Market Overview

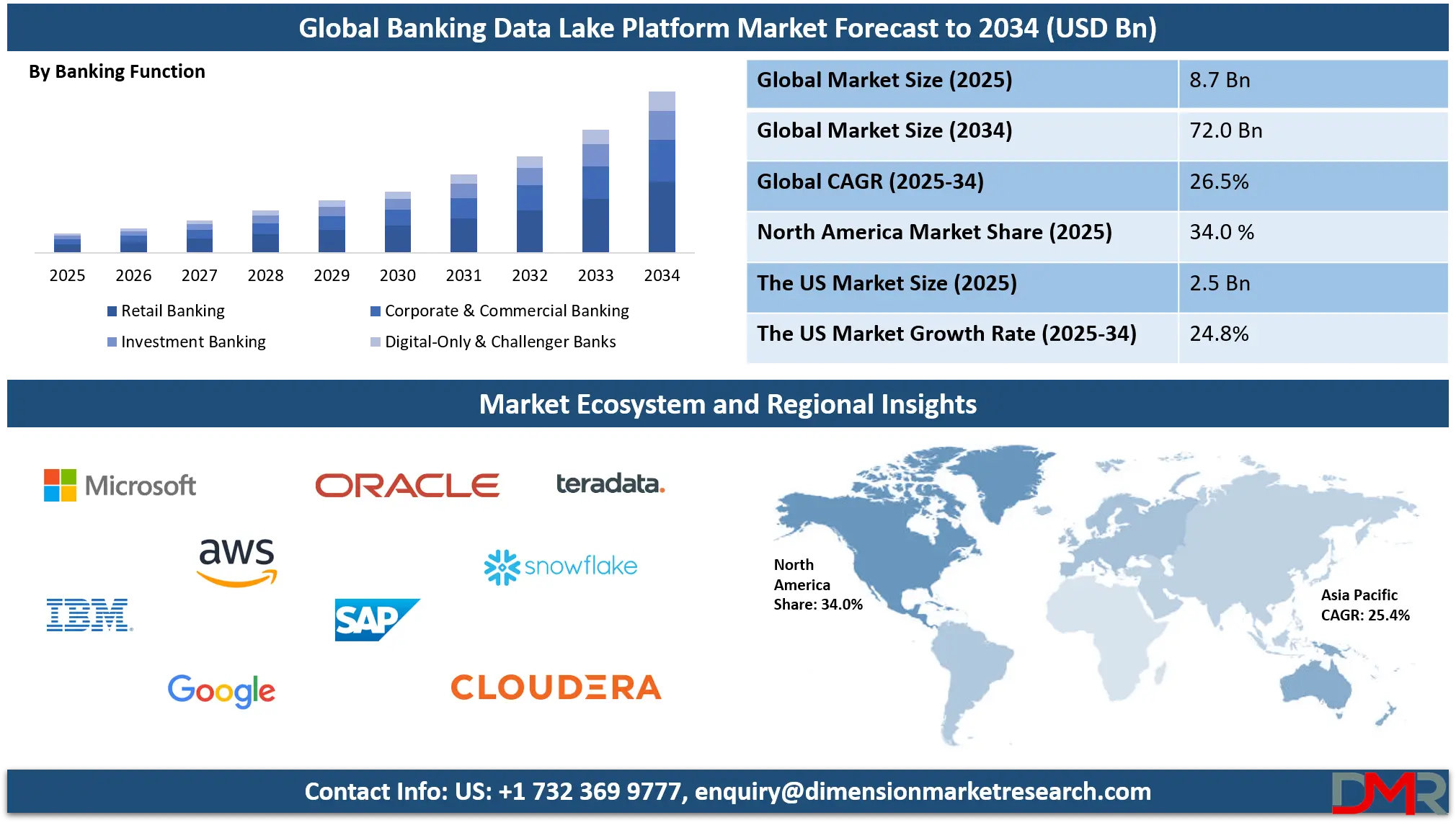

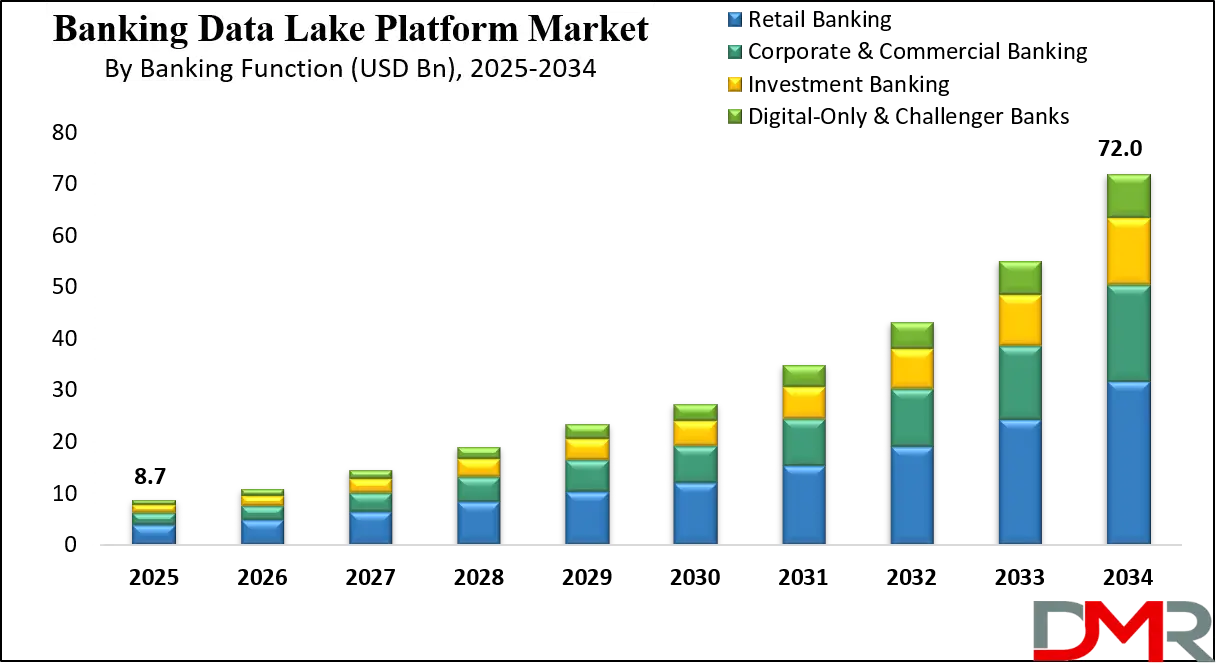

The global Banking Data Lake Platform Market was valued at USD 8.7 billion in 2025 and is projected to reach USD 72.0 billion by 2034, expanding at a CAGR of 26.5%, driven by rising adoption of advanced analytics data management solutions regulatory compliance platforms and scalable banking data infrastructure across global financial institutions.

A Banking Data Lake Platform is an enterprise grade data architecture designed specifically for banks to collect store process and analyze large volumes of structured semi structured and unstructured data generated across core banking systems digital channels payment networks risk engines and customer interaction platforms. It enables banks to centralize disparate data sources into a scalable repository while preserving data granularity and historical depth. The platform supports advanced analytics machine learning regulatory reporting and real time insights by integrating data ingestion governance security metadata management and analytics capabilities aligned with strict banking compliance and data privacy requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Banking Data Lake Platform Market represents the worldwide ecosystem of technologies solutions and services that enable financial institutions to modernize their data infrastructure and transition from traditional data warehouses to flexible analytics driven architectures. This market is driven by the growing need for banks to handle exponential data growth improve risk management capabilities enhance fraud detection accuracy and meet increasingly complex regulatory and reporting obligations across regions. Adoption is particularly strong among large banks seeking to consolidate enterprise wide data and unlock value from advanced analytics and

artificial intelligence.

In addition the global market is shaped by rapid digital banking expansion rising cloud adoption evolving customer expectations and the need for real time decision making across retail corporate and investment banking operations. Vendors in this market offer platforms that support scalable storage data integration advanced analytics data governance and security tailored to banking environments. As banks across developed and emerging economies accelerate digital transformation initiatives the Banking Data Lake Platform Market continues to expand as a foundational layer for data driven banking strategies and next generation financial services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Banking Data Lake Platform Market

