Market Overview

The Global

Bariatric Manual Wheelchair Market size is expected to reach a

value of USD 2,021.0 million in 2024, and it is further anticipated to reach a market

value of USD 3,683.3 million by 2033 at a

CAGR of 6.9%.

The global bariatric manual wheelchair market is expanding at a steady pace due to increasing cases of obesity globally, increasing awareness regarding mobility aids, and changing designs of wheelchairs. A bariatric wheelchair is designed specifically for individuals weighing more than 300 pounds with durable yet comfortable designs to support them during use.

North America is projected to lead the majority market share in the bariatric manual

wheelchair market, followed by Europe and the Asia-Pacific region. Higher rates of obesity, better infrastructure pertaining to health care, and strong adoption of advanced mobility solutions make the region lead. Besides, technological innovations to enhance the wheelchairs with lighter materials such as aluminum frames without losing strength further

fuels market growth.

The key players in the market, Invacare Corporation, Drive Medical, and GF Health Products, for

instance, are continually developing and upgrading their product lines to meet the rising demand. Innovations revolve around comfort, durability, and ease of use to ensure mobility solutions meet the peculiar needs that bariatric persons have.

With the continuous increase in aging and the growing obesity epidemic worldwide, the bariatric manual wheelchair market is expected to show continued growth over the next few years, hence presenting broad growth opportunities for manufacturers and suppliers in the sector.

Due to an increase in obesity and related health conditions worldwide, bariatric manual wheelchair sales are experiencing exponential growth. More individuals require mobility assistance for daily activities; bariatric wheelchairs have become an indispensable solution in providing comfort and support - these chairs cater specifically to individuals with higher weight capacities ensuring greater independence.

Recently introduced innovations to wheelchair design and materials have greatly enhanced the functionality and comfort of bariatric manual wheelchairs. Manufacturers are emphasizing lightweight yet strong materials to provide greater ease of use without compromising strength, while ergonomic features like adjustable footrests and enhanced cushioning have become more sought-after among users.

Demand for bariatric manual wheelchairs has seen steady increase across healthcare settings, particularly hospitals, rehabilitation centers, and home care environments. More healthcare providers recognize the significance of tailored mobility solutions and increasingly offer these products that enhance quality of life for individuals living with obesity or mobility difficulties.

Opportunities in the bariatric wheelchair market are emerging across both developed and developing regions. As awareness around obesity increases and healthcare access improves, demand for customized mobility solutions should rise accordingly. Manufacturers can capitalize on this demand by prioritizing product innovation while expanding availability in emerging markets.

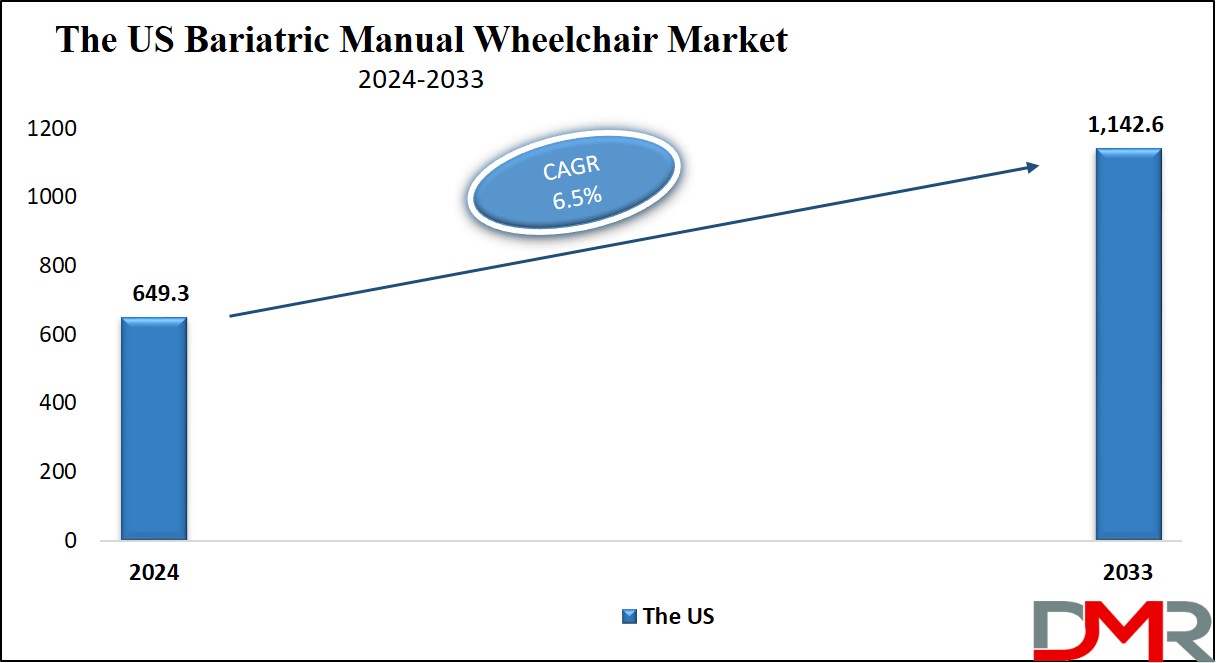

The US Bariatric Manual Wheelchair Market

The US Bariatric Manual Wheelchair Market is projected to be

valued at USD 649.3 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 1,142.6 million in 2033 at a

CAGR of 6.5%. U.S. bariatric manual wheelchair sales have experienced sustained expansion due to rising obesity rates and rising healthcare expenditures. Recent market reports confirm the U.S. is one of the world's leading markets for bariatric manual wheelchair sales due to an ever-increasing need for accessible mobility solutions in

healthcare and rehabilitation settings.

- One key trend in this market is an increasing focus on creating lightweight but sturdy wheelchair frames made of materials like aluminum or high-strength metals like titanium that meet the specific needs of bariatric individuals, offering comfort, mobility, ease of use for caregivers, and enhanced weight capacities.

- Developments such as adjustable seat widths are driving market growth as are advances in ergonomic design such as adjustable width seating systems that increase market revenue. As well as design innovations, there is also an increasing trend toward customized wheelchair solutions tailored specifically to individual patient needs. Manufacturers are emphasizing personalization by offering heavy-duty models capable of supporting up to 500 pounds per patient.

- Automated wheelchair technologies are also helping shape the U.S. market landscape, with features like electric assistance and smart sensors becoming increasingly prevalent, offering better mobility options to bariatric patients. Overall, the U.S. bariatric manual wheelchair market is expected to experience sustained growth thanks to technological advances, increasing healthcare investments, and rising obesity rates.

Key Takeaways

- Global Market Value: The global bariatric manual wheelchair market size is estimated to have a value of USD 2,021.0 million in 2024 and is expected to reach USD 3,683.3 million in 2033.

- The US Market Value: The US bariatric manual wheelchair market is projected to be valued at USD 1,142.6 million in 2033 from the base value of USD 649.3 million in 2024 at a CAGR of 6.5%.

