Market Overview

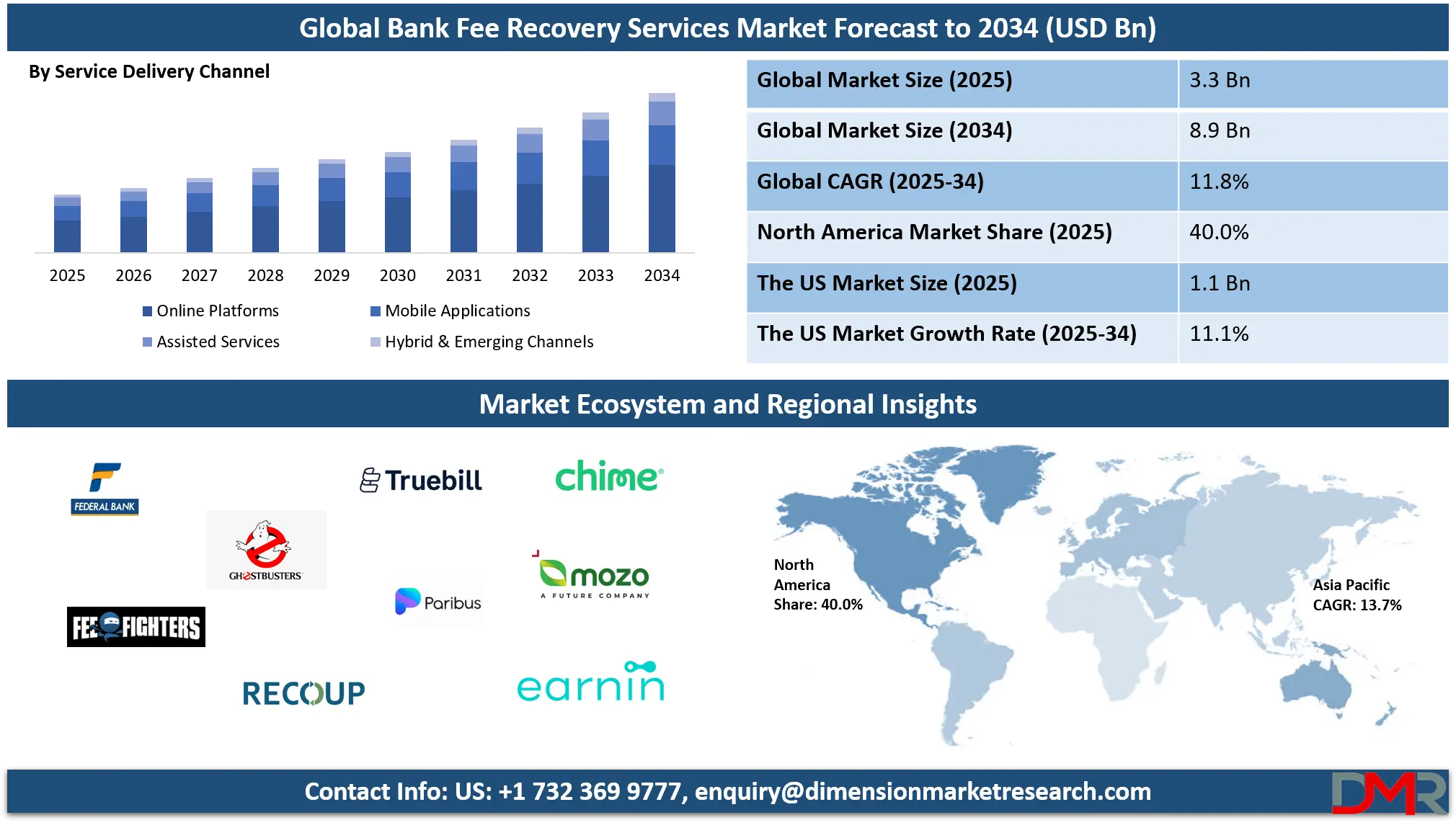

The Global Bank Fee Recovery Services Market was valued at USD 3.3 billion in 2025 and is projected to reach USD 8.9 billion by 2034, expanding at a CAGR of 11.8%, driven by rising adoption of automated fee recovery solutions, increasing banking fee transparency, growth in digital financial services, and expanding demand for AI powered dispute and refund management platforms across retail and commercial banking sectors.

Bank Fee Recovery Services refer to specialized financial services and technology driven solutions that identify monitor and recover unjustified or incorrect bank charges imposed on consumer and business accounts.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These services analyze transaction histories fee structures and banking terms to detect overdraft fees maintenance charges ATM fees foreign transaction fees and other penalty based costs that may be refundable under banking policies or regulatory guidelines. By leveraging automation data analytics and dispute management processes bank fee recovery providers assist individuals and organizations in reclaiming eligible fees while reducing the time effort and complexity involved in dealing directly with financial institutions.

