Market Overview

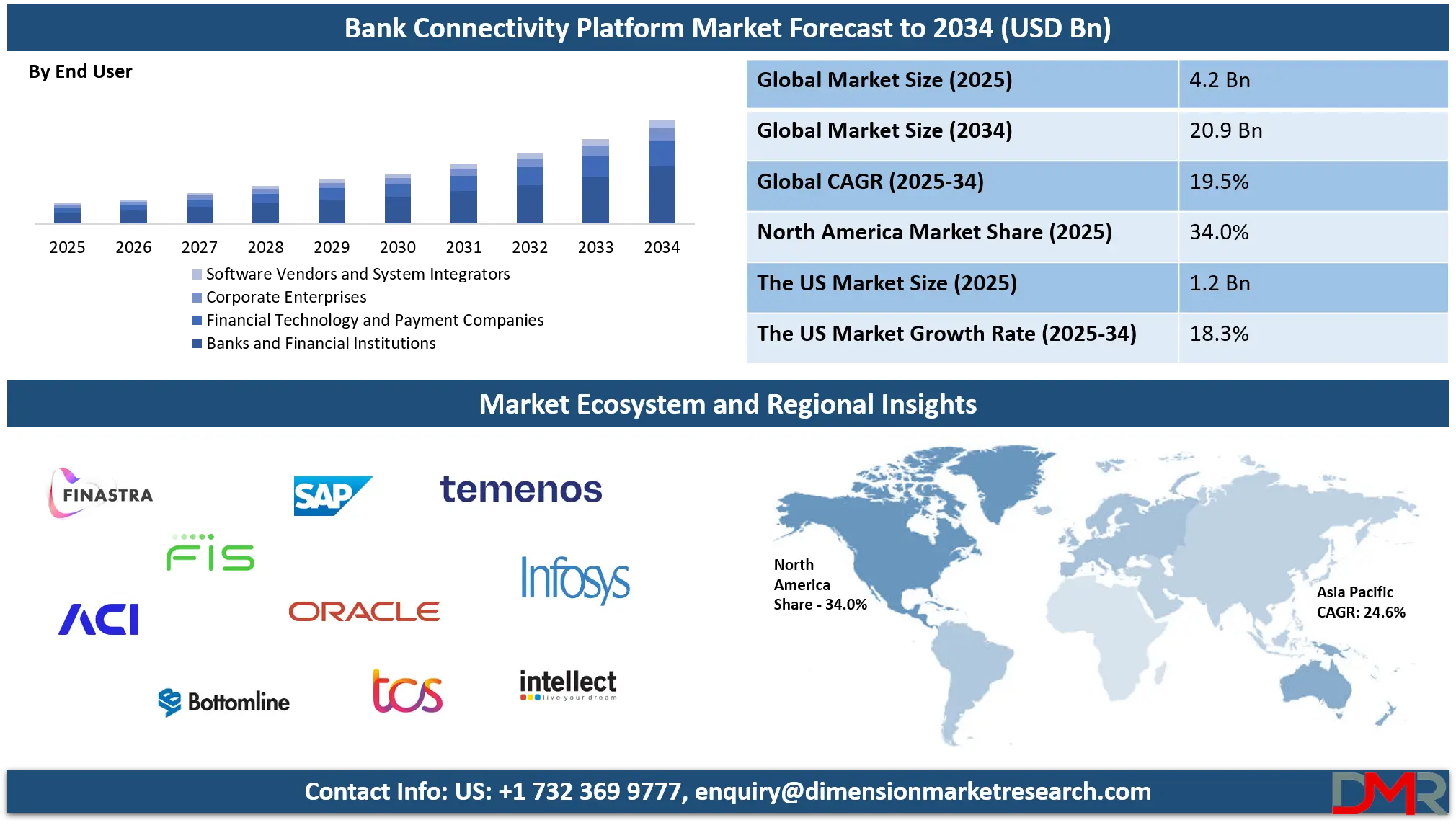

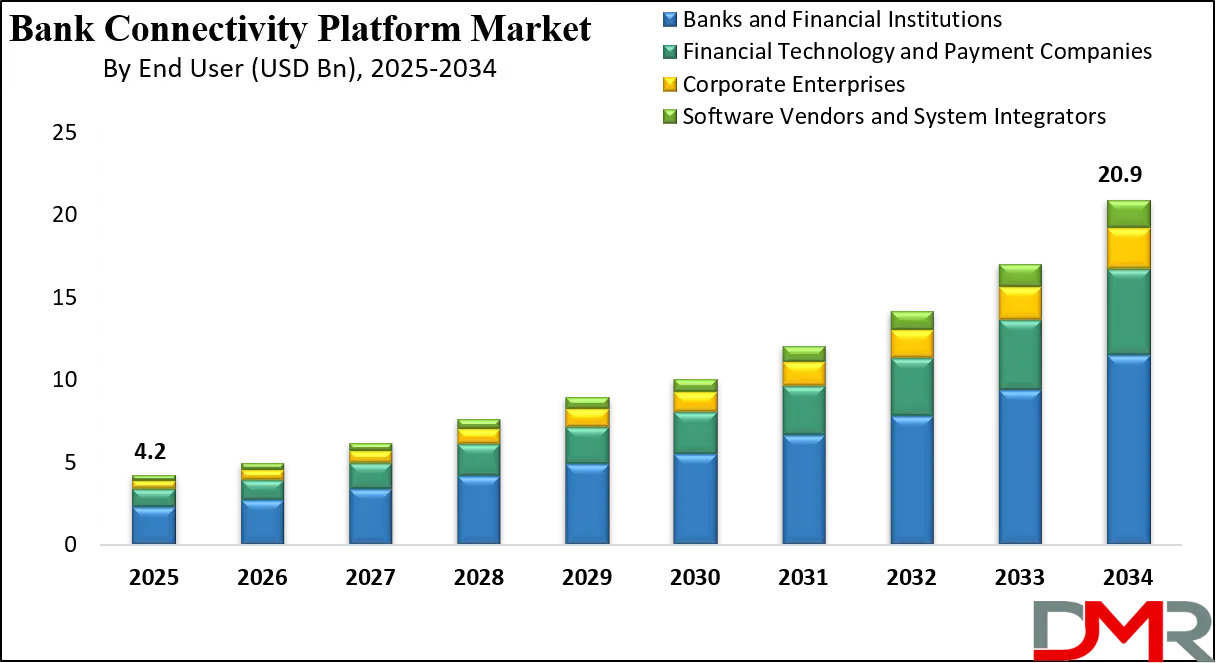

The global Bank Connectivity Platform Market was valued at USD 4.2 billion in 2025 and is projected to reach USD 20.9 billion by 2034, expanding at a CAGR of 19.5%, driven by rising adoption of API based banking integration, open banking frameworks, real time payment connectivity, and cloud enabled financial infrastructure across banks, fintech firms, and enterprises.

A Bank Connectivity Platform is a centralized software framework that enables secure, standardized, and scalable integration between banks, financial institutions, fintech companies, corporates, and external financial systems. It acts as a digital bridge that connects core banking systems, payment networks, enterprise resource planning systems, and regulatory interfaces through application programming interfaces, messaging layers, and data exchange protocols. These platforms simplify complex multi bank integrations, support real time and batch transaction processing, enhance visibility across accounts, and ensure compliance with financial regulations. By reducing manual processes and system fragmentation, bank connectivity platforms improve operational efficiency, data accuracy, security, and speed across the financial ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Bank Connectivity Platform Market represents the worldwide demand for technologies and services that enable seamless banking system integration across regions and financial networks. This market is driven by the rapid digitization of banking operations, the expansion of open banking initiatives, and the growing need for real time payments, automated treasury management, and cross border transaction visibility.

Financial institutions are increasingly investing in connectivity platforms to modernize legacy infrastructure, improve interoperability, and meet evolving customer expectations for faster and more transparent financial services. The adoption of cloud based architectures and API driven integration models has further accelerated market growth by offering scalability and cost efficiency.

In addition, the global market is shaped by rising collaboration between banks and fintech providers, increasing regulatory requirements for data sharing, and the growing complexity of multi-currency and multi geography operations. Enterprises and payment service providers are also contributing to market expansion as they seek centralized platforms to manage banking relationships and financial workflows.

Regional growth patterns vary, with mature markets focusing on platform modernization and emerging economies emphasizing financial inclusion and digital payment expansion. Overall, the global Bank Connectivity Platform Market continues to evolve as a critical enabler of connected banking ecosystems and digital financial transformation worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Bank Connectivity Platform Market

