Market Overview

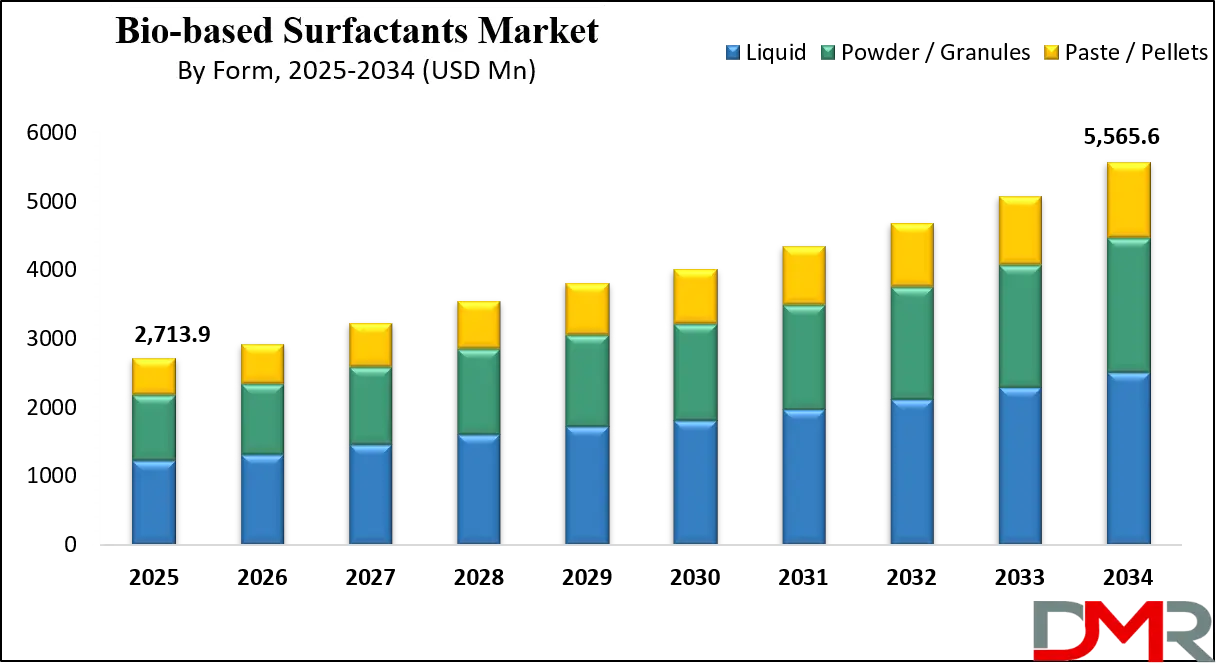

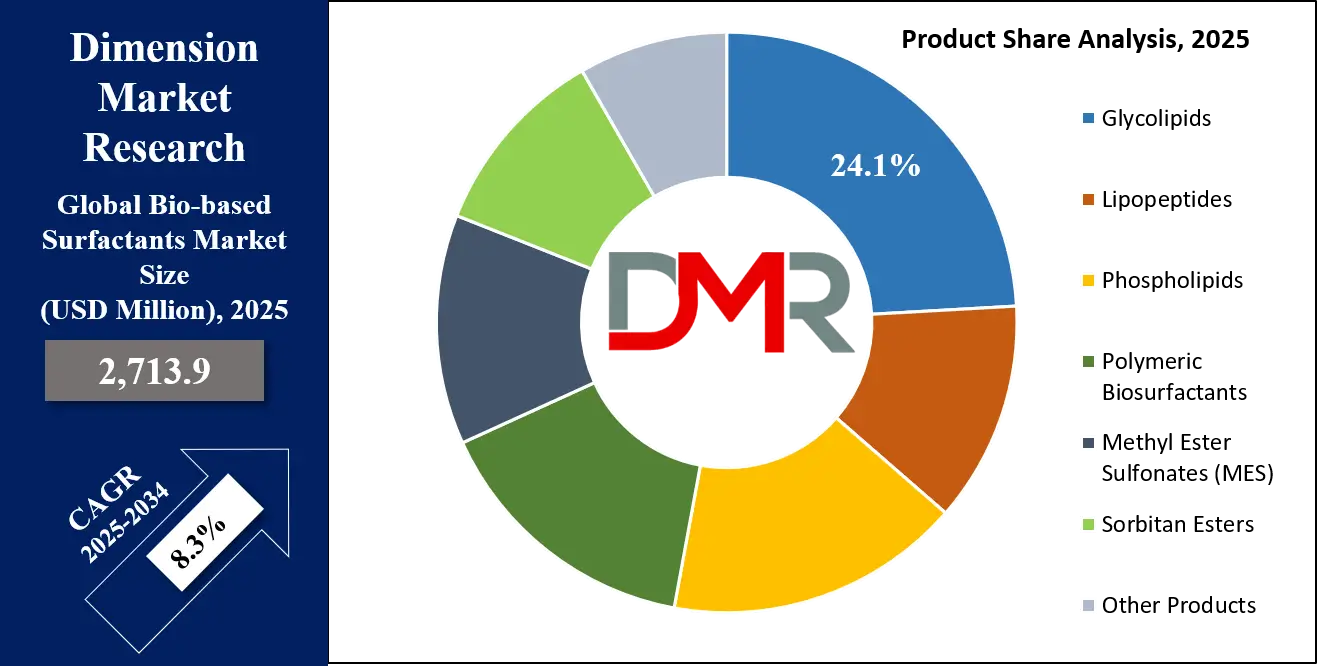

The Global Bio-based Surfactants Market is projected to reach USD 2,713.9 million in 2025 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2025 to 2034, attaining a market size of USD 5,565.6 million by 2034.