The global Bank Fee Recovery Services Market represents the worldwide ecosystem of platforms service providers and fintech solutions that enable the identification negotiation and recovery of bank imposed fees across retail commercial and corporate banking segments. This market is driven by rising digital banking adoption increasing fee transparency awareness among customers and the growing complexity of banking products and transaction based charges.

As financial institutions continue to introduce diversified fee structures consumers and enterprises are increasingly relying on third party recovery services to optimize cash flow improve financial efficiency and enhance account management outcomes.

At a global level the Bank Fee Recovery Services Market is shaped by advancements in artificial intelligence open banking integrations and cloud based financial software that allow continuous monitoring of accounts across multiple banks and regions. North America leads the market due to high banking penetration and strong consumer advocacy while Europe and Asia Pacific are witnessing accelerated growth supported by regulatory focus on fair banking practices and expanding digital finance ecosystems. The market continues to evolve as businesses seek scalable fee auditing solutions and consumers demand greater control over banking expenses through automated recovery and financial intelligence tools.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

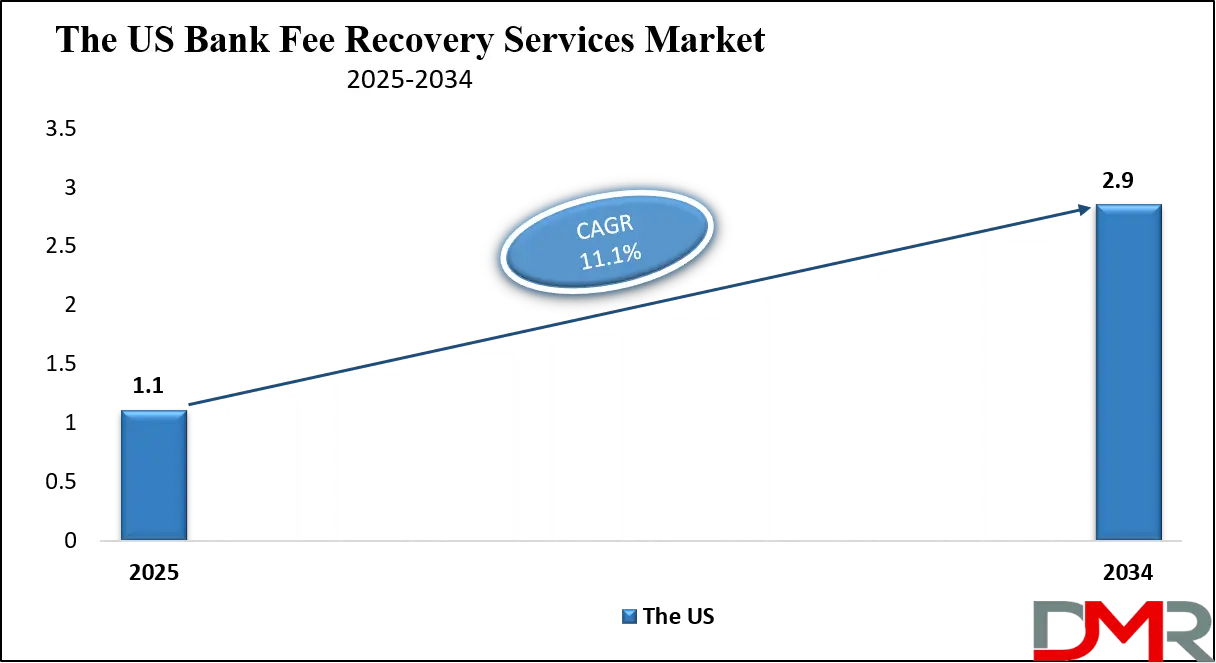

The US Bank Fee Recovery Services Market

The U.S. Bank Fee Recovery Services Market size was valued at USD 1.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.9 billion in 2034 at a CAGR of 11.1%.

The US Bank Fee Recovery Services Market is driven by the country’s highly mature banking ecosystem, widespread use of transaction based fee structures, and strong consumer awareness regarding unfair or incorrect charges. Retail customers and small businesses increasingly rely on digital fee recovery platforms to identify overdraft fees, ATM charges, maintenance fees, and foreign transaction costs. The presence of advanced fintech infrastructure, open banking adoption, and high penetration of mobile banking apps supports automated fee monitoring and dispute management, making the US the most dominant regional contributor to global market revenues.