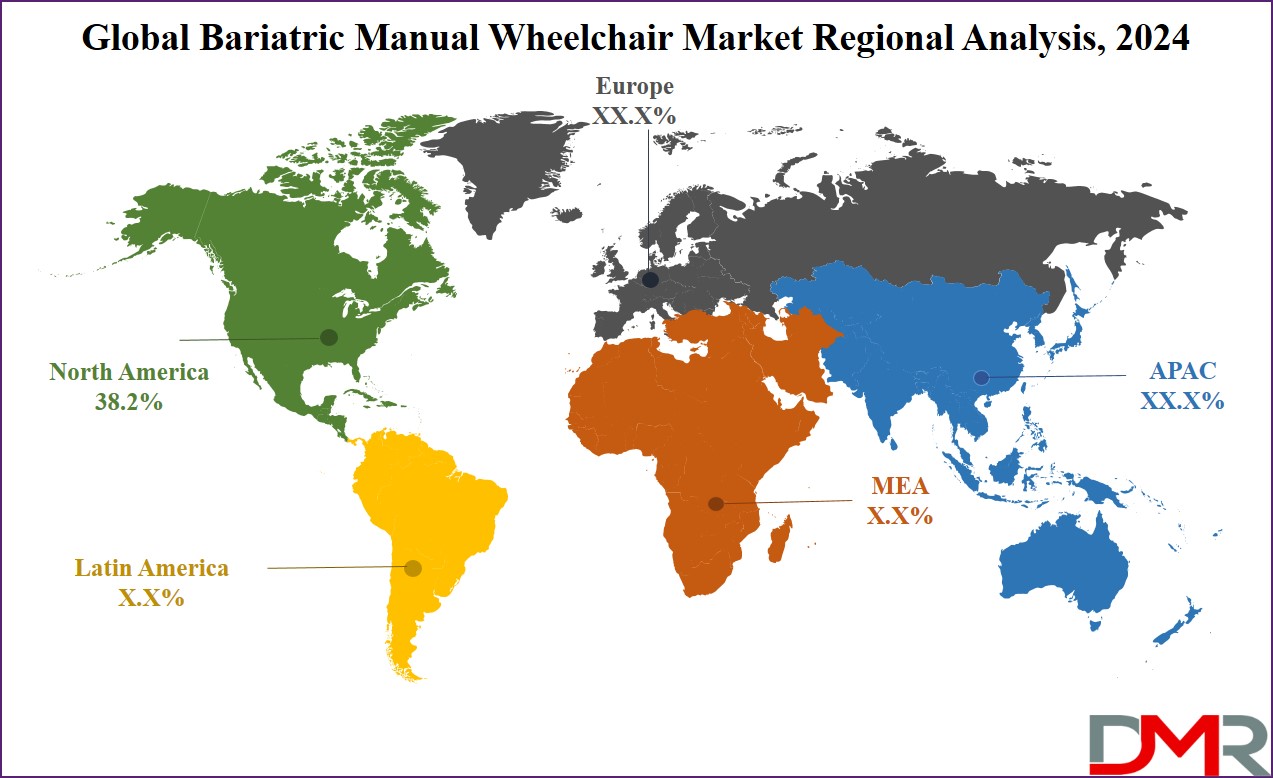

- Regional Analysis: North America is expected to have the largest market share in the global bariatric manual wheelchair market with a share of about 38.2% in 2024.

