Billing refers to producing and sending invoices for products or services provided, which includes calculating amounts due, applying taxes, discounts, or credits as appropriate, and maintaining records for both business and customers. Billing is a key part of financial operations across industries, ranging from retail and telecom to healthcare and utilities, helping businesses track sales, manage payments, and ensure timely revenue collection.

Further, recent years have witnessed an evolution in billing systems due to digital transformation. Paper-based billing has increasingly been replaced by electronic billing, or e-billing; this digital system automates tasks, reduces manual errors, and offers faster processing speeds. Cloud solutions now provide automatic payment reminders, subscription management capabilities, and integration with accounting platforms, which have made billing faster, more accurate, and more convenient for both businesses and their customers.

Due to the rise in the trend of digital services and mobile payments, billing systems have seen higher demand. Companies now offer flexible billing models like pay-per-use pricing or monthly subscriptions; modern billing platforms must support complex pricing structures with real-time updates for real-time businesses such as SaaS (Software-as-a-Service), streaming media, or cloud computing businesses.

Automation and artificial intelligence (AI) are quickly becoming key trends in billing. These technologies support identifying errors, predicting late payments, suggesting adjustments to invoice schedules based on customer behavior patterns, and detecting unusual payment patterns or suggesting better invoice schedules than manually input, saving both time and improving cash flow. Automation also reduces manual input, saving both time and improving cash flow.

Also, recent pandemic events drove many businesses to adopt digitization faster, like billing operations. Contactless payments, online billing portals, and mobile invoicing became more highly used among small businesses; some adopted simple billing apps for sending invoices remotely while receiving payments remotely, which highlighted the necessity of flexible yet easy-to-use billing systems suited for organizations with limited resources.

Overall, billing has expanded beyond being just an invoice delivery mechanism to be an essential part of customer experience and business intelligence. A good billing system can build trust with customers while simultaneously increasing revenue and offering useful insights into customer preferences and payment trends. As industries digitize further, billing will remain a focal point of innovation and expansion.

