Market Overview

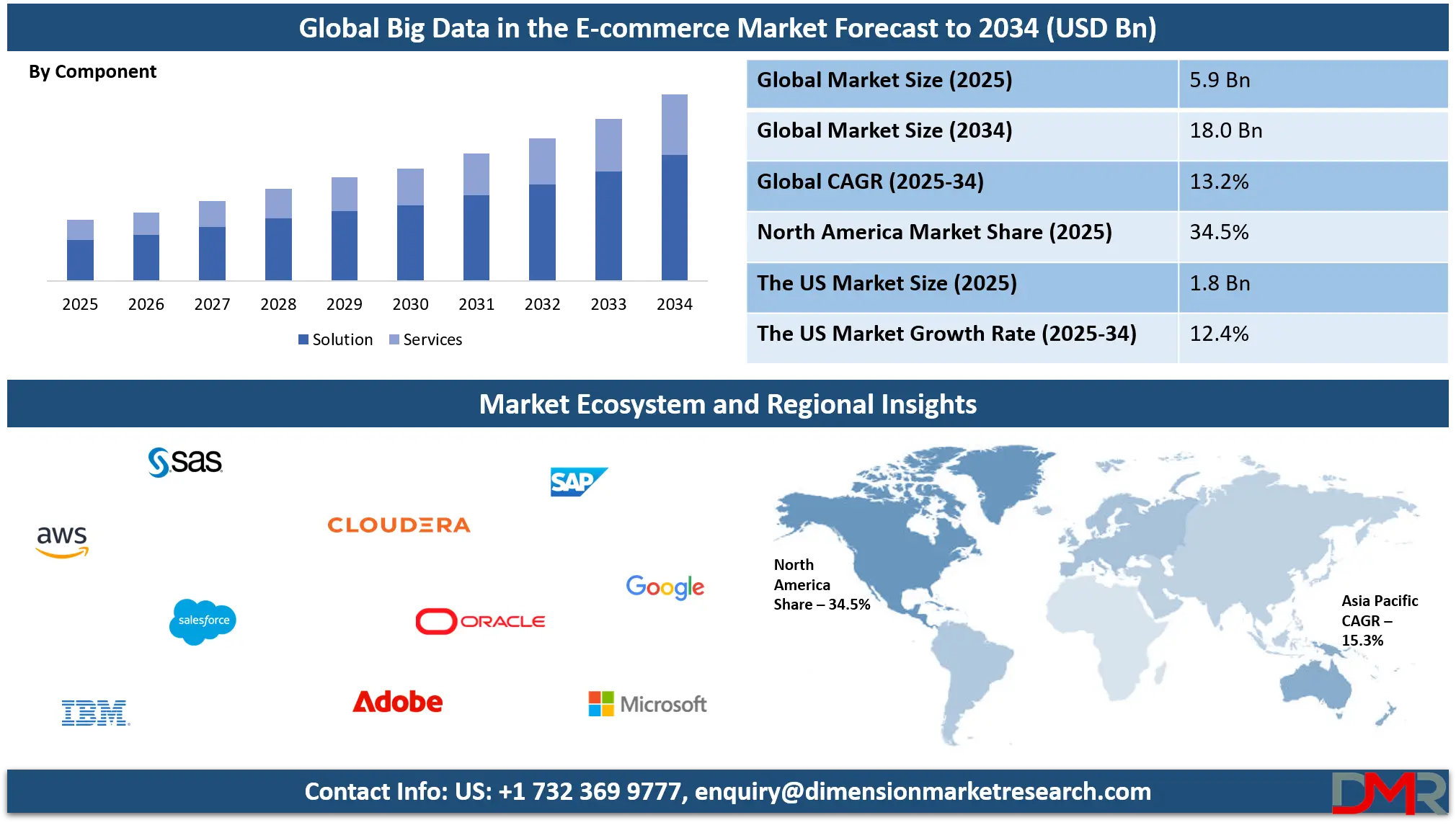

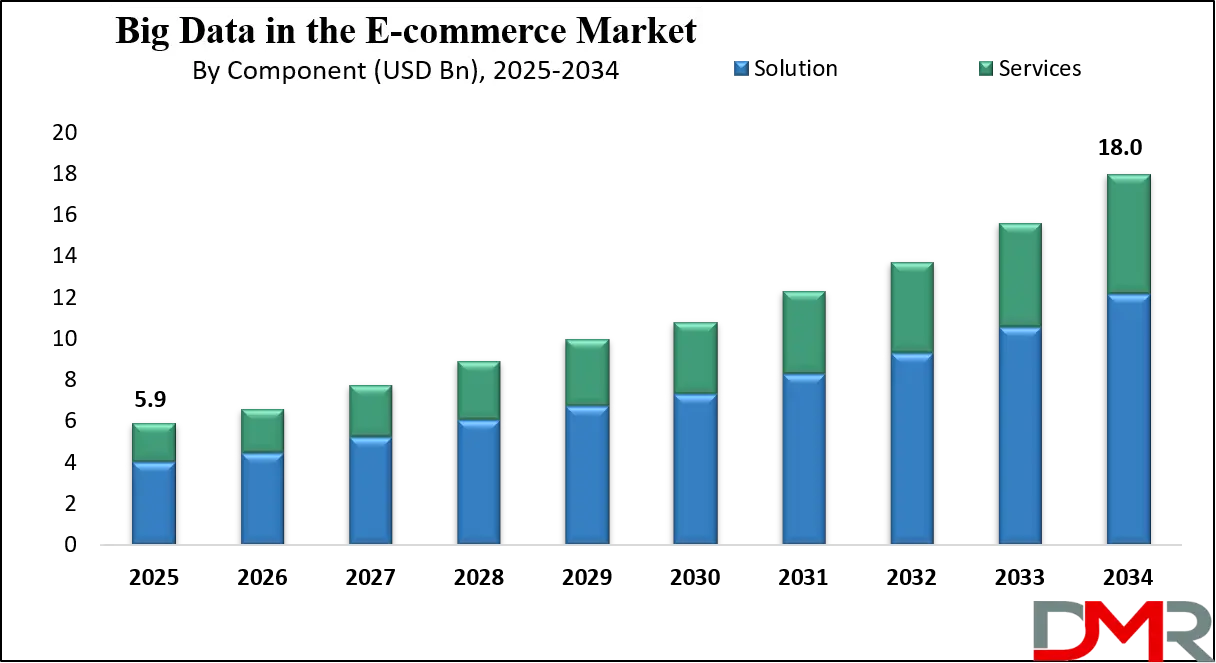

The Global Big Data in the E-commerce Market size is projected to reach USD 5.9 billion in 2025 and grow at a compound annual growth rate of 13.2% from there until 2034 to reach a value of USD 18.0 billion.

Big Data in the e-commerce market refers to the use of large volumes of digital information to improve online shopping experiences, streamline operations, and boost sales. This includes collecting data from customer behavior, website visits, social media, transaction history, and more. E-commerce platforms use Big Data tools to understand what customers want, when they want it, and how they shop. This helps online retailers personalize their offerings, recommend products, and improve their marketing strategies.

The demand for Big Data in e-commerce is growing fast due to the rise in the number of people shopping online. As billions of users browse and buy from digital platforms every day, companies need to manage and analyze this information in real time. Big Data makes it easier for businesses to keep track of customer preferences, supply chain performance, and competitor activities. With the growing use of smartphones and internet access, especially in emerging economies, more data is being generated than ever before, pushing companies to invest more in Big Data tools.

Several trends are shaping how Big Data is used in the e-commerce sector. Personalization is one of the top trends, where websites show products based on a customer’s past behavior. Predictive analytics is another growing trend that helps sellers forecast demand and plan inventory. Automation powered by artificial intelligence (AI) is also on the rise, using Big Data to improve customer service through chatbots and to speed up delivery planning. Data security and privacy have also become major concerns, encouraging companies to adopt safer ways to handle customer information.

In recent years, many events have accelerated the role of Big Data in e-commerce. The global pandemic increased online shopping dramatically, leading businesses to rely heavily on data to meet new demands. Supply chain disruptions also forced companies to use Big Data to track and manage inventory more accurately. Large online sales events, such as seasonal sales and shopping festivals, further highlighted the need for real-time data analysis to manage traffic and demand.

An important insight is that Big Data is not just for large companies anymore. Even small online sellers are starting to use data tools to understand their customers better and improve their business. Easy-to-use cloud platforms and software have made it possible for everyone to access the power of Big Data. This is leading to more competition and better service across the e-commerce space.

