Market Overview

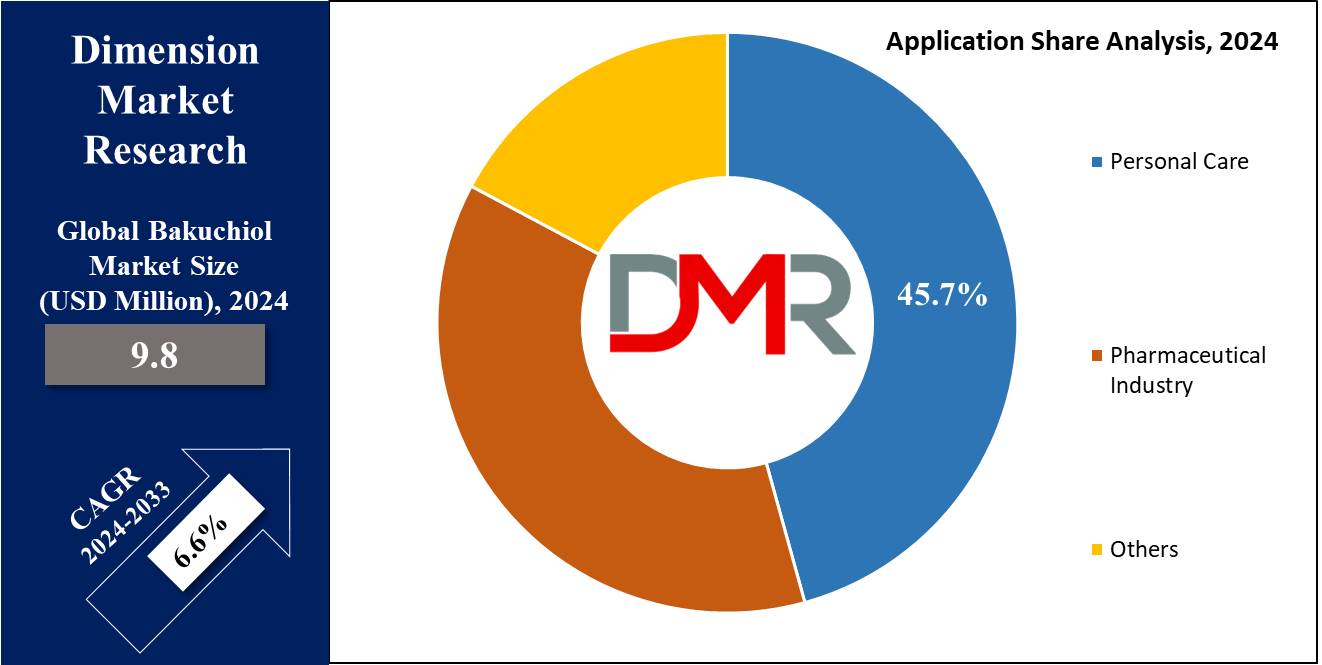

The Global Bakuchiol Market is projected to reach USD 9.8 million in 2024 and grow at a compound annual growth rate of 6.6% from there until 2033 to reach a value of USD 17.5 million.

Bakuchiol has drawn the attention of customers looking for natural alternatives to retinol in the beauty industry, as it attracts a large client base because of its anti-aging qualities and capacity to improve skin texture without the potential adverse effects of synthetic substances. As part of the broader shift toward natural skincare ingredients, skincare companies are more frequently combining Bakuchiol into their formulas to meet the growing demand for plant-based products.

It is suitable for sensitive skin types because of its mild and non-irritating nature as well, strengthening its position as a leading plant-derived retinol alternative.

The US Bakuchiol Market

The US

Bakuchiol Market is projected to reach

USD 3.5 million in 2024 at a compound annual

growth rate of 6.2% over its forecast period.

