Market Overview

The

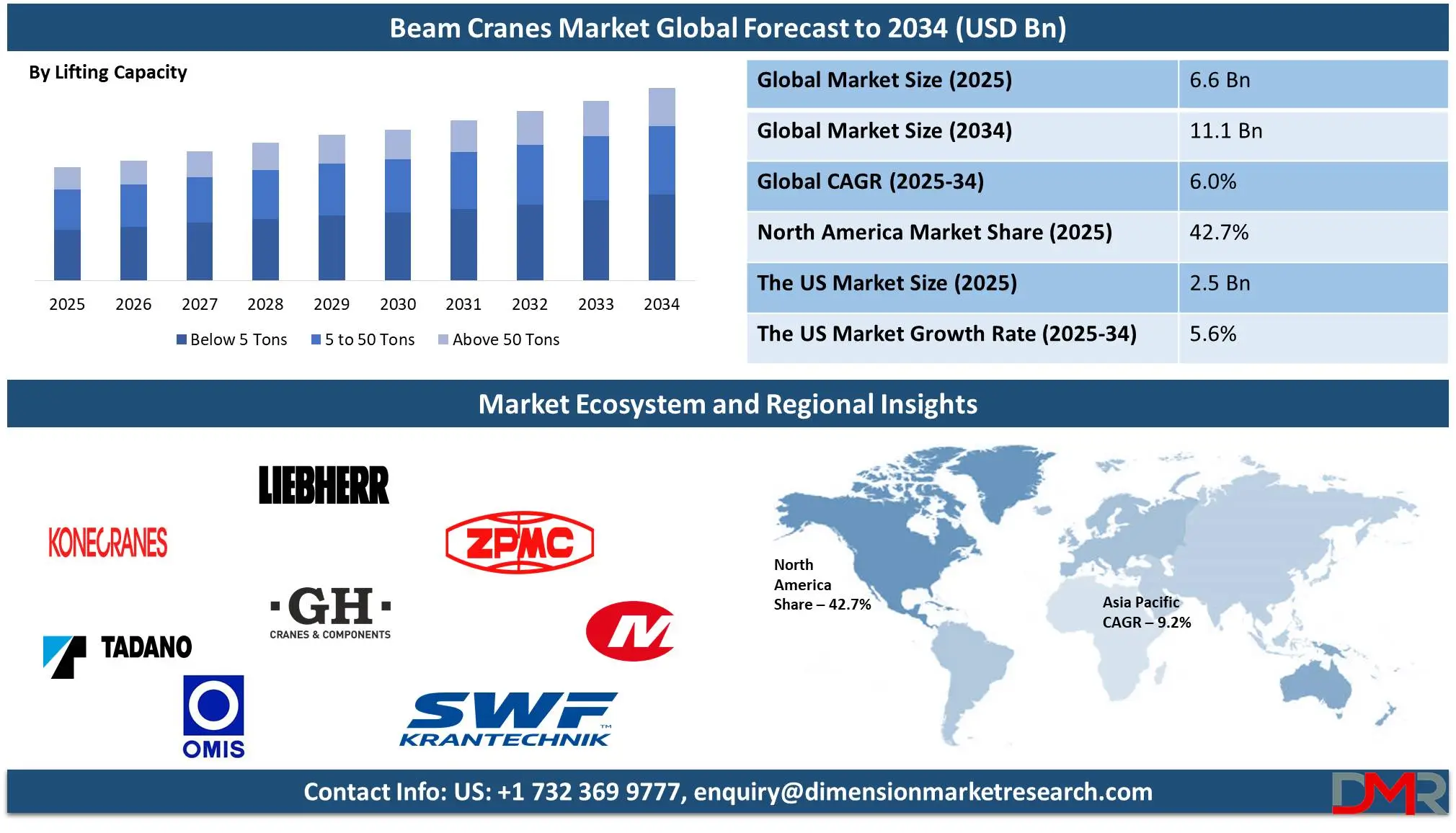

Global Beam Cranes Market is projected to reach

USD 6.6 billion in 2025 and grow at a compound annual

growth rate of 6.0% from there until 2034 to reach a

value of USD 11.1 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Beam cranes are overhead cranes used to move heavy loads in industrial settings. It consists of a horizontal beam (or girder) suspended between either single or double rail systems and supported by hoisting mechanisms; hoisting mechanisms lift and lower loads along this beam for efficient material handling. Beam cranes are mostly seen at factories, warehouses, shipyards, and construction sites, as they cover large areas with minimal space requirements, making them important tools in modern industry.

As global industry has expanded, demand for beam cranes has steadily risen due to industrial

expansion. Manufacturing industries, mainly automotive, steel and construction industries, demand efficient lifting solutions to move heavy components efficiently. Urbanization and infrastructure development have further driven up material-handling needs; automation also increases material-handling requirements, while smart beam cranes featuring remote monitoring features have become key investments for businesses looking to maximize productivity.

Several trends are shaping the beam crane market. Automation and smart technology integration is one such trend; modern beam cranes now include sensors, IoT (Internet of Things), and AI-based control systems that allow operators to remotely monitor and manage operations. Another main development in energy-efficient designs uses lightweight yet strong materials that lower energy consumption, while customization services have also grown significantly as industries demand specific crane configurations to meet specific lifting needs. All these innovations make beam cranes more effective, reliable, and safer in use.

Recent events have significantly shaped the beam crane market. While COVID-19 initially disrupted supply chains & industrial activities, recovery efforts have made construction activity surge, and crane sales have increased as demand increased for construction and infrastructure development projects. Government investments into smart factories and automation are driving an uptick in advanced beam crane system adoption, while trade regulations and tariffs on steel have led manufacturers to look for alternate materials and suppliers.

However, the industry still faces several significant hurdles, such as high initial costs and maintenance requirements. Installing a beam crane often requires significant upfront expenses, which may pose barriers for small businesses; regular maintenance checks to ensure safety and longevity incur additional operating costs; skilled labor shortages in crane operation have further necessitated user-friendly automated crane systems as an additional solution; all these challenges must be tackled for sustained market expansion.

The US Beam Cranes Market

The US Beam Cranes Market is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 5.6% over its forecast period.

The beam crane market in the US has strong growth opportunities due to rising infrastructure projects, expanding manufacturing, and increasing automation in industries. The need for smart, energy-efficient cranes is growing as companies look at efficiency and safety. The logistics and e-commerce sectors also drive adoption, while government investments in industrial modernization further boost market expansion.

Further, the market is driven by industrial automation, smart manufacturing, and growing infrastructure projects, increasing the need for efficient lifting solutions. However, high initial costs and maintenance expenses create challenges, especially for small businesses. Additionally, a shortage of skilled operators and strict safety regulations can slow adoption. Despite these restraints, technological advancements and modernization efforts continue to push the market forward.

Beam Cranes Market: Key Takeaways

- Market Growth: The Beam Cranes Market size is expected to grow by 3.2 billion, at a CAGR of 6.0% during the forecasted period of 2026 to 2034.

- By Lifting Capacity: The Below 5 Ton segment is anticipated to get the majority share of the Beam Cranes Market in 2025.

- By End User Industry: The construction segment is expected to get the largest revenue share in 2025 in the Beam Cranes Market.

- Regional Insight: North America is expected to hold a 42.7% share of revenue in the Global Beam Cranes Market in 2025.

- Use Cases: Some of the use cases of machine-to-machine M2M Connections include manufacturing & assembly lines, warehousing & logistics, and more.

Beam Cranes Market: Use Cases:

- Manufacturing & Assembly Lines: Beam cranes are broadly used in automotive, aerospace, and heavy machinery industries to lift and transport heavy parts during production and assembly processes.

- Warehousing & Logistics: In big warehouses and distribution centers, beam cranes help move heavy goods and materials efficiently, reducing manual labor and speeding up operations.

- Construction & Infrastructure: Beam cranes help in lifting steel beams, concrete blocks, and other heavy materials at construction sites, ensuring safe and precise material handling.

- Shipbuilding & Heavy Engineering: Shipyards and engineering industries use beam cranes to lift and position large ship components, engines, and industrial machinery with precision.

Stats & Facts

- According to Konecranes, 37% of crane accidents result from being crushed by the load due to load swing, load drop, or an unstable load falling over, leading to 33.8% of fatalities and 36.8% of injuries. In addition, 27% of incidents involve dropped loads, primarily caused by poor rigging practices. Falls account for 12% of injuries from heights between 8 feet and over 100 feet, while 11% of cases involve individuals being crushed or run over by overhead or gantry cranes, with 93% of these being fatal.

- Further, Konecranes reports that improper or absent Lock Out Tag Out (LOTO) procedures cause 6% of crane accidents, while another 7% fall under the "Other" category. OSHA violations related to crane operations have led to $2.3 million in fines, highlighting the financial impact of non-compliance.

- The financial burden of crane accidents is significant, with Konecranes stating that a major injury costs over USD 200,000, while a fatality can exceed USD 4 million. Additional direct costs include incident investigations, damaged equipment, medical expenses, site cleanup, compensation, and production losses, while indirect costs involve loss of future production, reduced safety ratings, higher insurance premiums, customer loss, legal fees, missed deliveries, and personal consequences.

- Moreover, the Konecranes found that 74% of crane-related incidents in a 10-year study occurred during routine job activities, focusing on stricter safety measures in everyday operations. The most effective safety improvements include operator and rigging training, lifecycle care, regular inspections, preventative and corrective maintenance, consulting services, modernization, and investment in new equipment.

- The Konecranes Training Institute enhances crane safety and productivity through training programs focused on sway control to reduce load sway, snag prevention to stop crane movement if a hook or load gets caught, and hook centering to prevent side pulling during lifts.

- The U.S. Bureau of Labor Statistics (BLS), reports that an average of 44 people die annually in crane-related accidents in the U.S., with incidents equally occurring at construction sites (24%) and factories/plants (24%). Nearly 70% of fatalities happen in the specialty trade, heavy and civil engineering, and construction industries, and over half of fatal injuries involve workers being struck by objects or equipment.

- Despite an overall decline in crane accidents, Block O’Toole & Murphy highlights multiple high-profile incidents in New York City, including a crane boom falling during disassembly in Brooklyn and Hurricane Zeta’s winds causing a crane in Midtown Manhattan to spin, dropping debris to the ground. A separate incident saw a floating crane hit the Marine Parkway-Gil Hodges Memorial Bridge, causing traffic congestion.

- The Crane Inspection and Certification Bureau (CICB) states that 90% of crane accidents result from human error, making proper training crucial. Common accident causes include dropped loads from improper securing or overloading, failure to use a trained signal person, lack of compliance with OSHA's 20-foot power line clearance rule, and inadequate maintenance, inspections, and disassembly procedures.

- According to Block O'Toole & Murphy, depending on negligence and accident circumstances, multiple parties, including crane operators, general contractors, property owners, crane manufacturers, and crane owners, can be held liable in crane accidents.

- Block O’Toole & Murphy has handled several significant crane accident cases, including a USD 15,000,000 settlement for the family of an HVAC technician killed when improperly rated hoist chains failed while lifting a 28,450-pound chiller unit. They also secured a USD 2,000,000 settlement for a Local 147 tunnel worker who fell 40 feet into a ventilation shaft while trying to stabilize a swaying crane basket. Another case resulted in a USD 6,000,000 settlement for a union operating engineer who suffered spinal injuries after falling 13 feet through an open hatch door while exiting a crane.

Market Dynamic

Driving Factors in the Beam Cranes Market

Industrial Expansion & AutomationThe rapid expansion of industries like manufacturing, logistics, and construction is creating a growth in demand for beam cranes. Businesses are investing in automation solutions that enhance productivity while decreasing manual labor. IoT-enabled monitoring, remote operation, and AI-powered control systems have gained in popularity and businesses increasingly prioritize safety and precision material handling. E-commerce and warehouse storage also fuel demand for efficient lifting equipment solutions.

Infrastructure Development & Urbanization

The rise in investments in infrastructure projects like roads, bridges and smart cities is driving large investments in beam cranes. Governments across the world are prioritizing large-scale construction projects that necessitate heavy lifting equipment; urbanization has led to an explosion of high-rise buildings and industrial complexes, which in turn increases crane adoption; wind and solar power projects also need cranes for equipment installation, contributing further to the steady growth of this market segment.

Restraints in the Beam Cranes Market

Beam Crane Installation Requires Significant Initial Investment and Maintenance Costs

Deploying beam cranes requires higher initial investments, making their adoption by small and midsized businesses difficult due to large upfront expenses that include not only the crane itself but also structural modifications, foundation work, advanced control systems, and regular maintenance costs like inspections and part replacements, not to mention unexpected breakdowns that cause downtime, productivity losses and higher operating expenses, also challenges faced when budget-constrained industries come to consider these financial obligations that could impede market growth potential.

Skilled Labor Shortage and Safety Concerns

Operating and maintaining beam cranes demands highly qualified operators and technicians, but there is a major shortage of qualified operators and technicians available for hire. Lack of staff can lead to inefficiencies, delays, safety risks, and improper handling of heavy loads, which may result in workplace accidents, equipment damage, or legal liabilities; companies should invest in training programs to ensure worker safety along with compliance with industry regulations; these concerns also lead to strict government policies, which further complicate and increase costs related to adopting beam cranes.

Opportunities in the Beam Cranes Market

Integration of Smart Technologies & Automation

Industry 4.0 and automation have opened up new opportunities for advanced beam cranes equipped with IoT, AI, and remote monitoring capabilities. Smart cranes equipped with sensors provide real-time information on load capacity, operational efficiency, and predictive maintenance reducing downtime and enhancing safety while automating material handling across industries like automotive, logistics, and aerospace using automated and remote-controlled beam cranes that use digital twin technology to further optimize performance optimization for optimal material handling operations, increasing demand for intelligent beam cranes as industries transition toward smart factories.

Beam Cranes to Support Infrastructure and Renewable Energy Projects

Large infrastructure investments across the world, like smart cities, highways, railways, and industrial zones, have increased demand for material-handling equipment such as beam cranes. Wind and solar power projects requiring crane installation/maintenance require specific crane types;

shipbuilding/aerospace industries provide considerable growth potential as do modernization programs by governments/private enterprises alike in logistics/construction areas that depend heavily on reliable lifting solutions, which will only continue as sustainable infrastructure projects increase significantly. Beam cranes will support these developments throughout their respective life cycles!

Trends in the Beam Cranes Market

Adopting IoT & Predictive Maintenance

Beam crane manufacturers are taking notice as IoT (Internet of Things) integration is transforming their industry by providing on-the-spot monitoring and predictive maintenance capabilities. Sensors collect information on load capacity, crane movements, and wear and tear to detect potential failures before they happen; this reduces downtime, repair costs, and overall operational efficiency while altogether optimizing performance with AI analytics while meeting compliance regulations, ensuring safe operations are more likely than before; remote control and automation features have also gained popularity with businesses that prioritize efficiency over safety, which has seen IoT-enabled beam cranes gain significant traction among manufacturers in recent years.

Manufacturers Focusing on Lightweight, Energy-Efficient Designs

Manufacturers have exponentially turned their attention towards designing beam cranes made of lightweight yet strong materials like aluminum and advanced alloys to increase efficiency and reduce energy usage. Modern designs utilize energy-efficient motors with regenerative braking systems as an energy-saving measure, while eco-friendly modular crane designs allow easier customization based on industrial needs. Demand for such cranes continues to increase.

Research Scope and Analysis

By Type

Single Girder Beam Cranes are expected to play an essential part in driving market growth and are set to dominate it by 2025 due to their affordability, versatility, and efficiency. These machines are ideal for small to mid-sized industries like manufacturing, warehousing, and logistics where only moderate lifting capacities are necessary. Their lightweight design helps make installation faster and less expensive. Single girder cranes require less maintenance and energy consumption in comparison to double girder cranes, making them the better option in industries that prioritize space-saving lifting solutions and budget-friendly lifting options. Their popularity has led to overall market expansion, particularly in emerging economies.

Further, underhung beam cranes are also expected to show significant market growth in the coming years, due to their space-saving design and flexible operation. Unlike top-running cranes, underhung beam cranes are suspended from the ceiling or roof structures instead of the floor, eliminating the need for extra floor support and making them perfect for factories, workshops, or warehouses with limited floor space. Their ability to move along existing building structures allows efficient material handling without major structural modifications required for material handling operations without incurring major operational costs; furthermore, they are lightweight energy-efficient cranes that contribute significantly towards market expansion as industries seek compact yet cost-effective lifting solutions; their increasing adoption contributes significantly towards market expansion.

By Lifting Capacity

The under 5-ton beam crane segment plays a critical role in driving market expansion due to its cost-effectiveness, ease of use, and suitability for small to medium-sized operations. Cranes with light to moderate lifting capabilities are widely utilized by industries including manufacturing, warehousing, logistics, and workshops. Their compact designs make them suitable for facilities with space restrictions, while their lower energy usage helps lower operational costs.

Small businesses and startups generally prefer lower-capacity cranes due to reduced structural reinforcement needs and maintenance requirements, making them ideal for use by smaller enterprises and startups. Thanks to automation and material handling efficiency gains, demand for below 5-ton beam cranes is rising steadily across emerging economies, aiding overall market expansion.

Further, the more than 50-ton beam crane market segment is driving growth by fulfilling the heavy lifting needs of industries like construction, shipbuilding, steel manufacturing, and aerospace. These cranes handle massive loads with precision to reduce operating costs while increasing efficiency across large-scale operations.

Their use in infrastructure projects, power plants, and heavy machinery manufacturing is growing as industries worldwide expand globally. Automated remote monitoring enhances safety while increasing performance significantly, contributing to overall market expansion as demand for heavy-duty lifting solutions increases among both developed economies and developing ones.

By End User Industry

Construction industries are expected to drive growth in the beam crane market in 2025, as they require effective lifting solutions for heavy materials like steel beams, concrete blocks, and prefabricated structures. Beam cranes help construction companies increase productivity by safely and precisely moving large loads at job sites, decreasing labor costs and improving efficiency. As urbanization, infrastructure investments, and smart city development around the world increase, the demand for high-performance cranes increases rapidly.

Governments and private sectors alike are investing heavily in roads, bridges, commercial buildings, and residential projects, leading to a surge in the need for beam cranes. Advanced technologies, like automation and remote-controlled cranes, enhance safety and efficiency making them more attractive choices for modern construction. Modular and prefabricated construction methods require specialized lifting solutions, increasing crane adoption. Furthermore, as the construction industry expands further so too does demand for beam cranes, fueling overall market growth.

Further, the Logistics and warehousing industries are two of the primary drivers of growth in the beam crane market, as these sectors demand efficient material handling for smooth operations. Beam cranes play a vital role in quickly lifting and transporting heavy goods, pallets, and containers quickly and safely while decreasing manual labor and enhancing efficiency. With the rise of e-commerce, global trade, and supply chain expansions, warehouses are adopting automated lifting solutions to handle rising volumes; space-saving and energy-efficient beam cranes have become popular choices within modern storage facilities while logistics continues its exponential expansion driving market expansion further along.

The Beam Cranes Market Report is segmented on the basis of the following

By Type

- Single Gider Beam Crane

- Double Beam Crane

- Underhung Beam Crane

- Top Running Beam Crane

By Lifting Capacity

- Below 5 Tons

- 5 to 50 Tons

- Above 50 Tons

By End User Industry

- Manufacturing

- Construction

- Mining & Metal Process

- Logistics & Warehousing

- Shipbuilding

- Energy

Regional Analysis

The Region with the largest share in Beam Cranes Market North America is expected to play an integral part in the growth of the beam cranes market by leading the market with a

share of 42.7% in 2025. Its well-established industrial base, particularly within the manufacturing, construction, and logistics sectors, drives demand for efficient material handling solutions. Infrastructure projects related to transportation and energy initiatives further grow this demand for advanced lifting equipment. Furthermore, automation technologies increase the appeal of modern beam cranes equipped with IoT connectivity along with remote monitoring features. Key market players and technological innovation help contribute to North America's dominance within this global industry.

The fastest growing region in Beam Cranes Market

The Asia Pacific region is projected to experience the fastest expansion in their beam crane market over the forecast period owing to rapid urbanization and significant infrastructure development projects. China and India are investing heavily in construction projects, industrial expansion, and transportation networks, creating an increased need for effective material-handling solutions like beam cranes.

Manufacturing sector expansion and the growth of e-commerce contribute significantly to Asia Pacific's rapid expansion, with warehouses and distribution centers needing advanced lifting equipment to handle high volumes of goods. Government megaprojects and favorable economic policies also attract investments into various industries across the Asia Pacific, further driving the adoption of beam cranes across this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The beam cranes market is highly competitive, with many global and regional players providing advanced lifting solutions. Companies aim at innovation, integrating smart technologies like IoT, automation, and remote monitoring to improve efficiency and safety. The market sees strong competition in pricing, customization, and energy-efficient designs. The growth in demand from industries like construction, manufacturing, and logistics drives companies to expand production and improve product quality. Partnerships, mergers, and acquisitions are common strategies for market growth. As industries modernize, manufacturers compete to provide cost-effective and high-performance beam cranes to meet evolving customer needs.

Some of the prominent players in the global Beam Cranes are

- Konecranes

- Liebherr Group

- Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC)

- The Manitowoc Company, Inc

- Tadano Ltd

- GH Cranes & Components

- ABUS Kransysteme GmbH

- OMIS Group

- SWF Krantechnik GmbH

- ABUS Kransysteme GmbH

- Other Key Players

Recent Developments

- In December 2024, Israel Creates a Laser Beam to Chase Cranes Out of Hula Valley in Cooperation With Jewish National Fund, as tens of thousands of cranes stay in northern Israel's Hula Valley over the winter and cause major damage to agricultural produce, prompting the Nature and Parks Authority to work with the JNF on finding a solution

- In December 2024, The Hambantota International Port Group (HIPG) unveiled a high investment of USD 41 million in crane technology, set to be fully operational by January 2025, which includes the installation of four Quay Cranes (QC) and 13 Rubber-Tyred Gantry (RTG) cranes at the Hambantota International Port (HIP), expanding the port’s capabilities to a handling capacity of 1 million TEUs.

- In October 2024, RHC Lifting announced its acquisition by the WH Scott Group, a leading name in the lifting industry across the UK and Ireland, which is a major step for the company, as it creates opportunities for the company to expand and strengthen its portfolio in the market.

- In September 2024, Mammoet launched the Mega Jack 10000, a new addition to its heavy-lifting portfolio. The new system includes 10,400 tons of lifting capacity per tower—upgraded from 5,200 tons without increasing the footprint of the tower base, as it makes less steel is required to support structures as they are lifted, and the heaviest lifts will be able to start meters closer to ground level.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 6.6 Bn |

| Forecast Value (2033) |

USD 11.1 Bn |

| CAGR (2024-2033) |

6.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Single Gider Beam Crane, Double Beam Crane, Underhung Beam Crane, and Top Running Beam Crane), By Lifting Capacity (Below 5 Tons, 5 to 50 Tons, and Above 50 Tons), By End User Industry (Manufacturing, Construction, Mining & Metal Process, Logistics & Warehousing, Shipbuilding, and Energy) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Konecranes, Liebherr Group, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC), The Manitowoc Company, Inc, Tadano Ltd, GH Cranes & Components, ABUS Kransysteme GmbH, OMIS Group, SWF Krantechnik GmbH, ABUS Kransysteme GmbH, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Beam Cranes Market?

▾ The Global Beam Cranes Market size is expected to reach a value of USD 6.6 billion in 2025 and is expected to reach USD 11.1 billion by the end of 2034.

Which region accounted for the largest Global Beam Cranes Market?

▾ North America is expected to have the largest market share in the Global Beam Cranes Market with a share of about 42.7% in 2025.

How big is the Beam Cranes Market in the US?

▾ The Beam Cranes Market in the US is expected to reach USD 2.5 billion in 2025.

Who are the key players in the Global Beam Cranes Market?

▾ Some of the major key players in the Global Beam Cranes Market are Konecranes, Liebherr Group, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC), and others

What is the growth rate in the Global Beam Cranes Market?

▾ The market is growing at a CAGR of 6.0 percent over the forecasted period.