissions and meeting regulatory standards for emissions; their versatility and efficiency in capturing airborne particulates make them popular choices both industrially and commercially. The incorporation of air filters in systems requiring high-performance filtration further reinforces their dominance in this market segment.

Liquid filters will account for around 30% of the Bag Filter Market in 2024. Liquid filters play a vital role in applications requiring fluid filtration, including chemical processing, food and beverage production, water treatment, and treatment processes. They're specially designed to handle various fluids including viscous liquids that must be handled for product purity and process efficiency - driving demand due to the increased need for effective fluid handling and processing applications; even though their market share compared with air filters may be smaller they still play a pivotal role.

By Application

Power Generation is expected to be the dominant segment in 2024 of the Bag Filter Market, holding approximately 40% of the total market share. This success can be attributed to power plants' need for effective filtration systems that help regulate emissions and meet stringent environmental regulations; bag filters in power generation facilities play a vital role in protecting equipment from dust and ash while managing particulate matter from combustion processes and managing combustion by-products effectively. Furthermore, their substantial market share speaks to ongoing investments into emission control technology as well as an emphasis on decreasing environmental impact.

Cement production will be responsible for approximately 25% of the Bag Filter Market in 2024. Bag filters play an essential role in cement manufacturing for controlling dust emissions at various stages of manufacturing including raw material handling, kiln operations, and finishing. Their prevalence can be explained by regulatory requirements that call for efficient dust collection to maintain operational efficiency while meeting environmental standards, and due to high dust loads that require continuous operation requirements within this sector they also highlight the significance of reliable filtration solutions.

Mining operations accounted for approximately 15% of the Bag Filter Market in 2024. Bag filters are used in mining operations to control dust and particulate matter generated during extractive and processing activities, with environmental regulations seeking to control airborne pollutants while assuring worker safety is one of the primary drivers behind effective filtration solutions. As mining operations expand and become more intensive, so does the demand for robust yet high-capacity bag filters continue to rise?

The chemical industry represented approximately 10% of the bag filter market in 2024, with critical applications in both production and the Chemical Logistics Market, where safe handling and transport of hazardous materials are paramount. Bag filters played an essential role in protecting staff against exposure to chemical dust during manufacturing, packaging, and storage, while also facilitating the safe processing and transfer of various chemicals.

High demand was seen for high-performance bag filters capable of handling corrosive or toxic materials especially in the Chemical Logistics Market, where filtration systems help prevent cross-contamination and ensure compliance with stringent safety regulations during transportation. Their relatively lower market share reflected niche applications, yet their importance remains undeniable for specialized chemical processing and logistics operations requiring dust control and emission reduction.

Pulp and Paper industries accounted for roughly five percent of the bag filter market in 2024. Bag filters are employed to manage dust generated during the production of paper products and processing of pulp mills, thereby contributing significantly to maintaining air quality while facilitating their efficient operations. Although only five percent is represented here, bag filters play a vital role in maintaining air quality for efficient pulp and paper mill operations.

Municipal Waste management represented approximately 3% of the market in 2024. Bag filters used in waste-to-energy plants and other municipal waste processing facilities to control emissions and manage dust contributed significantly to its growing importance, reflecting investments made in waste management technologies as well as an increasing need for effective filtration solutions to handle urban waste handling. In 2024, "Others", including specialty and custom applications, comprised approximately 2% of the Bag Filter Market. This segment covered diverse applications beyond major industries including custom filtration solutions tailored to specific operational needs or emerging sectors.

The Bag Filter Market Report is segmented based on the following

By Type

- Jet Filters

- Reverse Air Filters

- Shaker Filters

By Media

- Nonwoven Fabrics

- Woven Fabrics

- Others

By Fluid

- Air Filtration

- Liquid Filtration

By Application

- Power Generation

- Cement

- Mining

- Chemical

- Pulp & Paper

- Municipal Waste

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Regional Analysis

North America dominates the Bag Filter Market with an estimated market share of 37.3%, propelled by stringent environmental regulations and an established industrial base. This success can be attributed to stringent environmental regulations as well as advanced manufacturing sectors with an emphasis on emission control in both countries, which add up to an incredible market share for North America in this segment of the global filtration market. North America's position also benefits from high demand for high-performance filtration systems in power generation, automotive manufacturing, and other industrial fields; investment in infrastructure as well as technological innovations add strength in market strength for North America which further solidifies this region's dominance in this market segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe will hold approximately 30 % of the Bag Filter Market by 2024, reflecting its strong emphasis on environmental sustainability and stringent regulatory standards. Europe is driven by its dedication to reducing industrial emissions and improving air quality; thus driving significant demand for advanced filtration solutions such as those produced in Germany, France, and Britain - countries with significant industrial activities in power generation, chemical processing, and manufacturing activities that contribute significantly to its market share. Furthermore, innovative energy-saving bag filter technologies help this continent keep its advantage.

