Betaine is a natural compound found in many foods like beets, spinach, and grains. It is also made in laboratories for various uses. Chemically, it is known as trimethylglycine. Betaine is mainly used in animal feed, mainly for poultry and pigs, because it helps with growth and improves digestion. In the human health industry, betaine is used in dietary supplements to support liver function and help reduce a substance called homocysteine in the blood. Additionally, betaine is used in cosmetics and personal care products due to its ability to retain moisture and protect the skin.

In recent years, the demand for betaine has increased steadily. This growth is mainly driven by the animal feed industry, where there is a strong push to improve the health and productivity of livestock. As global meat consumption continues to rise, farmers are looking for feed additives like betaine to make animals grow faster and healthier. At the same time, more people are becoming health-conscious, which increases interest in betaine supplements for humans. The beauty industry is also using more betaine in skin and hair care products, adding to the overall demand.

One major trend is the shift toward natural and plant-based ingredients. Since betaine can be extracted from sugar beets and other plants, it fits well with this trend. Manufacturers are focusing on eco-friendly production and natural labeling to attract consumers. Another trend is the growing use of betaine in sports nutrition products. Athletes and fitness-focused individuals are turning to betaine for its potential benefits in improving muscle strength and endurance. These trends are pushing companies to explore new ways of using betaine in various products.

In the past few years, there have been new product launches and research studies focused on betaine. Some companies have introduced more advanced formulations for feed additives that combine betaine with other nutrients. Research has also explored the role of betaine in reducing stress in animals and improving gut health. In the cosmetics sector, betaine is being included in more clean-label and sensitive-skin products. Regulatory support for natural additives in feed and food has further encouraged its wider adoption.

Despite the growth, the betaine market faces some challenges. The cost of raw materials, especially natural sources like sugar beets, can impact production. Weather changes and crop yields also affect availability. Additionally, companies need to meet strict regulations, especially in feed and food products. Another issue is competition from synthetic alternatives or cheaper additives. However, the rising preference for natural, safe, and multi-functional ingredients gives betaine an advantage in many sectors.

The betaine industry is expected to keep evolving, driven by innovation and changing consumer preferences. Companies are investing in research to better understand how betaine works and where it can be most effective. There is strong potential for growth in developing countries, where demand for meat, personal care, and health supplements is increasing. Overall, betaine’s role as a flexible and natural ingredient positions it well in markets that value health, sustainability, and performance. The combination of scientific research, consumer interest, and industry adaptation is shaping a strong future for betaine.

The US Betaine Market

The US Betaine Market size is projected to reach USD 0.9 billion in 2025 at a compound annual growth rate of 4.3% over its forecast period.

The US plays an important role in the global betaine market, acting as both a key consumer and innovator. With a strong focus on health and wellness, the US market drives demand for betaine in dietary supplements and functional foods. The country’s large livestock industry also supports significant use of betaine as an animal feed additive to improve growth and feed efficiency.

Additionally, US manufacturers invest in research and development to create advanced betaine products, including those with enhanced purity and performance. Strict regulations in the US ensure product safety and quality, which helps build consumer trust. The US market’s emphasis on natural and clean-label products also encourages the growth of plant-based betaine sources, making it a critical hub for innovation and demand in the global betaine industry.

Europe Betaine Market

Europe Betaine Market size is projected to reach USD 1.3 billion in 2025 at a compound annual growth rate of 4.1% over its forecast period.

Europe plays a vital role in the betaine market through strong demand and regulatory influence. The region’s focus on sustainable agriculture and animal welfare drives the use of betaine as a natural feed additive to improve livestock health and productivity. European consumers also value clean-label and natural ingredients, boosting betaine’s presence in food, supplements, and personal care products.

Strict regulations on feed additives and cosmetics ensure high safety and quality standards, encouraging innovation and transparency. Europe is home to many key manufacturers who invest in research to develop new betaine applications, especially in the health and beauty sectors. Additionally, the region’s push toward reducing antibiotic use in animal farming supports betaine as a natural alternative, making Europe a significant and influential market in the global betaine industry.

Japan Betaine Market

Japan Betaine Market size is projected to reach USD 0.2 billion in 2025 at a compound annual growth rate of 4.9% over its forecast period.