The US Billing Market

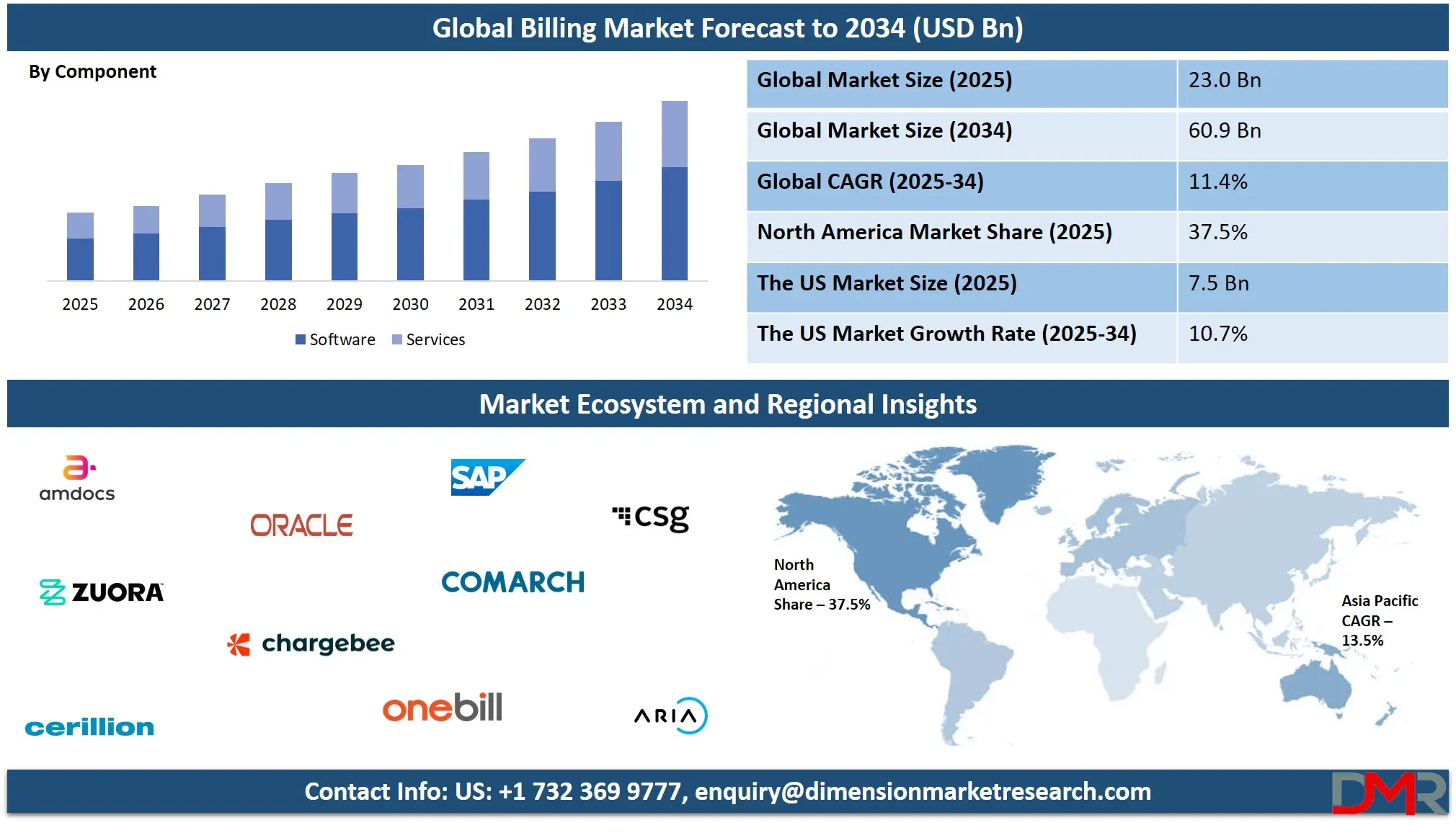

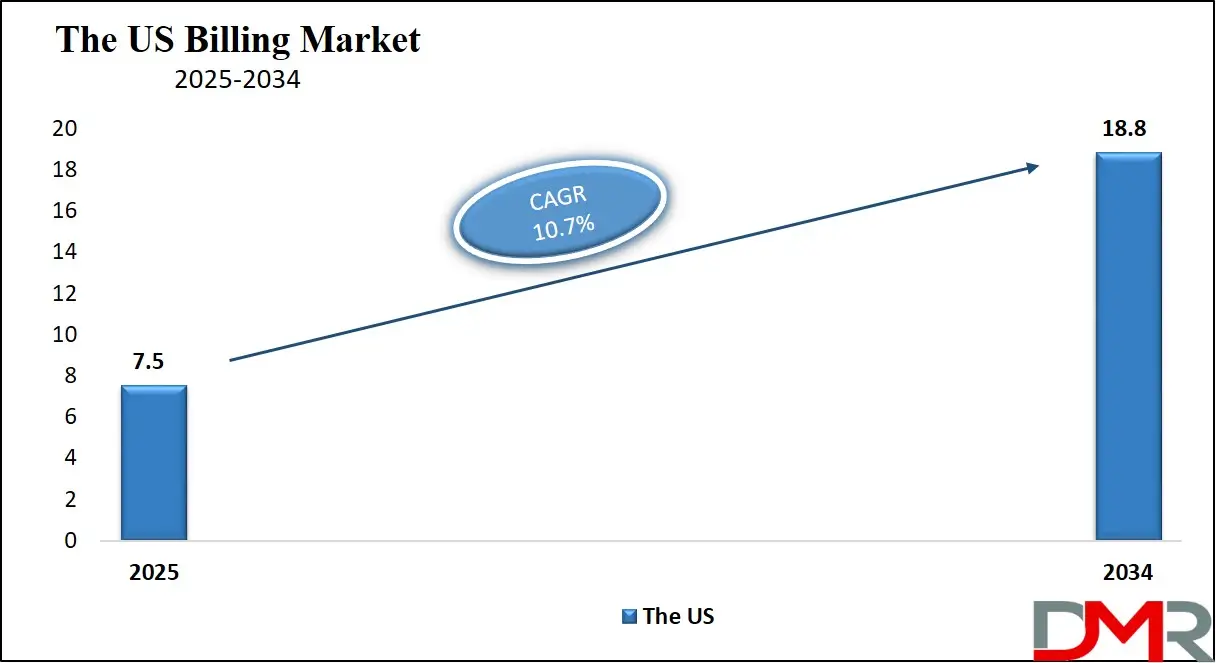

The US Billing Market size is projected to reach USD 7.5 billion in 2025 at a compound annual growth rate of 10.7% over its forecast period.

The US plays a pivotal role in the global billing market, serving as a key driver of innovation and demand. With its advanced technological infrastructure and large, diverse economy, the U.S. is home to many major telecom, utility, and subscription-based service providers who rely on specialized billing systems. The country's early adoption of cloud technologies, AI, and IoT has fostered the development of scalable, efficient billing solutions. Furthermore, the US has a significant number of large enterprises and small businesses adopting digital services, boosting the demand for automated and flexible billing platforms. Regulatory compliance requirements, such as GDPR and CCPA, also influence the evolution of billing solutions, making the US market crucial for industry growth and innovation.

Europe Billing Market

Europe Billing Market size is projected to reach USD 5.1 billion in 2025 at a compound annual growth rate of 8.5% over its forecast period.

Europe plays a crucial role in the global billing market, driven by its diverse economy and advanced technological landscape. The region is home to major telecom providers, utilities, and digital service companies that require sophisticated billing solutions to manage complex pricing structures and large customer bases. The adoption of cloud-based billing systems is widespread, with companies embracing automation, real-time analytics, and flexible payment models.

Europe’s strong regulatory frameworks, such as GDPR, have significantly influenced the development of billing technologies, pushing for enhanced data security and compliance. Additionally, the rise of subscription-based services, digital content, and renewable energy solutions in Europe further fuels demand for adaptive and scalable billing platforms, making the region a key player in the global billing market's growth.

