Market Overview

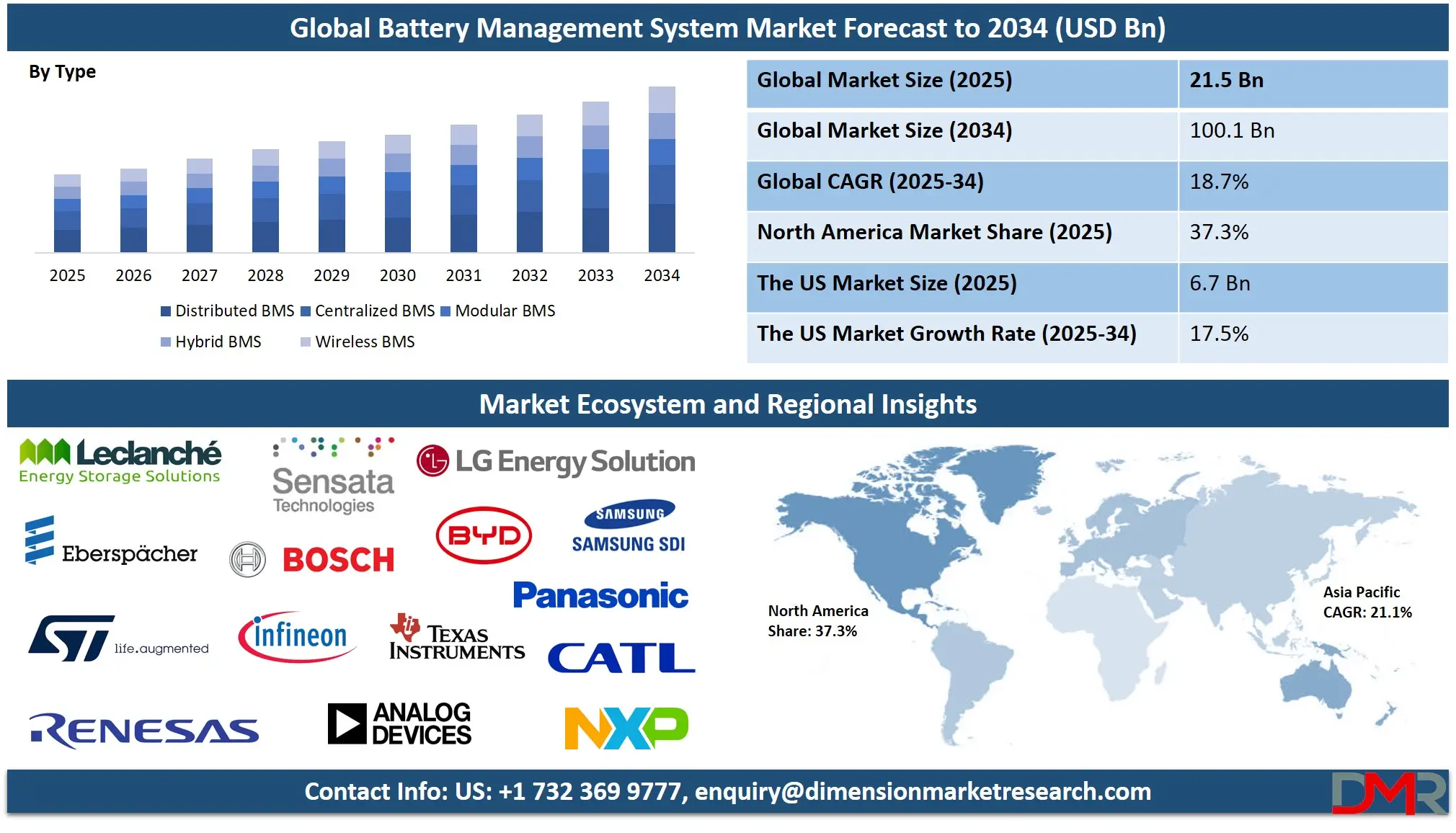

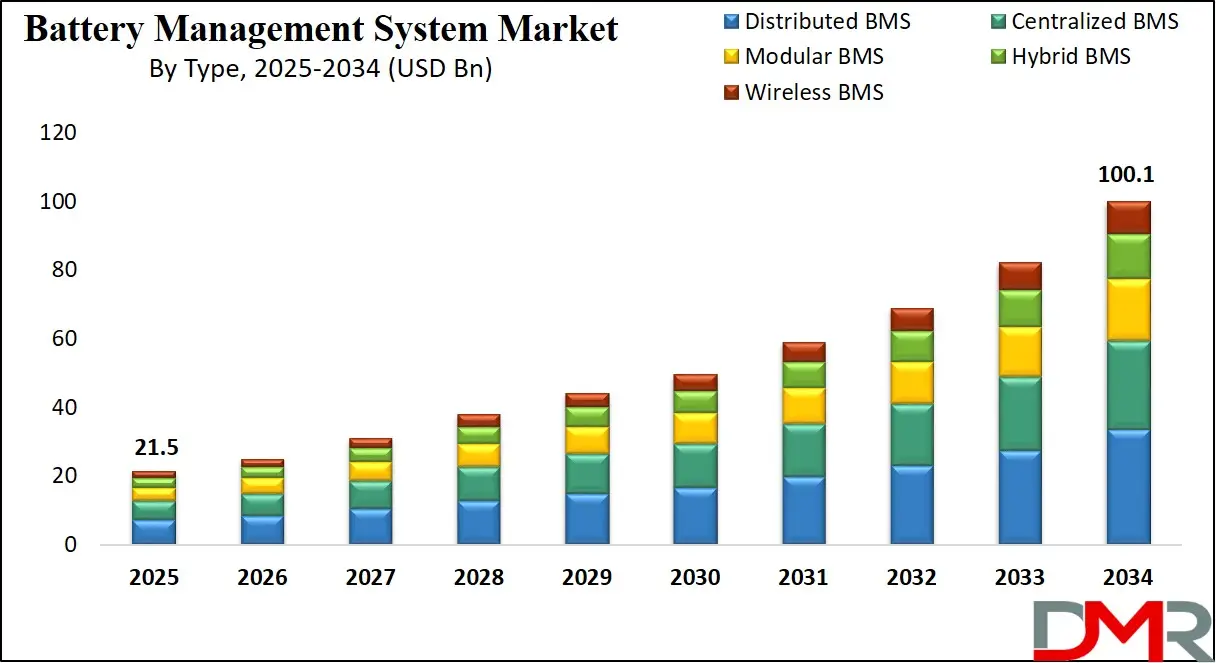

The Global Battery Management Systems (BMS) Market is projected to reach USD 21.5 billion in 2025 and is expected to grow at a CAGR of 18.7% from 2025 to 2034, attaining a value of USD 100.1 billion by 2034. The market’s rapid expansion is driven by accelerating adoption of electric vehicles (EVs), rising deployment of renewable energy storage systems, and the global shift toward electrification and advanced battery safety.

Battery Management System are critical electronic architectures that monitor, protect, balance, and optimize battery packs used in EVs, grid-scale storage, portable electronics, industrial equipment, and renewable-powered microgrids. These systems ensure cell-level safety, extend battery lifespan, improve charging efficiency, and prevent hazards such as overcharging, deep discharging, short circuits, and thermal runaway. The rising demand for lithium-ion battery technologies and the growing deployment of solid-state, LFP, and NMC chemistries, are significantly accelerating BMS utilization across industries.

Technological advancements, including AI-driven battery analytics, cloud-connected BMS platforms, embedded state-of-health (SOH) and state-of-charge (SOC) algorithms, wireless BMS architectures, and real-time thermal modeling, are transforming the market into a highly scalable and digitally integrated ecosystem. Integration of machine learning for degradation forecasting, anomaly detection, charging optimization, and predictive maintenance is reshaping energy-storage management accuracy.

Growing government initiatives promoting EV adoption, renewable energy integration, and grid modernization, combined with national policies surrounding battery safety and recycling, further accelerate global BMS adoption. However, challenges such as high implementation costs, battery pack complexity, interoperability issues, and evolving regulatory frameworks remain. Despite these limitations, the convergence of electrification, energy digitalization, and high-performance battery innovation positions BMS as a core enabler of the global clean-energy transformation through 2034.

The US Battery Management System Market

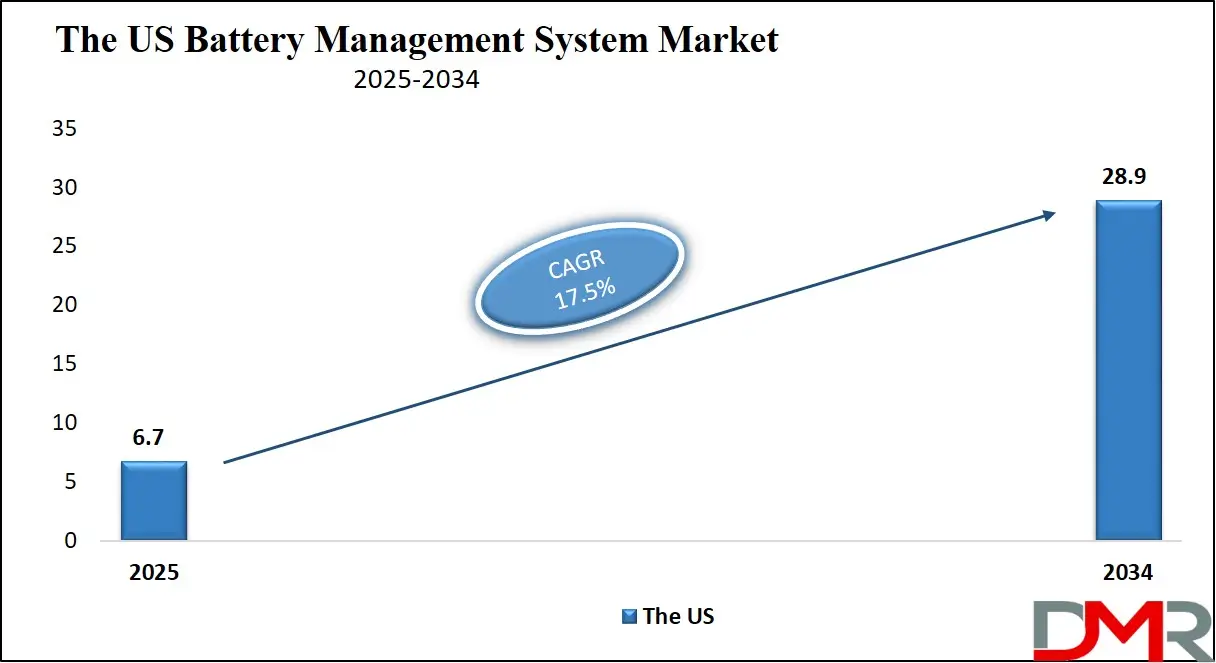

The U.S. Battery Management System (BMS) Market is projected to reach USD 6.7 billion in 2025 and grow at a CAGR of 17.5%, reaching USD 28.9 billion by 2034. The United States leads global adoption due to its rapidly expanding electric vehicle ecosystem, large-scale deployment of grid storage solutions, and widespread integration of smart energy infrastructures across residential, industrial, and utility environments.

More than 3.2 million EVs are already on U.S. roads, supporting immense demand for high-performance BMS solutions for battery-electric vehicles (BEVs), plug-in hybrids (PHEVs), and commercial electric fleets. Federal programs such as the IRA (Inflation Reduction Act), BIL (Bipartisan Infrastructure Law), and DOE battery initiatives are driving domestic manufacturing of advanced Li-ion and solid-state batteries each requiring sophisticated BMS for longevity, safety, and charging-control optimization.

Major automotive manufacturers such as Tesla, General Motors (Ultium), Ford, Rivian, and Stellantis have deployed cutting-edge BMS architectures integrating wireless communication, cell-level sensing, AI-enabled charge prediction, and thermal risk modeling. The U.S. also leads in battery data analytics, with cloud platforms enabling remote monitoring and predictive maintenance for EV fleets, stationary storage systems, and distributed energy resources (DERs).

U.S. utilities are aggressively adopting BMS-enabled grid-scale storage, including lithium-ion, LFP, flow-battery, and hybrid storage systems, to stabilize grids with high solar and wind penetration. Large energy-storage integrators such as Fluence, Tesla Energy, NextEra, and AES are incorporating advanced BMS algorithms for charge/discharge control, degradation forecasting, and safety assurance.

Battery safety regulations in the U.S. are evolving rapidly, driven by standards from UL, IEEE, SAE, NFPA, and DOT, pushing BMS upgrades for improved thermal propagation control and high-voltage system protection. Combined with a mature digital ecosystem, strong OEM presence, robust research infrastructure, and federal-level electrification incentives, the United States remains a global powerhouse in BMS innovation and deployment.

The Europe Battery Management System Market

The Europe Battery Management System (BMS) Market is projected to be valued at approximately USD 3,020 million in 2025 and is expected to reach around USD 12,720 million by 2034, growing at a CAGR of about 17.5% from 2025 to 2034. Europe’s leadership is anchored by strong environmental regulations, aggressive decarbonization goals, and major government-backed investments supporting EV proliferation, battery manufacturing, and renewable energy storage integration.

Countries such as Germany, France, the U.K., Norway, the Netherlands, Italy, and the Nordic region are among the fastest adopters of electric mobility, creating massive demand for advanced BMS platforms in passenger EVs, electric buses, heavy-duty trucks, and e-mobility solutions. The European Green Deal, the Fit for 55 Package, and the EU Battery Regulation mandate improved battery traceability, safety, recyclability, and performance monitoring all of which push automotive OEMs toward more sophisticated BMS architectures.

Europe hosts some of the world’s largest battery giga-factory expansions led by Northvolt, CATL Europe, ACC (Automotive Cells Company), LG Energy Solution, and Samsung SDI, accelerating demand for cell-level and module-level BMS integration across multiple chemistries including NMC, LFP, LCO, solid-state, and sodium-ion batteries.

The region is aggressively deploying utility-scale energy storage to support grid stability during the transition to renewables. Countries such as the U.K., Germany, and Spain are deploying multi-megawatt battery storage systems using advanced BMS for real-time monitoring, thermal risk mitigation, and charge optimization to support wind and solar variability. The strong emphasis on hydrogen–battery hybrid energy systems, microgrids, and distributed energy storage further accelerates BMS demand.

Europe’s public transportation ecosystem also drives growth, with widespread electrification of rail systems, commercial fleets, ferries, delivery vans, and public buses, each requiring robust BMS layers for cell balancing, voltage monitoring, thermal control, and functional safety compliant with ISO 26262.

The EU’s funding programs including Horizon Europe, IPCEI on Batteries, EIB lending, and national-level clean mobility subsidies accelerate advancements in AI-powered BMS, digital twin modeling, predictive battery analytics, and wireless BMS innovations. With strong regulatory governance, mature EV infrastructure, and rapid investment in localized battery production, Europe remains one of the most technologically advanced and rapidly scaling regions in the global BMS market.

The Japan Battery Management System Market

The Japan Battery Management System (BMS) Market is anticipated to be valued at approximately USD 560 million in 2025 and is expected to attain nearly USD 2,910 million by 2034, expanding at a CAGR of about 20.0% during the forecast period. Japan’s advanced automotive industry, strong position in battery materials and precision electronics, and national emphasis on electrification and energy resilience drive elevated demand for sophisticated BMS solutions.

Japan’s Ministry of Economy, Trade and Industry (METI) and national policy frameworks actively support battery innovation, safety standardization, and domestic cell manufacturing through subsidies, R&D grants, and industrial partnerships. These policies enable remote battery diagnostics, AI-based SOH forecasting, and in-vehicle BMS upgrades particularly for hybrid electric vehicles (HEVs), plug-in hybrids (PHEVs), and next-generation BEVs.

Japan’s leadership in precision manufacturing, power electronics, and robotics accelerates innovation in cell-level sensing, thermal propagation control, and redundant safety layers within BMS designs. Established technology and automotive groups including Panasonic, Toyota, Denso, Hitachi Energy, Toshiba, and NEC are integrating IoT-enabled BMS modules with cloud analytics, vehicle-to-grid (V2G) communication stacks, and battery recycling traceability features.

Japan’s concept of “Connected Energy Ecosystems”, driven by consortiums and major industrial players, integrates BMS-equipped EVs, home energy storage systems, and utility-scale microgrids into unified platforms. Urban centers such as Tokyo and Osaka pilot vehicle-to-home (V2H) and community-scale storage projects where BMS-led energy orchestration enables peak shaving, emergency backup, and frequency regulation services. Meanwhile, rural prefectures leverage BMS-equipped stationary storage to stabilize distributed renewable generation and support island microgrids.

Cultural emphasis on quality, safety, and long-term reliability combined with Japan’s strengths in battery materials (anode/cathode technologies), power semiconductors, and systems engineering positions the country as a high-growth innovator in Battery Management System. Japan is likely to remain a testbed for advanced thermal management, wireless balancing, and standards-driven BMS platforms throughout the 2025–2034 forecast period.

Global Battery Management System Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Battery Management System Market is expected to be valued at USD 21.5 billion in 2025 and is projected to reach USD 100.1 billion by 2034, showcasing rapid expansion supported by accelerating EV adoption, large-scale renewable energy storage deployments, and electrification across industrial and consumer segments.

- High CAGR Driven by Electrification and Energy Storage: The market is expected to grow at an impressive CAGR of 18.7% from 2025 to 2034, fueled by rising demand for advanced BMS functions including cell balancing, state-of-health (SOH) prediction, thermal management, and fleet-level telematics together with integration of AI-enabled battery analytics and cloud-connected diagnostics.

- Strong Growth Trajectory in the United States: The U.S. Battery Management System Market is projected to stands at USD 6.7 billion in 2025 and is projected to reach USD 28.9 billion by 2034, expanding at a CAGR of 17.5% due to federal electrification incentives, domestic battery manufacturing expansion, and deep integration of BMS into EV and utility-scale storage deployments.

- North America Maintains Regional Dominance: North America is expected to capture approximately 37.3% of the global market share in 2025, supported by advanced vehicle electrification programs, strong grid modernization initiatives, high digital maturity in EV telematics.

- Growing Demand from EVs and Renewable Integration: Rising global vehicle electrification, expansion of heavy-duty and commercial electric fleets, and the accelerating deployment of grid-scale and behind-the-meter storage for renewable smoothing and peak shaving are driving sustained demand for sophisticated BMS solutions that combine safety, performance, and interoperability.

Global Battery Management System Market: Use Cases

- Electric Vehicle Battery Monitoring & Safety: Battery Management System continuously monitor EV battery packs by tracking cell voltages, temperatures, current flow, and state-of-charge. BMS algorithms prevent overcharging, deep discharging, and thermal runaway, ensuring vehicle safety and optimal range performance.

- Grid-Scale Energy Storage Systems: Utility-scale lithium-ion and hybrid storage systems rely on BMS platforms to regulate charge/discharge cycles, manage thermal conditions, and secure system stability during renewable energy integration. The BMS enables peak shaving, frequency regulation, load balancing, and voltage support in renewable-rich grids.

- Industrial & Commercial Backup Power: Industrial UPS systems, telecom towers, data centers, hospitals, and manufacturing plants employ BMS solutions to ensure reliable backup power. BMS platforms protect battery banks from degradation, monitor redundancy levels, and deliver real-time health diagnostics essential for mission-critical applications.

- Residential Energy Storage & Smart Homes: Home battery systems integrated with rooftop solar, energy management platforms, and smart-home ecosystems rely on modern BMS modules for safe daily cycling, thermal control, and charge optimization. These BMS units support time-of-use energy arbitrage, emergency backup, and self-consumption enhancement.

- Heavy-Duty & Commercial Electric Fleets: Electric buses, trucks, delivery vans, forklifts, and mining vehicles require robust BMS systems capable of handling high load demands, long duty cycles, and extreme operating conditions. Fleet-oriented BMS units integrate telematics, GPS, and predictive health analytics to optimize charging schedules, reduce downtime, and enhance operational efficiency across large-scale electric mobility fleets.

Global Battery Management System Market: Stats & Facts

International Energy Agency (IEA)

- In the IEA’s STEPS scenario, global battery-electric vehicle (BEV) sales reach almost 45 million units by 2030.

- In the IEA STEPS, EV sales rise from ~14 million (2023) to ~65 million by 2035 in a later scenario.

- About 90% of lithium-ion batteries are used in the transport sector (IEA observation on sectoral use).

- The IEA warns energy-storage deployment must expand roughly six-fold by 2030 to support accelerated renewables deployment.

- The IEA reports sodium-ion batteries will remain a small (<10%) share for EVs to 2030, but a growing share in stationary storage.

- The IEA projects substantial near-term falls in capital costs for battery storage (IEA signals up to ~40% further cost declines for storage capital costs by 2030).

International Renewable Energy Agency (IRENA)

- IRENA reports battery storage project costs fell ~89% between 2010 and 2023 (installed project cost basis).

- Global annual battery capacity additions rose from ~0.1 GWh (2010) to ~95.9 GWh (2023) (IRENA deployment data).

- IRENA notes that battery storage costs continued steep declines into 2024 reporting very large cumulative reductions (agency summary of 2010–2024 trend).

- IRENA documents that cost declines and scale drove LFP chemistry to become dominant in many stationary storage procurements by the early 2020s.

U.S. National Renewable Energy Laboratory (NREL)

- NREL’s “100% Clean Electricity by 2035” analysis shows diurnal storage (2–12 h) deployments of ~120–350 GW by 2035 across scenarios.

- NREL’s Storage Futures work models large roles for batteries in a low-carbon grid through 2050, including multi-hour applications.

- NREL’s 2024 ATB updates provide modeled cost/performance baselines for 2–10 hour utility-scale lithium-ion systems, showing rapid cost improvement.

- NREL’s cost projection reports (2023–2025 work) are used by US planners to estimate declining utility-scale battery LCOE and capacity value across regions.

- NREL data underpin scenario modelling that shows battery durations, sizing, and round-trip efficiency materially change dispatch value for grid services.

U.S. Department of Energy (DOE)

- DOE analyses identify energy storage and battery supply-chain resilience as critical for grid reliability and national electrification goals.

- DOE’s supply-chain work documents that stationary and vehicle battery manufacturing, materials processing, and BMS/controls are strategic elements for U.S. energy security.

- DOE publications emphasise that BMS functions (thermal management, cell balancing, diagnostics) are central to safety and longevity at grid and vehicle scale.

European Commission / EU institutions

- The European Commission states global battery demand is set to increase ~14× by 2030, with the EU potentially accounting for ~17% of that demand.

- The EU’s new Batteries Regulation (Regulation (EU) 2023/1542) entered into the EU legal framework and sets lifecycle obligations for batteries (traceability, sustainability, waste rules).

- EU policy documents set strict recycling and collection ambitions and establish compliance, labelling, and information obligations for placed-on-market batteries.

- The EU’s battery policy explicitly aims to increase circularity, including minimum recycled content obligations and extended producer responsibilities.

UNECE / WP.29 (World Forum for Harmonization of Vehicle Regulations)

- WP.29 (UNECE) develops harmonised regulations for EVs that include battery safety performance, testing, and requirements for information display (e.g., battery health/read-outs).

- UNECE workstreams explicitly require technical requirements and performance criteria for electrified vehicle batteries and for on-board data relevant to battery condition.

Global Battery Management System Market: Market Dynamic

Driving Factors in the Global Battery Management System Market

Rising Electrification and EV Adoption

The accelerating shift to electric mobility across passenger cars, commercial vehicles, buses, and two-/three-wheelers is the single largest growth driver for BMS. Governments and OEMs worldwide are committing to aggressive EV targets and fleet electrification programs, creating exponential demand for safer, more efficient battery packs. BMS provides essential functions cell balancing, state-of-charge (SOC) and state-of-health (SOH) estimation, fault detection, and thermal management that ensure pack reliability, enable fast charging, and meet vehicle safety standards. As battery pack capacities and pack voltages scale upward, OEMs require advanced BMS intelligence to maximize usable energy, reduce cell-to-cell variation, and minimize performance loss over life. In commercial fleets and shared mobility, fleet operators increasingly depend on fleet-level BMS telematics to schedule charging, predict maintenance, and optimize operations, magnifying BMS value beyond safety into total-cost-of-ownership (TCO) reductions.

Integration with Renewable Energy & Grid Modernization

Rapid growth in utility-scale and behind-the-meter energy storage to accommodate solar and wind variability drives widespread BMS adoption. Utilities and project developers require BMS solutions that can coordinate large arrays of battery modules, manage complex charge/discharge profiles, and deliver services such as frequency regulation, capacity firming, and peak shaving. BMS platforms also enable safe second-life use of EV batteries in stationary applications by accurately tracking SOH and reconfiguring modules for repurposed usage. Integration with DER management systems, virtual power plants (VPPs), and grid-edge control frameworks creates new enterprise workflows that rely on BMS for interoperability, cybersecurity, and lifecycle asset management making BMS a core enabler of modern grid stability and renewable penetration.

Restraints in the Global Battery Management System Market

High System Complexity and Integration Costs

Sophisticated BMS solutions incorporating cell-level sensing, advanced thermal modeling, AI inference engines, and redundant safety channels increase bill-of-materials and engineering complexity. For low-cost applications and price-sensitive emerging markets, the added cost can slow adoption. Legacy vehicle platforms and stationary systems often require custom BMS integration, which extends development timelines and adds certification overhead. Additionally, variability in cell chemistries and form factors across suppliers complicates standardized BMS deployment, requiring extra validation and calibration that increases upfront CAPEX for manufacturers and integrators.

Regulatory Fragmentation & Standardization Challenges

Global regulatory frameworks for battery safety, second-life usage, data privacy, and vehicle cybersecurity remain fragmented. Differing regional standards for pack-level safety (e.g., UNECE R100 variants, UL standards, IEC norms) create compliance complexity for BMS suppliers targeting multiple markets. Lack of universally accepted data formats and BMS communication standards can impede interoperability between battery suppliers, OEMs, and charging infrastructure. Until regulatory harmonization and industry-wide standards mature, some customers may delay large-scale BMS upgrades pending clearer compliance pathways.

Opportunities in the Global Battery Management System Market

Second-Life & Circular Economy Services

Increasing volumes of retired EV batteries present lucrative opportunities for BMS vendors to develop second-life management software and modular reconfiguration services. BMS platforms that can reassess module SOH, re-balance arrays, and securely manage repurposed packs for stationary storage create new revenue streams in refurbishment, asset-tracking, and warranty-backed second-life offerings. Service layers that integrate battery provenance, recycling traceability, and regulatory reporting will become highly valuable as circular-economy mandates expand.

Fleet Electrification & Mobility Services

Large commercial fleets (buses, delivery, last-mile logistics, municipal vehicles) represent a major addressable market for BMS vendors offering fleet-scale telematics, predictive maintenance, and charge-optimization features. BMS providers that bundle analytics, software-as-a-service (SaaS) dashboards, and API-based integrations with fleet-management systems can capture recurring revenue and deepen ties with fleet operators. As electrified fleets scale, BMS-based energy orchestration for depot charging, vehicle-to-grid (V2G), and battery-swapping ecosystems will unlock operational savings and grid services revenue.

Trends in the Global Battery Management System Market

Standardization of Battery Data & Interoperability

The industry is moving toward common telemetry schemas, digital battery passports, and interoperability frameworks that standardize how SOH/SOC and safety events are reported. These data standards enable cross-supplier analytics, facilitate second-life repurposing, and support regulatory traceability. Expect increased collaboration among OEMs, cell suppliers, and software companies to produce modular BMS APIs and plug-and-play integrations for charging networks and energy management platforms.

Embedded Safety & Functional Safety Certification (ISO 26262, IEC 61508)

As battery voltages and energy densities climb, BMS implementations are increasingly subject to rigorous functional safety and cybersecurity requirements. Certifications aligned with ISO 26262 for automotive functional safety and IEC 61508 for industrial safety are becoming prerequisites for large customers. BMS vendors are therefore investing heavily in redundant sensing, fail-safe architectures, secure bootloaders, and encrypted telemetry to meet safety and cyber-hygiene expectations across automotive and stationary storage use cases.

Global Battery Management System Market: Research Scope and Analysis

By Type Analysis

Distributed (Cell/Module-Level) BMS is projected to dominate the global market due to its superior safety, scalability, and fault-tolerance for large-format packs used in EVs and grid storage. Distributed BMS architectures place intelligence and sensing at the cell or module level, enabling precise voltage and temperature monitoring, fine-grained balancing, and localized fault isolation. This reduces the impact of a single-point failure and improves thermal propagation control across high-energy packs. The architecture is particularly attractive for manufacturers scaling to gigafactories and for applications requiring high pack modularity (commercial vehicles, stationary arrays, and second-life reconfiguration). As battery architectures move to higher voltages and larger capacities, distributed BMS offers the fine control necessary to maximize usable energy and extend cycle life, making it the preferred choice for OEMs and system integrators through 2034.

Modular BMS (closely related to distributed) is the second-largest type due to its ease of serviceability and flexibility. Modular BMS designs enable rapid replacement of damaged modules, facilitate standardized manufacturing lines, and simplify testing during assembly. They support hybrid pack topologies (mixing chemistries or cell formats) and accelerate deployment for repurposed or retrofitted systems.

Centralized BMS retains importance in lower-cost and legacy applications, such as small consumer devices and some telecom backup systems, because of lower BOM costs and simpler integration. Hybrid BMS architectures that combine centralized and distributed elements are gaining traction for heavy-duty applications where cost and fault tolerance must be balanced. Wireless BMS and proprietary/other architectures complete the type taxonomy, with rapid adoption of wireless module controllers in high-volume automotive programs.

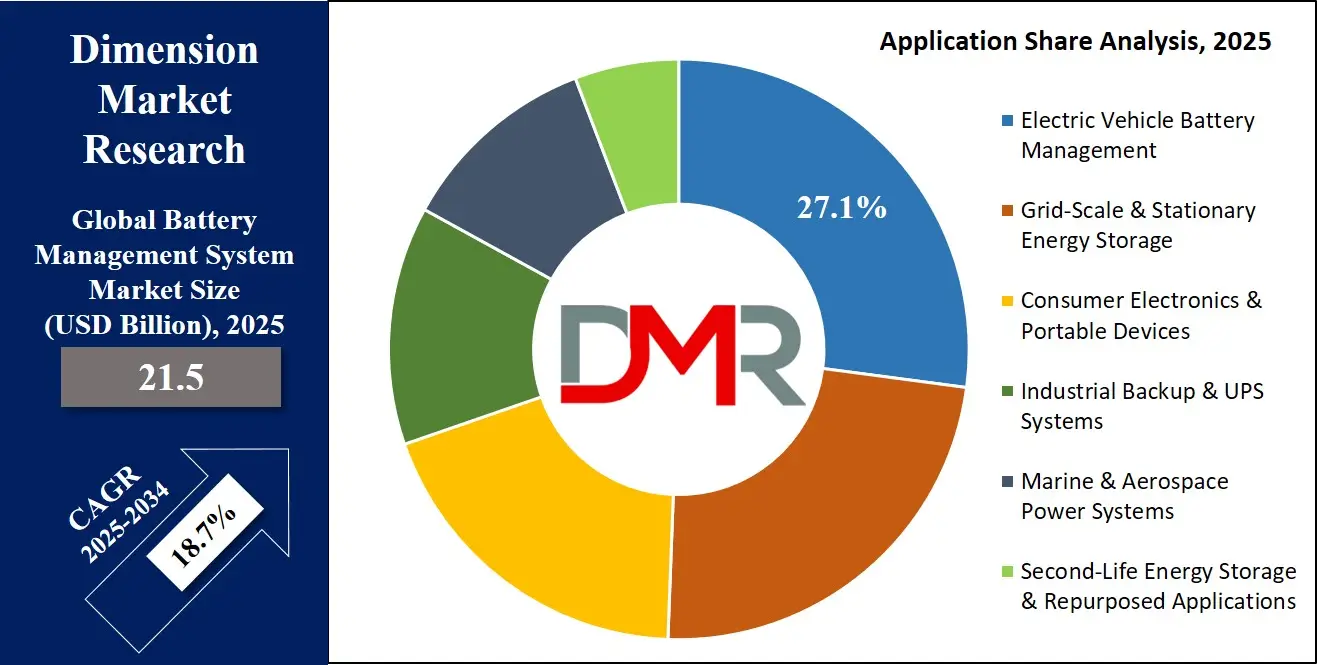

By Application Analysis

Electric Vehicle (EV) Battery Management is poised to be the largest and most dominant application segment in the BMS market, accounting for the highest share globally. With global EV adoption accelerating across passenger cars, commercial fleets, two/three-wheelers, and off-highway equipment, the demand for advanced BMS capabilities is paramount. EV BMS must manage fast-charging protocols, cell-to-cell balancing for large high-voltage packs, battery thermal management during high-duty cycles, and comprehensive safety interlocks to prevent incidents. OEMs prioritize BMS that enable extended range, predictable degradation, and over-the-air (OTA) firmware updates features that directly affect warranty costs and residual values. Government incentives for EVs and stricter vehicle safety standards further cement EV BMS as the dominant application through the forecast period.

Grid-Scale & Stationary Energy Storage ranks as the second-largest application due to rapid deployment of renewables and the need for multi-megawatt-hour storage systems. BMS for stationary applications emphasize long calendar life, module reconfiguration, charge/discharge efficiency, and integration with energy management systems (EMS) for services like frequency response and peak shaving.

Other significant applications include consumer electronics and portable devices, industrial backup and UPS systems, marine and aerospace power systems, and second-life energy storage each demanding tailored BMS features such as ultra-compact designs, ruggedization, or enhanced cycle-life management respectively.

By End User Analysis

OEMs & Vehicle Manufacturers are anticipated to dominate the BMS market as primary buyers because they integrate BMS directly into vehicle architectures and require deep customization, functional safety compliance (ISO 26262), and lifecycle support. OEMs typically select BMS partners who can deliver cell-agnostic algorithms, scalable module controllers, and over-the-air update capabilities. Large automotive groups and commercial vehicle OEMs prefer long-term partnerships with BMS suppliers that can co-develop pack-level solutions and provide warranty-backed analytics.

Utilities & Independent Power Producers (IPPs) represent the second-largest end-user segment, driven by demand for grid-forming and grid-following storage installations. Utilities require BMS that support multiple services, including ramp-rate control, grid-forming stability, and fleet-level orchestration across distributed assets.

Other prominent end users include Fleet Operators (buses, delivery, logistics) who value BMS-integrated telematics and predictive maintenance; OEM Aftermarket & Service Providers for retrofit and replacement solutions; Residential/Home Energy Storage customers seeking safe, user-friendly BMS for behind-the-meter applications; and Industrial & Data Center Operators that require high-reliability UPS and backup systems.

The Global Battery Management System Market Report is segmented on the basis of the following:

By Type

- Distributed BMS

- Centralized BMS

- Modular BMS

- Hybrid BMS

- Wireless BMS

By Application

- Electric Vehicle Battery Management

- Grid-Scale & Stationary Energy Storage

- Consumer Electronics & Portable Devices

- Industrial Backup & UPS Systems

- Marine & Aerospace Power Systems

- Second-Life Energy Storage & Repurposed Applications

By End User

- OEMs & Vehicle Manufacturers

- Utilities & IPPs

- Fleet Operators

- Residential / Home Energy Storage Users

- Diagnostic & Aftermarket Service Providers

- Industrial & Data Center Operators

Impact of Artificial Intelligence in the Global Battery Management System Market

- More-accurate SOC & SOH estimation: Machine-learning models (e.g., neural nets, ensemble regressors) infer state-of-charge and state-of-health from noisy real-world data far better than straight physics-only models improving range prediction, reducing over-conservatism, and enabling higher usable capacity safely.

- Predictive maintenance & lifespan extension: AI detects subtle degradation patterns and usage-driven failure modes early, enabling condition-based servicing and firmware-level mitigation (e.g., adaptive charge profiles), which reduces unplanned downtime and extends pack lifetime.

- Smarter charging & faster safe charging: Reinforcement learning and adaptive control let chargers tailor current/voltage profiles per cell/pack in real time minimizing charge time while avoiding thermal or electrochemical stress, so fast charging becomes safer and less damaging.

- Real-time cell balancing & thermal management: AI coordinates active/passive balancing and cooling strategies across many cells using predictive temperature and imbalance forecasts, improving uniformity, efficiency, and preventing hot-spots that accelerate failure.

- System-level optimization & grid/vehicle integration: Data-driven BMS enables fleet- and grid-aware decisions (e.g., V2G scheduling, peak shaving, second-life management) by forecasting availability and degradation unlocking new revenue streams and lowering total cost of ownership.

Global Battery Management System Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Battery Management System Market with ~37% market share by the end of 2025, driven by a powerful combination of advanced EV manufacturing, strong renewable energy integration, favorable electrification policies, and early adoption of digitalized battery monitoring ecosystems. The United States and Canada possess one of the world’s most mature EV and stationary storage landscapes, supported by robust national-level policies including the Inflation Reduction Act (IRA), EV tax incentives, DOE battery innovation programs, and major public–private investments in battery gigafactories.

North America has one of the highest concentrations of EV battery production, with rapid expansion from Tesla, GM’s Ultium, Ford, Panasonic, LG Energy Solution, and SK On. This large-scale cell manufacturing ecosystem directly accelerates BMS integration, as every new battery production line adopts increasingly sophisticated pack intelligence for safety, cell balancing, thermal monitoring, and automated diagnostics. EV penetration continues to rise sharply, and with battery packs often valued between 30–40% of the vehicle cost, the role of BMS in long-term warranty reduction, charging performance, and safety becomes indispensable.

The region also leads in grid-scale energy storage deployment, where BMS-enabled lithium-ion, LFP, and hybrid chemistries support frequency regulation, peak shaving, and renewable smoothing services. Utilities such as Fluence, NextEra, Tesla Energy, and AES rely heavily on advanced BMS software to monitor thousands of battery modules across distributed energy resources. Cloud-based analytics, digital twins, and AI-enhanced SOH prediction have become core aspects of North America's growing storage fleet.

Regulatory support is one of the strongest contributors to growth. Standards from UL, IEEE, SAE, NFPA, and federal EV safety frameworks mandate strict protection, fault detection, cybersecurity requirements, and thermal propagation prevention driving OEMs and battery integrators to invest in highly reliable and compliant BMS platforms.

Region with the Highest CAGR

Asia-Pacific (APAC) holds the highest CAGR and is poised to achieve the largest long-term market share in the global BMS industry. This unprecedented growth is driven by massive EV adoption, the world’s largest battery manufacturing capacity, widespread renewable-energy deployment, and government-backed electrification programs across major economies. APAC accounts for more than 60% of global battery production, with China, South Korea, and Japan leading global cell and pack manufacturing fundamentally positioning the region as the core of global BMS demand.

China represents the world’s largest EV market, manufacturing over 50% of global electric vehicles annually. The country’s rapid acceleration of passenger EVs, electric buses, two-wheelers, and commercial fleets has created unparalleled demand for advanced BMS solutions across voltage classes and chemistries. China’s “New Energy Vehicle (NEV)” policies, smart-grid investments, and large-scale energy storage mandates further accelerate BMS integration in utility-scale and distributed storage systems.

India is experiencing rapid electrification across two- and three-wheelers, public buses, and stationary storage markets, driven by programs such as FAME II, the National Electric Mobility Mission, and the National Green Hydrogen Mission. India’s growing gigafactory initiatives and rising inclination toward LFP-based systems create new opportunities for cost-optimized and scalable BMS platforms.

Japan and South Korea continue to innovate in high-quality battery manufacturing, solid-state battery development, and BMS safety engineering. Governments across APAC endorse AI-led diagnostics, standardized battery traceability systems, and digital battery passports further fueling demand for connected and intelligent BMS architectures.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Battery Management System Market: Competitive Landscape

The Global Battery Management System (BMS) Market is moderately fragmented, driven by a diverse ecosystem of automotive OEMs, battery manufacturers, semiconductor companies, power electronics firms, EV platform developers, energy-storage integrators, and AI-driven battery analytics providers. Leading battery and automotive technology companies including LG Energy Solution, Panasonic, CATL, BYD, Samsung SDI, Tesla, and Bosch dominate the hardware and systems integration landscape with advanced BMS platforms for EVs, hybrid vehicles, and stationary storage systems. These players increasingly embed cell-level sensing, thermal propagation mitigation, configurable control algorithms, and cloud connectivity features into their BMS designs.

Semiconductor and power-electronics leaders such as Texas Instruments, NXP Semiconductors, Infineon Technologies, Renesas Electronics, Analog Devices, STMicroelectronics, and Maxim Integrated significantly influence market dynamics by delivering the battery-monitoring ICs, microcontrollers, communication interfaces, and power-management chips essential to modern BMS architectures. Their innovations in high-precision sensing, wireless BMS chipsets, functional-safety certified MCUs, and cybersecurity modules make them core partners for global OEMs.

BMS-focused innovators such as Eberspächer, Lithium Balance (Sensata Technologies), Navitas, Elithion, Proterra Powered, Leclanché, and Nuvation Energy specialize in modular BMS platforms, stationary-storage BMS, second-life battery reconfiguration systems, and fleet telematics-integrated monitoring solutions. These companies deliver software-defined BMS ecosystems that support AI-driven SOH predictions, digital twins, multi-pack orchestration, and remote firmware upgrades.

Some of the prominent players in the Global Battery Management System Market are:

- LG Energy Solution

- Panasonic Corporation

- CATL – Contemporary Amperex Technology Co. Ltd.

- BYD Company Limited

- Samsung SDI

- Tesla, Inc.

- Bosch (Robert Bosch GmbH)

- Texas Instruments

- NXP Semiconductors

- Infineon Technologies AG

- Analog Devices, Inc.

- Renesas Electronics Corporation

- STMicroelectronics

- Sensata Technologies (Lithium Balance)

- Eberspächer

- Leclanché SA

- Elithion, Inc.

- Nuvation Energy

- Wärtsilä Energy

- Fluence Energy

- Sungrow Power Supply Co., Ltd.

- Proterra Powered

- Other Key Players

Recent Developments in the Global Battery Management System Market

November 2025: LG Energy Solution Launches Next-Gen Wireless BMS Platform

LG Energy Solution introduced its latest Wireless Battery Management System (wBMS) designed for high-voltage EV packs and next-generation LFP and NMC chemistries. The system eliminates traditional wiring harnesses, reduces pack weight, improves scalability, and enhances real-time diagnostics. The launch strengthens LG’s position in lightweight EV architectures and supports faster OEM integration across multiple vehicle platforms and energy-storage products.

October 2025: Panasonic Unveils AI-Based Battery Health Analytics Suite

Panasonic showcased its advanced AI-driven Battery Intelligence Cloud Platform at major industry events in Europe and Japan. The solution integrates machine-learning algorithms for SOH prediction, thermal anomaly detection, charge optimization, and life-cycle forecasting. The platform enables fleet operators, utilities, and OEMs to leverage predictive insights for improved safety and extended battery lifespan across EV and stationary applications.

October 2025: Tesla Expands Fleet-Level BMS Updates via OTA Firmware

Tesla announced major enhancements to its Over-the-Air (OTA) firmware system, enabling real-time BMS algorithm updates for billions of vehicles globally. New capabilities include improved fast-charging control, enhanced thermal management during extreme climates, and advanced cell-balancing logic. The update showcases Tesla’s growing emphasis on software-defined battery management and long-term pack sustainability.

September 2025: BYD Powers National Energy Storage Deployments with New BMS-Integrated LFP Systems

BYD secured national-level deployment contracts in Southeast Asia for its BMS-integrated LFP grid-storage systems. The deployment provides utility-scale frequency regulation and renewable integration services. BYD’s BMS platform includes redundancy layers, real-time thermal mapping, and automated module reconfiguration, improving system stability and supporting green energy expansion across developing nations.

August 2025: Bosch Acquires Solid-State BMS Specialist to Strengthen Next-Gen Architecture Portfolio

Bosch completed its acquisition of a leading solid-state battery BMS innovator, enhancing the company’s capabilities in next-generation pack safety, multi-layer fail-safe architectures, and ultra-fast charging support. The merger reinforces Bosch’s leadership in EV powertrain electronics and accelerates the commercialization of solid-state-ready BMS systems.

July 2025: CATL Introduces “SmartPack 4.0” with Digital Twin Battery Modeling

CATL launched SmartPack 4.0, an AI-powered BMS ecosystem featuring digital twin modeling, cloud synchronization, and adaptive thermal management algorithms. The system enables real-time simulation of battery degradation, helping OEMs reduce warranty costs and improve long-term reliability. The update marks CATL’s strategic expansion into software-centric energy platforms.

June 2025: Wärtsilä Showcases BMS-Enabled Hybrid Storage at Global Energy Summit

Wärtsilä highlighted its hybrid battery-energy storage systems integrated with advanced BMS safety layers, including high-resolution cell monitoring, dynamic module balancing, and predictive lifecycle analytics. The platform supports large-scale renewable integration and enhances resilience in grids facing intermittent solar and wind supply.

April 2025: Energy Storage Platforms Integrate Cybersecure BMS Frameworks

Global energy-storage platforms rolled out new cybersecurity-enhanced BMS frameworks compliant with IEC/ISA-62443 and automotive cybersecurity standards. These updates introduce encrypted communication, secure boot, firmware integrity verification, and cloud-authentication protocols. The cybersecurity evolution strengthens trust and reliability in increasingly interconnected EV and stationary battery ecosystems.

March 2025: NXP & Infineon Collaborate on ISO 26262-Certified BMS Chipsets

NXP Semiconductors and Infineon Technologies jointly announced a collaboration to develop next-generation functional-safety-certified battery monitoring ICs and microcontrollers for EV and stationary storage systems. These chipsets support high-precision sensing, integrated thermal modeling, and wireless communication, enabling safer and more flexible battery architectures for OEMs worldwide.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.5 Bn |

| Forecast Value (2034) |

USD 100.1 Bn |

| CAGR (2025–2034) |

18.7% |

| The US Market Size (2025) |

USD 6.7 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Distributed BMS, Centralized BMS, Modular BMS, Hybrid BMS, Wireless BMS), By Application (Electric Vehicle Battery Management, Grid-Scale & Stationary Energy Storage, Consumer Electronics & Portable Devices, Industrial Backup & UPS Systems, Marine & Aerospace Power Systems, Second-Life Energy Storage & Repurposed Applications) By End User (OEMs & Vehicle Manufacturers, Utilities & IPPs, Fleet Operators, Residential / Home Energy Storage Users, Diagnostic & Aftermarket Service Providers, Industrial & Data Center Operators) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

LG Energy Solution, Panasonic Corporation, CATL, BYD Company Limited, Samsung SDI, Tesla Inc., Bosch, Texas Instruments, NXP Semiconductors, Infineon Technologies AG, Analog Devices Inc., Renesas Electronics Corporation, STMicroelectronics, Sensata Technologies (Lithium Balance), Eberspächer, Leclanché SA, Elithion Inc., Nuvation Energy, Wärtsilä Energy, Fluence Energy, Sungrow Power Supply Co. Ltd., and Proterra Powered., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Battery Management System Market size is estimated to have a value of USD 21.5 billion in 2025 and is expected to reach USD 100.1 billion by the end of 2034.

The market is growing at a CAGR of 18.7 percent over the forecasted period of 2025 to 2034.

The US Battery Management System Market is projected to be valued at USD 6.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 28.9 billion in 2034 at a CAGR of 17.5%.

North America is expected to have the largest market share in the Global Battery Management System Market with a share of about 37.3% in 2025.

Some of the major key players in the Global Battery Management System Market are LG Energy Solution, Panasonic Corporation, CATL, BYD Company Limited, Samsung SDI, Tesla Inc., Bosch, Texas Instruments, NXP Semiconductors, Infineon Technologies AG, and many others.