Japan holds an important position in the betaine market, driven by its advanced technology and strong focus on health and wellness. Japanese consumers prioritize high-quality, natural ingredients in food, supplements, and cosmetics, which supports steady demand for betaine. The country’s animal farming sector also uses betaine to enhance feed efficiency and improve animal health, especially in poultry and aquaculture.

Japan’s strict regulatory environment ensures the safety and effectiveness of betaine products, pushing manufacturers to maintain high standards and innovate continuously. Additionally, Japanese companies invest in research to explore new betaine applications, such as in sports nutrition and skin care. Japan’s combination of technology, quality focus, and consumer awareness makes it a key player in the global betaine market.

Betaine Market: Key Takeaways

- Market Growth: The Betaine Market size is expected to grow by USD 2.0 billion, at a CAGR of 4.6%, during the forecasted period of 2026 to 2034.

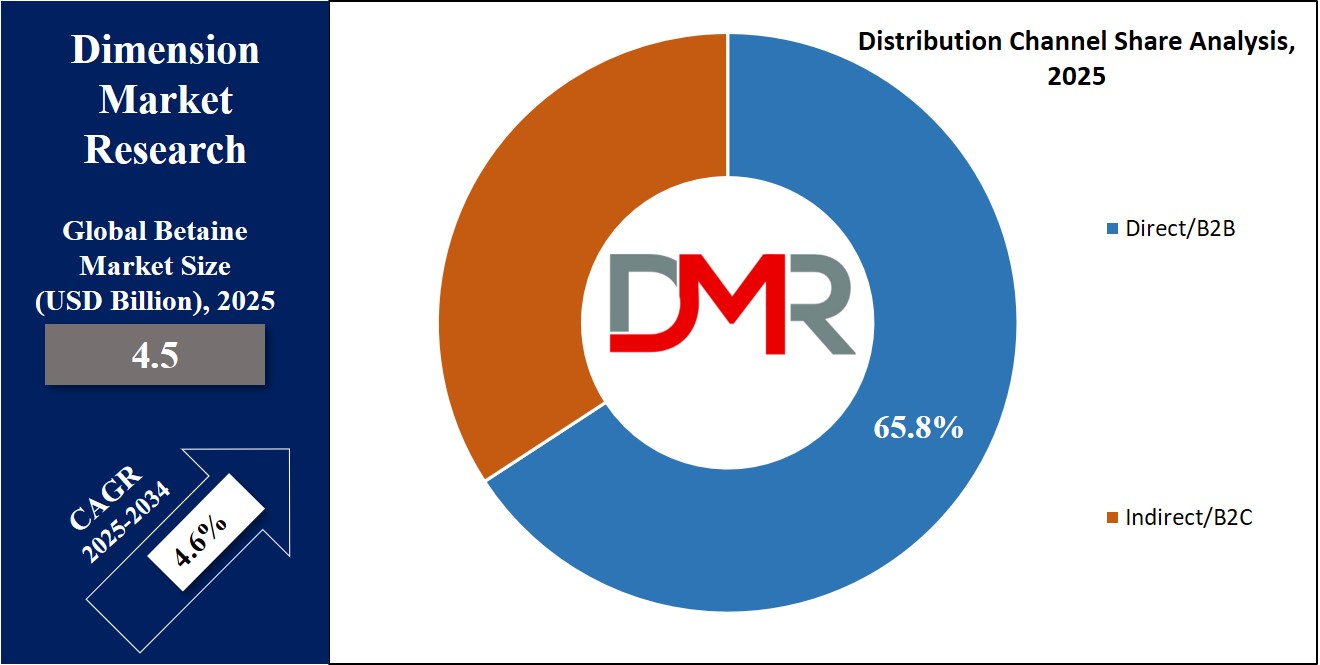

- By Distribution Channel: The Direct/B2B segment is anticipated to get the majority share of the Betaine Market in 2025.

- By Type: The natural segment is expected to get the largest revenue share in 2025 in the Betaine Market.

- Regional Insight: Asia Pacific is expected to hold a 36.2% share of revenue in the Global Betaine Market in 2025.

- Use Cases: Some of the use cases of Betaine include animal nutrition, dietary supplements, and more.

Betaine Market: Use Cases:

- Animal Nutrition: Betaine is widely used as a feed additive in livestock and poultry farming. It helps improve digestion, nutrient absorption, and growth performance in animals. It also supports better meat quality and helps animals cope with heat and stress.

- Dietary Supplements: In human nutrition, betaine is added to supplements to support liver health and metabolic functions. It plays a role in reducing homocysteine levels, which is linked to heart health. Athletes also use it for potential performance and endurance benefits.

- Cosmetics and Personal Care: Betaine is valued in skin and hair care products for its moisturizing and soothing properties. It helps maintain skin hydration and reduces irritation, making it ideal for sensitive-skin formulations. It also improves the texture and feel of creams and shampoos.

- Food and Beverage Industry: Betaine is used in functional foods and beverages for its health-supporting properties. It may be added to energy drinks, protein shakes, or fortified products aimed at improving wellness. Its natural origin fits well with clean-label and health-conscious trends.

Market Dynamic

Driving Factors in the Betaine Market

Rising Demand for Natural and Functional Ingredients

One of the key growth drivers of the betaine market is the increasing consumer preference for natural and functional ingredients. As awareness of health and wellness rises, both food and personal care industries are shifting toward cleaner labels and safer components. Betaine, being naturally derived from sources like sugar beets, fits perfectly into this trend. In cosmetics, it is favored for its gentle and moisturizing properties, especially in products for sensitive skin.

In the food and beverage sector, it is being added to functional products to enhance performance and support metabolic health. This demand for naturally sourced, multi-functional ingredients has significantly boosted the appeal of betaine. Companies are now investing in sustainable sourcing and eco-friendly production to meet consumer expectations. This shift is helping betaine gain wider acceptance in various markets across the globe.

Growth in Livestock Production and Feed Efficiency Needs

The global growth in meat and dairy consumption is another major driver for the betaine market, especially in the animal feed segment. Farmers and feed producers are constantly looking for ways to improve feed efficiency and animal health without relying heavily on antibiotics. Betaine helps by enhancing digestion, supporting liver function, and improving nutrient absorption in livestock, leading to better growth rates and healthier animals. It also aids animals in coping with heat stress, which is becoming increasingly important in warmer regions.

As developing countries expand their livestock production to meet rising food demands, the need for effective feed additives like betaine continues to grow. Regulatory bodies encouraging the reduction of antibiotic use in animal farming have also supported the adoption of natural alternatives like betaine. This ongoing push for improved animal health and production efficiency is a key factor driving market expansion.

Restraints in the Betaine Market

Fluctuating Raw Material Supply and Costs

One major restraint in the betaine market is the reliance on natural sources like sugar beets, which are subject to agricultural conditions. Weather patterns, crop diseases, and changes in farming practices can all impact the availability and quality of raw materials. This leads to unpredictable supply and price fluctuations that make it harder for manufacturers to maintain stable production and pricing.

In regions where sugar beet farming is limited, companies may face supply shortages or higher import costs. Additionally, the processing and extraction of betaine from natural sources require careful handling and technology, which can add to production expenses. These supply-related challenges make it difficult for small producers to compete, especially in cost-sensitive markets. Such fluctuations can slow down the adoption of betaine in emerging applications.

Regulatory and Compliance Challenges

Another restraint for the betaine market comes from strict regulations across different industries, especially in food, feed, and cosmetics. Each region has its own rules regarding the approval, labeling, and safety testing of additives, which can create hurdles for market entry. For example, introducing a new betaine-based feed additive may require extensive trials and documentation to meet government standards. These processes are often time-consuming and expensive, particularly for smaller companies.

In personal care, claims about natural or skin-friendly ingredients must be backed by scientific evidence, adding pressure on manufacturers. Furthermore, changing regulations can delay product launches or force reformulation. Navigating this complex regulatory landscape limits the speed at which companies can expand, affecting overall market growth and innovation in betaine applications.

Opportunities in the Betaine Market

Expansion into Emerging Markets

A major opportunity for the betaine market lies in the rapid growth of emerging economies. Countries in Asia, Africa, and Latin America are experiencing rising demand for meat, personal care products, and health supplements due to growing populations and rising incomes. This trend is increasing the need for high-quality animal feed, functional foods, and natural cosmetic ingredients—areas where betaine plays a key role.

As more consumers in these regions seek healthier and more natural products, manufacturers have a chance to introduce betaine-based solutions. Local production and distribution partnerships can help companies enter these markets more efficiently. Government support for agricultural improvements and health-focused products further strengthens this opportunity. The untapped potential in these regions could significantly boost global betaine demand in the coming years.

Product Innovation and New Applications

Another strong opportunity in the betaine market comes from innovation and the development of new uses. Research constantly uncover more health and performance benefits of betaine, opening the door for new formulations in sports nutrition, pharmaceuticals, and wellness drinks. Companies are also exploring advanced blends of betaine with other ingredients to enhance its effectiveness and broaden its appeal. In the cosmetics industry, the push for multifunctional, gentle, and sustainable ingredients allows for new personal care products using betaine.

Additionally, the use of betaine in pet nutrition and aquaculture is gaining attention as these sectors grow. Customizing betaine-based products for niche needs, such as heat-stress control in tropical farming, can also create new revenue streams. Continuous innovation will help companies differentiate themselves and expand their reach in a competitive market.

Trends in the Betaine Market

Surge in Demand for Natural and Clean-Label Ingredients

A significant trend in the betaine market is the increasing consumer preference for natural and clean-label ingredients. As health-conscious consumers seek products with minimal processing and recognizable components, betaine derived from natural sources like sugar beets and wheat has gained popularity.

This shift is evident in various industries, including food and beverages, personal care, and animal feed. In the food sector, betaine is utilized for its health benefits, such as supporting liver function and enhancing digestion. In personal care, its moisturizing properties make it a favored ingredient in skincare and haircare products. This growing demand aligns with the broader trend towards sustainability and transparency in product labeling, prompting manufacturers to incorporate betaine into their offerings to meet consumer expectations for natural and functional ingredients.

Technological Advancements in Betaine Production

Technological innovations are playing a pivotal role in the evolution of the betaine market. Advancements in extraction and production processes have led to more efficient and sustainable methods of obtaining betaine. For instance, companies are employing

artificial intelligence and advanced filtration systems to produce low-salt betaines, enhancing product quality and expanding application possibilities.

These technological developments not only improve the performance of betaine in various products but also contribute to cost reductions and increased production capacities. As a result, manufacturers can offer a wider range of betaine-based products, catering to the diverse needs of industries such as pharmaceuticals, cosmetics, and agriculture.

Research Scope and Analysis

By Type Analysis

Natural betaine, as a type, is expected to hold a significant share of around 57.5% in 2025, driving much of the market’s growth. Its popularity is rising due to increasing consumer preference for clean-label and plant-based ingredients. Derived mainly from sources like sugar beets and wheat, natural betaine is favored in animal feed, dietary supplements, and personal care products for its safety and effectiveness.

The growing focus on sustainability and environmentally friendly production methods also supports this segment. As more industries look for natural alternatives to synthetic additives, the demand for natural betaine continues to expand. This trend is reinforced by stricter regulations promoting natural ingredients and the rising awareness of health benefits among consumers, making natural betaine a key contributor to the overall growth of the market.

Synthetic betaine is also expected to experience significant growth over the forecast period, mainly due to its consistent quality and cost advantages. This type is commonly used where precise purity and performance are needed, such as in pharmaceuticals, cosmetics, and certain food applications. Additionally, the rise of autonomous service robots in industries like agriculture and food processing supports synthetic betaine’s growth by improving efficiency and quality control in production.

These robots help streamline the extraction and formulation processes, making synthetic betaine more accessible and affordable. With ongoing technological advancements and increased automation, synthetic betaine’s role in the market is set to expand alongside natural betaine, catering to diverse industry needs.

By Form Analysis

The powder form of betaine is projected to hold a strong position with an estimated share of around 47.2% in 2025, supporting significant market growth. This form is popular because it is easy to handle, store, and transport, making it ideal for use in animal feed, dietary supplements, and food products. Powdered betaine also offers longer shelf life and better stability compared to liquids, which makes it a preferred choice for many manufacturers.

Its versatility allows it to be mixed into various formulations without affecting taste or texture. As industries seek convenient and efficient ways to incorporate functional ingredients, the powder form of betaine continues to gain traction. This increasing preference is reinforced by advances in processing technology and growing demand for clean-label, natural additives.

Liquid betaine is expected to see notable growth over the forecast period due to its ease of mixing and quick absorption, making it useful in sectors like cosmetics, pharmaceuticals, and animal nutrition. The liquid form allows for fast incorporation into feeds, beverages, and skincare products, improving product performance.

Autonomous service robots in production facilities help maintain consistency and precision during the mixing and packaging of liquid betaine, enhancing quality control and efficiency. This technology reduces human error and speeds up manufacturing processes. As automation becomes more widespread in the industry, liquid betaine production benefits from improved scalability and cost-effectiveness, supporting its expanding use in multiple applications worldwide.

By Source Analysis

Sugar beet as a source is set to dominate the betaine market with an estimated share of about 61.1% in 2025, driving significant growth. This is because sugar beet provides a rich and natural supply of betaine, making it a preferred raw material for manufacturers focused on clean-label and sustainable products. Its availability in large quantities and relatively low extraction cost contribute to its popularity in industries such as animal nutrition, food, and personal care. The growing demand for natural and plant-based ingredients strengthens the role of sugar beet in the market.

Additionally, improvements in farming techniques and processing technologies are making it easier to produce high-quality betaine from sugar beets, supporting the expansion of this segment and meeting rising global demand.

Synthetic sources of betaine are expected to grow significantly over the forecast period, mainly due to their consistency in quality and purity. These sources allow manufacturers to produce betaine with specific characteristics suited for pharmaceuticals, cosmetics, and specialized food products. The integration of autonomous service robots in manufacturing facilities helps improve production efficiency by automating extraction, blending, and packaging processes.

This reduces errors, speeds up operations, and ensures uniform product quality. As technology advances, synthetic betaine production benefits from increased automation, making it more scalable and cost-effective. This trend supports wider adoption of synthetic betaine in various industries that require precise formulations and high performance.

By Application Analysis

Animal feed as an application is expected to hold a significant share of about 43.7% in 2025, fueling notable growth in the betaine market. Betaine is widely used in animal nutrition to improve feed efficiency, support digestion, and enhance growth performance in livestock and poultry. Its ability to help animals cope with heat stress and maintain overall health makes it highly valuable in farming.

As global demand for meat and dairy products rises, the need for effective and natural feed additives like betaine increases. Advances in farming practices and a focus on sustainable animal production further boost this segment. Additionally, rising awareness of antibiotic alternatives in animal feed encourages the adoption of betaine, driving steady growth in this application across different regions.

Cosmetics and personal care applications are set to see strong growth due to the rising demand for natural and gentle ingredients like betaine. This ingredient is valued for its moisturizing, soothing, and anti-irritant properties, making it popular in skincare and haircare products. The use of autonomous service robots in manufacturing helps improve product consistency and safety by automating mixing and packaging processes.

These robots enhance production speed and reduce contamination risks, which is critical for the cosmetics industry. With consumers increasingly seeking clean-label and effective personal care products, betaine’s role is expanding. Automation and innovation in production are helping companies meet this growing demand efficiently, supporting the market’s overall expansion.

By Distribution Analysis

Direct or B2B distribution is projected to lead the betaine market with an estimated share of around 65.8% in 2025, playing a major role in its growth. This channel allows manufacturers to supply betaine directly to industries such as animal feed, pharmaceuticals, and personal care, ensuring bulk orders and long-term contracts. The direct approach helps build strong relationships between suppliers and businesses, allowing for customized product solutions and better pricing. It also supports efficient supply chain management, reducing delays and improving reliability.

As companies focus on scaling production and meeting large demand, the B2B channel becomes increasingly important. Advances in technology and automation further streamline order processing and delivery, making direct sales more attractive and efficient, which contributes significantly to the expanding betaine market.

Indirect or B2C distribution is also set to experience notable growth as consumers increasingly seek products containing betaine in retail stores and online platforms. This channel reaches end-users directly through supermarkets, pharmacies, and e-commerce, making betaine-based supplements, cosmetics, and functional foods more accessible.

Autonomous service robots in warehouses and fulfillment centers enhance efficiency by automating packaging and shipping, speeding up order processing and reducing errors. These technological improvements help meet growing consumer demand for natural and effective products quickly and reliably. The expansion of online shopping and health awareness supports the rise of B2C distribution, making it a valuable channel for betaine market growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Betaine Market Report is segmented on the basis of the following:

By Type

- Natural Betaine

- Synthetic Betaine

By Form

By Source

- Sugar Beet

- Synthetic Sources

By Application

- Food & Beverages

- Functional Foods

- Sports Nutrition

- Dietary Supplements

- Animal Feed

- Poultry

- Swine

- Aquaculture

- Ruminants

- Pharmaceuticals

- Cosmetics & Personal Care

- Hair Care

- Skin Care

- Oral Care

- Detergents

- Industrial Applications

By Distribution Channel

- Direct/B2B

- Indirect/B2C

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

Regional Analysis

Asia Pacific Leading Region in the Betaine MarketAsia Pacific is playing a major role in the growth of the betaine market, with an estimated share of around

36.2% in 2025. This region is experiencing rapid growth due to increasing demand for animal feed additives, health supplements, and personal care products. Rising populations and improving living standards in countries like China, India, and Southeast Asian nations are boosting the need for better livestock production and healthier food options. The shift toward natural and clean-label ingredients is also strong in this region, encouraging the use of betaine sourced from plants like sugar beets.

Additionally, expanding awareness of health benefits and a growing middle class drive consumer interest in dietary supplements and cosmetics containing betaine. Governments supporting sustainable agriculture and stricter regulations on feed additives further promote market growth. Overall, Asia Pacific’s combination of rising demand, consumer awareness, and regulatory support is making it a key driver of the global betaine market’s expansion.

Fastest Growing Region in the Betaine Market

Latin America is showing significant growth in the betaine market over the forecast period, driven by rising demand in animal nutrition and health supplements. Countries in this region are expanding their livestock and poultry industries to meet increasing food consumption. This growth encourages the use of betaine as a natural feed additive to improve animal health and productivity. Additionally, growing consumer interest in natural and functional ingredients supports the use of betaine in dietary supplements and personal care products. With ongoing improvements in agriculture and a focus on sustainable farming practices, Latin America is becoming an important area for betaine market expansion. Increasing awareness about the benefits of betaine also helps boost its adoption across various sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The betaine market is becoming more competitive as demand grows across industries like animal feed, health supplements, and personal care. Many producers are working to improve their products by using natural sources and advanced processing methods. Some focus on making high-purity or blended versions of betaine to stand out. Others compete by offering better pricing, quality, or supply chain reliability. As more industries discover new uses for betaine, both small and large manufacturers are entering the market.

Companies are also investing in research to support the benefits of betaine, helping them create new opportunities. With rising global demand and different types of end-users, the market is active, with players trying to build strong positions through innovation, partnerships, and regional expansion.

Some of the prominent players in the Global Betaine are:

- BASF SE

- DuPont

- Evonik

- Dow Chemical

- Solvay

- Kao Corp

- Stepan Company

- Merck KGaA

- Lubrizol Corp

- New Japan Chemical

- Solazyme Inc

- Hinduja Global Solutions

- Amino GmbH

- United Sugars Corp

- Haike Group

- INOLEX

- IFF

- Other Key Players

Recent Developments

- In April 2025, BASF introduced its first personal care products under this label. The company’s cocoamidopropyl betaine ingredients, Dehyton PK 45 and Dehyton KE UP, are now certified as EcoBalanced grades using a biomass balance (BMB) method. Commonly used in products like body washes and toothpaste, betaines act as secondary surfactants. They improve foam, enhance viscosity, and reduce skin irritation—key features that boost cleansing performance and overall user satisfaction.

- In April 2025, AN SUPPS™, the North American arm of Applied Nutrition PLC and owner of brands like AN PERFORMANCE™, AN ESSENTIALS™, and ABE®, has entered a strategic partnership with TANG®, as the collaboration introduces co-branded TANG® sports nutrition products across North America, blending nostalgic appeal with modern wellness benefits. With AN SUPPS™ providing industry expertise, manufacturing, and distribution, TANG® marks its debut in the sports nutrition category with a range of flavors and product formats.

- In April 2025, Biotech company IFF has expanded its pet product range with the launch of Betafin® Pet, a natural betaine designed to support hydration, gut health, and overall wellness in dogs and cats, which aligns with IFF’s mission to transform companion animal care through innovation and advanced biotechnology. According to Jordon Gruber, Ph.D., the new portfolio enables brands to address major pet health concerns—like gut health, dental care, hydration, and odor control—while standing out in a highly competitive market.

- In April 2025, Eton Pharmaceuticals, Inc. a company specializing in treatments for rare diseases, has submitted a New Drug Application (NDA) to the U.S. FDA for ET-600, its patented oral desmopressin solution aimed at treating central diabetes insipidus. The company anticipates a standard 10-month FDA review period, which could lead to approval and commercial launch in the first quarter of 2026. ET-600 represents a key development in Eton’s mission to deliver innovative therapies for rare health conditions.