Market growth in the United States is further supported by regulatory scrutiny on banking fee practices and rising demand for financial transparency among consumers and enterprises. Banks and third party service providers are integrating artificial intelligence, predictive analytics, and cloud based recovery tools to streamline refund processes and improve customer retention. Small and medium enterprises are emerging as a high growth user group due to complex transaction volumes and cash flow sensitivity. Continuous innovation in data driven recovery models is strengthening market competitiveness and long term adoption across the US financial services landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Bank Fee Recovery Services Market

The Europe Bank Fee Recovery Services Market was valued at approximately USD 726 million in 2025, reflecting the region’s strong adoption of digital banking solutions and growing awareness among consumers and businesses about fee transparency. The market is supported by widespread implementation of mobile and online banking platforms, increased regulatory oversight on banking charges, and the rising complexity of account and transaction fees across retail and commercial banking segments. These factors collectively drive demand for automated fee recovery solutions capable of monitoring, analyzing, and disputing incorrect or excessive bank charges.

The market in Europe is projected to grow at a compound annual growth rate of around 11.0%, driven by the integration of artificial intelligence, machine learning, and cloud based recovery platforms that enhance accuracy and efficiency in refund management. Consumers and enterprises are increasingly adopting digital solutions to optimize account management, recover overdraft and ATM fees, and reduce operational costs associated with manual fee dispute processes. Regulatory encouragement for fair banking practices further supports the expansion of fee recovery services across major European countries.

Japan Bank Fee Recovery Services Market

The Japan Bank Fee Recovery Services Market was valued at approximately USD 231 million in 2025, driven by the country’s advanced banking infrastructure, high smartphone and digital banking penetration, and growing consumer awareness of transaction fees and account charges. Japanese retail and business banking customers increasingly face overdraft fees, ATM charges, and foreign transaction costs, which has created a rising demand for automated fee recovery platforms. These solutions provide secure transaction monitoring, analytics, and dispute management, enabling both individuals and enterprises to reclaim refundable fees efficiently and optimize financial management.

The market in Japan is expected to grow at a compound annual growth rate of around 10.5%, supported by adoption of AI and machine learning technologies, cloud based platforms, and integration with open banking APIs. Banks and fintech service providers are increasingly offering predictive fee detection, real time alerts, and automated refund workflows to enhance customer experience and reduce operational burden. Regulatory emphasis on transparency in banking fees and the expansion of digital financial services further contribute to steady market growth across the country.

Global Bank Fee Recovery Services Market: Key Takeaways

- AI and Automation Lead the Market: Artificial intelligence and machine learning drive accurate fee detection and automated dispute management, improving recovery speed and customer experience.

- Retail Banking Dominates End Users: Individual checking and savings accounts generate the highest demand for fee recovery, particularly for overdraft, ATM, and maintenance charges.

- Cloud Solutions Preferred: Cloud-based platforms enable scalable, real-time monitoring and multi-bank integration, outperforming traditional on-premises systems.

- Emerging Markets Show Rapid Growth: Asia Pacific and other emerging regions are expanding due to fintech adoption, digital banking penetration, and regulatory support for fee transparency.

- Integration with Digital Ecosystems: Fee recovery tools embedded in banking apps and fintech platforms enhance convenience, real-time alerts, and automated refund workflows for consumers and SMEs.

Global Bank Fee Recovery Services Market: Use Cases

- Consumer Banking Fee Refunds: Individuals use bank fee recovery services to detect and recover overdraft fees, maintenance charges, and ATM fees through automated monitoring and dispute management. These solutions improve fee transparency and reduce personal banking costs.

- SME Banking Cost Optimization: Small and medium enterprises apply fee recovery tools to identify excess transaction fees and service charges across business accounts. This supports better cash flow management and operational efficiency.

- Enterprise Fee Auditing and Recovery: Large organizations leverage recovery platforms to audit multi bank fee structures, reclaim foreign transaction charges, and improve financial governance using analytics driven reporting.

- Fintech Integrated Fee Recovery: Fintech platforms embed automated fee detection and refund management using AI and open banking APIs, enhancing digital banking experiences and customer value.

Impact of Artificial Intelligence on the global Bank Fee Recovery Services market

Artificial Intelligence is transforming the global Bank Fee Recovery Services market by significantly enhancing the speed accuracy and scalability of fee detection and refund processes. AI algorithms analyze millions of transaction records in real time to identify incorrect or excessive bank charges such as overdraft fees foreign transaction costs and maintenance penalties with greater precision than traditional rule-based systems. This reduces manual effort, minimizes false positives, and enables automated dispute preparation and submission, leading to faster recovery and improved customer satisfaction.

Moreover, AI-driven predictive analytics and machine learning models enable continuous learning from historical refund outcomes to forecast potential fee exposures before they occur, empowering consumers businesses and financial institutions to proactively manage fee risks and optimize account management strategies. The integration of natural language processing also allows chatbots and virtual assistants to guide users through recovery workflows, streamlining customer support and reducing operational costs. Overall, AI accelerates digital transformation, strengthens competitive differentiation among service providers, and expands market adoption by delivering smarter, data-driven bank fee recovery solutions.

Global Bank Fee Recovery Services Market: Stats & Facts

Consumer Financial Protection Bureau (CFPB) – U.S. Government

- In 2023 combined overdraft and NSF fee revenue was about USD 5.83 billion, down 51% from 2019 levels.

- Overdraft/NSF revenue in 2023 was 24% lower than in 2022.

- Since 2022, banks agreed to refund over USD 240 million to consumers for unfair overdraft and NSF fees.

- Combined account maintenance and ATM fees remained flat from 2019–2023 despite overdraft fee reductions.

- CFPB data shows 81% of households encountering overdraft/NSF fees had difficulty paying a bill at least once in the previous year.

Reserve Bank of Australia (RBA) – Australian Government

- Australian banks’ total fee revenue rose 5% in 2023/24, the first increase in seven years.

- Large businesses in Australia paid around 40% of total bank fees in 2023/24.

- Households and medium businesses each paid about 25% of total bank fees, with small businesses just under 10%.

Central Banking Payment Fee Regulation Data (Central Banking)

- 40.8% of central banks in surveyed jurisdictions leave payment system fees unregulated.

World Bank / IMF – Financial Access/Global Findex Data

- The Global Findex Database 2025 conveys worldwide trends in financial access and mobile technology usage.

- IMF Financial Access Survey indicates improvements in digital payment affordability correlate with increased adult banking access.

Global Bank Fee Recovery Services Market: Market Dynamics

Global Bank Fee Recovery Services Market: Driving Factors

Growing Digital Banking Adoption

The rapid expansion of digital and mobile banking solutions has increased the volume and complexity of fee transactions, exposing customers to a wide range of charges such as ATM fees, overdraft penalties, and foreign transaction costs. This digital shift has driven demand for automated bank fee recovery services that leverage real-time transaction monitoring and advanced analytics to identify and dispute incorrect fees on behalf of users.

Increasing Consumer Awareness and Regulatory Focus

Heightened consumer awareness around banking fee transparency, coupled with regulatory scrutiny on unfair or hidden charges, encourages individuals and businesses to seek professional fee dispute and refund solutions. As customers become more educated about their rights and banks face pressure to justify fee structures, service providers that offer fee audit, recovery, and reimbursement solutions are gaining wider market acceptance.

Global Bank Fee Recovery Services Market: Restraints

Data Privacy and Security Concerns

Bank fee recovery services require access to sensitive banking information, which raises concerns about data privacy, security, and compliance with regulations such as GDPR and CCPA. Fear of unauthorized access or data breaches can deter potential customers from using third-party recovery tools that integrate with their financial accounts through APIs or open banking platforms.

Complexity of Banking Fee Structures

Banks and financial institutions employ diverse and evolving fee schedules across regions and account types, making it challenging for recovery platforms to standardize detection and dispute workflows. This complexity increases operational costs for service providers and slows adoption among users who may not trust automated systems to accurately interpret varied fee policies.

Global Bank Fee Recovery Services Market: Opportunities

Integration with Open Banking and API Ecosystems

The rise of open banking standards presents a significant opportunity for bank fee recovery providers to embed their solutions directly into banking platforms and financial management apps through secure APIs. This integration allows seamless access to transaction data, real-time fee alerts, and automated recovery workflows, enhancing user experience and expanding service reach globally.

Expansion in Emerging Markets

Emerging economies, particularly in Asia Pacific, Latin America, and Africa, are experiencing rapid growth in digital financial services and smartphone banking adoption. These regions present untapped potential for bank fee recovery solutions as consumers and small businesses seek tools to monitor transaction costs and optimize financial performance across multiple banking relationships.

Global Bank Fee Recovery Services Market: Trends

Rise of AI-Driven Automated Fee Detection

Artificial intelligence and machine learning are becoming core components of fee recovery platforms, enabling more accurate identification of questionable bank charges and predictive analytics that forecast potential fee exposures. These technologies enhance operational efficiency, reduce manual intervention, and deliver personalized insights to users, shaping next-generation refund management services.

Embedded Financial Management Tools

Bank fee recovery capabilities are increasingly being integrated within broader financial management and budgeting applications offered by fintech companies and banks themselves. This trend toward embedded fee optimization tools allows users to monitor banking costs alongside spending patterns, savings goals, and account performance, fostering comprehensive personal and business financial intelligence.

Global Bank Fee Recovery Services Market: Research Scope and Analysis

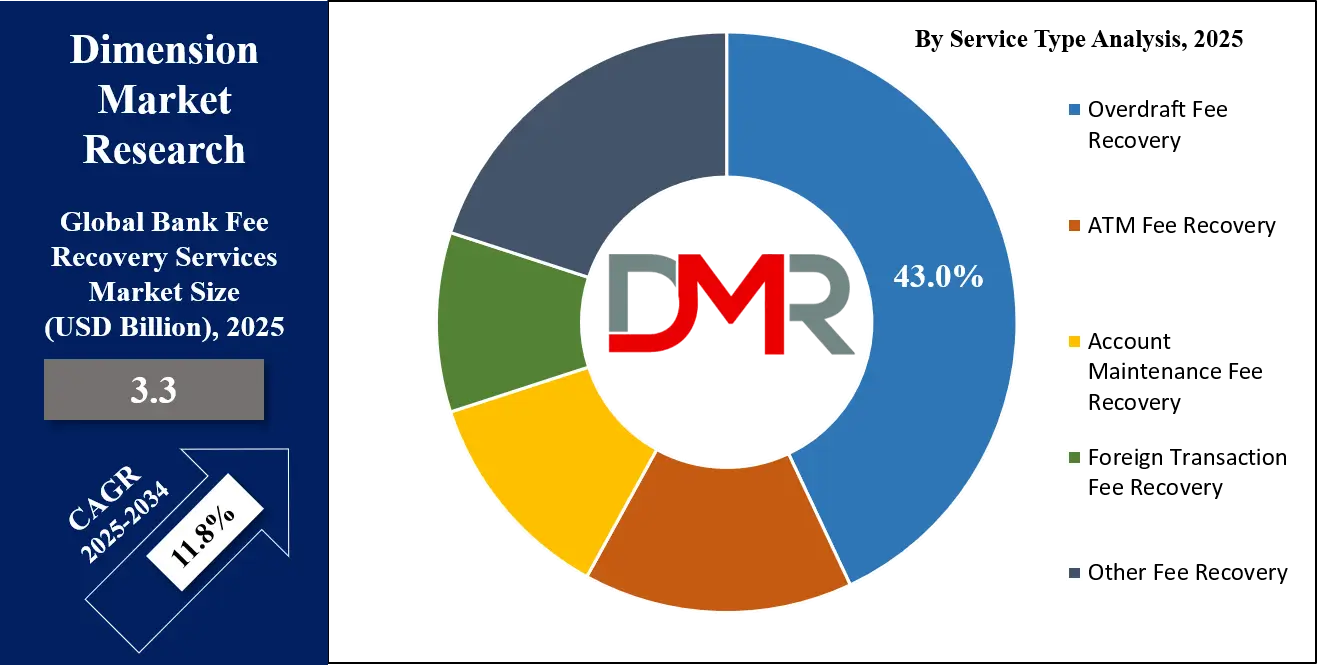

By Service Type Analysis

Overdraft Fee Recovery is anticipated to dominate the service type segment by capturing around 43.0% of the total market share in 2025, primarily due to the high frequency of overdraft charges across retail and small business banking accounts. Overdraft fees are often triggered by timing mismatches between deposits and withdrawals, making them one of the most common and contested banking charges. Bank fee recovery service providers leverage transaction analysis, historical account behavior, and automated dispute mechanisms to identify refundable overdraft fees, which drives strong adoption among consumers and SMEs seeking to reduce recurring banking costs and improve cash flow visibility.

ATM Fee Recovery also represents an important service type within the bank fee recovery services market, supported by continued global reliance on cash withdrawals and cross network ATM usage. Customers frequently incur excess charges from out of network withdrawals, international ATM access, and incorrect fee application, particularly during travel or cross border transactions. Fee recovery platforms help identify these charges by analyzing ATM transaction data and network fee rules, enabling users to reclaim eligible fees. While smaller in market share compared to overdraft recovery, ATM fee recovery remains relevant due to its consistent occurrence across both developed and emerging banking markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Banking Relationship Type Analysis

Retail Banking Accounts are anticipated to dominate the banking relationship type segment by capturing nearly 70.0% of the total market share in 2025, driven by the sheer volume of individual checking and savings accounts and the high frequency of fee based transactions. Consumers regularly encounter overdraft fees, maintenance charges, ATM fees, and foreign transaction costs, which creates strong demand for automated fee monitoring and recovery services. Increasing awareness of fee transparency, widespread mobile banking adoption, and the availability of consumer focused recovery platforms further support the dominance of retail banking accounts within the global bank fee recovery services market.

Business and Commercial Banking Accounts represent a significant and steadily growing segment within this market, supported by higher transaction volumes and more complex fee structures compared to retail accounts. Small and medium enterprises, in particular, face recurring charges related to wire transfers, payment processing, account servicing, and cash management services. Bank fee recovery solutions help businesses audit these charges, recover incorrect or excessive fees, and optimize banking relationships. Although smaller in share than retail accounts, this segment benefits from rising digitalization of business banking and increased focus on cost control and cash flow efficiency.

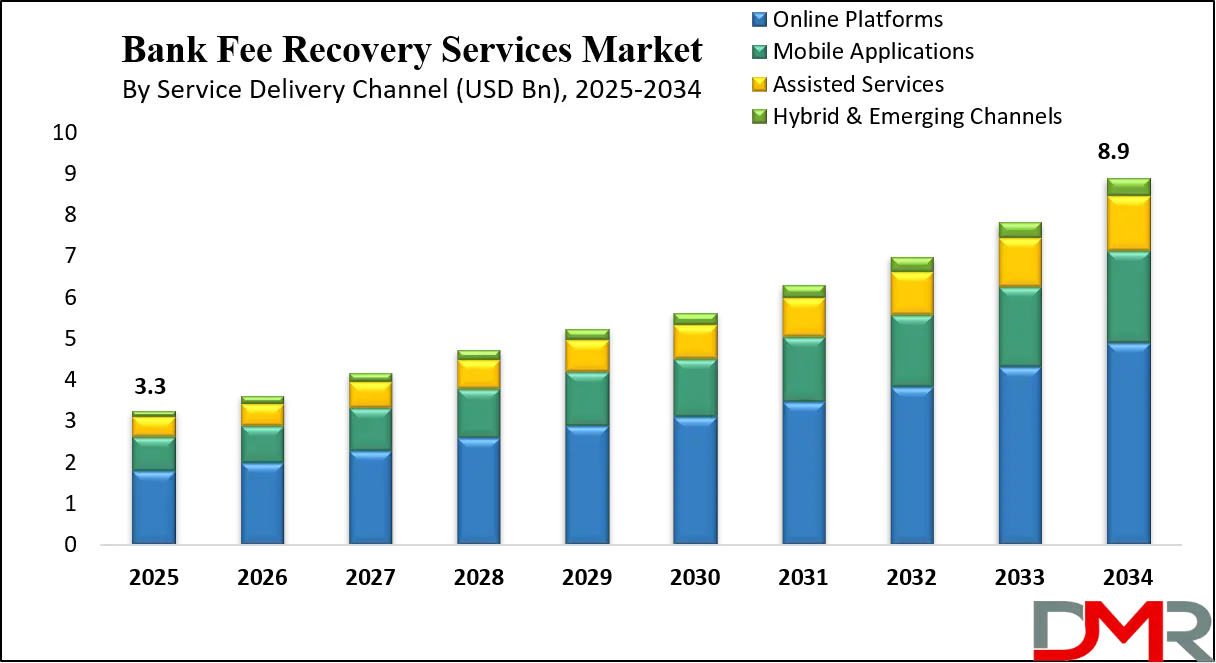

By Service Delivery Channel Analysis

Online platforms are anticipated to dominate the service delivery channel segment by capturing approximately 55.0% of the total market share in 2025, supported by their ease of access, scalability, and ability to manage large volumes of banking data. Web based fee recovery platforms allow users to securely connect multiple bank accounts, review historical transactions, and initiate automated fee disputes through centralized dashboards. These platforms are widely adopted by consumers, small businesses, and enterprises due to their compatibility with cloud based systems, advanced analytics capabilities, and integration with open banking frameworks, making them the preferred channel for comprehensive fee monitoring and recovery.

Mobile applications also play a vital role in the bank fee recovery services market, driven by the widespread use of smartphones and mobile banking applications. Mobile based recovery solutions enable real time fee alerts, transaction tracking, and instant dispute initiation, offering greater convenience and accessibility for users. These applications are particularly popular among retail customers and digitally native users who prefer on the go financial management. While mobile applications hold a smaller share compared to online platforms, their rapid adoption and continuous feature enhancements position them as a key growth channel within the market.

By Technology Type Analysis

AI and machine learning based fee detection are anticipated to dominate the technology type segment by capturing around 40.0% of the total market share in 2025, driven by their ability to analyze vast volumes of banking transactions with high accuracy and efficiency. These intelligent systems can identify patterns, detect irregular or excessive charges, and predict potential fee exposures before they occur. By automating dispute processes and continuously learning from historical refund data, AI powered solutions help consumers and businesses recover fees faster, reduce manual intervention, and improve overall financial management and transparency across multiple accounts and banking platforms.

Rule based fee identification systems also remain an important part of the technology landscape in the bank fee recovery services market. These systems operate on predefined rules and algorithms to detect incorrect or excessive charges such as overdraft fees, maintenance fees, and ATM transaction costs. While they are less flexible than AI driven platforms, rule based systems are widely used due to their simplicity, ease of implementation, and reliability for standard fee structures. They support automated alerts and basic refund workflows, making them suitable for smaller banks, SMEs, or customers with less complex account activities.

By Deployment Mode Analysis

Cloud based solutions are anticipated to dominate the deployment mode segment by capturing around 60.0% of the total market share in 2025, driven by their scalability, flexibility, and ability to provide real time fee monitoring and automated recovery across multiple banking accounts. These solutions allow service providers to deliver software as a service platforms that integrate with open banking APIs and offer centralized dashboards for consumers and businesses. Cloud based models reduce upfront infrastructure costs, enable seamless updates, and support advanced analytics and AI based fee detection, making them the preferred choice for both retail and enterprise users.

On premises solutions continue to serve a significant portion of the market, particularly among large enterprises and regulated financial institutions that require full control over data security and compliance. These systems are installed within the organization’s own IT infrastructure and allow banks or businesses to manage fee recovery processes internally. While they involve higher implementation and maintenance costs compared to cloud solutions, on premises deployments provide customization, strict data governance, and integration with existing enterprise resource planning or financial management systems, making them suitable for users with complex or sensitive account structures.

By End User Analysis

Retail banking customers are anticipated to dominate the end user segment by capturing around 70.0% of the total market share in 2025, driven by the high volume of individual checking and savings accounts and the frequent occurrence of fee based transactions such as overdraft charges, maintenance fees, ATM fees, and foreign transaction costs. These customers increasingly rely on automated fee recovery platforms that provide real time monitoring, transaction analysis, and dispute management, enabling them to reclaim refundable charges efficiently. The growing awareness of fee transparency and the convenience offered by digital recovery solutions further reinforce the dominance of retail banking customers in the market.

Small and medium enterprises are also a key end user segment within the bank fee recovery services market, supported by the complexity and volume of business banking transactions. SMEs often encounter recurring charges related to wire transfers, account maintenance, payment processing, and cash management services across multiple accounts and banks. Fee recovery solutions help these businesses audit transactions, identify incorrect or excessive fees, and streamline refund processes, which improves cash flow and operational efficiency. Although their market share is smaller than that of retail banking customers, SMEs represent a growing segment due to increased digital banking adoption and a strong focus on cost management.

The Bank Fee Recovery Services Market Report is segmented on the basis of the following:

By Service Type

- Overdraft Fee Recovery

- ATM Fee Recovery

- Domestic ATM Fees

- International ATM Fees

- Account Maintenance Fee Recovery

- Monthly Maintenance Fees

- Inactivity Fees

- Foreign Transaction Fee Recovery

- Currency Conversion Fees

- Cross-Border Transaction Fees

- Other Fee Recovery

By Banking Relationship Type

- Retail Banking Accounts

- Business & Commercial Banking Accounts

- Investment & Corporate Banking Accounts

By Service Delivery Channel

- Online Platforms

- Self-Service Dashboards

- Automated Claim Portals

- Mobile Applications

- App-Based Fee Monitoring

- Push-Notification-Driven Recovery

- Assisted Services

- Call-Center & Agent-Based Support

- Branch-Assisted Recovery

- Hybrid & Emerging Channels

- AI Chatbots

- Voice-Enabled & Virtual Assistants

By Technology Type

- Rule-Based Fee Identification Systems

- AI & Machine-Learning-Based Fee Detection

- Automated Dispute & Claim Management Tools

- Predictive Analytics & Fee Forecasting Tools

By Deployment Mode

- Cloud-Based

- SaaS Fee Recovery Platforms

- API-Integrated Banking Tools

- On-Premises

- Enterprise-Hosted Systems

- Compliance-Driven Deployments

By End User

- Retail Banking Customers

- Personal Checking & Savings Accounts

- Debit & Credit Card Fee Recovery

- Small & Medium Enterprises (SMEs)