Japan Billing Market

Japan Billing Market is projected to reach USD 1.6 billion in 2025 at a compound annual growth rate of 7.8% over its forecast period.

Japan plays a significant role in the global billing market, particularly in telecom, utilities, and digital services. Known for its technological innovation and advanced infrastructure, Japan is a key adopter of cutting-edge billing solutions, integrating AI, IoT, and cloud technologies into its systems. Japanese telecom providers, such as NTT and SoftBank, rely on sophisticated billing platforms to manage complex pricing models, mobile plans, and data usage tracking.

The growing adoption of digital services, including streaming platforms and e-commerce, further drives the demand for scalable, automated billing systems. Japan's strong emphasis on data privacy and regulatory compliance also shapes the development of billing technologies. As a leader in technological advancements, Japan remains crucial in pushing the boundaries of billing solutions in the global market.

Billing Market: Key Takeaways

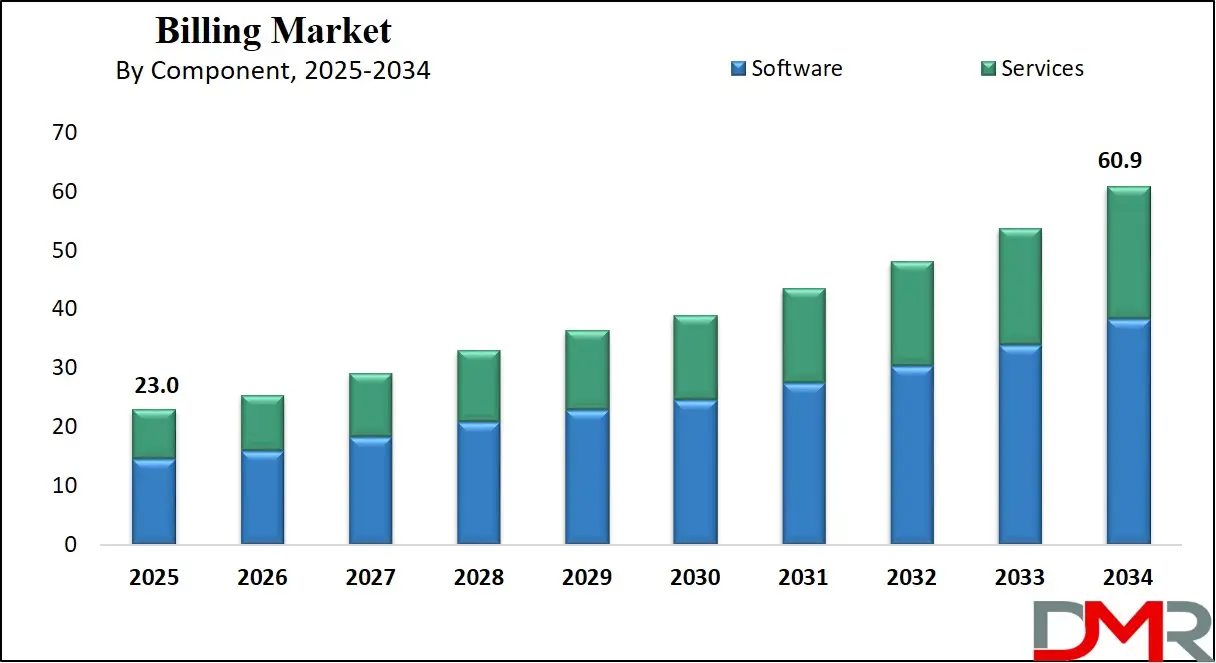

- Market Growth: The Billing Market size is expected to grow by 35.5 billion, at a CAGR of 11.4%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the Billing Market in 2025.