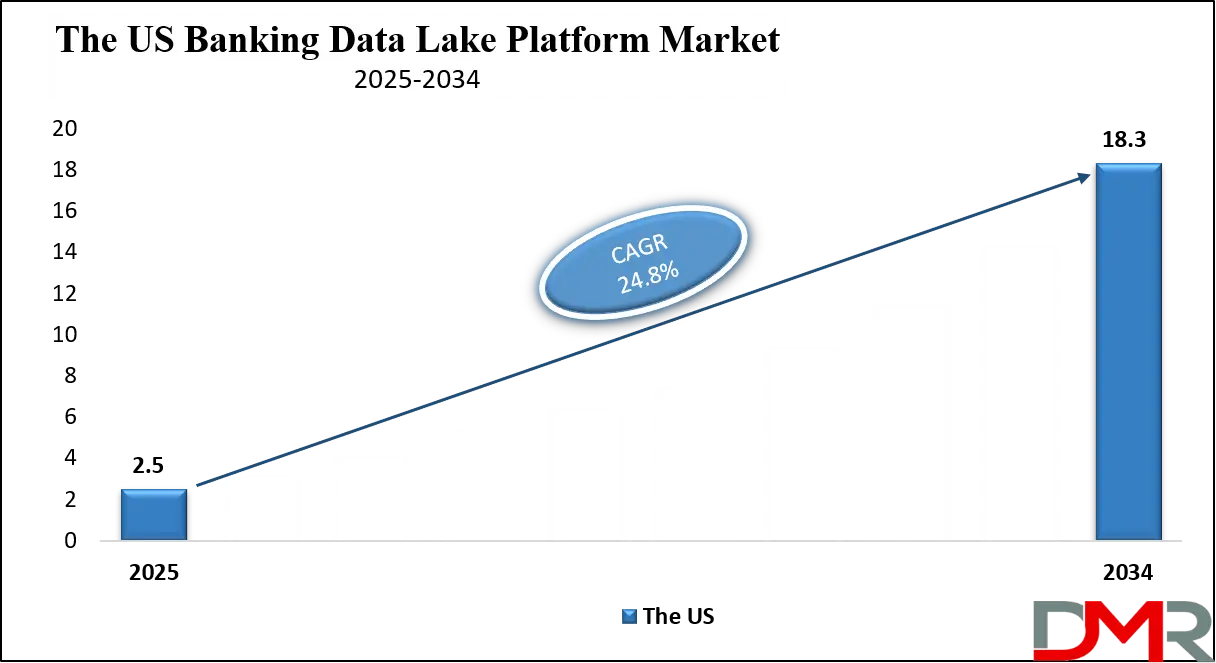

The U.S. Banking Data Lake Platform Market size was valued at USD 2.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 18.3 billion in 2034 at a CAGR of 24.8%.

The US Banking Data Lake Platform Market is driven by the country’s highly mature banking ecosystem, early adoption of advanced analytics, and strong focus on data driven decision making. Large commercial banks investment banks and digital first financial institutions are increasingly deploying data lake platforms to manage massive volumes of transactional customer and risk related data. Strict regulatory requirements related to data governance security and reporting further accelerate adoption, as banks require centralized and auditable data environments to support compliance analytics stress testing and enterprise risk management.

Additionally, the US market benefits from the strong presence of leading cloud providers data platform vendors and analytics technology companies that actively innovate in banking specific data architectures. Growing use of artificial intelligence machine learning and real time fraud detection has increased the need for scalable and flexible data lake infrastructures. Banks are also leveraging these platforms to enhance customer insights personalization and omnichannel banking experiences, positioning data lakes as a core foundation for digital transformation and next generation banking operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Banking Data Lake Platform Market

The Europe Banking Data Lake Platform Market was valued at USD 2.3 billion in 2025, reflecting the region’s growing emphasis on digital transformation, regulatory compliance, and advanced analytics adoption within the financial sector. Banks across Western and Central Europe are investing heavily in centralized data platforms to consolidate structured, semi‑structured, and unstructured data from core banking systems, payment networks, and digital channels. This enables institutions to streamline risk management, enhance fraud detection, and improve operational efficiency while adhering to strict data governance and reporting standards such as GDPR and Basel frameworks.

The market in Europe is further supported by the rising demand for cloud‑based and hybrid data lake solutions that offer scalability, real‑time analytics, and AI‑driven insights. Financial institutions are increasingly leveraging these platforms to enable customer personalization, predictive analytics, and enterprise‑wide decision making. Technology vendors are also focusing on enhancing platform interoperability, security, and compliance features to cater to diverse banking requirements. The combination of regulatory pressure, digital banking growth, and adoption of intelligent analytics tools is driving a steady CAGR of 24.3% in the European market.

Japan Banking Data Lake Platform Market

The Japan Banking Data Lake Platform Market was valued at USD 696 million in 2025, reflecting the country’s growing focus on digital transformation, data-driven banking, and regulatory compliance. Japanese banks are increasingly adopting centralized data lake platforms to consolidate structured, semi-structured, and unstructured data from core banking systems, payment networks, and customer interactions. These platforms enable enhanced risk management, improved fraud detection, and operational efficiency, while supporting strict compliance with local financial regulations and reporting standards.

The market growth in Japan is also driven by the rising implementation of cloud-based and AI-enabled data analytics solutions. Banks are leveraging these platforms to perform predictive analytics, generate customer insights, and optimize operational workflows. Technology vendors are focusing on offering scalable, secure, and interoperable data lake solutions tailored to the specific needs of Japanese financial institutions. This combination of digital adoption, regulatory requirements, and demand for advanced analytics contributes to a steady CAGR of 22.7% for the Japan market.

Global Banking Data Lake Platform Market: Key Takeaways

- Rapid Market Expansion: The global Banking Data Lake Platform market is projected to grow from USD 8.7 billion in 2025 to USD 72.0 billion by 2034, driven by increasing adoption of AI, analytics, and cloud-based banking solutions.

- North America Leads Adoption: North America holds the largest market share at 34.0% in 2025, supported by mature banking infrastructure, advanced analytics integration, and regulatory compliance initiatives.

- Cloud and AI Enablement: Cloud deployment and AI-driven analytics are key growth drivers, enabling real-time decision making, predictive insights, and scalable data management for banks of all sizes.

- Retail and Risk Focus: Retail banking and risk management applications dominate platform usage, as banks centralize customer and transactional data for fraud detection, compliance, and personalization.

- Emerging Markets Growth: Asia-Pacific, Japan, and Europe show strong growth potential due to digital banking expansion, regulatory pressures, and adoption of hybrid, AI-enabled data lake infrastructures.

Global Banking Data Lake Platform Market: Use Cases

- Risk Management and Regulatory Reporting: Banking data lake platforms enable centralized storage of enterprise risk data, supporting stress testing, compliance analytics, and regulatory reporting. They improve data accuracy, audit readiness, and risk visibility across banking operations.

- Fraud Detection and Financial Crime Analytics: These platforms consolidate transaction and behavioral data to support real time fraud detection and anomaly identification. Advanced analytics and machine learning help reduce false positives and strengthen financial crime prevention.

- Customer Analytics and Personalization: Banks use data lakes to unify customer data from digital channels and core systems. This enables customer segmentation, behavioral insights, and personalized product recommendations across banking touchpoints.

- Operational Intelligence and Performance Optimization: Data lake platforms support analysis of operational and system data to improve process efficiency, cost management, and service performance. They help banks optimize workflows and enhance overall operational resilience.

Global Banking Data Lake Platform Market: Stats & Facts

Ministry of Finance, Government of India

- Total digital payment transactions increased from 2,071 crore in FY 2017‑18 to 22,831 crore in FY 2024‑25, showing rapid expansion of digital financial services.

- The value of digital payment transactions grew substantially over the same period, underlining broad banking digitalisation efforts.

Reserve Bank of India (RBI) – Reported Data

- Digital payments comprised 99.8 % of total transaction volumes in the first half of 2025, indicating overwhelming adoption of electronic banking systems.

- Generative AI adoption could boost operational efficiency in Indian banking by nearly 46 %, highlighting government focus on AI in financial services.

Federal Reserve / US Payment System Statistics

- In 2023 the US Federal Reserve reported the FedACH network processed 18.9 billion commercial ACH transactions, rising from the prior year and indicating continued electronic payment growth.

- The FedNow instant payment service, launched in July 2023, saw transaction volume exceed 1 million payments in Q1 2025 and 2 million in Q2 2025, reflecting expanding real‑time payment adoption.

- In 2024 the modern ACH Network processed 33.6 billion payments, showing multi‑year increases in electronic funds transfers.

- US consumer payment trends in 2024 showed an average of 48 payments per month per person, up from 2023.

Bank of Japan / METI Japan Statistics

- Japan’s official cashless payment ratio rose to 42.8% in 2024, exceeding the government’s 2025 target ahead of schedule, demonstrating rapid cashless adoption.

- Japan’s cashless share included credit cards at 82.9%, electronic money at 4.4%, and code payments at 9.6% of cashless transactions in 2024.

European Central Bank Payment Statistics

- In the first half of 2024, non‑cash payment transactions in the euro area increased 7.4% to 72.1 billion compared with the same period in 2023.

- Card payments accounted for 56% of total non‑cash payments in the euro area in early 2024, with e‑money payments making up 6%.

- The number of contactless card payments in the euro area rose by 13.2% to 25.8 billion in the first half of 2024.

- Retail payment systems in the euro area processed around 52.1 billion non‑cash transactions in early 2024.

Impact of Artificial Intelligence on the global Banking Data Lake Platform market

The rise of artificial intelligence has significantly transformed the global Banking Data Lake Platform market by enhancing how banks process, analyze, and derive insights from massive volumes of data. AI driven analytics and machine learning models leverage unified data repositories to identify patterns, detect anomalies, and deliver predictive insights that improve decision making across risk management, fraud detection, and customer engagement. By embedding AI capabilities within data lake platforms, financial institutions can automate complex data preparation and modeling tasks, accelerate time to insight, and reduce dependency on manual processes.

AI integration also elevates the value proposition of data lake platforms by enabling real time intelligence and adaptive learning across diverse banking use cases. Intelligent data governance, natural language querying, and autonomous analytics improve operational efficiency and reduce compliance burdens. As banks increasingly adopt generative AI and deep learning for advanced credit scoring, sentiment analysis, and personalized banking experiences, demand for scalable, AI ready data lake infrastructures has surged. This has broadened the market scope, driven innovation among vendors, and positioned AI as a key accelerator for growth in the global Banking Data Lake Platform ecosystem.

Global Banking Data Lake Platform Market: Market Dynamics

Global Banking Data Lake Platform Market: Driving Factors

Growing Demand for Real-Time Decision Making

Financial institutions face rising pressure to make faster, data-driven decisions across risk management, customer engagement, and fraud detection. Banking data lake platforms enable real-time data ingestion from core banking systems, payment gateways, and digital channels, empowering AI-driven analytics and operational dashboards. This capability supports instant insights, enhances predictive modeling accuracy, and improves credit risk assessment, thereby driving market adoption globally.