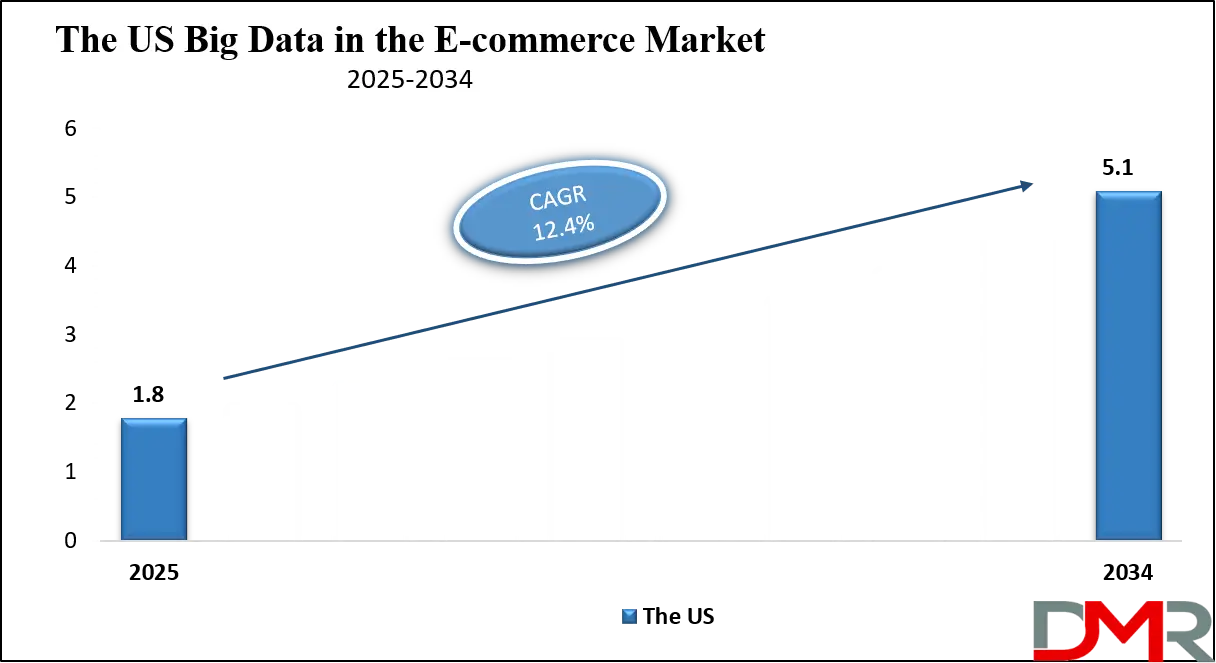

The US Big Data in the E-commerce Market

The US Big Data in the E-commerce Market size is projected to reach USD 1.8 billion in 2025 at a compound annual growth rate of 12.4% over its forecast period.

The US plays a major role in the Big Data in the e-commerce market due to its strong digital infrastructure, advanced technology adoption, and presence of major online retail companies. US-based businesses invest heavily in data analytics to enhance customer experience, manage inventory, and improve marketing strategies. The country also leads in the development and use of AI, cloud computing, and machine learning tools that power Big Data applications.

A highly competitive e-commerce environment in the US pushes companies to innovate constantly and use real-time data insights to stay ahead. Moreover, consumer behavior in the US generates vast amounts of valuable data, which further fuels analytics-driven growth. This makes the US a central hub for Big Data advancements in e-commerce.

Europe Big Data in the E-commerce Market

Europe Big Data in the E-commerce Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 12.9% over its forecast period.

Europe plays a significant role in the Big Data in the e-commerce market through its focus on data-driven innovation, privacy regulations, and digital transformation. Many European e-commerce businesses use Big Data to improve personalization, optimize logistics, and enhance customer service. The region is also home to strong regulatory frameworks like GDPR, which influence how data is collected, stored, and used—shaping global standards for ethical data practices.

European countries are investing in AI, cloud technologies, and analytics to support smart retail operations. Cross-border online shopping within Europe also generates large volumes of data, encouraging businesses to adopt multilingual, localized strategies based on insights. This makes Europe a key region in driving responsible and efficient use of Big Data in e-commerce.

Japan Big Data in the E-commerce Market

Japan Big Data in the E-commerce Market size is projected to reach USD 295 million in 2025 at a compound annual growth rate of 12.7% over its forecast period.

Japan plays an important role in the Big Data in the e-commerce market through its advanced technology landscape and strong consumer base. Japanese e-commerce companies use Big Data to improve customer experience, manage fast and accurate deliveries, and predict shopping trends. With a high level of internet and mobile usage, large volumes of data are generated daily, allowing businesses to gain detailed insights into customer behavior.

Japan is also focusing on automation, AI, and robotics in retail, all of which rely heavily on data analytics. The country’s emphasis on precision and efficiency drives the use of Big Data for inventory control, product recommendations, and marketing. Japan’s approach combines innovation with careful planning, making it a key player in the region’s e-commerce growth.

Big Data in the E-commerce Market: Key Takeaways

- Market Growth: The Big Data in the E-commerce Market size is expected to grow by USD 11.4 billion, at a CAGR of 13.2%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the Big Data in the E-commerce Market in 2025.