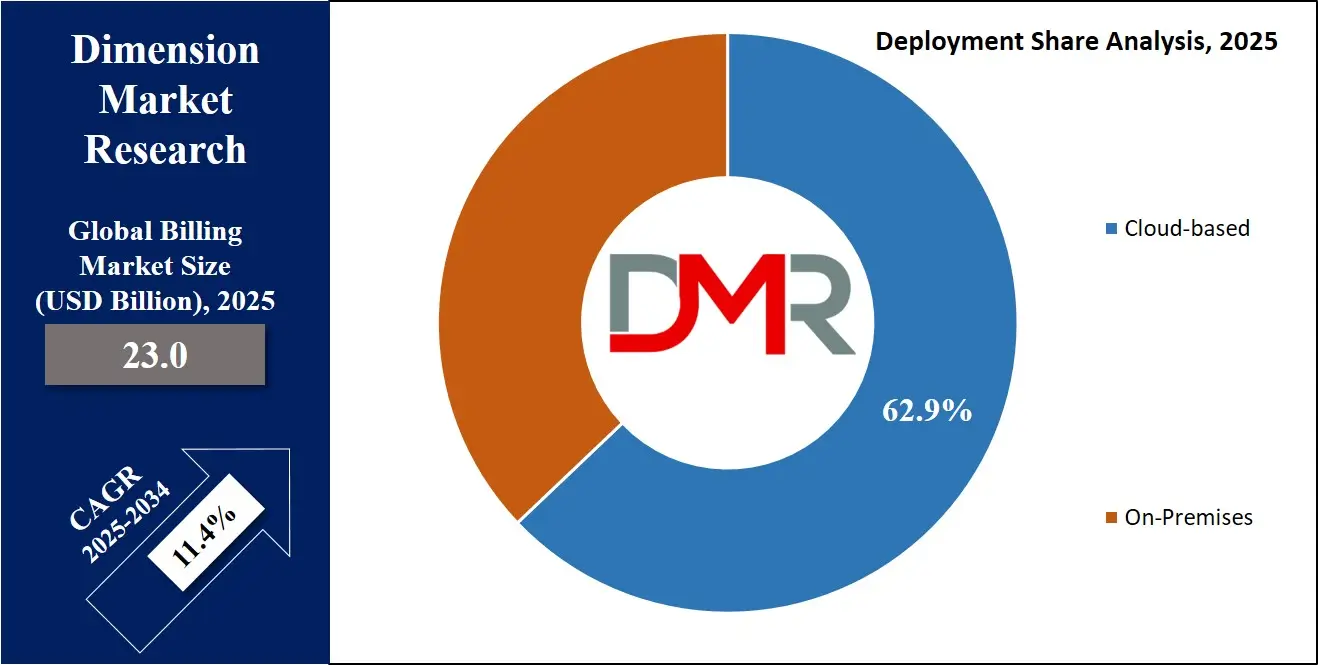

- By Deployment: The cloud-based segment is expected to get the largest revenue share in 2025 in the Billing Market.

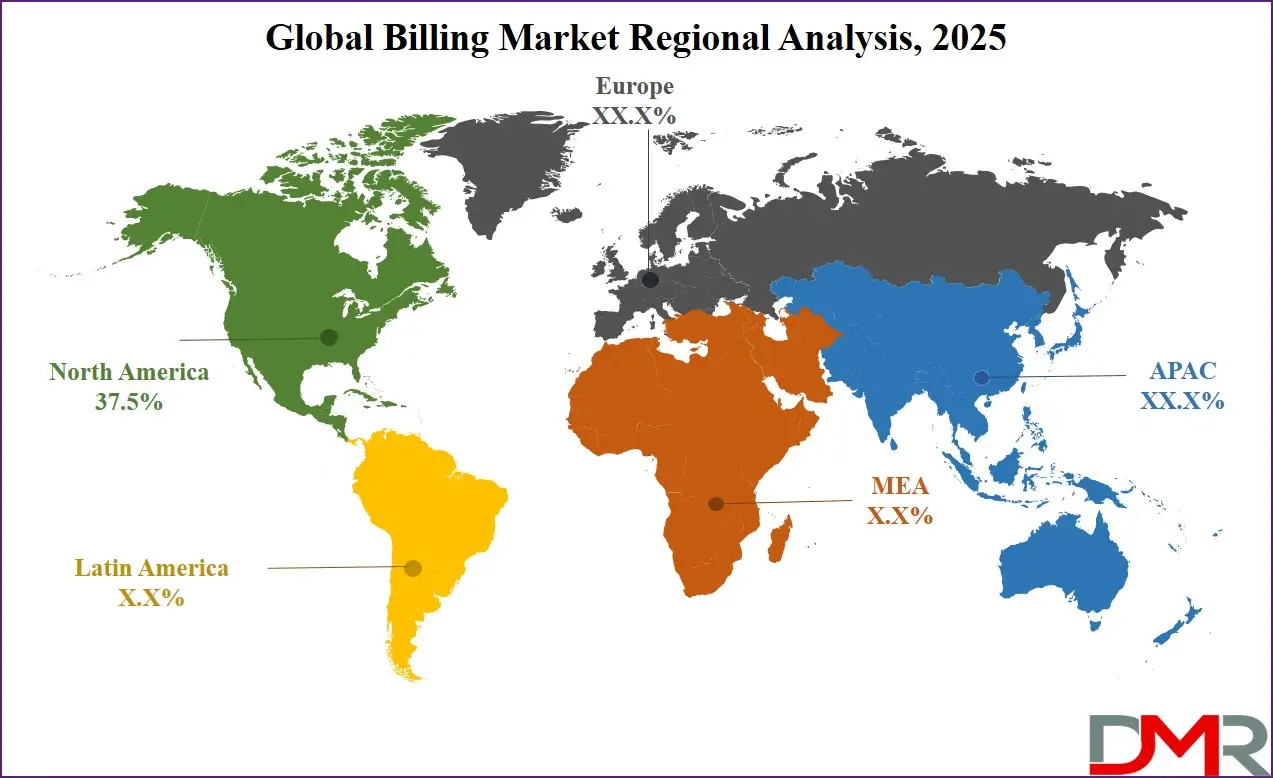

- Regional Insight: North America is expected to hold a 37.5% share of revenue in the Global Billing Market in 2025.

