Market Overview

The

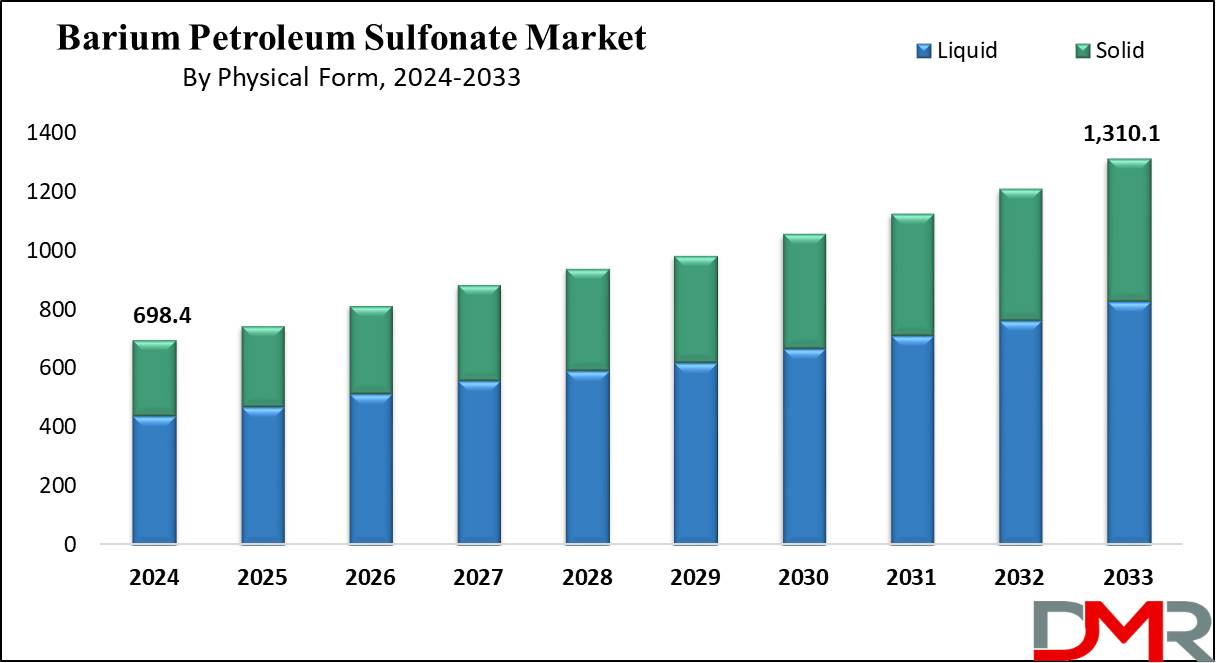

Global Barium Petroleum Sulfonate Market size is expected to reach a

value of USD 698.4 million in 2024, and it is further anticipated to reach a market

value of USD 1,310.1 million by 2033 at a

CAGR of 7.2%.

The barium petroleum sulfonate market is showing great growth due to extensive uses. The main use of this substance, along with its very good properties in rust-inhibiting and lubrication, made it one of the major additives within industries such as automotive, marine, and industrial manufacturing. Major manufacturers such as Xinji Rongchao Petroleum Chemical, Unicorn Petroleum Industries, and Eastern Petroleum are investing huge sums to develop more innovative products to attain more significant market shares.

Certain other vital market trends driving growth in demand for barium petroleum sulfonate products concern rust-prevention coatings, indicative of the growth of industrial activities globally along with the ever-increasing demand for high-performance lubricants. The increased demand from corrosion inhibitors for the oil and gas sector has gone ahead to strengthen the market. In fact, the products are necessary to make equipment survive the severe environmental conditions and to continue working effectively.

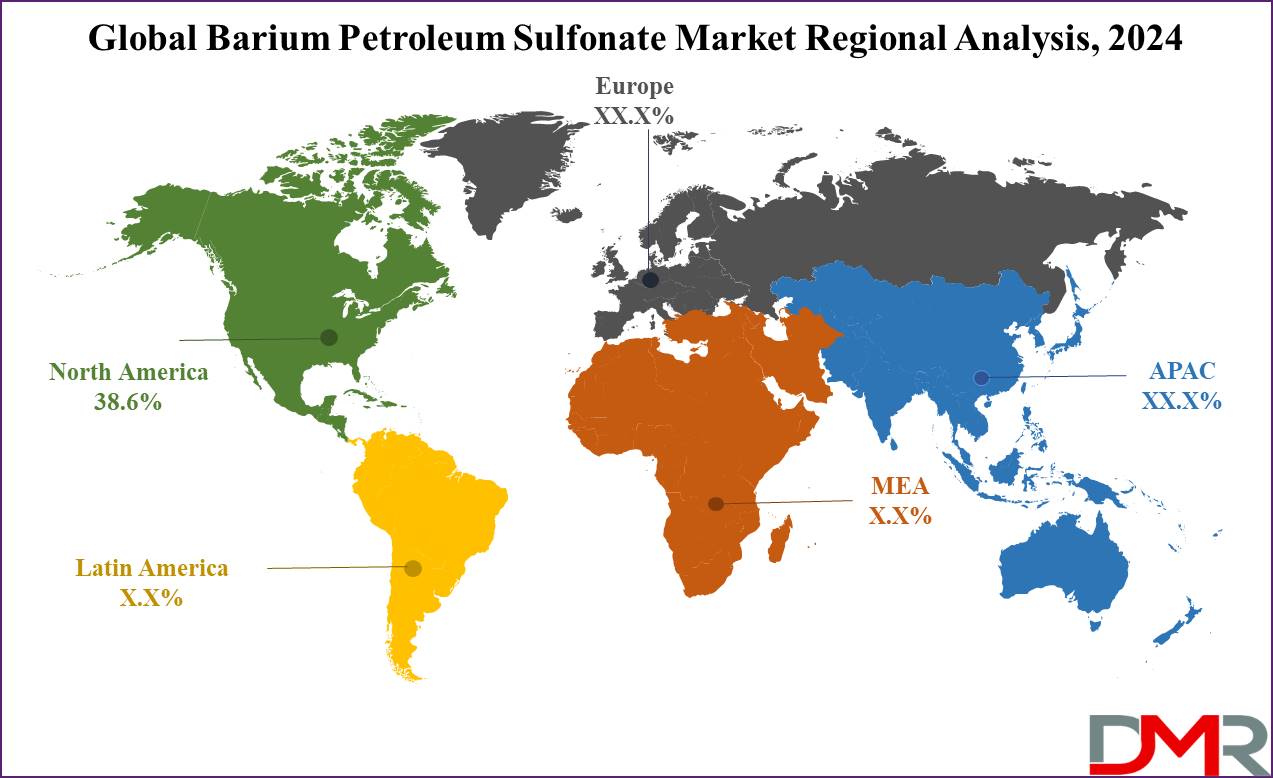

Geographically, the market is dominated by North America owing to geographical proximity to several well-established industrial infrastructures and the strong presence of key market participants. The North American region, along with the oil and gas industry, acts as a potent force in being one of the massive consumers of barium petroleum sulfonate. The increasing manufacturing base and growing automotive sectors will make the Asia-Pacific market lucrative.

However, the growth in this market is hindered by factors like fluctuating prices of raw materials and strict environmental regulations. This trend has led manufacturers to invest in the research and development of environmentally friendly and cost-effective formulations. These, together with strategic partnerships and expansions, will aid in overcoming these challenges, according to the research study.

In other words, the prospects for steady growth in the barium petroleum sulfonate industry look prominent over the forecast period. This may be because of increasing interest in sustainability, emerging technologies, and rising demand from emerging economies; thus, the market holds a bright prospect for players operating in the barium petroleum sulfonate market.

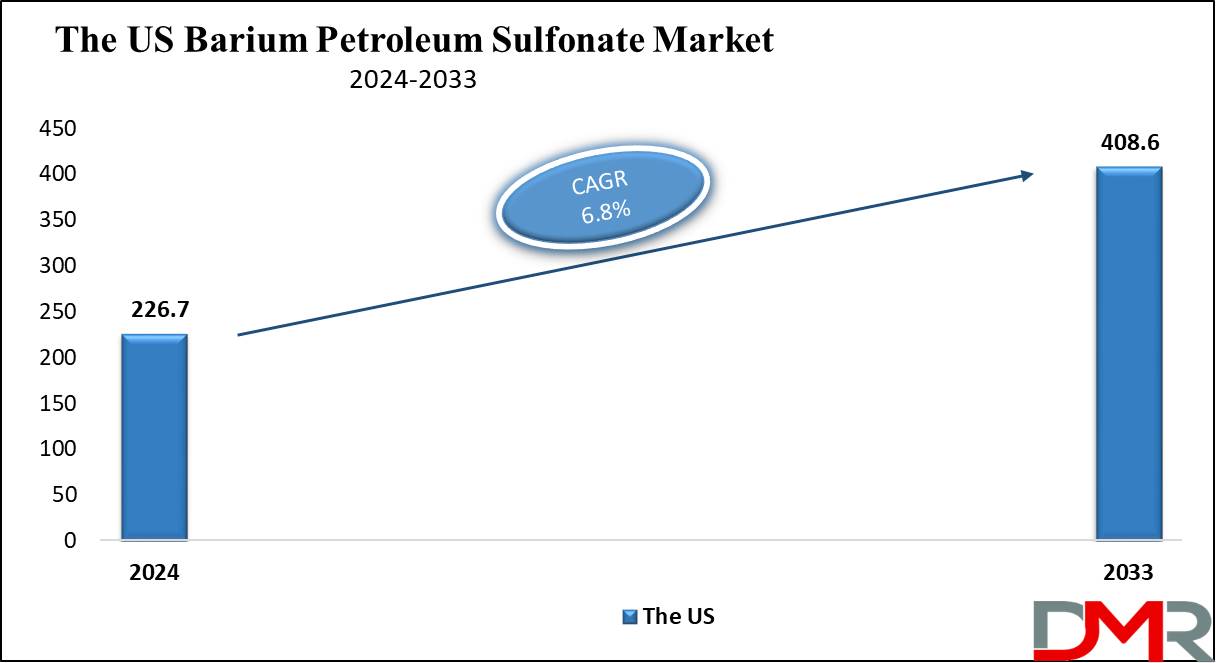

The US Barium Petroleum Sulfonate Market

The US Barium Petroleum Sulfonate Market is projected to be valued at USD 226.7 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 408.6 million in 2033 at a CAGR of 6.8%.

The United States barium petroleum sulfonate market epitomizes the backbone of the global market, on account of its industrial base and growing demand for corrosion inhibitors and high-performance lubricants within the country. The nation, accounting for one of the highest consumptions of industrial lubricants, witnesses continuous progressive developments in petroleum-based additives. The demand is especially high in the automotive, oil and gas, and manufacturing sectors.

Companies on the front lines, such as Eastern Petroleum and Unicorn Petroleum Industries, have introduced environment-friendly formulations in tune with the strict environmental regulations in place. Large market demand from the US oil and gas industry- which has the largest volume of offshore explorations employs barium petroleum sulfonate in great volume as a vital corrosion inhibitor for pipelines and rigs.

Apart from this, growing industrial automation and equipment maintenance is also favoring the growth of the market. Many market research reports have projected a steady growth trajectory for the U.S. barium petroleum sulfonate market with technological advancement and increasing investment in research and development. Innovation is being utilized by leading companies to sustain competition and meet the demands of a wide range of end-users with the advancement of the market.

Barium Petroleum Sulfonate Market: Key Takeaways

- Global Market Value: The Global Barium Petroleum Sulfonate Market size is estimated to have a value of USD 698.4 million in 2024 and is expected to reach USD 1,310.1 million by the end of 2033.

- The US Market Value: The US Barium Petroleum Sulfonate Market is projected to be valued at USD 226.7 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 408.6 million in 2033 at a CAGR of 6.8%.

- Regional Analysis: North America is expected to have the largest market share in the Global Barium Petroleum Sulfonate Market with a share of about 38.6% in 2024.

- By Physical Form Segment Analysis: The liquid segment is projected to command the physical form segment with 63.1% of the market share in 2024

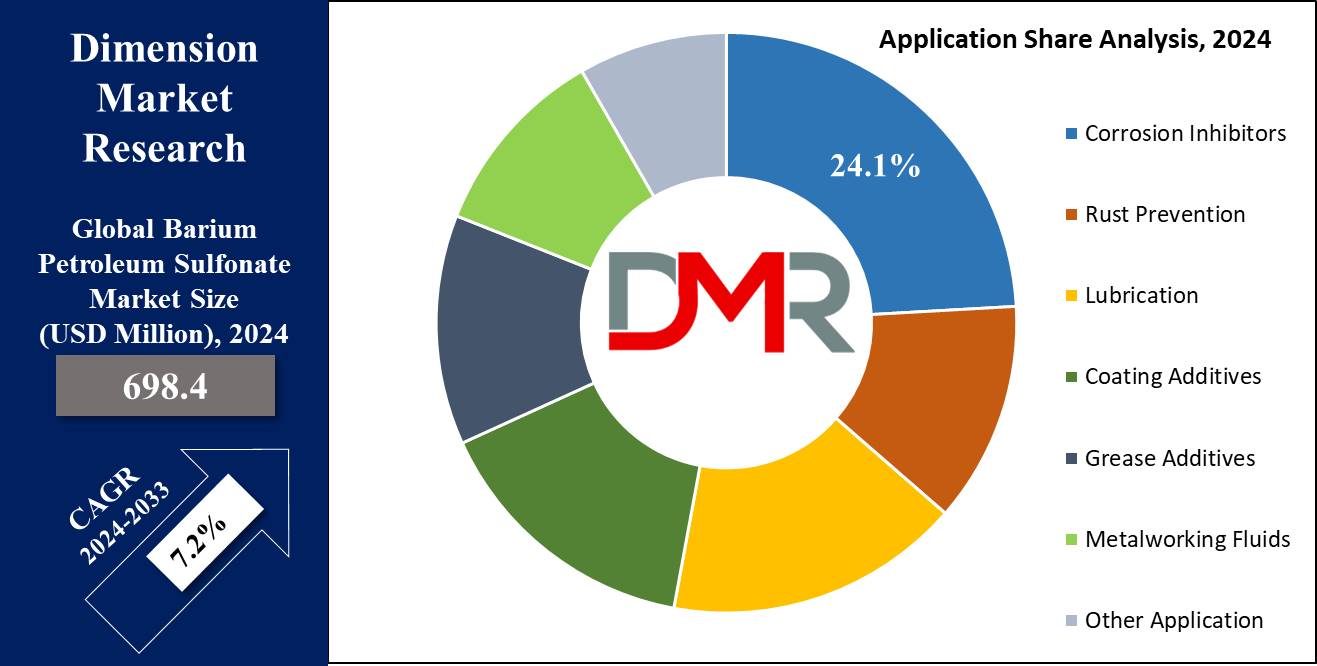

- By Application Segment Analysis: The corrosion inhibitor segment is projected to have 24.1% of the market share in this segment in 2024.

- Key Players: Some of the major key players in the Global Barium Petroleum Sulfonate Market are BASF SE, Eastern Petroleum, Unicorn Petroleum Industries, Xinji Rongchao Petroleum Chemical, Lanxess AG, Sonneborn LLC, Chemtura Corporation, Royal Precision Lubricants, and many others.

- Global Growth Rate: The market is growing at a CAGR of 7.2 percent over the forecasted period.

Barium Petroleum Sulfonate Market: Use Cases

- Rust Prevention: Used for protection in industrial coatings, rust serves to help machinery and structures used marine side, along with equipment, maintain their operating efficiency longer and stay functional even in inclement conditions.

- Lubricant Additives: Enhances lubricants used both in automotive and industrial applications and gives them anti-wear and anti-corrosion properties to last longer.

- Metalworking Fluids: Integral in cutting, drilling, and grinding processes, offering superior lubrication and rust protection.

- Oil and Gas: Pipeline and rig protection against corrosion, hence prolonging the life of such capital-intensive infrastructures under harsh conditions offshore.

Barium Petroleum Sulfonate Market: Dynamic

Trends in the Global Barium Petroleum Sulfonate Market

Rising Adoption of Coatings and LubricantsThe increasing demand for barium petroleum sulfonate products for industrial coatings and lubricants is one of the key trends that has been driving the growth of the market. For its corrosion protection properties, these products have become highly essential in industries such as automotive, oil and gas, and manufacturing. In coatings, additives based on barium petroleum sulfonate ensure a long-lasting protective layer even under extreme environmental conditions. In lubricants, their role in improving engine performance and wear and tear is driving widespread adoption. As industries increasingly focus on durability and efficiency, the demand for barium petroleum sulfonate in these applications is expected to grow steadily.

Eco-Friendly Innovations

Growing concern for the environment and strict regulatory standards make manufacturers adapt to sustainable solutions. Key players are highly investing in the development of eco-friendly and regulatory-compliant formulations development, including biodegradable and nontoxic barium petroleum sulfonate derivatives. Recent development has been directed at a balance between performance and environmental sustainability to make industrial processes greener across the world. Companies are also focused on the production of products that follow regulations laid down by REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and guidelines laid down by the EPA, positioning themselves as responsible market leaders.

Growth Drivers in the Global Barium Petroleum Sulfonate Market

Industrial Growth in Emerging Economies

Increasing industrialization in Asia-Pacific and Latin America fuels the demand for rust prevention and lubrication solutions. Increasing manufacturing activities, infrastructure projects, and industrial automation have surged the demand for high-performance corrosion inhibitors and lubricants. Therefore, massive growth in sectors such as automotive, construction, and heavy machinery industries of countries like China and India creates a lucrative opportunity for barium petroleum sulfonate manufacturers.

Growth in the Oil and Gas Sector

Robust growth in the oil and gas industry, especially in offshore explorations and drilling, serves as a key driver for barium petroleum sulfonate markets. These products are necessary for protecting pipelines, rigs, and storage tanks from corrosion brought about by harsh environmental conditions such as seawater exposure. It can, therefore, be expected that with rising energy demand, especially in emerging nations, the demand for such inhibitors will increase and, therefore, drive the market even more.

Growth Opportunities in the Global Barium Petroleum Sulfonate Market

Technological Advancements

High-performance lubricants and coatings open very great avenues of growth for the manufacturers. Recent developments in nanotechnology and chemical engineering have come up with specific formulations that offer great thermal stability, improved corrosion resistance, and eco-friendliness. These specialized products may be required to serve applications in high temperatures in automotive engines or marine appliances. Those companies that have invested in developing such technologies can win niche markets in this regard to meet the dynamic demands of customers.

Expanding Automotive Sector

The ever-expanding automobile industry in the world offers a very encouraging view towards the future of the barium petroleum sulfonate market. Increasing sophistication in motor vehicles calls for high-value lubricity additives that raise efficiency, lower friction in engines, and prolong the life of motor parts. Furthermore, the new emerging demand for electric motor- and gear-compatible lubricant solutions is stirring the market for electric vehicles.

Restraints in the Global Barium Petroleum Sulfonate Market

Environmental Regulations

The stern regulatory framework associated with petroleum-based additives acts as a growth inhibitor in the barium petroleum sulfonate market. REACH legislation in Europe and the EPA in the United States have enacted various directives that force manufacturers to limit the use of hazardous materials in their products. This compliance usually entails huge research and development expenses, thereby adding to the economic burden on the manufacturers. Besides this, non-compliance attracts penalties, restrictions to market access, and loss of reputation, which further hampers the growth of the market.

Raw Material Price Volatility

Fluctuating prices for certain raw materials, such as various derivatives of crude oil, are a key factor leading to a change in the per-unit production cost of barium petroleum sulfonate. Such price turbulence, induced by geopolitical conditions, supply chain disruptions due to accidents or natural disturbances, and altered demand cycles, is a major dragging factor.

The manufacturer resells at a price inclusive of profit margins but enough to keep the product fairly priced in the market while remaining competitive. Additionally, the price volatility might prevent investments, especially in long projects for industrial sectors where procurement is cost-sensitive. This issue requires better cost management and supply chain strategies, which may be difficult for smaller players in the market to address.

Research Scope and Analysis

By Physical Form Analysis

The liquid segment is projected to dominate the global barium petroleum sulfonate market in the context of physical form with 63.1% of the market share in 2024 due to its superior versatility, ease of application, and compatibility across diverse industrial processes. Liquid formulations containing barium petroleum sulfonate find extensive applications in metalworking fluids, lubricants, and corrosion inhibitors, wherein seamless blending and uniform distribution are critical.

This is attributed to a few reasons: high solubility and stability in liquid form provide excellent performance under harsh operational conditions. In fact, liquid barium petroleum sulfonate finds its application globally in large quantities to protect against corrosion in rigs and pipelines due to its properties of coating surfaces uniformly in the absence of any additional solvent.

Besides that, the liquid form allows flexibility in concentration adjustments, whereby manufacturers can make solutions for specific industrial needs. This adaptability has driven its adoption in sectors like automotive, where high-performance lubricants with anti-corrosion properties are crucial for engine efficiency and longevity. Manufacturers also prefer liquid formulations for their ease of transportation and storage, reducing logistical challenges compared to solid or powdered alternatives. Apart from this, the rising demand for performance additives in growing regions such as the Asia-Pacific will add to segment dominance.

This increasing emphasis on sustainable practices has also driven innovations related to eco-friendly liquid formulations to meet environmental regulations without compromising the performance that industries require. For this reason, the liquid segment is expected to continue holding the leading position during the forecast period.

By Grade Analysis

The industrial grade segment is anticipated to dominate the barium petroleum sulfonate market due to its wide application across critical industries such as oil and gas, automotive, and manufacturing. Industrial-grade barium petroleum sulfonate is known for its high-performance characteristics, which ensure superior rust prevention, lubrication, and corrosion resistance in demanding environments.

One of the major reasons for its dominance in these industries is that it resists extreme operating conditions. For instance, industrial barium petroleum sulfonate is very essential in the protection of pipelines, rigs, and machinery from severe environmental factors in both the oil and gas industries. With its great thermal stability and excellent protection qualities, it ensures a long life for these critical infrastructures and reduces maintenance costs.

In return, it gives a multiplier effect since industrial-grade formulations in automotive are used in engine oil and lubricants to extend operational efficiency and elongate the lifespan of an automobile, especially high-performance cars. Besides that, strong rust-prevention attributes have become an important reason why barium petroleum sulfonate in industrial grade is greatly dependent on the manufacturing sectors, especially in maintaining machinery and equipment within a production facility.

It involves continuous innovation from the side of the manufacturer within this grade, mainly to address various stringent regulatory standards being evolved with every passing day with an emphasis on improved environmental sustainability. Increasing industrial automation and demand for maintenance-free operations across emerging economies act as triggers for the added propagation of such industrial-grade formulation. The industrial grade, with its unparalleled performance and versatility, is likely to continue holding the leading position on the back of expanding industrial activities across the world.

By Application Analysis

The corrosion inhibitor segment is projected to have 24.1% of the market share of the global barium petroleum sulfonate market in 2024. This is because it serves a very broad spectrum, from general protection against the surrounding atmosphere to specialized protection under high humidity, saline exposure, or chemical interaction propensity. In the oil and gas industry, for instance, corrosion inhibitors formulated with barium petroleum sulfonate find wide applications in the protection of pipelines, drilling rigs, and other infrastructures from corrosion. These inhibitors contribute to operational efficiency, prevention of costly repairs, and an extended lifespan of equipment. Their effectiveness in forming a protective barrier on metal surfaces has made them a preferred choice in this sector.

The demand for the industrial manufacturing sector completes, as it uses corrosion inhibitors to protect machinery, tools, and metal components during and in storage. Another large scope of application is in automobile industries to prevent rusting in vehicles, especially under miserable weather conditions. The versatility of barium petroleum sulfonate-based inhibitors lies in their field of application, which ranges from water-based to oil-based systems, thus enlarging their scope of application.

Innovations in environmentally friendly or biodegradable formulations are continuously being made to make their application even more advantageous; this is in full accordance with the global trend toward greening industrial production processes. Since corrosion inhibitors play a very important role in ensuring durability and reduction of maintenance costs, the segment will continue to dominate the market during the forecast period.

By End Use Analysis

The oil and gas industry currently represents the dominant segment within the barium petroleum sulfonate market, since this industry is highly dependent on reliable corrosion protection solutions. These industries are among the most aggressive in operation, with continuous attacks from moisture, salinity, and high-pressure conditions on equipment and infrastructure. Among other uses, barium petroleum sulfonate is especially important in the protection of pipelines, storage tanks, and drilling rigs against corrosion.

Its superior rust prevention and lubrication properties translate into continued operations and minimize downtime-a very crucial component in the profitability of the capital-intensive industry. It is for this reason that barium petroleum sulfonate-based coatings find themselves applied onto offshore platforms where long-term protection against seawater-induced corrosion can hardly be achieved using other forms of coatings.

The main drivers for the segment include the growth in shale gas exploration in North America and an increase in offshore drilling activities globally. The growth of the oil and gas industry, with the increase in energy demand, further fuels the adoption of barium petroleum sulfonate products.

Apart from that, the products play a crucial role in enhancing the efficiency of the equipment by reducing maintenance costs and extending the lives of operations. The development related to green and high-performance formulations is also supporting its application in this industry. Thus, dominance in the barium petroleum sulfonate market by the oil and gas industry is expected to continue in the upcoming years, with the industry continuing to witness growth, especially in emerging economies.

The Barium Petroleum Sulfonate Market Report is segmented on the basis of the following

By Physical Form

By Grade

- Industrial Grade

- Food Grade

By Application

- Corrosion Inhibitors

- Rust Prevention

- Lubrication

- Coating Additives

- Grease Additives

- Metalworking Fluids

- Other Application

By End Use

- Oil and Gas

- Automotive

- Marine

- Industrial Manufacturing

- Aerospace

- Construction

Regional Analysis

North America is projected to dominate the global barium petroleum sulfonate market as it will command

38.6% of the market share by the end of 2024. North America is the leading region in the global barium petroleum sulfonate market due to its well-established industrial infrastructure, strong oil and gas industry, and developed automotive manufacturing sector. The significant investment in industrial activities in the region has driven demand for rust-prevention and lubrication solutions, making it a major consumer of barium petroleum sulfonate products.

The oil and gas sector of North America, especially the United States, is at the helm of this dominance. Its extreme exploration and production, not forgetting shale gas extraction, therefore has considerable demand for corrosion inhibitors and coatings of protection within the region. The solutions based on barium petroleum sulfonate are key to pipeline, storage tank, and drilling equipment protection against hostile conditions developed during these operations.

The fact is, North America is home to various high-performance automotive industries that depend greatly on barium petroleum sulfonate as an additive for engine oils and lubricants; these are added to extend the shelf-life of the engine and put them to work appropriately to achieve long-lasting results demanded by the manufacturing and consuming sides. These include Eastern Petroleum among other major leading market players within the region to further boost its dominant position.

These companies are strongly focusing on innovating the development of a sustainable and regulatory-compliance formulation to meet high environmental standards in North America. Infrastructure growth and developing industrial automation in the region would keep the barium petroleum sulfonate market dominant during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global barium petroleum sulfonate market presents with established participants combined with budding company accounts. Key participants that take the lead in the Industry include companies such as BASF SE, ExxonMobil, and Lanxess AG. Since these firms can offer vast portfolios of products, expanded distribution networks combined with intensive research and development facilities enables these firms to maintain over other firms since the barium petroleum sulfonates also go under a severe research and Development procedure. This growth in demand for barium petroleum sulfonate from oil and gas, automotive, and marine sectors has been possible because large-scale production and advanced manufacturing technologies are able to fulfill the demands of such companies.

Smaller companies are also gaining momentum, including Eastern Petroleum, Unicorn Petroleum Industries, and Xinji Rongchao Petroleum Chemical, by offering specialized products for niche applications such as rust prevention and lubrication. These usually focus on offering innovative, cost-effective, and sustainable solutions to enable them to compete with bigger players.

The recent agreement between Xinji Rongchao Petroleum Chemical and a European manufacturer of lubricants underlines the growing focus on product portfolio expansion and market penetration. Companies such as Sonneborn LLC and Chemtura Corporation are scaling up R&D to produce eco-friendly and high-performance formulations that meet the industry's emphasis on sustainability.