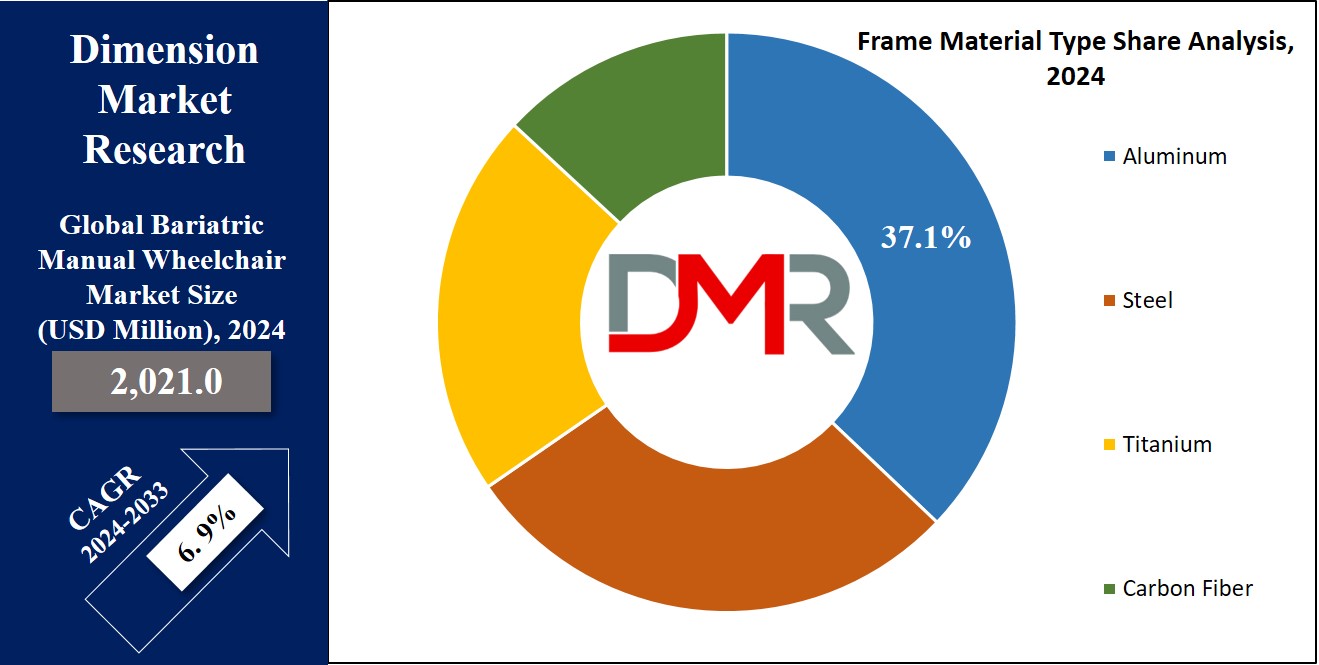

- By Material Type Segment Analysis: Aluminum is projected to dominate the material segment in this market as it will hold 37.1% of the total market share in 2024.

- By Product Type Segment Analysis: The standard bariatric manual wheelchair is projected to dominate the product type segment in this market as it holds 36.0% of the market share in 2024.

- Key Players: Some of the major key players in the global bariatric manual wheelchair market are Invacare Corporation, Sunrise Medical, Medline Industries Inc., Drive DeVilbiss Healthcare, and many others.

- Global Growth Rate: The market is growing at a CAGR of 6.9 percent over the forecasted period.

Use Cases

- Healthcare Facilities: Bariatric wheelchairs enjoy wide usage in hospitals and clinics for the mobilization of individuals who, for one reason or another, have limited mobility due to obesity or related conditions. These wheelchairs are designed to be strong, supporting higher weights for patient safety.

- Rehabilitation Centers: Bariatric wheelchairs find wide application in rehabilitation-related areas where patients recover from surgery, injury, or illness. Their ability to adjust seat widths and accommodate various weight capacities makes them perfect for personalized care.

- Home Care Settings: These wheelchairs provide comfort, safety, and ease in indoor and outdoor mobility for bariatric patients who require support mechanisms at their homes.

- Geriatric Care: As obesity spreads among older adults, bariatric manual wheelchairs in nursing care and long-term care are also becoming more utilized, therefore, elderly patients experience improved motility and independence.

Market Dynamic

Trends

Rising Obesity RatesThe increasing rate of obesity in the world provides a continuing demand for bariatric wheelchairs. As more of the population becomes less mobile because of excess body weight, the need for bariatric manual wheelchairs grows. This trend has most recently become apparent in countries from North America and Europe, where obesity rates are the highest, as evidenced by sales of higher-weight-capacity wheelchairs. Since obesity will likely be more of a concern in public health by 2033, chances are it will further boost the global bariatric manual wheelchair market.

Technological Advancements

Automation and motor-assisted technologies are becoming an emerging trend in bariatric wheelchairs. Added technological enhancements to the product, in turn, would assure the user's independence and create easy navigation without interference for the bariatric person. Programmable controls, smart sensors, remote operations, etc., are changing the dynamics of the bariatric manual wheelchair market, EventQueue improved user experience and expanded the functionality of the product.

Customization DemandCustomizable features such as adjustable seating, ergonomic backrests, and modular designs as people love customization of features like seat adjustability, ergonomic backrests, and modular design. With growing demand from users for personalized mobility solutions, companies are manufacturing a wide range of products. This, therefore, results in market growth due to the growing demand for comfort and mobility needs.

Growth Drivers

Increasing Healthcare ExpenditureOne of the major factors driving the growth of the bariatric manual wheelchair market is increasing healthcare expenditure across the world, particularly in developed economies such as the U.S. and Europe. As the number of bariatric patients is growing, governments and private healthcare institutions are increasingly investing in various

mobility solutions to accommodate these patients. Increasing hospital infrastructure spending and per-patient care spending further strengthen the demand for bariatric wheelchairs in institutions.