- Use Cases: Some of the use cases of Billing include subscription management, usage-based billing, and more.

Billing Market: Use Cases

- Subscription Management: Billing systems help manage recurring payments for subscription-based services. They automatically generate invoices, apply taxes, and handle renewals or cancellations, which ensures smooth payment cycles and enhances customer satisfaction with timely, accurate billing.

- Usage-Based Billing: In industries like cloud services or utilities, billing platforms track real-time usage data and calculate charges accordingly. This allows businesses to provide flexible pricing based on customer consumption. It enhances transparency and builds trust with users.

- Automated Invoicing and Reminders: Billing tools can automate the entire invoicing process, from creation to sending reminders for overdue payments. This minimizes manual effort and speeds up collections. It also lowers errors and helps maintain consistent cash flow.

- Integrated Financial Reporting: Modern billing systems often integrate with accounting software to provide real-time financial insights, which enables businesses to track revenue, monitor performance, and plan better. It supports smarter decision-making with up-to-date billing data.

Stats & Facts

- According to CMS.gov, the improper payment rate for Medicaid in FY 2024 was 5.09%, totaling USD 31.10 billion, showing a notable decline from the previous year’s 8.58%; importantly, 79.11% of these payments were due to insufficient documentation, usually indicating missed administrative steps rather than fraud or abuse.

- Based on data from Chargebee, 73% of businesses plan to increase prices in 2024, marking a strategic shift of more than ten percentage points compared to the 62% reported in 2023, reflecting a strong push to optimize revenue streams amid growing customer expectations.

- CMS.gov reported that the Medicare Fee-for-Service improper payment rate in 2024 was 7.66%, amounting to USD 31.70 billion; this continues an eight-year trend of staying below the 10% compliance threshold set by statutory requirements, showing consistent improvements in claim accuracy.

- As highlighted by Chargebee, 47% of subscription professionals consider improving customer retention as their top priority for 2024, emphasizing how vital loyal users are to sustaining growth in an increasingly competitive subscription economy.

- The value of UPI transactions in India surged from INR 1 lakh crore in FY 2017-18 to INR 200 lakh crore in FY 2023-24, representing a remarkable CAGR of 138%, as per NPCI; the ease of use and widespread acceptance among banks and fintechs has made UPI the top choice for real-time digital payments.

- According to RBI and NPCI, digital payment transaction volumes in India rose sharply from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24, reflecting a strong CAGR of 44%, further boosted by 8,659 crore transactions in just the first five months of FY 2024-25.

- Chargebee data reveals that 50% of subscription professionals expect churn rates to increase in 2024, a better outlook compared to 64% in 2023, indicating growing efforts across industries to enhance retention and reduce customer drop-off.

- CMS.gov estimates show that Medicare Part C had an improper payment rate of 5.61% or USD 19.07 billion in FY 2024, and while it is slightly down from 6.01% in FY 2023, the adjustment also reflects improved sampling to better represent the Medicare Advantage population.

- From FY 2017-18 to FY 2023-24, UPI transactions grew from 92 crore to 13,116 crore, according to NPCI, resulting in a phenomenal CAGR of 129%; in the first five months of FY 2024-25 alone, UPI volume reached 7,062 crore, signaling its deep penetration across user segments.

- The total digital payment value in India jumped from INR 1,962 lakh crore to INR 3,659 lakh crore at a CAGR of 11%, and as of the first five months of FY 2024-25, it stood at INR 1,669 lakh crore, showcasing sustained growth momentum, as reported by RBI, NPCI, and major banks.

- CMS.gov found that the CHIP improper payment rate dropped significantly to 6.11% or USD 1.07 billion in FY 2024, compared to 12.81% in 2023, with 61.56% of these payments resulting from missing documentation rather than malicious intent or fraud.

- Chargebee’s research shows strong growth optimism, with 96% of subscription professionals expecting a revenue increase in 2024, highlighting the sector's confidence and the continued evolution of flexible pricing and service models.

Market Dynamic

Driving Factors in the Billing Market

Digital Transformation and AutomationOne of the biggest growth drivers of the billing market is the rapid transformation toward digital transformation across industries. As businesses move away from manual and paper-based processes, there is a major need for automated billing systems that improve speed, accuracy, and efficiency. These modern solutions reduce human error, streamline operations, and enhance customer experiences through instant invoicing and real-time updates. Automation also allows businesses to scale easily, manage complex pricing models, and handle higher transaction volumes with minimal effort. With the growing adoption of cloud computing and remote work, digital billing tools have become essential. This push for digitization is creating massive demand for intelligent, integrated, and user-friendly billing platforms across all sectors.