It is further fragmented by regional players like Wuxi Qilian Petrochemical and Ganesh Benzoplast Limited, promoting localized productions to be able to offer a better competitive price and, overall, improving the market requirement for Asia-Pacific and Latin America.

Some of the prominent players in the Global Barium Petroleum Sulfonate Market are

- BASF SE

- Eastern Petroleum

- Unicorn Petroleum Industries

- Xinji Rongchao Petroleum Chemical

- Lanxess AG

- Sonneborn LLC

- Chemtura Corporation

- ExxonMobil

- Royal Precision Lubricants

- MORESCO Corporation

- Wuxi Qilian Petrochemical

- Ganesh Benzoplast Limited

- Lockhart Chemical Company

- Other Key Players

Recent Developments

- December 2024: Eastern Petroleum introduced a new eco-friendly rust inhibitor designed specifically for the marine sector, addressing corrosion challenges posed by harsh seawater environments.

- November 2024: Unicorn Petroleum Industries expanded its production facility in India, significantly increasing its manufacturing capacity to meet the rising demand for barium petroleum sulfonate products in the Asia-Pacific region.

- October 2024: Xinji Rongchao Petroleum Chemical announced a strategic partnership with a European lubricant manufacturer. This collaboration aims to enhance its product portfolio by incorporating advanced lubricant technologies tailored to meet European Union regulations, opening avenues for growth in the global lubricant market.

- August 2024: Lanxess AG unveiled a next-generation corrosion inhibitor, focusing on high-temperature industrial applications. The product is designed to withstand extreme conditions in sectors such as oil and gas.

- July 2024: Sonneborn LLC increased its R&D budget by 25% to develop specialized formulations of barium petroleum sulfonate products, targeting niche markets such as aerospace and renewable energy sectors. This investment underscores its focus on innovation-driven growth.

- June 2024: Royal Precision Lubricants expanded its distribution network in North America, aiming to enhance market accessibility for its high-performance rust inhibitors and lubricants, responding to increasing regional demand in automotive and industrial sectors.

- May 2024: Chemtura Corporation introduced an advanced testing facility in Europe, equipped to validate the performance of corrosion inhibitors under extreme conditions, ensuring product reliability and meeting evolving customer requirements.

- April 2024: A Japanese chemical company launched a customized additive line catering to specific industrial needs in construction equipment and marine vessels, leveraging its expertise in developing tailored chemical solutions.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 698.4 Mn |

| Forecast Value (2033) |

USD 1,310.1 Mn |

| CAGR (2024-2033) |

7.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 226.7 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Physical Form (Liquid, Solid), By Grade (Industrial Grade, Food Grade), By Application (Corrosion Inhibitors, Rust Prevention, Lubrication, Coating Additives, Grease Additives, Metalworking Fluids, Other Applications), By End Use (Oil and Gas, Automotive, Marine, Industrial Manufacturing, Aerospace, Construction) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BASF SE, Eastern Petroleum, Unicorn Petroleum Industries, Xinji Rongchao Petroleum Chemical, Lanxess AG, Sonneborn LLC, Chemtura Corporation, ExxonMobil, Royal Precision Lubricants, MORESCO Corporation, Wuxi Qilian Petrochemical, Ganesh Benzoplast Limited, Lockhart Chemical Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Barium Petroleum Sulfonate Market size is estimated to have a value of USD 698.4 million in 2024 and is expected to reach USD 1,310.1 million by the end of 2033.

The US Barium Petroleum Sulfonate Market is projected to be valued at USD 226.7 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 408.6 million in 2033 at a CAGR of 6.8%.

North America is expected to have the largest market share in the Global Barium Petroleum Sulfonate Market with a share of about 38.6% in 2024.

Some of the major key players in the Global Barium Petroleum Sulfonate Market are BASF SE, Eastern Petroleum, Unicorn Petroleum Industries, Xinji Rongchao Petroleum Chemical, Lanxess AG, Sonneborn LLC, Chemtura Corporation, ExxonMobil, Royal Precision Lubricants, and many others.

The market is growing at a CAGR of 7.2 percent over the forecasted period.