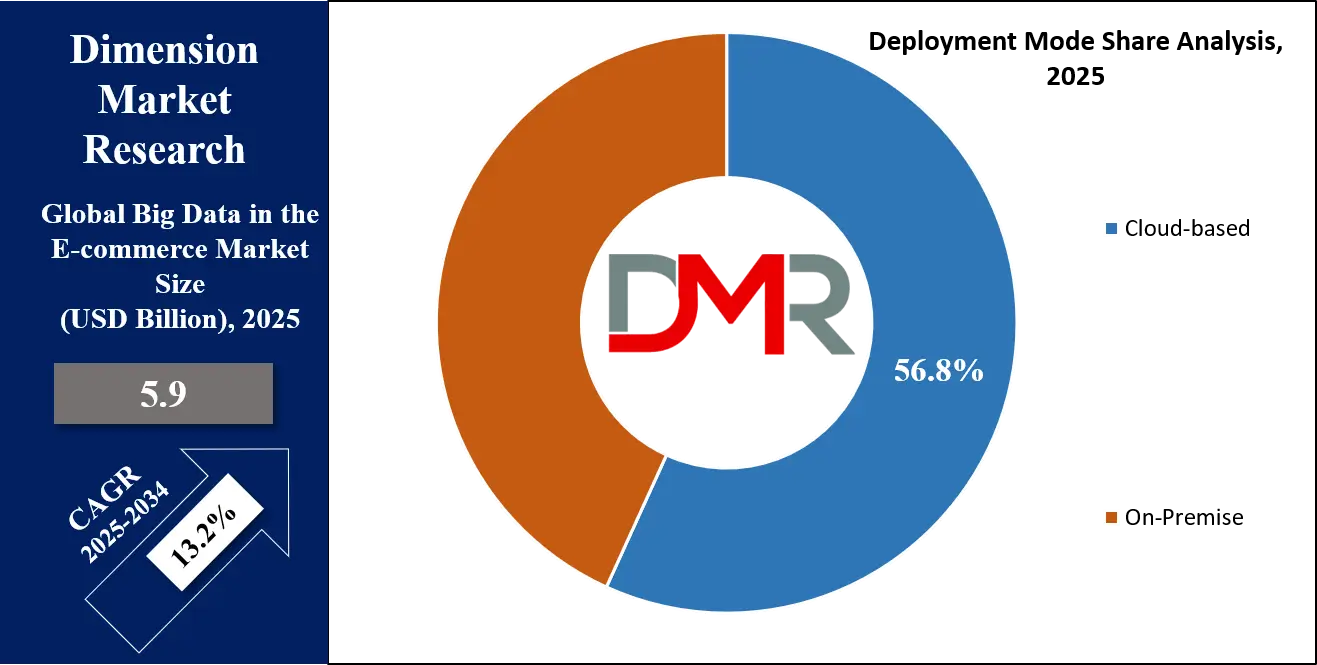

- By Deployment Mode: The Cloud-based segment is expected to get the largest revenue share in 2025 in the Big Data in the E-commerce Market.

- Regional Insight: North America is expected to hold a 34.5% share of revenue in the Global Big Data in the E-commerce Market in 2025.

- Use Cases: Some of the use cases of Big Data in the E-commerce include fraud detection, dynamic pricing, and more.

Big Data in the E-commerce Market: Use Cases

- Customer Personalization: E-commerce platforms use Big Data to analyze browsing and purchase behavior. This helps show customers products they are more likely to buy based on past activity. It leads to a better user experience and increased chances of sales.

- Dynamic Pricing: By tracking competitor prices, demand levels, and customer interest, companies can adjust product prices in real time. Big Data enables smarter pricing strategies that help businesses stay competitive while maximizing profits.

- Inventory Management: Big Data helps forecast product demand using historical sales, trends, and external factors like seasons. This allows e-commerce companies to stock the right products at the right time, reducing storage costs and avoiding stockouts.

- Fraud Detection: E-commerce businesses use Big Data to monitor unusual buying patterns and payment behaviors. It helps detect and prevent fraud by identifying suspicious activities quickly, ensuring a safer shopping environment for customers.

Stats & Facts

- According to SellersCommerce

- There are 2.77 billion global online shoppers, showing the huge size of the digital customer base and the increasing demand for personalized shopping driven by Big Data insights.

- In 2025, 21% of retail purchases are expected to happen online, and this figure is set to rise to 22.6% by 2027, indicating a continuous shift towards e-commerce as the preferred shopping method.

- Ecommerce sales are projected to surpass USD 6.8 trillion in 2025, highlighting the growing scale of the market and the need for robust data systems to manage customer journeys and transactions.

- There are over 28 billion eCommerce stores globally, showing the level of competition and the need for data-driven strategies to stand out and retain customers.

- 52% of online shoppers search for products internationally, reflecting the cross-border nature of modern e-commerce and the growing use of global consumer data for personalized marketing.

- 34% of shoppers shop online at least once a week, indicating a shift in buying frequency that requires real-time analytics and dynamic engagement strategies.

- 99% of customers look for reviews when shopping online, showing how important user-generated content and sentiment analysis have become in influencing purchase decisions.

- 84% of shoppers said they would install and use a mobile app for access to better pricing or sales, encouraging businesses to focus on mobile-first data strategies and user behavior tracking.

- Mobile commerce accounted for 60% of global e-commerce sales in 2023, with predictions of continued growth, reinforcing the importance of mobile data in driving sales and personalizing experiences.

- As per Exploding Topics

- Amazon sold over 100,000 items per minute during the most recent Prime Day, showing the intensity of demand during major events and the importance of real-time Big Data tools to handle such spikes.

- 85% of global consumers shop online, underlining the worldwide popularity of e-commerce and the need for strong data infrastructure to serve a massive and diverse user base.

- 53% of Americans shop on social media at least once per week, revealing the rise of social commerce and the need to track customer behavior across multiple platforms and formats.

