Market Overview

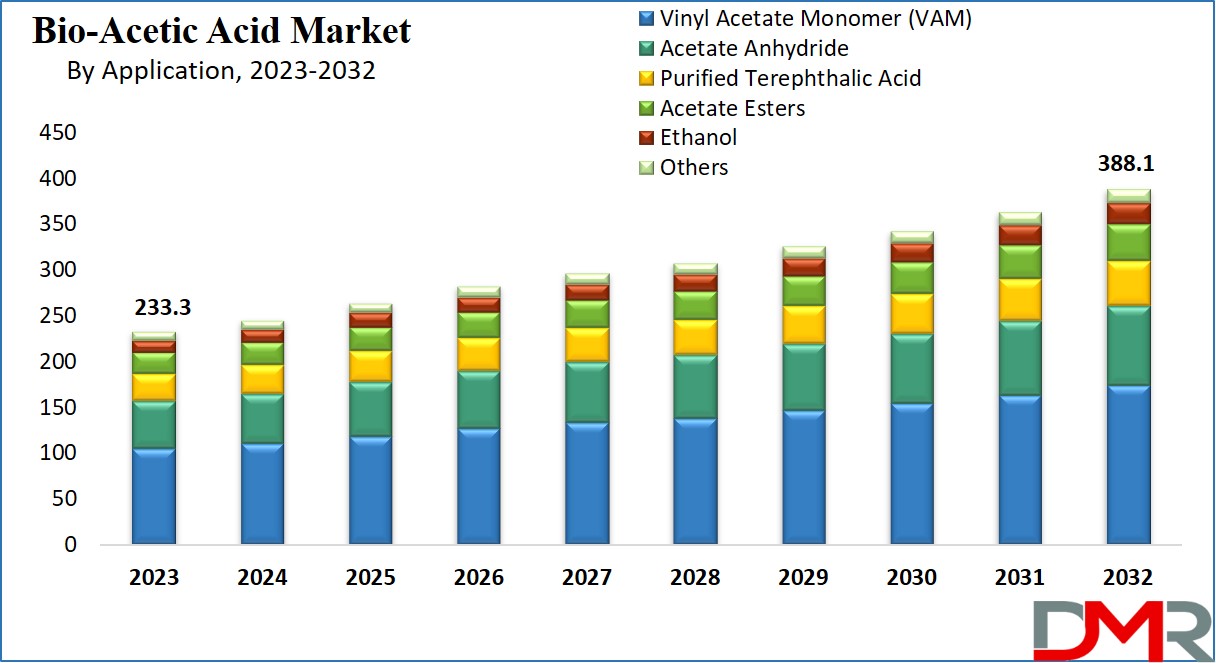

The Global Bio-Acetic Acid Market is expected to attain a valuation of USD 233.3 million in 2023, and it is projected to grow with a CAGR of 5.8% for the forecast period (2023 to 2032).

The growth in this market is the result of the rising demand for environmentally friendly, sustainable & suitable alternatives to earlier used petrochemical-based items. It works as a renewable substitute for petroleum-based acetic acid and finds its place in various applications such as solvents, textiles, and polymer production.

The increasing awareness and emphasis on reducing carbon footprints & environmental impacts across industries brought a shift towards more sustainable & eco-friendly manufacturing processes. And therefore, the demand for bio-based chemicals like bio-acetic acid has seen significant growth.

As various sectors look for alternatives to reduce their dependency on fossil fuels, the market for bio-acetic acid is expected to expand further, with a greener & more sustainable solution in various applications. This shift is closely aligned with the adoption of

Bio Plasticizers, which are being increasingly used to enhance the performance and flexibility of bio-based materials without compromising environmental goals.

Key Takeaways

- The Global Bio-Acetic Acid Market is projected to reach USD 233.3 million in 2023, growing at a CAGR of 5.8% between 2023 and 2032, driven by rising demand for renewable and sustainable chemical alternatives.

- Vinyl Acetate Monomer (VAM) is the dominant application segment, extensively used in films, textiles, adhesives, paints, and coatings, while Acetic Anhydride is gaining traction in pharmaceuticals and packaging applications.