The Bakuchiol market in the US offers growth opportunities driven by growth in demand for natural, plant-based

skincare products. As consumer preferences transform towards clean beauty and sustainable ingredients, brands can capitalize on this trend. In addition, the growing awareness of Bakuchiol’s gentle anti-aging benefits in comparison to retinol provides further potential for product innovation and expansion in the booming skincare industry, especially in clean beauty formulations.

Further, a key growth driver is the increase in the consumer demand for natural, clean beauty products, as Bakuchiol provides a plant-based alternative to retinol. However, a major challenge is limited consumer awareness compared to well-known ingredients like retinol, which can slow adoption and market growth despite its proven benefits for sensitive skin.

Key Takeaways

- Market Growth: The Bakuchiol Market size is expected to grow by 7.1 million, at a CAGR of 6.6% during the forecasted period of 2025 to 2033.

- By Type: The Natural segment is anticipated to get the majority share of Bakuchiol Market in 2024.

- By Form: Oil-based segment is expected to be leading the market in 2024

- By Application: Personal care segment is expected to get the largest revenue share in 2024 in the Bakuchiol Market.

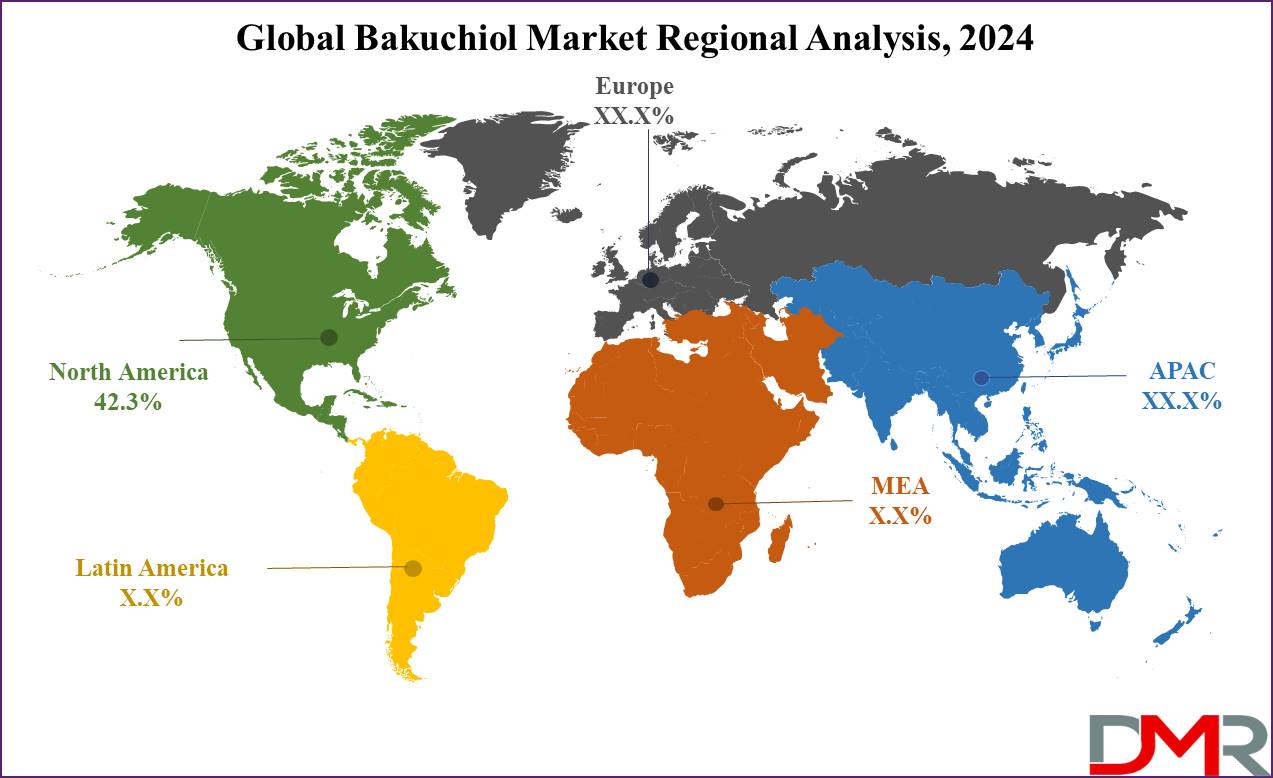

- Regional Insight: North America is expected to hold a 42.3% share of revenue in the Global Bakuchiol Market in 2024.