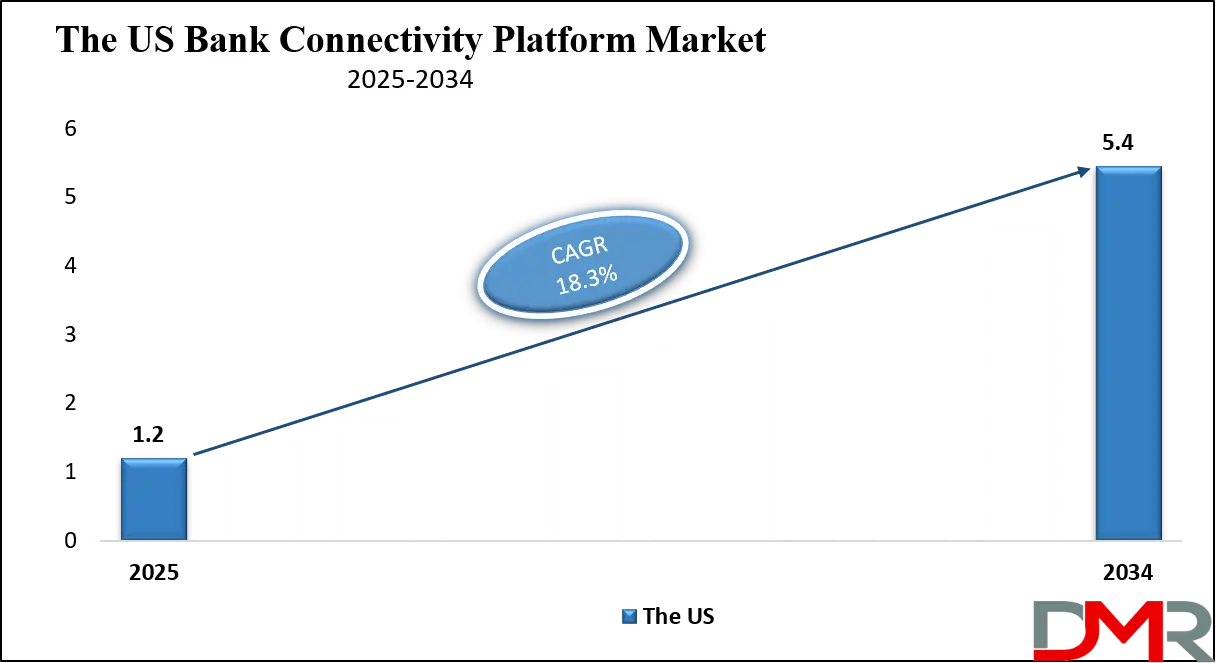

The U.S. Bank Connectivity Platform market size was valued at USD 1.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.4 billion in 2034 at a CAGR of 18.3%.

The United States Bank Connectivity Platform Market is driven by the country’s advanced banking infrastructure, early adoption of digital banking technologies, and strong presence of large financial institutions and fintech innovators. US banks increasingly rely on bank connectivity platforms to streamline integration between core banking systems, payment networks, treasury systems, and third party financial applications.

Growing adoption of application programming interfaces, real time payments, and cloud based integration platforms has accelerated demand for secure and scalable connectivity solutions. Regulatory initiatives supporting data sharing, along with rising customer expectations for instant transactions and unified financial visibility, are further strengthening market growth across retail banking, commercial banking, and enterprise financial operations.

In addition, the US market is shaped by increasing collaboration between banks, payment service providers, and technology vendors to support open banking, embedded finance, and multi bank connectivity use cases. Enterprises and large corporates are adopting bank connectivity platforms to centralize cash management, automate reconciliation, and improve liquidity forecasting across multiple financial institutions.

The focus on cybersecurity, data privacy, and regulatory compliance has also increased investment in advanced connectivity platforms with strong governance and monitoring capabilities. As financial ecosystems in the United States continue to evolve, bank connectivity platforms are becoming a critical foundation for digital transformation, interoperability, and innovation in the broader financial services landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Bank Connectivity Platform Market

The Europe Bank Connectivity Platform Market was valued approximately at USD 1.2 billion in 2025, reflecting the region’s strong adoption of digital banking solutions and modern financial infrastructure. Financial institutions across the region are increasingly investing in API based connectivity platforms and cloud enabled solutions to support real time payments, multi bank integrations, and automated treasury and cash management operations.

The market growth is further driven by regulatory initiatives such as PSD2 and open banking mandates, which encourage secure and standardized data sharing between banks, fintech companies, and third party service providers. Banks and enterprises are prioritizing connectivity solutions that enhance operational efficiency, enable seamless integration with multiple financial networks, and support compliance requirements across national and cross border transactions.

The Europe market is expected to expand at a robust CAGR of 20.5%, fueled by continuous innovation in banking technology and the growing demand for scalable, flexible, and secure connectivity platforms. Fintech adoption, rising customer expectations for instant and transparent financial services, and the push for digital transformation across both retail and corporate banking segments are key factors driving this growth.

Additionally, the increasing use of artificial intelligence, analytics, and automated workflow solutions within bank connectivity platforms is helping institutions reduce operational complexity, minimize errors, and improve decision making. As a result, Europe is poised to remain a leading and rapidly growing region in the global bank connectivity platform market over the coming years.

Japan Bank Connectivity Platform Market

The Japan Bank Connectivity Platform Market was valued at USD 33.6 million in 2025, reflecting a growing interest among banks and financial institutions in modernizing their payment and transactional infrastructure. The market growth is driven by the increasing adoption of API based banking solutions, cloud enabled connectivity platforms, and digital payment systems to enhance integration between core banking systems, payment networks, and corporate clients.

Financial institutions in Japan are also focusing on improving operational efficiency, enabling real time transaction processing, and supporting automated treasury and reconciliation workflows. Regulatory initiatives and a push toward digital transformation are further encouraging investment in secure, scalable, and interoperable bank connectivity solutions across the country.