Regulatory Compliance and Data Governance Requirements

Stringent regulatory frameworks such as Basel standards, anti-money laundering mandates, and data privacy laws require banks to maintain transparent, auditable data environments. Data lake platforms centralize disparate data sources and standardize metadata, enabling consistent reporting, traceability, and governance. Enhanced data lineage and security controls help organizations meet compliance obligations while reducing risk exposure and operational costs.

Global Banking Data Lake Platform Market: Restraints

Complexity of Integration with Legacy Systems

Many banks operate legacy core systems that are not built for modern data architectures. Integrating disparate ERP, transaction processing, and mainframe systems with next-generation data lakes can be costly and technically challenging. Complexity in data migration, transformation, and harmonization often slows deployment timelines and increases project risk, limiting faster market growth in some regions.

Shortage of Skilled Data Professionals

Successfully implementing data lake platforms requires expertise in big data engineering, cloud computing, data governance, and AI analytics. The shortage of skilled professionals in these domains creates a talent gap that hampers adoption, especially among mid-sized banks and institutions with limited IT budgets. Lack of in-house capability increases reliance on external consultants, raising operational expenses.

Global Banking Data Lake Platform Market: Opportunities

Complexity of Integration with Legacy Systems

Many banks operate legacy core systems that are not built for modern data architectures. Integrating disparate ERP, transaction processing, and mainframe systems with next-generation data lakes can be costly and technically challenging. Complexity in data migration, transformation, and harmonization often slows deployment timelines and increases project risk, limiting faster market growth in some regions.

Shortage of Skilled Data Professionals

Successfully implementing data lake platforms requires expertise in big data engineering, cloud computing, data governance, and AI analytics. The shortage of skilled professionals in these domains creates a talent gap that hampers adoption, especially among mid-sized banks and institutions with limited IT budgets. Lack of in-house capability increases reliance on external consultants, raising operational expenses.

Global Banking Data Lake Platform Market: Trends

Rise of Self-Service Analytics and Data Democratization

Banks are increasingly enabling business users to access insights without deep technical expertise. Self-service analytics tools layered on data lake platforms allow credit analysts, compliance officers, and marketing teams to explore datasets, create custom reports, and generate visualizations. This democratization accelerates data-driven decision making and enhances cross-departmental collaboration.

Focus on End-to-End Data Security and Privacy

With increasing cyber threats and strict data protection laws, security remains a top priority. Modern data lake platforms incorporate end-to-end encryption, role-based access control, and automated threat monitoring to protect sensitive financial data. Privacy-enhancing technologies such as tokenization and differential privacy are gaining traction, enabling banks to balance analytical use cases with regulatory compliance and customer trust.

Global Banking Data Lake Platform Market: Research Scope and Analysis

By Component Analysis

Software is anticipated to dominate the component segment of the Banking Data Lake Platform Market, accounting for 78.0% of the total market share in 2025, as banks increasingly prioritize scalable and intelligent data infrastructures over traditional data management tools. Software platforms form the core of banking data lake ecosystems by enabling data ingestion, storage, processing, governance, and advanced analytics within a unified environment. The rising adoption of artificial intelligence, machine learning, real time analytics, and regulatory compliance solutions further strengthens demand for sophisticated software capabilities that can handle high volume, high velocity banking data while ensuring security, auditability, and data quality across enterprise systems.

Services play a critical supporting role within this market segment by enabling successful deployment, optimization, and long term management of data lake platforms. Professional services such as consulting, system integration, and customization help banks align data lake architectures with existing core banking systems and regulatory frameworks.

Managed services are increasingly adopted to support ongoing operations, performance monitoring, and security management, particularly among mid-sized and resource constrained institutions. While services account for a smaller share of overall revenue, they remain essential for maximizing platform efficiency, reducing implementation risk, and accelerating time to value.

By Data Type Processed Analysis

Structured banking data are anticipated to dominate the data type processed segment, capturing 45.0% of the total market share in 2025, as financial institutions continue to rely heavily on well-organized transactional and financial records generated from core banking systems. This includes account information, payment transactions, loan records, and financial statements that follow predefined schemas and are essential for regulatory reporting, risk assessment, and financial analysis. Banking data lake platforms are increasingly used to centralize this structured data to improve data consistency, enable faster querying, and support analytics driven decision making across compliance, risk management, and performance monitoring functions.

Semi structured data represents a significant and rapidly growing portion of this market segment, driven by the expansion of digital banking channels and real time data streams. Data such as application logs, API outputs, payment messages, and event driven transaction records do not conform to rigid database structures but carry high analytical value. Banking data lake platforms are well suited to ingest and process semi structured data at scale, enabling banks to gain insights into customer behavior, system performance, and transaction flows. This capability supports advanced analytics use cases including fraud detection, operational intelligence, and customer experience optimization.

By Deployment Mode Analysis

On-premises deployment is anticipated to dominate the deployment mode segment, capturing 62.0% of the total market share in 2025, as banks continue to prioritize data security, regulatory compliance, and direct control over sensitive financial information. Many financial institutions operate within strict data residency and governance frameworks that require critical customer, transaction, and risk data to remain within bank controlled infrastructure. On-premises data lake platforms allow banks to integrate seamlessly with legacy core banking systems, maintain customized security protocols, and support complex regulatory audits, making them the preferred choice for large and highly regulated banking environments.

Cloud-based deployment represents a rapidly expanding segment within the market, driven by the need for scalability, flexibility, and cost efficiency. Cloud data lake platforms enable banks to handle growing data volumes, support advanced analytics workloads, and accelerate innovation through access to artificial intelligence and machine learning services. Improved cloud security standards, industry specific compliance certifications, and hybrid integration capabilities are encouraging greater adoption, particularly among digital banks and mid-sized institutions seeking faster deployment and reduced infrastructure overhead.

By Banking Function Analysis

Retail banking is anticipated to dominate the banking function segment, capturing 44.0% of the total market share in 2025, driven by the high volume and diversity of data generated from customer transactions, digital banking channels, and payment activities. Retail banks manage millions of customer interactions across mobile banking, online platforms, ATMs, and branch networks, creating a strong need for centralized data lake platforms. These platforms enable customer analytics, personalization, fraud detection, and real time insights, supporting improved customer experience, cross selling strategies, and regulatory reporting across large scale retail operations.

Corporate and commercial banking represents a significant segment within the market, supported by complex financial data related to treasury operations, trade finance, cash management, and corporate lending. Data lake platforms help consolidate transactional, contractual, and market data from multiple systems, enabling advanced analytics for credit risk assessment, liquidity management, and client profitability analysis. As corporate banking clients demand faster services and data driven insights, adoption of data lake platforms continues to grow to support operational efficiency and informed decision making.

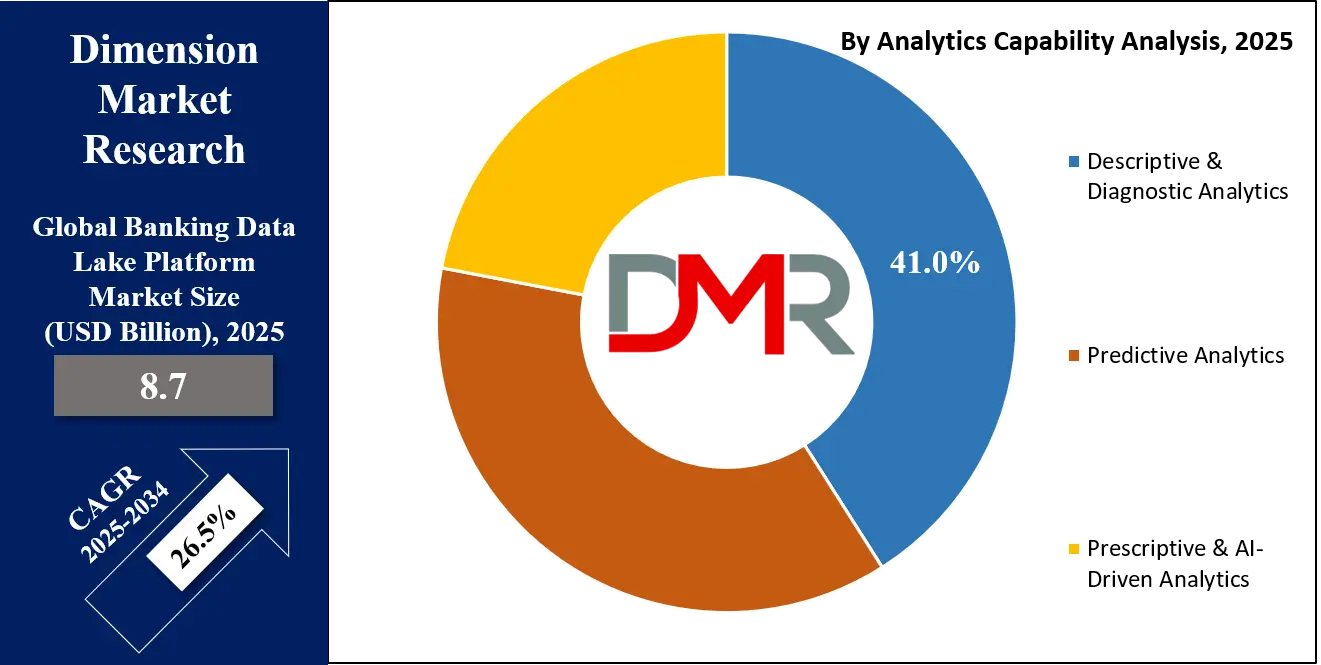

By Analytics Capability Analysis

Descriptive and diagnostic analytics are anticipated to dominate the analytics capability segment, capturing 41.0% of the total market share in 2025, as banks rely heavily on historical and transactional data to understand past performance and identify the root causes of operational, financial, and customer behavior trends. Banking data lake platforms enable the aggregation and visualization of large volumes of structured and semi-structured data from core banking systems, digital channels, and risk engines. This allows financial institutions to generate reports, monitor key performance indicators, and gain actionable insights that support decision making, regulatory reporting, and operational efficiency.