Growing Aging Population

Another critical factor contributing to the growth of the manual wheelchair market is the increasing geriatric population worldwide. This is because not only do elderly people have mobility issues, but a large number of elderly people suffer from obesity as well, and for all such conditions, there is an increased demand for bariatric manual wheelchairs with higher weight limits and better ergonomics. This trend is most likely to continue during the forecast period, with North America and Europe seeing the highest demand owing to their aged populations.

Advancements in Lightweight Frame Materials

Innovation in lightweight, stronger materials-lightweight aluminum and titanium alloys-is the driver for manual wheelchair growth. These provide greater tensile strength in wheelchairs without increasing the overall weight and at the same time offer ease to both the caregiver and user in moving the wheelchair. This development has benefited the bariatric manual wheelchair segment, wherein reinforced frames are needed for the safety and comfort of the users.

Growth Opportunities

Untapped Markets in Emerging Economies

The increasing incidence of obesity in emerging economies will provide enormous growth opportunities for the global bariatric manual wheelchair market. Most of the markets in these regions are under-penetrated, and the rising disposable income in these regions would drive demand for bariatric wheelchairs. Thus, companies focusing on expanding their operations in these regions can capitalize on the unmet demand for bariatric mobility solutions.

Innovations in Assistive Technologies

Ongoing growth in the assistive technology industry, coupled with automated mobility systems, has created great opportunities. Voice-controlled wheelchairs and AI navigation are further expected to emerge in the bariatric manual wheelchair market. These will create new sales opportunities by attracting consumers who seek innovative solutions that make life easier.

Increasing Demand for Post-Surgery Rehabilitation

This has resulted in a felt need for bariatric-specific mobility solutions following such surgeries. Patients who undergo these weight-reduction surgeries require comfort and strength from wheelchairs during their stay in the hospital. It therefore holds a good market prospect for bariatric manual wheelchairs in healthcare facilities where rehabilitation is part of treatment wings that emanate in the instance of such surgeries. The manufacturers stand in advantageous positions by providing products targeting the needs of the post-surgical patient.

Restraints

High Costs of Bariatric Manual Wheelchairs

One of the major factors still affecting the global bariatric manual wheelchair market is high pricing. Advanced models have automated assistance, smart controls, and durable materials; these all add up considerably to the price of the wheelchair, putting it out of reach for the lower-income population. This, in essence, serves as one of those price barriers that potentially hamper market growth because of a lack of affordability, especially in developing nations.

Limited Awareness in Developing Regions

Even while obesity rates are considerably increasing, awareness of bariatric wheelchairs has yet to be implemented in many regions, especially those in the Asia-Pacific and Africa. The health providers in those specific regions can remain ignorant about the special mobility solutions available for bariatric people, hence not letting this happen. Consequently, such lack of awareness acts as the big deterring factor in keeping market growth in those unexploited areas behind.

Complex Regulations and Standards

Despite the stringent regulations surrounding medical devices, another major factor that plays a restraining role on manufacturers is the strict regulatory policies related to devices, including the bariatric manual wheelchair. For companies operating in North American and European markets, the onus of complex safety standards and multiple certifications before new product launches becomes time-consuming and costly. This increases the time taken and cost of bringing the product to market, which again takes away the pace of innovation and growth.

Research Scope and Analysis

By Frame Material Type

In the global bariatric manual wheelchair market, aluminum is projected to dominate the material segment as it will hold 37.1% of the total market share in 2024. the dominance in the frame material type segment has been established by aluminum due to its combination of flexibility and hardness that collectively imparts strength, lightweight properties, and corrosion resistance.

The prime advantage that differentiates aluminum is that it can impart high durability at a much lighter rate when compared to other materials such as steel. This is particularly important in the bariatric wheelchair market, where weight is of most importance to users and caregivers alike. In these bariatric wheelchairs, aluminum provides the structural integrity to support individuals weighing over 300 lbs without sacrificing comfort or maneuverability. Users will enjoy easier mobility, particularly when manually operating their wheelchairs, through the reduced overall weight. In addition, aluminum frames provide more ease in transportation and storage, among other key factors that caregivers consider in helping patients in different environments.