- Use Cases: Some of the use cases of Bakuchiol include anti-aging, acne treatment, and more.

Use Cases

- Anti-aging: Bakuchiol supports reduce the appearance of fine lines & wrinkles by replicating collagen production without irritating it, making it suitable for sensitive skin.

- Acne treatment: It has anti-inflammatory and antibacterial properties that assist in reducing acne breakouts and calming irritated skin.

- Skin tone improvement: Bakuchiol can even out skin tone and minimizes hyperpigmentation, providing a brighter complexion over time.

- Gentle alternative to retinol: Unlike retinol, it doesn't cause redness, dryness, or peeling, making it ideal for people with sensitive or dry skin.

Market Dynamic

Driving Factors

Rising Demand for Natural and Clean Beauty Products

With a large consumer preference for natural &plant-based ingredients, Bakuchiol has gained popularity as a safe alternative to traditional synthetic retinoids, which is driving market growth as consumers look for effective skincare solutions without harsh chemicals.

Growing Awareness of Skin Health and Anti-aging Solutions

As awareness about skin health and the vitality of preventive skin care rises, Bakuchiol's effectiveness in addressing aging concerns, like fine lines and wrinkles, has led to better adoption among consumers, which is supported by the expanding beauty and wellness industry, which continually seeks innovative ingredients that deliver results.

Restraints

Limited Consumer Awareness

Despite its benefits, Bakuchiol is still relatively new to many consumers in comparison to established ingredients like retinol. Limited awareness & understanding of its effectiveness can impact market growth as consumers may be hesitant to switch from familiar products.

Variable Quality and Sourcing Issues

The efficiency of Bakuchiol can vary based on the quality & source of the ingredient. Inconsistent sourcing & potential contamination during extraction can affect the product's effectiveness and safety, creating skepticism among consumers and manufacturers.

Opportunities

Expansion in Emerging Markets

As the global beauty & personal care industry grows, emerging markets provide many opportunities for Bakuchiol. Higher disposable incomes and growth in the middle class in regions like Asia-Pacific and Latin America are driving the need for skincare products, allowing for market expansion.

Innovative Product Development

The versatility of Bakuchiol enables its incorporation into, many skincare products, like serums, moisturizers, and masks. Brands can innovate by developing new formulations that integrate Bakuchiol with other active ingredients, meeting specific skin concerns, and attracting a broader consumer base.

Trends

Formulation with Other Active Ingredients

There is a major trend of formulating Bakuchiol alongside other popular skincare ingredients, like hyaluronic acid, vitamin C, and peptides, which focuses on enhancing the overall efficacy of products, addressing multiple skin concerns simultaneously, and appealing to consumers looking for complete skincare solutions.

Sustainability and Eco-friendly Packaging

With a major focus on sustainability in the beauty industry, brands are aiming on source Bakuchiol from environmentally friendly & sustainable practices. In addition, there is a trend towards eco-friendly packaging solutions, which aligns with the values of environmentally conscious consumers and improves brand loyalty.

Research Scope and Analysis

By Type

Natural-type Bakuchiol is expected to play a crucial role in the growth of Bakuchiol market in 2024 by appealing to consumers looking for plant-based and eco-friendly skincare solutions. As awareness of synthetic ingredients’ potential side effects grows, many people prefer natural alternatives like Bakuchiol for their effectiveness without harshness, which allows brands to aim for sourcing high-quality, sustainably produced Bakuchiol, ensuring purity and potency.