Asia Pacific currently accounts for 25% of the Bag Filter Market by 2024 and has experienced rapid expansion driven by industrialization and urbanization. Key markets in this region include China, India, and Japan where expanding manufacturing sectors, energy production, and focus on air quality management are driving forces of expansion. Asia Pacific's substantial investments in infrastructure development and industrial expansion also contribute to rising demand for efficient filtration solutions - as do growing regulatory frameworks aimed at controlling air pollution control within this market.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Danaher Corporation and Donaldson Company, Inc. have both demonstrated significant influence in the Bag Filter Market over 2024 through their technological expertise and deep industry experience. Both companies stand out for providing innovative filtration solutions, driving innovation and efficiency in diverse industrial applications. Danaher stands out for their cutting-edge technology and comprehensive distribution network while Donaldson boasts its diverse product offerings to maintain market leadership. Both firms are well-positioned to capitalize on emerging trends related to high-performance and sustainable filtration systems.

Thermax Limited, Babcock & Wilcox Co., and Eaton Corporation all play pivotal roles in the market. Thermax stands out with its dedication to environmental solutions that align with growing sustainability trends, making its products particularly valuable in the cement and chemical industries. Babcock & Wilcox excels at producing high-efficiency bag filters for power generation that help meet stringent emission regulations; while Eaton boasts broad technological capabilities which provide efficient filtration solutions across numerous sectors and strengthen its competitive position within the market. Mitsubishi Hitachi Power Systems, General Electric (GE), and Camfil Farr all make significant contributions to market dynamics with their diverse offerings.

Mitsubishi Hitachi excels at developing advanced filtration technologies to enhance power generation performance, while GE provides comprehensive solutions tailored to address various industrial requirements. Furthermore, Camfil Farr offers air filtration systems specifically tailored to comply with stringent air quality regulations. BWF Envirotech, W.L. Gore & Associates, Lenntech, Rosedale Products, and Parker Hannifin Corporation all contribute significantly by offering innovative filtration solutions designed to address niche or high-performance applications. Their combined strengths foster market expansion while meeting evolving industry requirements.

Some of the prominent players in the Global Bag Filter Market are:

- Danaher

- Donaldson

- Thermax

- Babcock & Wilcox CO

- Eaton Corporation

- Mitsubishi Hitachi Power Systems

- General Electric

- Camfil Farr

- BWF Envirotech

- L. Gore & Associates

- Lenntech

- Rosedale Products

- Parker Hannifin Corporation.

Recent developments

- In March 2024, Pentair plc introduced a new line of high-efficiency bag filters designed to improve performance in industrial air and water filtration applications. These filters feature advanced media technology to enhance contaminant removal and extend service life.

- In September 2024, Camfil launched a range of eco-friendly bag filters made from recycled materials, aligning with sustainability trends and regulatory requirements for greener industrial practices while maintaining high filtration efficiency.

- In July 2024, Clarcor Air Filtration Products expanded its portfolio with the introduction of next-generation bag filters tailored for high-dust and high-temperature environments, offering enhanced durability and efficiency for industrial applications.

- In August 2024, Filtration Group Corporation unveiled a new line of HEPA bag filters designed for critical cleanroom environments, featuring advanced filtration media that provides superior particle capture and air quality control.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.2 Billion |

| Forecast Value (2033) |

USD 6.3 billion |

| CAGR (2024-2033) |

4.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type(Pulse Jet Filters,Reverse Air Filters,Shaker Filters),By Media(Nonwoven Fabrics,Woven Fabrics,Others),By Fluid(Air Filtration,Liquid Filtration),By Application(Power Generation,Cement,Mining,Chemical,Pulp & Paper,Municipal Waste,Others),By Region(North America,Europe,Asia Pacific,Middle East & Africa,South America) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Danaher,Donaldson,Thermax,Babcock & Wilcox CO,Eaton Corporation,Mitsubishi Hitachi Power Systems,General Electric,Camfil,Farr,BWF Envirotech,W.L. Gore & Associates,Lenntech,Rosedale Products,Parker Hannifin Corporation. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |