A battery is a device that stores energy and releases it as electricity. It works by converting chemical energy into electrical energy through a reaction inside the battery cells. Batteries come in different types, like lithium-ion, lead-acid, and solid-state. They power many things in daily life, such as smartphones, laptops, electric vehicles (EVs), and backup power systems. Rechargeable batteries are broadly used owing to they can be used multiple times, making them more efficient and environmentally friendly than disposable ones.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The need for batteries has been growing rapidly in recent years, which is mainly due to the increasing popularity of electric vehicles, renewable energy storage, and consumer electronics. Many companies & governments are investing in battery production to support the transformation towards cleaner energy. The growth of EVs has mainly driven demand for

lithium-ion batteries, which are lightweight and have a long lifespan. Countries like China, the United States, and European nations are competing to become leaders in battery production and technology.

Further, a few trends are shaping the battery industry. One major trend is the enhancement of battery technology to make them more efficient, safer, and longer-lasting. For instance, solid-state batteries are seen as the next big breakthrough because they offer higher energy density and lower risks of overheating. Another trend is the push for sustainable battery materials, as mining lithium, cobalt, and nickel can harm the environment. Companies are exploring alternative materials like sodium-ion and iron-based batteries to reduce environmental impact.

In recent years, there have been major events in the battery industry. Many automakers have announced plans to switch to fully electric vehicles in the coming decades, with growth in battery demand. Some governments have also introduced incentives and policies to encourage EV adoption and renewable energy storage. Battery recycling efforts have gained attention, as old batteries can be reused to minimize waste and reliance on raw materials. Several battery factories have been built around the world to meet rising demand.

The battery industry faces some challenges despite its rapid growth. Battery production requires scarce materials, leading to high costs and supply chain issues. Environmental concerns related to battery disposal and mining also need solutions. Scientists and engineers are working on improving battery recycling and developing batteries that use more abundant and eco-friendly materials. Companies are also focusing on making batteries charge faster and last longer.

Overall, batteries are a vital part of modern life, supporting everything from communication to transportation. As technology advances, batteries will become even more efficient, affordable, and sustainable. Governments, researchers, and businesses are working together to ensure batteries can support future energy needs without harming the environment. The coming years will likely bring innovations that make batteries even better and more accessible for everyone.

The US Battery Market

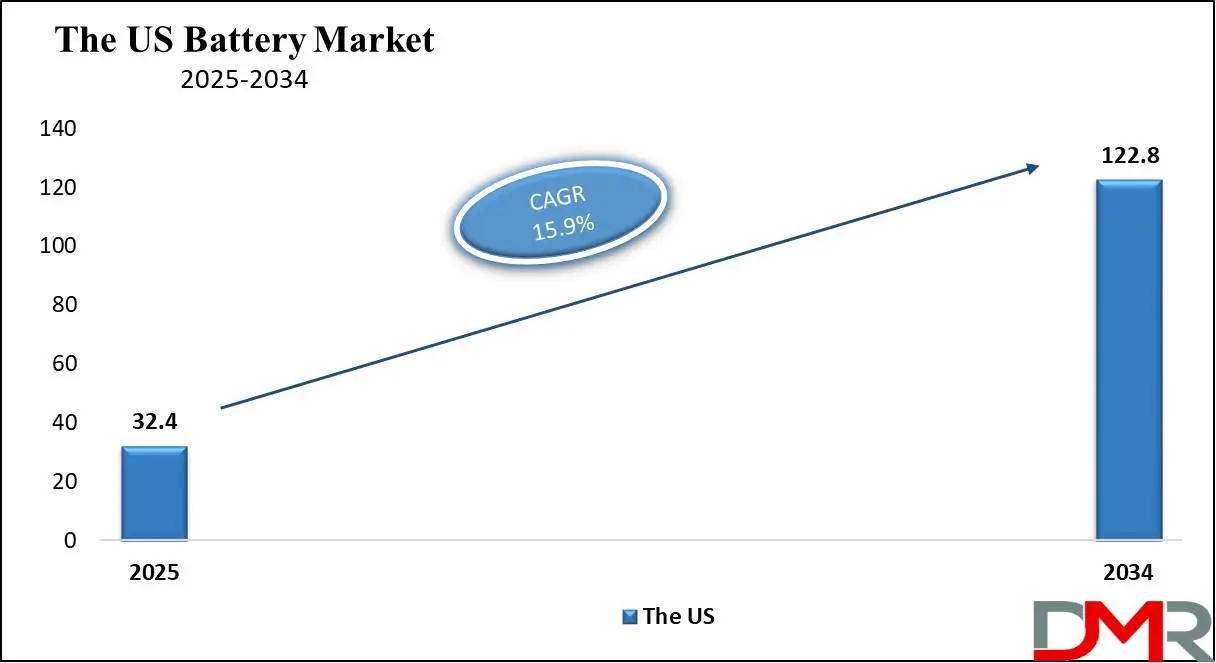

The US Battery Market is projected to reach USD 32.4 billion in 2025 at a compound annual growth rate of 15.9% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US battery market has strong growth opportunities driven by growth in electric vehicle adoption, expanding renewable energy projects, and government incentives like the Inflation Reduction Act. Investments in domestic battery manufacturing and recycling are expanding, minimizing dependency on imports. Developments in solid-state and lithium-ion technologies will further boost the market, supporting clean energy goals and energy storage expansion.

Further, the market is driven by the rapid adoption of electric vehicles, growing renewable

energy storage needs, and strong government support through policies and incentives. Investments in domestic manufacturing and advanced battery technologies further boost growth. However, challenges like supply chain disruptions, high production costs, and dependence on critical minerals remain key restraints. Addressing these issues through innovation and policy support will be crucial for sustained market expansion.

Battery Market: Key Takeaways

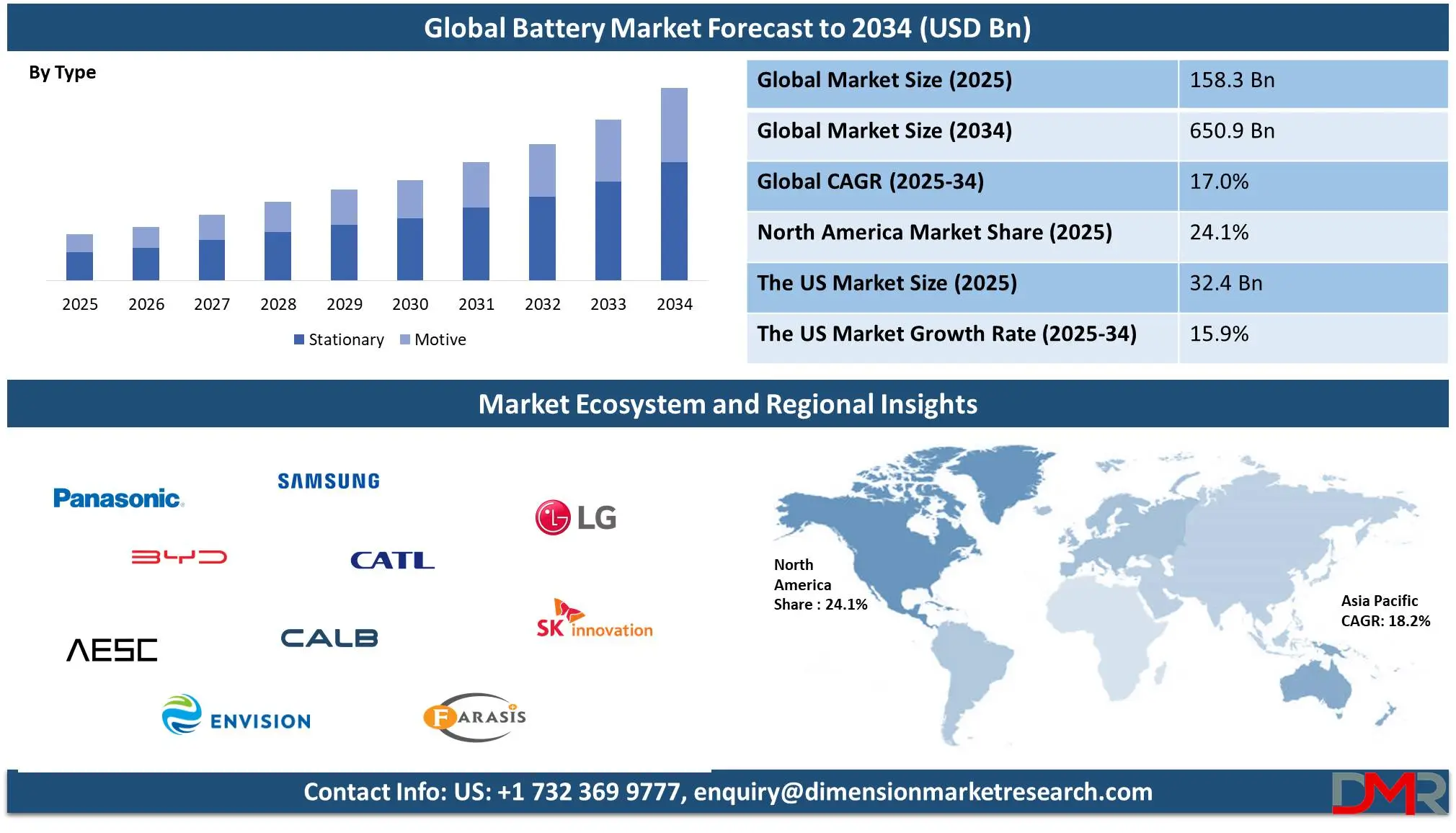

- Market Growth: The Battery Market size is expected to grow by 468.4 billion, at a CAGR of 17.0%, during the forecasted period of 2026 to 2034.

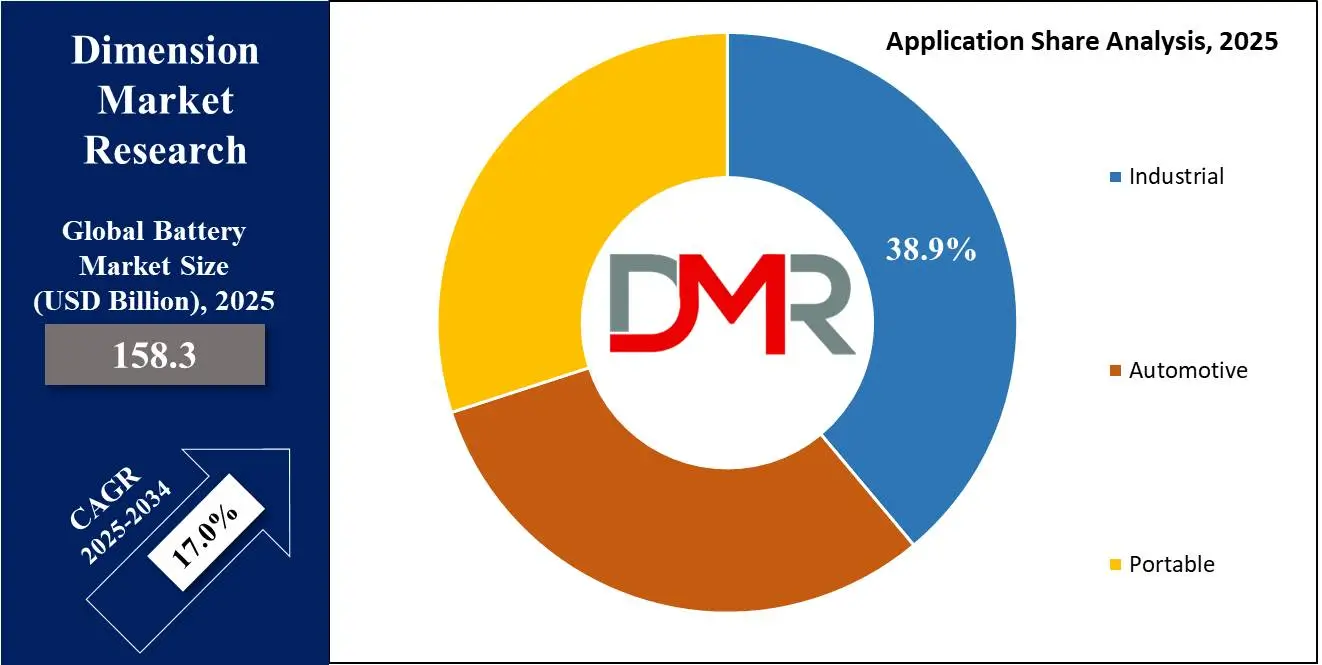

- By Application: The Industrial segment is anticipated to get the majority share of the Battery Market in 2025.

- By Type: The stationary segment is expected to get the largest revenue share in 2025 in the Battery Market.

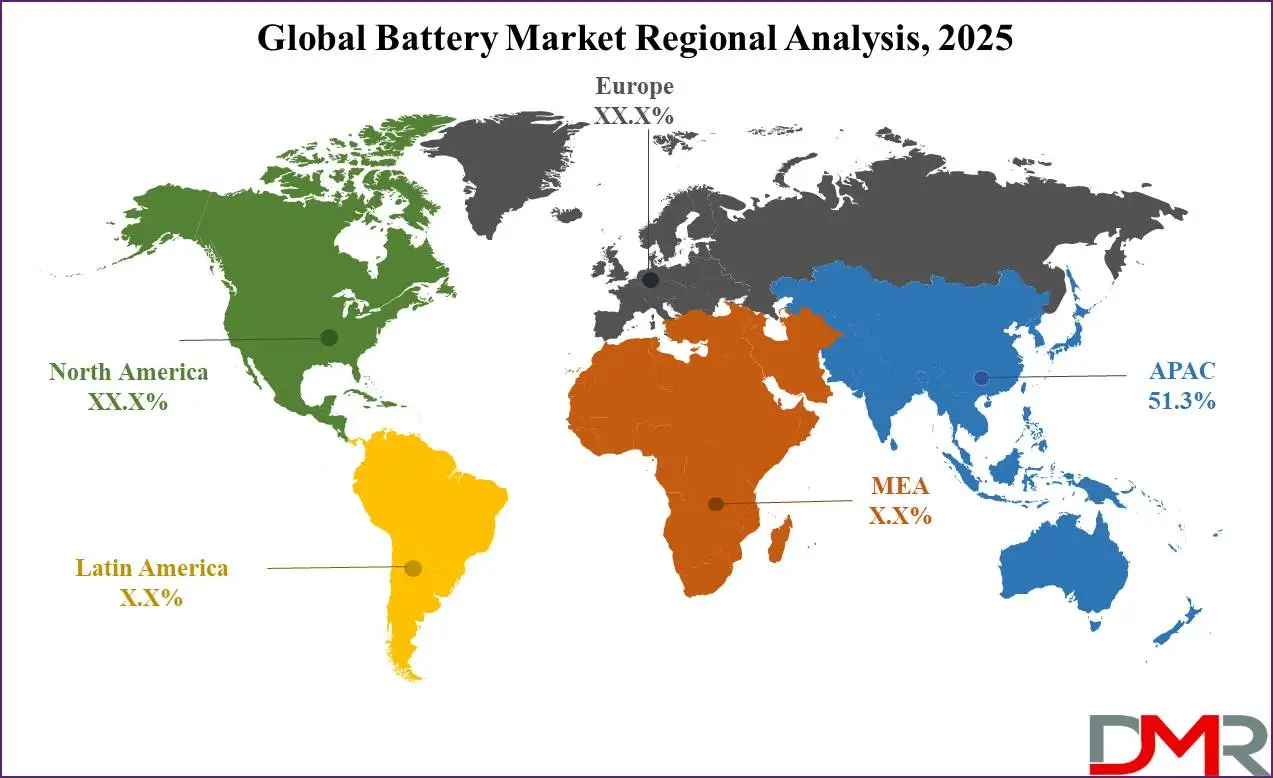

- Regional Insight: Asia Pacific is expected to hold a 51.3% share of revenue in the Global Battery Market in 2025.

- Use Cases: Some of the use cases of Battery include EVs, consumer electronics, and more.

Battery Market: Use Cases

- Electric Vehicles (EVs): Batteries power electric cars, bikes, and buses, minimizing dependency on fossil fuels and lowering carbon emissions. They allow long-distance travel with improved energy efficiency and fast-charging capabilities.

- Consumer Electronics: Smartphones, laptops, smartwatches, and tablets depend on rechargeable batteries for daily use. Developments in battery technology have enhanced device performance, battery life, and energy efficiency.

- Renewable Energy Storage: Batteries store excess energy from solar panels and wind turbines, making renewable energy available even when the sun isn’t shining or the wind isn’t blowing, which stabilizes power grids and promotes clean energy usage.

- Backup Power & Grid Support: Large-scale battery systems provide emergency power during blackouts and support power grids by balancing supply and demand, ensuring a stable electricity supply for homes and industries.

Stats & Facts

- According to Electroiq, modern flagship smartphones offer over 24 hours of battery life, with the iPhone 14 Pro Max lasting around 29 hours during video playback and the Samsung Galaxy S23 Ultra around 28 hours. However, high-performance activities like gaming can reduce battery life by 30-40%, bringing usage time down to approximately 16-18 hours.

- The International Energy Agency reports that demand for EV batteries reached more than 750 GWh in 2023, increasing by 40% compared to 2022, with electric cars accounting for 95% of this growth. The United States and Europe experienced the fastest growth at more than 40% year-on-year, followed closely by China at around 35%.

- Lithiumcycle states that approximately 77% of the world’s lithium-ion batteries are manufactured in China, with Australia's leading lithium mine production at an estimated 86,000 metric tons in 2023. About 15 tonnes of CO2 are emitted for every tonne of lithium extracted, contributing significantly to environmental concerns.

- Based on data from the International Energy Agency, in 2023, the United States was the smallest of the three major EV battery markets, consuming around 100 GWh compared to Europe’s 185 GWh and China’s 415 GWh. The rest of the world experienced a surge of over 70% in battery demand growth compared to 2022 due to increasing EV sales.

- Electroiq highlights that software updates can reduce battery life by up to 15%, with iOS 16.4 reportedly decreasing battery efficiency by 10-12% on older iPhones, reducing their battery life from 24 hours to approximately 21-22 hours. AI-driven battery management and eco-friendly materials have improved energy efficiency by 25%, extending usage times.

- The International Energy Agency notes that PHEVs in China accounted for about one-third of total electric car sales in 2023 and 18% of battery demand, up from one-quarter of total sales in 2022. EREVs, which have larger batteries than PHEVs, made up 25% of PHEV sales in China in 2023, compared to about 15% in 2021-2022.

- Lithiumcycle reveals that producing an 80 kWh lithium-ion battery, such as for a Tesla Model 3, results in CO2 emissions ranging from 2.4 to 16 metric tons. This environmental impact, combined with rising demand for EVs, is driving interest in alternative battery technologies like sodium-ion batteries and LFP chemistries.

- As per the International Energy Agency, battery demand for lithium in 2023 stood at around 140 kt, making up 85% of total lithium demand and increasing by over 30% compared to 2022. Similarly, battery demand for cobalt rose by 15% to 150 kt (70% of total cobalt demand), while demand for nickel reached almost 370 kt, up nearly 30%.

- Electroiq reports that 65% of people experience discomfort due to battery drainage, and 72% become nervous or anxious when their battery drops to 20%. Around 85% of users continue to use their phones while charging, which accelerates battery degradation and contributes to frequent replacements.

- The International Energy Agency indicates that Europe and the United States still rely significantly on battery imports, meeting over 20% and 30% of their EV battery demand, respectively, through imports. China remains the world’s largest EV battery exporter, exporting around 12% of its production.

- Electroiq states that the average smartphone user has a screen time of 7-9 hours per day, using their device for 10-20 hours depending on activities like calling, browsing, and gaming. The battery degradation rate is about 20% capacity loss after 500 charge cycles, leading to reduced battery life over time.

- According to the International Energy Agency, China accounted for nearly 90% of global installed cathode active material manufacturing capacity and over 97% of anode active material capacity in 2023. The country’s production of EV batteries exceeded domestic demand, with less than 40% of its maximum cell output utilized.

- Electroiq highlights that battery manufacturing costs in the United States remain about 20% higher than in China, even without accounting for regional material cost differences. China’s dominance in LFP battery production, which is over 20% cheaper than NMC, further enhances its cost advantage in global EV battery supply.

- The International Energy Agency reports that in 2023, Poland produced around 60% of all EV batteries in Europe, while Hungary accounted for almost 30%. Germany led EV production, making nearly 50% of Europe’s electric cars, followed by France and Spain, which each accounted for just under 10%.

- Lithiumcycle reveals that Morocco, home to the world’s largest phosphate reserves, has attracted nearly USD 15.3 billion in battery-related investments since 2022, particularly in LFP production. This follows the expiration of LFP patents in 2022, enabling countries outside China to develop domestic manufacturing capacity.

Market Dynamic

Driving Factors in the Battery Market

Rising Electric Vehicle (EV) Adoption

The growth in the demand for

electric vehicles is a major driver of the battery market. Governments around the world are pushing for cleaner transportation through subsidies, tax benefits, and stricter emission regulations. Automakers are rapidly expanding their EV production, increasing the need for high-performance batteries. Advancements in fast-charging technology and extended battery life make EVs more attractive to consumers. Additionally, declining battery costs are making EVs more affordable, boosting global sales and further accelerating battery market growth.

Expansion of Renewable Energy Storage

The transformation towards renewable energy sources like solar and wind has increased the demand for efficient energy storage solutions. Batteries help store excess energy generated during peak production times and supply it when the need is high or when natural conditions are unfavorable. Governments and businesses are investing in grid-scale battery storage to ensure a stable & reliable power supply. Developments in battery technology, like solid-state and sodium-ion batteries, have enhanced storage capacity and efficiency, as the growing demand for energy storage solutions is significantly driving the battery market forward.

Restraints in the Battery Market

High Raw Material Costs and Supply Chain Challenges

The battery market depends on critical minerals like lithium, cobalt, and nickel, which are costly and have limited global supply. Fluctuating raw material prices increase production costs, making batteries less affordable for manufacturers and consumers. In addition, supply chain disruptions, geopolitical tensions, and trade restrictions can create shortages, slowing down battery production. Various countries and companies are working to secure raw materials through mining investments and recycling, but supply risks remain a major challenge.

Environmental and Recycling Challenges

While batteries support clean energy, their production and disposal have numerous environmental impacts. Mining for lithium and cobalt leads to habitat destruction, water pollution, and high carbon emissions. Moreover, battery waste is a growing concern, as improper disposal can release toxic chemicals into the environment. Although recycling efforts are growing, current processes are costly and inefficient, limiting large-scale adoption. Developing sustainable battery materials and improving recycling technology are essential to overcoming these environmental challenges.

Opportunities in the Battery Market

Advancements in Battery Technology

Continuous R&D in battery technology provides a major opportunity for market growth. Developments like solid-state batteries, sodium-ion batteries, and lithium-sulfur batteries promise higher energy density, faster charging, and longer lifespans. These enhancements can make electric vehicles, renewable energy storage, and consumer electronics more efficient and affordable. Additionally, new manufacturing techniques, like cell-to-pack and cell-to-chassis designs, are enhancing battery performance. As these innovations become commercially viable, they will drive further adoption and expansion of the battery market.

Growing Focus on Battery Recycling and Sustainability

With increasing concerns about resource scarcity and environmental impact, battery recycling and sustainable alternatives offer a major opportunity. Governments and companies are investing in advanced recycling technologies to recover valuable materials like lithium, cobalt, and nickel, reducing dependency on raw material mining. Circular economy initiatives and stricter environmental regulations are pushing for more efficient and eco-friendly battery disposal solutions. In addition, the development of batteries using abundant and less harmful materials, like iron-based or organic batteries, could reshape the market. These efforts will make batteries more sustainable and cost-effective in the long run.

Trends in the Battery Market

Shift Towards Lithium Iron Phosphate (LFP) Batteries

LFP batteries are becoming highly popular, mainly in the electric vehicle (EV) sector, owing to their lower cost, longer lifespan, and better safety. Unlike nickel-based chemistries, LFP batteries do not depend on expensive and scarce materials like cobalt and nickel, making them a more sustainable option. China leads in LFP battery production, with major EV manufacturers adopting this chemistry for affordability and efficiency. The share of LFP batteries in global EV sales has grown highly in recent years. With ongoing innovations improving their energy density, LFP batteries are expected to dominate even more in the coming years.

Expansion of Gigafactories and Regional Battery Production

Countries worldwide are investing heavily in battery manufacturing to minimize dependence on imports and strengthen local supply chains. The US and Europe are rapidly expanding gigafactories to meet the growing demand for EV batteries and energy storage solutions. Policies like the US Inflation Reduction Act (IRA) are encouraging domestic battery production by providing incentives for local manufacturing. Asian battery giants, including Korean and Chinese companies, are also setting up production facilities in other regions, which is expected to enhance supply chain stability, reduce costs, and accelerate battery market growth.

Research Scope and Analysis

By Type Analysis

In 2025, the stationary segment will lead the battery market with a 61.7% share, due to the growth in the demand for energy storage solutions in homes, businesses, and power grids. With the increase in the use of renewable energy sources like solar and wind, batteries are vital for storing excess power and ensuring a stable energy supply. Many industries & commercial buildings are installing battery storage systems to minimize electricity costs and maintain backup power during outages.

Governments and energy companies are investing in large-scale battery projects to enhance grid reliability and reduce dependence on fossil fuels. Residential battery storage is also becoming popular, allowing homeowners to store solar energy for later use. Developments in battery technology, like longer lifespan and improved efficiency, are making stationary storage systems more effective and affordable. As the demand for reliable and sustainable energy solutions grows, the stationary battery segment will continue to be a major driver of market expansion.

The motive segment will see major growth over the forecast period as electric vehicles (EVs),

Electric Cars,

Electric Bicycles, industrial machinery, and transportation systems majorly depend on battery power. With the push for cleaner mobility, EV adoption is growing, driving demand for high-performance batteries. Public & private transport systems, like Electric Buses, trains,

Electric Tractors, and two-wheelers, are also transforming to battery power to minimize emissions.

Industries are using battery-operated forklifts, automated guided vehicles (AGVs), and other machinery for better efficiency. Improvements in battery technology, such as higher energy density and faster charging, are making these applications more practical. As the transportation and industrial sectors embrace electrification, the motive battery segment will continue expanding.

By Material Analysis

The lithium-ion segment will lead the battery market with a 47.1% share in 2025, driven by its high usage in electric vehicles, consumer electronics, and energy storage systems. Known for its high energy density, fast charging, and long lifespan, lithium-ion technology remains the preferred choice for various applications. Automakers are highly depending on lithium-ion batteries to power electric cars, while tech companies use them in smartphones, laptops, and wearable devices.

The increase in demand for renewable energy storage has also boosted lithium-ion adoption in residential and industrial battery systems. Constant advancements are making these batteries safer, more efficient, and cost-effective. Governments and private companies are investing heavily in lithium-ion production and recycling to ensure a stable supply. With the push for clean energy and sustainable transportation, lithium-ion batteries will continue to dominate the market, playing a crucial role in the future of energy storage and electric mobility.

The flow battery segment will experience major growth over the forecast period as the need for long-duration energy storage solutions increases. These batteries are ideal for renewable energy storage, providing a stable power supply for solar and wind farms. Their ability to store large amounts of energy for extended periods makes them valuable for grid stabilization and industrial applications. Unlike traditional batteries, flow batteries have a longer lifespan and can be recharged without degradation. Governments and energy companies are investing in flow battery technology to improve energy security and efficiency. As renewable energy adoption grows, flow batteries will play a key role in sustainable power storage.

By Application Analysis

As an application, the industrial segment will lead the battery market with a 38.9% share in 2025, driven by the increase in the demand for energy storage solutions, automation, and electrification in industries. Various factories and warehouses are switching to battery-powered equipment, like forklifts, robots, and backup power systems, to enhance efficiency and minimize emissions. Large-scale battery storage is also supporting industries to manage electricity use, mainly with the growth of renewable energy sources like solar and wind.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Mining, construction, and manufacturing sectors are investing in advanced battery technologies to power heavy machinery and minimize dependency on fossil fuels. In addition, grid-scale battery projects support a stable energy supply, preventing blackouts and balancing power demand. As industries constantly adopt cleaner and more efficient energy solutions, battery demand in this segment will grow steadily, making it a key driver of the market’s expansion.

Further, the automotive segment will see significant growth over the forecast period, driven by the growth in the adoption of electric vehicles (EVs) worldwide. Governments are pushing for cleaner transportation through incentives and stricter emission rules, encouraging automakers to expand their EV offerings. Falling battery costs & improving technology, such as fast charging and longer range, are making EVs more appealing to consumers.

Major car manufacturers are investing in battery production to secure supply & reduce dependence on imports. Hybrid and plug-in hybrid vehicles are also contributing to battery demand. As the transition to electric mobility accelerates, the automotive sector will remain a major force in the battery market’s expansion.

By End Use Industry Analysis

The automobile sector will lead the battery market in 2025 with a 33.9% share, due to the rapid transformation toward electric mobility. With automakers focusing on minimizing carbon emissions, the need for batteries in electric vehicles (EVs), hybrid cars, and plug-in hybrids is rising. Battery technology advancements, like higher energy density and faster charging, are making EVs more practical for daily use.

Governments worldwide are providing subsidies and tax benefits to boost EV adoption, further fueling battery demand. Automakers are also investing in their battery production facilities to minimize costs and secure a stable supply. The growing popularity of electric two-wheelers, buses, and trucks is expanding battery use beyond passenger cars. As EV adoption accelerates, the automobile sector will continue to be a major driver of growth in the battery market.

In addition, the energy & power industry sector will experience significant growth over the forecast period as the need for reliable energy storage solutions increases. With the rapid expansion of renewable energy sources like solar and wind, large-scale battery storage is becoming vital for balancing supply and demand. Batteries support storing excess energy and provide backup power during shortages or outages, enhancing grid stability.

Power companies are investing in advanced battery technologies to enhance energy efficiency and minimize dependency on fossil fuels. Governments are also supporting battery storage projects through policies and incentives. As the shift toward clean energy accelerates, the energy & power sector will play a vital role in driving battery market growth.

The Battery Market Report is segmented on the basis of the following

By Type

By Material

- Lead Acid

- Lithium Ion

- Nickel-based

- Flow Battery

- Small Sealed Lead-acid Batteries

- Others

By Application

- Automotive

- Industrial

- Portable

By End Use Industry

- Aerospace

- Automobile

- Consumer Electronics

- Telecom

- Energy & Power Industry

- Military Defense

- Others

Regional Analysis

Leading Region the Battery Market

In 2025, Asia Pacific will lead the battery market with a

51.3% share, driven by strong demand from electric vehicles, consumer electronics, and renewable energy storage. Countries like China, Japan, and South Korea dominate battery production, benefiting from advanced technology, large-scale manufacturing, and strong government support. Here, China is a global leader in EV battery production, supplying both domestic and international markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The growing adoption of electric vehicles and the expansion of solar and wind energy projects are further fueling battery demand in the region. In addition, major investments in battery manufacturing plants and raw material refining are strengthening Asia Pacific’s position in the global market.

Companies are also aiming to develop next-generation batteries with higher efficiency and lower costs. With rapid industrialization, growing energy needs, and a growing focus on clean energy solutions, Asia Pacific will remain at the forefront of battery market growth in the coming years.

Fastest Growing Region in the Battery Market

North America will see significant growth in the battery market over the forecast period, driven by the higher demand for electric vehicles, energy storage solutions, and consumer electronics. The region is highly investing in domestic battery production to minimize dependency on imports and strengthen supply chains.