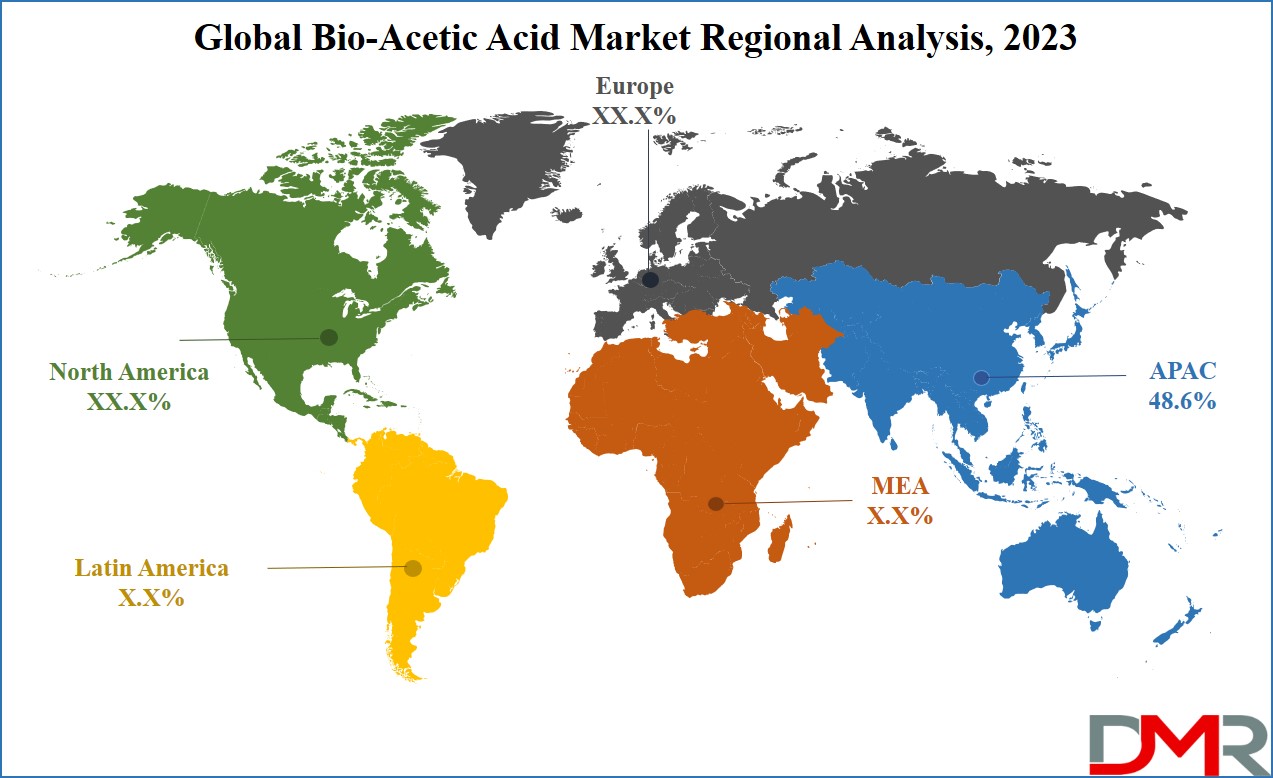

- Asia-Pacific leads with 48.6% of the global market share in 2023, supported by strong growth in automotive, plastics, and coatings industries, while North America sees robust demand from packaging and cosmetics.

- Increasing adoption of green chemistry solutions and the shift from fossil fuel dependency toward bio-based chemicals are key drivers accelerating the market’s growth.

- The paints, coatings, automotive, and construction sectors are expected to be major growth contributors, as demand for adhesives, emulsions, and high-performance polymers rises.

- Key players such as Cargill Inc., Wacker Chemie AG, LanzaTech, and Novozymes AS are focusing on mergers, acquisitions, and product innovations to strengthen their market presence.

Use Cases

- Vinyl Acetate Monomer (VAM) Applications: VAM dominates the bio-acetic acid market, serving as a key ingredient in films, adhesives, coatings, paints, and textiles. It is crucial in producing polymers and resins used in construction, automotive, packaging, and consumer goods, supporting both durability and eco-friendly manufacturing.

- Acetic Anhydride Applications: Acetic anhydride is widely used in pharmaceuticals, cellulose acetate, and chemical intermediates. It is essential in producing drugs such as paracetamol, aspirin, and cortisone, as well as in packaging materials, highlighting the pharmaceutical and industrial relevance of bio-acetic acid.

- Purified Terephthalic Acid (PTA) & Acetate Esters: These derivatives of bio-acetic acid are used in the production of polyethylene terephthalate (PET), clear films, and food packaging materials. PTA and acetate esters support high-performance polymers, contributing to sustainable packaging solutions and industrial applications.

- Ethanol-Derived Applications: Bio-acetic acid obtained from ethanol serves as a renewable feedstock for various chemical processes, including the production of solvents, bio-plasticizers, and eco-friendly intermediates. This supports industries looking to reduce reliance on fossil fuels and adopt greener chemical processes.

Market Dynamic

The growing Bio-Acetic Acid Market can be accredited to the rising use of VAM (Vinyl acetate monomer) and increasing crude oil prices. Bio-acetic acid finds application in numerous manufacturing processes for substrate processing. Additionally, it serves as a chemical reagent in the production of various chemical compounds, including acetic anhydride, esters, vinyl acetate monomer, vinegar, and a wide range of polymer products. The increased interest in

Bio-polybutadiene, especially in polymer blending, also contributes to the adoption of bio-acetic acid in synthetic rubber applications.

The expansion of the bio-acetic acid industry further drives demand in the

Chemical Logistics, as efficient transportation and storage solutions are required to handle these chemicals safely and comply with stringent regulations. The growing relevance of green chemistry solutions also plays a pivotal role, as industries aim to balance production efficiency with environmental safety.

In North America, the United States holds the position of the largest utilizer of the product, accounting for a share of 76.9% in 2022. This can be credited to the increasing demand for VAM in the countries and automobile, and paints & coatings sectors. VAM plays a crucial role as a crucial ingredient in copolymer’s production & is utilized in various coatings, including industrial & automotive coatings, due to its exceptional properties of adhesion.

Furthermore, VAM is utilized in the creation of PVOH (polyvinyl alcohol), which finds application in adhesives & coatings because of its unique property of film formation. As a result, the growing demand for construction activities & automotive sectors in the United States is expected to drive the demand for paints & coatings in the country till 2032.

This surge in infrastructure and automotive development directly impacts the

Construction Chemicals, as high-performance coatings, adhesives, and sealants are essential for modern building projects. The increased need for these materials further fuels the demand for bio-acetic acid, a key component in VAM production and a major segment within the renewable chemicals market.

Research Scope and Analysis

By Application

In the Application segment, VAM emerges as the dominant one in this market segment. This growth can be credited to its extensive usage in the production of films, adhesives, textiles, coatings, paints, and various other applications. VAM serves as a vital key ingredient in the manufacturing process of numerous polymers & resins.

Furthermore, it plays a crucial role in the development of high-performance emulsions and adhesives, which find a place in various sectors such as construction, automotive, &packaged food. The rising demand for Vinyl acetate monomer & its derivatives is anticipated to have a positive impact on the bio-acetic acid market’s growth in the forthcoming years.

Yet another segment of acetic anhydride is anticipated to experience substantial growth till 2032. This intermediate compound is widely utilized in the manufacturing of pharmaceutical items, cellulose acetate, TAED (tetraacetylethylenediamine), and others. The extensive use of acetic anhydride in the manufacturing of drugs like paracetamol, aspirin, acetylcholine hydrochloride, cortisone, sulfa drugs, & acetanilide, among others, along with the increasing cellulose acetate’s demand from the packaging sector, will serve as significant drivers for this segment's growth.

Furthermore, the rising demand for food packaging, clear masks, etc. has led to an increased need for, dimethyl terephthalate, purified terephthalic acid, & polyethylene terephthalate. contributed to the Moreover, enhancements in production techniques are also expected to present opportunities in the future. And further, fuel the segments’ growth.

The Global Bio-Acetic Acid Market Report is segmented on the basis of the following:

By Application

- Acetic Anhydride

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid

- Acetate Esters

- Ethanol

- Other applications.

Regional Analysis

Asia Pacific dominates the market with a share of 48.6% in 2023. This growth can be seen due to the presence of several key players in the region & the rising demand from various sectors such as automobiles, plastics, paints & coatings, etc. The automotive sector in the region is driven by the presence of renowned manufacturers in the motor vehicle sector, like Nissan, Toyota, & Hyundai.

The Asia Pacific region sold a significant number of cars & two-wheelers in 2022. The increase in production & sales of vehicles is a result of the growing consumer purchasing power and the expanding population in Asia Pacific. These factors are expected to fuel the demand for paints & coatings, and

plastics, and drive the overall growth.

Additionally, the North American market is experiencing notable growth driven by the rising demand for VAM from the food & beverage, and packaging sectors. Furthermore, bio-acetic acid serves as a crucial raw material utilized in the production of self-care products like creams, shampoos, conditioners, etc. It acts as a pH regulator & preservative in these products.

According to the ITA (International Trade Administration), the market for self-care & cosmetics in Canada alone accounted for USD 1.24 billion in 2021. Therefore, the flourishing self-care & cosmetics sector in Canada is expected to drive the demand for bio-acetic acid in upcoming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Bio-Acetic Acid Market is marked by intense competition as it involves numerous manufacturers and suppliers, both large and small. To meet the increasing market demand, product manufacturing enterprises employ various strategies. These strategies focus on expanding their global presence while optimizing distribution costs for potential consumers.

Companies are actively pursuing mergers, acquisitions, joint ventures, and expansion activities to capitalize on opportunities in the global market. In addition, market players are actively engaged in technological innovations and the introduction of new products to establish their market position. This emphasis on innovation and product launches enables companies to stay competitive and meet evolving customer needs.

Some of the prominent players in the Global Bio-Acetic Acid Market are:

• Godavari Biorefineries Ltd.

• Bio-corn products EPZ Ltd

- August 2025: Bio-Acetic Acid Market is Projected to Reach USD 233.3 mn in 2023 and Grow at a CAGR of 5.8% from There Until 2032 to Reach a value of USD 388.1 Mn by 2032

- July 2025: Wacker Chemie AG announced a pilot-scale production of bio-acetic acid from biogenic CO₂, aiming for large-scale commercialization in eco-friendly adhesives and coatings.

- June 2025: LanzaTech Inc. partnered with a global packaging firm to develop bio-acetic acid from industrial waste gases, targeting sustainable PET and packaging solutions.

- May 2025: Godavari Biorefineries increased its bio-acetic acid output to meet growing regional demand in Asia for green solvents and food-grade applications.

- February 2025: The bio-acetic acid market size is estimated at 1.40 million tons in 2025, expected to reach 1.62 million tons by 2030, at a CAGR of greater than 3%.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 233.3 Mn |

| Forecast Value (2033) |

USD 388.1 Mn |

| CAGR (2024-2033) |

5.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Application (Acetic Anhydride, Vinyl Acetate Monomer, Purified Terephthalic Acid, Purified Terephthalic Acid, Acetate Esters, Ethanol, Other Applications).. |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Godavari Biorefineries Ltd, Bio-corn products EPZ Ltd, Cargill, Inc, Lanza Tech, Sucroal SA, Zea2, Afyren SAS, Wacker Chemie AG, Novozymes AS and Other Key Players. |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Bio-Acetic Acid Market is anticipated to reach a valuation of USD 233.3 million in 2023.

The expected CAGR for the Global Bio-Acetic Acid Market is 5.8% (from 2023 to 2032).

Asia Pacific emerges as the dominant region in the Global Bio-Acetic Acid Market with a revenue share of 48.6%.

Some of the prominent players In the Global Bio-Acetic Acid Market include Godavari Biorefineries Ltd, Bio-corn products EPZ Ltd, Cargill, Inc, Lanza Tech, etc.