From this, it can be added that resistance to rust and wear from aluminum provides long-term performance even with frequent use. This makes it an economic solution for

health facilities and personal use since wheelchairs constructed with an aluminum frame require less maintenance and last longer compared to other materials. From a design perspective, aluminum allows for more flexibility in the personalization of wheelchairs by manufacturers into ergonomic models that more finitely tune-up to the needs of a bariatric patient. Currently, therefore, aluminum remains dominant in this segment and has continued to drive growth and innovation.

By Product Type

The standard bariatric manual wheelchair is projected to dominate the product type segment in the global bariatric manual wheelchair market as it hold 36.0% of the market share by the end of 2024. The standard bariatric manual wheelchair dominates the segment in the global bariatric manual wheelchair market on account of its practicality, affordability, and wide adoption within healthcare and personal uses.

These are designed to accommodate the special needs that come with bariatric cases and offer an economic solution compared to the more sophisticated or automated models. One major reason why standard bariatric manual wheelchairs dominate the market is because of their simple, reliable design; they have made them very accessible to both users and caregivers alike. Most of them are manufactured from heavy-duty material construction made of aluminum or reinforced steel to give the chair the needed strength required for higher weight capacities, which generally falls within a range of 351 to 500 pounds. These are made of heavy-duty material, yet light enough to be maneuvered easily by their caregivers, and thus make for perfect models in institutions and at home.

Besides that, a standard manual bariatric wheelchair is relatively affordable, thus adding much to their popularity. Many bariatric patients or health care providers who have had to make economic resources find themselves settling well with them because they serve excellently without the higher costs involved in their automated or high-tech counterparts, thus being attractive to individual or institutional budget constraints. Apart from that, standard wheelchairs are also preferred for long-term use as they can be used variably and require less maintenance.

They can be customized with various accessories, such as cushions or adjustable armrests, at minimal added costs to provide greater comfort. Therefore, the standard bariatric manual wheelchair still held the leading position among product types and drove a significant surge in the overall bariatric manual wheelchair market size during the forecast period.

By Seat Width

The bariatric manual wheelchair market is dominated by the 23-26-inch seat width segment, which will be able to offer optimum balance between user comfort and wheelchair maneuverability. This range of seat width is designed only for the greater size of the body of bariatric patients and is designed to provide enough space for comfort with efficiency in mobility. Bariatric users do require a wider seating area to prevent pressure points and discomfort caused by prolonged use. Also, the width of the seat should ideally fall within the range of 23-26 inches and need to provide ample room for users without being too heavy for caregivers or healthcare staff while moving or transporting the wheelchair.

The size of this range can be fitted with various ergonomic features like adjustable backrests, increased cushioning, and many more that provide much-improved user comfort. The same width thus plays a critical role in the healthcare setting to promote increased patient care, as it can accommodate a wide range of body types. For this reason, this becomes the width of choice for hospitals and rehabilitation centers where different patients use the same wheelchair. This extra space has the added benefit of being a plus for bariatric individuals with mobility problems, where discomfort and injury from narrow seating are greatly reduced.

The 23-26-inch width also offers great ease of access through indoor and outdoor environments. This strikes the right balance, where the chair is wide enough for comfort but isn't so big that it won't be able to pass through standard doorways or tight spaces, hence being highly practical for daily usage. During this, with the demand for personalized mobility solutions, the majority share will be maintained by the 23–26-inch seat width segment.

By Application

Healthcare facilities are projected to dominate the application segment in the bariatric manual wheelchair market with the highest market share in 2024. In the application segment, the bariatric manual wheelchair market is dominated by healthcare facilities due to lofty requirements and the need for mobility solutions able to accommodate the bariatric patient in a medical environment. Durable, reliable, and versatile wheelchairs are urgently needed to be employed by hospitals, rehabilitation centers, and long-term care facilities to ensure the necessary transportation of patients in comfort and safety.

The main reason this segment dominates is that the increase in the prevalence of obese health conditions, such as diabetes and cardiovascular diseases, has increased the need for bariatric wheelchairs within a medical setting. Since most bariatric patients require special care, medical facilities are installed with heavy-duty wheelchairs that support weights of higher capacity, normally ranging between 351 and 500 lbs. These wheelchairs are very important in helping the patients get around in the course of their recovery, physical therapies, or daily programs within the institutions.