- China is home to over half of global e-commerce retail sales, positioning it as a global leader and emphasizing the need for localized analytics and region-specific consumer data strategies.

- 40% of online shoppers have refused to buy from a brand due to concerns about personal data, showing how trust, transparency, and secure data practices have become essential in the digital shopping experience.

Market Dynamic

Driving Factors in the Big Data in the E-commerce Market

Growing Online Shopping and Digital Transactions

One of the main drivers of Big Data in the e-commerce market is the rapid rise in online shopping and digital payments. As more people prefer buying products online, huge amounts of data are being generated daily through clicks, searches, cart additions, and purchases. This data gives e-commerce companies valuable insights into customer behavior, product preferences, and buying trends. With more smartphones and better internet access, especially in developing regions, the volume of digital transactions continues to rise.

E-commerce businesses are now focusing on using this data to personalize services, improve user experience, and increase conversion rates. Big Data allows for real-time analysis, helping businesses make faster and smarter decisions. This ongoing shift to digital commerce is fueling the growing need for advanced data tools.

Need for Better Customer Experience and Personalization

Another major growth driver is the increasing demand for a more personalized and seamless customer experience. Today’s shoppers expect websites to understand their preferences and show relevant product suggestions instantly. Big Data enables this by collecting and analyzing information from multiple sources such as browsing history, previous purchases, location, and even social media activity. With this information, e-commerce platforms can create custom recommendations, targeted promotions, and personalized emails.

This not only boosts customer satisfaction but also encourages repeat purchases. Businesses that can meet these expectations are more likely to retain loyal customers. As competition grows in the e-commerce space, personalization powered by Big Data is becoming a must-have feature rather than an extra benefit.

Restraints in the Big Data in the E-commerce Market

Data Privacy and Security Concerns

One of the key restraints in the Big Data in e-commerce market is the rising concern over data privacy and security. Customers share a lot of personal information while shopping online, including names, addresses, payment details, and preferences. If not properly protected, this data can be targeted by cybercriminals, leading to fraud, identity theft, and data breaches. Strict data protection regulations like GDPR have made companies more cautious about how they collect and use customer information.

Compliance adds complexity and cost, especially for smaller businesses. Failure to manage data securely can damage brand trust and lead to heavy legal penalties. These risks make many companies hesitant to fully adopt or expand Big Data strategies, slowing down overall market growth.

Lack of Skilled Professionals and High Implementation Costs

Another major restraint is the shortage of skilled professionals who can manage, analyze, and interpret Big Data effectively. Working with large volumes of data requires expertise in data science, machine learning, and analytics tools—skills that are in high demand but limited supply.

Alongside this, setting up Big Data systems can be expensive, especially for small and mid-sized e-commerce companies. The cost of software, cloud storage, system integration, and ongoing maintenance can be high. Many businesses also struggle with legacy systems that are not compatible with modern data technologies. These technical and financial challenges limit how quickly and effectively businesses can adopt Big Data solutions.

Opportunities in the Big Data in the E-commerce Market

Expansion of AI and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics presents a major opportunity for the Big Data in e-commerce market. By using advanced algorithms, businesses can predict customer behavior, forecast demand, and make smarter decisions. These tools help personalize shopping experiences, optimize pricing strategies, and manage supply chains more efficiently.

As AI technology becomes more accessible, even smaller e-commerce players can use it to gain insights from their data. Predictive analytics can also reduce returns and improve customer satisfaction by showing the right products to the right users. This growing demand for intelligent, data-driven decision-making is opening up new possibilities for innovation and growth across the entire e-commerce sector.

Rise of Omnichannel and Cross-Border Commerce

The growing trend of omnichannel retail and global e-commerce expansion offers new opportunities for Big Data solutions. Customers today shop through websites, mobile apps, social media, and even offline stores—generating data across all these touchpoints. Big Data helps connect this information to give businesses a complete view of the customer journey. This unified insight improves service delivery, marketing efforts, and inventory planning.

Similarly, as more businesses enter cross-border e-commerce, they need to understand different markets, buyer habits, and logistics challenges. Big Data tools can support this by analyzing regional data, preferences, and behaviors, helping businesses tailor strategies for each market. This global and multi-channel expansion creates more demand for smart, scalable data solutions.

Trends in the Big Data in the E-commerce Market

AI-Driven Real-Time and Contextual Analytics

A growing trend in e-commerce is the use of artificial intelligence to analyze customer behavior in real time. As shoppers browse online stores, AI tools track actions like clicks, time spent on a product, or items added to the cart. This helps businesses respond immediately by offering discounts, recommendations, or customer support at just the right moment.

These insights are processed instantly, allowing e-commerce platforms to react to each user’s behavior as it happens. This trend is making online shopping feel more personal and interactive. It also helps improve conversion rates by reducing delays and targeting customer needs with precision. Real-time analytics is becoming a key tool in the competition to capture online attention.

Integration of IoT, AR/VR, Voice, and Social Data

E-commerce businesses are now using data from a wide range of new sources to improve customer experience. Information from smart devices, virtual and augmented reality, voice assistants, and social media is being collected and analyzed. This helps brands understand how, when, and why people shop. For example, virtual try-on tools generate data about what products customers interact with. Voice searches reveal customer intent, while social media activity shows trending products and user opinions. By combining these different data points, businesses can create more engaging and relevant shopping experiences. This trend highlights how Big Data is becoming more diverse, going far beyond just clicks and purchases.

Research Scope and Analysis

By Component Analysis

Solution segment will be leading the Big Data in the e-commerce market in 2025 with a share of 67.6%, driven by the growing need for advanced analytics, data visualization, and real-time insights. As online shopping grows, e-commerce businesses are turning to ready-made solutions that help them process large volumes of customer data quickly and accurately. These solutions include data management platforms, customer behavior tracking tools, and AI-powered recommendation engines. With easy integration and scalable options, many companies prefer solutions over building in-house systems.

The demand for fast decision-making, personalized experiences, and competitive pricing strategies is pushing more retailers to adopt comprehensive Big Data solutions. Cloud-based offerings further boost this segment by allowing small and medium businesses to use powerful tools without heavy investment. As companies continue to digitize their operations, the solution segment is expected to remain a key driver of market expansion during the ongoing year and beyond.

On the other hand, services segment is having significant growth over the forecast period in the Big Data in the e-commerce market due to the rising need for expert support, consulting, and managed analytics. As many businesses lack in-house data teams, they turn to service providers for help with implementation, maintenance, and strategy. This segment includes training, support, and integration services that ensure the smooth use of Big Data tools.

Service providers help customize solutions to match business needs and provide continuous updates and performance improvements. With increasing complexity in customer behavior, inventory planning, and logistics, service-based offerings are becoming more valuable. The demand is especially strong among small and mid-sized companies that need external guidance to make the most of Big Data. This growing reliance on expert services is helping drive steady growth in this component across different regions.

By Deployment Mode Analysis

Cloud-based deployment is set to lead the Big Data in the e-commerce market in 2025 with a share of 56.8%, supported by its flexibility, scalability, and cost-effectiveness. Many online retailers are choosing cloud platforms to manage and analyze vast amounts of customer and sales data without the need for expensive hardware. Cloud solutions allow businesses to access tools and insights from anywhere, making operations more agile and responsive. With growing online transactions, cloud deployment helps handle traffic spikes, large datasets, and complex analytics with ease.

Small and mid-sized e-commerce players also prefer cloud-based systems due to lower setup and maintenance costs. Regular updates, better security features, and integration with various applications make cloud-based Big Data solutions attractive. As digital transformation accelerates, cloud adoption is expected to drive continued growth in this segment during 2025 and beyond.

In contrast, on-premise deployment is having significant growth over the forecast period in the Big Data in the e-commerce market, mainly among large enterprises with strict control and security requirements. This deployment mode gives businesses complete ownership of their infrastructure and data handling, which is important for companies managing sensitive customer information.

On-premise systems are often preferred by firms that have existing IT setups and the resources to maintain them. These systems offer high customization and can be tailored to match unique business needs. While cloud solutions are rising, some businesses still choose on-premise options to ensure compliance with internal policies or industry regulations. The segment continues to grow as companies balance between security needs and performance demands in their data strategies.

By Organization Size Analysis

Large enterprises are set to be leading the Big Data in the e-commerce market in 2025 with a share of 63.1%, backed by their ability to invest in advanced data infrastructure and technologies. These companies handle massive volumes of customer, product, and transaction data daily, requiring powerful analytics tools to manage and interpret it effectively. With large teams and dedicated resources, they can adopt complex data platforms, including AI, machine learning, and cloud computing.

Big Data helps them personalize customer experiences, forecast demand, optimize inventory, and streamline operations across multiple regions. These enterprises often run multi-channel retail operations, where data integration becomes crucial for unified insights. Their focus on gaining a competitive edge through data-driven strategies ensures continuous investment in analytics. With strong technical teams, established systems, and global customer reach, large enterprises are expected to continue driving the demand for Big Data tools in e-commerce throughout the forecast year and beyond.

On the growth path during the forecast period, SMEs are having significant traction in adopting Big Data in the e-commerce market due to increasing access to affordable, cloud-based tools and services. These smaller businesses are realizing the value of data in understanding customer needs, improving product listings, and running smarter marketing campaigns. While they may not have the same budgets as large enterprises, many SMEs use scalable and easy-to-use Big Data platforms that support real-time insights.

As competition in online selling rises, SMEs are turning to analytics to boost sales, manage stock, and enhance customer satisfaction. Government support for digital adoption and a growing number of tech-savvy entrepreneurs also contribute to this trend. The flexibility of cloud solutions and the rise of plug-and-play analytics tools make Big Data more accessible than ever for small and mid-sized e-commerce companies across various regions.

By Application Analysis

Customer analytics will be dominating the Big Data in the e-commerce market in 2025 with a share of 21.8%, as businesses focus more on understanding and serving their buyers better. This application helps online retailers analyze customer behavior, preferences, and shopping patterns using data collected from websites, apps, and social media. With these insights, businesses can personalize product recommendations, create targeted marketing campaigns, and improve overall user experience.

The ability to study what customers want in real time helps companies make faster, smarter decisions. Whether it’s identifying popular products or improving website navigation, customer analytics supports better engagement and higher conversion rates. As competition in online retail grows, businesses are turning to this application to stay ahead. The continuous rise in digital shopping and data availability makes customer analytics a powerful tool for improving satisfaction and boosting sales during the ongoing year and beyond.

Fraud & risk management is having significant growth over the forecast period in the Big Data in the e-commerce market due to the rising number of online transactions and increasing threats. As more customers use digital platforms for shopping and payments, businesses face a higher risk of fraud, such as fake transactions, identity theft, and data breaches.

This application uses Big Data to detect unusual patterns and alert businesses in real time. It helps prevent financial losses and protects both the company and its customers. E-commerce platforms are using data-driven tools to verify users, monitor transactions, and stop suspicious activity before it causes harm. With stronger data protection rules and higher customer expectations for safety, businesses are making fraud detection a key part of their operations. The demand for reliable, accurate, and quick risk management solutions continues to grow as digital commerce expands.

By End Use Analysis

Fashion & apparel will be leading the Big Data in the e-commerce market in 2025 with a share of 23.6%, supported by the fast-changing trends and high demand for personalization in this segment. Online fashion retailers use Big Data to track customer preferences, predict upcoming trends, and offer personalized product suggestions. With a wide variety of styles, sizes, and seasonal changes, managing inventory and demand becomes more efficient through data insights. Big Data also helps fashion brands understand return patterns and optimize pricing strategies.

Social media plays a key role in this sector, and analyzing data from these platforms allows brands to respond quickly to what’s trending. By improving product recommendations and user experience, fashion e-commerce companies can boost engagement and sales. As consumer behavior shifts rapidly, data-driven decisions give fashion retailers a major advantage in staying relevant and competitive throughout 2025 and the years ahead.

Consumer electronics segment is having significant growth over the forecast period in the Big Data in the e-commerce market due to increasing demand for gadgets, smart devices, and home technology. As online shoppers compare specifications, read reviews, and explore features before buying, large volumes of data are generated. E-commerce companies in this space use Big Data to track buyer behavior, manage product availability, and adjust pricing dynamically.

Analytics also help in predicting future demand for new releases and identifying popular products based on user interest. This information supports better marketing, faster delivery, and improved customer service. With frequent product updates and rising competition, businesses in consumer electronics are using data to stay ahead and meet customer expectations. The growing use of connected devices and tech-savvy buyers further boosts the need for smart data tools in this segment.

The Big Data in the E-commerce Market Report is segmented on the basis of the following:

By Component

- Solutions

- Data Analytics

- Data Management

- Data Discovery

- Data Visualization

- Data Integration

- Services

- Managed Services

- Professional Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Deployment Mode

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Customer Analytics

- Marketing Analytics

- Merchandising Analytics

- Supply Chain Analytics

- Operational Analytics

- Price Optimization

- Fraud Detection & Risk Management

- Inventory Management

By End Use

- Fashion & Apparel

- Consumer Electronics

- Home & Furniture

- Food & Beverages

- Health & Personal Care

- Automotive

- Others

Regional Analysis

Leading Region in the Big Data in the E-commerce Market

North America is leading the Big Data in the e-commerce market in 2025 with a share of 34.5%, driven by strong digital infrastructure, widespread internet use, and high consumer demand for personalized online shopping experiences. The region is home to some of the most advanced e-commerce platforms and data analytics companies, making it a major hub for innovation.

Businesses across North America are using Big Data to understand customer behavior, improve inventory management, and deliver more targeted marketing campaigns. With the growing use of mobile devices, social media, and smart technologies, data generation continues to rise. The region’s focus on fast, seamless online services pushes companies to invest in real-time data analysis and automation.

Supportive government policies, strong cloud adoption, and a tech-savvy population are also contributing to this growth. While 2025 is still ongoing, North America’s consistent leadership in technology and consumer trends keeps it at the front of the global Big Data in e-commerce landscape.

Fastest Growing Region in the Big Data in the E-commerce Market

Asia Pacific is showing significant growth over the forecast period in the Big Data in the e-commerce market due to rising internet users, expanding digital payments, and growing mobile commerce. Countries like China, India, and Southeast Asian nations are witnessing a surge in online shopping, leading to a sharp increase in data generation.

E-commerce companies in the region are using Big Data analytics to understand customer preferences, personalize offers, and manage supply chains more effectively. With increasing smartphone penetration and affordable data access, more consumers are shopping online, boosting the demand for real-time data insights. The region is estimated to continue its strong momentum as businesses invest in digital transformation and advanced analytics tools.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the Big Data in the e-commerce market is growing more intense as both new and established players try to use data to gain an edge. Companies compete by offering faster data analysis, easier tools, and more accurate predictions to help online sellers make better decisions. Many focus on improving customer experience, tracking buying behavior, and managing inventory more smartly.

There is also competition in offering secure and affordable cloud-based solutions that even small businesses can use. Some focus on real-time insights, while others specialize in AI-powered features. As e-commerce continues to grow, more businesses are investing in advanced data tools, leading to constant innovation, better services, and stronger demand for smarter, faster, and simpler Big Data solutions.

Some of the prominent players in the global Big Data in the E-commerce are:

- Amazon Web Services (AWS)

- Google Cloud (Alphabet Inc.)

- Microsoft Azure

- IBM Corporation

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- Adobe Inc.

- Snowflake Inc.

- Cloudera, Inc.

- Teradata Corporation

- SAS Institute Inc.

- Splunk Inc.

- Palantir Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- Alibaba Cloud (Alibaba Group)

- Databricks Inc.

- Tableau Software (Salesforce)

- Qlik Technologies

- MicroStrategy Incorporated

- Other Key Players

Recent Developments

- In April 2025, Toshiba Digital Solutions Corporation launched GridDB® Cloud, a managed cloud-based service designed for handling IoT and high-frequency big data generation. Previously available only in Japan, it is now offered in 26 countries and regions. As digital transformation (DX) gains momentum worldwide, GridDB® Cloud serves as a core data infrastructure, enabling businesses to collect and analyze data for new insights and opportunities. The service reduces setup costs and operational effort, supports scalable resource use, and easily integrates with cloud-native applications to support DX initiatives.

- In February 2025, SAP introduced SAP Business Data Cloud, a fully managed SaaS solution designed to unify and govern all SAP data while integrating seamlessly with third-party data. It combines SAP Datasphere, SAP Analytics Cloud, and SAP Business Warehouse into one platform, offering a cohesive experience that delivers valuable insights across business functions. Additionally, SAP announced a major partnership with Databricks, bringing Databricks’ capabilities directly into SAP Business Data Cloud. This collaboration aims to transform enterprise data management by bridging applications and data platforms more effectively.

- In December 2024, Nextuple Inc. unveiled a renewed emphasis on IT consulting services tailored for retailers, grocers, and B2B distributors navigating omnichannel commerce. At NRF 2025 (booth 1039), the company will highlight its expanded professional services alongside the Nextuple Order Management Studio (NOMS)—a microservices-based suite designed to accelerate omnichannel transformations. These offerings aim to improve inventory efficiency, enhance e-commerce order management, and leverage AI/ML, Big Data, and Cloud technologies for faster time-to-market and greater operational agility.

- In November 2024, Global-e partnered with Harrods to expand the luxury retailer’s international online presence across over 200 markets. This partnership aims to replicate Harrods' renowned in-store service through a premium digital experience. By using Global-e's platform, Harrods will offer localized shopping with local currencies, various payment methods, accurate duty and tax calculations, prepaid costs, attractive shipping, and easy returns. The collaboration combines advanced localization, trade compliance, and big-data intelligence to help Harrods manage the complexities of global e-commerce and enhance international customer engagement.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.9 Bn |

| Forecast Value (2034) |

USD 18.0 Bn |

| CAGR (2025–2034) |

13.2% |

| The US Market Size (2025) |

USD 1.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (On-Premises and Cloud-Based), By Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), By Application (Customer Analytics, Marketing Analytics, Merchandising Analytics, Supply Chain Analytics, Operational Analytics, Price Optimization, Fraud Detection & Risk Management, and Inventory Management), By End Use (Fashion & Apparel, Consumer Electronics, Home & Furniture, Food & Beverages, Health & Personal Care, Automotive, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amazon Web Services (AWS), Google Cloud (Alphabet Inc.), Microsoft Azure, IBM Corporation, Oracle Corporation, SAP SE, Salesforce, Inc., Adobe Inc., Snowflake Inc., Cloudera, Inc., Teradata Corporation, SAS Institute Inc., Splunk Inc., Palantir Technologies Inc., Hewlett Packard Enterprise (HPE), Alibaba Cloud (Alibaba Group), Databricks Inc., Tableau Software (Salesforce), Qlik Technologies, MicroStrategy Incorporated, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Big Data in the E-commerce Market size is expected to reach a value of USD 5.9 billion in 2025 and is expected to reach USD 18.0 billion by the end of 2034.

North America is expected to have the largest market share in the Global Big Data in the E-commerce Market, with a share of about 34.5% in 2025.

The Big Data in the E-commerce Market in the US is expected to reach USD 1.8 billion in 2025.

Some of the major key players in the Global Big Data in the E-commerce Market are Microsoft, Google, AWS, and others

The market is growing at a CAGR of 13.2 percent over the forecasted period.