Rise of Subscription and Usage-Based Models

The growing popularity of subscription services and usage-based pricing is another key growth driver in the billing market. Industries like software, media, telecom, and utilities are adopting flexible billing models that require dynamic and responsive billing systems. Traditional systems can’t easily handle real-time adjustments, metered usage, or personalized pricing, so businesses are investing in advanced platforms that can. These systems support automatic renewals, upgrades, downgrades, and prorated charges, making them vital for customer retention and revenue optimization. As more consumers and businesses expect flexibility and convenience, the need for billing solutions that can adapt to changing customer behaviors and pricing models constantly grows, fueling market expansion.

Restraints in the Billing Market

Data Security and Privacy Concerns

One major restraint in the billing market is the growing concern around data security and privacy. Billing systems handle sensitive customer information, including payment details, personal data, and transaction history. Any breach or unauthorized access can lead to financial losses, legal issues, and a damaged reputation for businesses. With the growth in cyberattacks and stricter data protection laws across regions, companies must invest heavily in security features like encryption, multi-factor authentication, and compliance certifications. However, not all businesses, mainly small and medium ones, have the resources to implement high-level security, which can slow down the adoption of advanced billing systems and limit growth, mainly in markets where digital infrastructure is still developing.

Integration and System Complexity

Another challenge for the billing market is the complexity involved in integrating billing systems with other business software. Companies often use multiple platforms for customer relationship management, finance, accounting, and analytics. Ensuring that the billing software works smoothly with all these systems can be technically difficult and time-consuming. Poor integration can lead to issues like data mismatches, reporting errors, and delayed payments. Additionally, businesses may face a learning curve or require staff training to fully utilize new billing tools. These complications can discourage some companies from upgrading their billing systems or cause delays in implementation, thereby restraining the market’s full potential.

Opportunities in the Billing Market

Expansion in Emerging Markets

The expanding digital infrastructure and internet penetration in emerging markets present a strong opportunity for the billing market. As more businesses in regions like Asia, Africa, and Latin America go digital, there is a rising demand for efficient and affordable billing solutions. Small and medium enterprises in these regions are beginning to adopt cloud-based tools to streamline their operations and manage finances better. Governments and financial institutions are also promoting digital payments and financial inclusion, further boosting the need for modern billing systems. Since these markets are still developing, providers have the chance to offer localized solutions tailored to specific needs and regulations. This expansion potential can drive long-term growth for billing technology providers across various industries.

Adoption of AI and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics into billing platforms offers exciting new opportunities. AI can automate routine billing tasks, detect anomalies, and predict late payments or customer churn. Predictive tools help businesses make better decisions on pricing, discounts, and payment schedules based on customer behavior and historical data. These smart features can improve operational efficiency, enhance customer satisfaction, and optimize revenue. As companies increasingly look for ways to personalize billing and improve financial planning, the demand for AI-powered billing solutions is set to rise. This opens up new avenues for innovation and competitive advantage within the billing technology landscape.

Trends in the Billing Market

Shift Toward Cloud-Based Billing Solutions

A key recent trend in the billing market is the strong shift toward cloud-based billing platforms. Businesses are moving away from traditional on-premise systems in favor of cloud solutions that offer flexibility, scalability, and lower upfront costs. These platforms allow for real-time updates, remote access, and seamless integration with other digital tools. As companies grow or enter new markets, cloud billing systems help them scale operations without the need for heavy IT infrastructure. This trend is especially prominent among small and medium enterprises looking for cost-effective and easy-to-deploy solutions. Cloud billing also supports automatic updates and enhanced security features, making it a preferred choice in today’s fast-moving digital economy.

Focus on Customer-Centric Billing Experiences

Another emerging trend is the emphasis on creating customer-friendly billing experiences. Businesses are realizing that billing is not just a financial process but also a key touchpoint in the customer journey. As a result, they are investing in systems that provide transparency, multiple payment options, self-service portals, and clear communication. Features like personalized invoices, real-time billing updates, and responsive customer support are becoming standard expectations. This trend is driven by rising customer demands and the need to improve satisfaction and loyalty. By making billing smoother and more intuitive, companies can reduce disputes, increase retention, and build stronger relationships with their clients.

Research Scope and Analysis

By Component Analysis

Software as a component is estimated to lead the billing market in 2025 with a dominant share of 62.9%, reflecting its critical role in driving market growth. As businesses increasingly adopt advanced billing software, they benefit from automation of invoicing, management of recurring payments, customer usage tracking, and dynamic pricing capabilities. These software solutions provide real-time billing, data analytics, customizable dashboards, and seamless integration with accounting and CRM systems.

With the expansion of companies across digital platforms and the emergence of new service models, dependable billing software has become essential for operational efficiency. It enhances accuracy, reduces manual errors, and ensures compliance with regulatory standards. The inclusion of cloud deployment and AI-driven features further supports both small businesses and large enterprises in optimizing revenue cycles and boosting customer satisfaction, making software a foundational element of modern business infrastructure.

Services as a component are also expected to witness significant growth during the forecast period, gaining momentum as businesses increasingly seek expert support for implementing and managing billing systems. These services encompass consulting, system integration, training, and ongoing maintenance, offering tailored solutions that align with specific industry requirements. Service providers play a pivotal role in enabling smooth transitions from legacy systems to modern billing platforms while ensuring data integrity and operational continuity.