This strong growth outlook is driven by rising demand for eco-friendly cleaning agents, sustainable personal care formulations, renewable raw materials, and biodegradable surfactant alternatives across industries such as detergents, cosmetics, agriculture, and food processing. Increasing environmental regulations, consumer preference for green chemistry, and advancements in bio-based raw material sourcing are further accelerating market adoption, positioning bio-based surfactants as a key component in the global shift toward sustainable chemical solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global bio-based surfactants market is experiencing robust expansion, driven by the rising demand for sustainable and biodegradable ingredients across home care, personal care, food processing, agrochemicals, and oilfield applications. Growing restrictions on petrochemical surfactants due to toxicity, ecological damage, and carbon-intensive production are accelerating the adoption of glycolipids, lipopeptides, MES, APG, sorbitan esters, and other naturally derived surfactants. Consumers are increasingly favoring eco-certified detergents and personal care products, while industries leverage bio-based formulations to meet tightening environmental regulations, particularly under frameworks such as the EU Green Deal and global ESG compliance requirements.

Trends indicate that multinational companies are strategically investing in microbial fermentation and enzymatic synthesis platforms to scale up sophorolipids, rhamnolipids, and polymeric biosurfactants with higher yield efficiency and lower costs. Strategic collaborations between chemical giants, startups, and biotechnology firms are enhancing supply chain resilience and unlocking applications beyond cleaning, including textiles, lubricants, and specialty coatings. At the same time, natural feedstock diversification from vegetable oils, sugarcane, glycerol, and food-processing byproducts is reducing dependency on palm oil and strengthening supply sustainability.

Opportunities lie in premium personal care, food-grade emulsifiers, and high-performance industrial cleaning, where consumer awareness of green chemistry aligns with rising disposable incomes and brand sustainability goals. Emerging markets in Asia-Pacific are offering substantial growth prospects, supported by government incentives for bio-manufacturing and regional demand for eco-label-certified consumer goods.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Restraints include high production costs, scalability issues in microbial processes, and limited standardization in biosurfactant performance compared to synthetic counterparts. Despite these challenges, the market is projected to nearly double over the next decade, with innovations in biotechnology, continuous fermentation, and biorefinery integration paving the way for cost competitiveness. The convergence of regulatory pressure, corporate sustainability targets, and consumer preference positions bio-based surfactants as a core pillar in the global shift toward green chemistry.

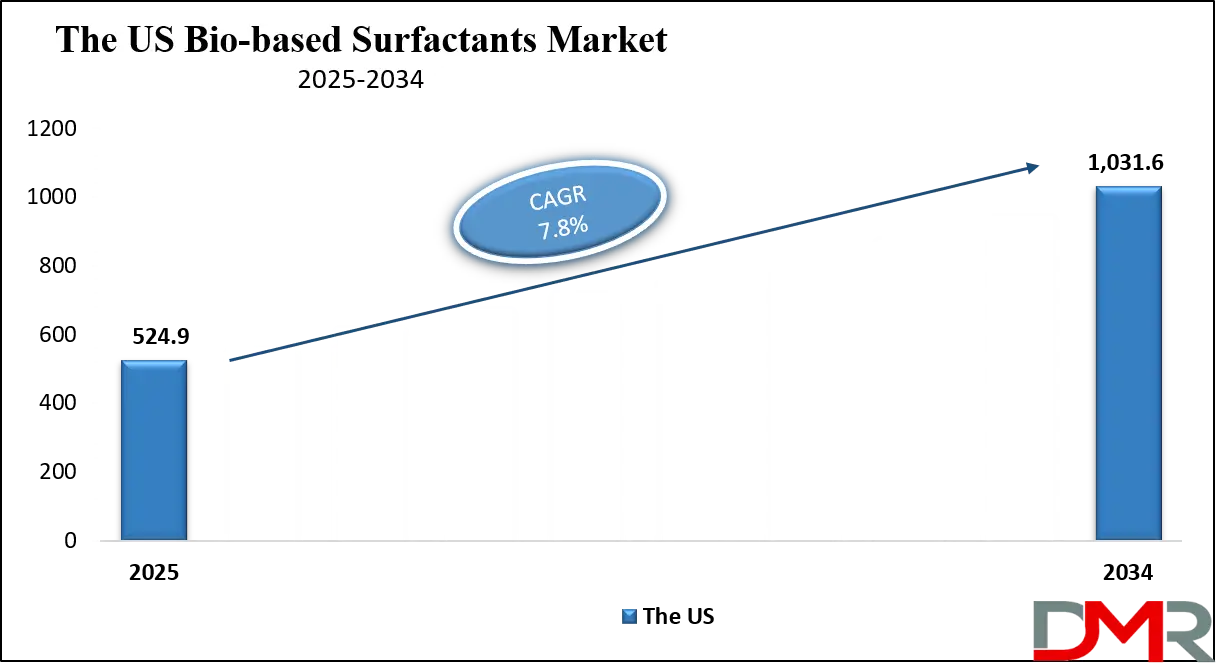

The US Bio-based Surfactants Market

The US Bio-based Surfactants Market is projected to reach USD 524.9 million in 2025 at a compound annual growth rate of 7.8% over its forecast period.

The U.S. bio-based surfactants market is supported by strong environmental policies and an advanced consumer base that prioritizes sustainable products. According to the U.S. Environmental Protection Agency (EPA), household cleaning agents and personal care formulations contribute to significant waterway pollution when derived from non-biodegradable surfactants, thereby driving regulatory emphasis on bio-based alternatives. The U.S. Department of Agriculture (USDA) BioPreferred Program further strengthens adoption by certifying and promoting renewable chemical products, providing both recognition and procurement advantages for bio-based surfactant producers.

Demographically, the U.S. market benefits from high consumer awareness of eco-labels, strong purchasing power, and the influence of millennial and Gen Z populations that actively support sustainable consumer goods. Data from the U.S. Census Bureau indicates steady growth in personal care spending, coupled with increasing detergent consumption across larger households, which creates consistent demand for bio-derived surfactants. Additionally, the Department of Energy’s initiatives on bioeconomy expansion encourage industrial-scale use of microbial and enzymatic production pathways, reducing costs over time.