Predictive analytics represents a growing segment within this market, driven by the increasing need for forward-looking insights in risk management, fraud detection, and customer engagement. By leveraging machine learning models and AI algorithms on consolidated banking data, data lake platforms can forecast credit risk, detect anomalous transactions, anticipate customer behavior, and optimize marketing strategies. Predictive analytics enables banks to proactively manage portfolio performance, reduce potential losses, and deliver personalized financial services, making it an essential capability for modern, data-driven banking operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

Large and Tier-1 banks are anticipated to dominate the organization size segment, capturing 73.0% of the total market share in 2025, due to their extensive operations, high transaction volumes, and complex regulatory requirements. These institutions generate massive amounts of structured and unstructured data from retail, corporate, and investment banking activities, making centralized data lake platforms essential for data management, advanced analytics, and regulatory compliance. Large banks invest heavily in scalable storage, AI-driven analytics, and robust governance frameworks to ensure accurate reporting, risk assessment, fraud detection, and personalized customer services across multiple channels and regions.

Mid-sized and regional banks represent a smaller but growing segment within this market, driven by their need to modernize legacy systems and enhance data-driven decision making. Data lake platforms offer these banks scalable and cost-effective solutions for integrating transactional, operational, and customer data from diverse sources. Adoption enables improved analytics for credit scoring, risk monitoring, regulatory reporting, and customer insights, while reducing dependency on traditional data warehouses. As cloud-based and managed services become more accessible, mid-sized and regional banks are increasingly leveraging these platforms to compete with larger institutions and deliver efficient, data-driven banking solutions.

By Application Analysis

Risk management and stress testing are anticipated to dominate the application segment, capturing 36.0% of the total market share in 2025, as banks increasingly rely on data lake platforms to consolidate enterprise-wide risk data from credit, market, liquidity, and operational sources. These platforms enable financial institutions to perform comprehensive stress testing, scenario analysis, and regulatory reporting with higher accuracy and efficiency. By integrating real-time and historical data, banks can identify potential vulnerabilities, optimize capital allocation, and comply with stringent regulatory frameworks, making risk management one of the most critical use cases driving market adoption.

Customer analytics and personalization represent a significant segment within the market, driven by the need for banks to enhance customer experience and engagement. Data lake platforms allow consolidation of transactional, behavioral, and digital interaction data across multiple channels, enabling detailed customer segmentation, preference analysis, and personalized product recommendations. By leveraging advanced analytics and AI models, banks can tailor marketing campaigns, improve cross-selling opportunities, and anticipate customer needs, supporting loyalty and revenue growth while optimizing overall service delivery.

The Banking Data Lake Platform Market Report is segmented on the basis of the following:

By Component

- Software

- Data Lake Management & Orchestration

- Data Integration & Ingestion

- Analytics & AI Enablement

- Data Governance, Security & Metadata Management

- Services

- Implementation & Integration

- Consulting & Customization

- Managed Data Lake Operations

By Data Type Processed

- Structured Banking Data

- Semi-Structured Data

- Unstructured Data

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid Deployment

By Banking Function

- Retail Banking

- Corporate & Commercial Banking

- Investment Banking

- Digital-Only & Challenger Banks

By Analytics Capability

- Descriptive & Diagnostic Analytics

- Historical Analysis

- Reporting & Dashboards

- Predictive Analytics

- Credit Scoring

- Fraud Prediction

- Prescriptive & AI-Driven Analytics

- Automated Decisioning

- GenAI & ML Models

By Organization Size

- Large & Tier-1 Banks

- Mid-Sized & Regional Banks

By Application

- Risk Management & Stress Testing

- Credit Risk

- Market & Liquidity Risk

- Enterprise Risk Analytics

- Customer Analytics & Personalization

- Behavioral Analytics

- Cross-Sell & Upsell Intelligence

- Regulatory Compliance & Reporting

- Basel III/IV

- AML & KYC Reporting

- Fraud Detection & Financial Crime

- Real-Time Fraud Analytics

- Anomaly Detection

- Operational Intelligence

- Performance Monitoring

- Cost & Process Optimization

Global Banking Data Lake Platform Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global Banking Data Lake Platform Market, capturing 34.0% of total market revenue in 2025, driven by the region’s mature banking sector, early adoption of advanced analytics, and strong focus on digital transformation. Large commercial banks, investment banks, and fintech firms are increasingly deploying data lake platforms to centralize structured and unstructured data, enhance risk management, support real-time fraud detection, and enable personalized customer experiences. The presence of leading technology vendors, cloud infrastructure providers, and regulatory compliance frameworks further accelerates market growth in the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the Banking Data Lake Platform Market, driven by rapid digital banking adoption, expanding financial inclusion, and increasing investment in cloud and AI‑enabled data infrastructures. Banks across China, India, Japan, and Southeast Asia are modernizing legacy systems to handle growing transaction volumes, improve customer analytics, and enhance risk management capabilities. The rising demand for real‑time decision making, personalized financial services, and regulatory compliance solutions is further accelerating the adoption of scalable and flexible data lake platforms, positioning Asia-Pacific as a high-growth market in the global landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Banking Data Lake Platform Market: Competitive Landscape

The competitive landscape of the global Banking Data Lake Platform Market is characterized by intense innovation and strategic investments as vendors strive to differentiate through advanced analytics capabilities, scalable data management solutions, and integrated artificial intelligence and machine learning features. Market players are focusing on expanding their cloud‑native offerings, enhancing data governance and security functionalities, and forging partnerships with financial institutions to deliver tailored solutions that address evolving regulatory, operational, and customer experience challenges. As demand grows for real‑time insights and predictive analytics, competition is also driving continuous improvements in platform performance, ease of deployment, and end‑to‑end data orchestration across hybrid and multi‑cloud environments.

Some of the prominent players in the global Banking Data Lake Platform market are:

- Microsoft Corporation

- Amazon Web Services (AWS)

- IBM Corporation

- Google LLC

- Oracle Corporation

- SAP SE

- Cloudera Inc.

- Teradata Corporation

- Snowflake Inc.

- Hewlett Packard Enterprise (HPE)

- Informatica LLC

- SAS Institute Inc.

- Dell Technologies Inc.

- Hitachi Vantara

- Talend S.A.

- Atos SE

- Capgemini SE

- Tata Consultancy Services (TCS)

- Infosys Limited

- Accenture plc

- Other Key Players

Global Banking Data Lake Platform Market: Recent Developments

- January 2026: ClickHouse, a database management and real‑time analytics firm, secured USD 400 million in Series D funding, valuing the company at USD 15 billion and reflecting investor appetite for scalable analytics and real‑time data processing infrastructure.

- December 2025: Huawei released its AI Data Lake Solution at the Innovative Data Infrastructure Forum, combining data storage, management, and AI toolchain components to accelerate industry intelligence and high‑performance analytics support across enterprise data environments.

- December 2025: AI startup Flex raised USD 60 million in funding to develop AI‑powered finance tools for mid‑sized businesses, highlighting increased investment in data analytics and automation technologies supporting financial decisioning.

- June 2025: Snowflake announced its acquisition of Crunchy Data, a cloud‑based PostgreSQL database provider, strengthening its enterprise data platform and open source database capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.7 Bn |

| Forecast Value (2034) |

USD 72.0 Bn |

| CAGR (2025–2034) |

26.5% |

| The US Market Size (2025) |

USD 2.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Services), By Data Type Processed (Structured Banking Data, Semi-Structured Data, Unstructured Data), By Deployment Mode (On-Premises, Cloud-Based, Hybrid Deployment), By Banking Function (Retail Banking, Corporate & Commercial Banking, Investment Banking, Digital-Only & Challenger Banks), By Analytics Capability (Descriptive & Diagnostic Analytics, Predictive Analytics, Prescriptive & AI-Driven Analytics), By Organization Size (Large & Tier-1 Banks, Mid-Sized & Regional Banks), and By Application (Risk Management & Stress Testing, Customer Analytics & Personalization, Regulatory Compliance & Reporting, Fraud Detection & Financial Crime, Operational Intelligence) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft Corporation, Amazon Web Services (AWS), IBM Corporation, Google LLC, Oracle Corporation, SAP SE, Cloudera Inc., Teradata Corporation, Snowflake Inc., Hewlett Packard Enterprise (HPE), Informatica LLC, SAS Institute Inc., Dell Technologies Inc., and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Banking Data Lake Platform market?

▾ The global Banking Data Lake Platform market size was valued at USD 8.7 billion in 2025 and is expected to reach USD 72.0 billion by the end of 2034.

What is the size of the US Banking Data Lake Platform market?

▾ The US Banking Data Lake Platform market was valued at USD 2.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 18.3 billion in 2034 at a CAGR of 24.8%.

Which region accounted for the largest global Banking Data Lake Platform market?

▾ North America is expected to have the largest market share in the global Banking Data Lake Platform market, with a share of about 34.0% in 2025.

Who are the key players in the global Banking Data Lake Platform market?

▾ Some of the major key players in the global Banking Data Lake Platform market are Microsoft Corporation, Amazon Web Services (AWS), IBM Corporation, Google LLC, Oracle Corporation, SAP SE, Cloudera Inc., Teradata Corporation, Snowflake Inc., Hewlett Packard Enterprise (HPE), Informatica LLC, SAS Institute Inc., Dell Technologies Inc., and Others.