In addition, natural Bakuchiol products align with the clean beauty movement, enhancing their marketability, which not only meets consumer preferences but also drives innovation, leading to a broad range of natural skincare products featuring Bakuchiol.

Further, completely synthetic Bakuchiol are anticipated to grow at a higher rate, as it plays a significant role in the Bakuchiol market by providing a consistent and stable alternative to natural sources, which allows manufacturers to develop formulations with accurate dosages, ensuring reliability and effectiveness.

Brands can also capitalize on cost advantages, as synthetic production can minimize variability and lower prices. While natural Bakuchiol is popular, the synthetic option looks to a segment of consumers who prioritize performance and affordability in their skincare products.

By Form

Oil-based Bakuchiol formulations play a major role in the market by providing a deeply nourishing option for consumers with dry or sensitive skin. The oil-based form supports delivering the active ingredient more effectively while also moisturizing the skin.

These products are mainly popular in facial oils and serums, where Bakuchiol’s soothing properties integrate with oils to improve hydration, which appeals to consumers looking for multi-functional skincare that targets both anti-aging and skin nourishment.

Further, the Serum-based Bakuchiol products are vital in the market as they provide a concentrated dose of the ingredient, allowing for effective penetration into the skin. Serums are lightweight and smoothly absorbed, making them ideal for targeting specific skin concerns like fine lines, wrinkles, and uneven skin tone, which appeals to consumers looking for powerful yet gentle skincare solutions.

In addition, serum formulations can be easily combined with other active ingredients, improving their effectiveness and versatility in skincare routines.

By Application

The personal care applications of Bakuchiol are expected to lead overall market revenue in 2024, as its use continues to expand beyond traditional skincare into body lotions, shampoos, and even oral care products offering consumers comprehensive beauty solutions that support skin and hair health. With the growing integration of

Health Informatics, brands are better able to analyze consumer preferences and product performance data, enabling them to tailor Bakuchiol-based formulations more effectively. By incorporating Bakuchiol across a wide range of personal care items, companies can attract a broad audience seeking natural ingredients with proven anti-aging and soothing benefits, ultimately strengthening their product portfolios and market presence.

Further, the pharmaceutical industry plays a major role in the Bakuchiol market by looking into its therapeutic potential beyond cosmetic applications. Bakuchiol’s anti-inflammatory & antioxidant properties make it vital for developing treatments for many skin conditions, like acne, eczema, and psoriasis.

Pharmaceutical companies are researching formulations that use Bakuchiol to improve skin healing and enhance overall skin health, which not only diversifies Bakuchiol's usage but also reduces its status as a beneficial compound, attracting attention from both consumers and healthcare professionals interested in effective, natural treatment options.

The Bakuchiol Market Report is segmented on the basis of the following

By Type

- Natural

- Semi-Synthetic

- Completely Synthetic

By Form

- Oil-based

- Cream-based

- Serum-based

- Plant-based

By Application

- Personal Care

- Pharmaceutical Industry

- Others

Regional Analysis

North America plays a major role in the growth of the Bakuchiol market and is expected to

hold 42.3% of the revenue share in 2024 due to its higher demand for clean beauty and natural skincare products. Consumers in the region are highly aware of the benefits of plant-based alternatives like Bakuchiol, which are driving its adoption in many skincare formulations.

The region’s developed beauty and personal care industry and a major focus on sustainability and ethical sourcing further fuel market expansion. In addition, the presence of key skincare brands and high consumer spending power in North America accelerates the growth and innovation of Bakuchiol-based products.

Further, the Asia-Pacific region is anticipated to be the fastest-growing Bakuchiol market during the forecast period, due to the growth of disposable incomes and the transformation of consumer lifestyle trends. The region’s growing cosmetics industry, along with the presence of various small and medium-sized companies in the haircare and skincare sectors, is contributing to market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Bakuchiol market is rapidly transforming, with many players entering the space due to the ingredient's growing popularity. Established skincare brands are incorporating Bakuchiol into their product lines, using its anti-aging and skin-soothing properties to attract consumers. Newer, specialized brands are also emerging, often focusing on natural and clean beauty formulations, which drives innovation in product development and marketing strategies, leading to varied offerings that looks into different skin types and concerns.

