Market Overview

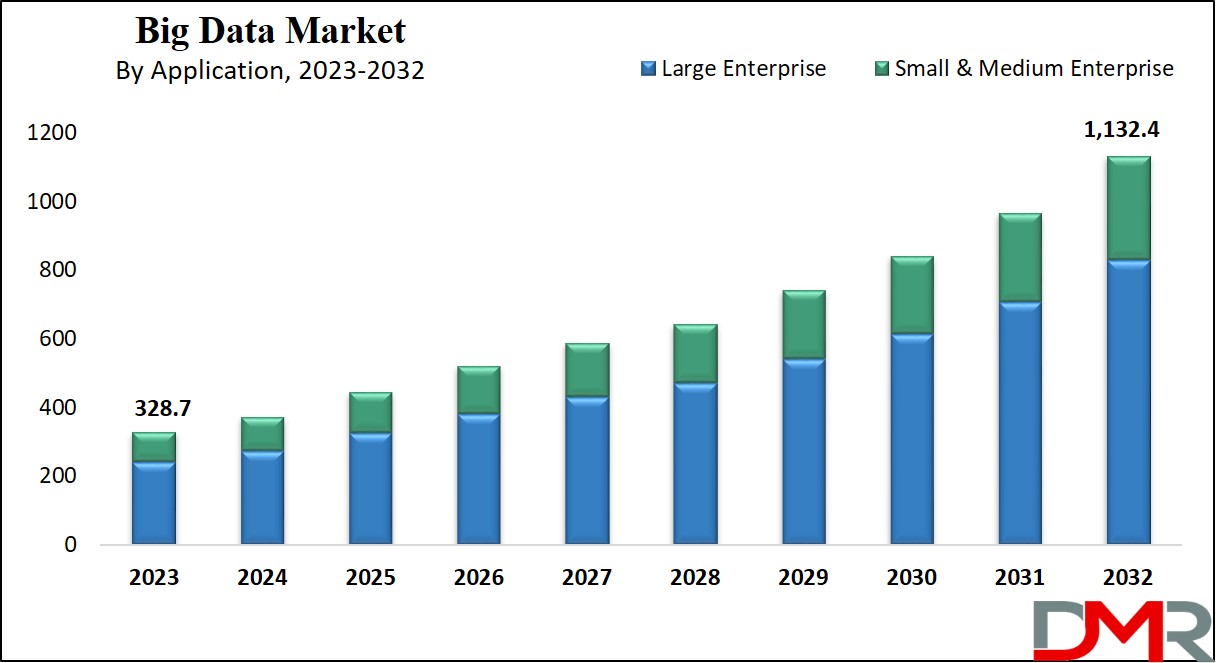

The Global Big Data Market size is estimated to be USD 328.7 billion in 2023 and is expected to reach USD 1,132.4 billion in 2033 at a CAGR of 14.7% by the end of 2032.

The global big data market constitutes a dynamic economic ecosystem encompassing the production, distribution, and consumption of technologies, solutions, and services dedicated to managing extensive datasets. Within this market, organizations are engaged in activities aimed at harnessing the potential of large data volumes for insightful analytics, improved decision-making, and addressing business challenges. Key components include data technologies and infrastructure, covering hardware and software for data storage, processing, and management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Analytics and business intelligence tools facilitate data analysis and insights derivation. Cloud-based solutions play a significant role, in offering scalable environments for big data applications. Data science and machine learning technology extract meaningful patterns from massive datasets. The integration of

IOT Microcontroller systems within IoT ecosystems is further enhancing data capture capabilities, fueling the demand for efficient big data platforms.

Industry-unique programs cater to the precise desires of sectors like healthcare and finance. For instance, healthcare applications now combine analytics with connected

medical devices to improve diagnostics, monitoring, and patient care outcomes. Consulting and integration services aid in making plans and implementation, while information protection and governance solutions cope with privacy and compliance concerns, reflecting the multifaceted nature of the global big data analytics landscape.

The growing adoption of Machine Learning (ML), the Internet of Things (IoT), and Artificial Intelligence (AI) is driving a significant increase in the volume of connected IoT devices. According to data from the International Data Corporation (IDC), 152,200 IoT devices are projected to connect per minute by 2025. This rising demand for connected devices is accelerating the implementation of edge computing.

Edge computing refers to an architecture where data processing occurs closer to the source or destination, rather than relying on centralized cloud systems, enabling faster data handling and improved efficiency in IoT-driven ecosystems, often in conjunction with Data

Center Liquid Immersion Cooling systems that optimize performance and energy efficiency in large-scale deployments.

Key Takeaways

- In the context of enterprise type, large enterprises dominate this segment as they hold 73.1% of the market in 2023.

- In the context of enterprise type, large enterprises dominate this segment as it holds 73.1% of the market share in 2023.

- Based on application, data discovery and visualization (DDV) has emerged as a dominant segment in the big data market due to its widespread adoption and effectiveness.

- The dominance of the Banking, Financial Services, and Insurance (BFSI) sector in this segment, as they hold the highest market share in 2023.

- North America dominates the global big data market as it holds 39.2% of the market share in 2023 and is projected to show subsequent growth in the upcoming years of 2023 to 2032.

Market Dynamic

The big data market is shaped by various factors that influence organizations to leverage data for insights and decision-making. The latest technological improvements, inclusive of innovations in statistics processing, device mastering, and garage solutions, force the evolution of huge data technology. The vast adoption of cloud computing complements scalability and versatility in imposing large statistics solutions. Integration with synthetic intelligence and gadget mastering enhances predictive analytics skills.

Data privacy and protection issues, coupled with regulatory requirements, impact the development and deployment of huge facts answers. The concept of Data-as-a-Service allows agencies to get admission to outside facts assets successfully. Sustainability considerations are shaping environmentally pleasant records processing solutions.

Global economic conditions impact price range priorities and era adoption fees. This industry ecosystem is forming, and fostering collaboration and innovation. A special understanding of these dynamics is crucial for stakeholders to navigate the evolving large information panorama and make knowledgeable selections in era adoption and funding strategies, including emerging markets like

The Kingdom of Saudi Arabia Big Data initiatives, which are rapidly gaining momentum in the region’s vision for economic diversification.

Driver

An explosion of data creation across industries is driving growth of the big data market. Businesses in sectors like healthcare, retail, finance, and manufacturing are producing massive amounts of structured and unstructured information from IoT devices, social media channels, and business operations that is fed into big data analytics for actionable insights, process optimization, and improved decision making. Digital transformation initiatives combined with cloud computing adoption have only intensified this need further, creating great opportunities for this sector of technology. Emerging sectors such as

Digital Railways also rely on big data to optimize passenger safety, predictive maintenance, and operational efficiency.

Trend

Its A significant trend in the big data market is the increasing use of artificial intelligence (AI) and machine learning (ML) technologies, particularly artificial neural networks (ANNs) like deep neural networks (DNNs). AI/ML solutions help businesses efficiently process large datasets while deriving predictive and prescriptive analytics more easily.

They can uncover hidden patterns, automate decision making processes and deliver real time insights something industries like customer experience management, predictive maintenance and fraud detection are beginning to benefit from. As companies innovate further with AI/ML solutions being integrated into big data analytics which will eventually enable more intelligent adaptive business strategies than ever before.

Restraint

Data security and privacy issues present a major barrier to the growth of the big data market. Organizations deal with vast quantities of sensitive information that makes them susceptible to breaches, cyberattacks and data misuse; compliance with stringent data protection regulations like GDPR, CCPA and HIPAA increases operational costs significantly.

While the lack of robust governance frameworks and secure storage solutions deters some companies from fully adopting big data technologies this often necessitates investments into cybersecurity measures which may prove prohibitively expensive for small and medium sized enterprises (SMEs).

Opportunity

Emerging economies represent an enormous market opportunity for big data solutions. Asia Pacific, Latin America and Africa are seeing rapid digitalization with smart devices proliferating throughout their economies leading to an explosion of data generated.

Governments and enterprises in these regions have begun investing in big data analytics as an asset management strategy for improving operational efficiency, customer engagement and driving economic growth particularly within sectors like e commerce, banking and healthcare which leverage big data analytics solutions in particular for addressing local challenges and capitalizing on opportunities. Creating tailored, cost effective solutions can unlock untapped potential and accelerate further expansion.

Research Scope and Analysis

By Component

In the context of enterprise type, the software program phase poised for the maximum fast growth over the forecast duration is visualization, with a projected Compound Annual Growth Rate (CAGR) exceeding expectations.

This surge is normally driven by way of the escalating patron call for on-demand get entry to information, prompting an extensive push for cellular records visualization options. Another widespread phase expected to experience strong growth in the imminent years is analytics.

This boom is by and large attributed to the increasing recognition, necessity, and adoption of big statistics analytics amongst each small and big firm. The escalating adoption of these answers by means of companies is a reaction to the growing vital of making strategic business choices primarily based on authentic insights. This strategic method is essential for mitigating the danger of failure and thriving inside the intensely aggressive business panorama.

By Enterprise Type

In the context of enterprise type, large enterprises dominate this segment as it holds 73.1% of the market share in 2023 and is expected to show subsequent growth in the upcoming years of 2023 to 2032. This dominance can be attributed to the adoption of huge data technology, broadly speaking because of the scale, sources, and organizational complexity inherent in their operations.

These businesses take care of large volumes of records generated utilizing diverse business operations, complicated delivery chains, and worldwide presence. With extra funding ability, big establishments can allocate significant budgets to put into effect complete huge records answers, leveraging superior analytics and gadget getting to know for deeper insights. Regulatory compliance necessities and the need for a competitive benefit in addition drive the adoption of massive facts.

Large companies regularly establish in-house records technology groups, making ensure know-how in coping with complicated datasets. The scale of purchaser interactions and employer-extensive collaboration additionally benefits from huge information analytics.

While huge firms lead in large records adoption, improvements in cloud computing and scalable solutions are making that technology increasingly reachable to small and medium enterprises, broadening the blessings of huge statistics throughout numerous companies.

By Application

Based on application, data discovery and visualization (DDV) has emerged as a dominant segment inside the massive records marketplace due to its widespread adoption and effectiveness. The consumer-friendly interface of DDV gear enables each technical and non-technical customer to interact with complicated datasets, fostering a more inclusive and statistics-pushed subculture within corporations.

By presenting information in visually understandable formats, these tools facilitate advanced selection-making with the aid of helping users speedy draw close developments, outliers, and relationships within the information.

DDV tools excel in identifying trends and patterns within large datasets, supporting big data applications, and offering real-time insights which is crucial for dynamic business environments.

Integration with advanced analytics, adaptability to varied data types, and the democratization of data are additional factors that underscore the dominance of data discovery and visualization in the big data landscape, ultimately leading to enhanced collaboration, understanding, and actionable insights across diverse user groups.

By End User

The dominance of the Banking, Financial Services, and Insurance (BFSI) region in this phase, as they preserve the highest marketplace share in 2023 because of the adoption of massive records technology in the inherently statistics-in-depth nature of BFSI operations. In BFSI massive records generation offers an extensive quantity of records on transactions, market actions, and risk assessments, and aligns seamlessly with the talents of huge data analytics.

The area benefits drastically from actual-time analytics for well-timed decision-making in economic markets and employs huge statistics to beautify chance control, stumble on fraud, and ensure compliance with stringent regulatory necessities.

Big information contributes to customized customer reports, providing insights into patron behavior and alternatives for tailor-made monetary services. The era also plays an important function in credit score scoring, underwriting procedures, and operational efficiency, lowering prices for economic establishments.

Moreover, the BFSI zone's proclivity for technological innovation and virtual transformation projects, pushed in part utilizing the rise of FinTech businesses, underscores massive information's indispensable role in preserving competitiveness and strategic selection-making.

While BFSI remains a major adopter of large data, it's noteworthy that other industries, along with healthcare, retail, and telecom, are increasingly spotting the value of large data for diverse functions, every encouraged by enterprise-unique challenges and opportunities.

The Big Data Market Report is segmented on the basis of the following:

By Component

- Software

- Credit Risk Management

- Business Analytics

- CRM Analytics

- Compliance Analytics

- Workforce Analytics

- Others

- Hardware

- Service

By Enterprise Type

- Large Enterprise

- Small & Medium Enterprise

By Application

- Data Discovery and Visualization (DDV)

- Advanced Analytics

By End User

- BFSI

- Automotive

- Telecom/Media

- Healthcare

- Retail

- Energy & Utility

- Others

Regional Analysis

North America dominates the global big data market as it

holds 39.2% of the market share in 2023 and is projected to show subsequent growth in the upcoming years of 2023 to 2032.

This region's dominant position within the global big information market is due to different factors like its nicely advanced technological infrastructure, which includes advanced statistics facilities and established IT surroundings. These factors assist the improvement and implementation of big facts answers.

North America is domestic to many important generation innovators which include Amazon, Microsoft, Google, and IBM, who've witnessed early adoption and non-stop innovation in large facts technologies across sectors like finance, healthcare, e-commerce, and era. The strong subculture of innovation, massive investment in studies and development, and vibrant entrepreneurial surroundings, notably exemplified by Silicon Valley, have fostered the boom of startups and improvements in big facts analytics.

The location's massive corporations, coupled with a regular data-driven subculture and collaboration among academia and industry, similarly contribute to its management inside the large records landscape.

However, it is crucial to understand that other areas, which include Europe and Asia-Pacific, are experiencing huge growth, and different factors, together with regulatory environments and cultural attitudes toward records privateness, can affect the evolving dynamics of the global big records market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global big data marketplace functions with key players spanning numerous sectors. Established generation giants, which include Amazon Web Services (AWS), Microsoft, Google Cloud Platform (GCP), IBM, and Oracle, dominate the space, offering complete cloud-based massive statistics services. Pure-play organizations like Cloudera and Hortonworks specialize in Hadoop-based answers, even as analytics and enterprise intelligence providers together with Tableau, Qlik, and MicroStrategy make contributions significantly to the marketplace.

The open-source community stays influential, with Apache Hadoop, Apache Spark, and Apache Flink broadly applied for huge-scale information processing. The market is likewise marked by way of the presence of innovative startups specializing in areas of interest areas like actual-time analytics and information governance. Vertical answers vendors cater to industry-particular desires, while consulting and integration services from corporations like Accenture and Deloitte play a crucial position in enforcing and supporting huge facts projects.

Global system integrators like TCS, Infosys, and Cognizant make contributions to the huge-scale implementation and control of massive records answers for corporations. The aggressive landscape of the worldwide big facts marketplace displays a blend of enterprise leaders, specialized gamers, and collaborative ecosystems, driving innovation and advancements in this market.

Some of the prominent players in the Global Big Data Market are

- IBM Corporation

- SAP SE

- Microsoft Corporation

- SAS Institute Inc.

- Fair Issac Corporation

- Oracle Corporation

- Salesforce Inc.

- Equifax Inc.

- TransUnion

- QlikTech International AB

- Other Key Players

Recent Developments

- In November 2023, the Global Data Ecosystem Conference 2023 (GDEC 2023) took place in Shanghai and was themed "Data World, Connected Future," the conference witnessed the simultaneous launch of international data products and highlighted key achievements in data factor market infrastructure development. Collaborating data exchange institutions established DexChain, a data exchange chain, and jointly introduced the "Trust Framework" initiative, aiming to enhance the integrity of the data factor market.

- In January 2022, Oracle updated the Oracle Analytics Cloud, Oracle’s new redwood design experience would help users to identify, display & act on crucial points with a new style, greater sparking new style, greater spacing, and interface that are suitable for large amounts of data.

- In April 2022, Wipro formed a collaboration with DataRobot to boost their competitive edge offer augmented intelligence business, and help them become an AI-powered company.’

- In March 2022, Microsoft released Azure Health Data Services, a service platform designed to support transactional and analytical works. It is AI-powered and helps in combining health data in the cloud, supporting in protection of the health care information of patients.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 328.7 Bn |

| Forecast Value (2032) |

USD 1,132.4 Bn |

| CAGR (2023-2032) |

14.7% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, Hardware and Service), By Enterprise Type (Large Enterprise and Small & Medium Enterprise), By Application (Data Discovery and Visualization (DDV) and Advanced Analytics), By End User (BFSI, Automotive, Telecom/Media, Healthcare, Retail, Energy & Utility and Others. |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

IBM Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., Fair Issac Corporation, Oracle Corporation, Salesforce Inc., Equifax Inc., TransUnion, QlikTech International AB, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Big Data Market?

▾ The Global Big Data Market size is estimated to be USD 328.7 billion in 2023 and is expected to reach

USD 1,132.4 billion by the end of 2032.

Which region accounted for the largest Global Big Data Market?

▾ North America has the largest market share for the Global Big Data Market with a share of about 39.2%

in 2023.

Who are the key players in the Global Big Data Market?

▾ Some of the major key players in the Global Big Data Market are IBM Corporation, SAP SE, Microsoft

Corporation, SAS Institute Inc., Fair Issac Corporation, Oracle Corporation, Salesforce Inc., Equifax Inc.,

TransUnion, QlikTech International AB, and many others.

What is the growth rate in the Global Big Data Market?

▾ The market is growing at a CAGR of 14.7 percent over the forecasted period.