The Japan market is expected to grow at a steady CAGR of 18.0%, supported by the gradual adoption of open banking frameworks and the rising demand for faster, more transparent financial services. Japanese banks and fintech companies are increasingly leveraging connectivity platforms to integrate with multiple financial networks, manage cross border transactions, and improve data visibility for corporate clients.

The market is also benefiting from the integration of advanced technologies such as artificial intelligence, predictive analytics, and automated monitoring within bank connectivity platforms, which help reduce operational errors, enhance risk management, and optimize workflow efficiency. As a result, Japan represents a growing yet strategically important segment in the global bank connectivity platform market.

Global Bank Connectivity Platform Market: Key Takeaways

- Strong Market Growth Driven by API and Cloud Adoption: The global Bank Connectivity Platform market is expanding rapidly due to increasing adoption of API driven integration, cloud based solutions, and real time payment infrastructures across banks, fintechs, and enterprises.

- North America Leads While APAC Shows High Growth Potential: North America dominates with advanced banking infrastructure and open banking frameworks, whereas Asia Pacific is emerging as a high growth region fueled by digital payment adoption and financial inclusion initiatives.

- Solutions Segment Dominates Over Services: Core platform solutions, including API management, monitoring, and pre-built connectors, capture the largest share, while services such as integration, consulting, and maintenance remain essential for platform deployment and performance optimization.

- Large Enterprises and Banks Drive Adoption: Complex operational needs of large banks and multinational corporations make them primary consumers, though SMEs and fintech companies are increasingly adopting scalable, cloud based platforms for cost efficiency and integration simplicity.

- AI and Open Banking Transform Platform Capabilities: Artificial intelligence enhances automation, predictive analytics, and anomaly detection, while open banking regulations drive secure data sharing, enabling innovative financial services, improved risk management, and real time operational efficiency.

Global Bank Connectivity Platform Market: Use Cases

- Real Time Payments Integration: Bank connectivity platforms enable instant transaction processing by connecting banks with payment networks through APIs and messaging systems, improving settlement speed and transaction accuracy.

- Multi Bank Cash Management: These platforms centralize account data from multiple banks, providing real time visibility, automated reconciliation, and improved liquidity management for enterprises and financial institutions.

- Open Banking Enablement: Bank connectivity platforms support secure data sharing between banks and third party providers, enabling open banking, embedded finance, and digital financial services.

- Regulatory Reporting Automation: They streamline compliance by integrating banking systems with regulatory authorities, ensuring accurate reporting, monitoring, and audit readiness.

Impact of Artificial Intelligence on the global Bank Connectivity Platform market

Artificial intelligence is significantly transforming the global Bank Connectivity Platform market by enhancing automation, intelligence, and efficiency across connectivity solutions. AI driven data processing and intelligent workflow automation reduce manual efforts in transaction mapping, error handling, and reconciliation, enabling financial institutions to achieve faster integration between core banking systems, payment networks, and external applications. Machine learning algorithms improve anomaly detection and predictive analytics, strengthening risk management and fraud identification within connectivity platforms. This leads to more reliable real time payments, smarter routing, and improved operational performance across multi bank ecosystems.

AI also enhances the adaptive capabilities of APIs and integration layers by enabling systems to learn from usage patterns and optimize data flows, reducing latency and improving connectivity resilience. Natural language processing powered interfaces simplify configuration and monitoring, making it easier for IT teams and business users to manage complex connectivity landscapes.

Additionally, AI supports advanced monitoring and governance by identifying performance bottlenecks and suggesting corrective actions, which drives higher uptime and service quality. As financial institutions and fintech firms increasingly adopt cognitive technologies, AI’s impact on bank connectivity platforms continues to accelerate digital transformation, improve customer experience, and unlock new efficiencies across the global financial services landscape.

Global Bank Connectivity Platform Market: Stats & Facts

Reserve Bank of India Digital Payments Index Data (Government Source - RBI)

- As of September 2024, the RBI Digital Payments Index stood at 465.33, reflecting strong growth in digital payment adoption and infrastructure performance across India, compared to the base period of March 2018 (Index=100).

UK Open Banking Adoption Data (Open Banking Limited / UK Government‑mandated body)

- In July 2025, open banking usage in the UK reached 15.16 million users, representing nearly one in three adults engaging with API‑enabled financial services.

- In July 2025, the UK open banking ecosystem recorded over 2 billion monthly API calls, underlining mainstream adoption of secure data sharing.

- As of March 2025, there were 13.3 million active open banking users in the UK, up 40% year‑on‑year, with 31 million open banking payments made in March alone.

Unified Payments Interface (UPI) Usage and Adoption (Government/NPCI Data)

- India’s Unified Payments Interface (UPI) accounted for 85% of total digital payment volumes in H1 CY25, highlighting dominant usage of the real‑time payment system.

- By November 2025, there were 684 banks live on UPI, processing tens of thousands of transactions monthly.

Central Bank Digital Financial Inclusion (IMF / Government‑cited data)

- Digital financial transactions per adult in emerging market and developing economies increased from 55 to 251 per adult between 2017 and 2024, indicating significant digital adoption across low‑income regions.

Global Bank Connectivity Platform Market: Market Dynamics

Global Bank Connectivity Platform Market: Driving Factors

Rapid Adoption of API Based Banking Integration

The shift toward application programming interface driven connectivity is a major growth driver for the bank connectivity platform market. Financial institutions and fintech companies are increasingly deploying API frameworks to enable seamless data exchange, real time payments, and interoperable banking services. This trend supports faster onboarding of digital channels, enhances system interoperability, and reduces integration complexity between legacy core banking systems and modern financial applications.

Demand for Cloud Enabled Financial Infrastructure

The increasing preference for scalable, secure, and cost efficient cloud based connectivity solutions is propelling market growth. Cloud platforms support high availability, automated updates, and elastic resource provisioning, which are essential for handling growing transaction volumes and complex multi-bank linkages. Adoption of cloud architecture also enables financial institutions to leverage advanced analytics, robust disaster recovery, and distributed network performance improvement.

Global Bank Connectivity Platform Market: Restraints

Legacy System Integration Challenges

Many banks continue to rely on outdated core systems that lack standard interfaces, creating complexity and cost in integrating modern connectivity platforms. These legacy environments require custom adapters or middleware, increasing implementation time and hindering the seamless flow of financial data. Such integration barriers can delay digital transformation initiatives and deter investments in advanced connectivity solutions.

Security and Data Privacy Concerns

The expansion of bank connectivity platforms increases the attack surface for financial networks and exposes sensitive customer data across multiple endpoints. Strict regulatory requirements for data protection, varying regional privacy laws, and rising cyber threats create compliance challenges. Financial institutions must invest in robust encryption, continuous monitoring, and secure access controls, increasing operational expenditure and slowing deployment.

Global Bank Connectivity Platform Market: Opportunities

Expansion of Open Banking Ecosystems

Open banking regulations in North America, Europe, and the Asia Pacific are creating new avenues for bank connectivity platforms. By facilitating secure data sharing among banks, fintechs, and third party developers, connectivity solutions can unlock innovative digital financial products, personalized services, and third party application ecosystems. This regulatory shift offers platform vendors the chance to capture new segments and deliver value added services.

Growth in Cross Border Payments and Treasury Automation

Globalization of business operations and increasing cross border transaction volumes present a strong opportunity for connectivity platforms. Financial institutions and enterprises are seeking centralized systems to manage international cash flows, multi-currency settlements, and cross border payment compliance. Connectivity platforms that support standardized messaging, real time visibility, and automated reconciliation can significantly improve efficiency and reduce operational costs.

Global Bank Connectivity Platform Market: Trends

Integration of Artificial Intelligence for Smart Processing

Artificial intelligence and machine learning are being embedded into connectivity platforms to automate routine tasks, enhance anomaly detection, and improve predictive analytics. AI based process automation helps in intelligent routing of financial messages, reducing manual intervention and strengthening fraud detection capabilities. This trend is enabling more resilient, adaptive, and self-optimizing connectivity solutions.

Rise of Embedded Finance and Platform Ecosystems

Bank connectivity platforms are increasingly supporting embedded finance initiatives, allowing non-banking businesses to offer financial services within their own customer journeys. Integration with ecommerce, enterprise resource planning systems, and payment gateways is creating an interconnected ecosystem of financial services. This trend is accelerating platform interoperability and creating new revenue streams for connectivity solution providers.

Global Bank Connectivity Platform Market: Research Scope and Analysis

By Component Analysis

By component analysis indicates that solutions are anticipated to dominate the bank connectivity platform market, capturing around 65.0% of the total market share in 2025. This dominance is driven by the growing demand for core connectivity platforms that enable secure and seamless integration between banking systems, payment networks, enterprise applications, and third party financial services.

Solution offerings typically include API management layers, integration middleware, pre-built banking connectors, and monitoring tools that support real time and batch transaction processing. Financial institutions and fintech companies increasingly prefer solution based deployments as they provide scalability, faster implementation, improved interoperability, and long term operational efficiency, making them a critical foundation for digital banking and open banking initiatives.

Services also play a vital role within the component segment, supporting the effective deployment and ongoing performance of bank connectivity platforms. Service offerings primarily include integration and implementation support, system customization, consulting, and continuous maintenance. As banks often operate in complex legacy environments, professional services help align connectivity platforms with existing core banking systems, regulatory requirements, and internal workflows.

Additionally, managed support and maintenance services ensure system reliability, security updates, and performance optimization, enabling organizations to maximize the value of their connectivity investments while reducing operational risks and technical complexity.