Government policies, like incentives for EV adoption and clean energy projects, are further boosting market expansion. Companies in the US and Canada are focusing on advanced battery technologies, like lithium-ion and solid-state batteries, to improve performance and efficiency. With rising renewable energy projects and the push for electrification, North America will play a key role in shaping the future of the battery industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The battery market is highly fragmented, with major global players focusing on innovation, large-scale production, and cost reduction. Companies like CATL, LG Energy Solution, Panasonic, Samsung SDI, and BYD dominate the industry, supplying batteries for electric vehicles, consumer electronics, and energy storage. Competition is growing as more manufacturers expand production capacities and invest in new technologies like solid-state and sodium-ion batteries. Governments are supporting domestic manufacturing through policies and incentives to reduce dependence on imports.

Mergers, partnerships, and research investments are common as companies strive to improve battery performance and lower costs. With increasing demand for sustainable energy solutions, the competition in the battery market will continue to intensify, driving further advancements and market expansion.

Some of the prominent players in the Global Battery are:

- Panasonic

- Samsung

- LG

- BYD

- CATL

- SK Innovations

- AESC

- CALB

- Envision

- Farasis Energy

- BAK Battery

- Guoxuan High-Tech Co. Ltd.

- China Guangyu Group

- Lishen Battery

- Sungrow Power Supply Co. Ltd.

- EVE Energy

- REPT Energy Co. Ltd

- Ganfeng Lithium Co. Ltd.

- Tianneng Battery Group Co. Ltd.

- Sunwoda Electronic Co. Ltd.

- Other Key Players

Recent Developments

- In March 2025, SK On and Nissan announced a battery supply agreement that will support Nissan's electric vehicle (EV) production in North America. Under the agreement, SK On, a leading global battery manufacturer, will provide nearly 100 GWh of high-performance, high-nickel batteries to Nissan from 2028 to 2033. These U.S.-manufactured batteries will power Nissan's next-generation EVs to be produced at its Canton, Mississippi assembly plant, which reinforces both companies' commitment to electrification and sustainable mobility, as it will support 1,700 U.S. jobs at SK On and will involve a total investment of USD 661 million, including equipment purchases in addition to Nissan's USD 500 million in investments for EV production at the Canton Assembly Plant.

- In January 2025, Amprius Technologies, Inc. introduced a new SiCore™ cell as part of its expanding SiCore product platform. Designed to transform high-performance electric mobility, the SiCore platform uses a proprietary silicon anode material system to deliver the best-known commercially available energy and power performance in one cell. The new SiCore cell provides unparalleled power-to-energy capabilities for high-demand applications. With an impressive energy density of 370 Wh/kg, the SiCore cell extends runtimes while still providing exceptional high-power performance exceeding 3000 W/kg.

- In January 2025, Microvast Holdings, Inc unveiled a major milestone in the development of its True All-Solid-State Battery (ASSB) technology, which represents a key step forward in improving safety, energy density, and efficiency for critical applications like data center backup power systems and electric school buses, while also creating the way for future innovations in robotics and other high-demand sectors such as electric vehicles.

- In December 2024, Stellantis N.V. and Zeta Energy Corp. announced a partnership focused on advancing battery cell technology for electric vehicle applications, as the partnership looks to develop lithium-sulfur EV batteries with game-changing gravimetric energy density while achieving a volumetric energy density comparable to the latest lithium-ion technology. For customers, it is potentially a major lighter battery pack with the same usable energy as contemporary lithium-ion batteries, allowing greater range, improved handling, and better performance. In addition, the technology has the potential to enhance fast-charging speed by up to 50%, making EV ownership even more convenient. Lithium-sulfur batteries are expected to cost less than half the price per kWh of current lithium-ion batteries.

- In December 2024, NeoVolta Inc. announced the execution of a non-binding letter of intent (“LOI”) with Expion360 Inc. to provide the framework for a potential collaboration. The collaboration will focus on utilizing the parties’ shared resources to engineer an advanced battery manufacturing facility and develop innovative lithium-ion battery cell and module product designs, marking a significant milestone in the production of American-made batteries.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 158.3 Bn |

| Forecast Value (2034) |

USD 650.9 Bn |

| CAGR (2025-2034) |

17.0% |

| The US Market Size (2025) |

USD 32.4 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Stationary and Motive), By Material (Lead Acid, Lithium Ion, Nickel-based, Flow Battery, Small Sealed Lead-acid Batteries, and Others), By Application (Automotive, Industrial, and Portable), By End Use Industry (Aerospace, Automobile, Consumer Electronics, Telecom, Energy & Power Industry, Military Defense, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Panasonic, Samsung, LG, BYD, CATL, SK Innovations, AESC, CALB, Envision, Farasis Energy, BAK Battery, Guoxuan High-Tech Co. Ltd, China Guangyu Group, Lishen Battery, Sungrow Power Supply Co. Ltd, EVE Energy, REPT Energy Co. Ltd, Ganfeng Lithium Co. Ltd, Tianneng Battery Group Co. Ltd, Sunwoda Electronic Co. Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |