Market Overview

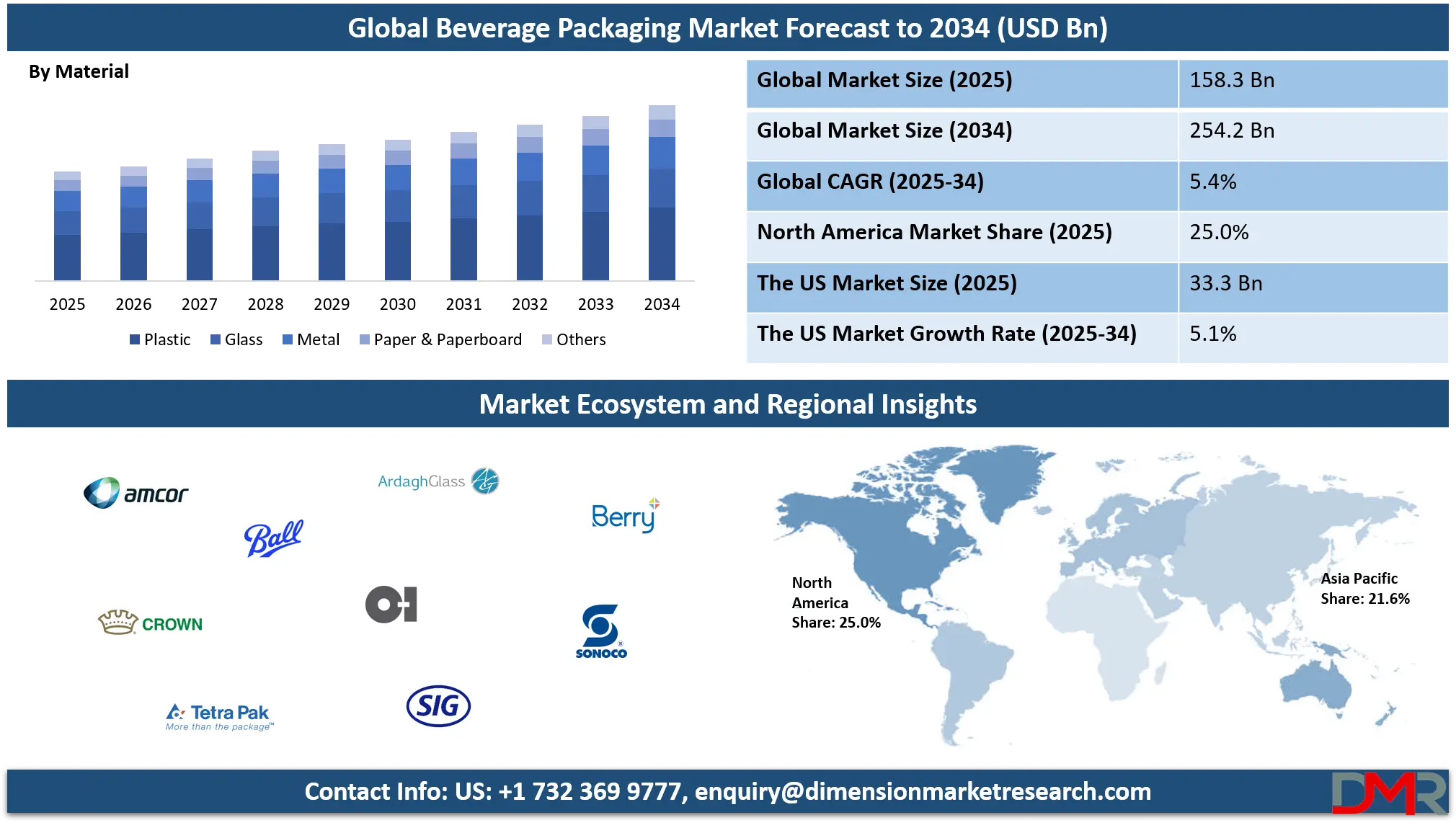

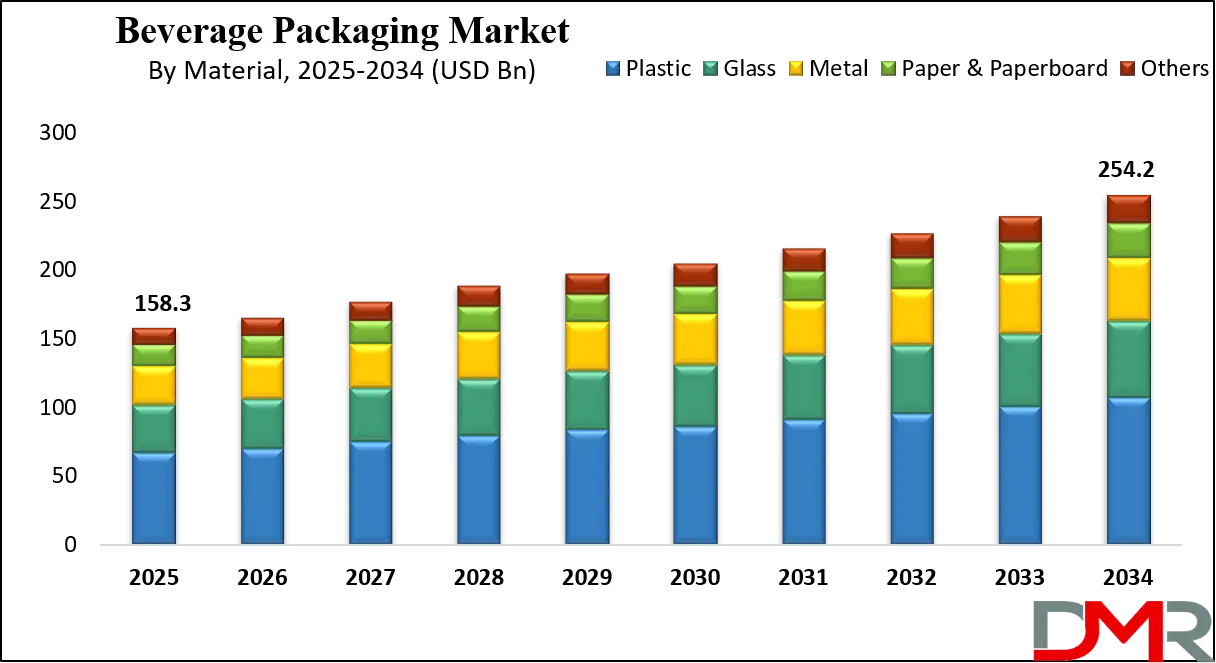

The global beverage packaging market is projected to reach USD 158.3 billion in 2025 and is expected to grow to USD 254.2 billion by 2034, expanding at a CAGR of 5.4%. This growth is driven by rising demand for sustainable packaging, growing consumption of ready-to-drink beverages, and advancements in smart and eco-friendly packaging materials.

Beverage packaging refers to the process and materials used to encase and protect beverages during storage, transportation, and consumption. It encompasses various formats such as bottles, cans, cartons, and pouches, crafted from plastic, glass, metal, and paperboard. The primary function of beverage packaging is to maintain the drink's integrity, safety, and freshness while offering ease of use and aesthetic appeal to the consumer.

Additionally, it plays a crucial role in brand visibility, labeling, portion control, and compliance with food safety regulations. Innovations in sustainable packaging and smart packaging technologies are reshaping how beverages are presented in the market, aiming to balance convenience with environmental responsibility.

The global beverage packaging market is experiencing substantial growth, driven by evolving consumer preferences, growing urbanization, and the expanding variety of drink products in the retail and on-the-go segments. Rising demand for ready-to-drink products, functional beverages, and sustainable solutions has spurred packaging manufacturers to invest in lightweight, recyclable, and biodegradable materials. The proliferation of personalized and premium beverages across emerging economies, particularly in Asia Pacific and Latin America, is further contributing to the market's expansion. Growth is also supported by technological advancements in packaging machinery and automation, enhancing production efficiency and reducing waste.

Moreover, regulatory pressure around environmental concerns and single-use plastics has led to a surge in demand for eco-friendly beverage containers such as paper-based bottles and plant-based polymers. As e-commerce and direct-to-consumer delivery channels grow, manufacturers are also prioritizing protective, leak-proof, and tamper-evident packaging formats. With continuous innovation and strategic partnerships among packaging firms and beverage brands, the global market is poised to witness consistent evolution, catering to both mass-market and niche beverage categories across the globe.

The US Beverage Packaging Market

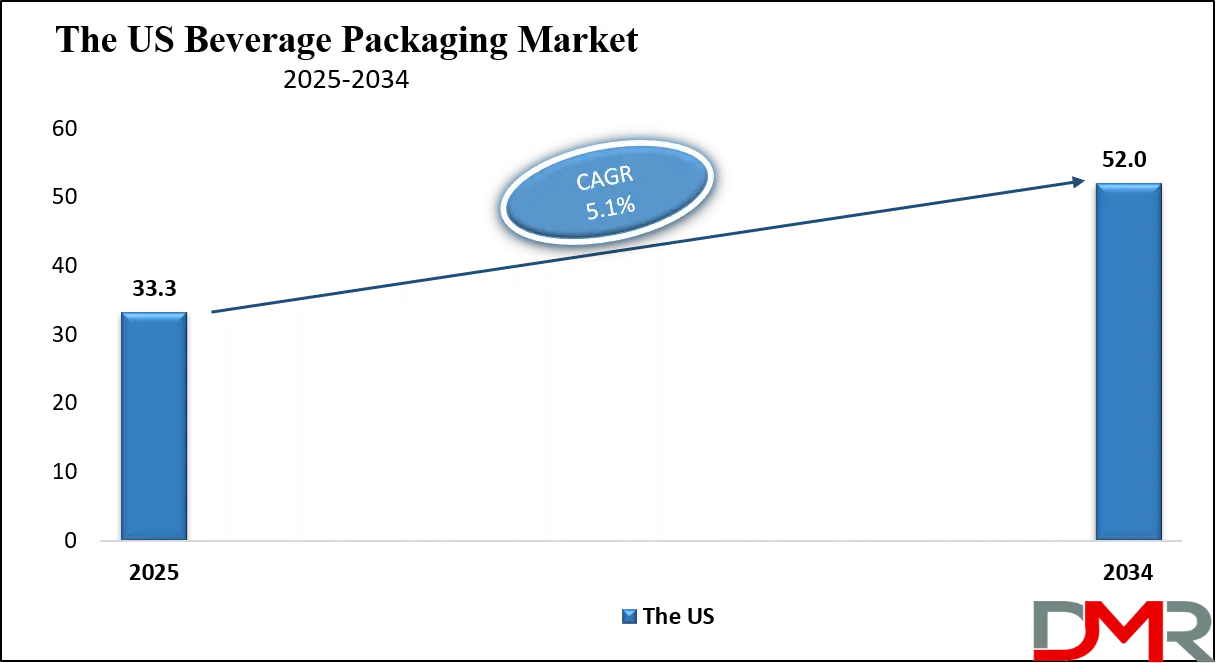

The U.S. Beverage Packaging Market size is projected to be valued at USD 33.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 52.0 billion in 2034 at a CAGR of 5.1%.

The U.S. beverage packaging solutions market is witnessing rapid transformation driven by shifting consumer lifestyles, growing preference for on-the-go consumption, and a strong emphasis on sustainability. Packaging innovation in the United States is being influenced by the growing demand for convenience, shelf appeal, and functional designs that cater to diverse beverage categories such as sparkling water, plant-based drinks, craft beverages, and fortified functional beverages. Key players in the industry are focusing on lightweight materials, resealable formats, and tamper-evident closures to enhance user experience and product safety. Additionally, the rising trend of personalized and limited-edition packaging is gaining traction among brands seeking to boost consumer engagement and brand loyalty.

Sustainability remains a core driver in the evolution of beverage packaging solutions in the U.S., with growing regulatory and consumer pressure to reduce single-use plastics and carbon footprints. This has led to a surge in demand for recyclable, compostable, and biodegradable packaging options, including paper-based cartons, aluminum cans, and bioplastic bottles.

The integration of smart packaging technologies such as QR codes, NFC tags, and freshness indicators is also growing, especially in premium and health-focused beverage segments. As e-commerce and direct-to-consumer beverage sales rise, packaging designs are also being optimized for durability, leak prevention, and temperature control. Together, these trends are shaping a dynamic and forward-looking beverage packaging ecosystem in the United States.

The European Beverage Packaging Market

Europe’s beverage packaging market is poised to reach approximately USD 34.8 billion in 2025, reflecting its significant role within the global landscape. This strong market value is underpinned by the region’s mature beverage industry, characterized by a wide variety of products ranging from carbonated soft drinks and bottled water to premium alcoholic beverages and functional drinks. European consumers are demanding sustainable and innovative packaging solutions, which has driven companies to invest heavily in eco-friendly materials such as biodegradable plastics, recycled PET, and lightweight aluminum cans.

Additionally, stringent environmental regulations across countries like Germany, France, and the Netherlands are pushing manufacturers to adopt circular economy principles and reduce their carbon footprint, further accelerating market growth. The presence of leading packaging companies and well-established supply chains also contributes to Europe’s robust market position.

The region is expected to experience a healthy compound annual growth rate of around 7.0% through 2025, fueled by ongoing innovation and changing consumer preferences. Growth drivers include rising demand for convenience packaging, the expansion of ready-to-drink and health-oriented beverages, and growing adoption of smart packaging technologies such as QR codes and tamper-evident seals.

Furthermore, the rise of e-commerce and modern retail formats in Europe is creating new opportunities for packaging that offers durability and an enhanced user experience during transport and storage. Overall, Europe’s beverage packaging market is set to expand steadily, supported by a combination of regulatory support, consumer awareness, and technological advancements.

The Japanese Beverage Packaging Market

Japan’s beverage packaging market is projected to reach approximately USD 11.0 billion in 2025, highlighting its important position within the Asia-Pacific region and the global beverage packaging landscape. The market benefits from Japan’s strong beverage industry, which includes a diverse range of products such as bottled water, tea, coffee, carbonated drinks, and alcoholic beverages like sake and craft beer. Japanese consumers place a high value on quality, convenience, and innovation, driving demand for advanced packaging solutions that preserve freshness, enhance portability, and provide user-friendly features.

Additionally, sustainability is gaining prominence, with growing interest in recyclable materials and environmentally responsible packaging practices, reflecting both consumer awareness and government initiatives focused on reducing plastic waste and promoting circular economy principles.

Despite a relatively moderate growth rate, the Japanese market is expected to expand at a steady compound annual growth rate of around 3.0% through 2025. This growth is supported by ongoing technological advancements, including lightweight packaging materials, aseptic packaging, and smart packaging features that improve product safety and traceability. The rising popularity of ready-to-drink beverages and functional drinks such as health supplements and vitamin-infused waters is also stimulating demand for innovative packaging formats tailored to on-the-go lifestyles.

Moreover, the country’s efficient distribution networks and growing adoption of e-commerce channels provide further momentum, ensuring that Japan’s beverage packaging market remains resilient and continues to evolve in line with consumer trends and environmental priorities.

Global Beverage Packaging Market: Key Takeaways

- Market Value: The global beverage packaging market size is expected to reach a value of USD 254.2 billion by 2034 from a base value of USD 158.3 billion in 2025 at a CAGR of 5.4%.

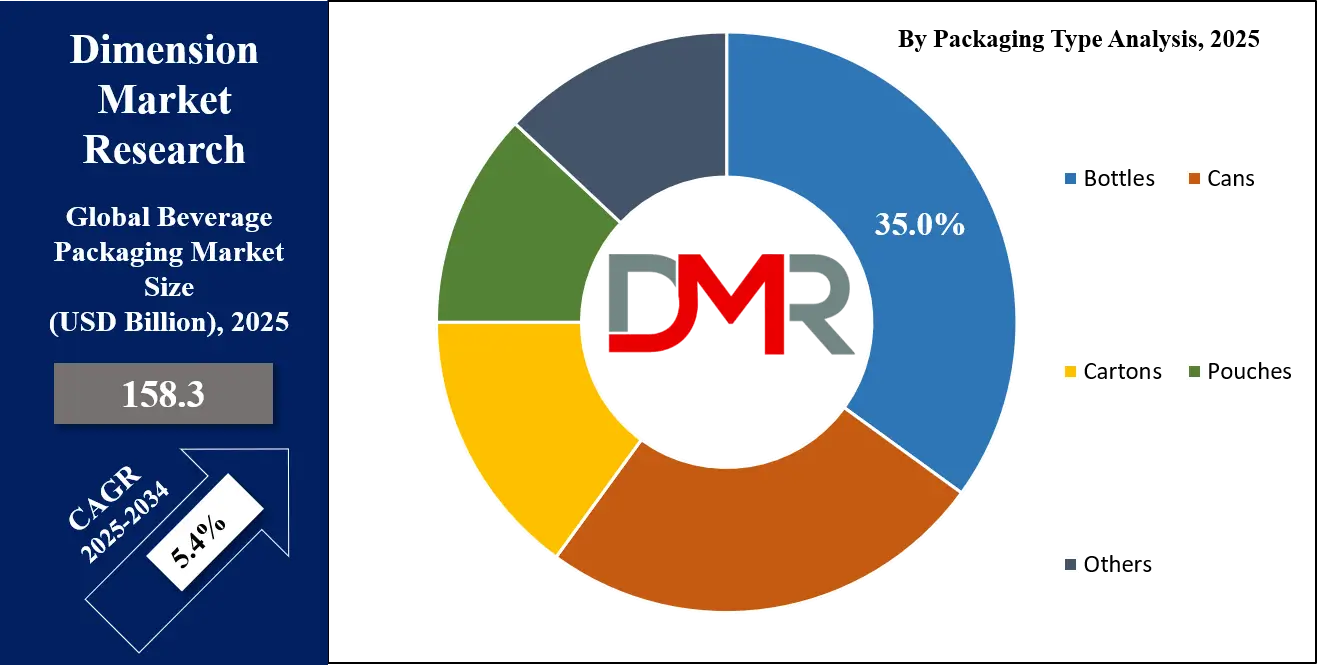

- By Packaging Type Segment Analysis: Bottles are poised to consolidate their dominance in the packaging type segment, capturing 35.0% of the total market share in 2025.

- By Material Segment Analysis: Plastic materials are anticipated to maintain their dominance in the material segment, capturing 42.0% of the total market share in 2025.

- By Beverage Type Segment Analysis: Non-Alcoholic Beverages are expected to maintain their dominance in the beverage type segment, capturing 65.0% of the total market share in 2025.

- By Technology Segment Analysis: Standard Packaging will lead in the technology segment, capturing 55.0% of the market share in 2025.

- By End-Use Industry Vertical Segment Analysis: The Retail industry is anticipated to maintain its dominance in the end-use industry vertical segment, capturing 68.0% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global beverage packaging market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global beverage packaging market are Amcor, Ball Corporation, Crown Holdings, Tetra Pak, Ardagh Group, Owens-Illinois (O-I), SIG Combibloc, Berry Global, Sonoco Products Company, Smurfit Kappa, Mondi Group, Sealed Air Corporation, DS Smith, Reynolds Group Holdings, WestRock, Uflex Ltd., Huhtamaki, ALPLA Group, and Other Key Players.

Global Beverage Packaging Market: Use Cases

- Sustainable Packaging Solutions for Eco-Conscious Consumers: With growing environmental awareness, beverage brands are adopting sustainable packaging materials to align with consumer values and meet regulatory standards. Companies are using recyclable PET bottles, aluminum cans, and paper-based cartons that reduce landfill waste and lower carbon emissions. Major beverage companies are launching circular economy initiatives, such as refillable packaging models and closed-loop recycling systems, to promote eco-friendliness. This use case reflects the industry's shift toward biodegradable materials, compostable plastics, and plant-based polymers in response to the plastic pollution crisis and extended producer responsibility (EPR) policies in regions like Europe and North America.

- Smart Packaging for Enhanced Consumer Interaction and Product Safety: Smart packaging technologies such as QR codes, RFID tags, and temperature sensors are being integrated into beverage packaging to improve traceability, freshness monitoring, and consumer engagement. In functional drinks and premium health beverages, freshness indicators or tamper-proof seals are used to assure quality and safety. QR-enabled packaging allows consumers to access digital content, nutritional information, or loyalty programs, enhancing brand interaction and transparency. This use case exemplifies how smart beverage packaging creates value beyond containment, combining digital innovation with product functionality.

- On-the-Go Packaging for Urban and Mobile Lifestyles: In urban environments, consumer demand for portability and ease of use is driving the adoption of lightweight, resealable, and spill-proof beverage containers. Ready-to-drink coffees, energy drinks, and flavored waters are packaged in single-serve formats such as slim cans, flexible pouches, or compact bottles. These formats are optimized for convenience, storage efficiency, and mobility. Packaging designs often include ergonomic grips, twist caps, and durable materials that cater to busy lifestyles, fitness routines, and travel needs. This use case highlights the role of beverage packaging in improving user convenience and growing impulse purchases at retail points.

- Brand Differentiation through Premium and Custom Packaging: Beverage packaging plays a critical role in branding, shelf visibility, and market positioning. Brands are using unique shapes, vibrant designs, textured finishes, and limited-edition packaging to stand out in a crowded marketplace. For example, premium wine and spirit brands invest in embossed glass bottles and foil stamping to convey luxury, while emerging startups in the kombucha or CBD beverage space use minimalist, eco-inspired designs to appeal to niche markets. Customization and digital printing technologies enable small batch runs with personalized labels, fostering consumer connection and loyalty. This use case demonstrates how packaging enhances brand identity, storytelling, and perceived product value.

Global Beverage Packaging Market: Stats & Facts

United States

- In 2018, the generation of aluminum packaging was estimated at 1.9 million tons, accounting for 0.7% of total municipal solid waste (MSW) generation.

- Approximately 50.4% of aluminum beverage cans were recycled in 2018.

- The recycling rate for corrugated boxes was 96.5% in 2018.

- The generation of plastic containers and packaging was estimated at 14.5 million tons in 2018, representing about 5.0% of total MSW generation.

- The New York State Senate passed the Packaging Reduction and Recycling Infrastructure Act, aiming to reduce packaging waste and improve recyclability over the next 25 years.

Canada

- In 2023, the return rate for beverage containers under the Return-It system was 79.6%.

- Approximately 1.73 billion beverage containers were sold in 2023, with about 1.38 billion recovered.

- Since 2007, approximately 3 billion alcohol containers have been recycled through the Ontario Deposit Return Program.

- Annually, about 80% of all beverage containers are returned to The Beer Store for recycling.

European Union and Europe

- In 2019, the European Parliament voted to ban all food and beverage containers made from expanded polystyrene throughout EU member states.

- Austria introduced a 25-cent deposit on all plastic bottles and aluminum cans in 2025.

- Belgium applies deposits of €0.10 and €0.20 on smaller and larger beer bottles, respectively.

- Croatia levies a refundable deposit of 0.50 kn on non-refillable containers, achieving up to a 90% collection rate in 2015.

- The Czech Republic has a deposit system with a CZK 3 deposit on non-refillable beer bottles.

- Estonia has operated a universal deposit and recycling system since 2005, with a €0.10 deposit on most beverage containers.

- Ireland introduced a Deposit Return Scheme for plastic bottles and aluminum cans in 2024, with deposits from €0.15 to €0.25.

- Lithuania’s deposit legislation, implemented in 2016, achieved a 93% return rate by 2018.

- In Europe, the steel can recycling rate was 79.5% in 2016.

- Aluminum cans are the most recycled beverage containers globally, with a 69% recycling rate.

- More than 85% of all steel products in Europe are recycled at the end of life.

- An estimated 630 million tonnes of steel scrap were recycled globally in 2017, saving 945 million tonnes of CO₂ emissions.

- Recycling one tonne of steel saves 1.5 tonnes of CO₂, 1.4 tonnes of iron ore, and 740 kg of coal.

Australia

- Over 97% of Australia's population lives in areas where expanded polystyrene is banned, with bans enacted between 2021 and 2023.

United Kingdom

- The UK introduced a packaging tax under the Extended Producer Responsibility initiative, expected to raise prices on drinks, kitchenware, and small appliances.

- British food firms lobbied for a one-year delay on a £1.7 billion plastic packaging tax initially aimed at improving recycling rates and reducing pollution.

- Small food businesses expressed concerns that the packaging tax could cost the sector £1.4 billion in its first year.

India (Andhra Pradesh)

- The Andhra Pradesh government revived its anti-plastic initiative to combat plastic pollution in major urban centers such as Vijayawada, Visakhapatnam, Tirupati, and Kurnool.

Global Beverage Packaging Market: Market Dynamics

Global Beverage Packaging Market: Driving Factors

Surge in Demand for Functional and Ready-to-Drink Beverages

The rising consumption of functional beverages, including energy drinks, sports drinks, and health-infused waters, is significantly boosting demand for innovative beverage packaging formats. Consumers are seeking convenience and health benefits, leading brands to introduce single-serve, resealable, and easy-to-carry packaging. Lightweight materials, user-friendly closures, and portable sizes have become essential features. This consumer shift is particularly evident in urban areas and among younger demographics, fueling demand for flexible pouches, slim cans, and recyclable PET bottles.

Growing Focus on Sustainable and Recyclable Packaging Materials

Environmental concerns and stricter sustainability regulations are compelling beverage manufacturers to shift toward eco-friendly packaging. Brands are replacing traditional plastics with recyclable aluminum, biodegradable bioplastics, and compostable paperboard cartons. Governments and environmental agencies across North America and Europe are enforcing Extended Producer Responsibility (EPR) laws, accelerating this transition. As a result, packaging companies are investing in closed-loop systems and plant-based materials to reduce their carbon footprint and align with global climate goals.

Global Beverage Packaging Market: Restraints

High Costs of Sustainable and Smart Packaging Technologies

While demand for sustainable and smart packaging is growing, the high cost of biodegradable materials, advanced printing, and integrated tracking technologies presents a barrier for many manufacturers, especially small and medium enterprises. These costs often translate into higher product prices, which can limit mass adoption in cost-sensitive markets. Additionally, transitioning existing production lines to accommodate these materials involves significant capital expenditure.

Recycling Infrastructure and Material Contamination Issues

Despite the rising use of recyclable packaging materials, limited recycling infrastructure in several developing and emerging markets restricts effective waste management. Cross-contamination of materials such as mixed plastics or multilayer laminates often renders the packaging unrecyclable. Furthermore, the lack of standardized recycling guidelines across countries hampers the implementation of sustainable packaging solutions on a global scale.

Global Beverage Packaging Market: Opportunities

Rapid Expansion of E-Commerce and Direct-to-Consumer Beverage Brands

The growth of e-commerce and direct-to-consumer beverage startups has opened new avenues for tailored packaging solutions. Online beverage delivery requires robust, protective, and leak-resistant packaging to maintain product integrity during transit. This offers packaging companies the opportunity to innovate in the areas of shock-resistant cartons, insulated containers, and tamper-evident seals optimized for digital retail. Custom branding and digital printing are also in high demand for limited runs in subscription models.

Rising Adoption of Plant-Based and Biodegradable Packaging

As consumers become more eco-conscious, there is a growing preference for plant-based materials such as PLA (polylactic acid), cellulose films, and mushroom-based packaging in the beverage industry. These biodegradable alternatives present significant growth potential, particularly in organic and premium drink segments. Companies investing in these novel materials stand to differentiate their brand and gain market share in sustainability-driven markets like Europe and North America.

Global Beverage Packaging Market: Trends

Personalization and Digital Printing in Beverage Packaging

Brands are leveraging advanced digital printing technologies to offer personalized packaging for events, promotions, and seasonal launches. This trend is enhancing customer engagement and brand loyalty, especially among Gen Z and millennial consumers who value uniqueness and emotional connection. Custom labels, interactive QR codes, and limited-edition themes are reshaping how beverages are marketed and consumed.

Integration of Smart Packaging Features

The beverage industry is incorporating smart packaging solutions like NFC-enabled caps, freshness indicators, and blockchain-enabled traceability tools. These technologies provide real-time information on product origin, temperature control, and expiration dates, adding transparency and security to the supply chain. This trend is particularly relevant for high-value segments such as cold-pressed juices, craft beers, and probiotic drinks, where quality assurance is critical.

Global Beverage Packaging Market: Research Scope and Analysis

By Packaging Type Analysis

Bottles are expected to maintain their leading position in the beverage packaging type segment, accounting for an estimated 35.0% of the total market share in 2025. Their dominance is largely driven by their widespread use across various beverage categories such as bottled water, carbonated soft drinks, juices, dairy-based drinks, and alcoholic beverages like spirits and beer.

PET bottles, in particular, continue to gain popularity due to their lightweight nature, cost-effectiveness, recyclability, and convenience for on-the-go consumption. Glass bottles are also preferred in the premium and craft beverage segments for their aesthetic appeal and ability to preserve flavor. The versatility of bottle designs, availability in multiple sizes, and compatibility with branding and labeling innovations further contribute to their sustained preference among beverage manufacturers.

Cans represent another significant segment within beverage packaging, widely adopted in the packaging of carbonated drinks, energy beverages, craft beer, and ready-to-drink cocktails. The popularity of cans stems from their durability, portability, and excellent barrier properties that protect beverages from light and oxygen, thereby extending shelf life. Aluminum cans are highly valued for their recyclability, lightweight structure, and quick chilling capacity, making them ideal for both retail and outdoor consumption scenarios.

In recent years, the resurgence of canned alcoholic beverages and functional drinks has further accelerated their adoption. Additionally, advancements in digital printing and can design have enabled brands to differentiate their products on store shelves, boosting consumer engagement and reinforcing the segment’s growth trajectory.

By Material Analysis

Plastic materials are projected to retain their dominant position in the material segment of the beverage packaging market, accounting for approximately 42.0% of the total market share in 2025. Their widespread use is primarily attributed to their lightweight nature, affordability, and versatility across multiple beverage categories, including bottled water, carbonated drinks, juices, and dairy products. PET (polyethylene terephthalate) is the most commonly used plastic due to its strength, transparency, and recyclability.

Plastic packaging is also preferred for its resistance to breakage, ease of transportation, and compatibility with a variety of closure systems such as caps, pumps, and flip-tops. Moreover, the growing development of bio-based and recyclable plastics is helping brands meet sustainability targets while maintaining the convenience and functionality of plastic bottles and containers.

Glass remains a significant material in beverage packaging, particularly in the premium and alcoholic beverage sectors. Its inert nature makes it ideal for preserving the original taste, aroma, and quality of drinks such as wine, spirits, craft beer, and high-end juices. Glass packaging is often associated with luxury and heritage branding, offering a premium feel that enhances shelf appeal and consumer perception.

Although heavier and more fragile than other materials, glass is infinitely recyclable without loss of purity or quality, making it a sustainable choice for environmentally conscious brands. As consumers seek out premium and artisanal products, the demand for glass packaging is expected to remain steady, supported by its aesthetic value and strong brand differentiation capabilities.

By Beverage Type Analysis

Non-alcoholic beverages are anticipated to continue their dominance in the beverage type segment, capturing around 65.0% of the total market share in 2025. This strong position is driven by the growing consumer preference for healthier and functional drink options such as bottled water, carbonated soft drinks, fruit juices, ready-to-drink teas, and energy drinks. The growing awareness about hydration, wellness, and nutritional benefits is pushing demand for innovative packaging solutions that offer convenience, portion control, and freshness preservation.

Sustainable and recyclable packaging materials are also gaining traction in this segment as consumers become more environmentally conscious. Additionally, the expanding urban population and on-the-go lifestyles are fueling the growth of single-serve and portable packaging formats, further strengthening the presence of non-alcoholic beverages in the global packaging market.

Alcoholic beverages, while occupying a smaller share compared to non-alcoholic drinks, represent a significant and growing segment within the beverage packaging market. This category includes beer, wine, spirits, and ready-to-drink cocktails, where packaging plays a crucial role in brand differentiation and consumer appeal. Glass bottles remain the preferred choice due to their premium look and ability to preserve the product’s flavor and aroma.

However, cans and innovative formats are gaining popularity, especially in the craft beer and ready-to-drink cocktail segments, due to their portability, recyclability, and convenience. The rising trend of premiumization and consumer demand for unique experiences is driving brands to experiment with packaging designs, finishes, and closures. Overall, alcoholic beverage packaging is evolving to meet consumer expectations for quality, sustainability, and aesthetic appeal.

By Technology Analysis

Standard packaging is expected to lead the technology segment in beverage packaging, capturing approximately 55.0% of the market share in 2025. This dominance is largely due to its widespread application across a broad range of beverages, including carbonated drinks, bottled water, juices, and alcoholic beverages. Standard packaging technologies such as blow molding for plastic bottles, canning, and glass bottling are well-established, cost-effective, and supported by mature manufacturing processes. These methods offer reliability, ease of mass production, and compatibility with various packaging materials, making them the preferred choice for many beverage manufacturers.

Additionally, the adaptability of standard packaging to accommodate different sizes, shapes, and branding elements contributes to its sustained popularity in both developed and emerging markets.

Aseptic packaging, although representing a smaller share, plays a critical role in the beverage packaging landscape, particularly for products requiring extended shelf life without refrigeration. This technology involves sterilizing both the packaging material and the beverage before filling, which preserves the freshness, taste, and nutritional value while preventing microbial contamination. Aseptic packaging is commonly used for dairy-based drinks, fruit juices, plant-based beverages, and ready-to-drink teas. Its ability to maintain product quality without the need for preservatives appeals to health-conscious consumers.

Moreover, aseptic cartons and pouches made from multilayer materials offer sustainability benefits through reduced energy consumption during transportation due to their lightweight nature. As demand for clean-label and natural beverages grows, aseptic packaging is poised to gain traction as an innovative solution in the market.

By End-Use Industry Analysis

The retail industry is expected to maintain its dominant position in the end-use industry vertical segment, capturing around 68.0% of the total market share in 2025. This dominance is driven by the extensive distribution of packaged beverages through supermarkets, hypermarkets, convenience stores, and online retail platforms. Retailers cater to a wide consumer base with diverse preferences, ranging from bottled water and soft drinks to juices and ready-to-drink coffees. Packaging in this segment emphasizes shelf appeal, brand visibility, and convenience features such as resealable caps and single-serve sizes to attract impulse purchases and repeat buyers.

Additionally, the rise of e-commerce and direct-to-consumer sales channels has accelerated the need for durable, protective packaging that ensures product integrity during shipping. As a result, innovative packaging solutions focused on sustainability, convenience, and differentiation are favored in the retail beverage sector.

In contrast, the foodservice industry represents a smaller but significant segment within the beverage packaging market, encompassing restaurants, cafes, bars, and catering services. Packaging solutions in this vertical prioritize functionality, portability, and ease of use to support on-premise consumption, takeaway, and delivery services. Single-use cups, cartons, and bottles designed for hot and cold beverages are common, often featuring insulated or spill-proof elements to enhance customer experience.

The foodservice sector is also seeing a growing demand for eco-friendly packaging alternatives, driven by sustainability initiatives and consumer expectations for reduced environmental impact. Packaging in this segment must balance cost-effectiveness with durability, as products often face higher handling and transportation challenges. As foodservice providers expand delivery and takeaway options, the importance of innovative packaging tailored to convenience and sustainability continues to rise.

The Beverage Packaging Market Report is segmented on the basis of the following:

By Packaging Type

- Bottles

- Cans

- Cartons

- Pouches

- Others

By Material

- Plastic

- Glass

- Metal

- Paper & Paperboard

- Others

By Beverage Type

- Non-Alcoholic Beverages

- Alcoholic Beverages

By Technology

- Standard Packaging

- Aseptic Packaging

- Modified Atmosphere Packaging (MAP)

- Vacuum Packaging

- Active & Intelligent Packaging

By End-Use Industry

- Retail

- Foodservice

- Institutional

Global Beverage Packaging Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global beverage packaging market, accounting for approximately 38.0% of the total market revenue in 2025. This leadership is driven by rapid urbanization, rising disposable incomes, and shifting consumer preferences toward packaged and ready-to-drink beverages across countries like China, India, Japan, and Southeast Asia. The region's expanding middle-class population and growing demand for convenience and health-oriented drinks are fueling the growth of diverse packaging formats such as PET bottles, cans, and cartons.

Additionally, strong growth in e-commerce and modern retail channels is accelerating the adoption of innovative and sustainable packaging solutions. Investments in manufacturing infrastructure, integrated with government initiatives supporting sustainability and recycling, are further reinforcing Asia Pacific’s dominant position in the global beverage packaging landscape.

Region with significant growth

The Middle East and Africa region is projected to register the highest compound annual growth rate (CAGR) in the global beverage packaging market. This rapid growth is fueled by growing urbanization, rising disposable incomes, and expanding young populations with evolving lifestyle preferences that favor packaged and convenient beverage options.

Additionally, growing investments in retail infrastructure, modernization of supply chains, and a surge in demand for sustainable and innovative packaging solutions are driving market expansion. The region’s beverage industry is also benefiting from growing foreign direct investments and government initiatives aimed at boosting manufacturing capabilities, which together contribute to its accelerated pace of growth compared to other regions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Beverage Packaging Market: Competitive Landscape

The global beverage packaging market is highly competitive and characterized by the presence of several key multinational corporations and regional players striving for innovation, sustainability, and market expansion. Leading companies focus heavily on research and development to introduce advanced packaging technologies, such as lightweight materials, recyclable solutions, and smart packaging features that enhance consumer convenience and product safety. Strategic mergers, acquisitions, and partnerships are common as firms aim to expand their geographic reach and diversify product portfolios.

Additionally, growing consumer demand for eco-friendly packaging is pushing competitors to invest in biodegradable and plant-based materials, aligning their offerings with evolving environmental regulations and corporate social responsibility goals. The competitive landscape is further shaped by the growing penetration of digital printing and customization capabilities, enabling brands to create differentiated packaging that resonates with target markets globally. Overall, innovation, sustainability, and adaptability remain the key drivers shaping competition in this dynamic market.

Some of the prominent players in the global beverage packaging market are:

- Amcor

- Ball Corporation

- Crown Holdings

- Tetra Pak

- Ardagh Group

- Owens-Illinois (O-I)

- SIG Combibloc

- Berry Global

- Sonoco Products Company

- Smurfit Kappa

- Mondi Group

- Sealed Air Corporation

- DS Smith

- Reynolds Group Holdings

- WestRock

- Uflex Ltd.

- Huhtamaki

- ALPLA Group

- International Paper Company

- Stora Enso

- Other Key Players

Global Beverage Packaging Market: Recent Developments

Product Launches

- June 2025: Amcor launched a new line of sustainable beverage bottles made from 100% recycled PET, designed to reduce the carbon footprint and enhance recyclability in response to growing environmental concerns.

- April 2025: Ball Corporation introduced lightweight aluminum cans with advanced barrier technology aimed at preserving flavor and extending shelf life for craft beer and ready-to-drink beverages.

Mergers and Acquisitions

- May 2025: Crown Holdings completed the acquisition of a European sustainable packaging firm specializing in biodegradable materials, aiming to expand its eco-friendly product portfolio and strengthen its presence in the region.

- March 2025: Tetra Pak acquired a startup focused on innovative aseptic packaging technology to enhance its offerings in long-life beverage cartons and increase production efficiency.

Funding and Investments

- July 2024: A consortium led by SIG Combibloc secured USD 50 million in funding to accelerate the development of plant-based packaging materials and scale sustainable production capabilities.

- January 2024: Berry Global received a USD 30 million investment from a private equity firm to expand its manufacturing capacity for recyclable plastic beverage containers and support R&D for next-generation packaging solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 158.3 Bn |

| Forecast Value (2034) |

USD 254.2 Bn |

| CAGR (2025–2034) |

5.4% |

| The US Market Size (2025) |

USD 33.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Packaging Type (Bottles, Cans, Cartons, Pouches, Others), By Material (Plastic, Glass, Metal, Paper & Paperboard, Others), By Beverage Type (Non-Alcoholic Beverages, Alcoholic Beverages), By Technology (Standard Packaging, Aseptic Packaging, Modified Atmosphere Packaging, Vacuum Packaging, Active & Intelligent Packaging), and By End-Use Industry (Retail, Foodservice, Institutional)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amcor, Ball Corporation, Crown Holdings, Tetra Pak, Ardagh Group, Owens-Illinois (O-I), SIG Combibloc, Berry Global, Sonoco Products Company, Smurfit Kappa, Mondi Group, Sealed Air Corporation, DS Smith, Reynolds Group Holdings, WestRock, Uflex Ltd., Huhtamaki, ALPLA Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global beverage packaging market size is estimated to have a value of USD 158.3 billion in 2025 and is expected to reach USD 254.2 billion by the end of 2034.

The US beverage packaging market is projected to be valued at USD 33.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 52.0 billion in 2034 at a CAGR of 5.1%.

Asia Pacific is expected to have the largest market share in the global beverage packaging market, with a share of about 38.0% in 2025.

Some of the major key players in the global beverage packaging market are Amcor, Ball Corporation, Crown Holdings, Tetra Pak, Ardagh Group, Owens-Illinois (O-I), SIG Combibloc, Berry Global, Sonoco Products Company, Smurfit Kappa, Mondi Group, Sealed Air Corporation, DS Smith, Reynolds Group Holdings, WestRock, Uflex Ltd., Huhtamaki, ALPLA Group, and Other Key Players.

The market is growing at a CAGR of 5.4 percent over the forecasted period.