The growing demand for functional and durable solutions in healthcare settings, on the other hand, fosters the global bariatric manual wheelchair market. So, the wheelchairs used within hospitals and clinics must be able to withstand wear and tear from continuous use to make them last longer and also provide cost efficiency for the institutions. The usage of automated bariatric wheelchairs increases the desirability of the products within the healthcare settings as these reduce the physical stress on patients and caretakers alike.

The high rise of bariatric surgeries and, hence, better demand for post-operatory solutions have added to the increasing adoption of bariatric wheelchairs in healthcare facilities. Such factors will continue as they advance, keeping healthcare facilities at the top within the application segment for the market of manual wheelchairs and driving further market growth.

The Bariatric Manual Wheelchair Market Report is segmented on the basis of the following

By Frame Material Type

- Aluminum

- Steel

- Titanium

- Carbon Fiber

By Product Type

- Standard Bariatric Manual Wheelchair

- Heavy-Duty Bariatric Manual Wheelchair

- Ultra-Lightweight Bariatric Manual Wheelchair

- Customized Bariatric Manual Wheelchair

By Seat Width

- 22 inches and below

- 23-26 inches

- 27-30 inches

- 31 inches and above

By Application

- Personal Use

- Healthcare Facilities

- Rental Services

- Educational Institutions

Regional Analysis

North America is projected to dominate the global bariatric manual wheelchair market as it is anticipated to

command over 38.2% of the total market revenue in 2024 and is further expected to show subsequent growth in the upcoming period of 2033. Currently, North America holds the highest market share in the global bariatric manual wheelchair market due to its high prevalence of obesity and improved health infrastructure. This region dominates this market, possibly due to an increasing population with bariatric needs who have to rely on technologically advanced inventions for locomotion.

Established healthcare infrastructure and high healthcare expenditures in the country have triggered a very high demand for bariatric manual wheelchairs from several hospitals, rehabilitation centers, and nursing homes. The presence of key players operating in the market, such as Invacare Corporation and Drive Medical, had also been another reason for North America's leading market position, the players are leading innovators in the field of manual wheelchairs. Additionally, some companies have been investing in research and development to produce more advanced and durable wheelchairs, hence making the market very strong in the region. Awareness of bariatric mobility solutions among healthcare providers and patients is high, too, so demand remains great.

The region also has favorable reimbursement policies for medical devices, which allows easier access to bariatric manual wheelchairs on the part of end-users. Apart from the factors mentioned above, government assistance programs, such as Medicare and Medicaid, which enable funding for purchasing a wheelchair by beneficiaries, also add to the growth impulse experienced by the market. As obesity rates in North America have been continually increasing, the region is likely to retain its dominance in the bariatric manual wheelchair market during the forecast period as well.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global bariatric manual wheelchair market is fiercely competitive, with various large-scale players competing for innovative products to attain geographical presence. Key participants who dominate the market based on product innovation, distribution networks, and customer servicing include Invacare Corporation, Drive Medical, GF Health Products, and Karman Healthcare. These companies are working toward improving their product portfolios through technological advancements such as automated controls and features that can be tailored according to the particular needs of the bariatric patient.

Other manufacturers are also widening their product range by offering lightweight models made from materials such as aluminum and titanium, which enhance durability without compromising ease of use.

Besides, the companies follow several strategies such as collaborations, mergers, and acquisitions to strengthen their market position. For example, Invacare Corporation concentrated on strategic acquisitions as one of its key strategies for expanding its product portfolio and enhancing its competitive positioning in the bariatric manual wheelchair market.

Furthermore, the manufacturers are well-positioned to penetrate new markets within Asia-Pacific and Latin America due to the growing prevalence of obesity, together with developing healthcare infrastructure in these regions. While the competition is growing intensely, market players are also investing in research and development to introduce new products that meet the growing demand for customized mobility solutions.

Some of the prominent players in the Global Bariatric Manual Wheelchair Market are

- Invacare Corporation

- Sunrise Medical

- Medline Industries Inc.

- Drive DeVilbiss Healthcare

- Karman Healthcare

- Graham-Field Health Products Inc.

- Nova Medical Products

- Permobil

- Ottobock

- Pride Mobility Products Corp.

- Hoveround Corporation

- Medline

- Convaquip Industries Inc.

- GF Health Products Inc.

- Other Key Players

Recent Developments

- August 2024: Drive Medical introduced its revolutionary automated bariatric manual wheelchair featuring programmable controls, advanced sensor technology, and remote operation capabilities to enhance user mobility by empowering bariatric individuals to navigate independently without caregiver assistance. This model's goal was to increase mobility for this specific population segment of society.

- July 2024: Invacare Corporation introduced its heavy-duty bariatric wheelchair with an increased weight capacity of up to 600 lbs, designed specifically to address hospital and rehabilitation center use cases. Featuring reinforced titanium frames with variable seat width settings for increased user comfort.

- June 2024: Invacare Corporation completed their purchase of Advanced Bariatrics a niche manufacturer that specializes in customized bariatric manual wheelchairs, further expanding both Invacare's product offering and production capacities. This merger ensures an expanded product offering to their customer base as well as increased production capacities.

- May 2024: GF Health Products unveiled a lightweight aluminum-framed bariatric manual wheelchairs featuring detachable seating components to make transportation and storage simpler, intended specifically for healthcare facilities where ease of use and maintenance are top priorities.

- March 2024: Karman Healthcare announced its new line of heavy-duty bariatric manual wheelchairs geared toward both individual consumers and healthcare providers. Their modular designs enable users to adjust the seat width, backrest height, and armrest positions based on personal preference.

- February 2024: Permobil, a leading player in the manual wheelchair market, announced plans to invest heavily in R&D to develop an automated bariatric wheelchair with AI-powered navigation capabilities. The company aims to roll out this product by mid-2025.

- December 2023: Karman Healthcare launched an ergonomically designed bariatric manual wheelchair with reinforced seating designed for long-term use in nursing homes and healthcare facilities. The product was well-received in North America, where the market for bariatric solutions in healthcare settings continues to grow.

- October 2023: Pride Mobility Products Corp. unveiled a new line of ultra-heavy-duty bariatric manual wheelchairs with a weight capacity of 700 lbs, making them some of the most durable models in the industry. These wheelchairs feature wide seat widths and customizable armrests, catering to a niche segment of the market.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,021.0 Mn |

| Forecast Value (2033) |

USD 3,683.3 Mn |

| CAGR (2024-2033) |

6.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 649.3 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Frame Material Type (Aluminum, Steel, Titanium,

and Carbon Fiber), By Product Type (Standard

Bariatric Manual Wheelchair, Heavy-Duty Bariatric

Manual Wheelchair, Ultra-Lightweight Bariatric

Manual Wheelchair, and Customized Bariatric

Manual Wheelchair), By Seat Width (22 inches and

below, 23-26 inches, 27-30 inches, 31 inches and

above), By Application (Personal Use, Healthcare

Facilities, Rental Services, and Educational

Institutions) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Invacare Corporation, Sunrise Medical, Medline

Industries Inc., Drive DeVilbiss Healthcare, Karman

Healthcare, Graham-Field Health Products Inc., Nova

Medical Products, Permobil, Ottobock, Pride Mobility

Products Corp., Hoveround Corporation, Medline,

Convaquip Industries Inc., GF Health Products Inc.,

and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Bariatric Manual Wheelchair Market size is estimated to have a value of USD 2,021.0 million in 2024 and is expected to reach USD 3,683.3 million by the end of 2033.

The US Bariatric Manual Wheelchair Market is projected to be valued at USD 649.3 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,142.6 million in 2033 at a CAGR of 6.5%.

North America is expected to have the largest market share in the Global Bariatric Manual Wheelchair Market with a share of about 38.2% in 2024.

Some of the major key players in the Global Bariatric Manual Wheelchair Market are Invacare Corporation, Sunrise Medical, Medline Industries Inc., Drive DeVilbiss Healthcare, and many others.

The market is growing at a CAGR of 6.9 percent over the forecasted period.