With billing processes becoming more complex due to varied pricing models and cross-border transactions, professional services help organizations minimize downtime, improve system performance, and maintain regulatory compliance. Additionally, these services support the customization of billing workflows and offer technical assistance to ensure that systems run efficiently and effectively.

By Billing Model Analysis

Postpaid billing is expected to lead the billing market in 2025 with an estimated share of 47.1%, playing a pivotal role in supporting businesses that deliver services upfront and collect payment afterward. This model is mainly adopted across sectors such as telecom, utilities, and enterprise services, where billing occurs after customer usage is measured. Postpaid billing systems enable flexible payment cycles, detailed usage tracking, and personalized pricing structures.

They foster customer loyalty by facilitating credit-based services and offering long-term user benefits. As the demand for subscription-based services and bundled offerings grows, postpaid billing helps businesses strengthen customer relationships and maximize revenue potential. The use of advanced billing software within postpaid models further enhances operations through real-time monitoring, fraud detection, and streamlined collections, making it an indispensable solution for large-scale service providers managing high-volume and complex billing scenarios.

Prepaid billing is anticipated to experience substantial growth during the forecast period, driven by increasing adoption among businesses and consumers looking for greater control over their expenses. In this model, customers prepay for services or usage credits, enabling businesses to maintain healthy cash flow and minimize payment default risks. Widely used in telecom, streaming, and utility industries, prepaid billing allows users to track their consumption and recharge as needed.

It empowers businesses to expand their reach, particularly in regions with limited credit or banking infrastructure. In addition, prepaid billing supports flexible service plans, immediate activation, and enhanced transparency—factors that contribute to improved customer satisfaction. With the rapid expansion of digital wallets and mobile payment solutions, prepaid billing is becoming more accessible and appealing, accelerating its growth across various industry verticals.

By Type Analysis

Telecom billing is set to dominate the billing market in 2025 with an estimated share of 29.8%, playing a crucial role in supporting the rapid growth of mobile services, internet connectivity, and digital content consumption. Telecom companies mainly depend on sophisticated billing systems to manage extensive customer networks, monitor usage, and coordinate a variety of service packages. These telecom billing solutions enable real-time charging, accurate data usage tracking, and seamless management of bundled offerings, features that are essential in today's dynamic digital environment.

They also contribute to revenue assurance by minimizing leakage and ensuring prompt payments. As technologies like 5G, IoT, and OTT services expand, the need for precise and scalable telecom billing systems becomes even more pronounced. This billing type empowers telecom providers to introduce flexible pricing models, handle high transaction volumes, and deliver an enhanced customer experience while maintaining operational efficiency.

Subscription billing is projected to witness robust growth throughout the forecast period, emerging as one of the fastest-growing billing types in the market. Widely adopted by businesses offering digital products, SaaS platforms, media services, and consumer memberships, this model caters to customers seeking convenience and flexible payment options.

Subscription billing enables recurring payment setups, tiered pricing structures, and smooth free trial conversions, all of which contribute to simplified revenue management and increased customer lifetime value. As demand rises for online content, fitness applications, and software-as-a-service offerings, more companies are turning to this billing approach. With features like automated invoicing, proactive payment reminders, and real-time account updates, subscription billing helps reduce churn, strengthen customer loyalty, and support scalable growth across industries.

By Deployment Analysis

Cloud-based deployment is anticipated to lead the billing market in 2025 with an estimated share of 62.9%, playing a pivotal role in driving industry growth as businesses transition from traditional systems to more agile, scalable, and cost-efficient cloud billing solutions. These platforms provide remote accessibility, real-time updates, and seamless integration with vital business tools like CRMs and payment gateways.

Cloud billing solutions also allow automation, subscription management, and advanced analytics, allowing companies to manage complex pricing structures and enhance the customer experience. With the growing demand for digital services and increasing reliance on mobile devices, cloud-based billing is emerging as the preferred choice for businesses seeking flexibility and rapid deployment. Its ease of use, lower maintenance requirements, and fast implementation make it an attractive option for organizations of all sizes, particularly in fast-evolving and innovation-driven sectors.

Further, On-premises deployment is anticipated to maintain steady growth over the forecast period, constantly serving organizations that require greater control over their billing infrastructure and sensitive data, which is often favored by businesses with stringent data security requirements or limited internet connectivity. On-premises billing solutions offer high levels of customization and help enterprises comply with internal IT governance and regulatory mandates.

Although the initial investment and maintenance costs can be higher compared to cloud alternatives, these systems deliver reliability and direct system oversight. Industries like finance, government, and healthcare often rely on on-premises deployment to meet specific compliance and operational standards. While the broader market trends lean toward cloud adoption, on-premises billing solutions remain relevant in niche environments where data sovereignty and system autonomy are paramount.

By Enterprises Size Analysis

Large enterprises are anticipated to lead the billing market in 2025 with an estimated share of 67.7%, playing a significant role in its growth due to their complex operations and high-volume transactions. These organizations often manage diverse customer bases, multiple pricing models, and global billing needs, which require strong and scalable billing solutions. Advanced billing software allows large enterprises to automate workflows, minimize manual errors, and ensure compliance with industry regulations.

They also gain from real-time reporting, integrated payment gateways, and customizable billing features that align with their specific business objectives. As these companies expand into digital services and subscription-based models, efficient billing systems are essential for managing diverse revenue streams and enhancing customer satisfaction. Their strong investment capacity further supports the adoption of the latest technologies, driving innovation and increasing demand within the billing software market.

Also, Small and medium-sized enterprises (SMEs) are anticipated to experience significant growth over the forecast period, becoming key contributors to the billing market's expansion. As more SMEs enter digital spaces and adopt cloud-based services, there is a growing need for cost-effective and flexible billing systems. These businesses utilize billing tools to manage subscriptions, track customer payments, and automate invoicing, all without the need for large IT teams. Billing software allow SMEs to improve cash flow, maintain accurate records, and provide professional billing experiences to their clients.

With ongoing digital adoption in retail, e-commerce, and service sectors, SMEs are increasingly seeking solutions that are easy to implement and can scale as their businesses grow. In addition, support from government initiatives and digital payment platforms is helping smaller businesses modernize their billing practices, positioning them as an increasingly important segment in the market.

By Industry Vertical Analysis

The telecommunication sector is projected to dominate the billing market in 2025 with an estimated share of 28.4%, playing a vital role in market growth due to its massive user base, wide-ranging service offerings, and complex usage patterns. Telecom providers depend on advanced billing systems to effectively manage mobile plans, data consumption, roaming charges, and bundled service packages across millions of customers. Key features like real-time billing, automated invoicing, and flexible payment models are vital for delivering seamless and efficient user experiences.

As emerging technologies like 5G, IoT, and digital entertainment continue to evolve, telecom companies require scalable and intelligent billing platforms to meet growing demands and integrate new digital services. These solutions are instrumental in minimizing revenue leakage, enhancing operational performance, and maintaining compliance with international standards. The industry's need for detailed usage analytics, adaptable pricing structures, and personalized customer plans solidifies telecom as one of the most influential drivers behind the adoption of modern billing systems.

The utilities sector is anticipated to witness major growth throughout the forecast period, becoming an increasingly important segment within the billing market as energy demand rises and digital transformation accelerates. Utility providers, managing services such as electricity, gas, and water, face unique challenges like dynamic pricing models and seasonal consumption fluctuations. Modern billing solutions empower these companies to monitor usage in real time, produce accurate and customized invoices, and maintain transparency with customers.

In addition to supporting regulatory compliance and facilitating both prepaid and postpaid models, billing systems also enhance outage management and service reliability. With the increasing adoption of smart meters and IoT devices, utilities need agile billing platforms capable of processing large volumes of consumption data and enabling quick configuration updates. Moreover, the global shift toward renewable energy and sustainability introduces new billing complexities, making it essential for utility providers to rely on flexible, future-ready billing solutions for both residential and commercial users.

The Billing Market Report is segmented on the basis of the following

By Component

- Software

- Services

- Consulting

- Implementation

- Support & Maintenance

By Billing Model

By Type

- Telecom Billing

- Utility Billing

- Medical Billing

- Subscription Billing

- Tax & Invoice Billing

By Deployment Type

By Enterprise Size

By Industry Vertical

- Telecommunications

- BFSI

- Healthcare

- Retail & E-Commerce

- IT & Software

- Utilities

- Government

- Education

Regional Analysis

Leading Region in the Billing Market

Leading in 2025 with a

share of 37.5%, North America is expected to hold a strong position in the global billing market due to its advanced digital infrastructure and early adoption of automation tools. The region is home to a large number of technology-driven companies that rely on subscription billing, cloud invoicing, and recurring payment systems to manage revenue streams. Growing demand for real-time billing, seamless payment processing, and customer retention tools has pushed businesses to invest in smart billing software.

The rise of digital wallets, contactless transactions, and integrated financial tools also supports the shift to modern billing platforms. Strict data privacy regulations encourage the use of secure and compliant billing systems that protect sensitive customer information. In sectors like healthcare, telecom, and software, billing accuracy and speed are critical, further fueling the need for efficient solutions. With strong demand for advanced features like analytics, automation, and flexible pricing options, North America continues to be a key driver in shaping the future of billing technologies.

Fastest Growing Region in the Billing Market

Asia Pacific is seeing significant growth over the forecast period in the billing market due to rapid digitalization, rising internet usage, and strong economic development. More businesses are moving online and adopting cloud-based billing systems to support expanding customer bases and complex pricing models. The boom in e-commerce, fintech, and mobile payments is creating high demand for flexible and automated billing solutions. Governments across the region are also pushing digital payment adoption, helping small and medium businesses modernize their operations. With increasing smartphone penetration and growth in subscription-based services, Asia Pacific is becoming a dynamic hub for billing software provider, offering new opportunities for expansion and innovation.