As consumer awareness grows, brands are highly focused on sustainability and ethical sourcing to differentiate themselves in the market.

Some of the prominent players in the Global Bakuchiol are

- The Natural Co

- Wishcompany

- Sederma

- Snow Lotus

- Indena S.p.A

- Anecdotal

- Sytheon

- Cayman Chemical

- Chengdu Mansite Bio

- Chengdu Biopurify Phytochemicals.

- Other Key Players

Recent Developments

- In April 2024, Wishcompany launched “Pore Smoothing Bakuchiol Sun Stick, which is a chemical sunscreen product containing Bakuchiol, an ingredient under the limelight as the next-generation retinol. It’s a suncare product that helps develop smooth and healthy skin, along with its powerful UV protection (SPF50+ PA++++). Further, it features a primer function that corrects pores and irregularities on the skin and can be used to achieve smooth and flawless skin when used before applying makeup.

- In April 2024, Allergan Aesthetics launched two new products from SkinMedica® by the makers of BOTOX® Cosmetic, namely, the SkinMedica Acne Clarifying Treatment and SkinMedica Pore Purifying Gel Cleanser, breakthroughs in skincare, delivering effective & balanced care for people with acne-prone skin.

- In February 2024, Wishcompany unveiled that By Wishtrend, the its high-functioning skincare brand launched a new body lotion, “Vitamin A-mazing Bakuchiol Body Lotion, which is exclusively for the body and characterized by reducing irritation and improving skin elasticity with retinal (Vitamin A) and bakuchiol, known as the next-generation plant-based retinol for aging care.

- In November 2023, 82°E launched its mini collection, which features ten of its most popular skincare products namely Sugarcane Soak, Lotus Splash, Ashwagandha Bounce, Cucumber Quench, Gotu Kola Dew, Bakuchiol Slip, and more, as the company aims to make the practice of self-care a simple, joyful and effective part of its consumer’s daily lives. Further, ideal for both travel and trial, consumers have the opportunity to try or test out its Cleanse – Hydrate- Protect routines and other essential, pamper products in compact, trial-size options.

- In November 2023, The Beauty Health Company parent to Hydrafacial, launched the Hydrafacial and Dr. Dennis Gross Phyto-Retinol Firming Booster, a collaboration a year in development. In partnership with Dr. Gross, a Board-Certified Dermatologist and industry developer, the booster uses the Phyto-Retinol Blend to provide retinol differently, which improves hydration, boosts radiance, and reduces fine lines and wrinkles across three skin layers, all without irritating.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 9.8 Mn |

| Forecast Value (2033) |

USD 17.5 Mn |

| CAGR (2024–2033) |

6.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 3.5 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Natural, Semi-Synthetic, and Completely Synthetic), By Form (Oil-based, Cream-based, Serum-based, and Plant-based), By Application (Personal Care, Pharmaceutical Industry, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

The Natural Co, Wishcompany, Sederma, Snow Lotus, Indena S.p.A, Anecdotal, Sytheon, Cayman Chemical, Chengdu Mansite Bio, Chengdu Biopurify Phytochemicals, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Bakuchiol Market size is expected to reach a value of USD 9.8 million in 2024 and is expected to reach USD 17.5 million by the end of 2033.

North America is expected to have the largest market share in the Global Bakuchiol Market with a share of about 42.3% in 2024.

The Bakuchiol Market in the US is expected to reach USD 3.5 million in 2024.

Some of the major key players in the Global Bakuchiol Market are The Natural Co, Wishcompany, Sederma, and others.

The market is growing at a CAGR of 6.6 percent over the forecasted period.