By Deployment Model Analysis

By deployment model analysis shows that cloud deployment is anticipated to dominate the bank connectivity platform market, accounting for approximately 60.0% of the total market share in 2025. This dominance is largely driven by the flexibility, scalability, and cost efficiency offered by cloud based platforms, which allow banks and financial institutions to rapidly deploy connectivity solutions without heavy upfront infrastructure investments.

Cloud deployment supports real time data exchange, API driven integration, and seamless upgrades, making it well suited for open banking, real time payments, and multi bank connectivity use cases. Additionally, cloud environments enable improved disaster recovery, high availability, and easier compliance management, which are critical for handling growing transaction volumes and evolving regulatory requirements.

On premises deployment continues to hold a significant share of the market, particularly among large banks and financial institutions with strict data security, compliance, and control requirements. Organizations with legacy core banking systems often prefer on premises solutions to maintain direct oversight of sensitive financial data and internal infrastructure. While on premises deployments may involve higher implementation and maintenance costs, they offer greater customization and tighter integration with existing systems. This deployment model remains relevant in regions with stringent data residency regulations or in institutions that are gradually transitioning toward hybrid or cloud based connectivity strategies.

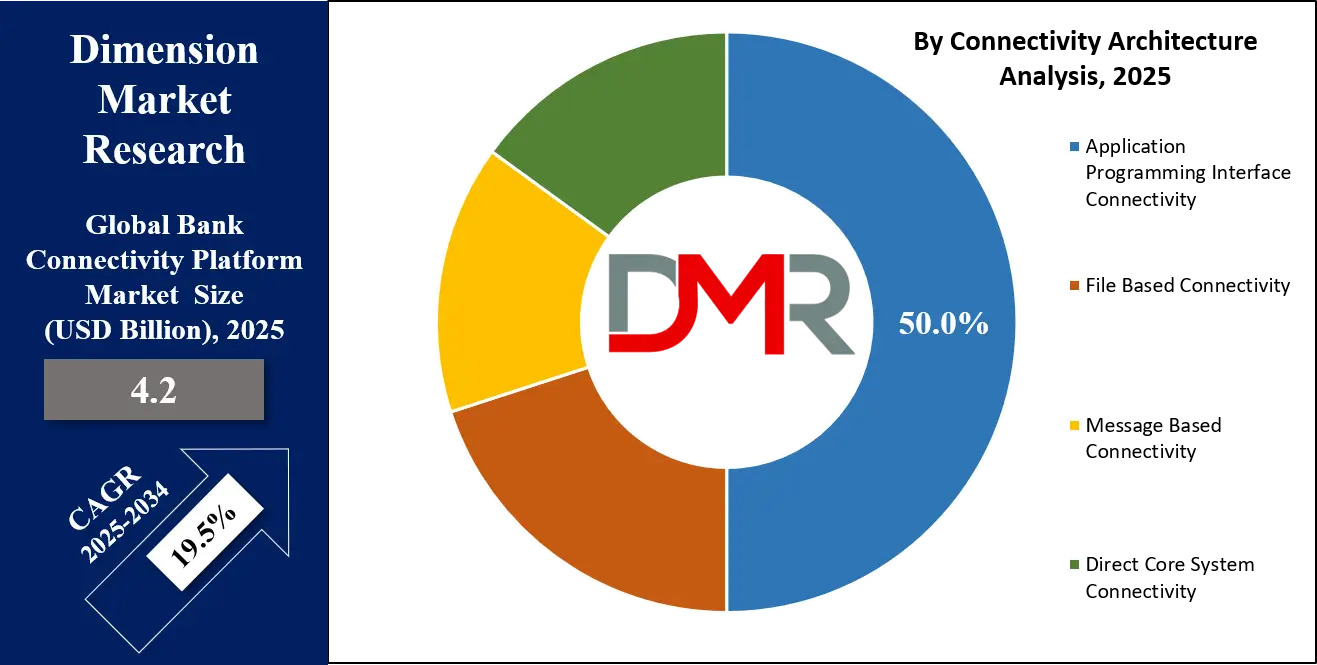

By Connectivity Architecture Analysis

By connectivity architecture analysis indicates that application programming interface connectivity is anticipated to dominate the bank connectivity platform market, capturing around 50.0% of the total market share in 2025. This dominance is driven by the growing adoption of API driven integration models that enable real time data exchange between banks, fintech platforms, payment networks, and enterprise systems.

API connectivity supports faster onboarding, improved interoperability, and greater flexibility compared to traditional integration methods, making it a preferred architecture for open banking, embedded finance, and digital payment applications. Financial institutions are increasingly leveraging APIs to modernize legacy infrastructure, enhance customer experiences, and enable scalable connectivity across multiple channels.

File based connectivity continues to play an important role within the connectivity architecture segment, particularly for scheduled and batch oriented financial processes. This architecture is commonly used for activities such as end of day settlement, reconciliation, regulatory reporting, and large volume data transfers where real time processing is not essential. File based connectivity remains widely adopted due to its reliability, compatibility with legacy banking systems, and established security protocols. Many banks and enterprises rely on this method to maintain operational continuity while gradually transitioning toward more modern API driven connectivity frameworks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Usage Pattern Analysis

By usage pattern analysis shows that real time transaction processing is anticipated to dominate the bank connectivity platform market, capturing approximately 45.0 percent of the total market share in 2025. This dominance is driven by the rising demand for instant payments, real time account updates, and immediate transaction validation across banking and financial services.

Bank connectivity platforms supporting real time processing enable continuous data exchange between core banking systems, payment networks, and digital channels, improving transaction speed, accuracy, and customer experience. The growing adoption of real time payment infrastructures, digital wallets, and on demand financial services is further accelerating the need for low latency and always on connectivity solutions.

Scheduled batch processing continues to hold a significant share within the usage pattern segment, supporting non time sensitive financial operations that require high volume data handling. This usage pattern is commonly applied in areas such as end of day settlements, reconciliation, compliance reporting, and historical data processing.

Batch processing remains essential for banks and enterprises that operate legacy systems or manage large transaction datasets, as it offers stability, predictability, and cost efficiency. Many organizations adopt a hybrid approach, combining real time processing for customer facing activities with batch processing for back office and regulatory functions.

By Organization Size Analysis

By organization size analysis indicates that large enterprises are anticipated to dominate the bank connectivity platform market, capturing approximately 60.0 percent of the total market share in 2025. This dominance is largely driven by the complex banking requirements of multinational banks, financial institutions, and large corporations that manage multiple accounts, currencies, and cross border transactions.

Large enterprises adopt advanced connectivity platforms to centralize cash management, automate reconciliation, ensure real time visibility, and integrate core banking systems with payment networks and third party applications. The scale, regulatory obligations, and operational complexity of these organizations make them the primary consumers of comprehensive and feature rich connectivity solutions.

Small and medium sized enterprises continue to hold a smaller share within the organization size segment, as they generally have simpler banking needs and lower transaction volumes. SMEs often rely on cloud based or service oriented connectivity platforms that are cost effective, easy to implement, and require minimal IT infrastructure. While the adoption rate among SMEs is growing due to increasing digitalization, integration with multiple banks, and the need for streamlined cash flow management, their overall market contribution remains limited compared to large enterprises. Nevertheless, SMEs present an emerging growth opportunity as vendors develop scalable and affordable connectivity solutions tailored to their requirements.

By End User Analysis

By end user analysis shows that banks and financial institutions are anticipated to dominate the bank connectivity platform market, capturing approximately 55.0 percent of the total market share in 2025. This dominance is driven by the need for secure and efficient integration between core banking systems, payment networks, and enterprise applications.

Banks and financial institutions leverage connectivity platforms to enable real time transaction processing, improve interoperability, enhance treasury and cash management, and comply with regulatory requirements. The growing focus on digital banking, open banking initiatives, and customer demand for instant financial services further reinforces the reliance of these institutions on advanced connectivity solutions.

Financial technology and payment companies continue to hold a significant share within the end user segment as they increasingly adopt connectivity platforms to support scalable and seamless integration with multiple banks and financial networks. Fintech firms, digital banks, and payment service providers use these platforms to offer real time payments, automated reconciliation, and innovative financial products such as digital wallets and embedded finance solutions. While their market share is smaller compared to traditional banks, the rapid growth of fintech adoption and expansion into new markets presents strong opportunities for connectivity platform providers to deliver specialized solutions tailored to the unique operational and regulatory needs of this segment.

The Bank Connectivity Platform Market Report is segmented on the basis of the following:

By Component

- Solutions

- Core connectivity platform software

- Pre-built banking and payment connectors

- Monitoring, analytics, and governance modules

- Services

- Integration and implementation services

- Support and maintenance services

- Consulting and customization services

By Deployment Model

- Cloud Deployment

- On-Premises Deployment

- Fully Managed Deployment

By Connectivity Architecture

- Application Programming Interface Connectivity

- Modern REST-based APIs

- Legacy web service APIs

- Regulatory open banking APIs

- File-Based Connectivity

- Secure file transfer integrations

- Batch processing integrations

- Message-Based Connectivity

- Direct Core System Connectivity

- Core banking system interfaces

- Payment network interfaces

By Usage Pattern

- Real Time Transaction Processing

- Scheduled Batch Processing

- Hybrid Integration Usage

By Organization Size

By End User

- Banks and Financial Institutions

- Financial Technology and Payment Companies

- Corporate Enterprises

- Software Vendors and System Integrators

Global Bank Connectivity Platform Market: Regional Analysis

Region with the Largest Revenue Share

Regional analysis indicates that North America is anticipated to lead the global bank connectivity platform market, capturing approximately 34.0 percent of the total market revenue in 2025. The region’s dominance is driven by the presence of advanced banking infrastructure, high adoption of digital banking solutions, and early implementation of open banking frameworks.

Financial institutions and fintech companies in North America increasingly deploy API based and cloud enabled connectivity platforms to support real time payments, multi bank integrations, and automated treasury management. Strong regulatory support, technological innovation, and a focus on digital transformation further reinforce the region’s position as a key driver of growth in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the global bank connectivity platform market over the coming years. This growth is fueled by rapid digitalization of banking services, increasing adoption of mobile banking and real time payment systems, and expanding fintech ecosystems in countries such as China, India, and Singapore. Financial institutions in the region are investing in cloud based and API driven connectivity solutions to improve operational efficiency, enable multi bank integrations, and support regulatory compliance. Rising demand for financial inclusion, cross border payments, and modernized banking infrastructure is further accelerating the adoption of bank connectivity platforms across the Asia Pacific market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Bank Connectivity Platform Market: Competitive Landscape

The competitive landscape of the global bank connectivity platform market is characterized by intense competition among technology providers, system integrators, and service vendors offering solutions that enable seamless banking integration. Key players focus on strategic initiatives such as product innovation, cloud and API based platform enhancements, mergers and acquisitions, and partnerships with banks and fintech firms to strengthen market presence.

Companies are also investing in advanced features such as artificial intelligence driven automation, real time transaction monitoring, multi bank connectivity, and regulatory compliance support to differentiate their offerings. The market remains dynamic, with continuous emphasis on scalability, security, and interoperability to address evolving customer demands and the growing complexity of global financial networks.

Some of the prominent players in the global Bank Connectivity Platform market are:

- Finastra

- FIS (Fidelity National Information Services)

- ACI Worldwide

- Bottomline Technologies

- SAP SE

- Oracle Corporation

- Tata Consultancy Services (TCS)

- Infosys

- Temenos

- Intellect Design Arena

- Volante Technologies

- Kyriba

- Serrala

- Cashfac (or Cashforce)

- Nexi

- Sopra Banking Software

- Fiserv

- SWIFT

- Banking Circle

- Treasury Intelligence Solutions (TIS)

- Other Key Players

Global Bank Connectivity Platform Market: Recent Developments

- December 2025: Engage Fi completed its acquisition of Intellectual Dimensions, adding an intelligent data automation platform that accelerates core conversions and data integration for financial institutions.

- December 2025: Dutch financial technology firm Mollie agreed to acquire a UK payments and bank connectivity player GoCardless for €1.05 billion, expanding its payments infrastructure and cross‑border financial services capabilities.

- December 2025: A major US bank unveiled a redesigned open banking API framework that significantly improves commercial and corporate client connectivity by enabling direct API integration with enterprise systems and reducing onboarding times from weeks to minutes.

- December 2025: AI‑focused fintech startup Flex raised USD 60 million in a Series B round to expand its financial tools and payment capabilities for mid‑sized businesses, indicating strong investor interest in integrated financial platforms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.2 Bn |

| Forecast Value (2034) |

USD 20.9 Bn |

| CAGR (2025–2034) |

19.5% |

| The US Market Size (2025) |

USD 1.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions, Services), By Deployment Model (Cloud Deployment, On-Premises Deployment, Fully Managed Deployment), By Connectivity Architecture (Application Programming Interface Connectivity, File-Based Connectivity, Message-Based Connectivity, Direct Core System Connectivity), By Usage Pattern (Real Time Transaction Processing, Scheduled Batch Processing, Hybrid Integration Usage), By Organization Size (Large Enterprises, SMEs), and By End User (Banks and Financial Institutions, Financial Technology and Payment Companies, Corporate Enterprises, Software Vendors and System Integrators) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Finastra, FIS (Fidelity National Information Services), ACI Worldwide, Bottomline Technologies, SAP SE, Oracle Corporation, Tata Consultancy Services (TCS), Infosys, Temenos, Intellect Design Arena, Volante Technologies, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Bank Connectivity Platform market?

▾ The global Bank Connectivity Platform market size was valued at USD 4.2 billion in 2025 and is expected to reach USD 20.9 billion by the end of 2034.

What is the size of the US Bank Connectivity Platform market?

▾ The US Bank Connectivity Platform market was valued at USD 1.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.4 billion in 2034 at a CAGR of 18.3%.

Which region accounted for the largest global Bank Connectivity Platform market?

▾ North America is expected to have the largest market share in the global Bank Connectivity Platform market, with a share of about 34.0% in 2025.

Who are the key players in the global Bank Connectivity Platform market?

▾ Some of the major key players in the global Bank Connectivity Platform market are Finastra, FIS (Fidelity National Information Services), ACI Worldwide, Bottomline Technologies, SAP SE, Oracle Corporation, Tata Consultancy Services (TCS), Infosys, Temenos, Intellect Design Arena, Volante Technologies, and Others.