In the industrial sector, Institutional and Industrial (I&I) cleaners are adopting greener chemistries to comply with Occupational Safety and Health Administration (OSHA) workplace safety norms and state-level environmental policies such as California’s Safer Consumer Products regulations. This creates opportunities for bio-based surfactants to replace synthetic counterparts in hard-surface cleaners, disinfectants, and degreasers. Challenges remain around scaling production and competing on price with petrochemical surfactants, but innovation in fermentation technologies and partnerships between biotech startups and U.S. chemical manufacturers are gradually closing the gap.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Bio-based Surfactants Market

The Europe Bio-based Surfactants Market is estimated to be valued at USD 1,248 million in 2025 and is further anticipated to reach USD 2,496.9 million by 2034 at a CAGR of 8.0%.

Europe holds the largest market share in the global bio-based surfactants landscape, underpinned by robust regulatory enforcement, widespread consumer acceptance of sustainable products, and strong institutional support for green chemistry. The European Commission’s Green Deal and REACH regulations impose strict guidelines on synthetic surfactants due to toxicity and biodegradability concerns, which accelerate the shift to bio-based alternatives. National initiatives in Germany, France, and the Nordic countries actively promote bio-manufacturing, while the European Chemicals Agency (ECHA) enforces sustainability standards that prioritize safer and renewable raw materials.

Consumer demographics in Europe further strengthen adoption, with Eurostat data showing high per capita spending on personal care, home care, and cosmetic products, especially in Western European economies. The trend toward natural and vegan-certified cosmetics amplifies the demand for glycolipids and lipopeptides sourced from fermentation and natural oils. The eco-label scheme under the European Union also plays a significant role in ensuring consumer trust, making certified bio-based surfactants a preferred option in detergents, household care, and food processing.

Additionally, the industrial cleaning and textile sectors in Europe are transitioning toward eco-friendly solutions, supported by EU directives on circular economy practices. Energy-intensive sectors such as oil and petroleum are integrating bio-based surfactants for enhanced recovery and reduced environmental footprint. While high production costs pose challenges, the European Investment Bank’s financing for sustainable chemistry innovation is bridging the gap between R&D and commercialization. Overall, Europe’s stringent environmental laws, consumer sustainability preferences, and financial support mechanisms ensure steady market leadership through 2034.

The Japan Bio-based Surfactants Market

The Japan Bio-based Surfactants Market is projected to be valued at USD 162.8 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 317.1 million in 2034 at a CAGR of 7.6%.

Japan’s bio-based surfactants market is expanding steadily, driven by demographic shifts, industrial innovation, and government sustainability frameworks. According to the Ministry of Economy, Trade and Industry (METI), Japan’s chemical industry is increasingly focused on bio-based and renewable feedstocks to reduce reliance on imported petrochemicals and align with carbon-neutrality targets for 2050. The government’s Basic Plan for Establishing a Recycling-Oriented Society encourages industries to integrate biodegradable and renewable surfactants into home care, cosmetics, and industrial cleaners.

Demographically, Japan faces an aging population and shrinking household size, but this dynamic translates into higher per capita spending on personal care and hygiene products, particularly among elderly and health-conscious consumers. Statistics from the Ministry of Internal Affairs and Communications highlight sustained growth in cosmetic and skincare expenditures, creating a favorable market for naturally derived surfactants. Japanese consumers also demonstrate high sensitivity to product safety, quality, and environmental impact, making bio-based surfactants particularly attractive in premium and dermatologically safe formulations.

In the industrial sector, the textile, agriculture, and petroleum industries are integrating bio-based surfactants for emulsification, foaming, and enhanced recovery. Japan’s agricultural sector, guided by the Ministry of Agriculture, Forestry, and Fisheries (MAFF), is emphasizing environmentally sustainable agrochemicals to reduce soil and water pollution. Industrial cleaning regulations also promote low-toxicity solutions in manufacturing and public facilities. Although cost competitiveness against synthetic surfactants remains a barrier, collaborative R&D between Japanese chemical corporations, universities, and biotech firms is rapidly improving yields and reducing dependence on costly imports. With strong policy direction and consumer trust, Japan is poised for steady CAGR-led growth in this segment.

Global Bio-based Surfactants Market: Key Takeaways

- Global Market Size Insights: The Global Bio-based Surfactants Market size is estimated to have a value of USD 2,713.9 million in 2025 and is expected to reach USD 5,565.6 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Bio-based Surfactants Market is projected to be valued at USD 524.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,031.6 million in 2034 at a CAGR of 7.8%.

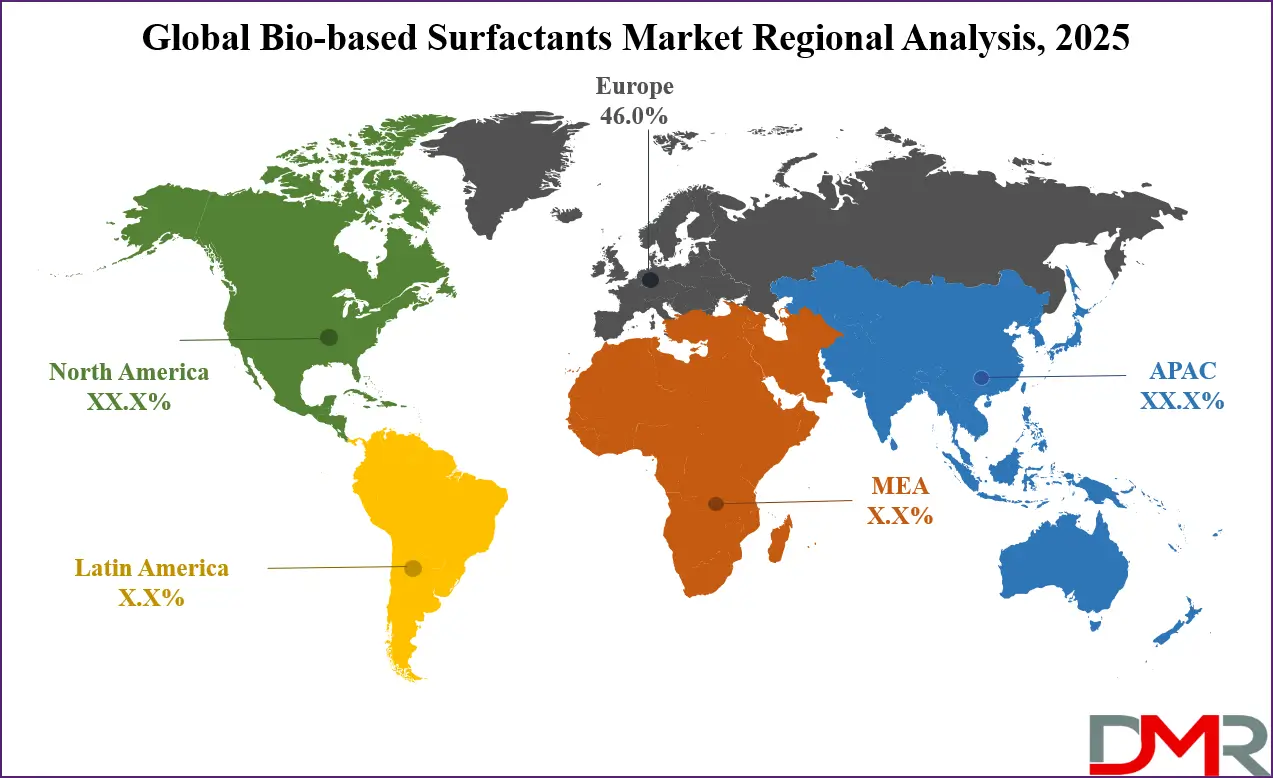

- Regional Insights: Europe is expected to have the largest market share in the Global Bio-based Surfactants Market with a share of about 46.0% in 2025.

- Key Players: Some of the major key players in the Global Bio-based Surfactants Market are BASF SE, Evonik Industries AG, Clariant AG, Solvay S.A., Croda International Plc, AkzoNobel N.V., Dow Inc., Kao Corporation, Ecover (S.C. Johnson & Son, Inc.), Henkel AG & Co. KGaA, and many others.

Global Bio-based Surfactants Market: Use Cases

- Household Detergents: Bio-based surfactants replace petrochemical detergents in laundry and dishwashing products, offering superior biodegradability, reduced aquatic toxicity, and compliance with eco-label certifications, while meeting consumer demand for safer, sustainable, and skin-friendly cleaning solutions across home care applications worldwide.

- Personal Care: Sophorolipids and APG are increasingly used in shampoos, body washes, and skincare formulations, delivering mild cleansing, foam stability, and moisturizing effects, while aligning with rising consumer preference for natural, vegan, and dermatologically safe personal care products globally.

- Industrial Cleaners: Bio-based surfactants enable effective degreasing and soil removal in institutional cleaning applications, reducing hazardous chemical exposure for workers, ensuring compliance with workplace safety regulations, and minimizing wastewater pollution compared to conventional non-biodegradable industrial surfactants.

- Food Processing: Naturally derived surfactants act as emulsifiers, stabilizers, and foaming agents in baked goods, dairy products, and beverages, ensuring food safety, extending shelf life, and supporting regulatory approval for clean-label formulations in global food manufacturing industries.

- Oilfield Applications: Rhamnolipids and lipopeptides improve oil recovery efficiency through eco-friendly emulsification and dispersion in petroleum extraction, while lowering environmental risks, reducing dependence on synthetic chemical additives, and supporting energy sector decarbonization and sustainability targets across oilfield operations.

Global Bio-based Surfactants Market: Stats & Facts

United States Department of Agriculture (USDA)

- Biobased products (the broader biobased products sector) contributed USD 489 billion to the U.S. economy in 2021.

- USDA’s BioPreferred program has defined minimum biobased content standards across 139 product categories.

U.S. Environmental Protection Agency (EPA)

- The EPA’s Safer Choice program reports ~1,724 Safer Choice-certified products (FY figures reported in program performance measures).

- EPA’s FY 2022–2026 strategic goal includes reaching 2,300 Safer Choice-certified products by Sept 30, 2026.

- EPA identifies rate of biodegradation, degradation products, and aquatic toxicity as the primary criteria for surfactant safety/performance evaluation.

European Chemicals Agency (ECHA)

- ECHA’s Candidate List of substances of very high concern contained 233 entries after recent additions.

- ECHA’s new ECHA CHEM platform publishes data from more than 100,000 REACH registrations / chemical records (large central chemicals database).

- In 2023, ECHA/competent authorities conducted roughly 301 compliance reviews covering >1,750 REACH registration dossiers (274 substances targeted).

Food and Agriculture Organization of the United Nations (FAO)

- Global production of the main oil crops (oil palm fruit, soybeans, and rapeseed) reached 893 million tonnes in 2023 (key feedstocks for many bio-surfactant feedstock pathways).

- FAO’s World Food and Agriculture Statistical Yearbook remains the authoritative compilation of global crop production and trade data used by industry and policy planners.

International Energy Agency (IEA)

- Biofuel demand reached a record 4.3 EJ (≈170 billion litres) in 2022 — demonstrating rapid scale-up in bio-based liquid production and feedstock competition.

- IEA scenarios and reporting highlight structural shifts in fossil feedstock demand that affect petrochemical supply chains relevant to surfactant raw materials.

Eurostat / European Commission

- In 2023, EU aggregate household final consumption expenditure was ~52.1% of GDP (household spending remains a major driver of detergent and personal-care demand).

- Eurostat household budget data show a large variation in per-capita consumption by income, with top-20% households frequently spending more than double bottom-20% on consumption.

- Eurostat & EC chemical statistics provide the official EU picture of production/consumption indicators used to monitor chemicals policy impacts and substitution trends.

U.S. Bureau of Economic Analysis (BEA) & Bureau of Labor Statistics (BLS)

- Per-capita Personal Consumption Expenditures (PCE) in the U.S. were USD 56,202 in 2023 (BEA).

- Average annual consumer expenditures across U.S. consumer units were USD 77,280 in 2023 (BLS report).

- BLS reported personal care products and services spending rose ≈9.7% in 2023 (noting strong consumer demand dynamics relevant to surfactant-containing products).

World Health Organization (WHO) / UNICEF / UN-Water / World Bank (WASH & wastewater context)

- WHO / UNICEF JMP (2023 update): 3.5 billion people lacked safely managed sanitation services in 2022 (global sanitation gap relevant to wastewater surfactant discharge risk).

- UN-Water / World Bank reporting: an estimated 80% of the world’s wastewater is released to the environment without adequate treatment (global scale of untreated wastewater).

- WHO data indicate that the proportion of safely treated domestic wastewater flows remained at ~56% in 2020 (extrapolated monitoring across countries).

United Nations / World Bank (water & sanitation/resource context)

- World Bank reporting: in 2022, roughly 2.2 billion people lacked safely managed drinking water and 3.5 billion lacked safely managed sanitation—important when evaluating environmental fate and regulation of surfactants.

- UN (global issues) reiterates that improving water and sanitation systems is central to reducing chemical release and exposure risks linked to household and industrial surfactants.

Organisation for Economic Co-operation and Development (OECD)

- OECD maintains industrial production and chemicals indicators used by governments to measure manufacturing output and policy impacts (industrial production indices are published regularly as official statistics).

- OECD data portals are commonly used to benchmark chemical sector activity and productivity across member states (industrial output trend signals demand for specialty chemicals, including bio-surfactants).

Japan — Government sources (METI, Statistics)

- Japan’s official strategy documents (METI) commit the nation to carbon neutrality by 2050, guiding industrial decarbonization and bio-based chemical adoption.

- World Bank / national statistics: ~29–30% of Japan’s population is aged 65 or over (Japan’s demographic profile: ~36.2 million people aged 65+), shaping higher per-capita personal-care and hygiene product demand.

- METI’s Green Growth Strategy explicitly promotes bio-based feedstocks and circular solutions in the chemicals and materials sectors.

United Nations Food & Agriculture / Agricultural feedstock context (additional FAO / WB notes)

- FAO/World Bank analyses show vegetable oil production growth (key surfactant feedstock) is expected to continue, with projected increases driven by food demand in low- and middle-income countries — relevant for feedstock availability and price pressure on bio-surfactant production.

- FAO yearbook and reports are routinely used by industry to model feedstock supply scenarios for biobased chemical manufacture.

European Chemical Industry Council (CEFIC) / EU policy context

- CEFIC and EC reporting underscore that EU regulatory pressure (Green Deal, REACH) is materially changing chemical industry costs and pushing substitution toward safer, renewable chemistries — a systemic driver for bio-surfactant demand.

- European Commission chemical strategy documents establish innovation and regulatory instruments to accelerate safe & sustainable alternatives adoption in the EU market.

Global Bio-based Surfactants Market: Market Dynamics

Driving Factors in the Global Bio-based Surfactants Market

Stringent environmental regulations favoring biodegradability

Government policies worldwide are restricting the use of synthetic, petroleum-derived surfactants due to their persistence in ecosystems and toxicological impacts. Regulations such as the European Union’s REACH standards, U.S. EPA guidelines, and Japan’s Chemical Substances Control Law push industries to transition toward eco-friendly alternatives.

Bio-based surfactants offer a natural solution, being biodegradable, renewable, and non-toxic. Compliance with global sustainability goals, such as the United Nations’ SDG 12 on responsible consumption and production, reinforces this momentum. The chemical and personal care industries, under strict monitoring, are therefore accelerating adoption to avoid penalties, improve brand image, and secure consumer loyalty.

Expanding renewable feedstock availability and agricultural integration

A key driver is the increasing availability of renewable feedstocks like vegetable oils, sugarcane derivatives, corn starch, and palm oils. Advancements in sustainable agriculture and circular bioeconomy models are enhancing supply reliability. Countries with strong agricultural bases, such as Brazil, India, and Indonesia, are leveraging surplus crops to develop bio-based industrial inputs.

This integration of agricultural value chains with green chemistry industries reduces dependency on petrochemical derivatives while generating rural economic opportunities. Moreover, collaborations between agricultural cooperatives, biotech firms, and consumer goods companies are improving scalability. This synergy is enabling the industry to overcome cost barriers and enhance adoption across high-volume sectors.

Restraints in the Global Bio-based Surfactants Market

High production costs and scalability challenges

Despite rapid technological advancements, the large-scale production of biosurfactants remains costlier compared to synthetic alternatives. The need for controlled fermentation, specialized bioreactors, and costly downstream processing creates economic barriers. Price competitiveness with petrochemical surfactants is a critical challenge, especially for cost-sensitive industries such as detergents and agriculture.

Scaling production without compromising quality is another hurdle. Limited global infrastructure for biosurfactant production constrains supply, further increasing costs. Unless addressed through breakthroughs in biotechnology, supply chain integration, or government subsidies, high production costs may restrict market penetration and delay mainstream adoption across multiple industries.

Feedstock dependency and supply chain volatility

The bio-based surfactants industry is heavily dependent on agricultural feedstocks, making it vulnerable to fluctuations in crop yields, price volatility, and geopolitical risks. Weather changes, climate disruptions, and competition with food industries for raw materials such as palm oil, sugarcane, and corn can impact availability and pricing.

Additionally, concerns around deforestation and land-use changes linked to certain feedstocks raise sustainability issues, potentially undermining the eco-friendly narrative of bio-based surfactants. These challenges may limit consistent production and market stability, especially in regions without robust agricultural infrastructure. Supply chain volatility thus remains a critical restraint for the industry.

Opportunities in the Global Bio-based Surfactants Market

Expansion into pharmaceutical and biomedical applications

Biosurfactants present unique opportunities in pharmaceutical formulations, drug delivery systems, antimicrobial therapies, and tissue engineering. Their biocompatibility, low toxicity, and surface-active properties make them highly suitable for solubilizing hydrophobic drugs, stabilizing emulsions, and enhancing drug bioavailability. In biomedical research, lipopeptides and glycolipids demonstrate antimicrobial and antiadhesive properties, which can be used to combat drug-resistant pathogens.

Additionally, biosurfactants are showing potential in cancer treatment as delivery agents for hydrophobic chemotherapeutics. The healthcare industry’s growing demand for safe, natural excipients provides a lucrative long-term growth avenue for bio-based surfactants beyond traditional industrial and consumer applications.

Industrial adoption in the oilfield and agriculture sectors

Bio-based surfactants are increasingly being recognized for their role in enhancing sustainability in agriculture and petroleum applications. In oilfields, they are used in microbial enhanced oil recovery (MEOR) and bioremediation, replacing harsh chemical surfactants in drilling fluids and soil cleaning processes.

Their biodegradability reduces environmental risk in sensitive ecosystems. In agriculture, they act as adjuvants in pesticide formulations, wetting agents, and soil conditioners, improving crop yield while reducing chemical residues. With governments encouraging sustainable farming practices and energy firms facing decarbonization pressures, biosurfactants offer an attractive eco-alternative. This industrial-scale adoption represents a significant untapped revenue stream for manufacturers.

Trends in the Global Bio-based Surfactants Market

Rising demand for sustainable cleaning and personal care products

The global shift toward eco-friendly solutions is driving increased adoption of bio-based surfactants in household cleaning agents, shampoos, skincare products, and detergents. With consumers becoming highly conscious of product ingredients, biodegradable and plant-derived surfactants such as rhamnolipids, sophorolipids, and alkyl polyglucosides are gaining momentum.

Major multinational FMCG companies are reformulating product lines to incorporate greener alternatives, aligning with evolving consumer preferences and regulatory pressure. This trend is also evident in high-growth categories like baby care, where safety, gentleness, and sustainability are critical. Increased availability of plant oils and renewable feedstocks further supports this transition.

Integration of biotechnology and fermentation technologies

Technological innovation is shaping the bio-based surfactants industry through advanced microbial fermentation, enzyme engineering, and metabolic pathway optimization. These innovations reduce production costs, improve yields, and enhance performance consistency across formulations. Companies are investing heavily in biotechnology platforms to create scalable biosurfactants with competitive pricing against synthetic counterparts.

Emerging innovations include engineered microorganisms designed to produce high-purity rhamnolipids and tailor-made surfactants for specific industrial applications. The convergence of biotechnology with green chemistry enables the development of surfactants that perform under challenging industrial conditions while maintaining biodegradability. This trend is expected to make biosurfactants more commercially viable for broader industrial deployment.

Global Bio-based Surfactants Market: Research Scope and Analysis

By Product Analysis

Methyl Ester Sulfonates (MES) is projected to dominate the global bio-based surfactants market due to their cost-effectiveness, biodegradability, and scalability in production. Derived primarily from renewable feedstocks such as palm oil and coconut oil, MES offers an environmentally friendly alternative to petroleum-based surfactants without compromising performance. Their excellent detergency, high foaming capacity, and stability in hard water conditions make them highly suitable for laundry detergents and household cleaning products, which form the largest consumer base for surfactants worldwide.

Moreover, MES is favored because it has a lower carbon footprint compared to Linear Alkylbenzene Sulfonates (LAS), the conventional petrochemical-derived surfactant. Regulatory bodies in Europe and North America actively support the shift towards MES by encouraging manufacturers to adopt bio-based surfactants under green chemistry and sustainability frameworks. Industrial scaling is also feasible since MES production technologies, like transesterification and sulfonation, are already well established.

Cost advantages further drive adoption; MES is cheaper than many other bio-based surfactants due to the abundant availability of vegetable oils. With increasing demand for eco-friendly detergents, MES stands out as the product type with the broadest commercial viability. In addition, growing bans on phosphate-based detergents worldwide have accelerated the integration of MES into mainstream formulations, strengthening its dominance across global markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Form Analysis

Liquid bio-based surfactants are poised to dominate the market because of their versatility, ease of formulation, and compatibility with various end-use industries. Liquid surfactants dissolve easily in water, making them suitable for manufacturing detergents, household cleaners, and personal care products such as shampoos, shower gels, and liquid soaps. Manufacturers prefer liquid surfactants because they allow precise dosing, better process control, and adaptability in continuous production lines.

Furthermore, liquids provide superior performance in applications requiring immediate solubility and dispersion, such as textile wetting agents and agricultural sprays. The shift towards concentrated liquid detergents, especially in developed markets like the U.S. and Europe, has amplified the demand for liquid formulations due to reduced packaging requirements and lower transportation costs. In industrial applications, liquid surfactants are easier to blend with solvents and additives compared to powders or pellets, giving them an operational edge.

Additionally, liquid surfactants often demonstrate improved bioavailability and biodegradability compared to solid forms, aligning well with consumer demand for eco-friendly solutions. With rising consumption of liquid laundry detergents, liquid dishwashing products, and liquid-based personal care formulations, the liquid form has established itself as the most commercially dominant category, maintaining strong traction in both developed and emerging economies.

By Application Analysis

Household detergents and cleaners are anticipated to dominate the bio-based surfactants market due to high consumption volumes and the global transition towards sustainable cleaning solutions. Detergents represent the largest application segment for surfactants overall, as consumers worldwide rely on them daily for laundry, dishwashing, and surface cleaning. Bio-based surfactants, especially MES, glycolipids, and lipopeptides, have become increasingly important because they provide comparable or superior cleaning performance while reducing environmental harm.

Stringent environmental regulations, such as the European Union’s ban on phosphates in detergents and the U.S. EPA’s Safer Choice Program, have significantly boosted the adoption of bio-based formulations in household cleaning products. Multinational brands like Procter & Gamble, Unilever, and Henkel are investing heavily in bio-based detergents to align with sustainability commitments and consumer expectations.

Moreover, consumer demand for “green,” hypoallergenic, and skin-safe products is on the rise, fueling demand for eco-friendly household cleaners. Bio-based surfactants also degrade more quickly in wastewater treatment plants, minimizing aquatic toxicity, a growing concern in regions with strict wastewater regulations. The scalability of bio-based surfactant production, coupled with the cost advantages of MES, ensures that detergents and cleaners remain the largest application sector. As middle-class populations expand in Asia-Pacific and Africa, detergent consumption continues to rise, further cementing household detergents/cleaners as the dominant segment.

The Global Bio-based Surfactants Market Report is segmented on the basis of the following:

By Product

- Glycolipids

- Rhamnolipids

- Sophorolipids

- Trehalolipids

- Lipopeptides

- Phospholipids

- Polymeric Biosurfactants

- Methyl Ester Sulfonates (MES)

- Sorbitan Esters

- Other Products

By Form

- Liquid

- Powder / Granules

- Paste / Pellets

By Application

- Household Detergents / Cleaners

- Personal Care

- Industrial & Institutional Cleaners

- Food Processing

- Oilfield / Petroleum Chemicals

- Agricultural Chemicals

- Textiles & Leather

- Other Application

Impact of Artificial Intelligence in the Global Bio-based Surfactants Market

- AI-Driven R&D Acceleration: Artificial intelligence accelerates research and development in bio-based surfactants by simulating molecular interactions, predicting biodegradability, and optimizing fermentation pathways, reducing experimentation time, enabling faster innovation, and lowering costs in developing high-performance, eco-friendly surfactant formulations for diverse applications.

- Process Optimization in Manufacturing: AI enhances bio-based surfactant manufacturing through predictive analytics and real-time monitoring, improving fermentation yields, minimizing raw material waste, and optimizing energy consumption. This leads to cost efficiency, higher product consistency, and scalability across chemical, agricultural, and consumer product industries.

- Market Forecasting & Demand Analysis: AI-enabled predictive models assess consumer preferences, sustainability trends, and regional demand fluctuations for bio-based surfactants. These insights support producers in aligning production with market requirements, reducing overcapacity, and ensuring competitive pricing strategies in the rapidly growing green chemicals sector.

- Supply Chain Efficiency: Artificial intelligence strengthens global supply chains by forecasting raw material availability, mitigating disruptions, and enabling smart logistics for bio-based surfactants. This ensures timely delivery, reduced costs, and improved inventory management while enhancing resilience against global trade and sustainability challenges.

- Customization for End-Use Industries: AI empowers tailored bio-based surfactant development by analyzing end-user requirements in detergents, personal care, oilfield, and agriculture. It helps design formulations with optimized foaming, emulsification, or antimicrobial properties, delivering high-value customized solutions for specific industry applications worldwide.

Global Bio-based Surfactants Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to dominate the global bio-based surfactants market with 46.0% of the total revenue by the end of 2025, primarily due to its strong regulatory framework, advanced chemical industry infrastructure, and consumer-driven preference for sustainable products. The European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations and the European Green Deal mandate industries to reduce reliance on petrochemical-based surfactants and transition toward eco-friendly alternatives.

This regulatory push has incentivized leading manufacturers to invest heavily in biosurfactant production facilities. Moreover, Europe hosts global chemical giants such as BASF SE, Evonik Industries, and Clariant, which are front-runners in commercializing glycolipids, sophorolipids, and methyl ester sulfonates.

Consumer awareness about biodegradable detergents, eco-friendly cosmetics, and sustainable cleaning agents is also higher in Europe compared to other regions, driving strong demand from household detergents and personal care applications. Additionally, strategic government funding into biotechnology clusters in Germany, France, and the Netherlands has supported large-scale R&D programs for bio-based chemicals. With increasing collaborations between research institutes and private firms, innovations are advancing rapidly.

Furthermore, Europe’s robust supply chain, availability of agricultural feedstocks, and focus on circular economy principles provide a cost-effective advantage for large-scale biosurfactant production. Taken together, stringent environmental laws, early adoption of sustainable chemistry, and strong consumer preferences make Europe the undisputed leader in this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is projected to record the highest CAGR in the bio-based surfactants market, driven by strong investments in green technologies, increasing consumer awareness, and rising corporate sustainability commitments. The U.S. Environmental Protection Agency (EPA) and the Canadian Environmental Protection Act are tightening restrictions on synthetic surfactants due to their toxicity and persistence in water bodies, accelerating the adoption of natural alternatives. Unlike Europe’s mature market, North America is in a high-growth phase with numerous start-ups and biotech firms entering the space. Companies are leveraging AI-driven bioprocess optimization and synthetic biology to scale up cost-effective biosurfactant production.

The region also benefits from abundant availability of raw materials such as corn, soybean, and canola, which act as feedstock for biosurfactant production. Strong demand from the personal care industry, especially in natural skincare and black hair care products, is fueling rapid market penetration. Moreover, the oilfield and petroleum chemicals segment presents a unique growth driver in North America, as companies explore biosurfactants for enhanced oil recovery and bioremediation applications.

Investment from multinational corporations such as Dow, Stepan Company, and Croda is boosting domestic manufacturing capacity. In addition, growing collaborations between academic institutions and biotech firms are enhancing technological development. Consumer preference for eco-labeled household products, combined with aggressive marketing by green brands, is expanding adoption rates across the U.S. and Canada. With regulatory pressures, sustainable consumer demand, and active industry investments converging, North America is set to experience the fastest growth in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Bio-based Surfactants Market: Competitive Landscape

The global bio-based surfactants market is highly competitive, characterized by the presence of multinational chemical giants, biotechnology start-ups, and specialized surfactant producers. Leading players such as BASF SE, Evonik Industries, Clariant AG, Solvay, Croda International, and Stepan Company dominate the market through extensive product portfolios, strong R&D capabilities, and global distribution networks. These companies are focusing on biosurfactants like sophorolipids, rhamnolipids, and methyl ester sulfonates to cater to diverse industries ranging from household cleaning and personal care to agriculture and oilfield applications.

Collaborations and joint ventures remain a key strategy, with firms increasingly partnering with biotech start-ups to accelerate innovation and reduce production costs. For instance, several European firms are investing in large-scale fermentation technologies, while North American companies are emphasizing AI-based optimization and enzyme engineering to improve yields. Sustainability-driven acquisitions are also shaping competition, as larger firms acquire niche bio-based surfactant producers to strengthen market share.

Regional expansion is another critical strategy, with leading players setting up new production units in Asia-Pacific and North America to meet growing demand and reduce dependence on Europe. At the same time, smaller players are gaining traction by offering highly customized and application-specific biosurfactants, particularly in personal care and agricultural markets. With increasing regulatory pressures and rising consumer demand for eco-friendly products, competition is expected to intensify, pushing companies toward sustainable innovations, supply chain resilience, and value-added product differentiation to secure long-term leadership in the bio-based surfactants market.

Some of the prominent players in the Global Bio-based Surfactants Market are:

- BASF SE

- Evonik Industries AG

- Clariant AG

- Solvay S.A.

- Croda International Plc

- AkzoNobel N.V.

- Dow Inc.

- Kao Corporation

- Ecover (part of S.C. Johnson & Son, Inc.)

- Henkel AG & Co. KGaA

- Lion Corporation

- LG Household & Health Care Ltd.

- Stepan Company

- SEPPIC (Air Liquide Group)

- Galaxy Surfactants Ltd.

- Akola Chemicals (India) Ltd.

- Saraya Co., Ltd.

- Lonza Group AG

- Allied Carbon Solutions Co., Ltd.

- TeeGene Biotech Ltd.

- Other Key Players

Recent Developments in the Global Bio-based Surfactants Market

Investments & Expansions

- May 2024: Evonik announced a major investment to double its production capacity for sustainable, bio-based rhamnolipids at its Slovenská Ľupča site in Slovakia. This expansion, set to be operational by 2025, directly responds to growing demand in the cosmetic, personal care, and household cleaning markets.

- April 2024: Solvay secured a €5 million grant from the European Union's Just Transition Fund (JTF) to build a pilot plant for producing advanced bio-surfactants from wood residues at its Tavaux site in France. This project aims to validate a new, circular production process at an industrial scale.

- February 2024: Locus Ingredients (formerly Locus Fermentation Solutions) announced a strategic investment from ICM Ventures to scale up the production of its sophorolipid-based bio-surfactants, targeting the agricultural, oil & gas, and cleaning product industries.

Collaborations & Partnerships

- March 2024: Unilever and Holiferm announced an extended partnership to scale up the production and integration of Holiferm's biosurfactants, specifically glycolipids, into Unilever's home care and beauty & wellbeing product portfolios. This builds on a previous collaboration initiated in 2022.

- January 2024: BASF and Stepan Company entered into an agreement where Stepan will manufacture and market certain bio-based surfactants based on BASF's proprietary "Sokalan" technology, combining BASF's R&D with Stepan's manufacturing and commercial strength.

Expos & Conferences (2024)

- In-Cosmetics Global (April 16-18, 2024, Paris, France): A premier event where numerous companies (including Evonik, BASF, Clariant) showcased their latest bio-based surfactant innovations for the personal care industry.

- Cleaning Products Europe (March 12-14, 2024, Warsaw, Poland): Focused on sustainable ingredients, including bio-based surfactants, for the industrial and household cleaning sectors.

- World Surfactants Council (CESIO) Congress (June 4-7, 2024, Istanbul, Turkey): The most important global event for the surfactants industry, featuring numerous presentations and exhibitions on bio-based and sustainable surfactant technologies.

Mergers & Acquisitions (M&A)

- October 2023: Clariant completed the acquisition of BASF's U.S.-based attapulgite business assets. While focused on adsorbents, this strengthens Clariant's portfolio of natural, bio-based ingredients for industrial applications, often used in conjunction with surfactants.

- July 2023: Givaudan (Fragrance & Beauty division) acquired Amyris's cosmetic ingredients business, which included a portfolio of bio-based surfactants like Neossance® Squalane and other sugarcane-derived emollients, expanding its sustainable offering.

Investments & Expansions

- November 2023: LG Household & Health Care invested in expanding its R&D and production capabilities for bio-based materials, including surfactants derived from corn and other biomass, as part of its long-term sustainability strategy.

- September 2023: Croda International Plc opened a new bio-based innovation center in the United States, focusing on developing next-generation, sustainable ingredients, including bio-surfactants for agrochemicals and industrial markets.

Collaborations & Partnerships

- June 2023: LanzaTech (known for carbon recycling) and Syntex partnered to develop new supply chains for producing surfactants from captured carbon emissions, creating a novel pathway for bio-based and circular surfactants

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,713.9 Mn |

| Forecast Value (2034) |

USD 5,565.6 Mn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 524.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Glycolipids, Lipopeptides, Phospholipids, Polymeric Biosurfactants, Methyl Ester Sulfonates (MES), Sorbitan Esters, and Other Products), By Form (Liquid, Powder/Granules, and Paste/Pellets), By Application (Household Detergents/Cleaners, Personal Care, Industrial & Institutional Cleaners, Food Processing, Oilfield/Petroleum Chemicals, Agricultural Chemicals, Textiles & Leather, and Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Evonik Industries AG, Clariant AG, Solvay S.A., Croda International Plc, AkzoNobel N.V., Dow Inc., Kao Corporation, Ecover (S.C. Johnson & Son, Inc.), Henkel AG & Co. KGaA, Lion Corporation, LG Household & Health Care Ltd., Stepan Company, SEPPIC (Air Liquide Group), Galaxy Surfactants Ltd., Akola Chemicals (India) Ltd., Saraya Co. Ltd., Lonza Group AG, Allied Carbon Solutions Co. Ltd., TeeGene Biotech Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Bio-based Surfactants Market?

▾ The Global Bio-based Surfactants Market size is estimated to have a value of USD 2,713.9 million in 2025 and is expected to reach USD 5,565.6 million by the end of 2034.

What is the growth rate in the Global Bio-based Surfactants Market in 2025?

▾ The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

What is the size of the US Bio-based Surfactants Market?

▾ The US Bio-based Surfactants Market is projected to be valued at USD 524.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,031.6 million in 2034 at a CAGR of 7.8%.

Which region accounted for the largest Global Bio-based Surfactants Market?

▾ Europe is expected to have the largest market share in the Global Bio-based Surfactants Market with a share of about 46.0% in 2025.

Who are the key players in the Global Bio-based Surfactants Market?

▾ Some of the major key players in the Global Bio-based Surfactants Market are BASF SE, Evonik Industries AG, Clariant AG, Solvay S.A., Croda International Plc, AkzoNobel N.V., Dow Inc., Kao Corporation, Ecover (S.C. Johnson & Son, Inc.), Henkel AG & Co. KGaA, and many others.