- Business Account Fees

- Transaction & Payment Processing Fees

- Large Enterprises

- Multi-Account Fee Audits

- Cross-Border Banking Fee Recovery

Global Bank Fee Recovery Services Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global Bank Fee Recovery Services Market, accounting for approximately 40.0% of total market revenue in 2025, driven by the region’s mature banking infrastructure, high digital banking penetration, and strong consumer awareness regarding fee transparency. The prevalence of overdraft charges, maintenance fees, and other transaction based costs creates significant demand for automated fee recovery solutions among retail customers and businesses. Advanced fintech adoption, cloud based platforms, and AI powered dispute management tools further strengthen the region’s dominance, making North America the most developed and competitive market for bank fee recovery services globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the Bank Fee Recovery Services Market due to the rapid expansion of digital banking, increasing smartphone penetration, and rising adoption of fintech solutions across emerging economies. Consumers and small businesses in countries such as India, China, and Southeast Asian nations are becoming more aware of banking fees and seeking automated solutions to monitor and reclaim overdraft charges, ATM fees, and maintenance costs. The region’s growing financial inclusion initiatives, regulatory support for transparent banking, and investment in AI and cloud based recovery platforms are driving strong market momentum.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Bank Fee Recovery Services Market: Competitive Landscape

The global Bank Fee Recovery Services Market is highly competitive, characterized by a mix of specialized fee recovery providers, fintech platforms, and banking software solution vendors. Companies are focusing on innovation through AI powered fee detection, cloud based deployment, and integration with open banking APIs to enhance accuracy and efficiency in dispute management. Competitive strategies include expanding service offerings, improving digital user experiences, and targeting both retail and enterprise segments. The market is also shaped by continuous investments in predictive analytics, automated refund workflows, and advanced transaction monitoring tools, which are helping service providers differentiate themselves and capture a larger share of the growing global demand.

Some of the prominent players in the global Bank Fee Recovery Services market are:

- BankFeeFinder

- FeeBusters

- FeeFighters

- Recoup

- Truebill (Rocket Money)

- Paribus

- Earnin

- Chime Financial

- Mozo

- Fiserv

- Wolters Kluwer

- ACI Worldwide

- Jack Henry & Associates

- Oracle Financial Services

- Temenos

- Infosys Finacle

- SAP SE

- Bottomline Technologies

- Sopra Banking Software

- Alkami Technology

- Other Key Players

Global Bank Fee Recovery Services Market: Recent Developments

- January 2026: A UK‑based fintech focused on affordable financial services for workers raised USD 90 million in a funding round led by major investors to support expansion and new service development.

- January 2026: A leading Indian fintech firm announced the launch of an AI‑driven end‑to‑end financial services platform designed to enable instant deployment of intelligent banking solutions with real‑time automation and compliance capabilities, setting a new benchmark for digital banking services in the region.

- January 2026: A global fintech company expanded its presence in Asia by acquiring a South Korean payment firm with key regulatory licences, enabling direct operations in local markets and broader payment services.

- December 2025: An AI‑powered financial tools provider raised USD 60 million in a Series B funding round, boosting its platform development for mid‑sized business finance solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.3 Bn |

| Forecast Value (2034) |

USD 8.9 Bn |

| CAGR (2025–2034) |

11.8% |

| The US Market Size (2025) |

USD 1.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Overdraft Fee Recovery, ATM Fee Recovery, Account Maintenance Fee Recovery, Foreign Transaction Fee Recovery, Other Fee Recovery), By Banking Relationship Type (Retail Banking Accounts, Business & Commercial Banking Accounts, Investment & Corporate Banking Accounts), By Service Delivery Channel (Online Platforms, Mobile Applications, Assisted Services, Hybrid & Emerging Channels), By Technology Type (Rule-Based Fee Identification Systems, AI & Machine-Learning-Based Fee Detection, Automated Dispute & Claim Management Tools, Predictive Analytics & Fee Forecasting Tools), By Deployment Mode (Cloud-Based, On-Premises), and By End User (Retail Banking Customers, Small & Medium Enterprises (SMEs), Large Enterprises) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BankFeeFinder, FeeBusters, FeeFighters, Recoup, Truebill (Rocket Money), Paribus, Earnin, Chime Financial, Mozo, Fiserv, Wolters Kluwer, ACI Worldwide, Jack Henry & Associates, Oracle Financial Services, and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Bank Fee Recovery Services market?

▾ The global Bank Fee Recovery Services market size was valued at USD 3.3 billion in 2025 and is expected to reach USD 8.9 billion by the end of 2034.

What is the size of the US Bank Fee Recovery Services market?

▾ The US Bank Fee Recovery Services market was valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.9 billion in 2034 at a CAGR of 11.1%.

Which region accounted for the largest global Bank Fee Recovery Services market?

▾ North America is expected to have the largest market share in the global Bank Fee Recovery Services market, with a share of about 40.0% in 2025.

Who are the key players in the global Bank Fee Recovery Services market?

▾ Some of the major key players in the global Bank Fee Recovery Services market are BankFeeFinder, FeeBusters, FeeFighters, Recoup, Truebill (Rocket Money), Paribus, Earnin, Chime Financial, Mozo, Fiserv, Wolters Kluwer, ACI Worldwide, Jack Henry & Associates, Oracle Financial Services, and Others