Market Overview

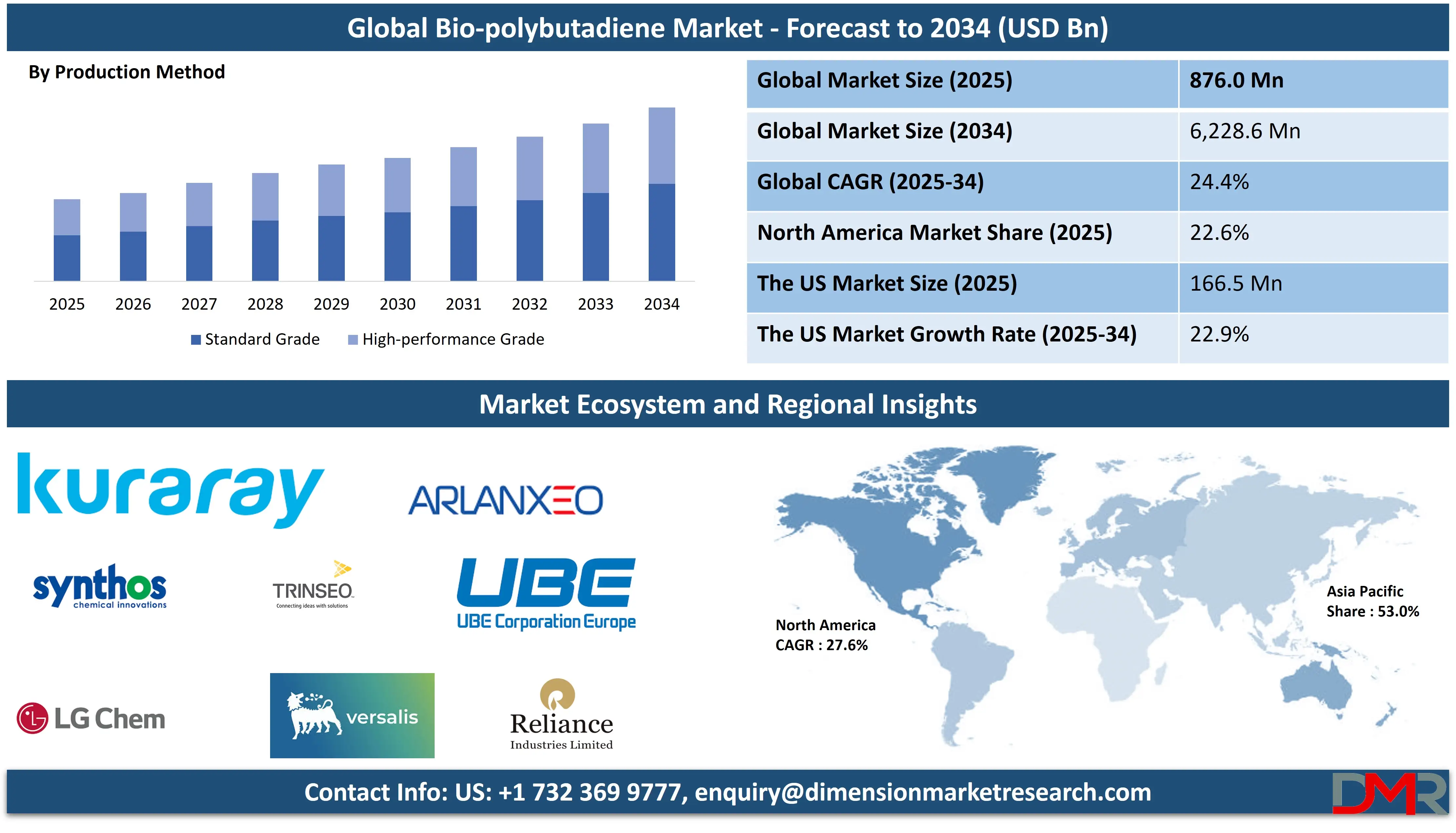

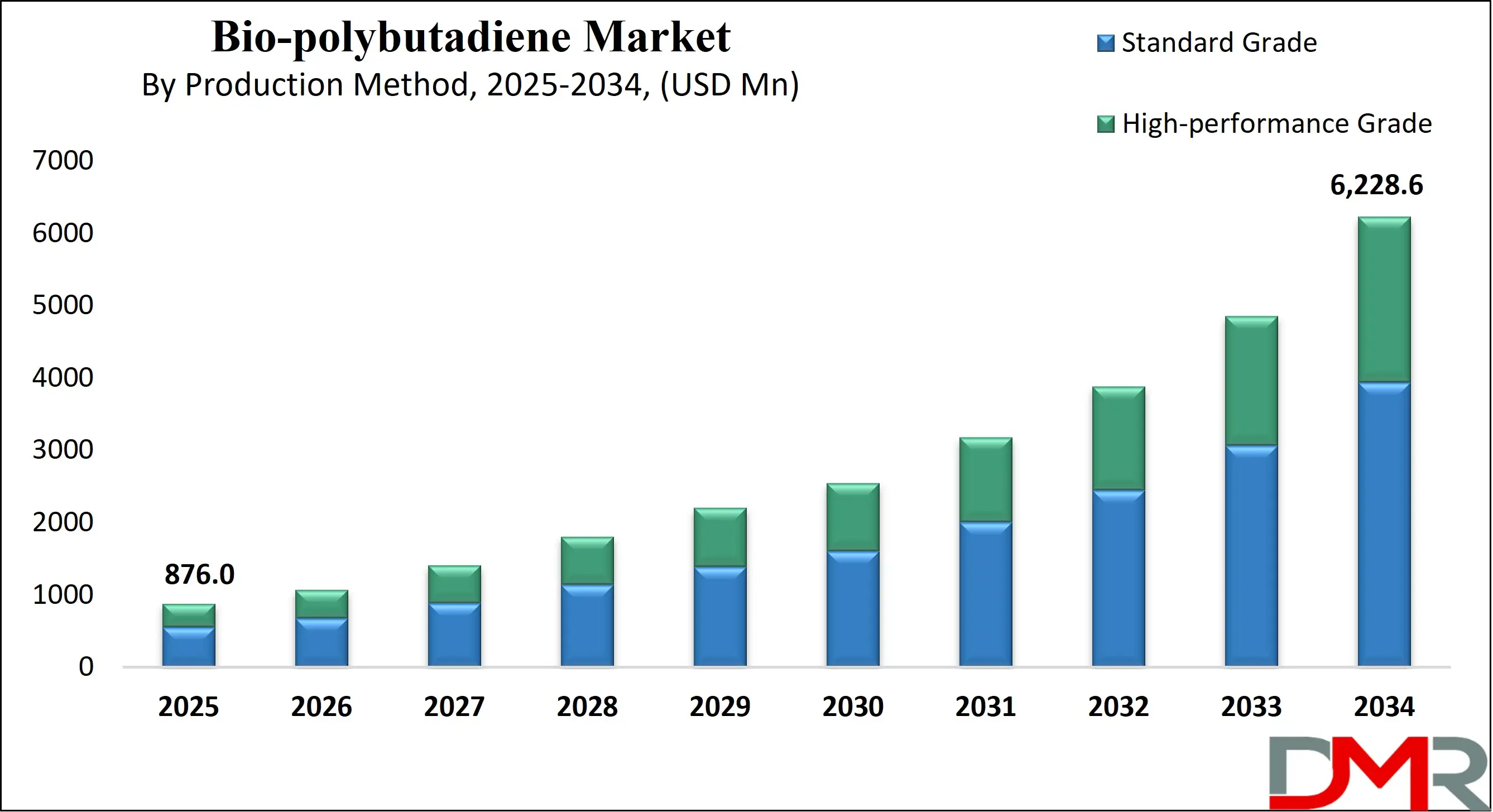

The Global Bio-polybutadiene Market is predicted to be valued at USD 876.0 million in 2025 and is expected to grow to USD 6,228.6 million by 2034, registering a compound annual growth rate (CAGR) of 24.4% from 2025 to 2034.

Bio-polybutadiene is a sustainable synthetic rubber derived from renewable biological sources, such as biomass, bio-ethanol, or plant-based feedstocks, instead of traditional petroleum-based materials. It offers similar properties to conventional polybutadiene, including high elasticity, abrasion resistance, and low-temperature performance. This eco-friendly material is primarily used in the production of tires, footwear, automotive parts, and various industrial applications.

Bio-polybutadiene helps reduce the carbon footprint and dependence on fossil fuels, aligning with growing environmental regulations and green manufacturing goals. Its adoption is increasing due to rising demand for sustainable materials in the automotive, packaging, and consumer goods industries, focused on circular economy and climate-conscious production.

The global bio-polybutadiene market is experiencing robust growth, driven by the rising demand for sustainable alternatives to conventional synthetic rubbers. As industries transition toward greener manufacturing practices, bio-based polymers have emerged as vital materials across various sectors. Bio-polybutadiene, a renewable rubber synthesized from bio-based feedstocks such as biomass or sugar-derived bio-ethanol, is gaining traction due to its excellent mechanical properties, low environmental impact, and compatibility with existing processing systems.

Automotive manufacturers are increasingly incorporating bio-polybutadiene in tire production to enhance fuel efficiency and reduce rolling resistance, aligning with global emission norms. In the consumer goods sector, the use of eco-friendly rubber in products like footwear, adhesives, and sporting goods is also expanding. Furthermore, the packaging industry is adopting bio-based materials to minimize plastic waste and promote recyclable alternatives.

Technological advancements in polymerization techniques and bio-refinery processes have improved the quality and scalability of bio-polybutadiene, making it a competitive option in the elastomers market. Research institutions and chemical companies are investing in R&D to further enhance the performance and cost-effectiveness of this renewable material.

Regulatory support and favorable government policies aimed at reducing carbon emissions and encouraging bio-economy development are creating a positive outlook for market growth. Moreover, the rise in consumer awareness regarding environmental sustainability is propelling the demand for bio-based elastomers. With increasing focus on circular economy practices, the global bio-polybutadiene market is positioned for continuous innovation and expansion, offering promising opportunities across automotive, industrial, packaging, and consumer applications.

The US Bio-polybutadiene Market

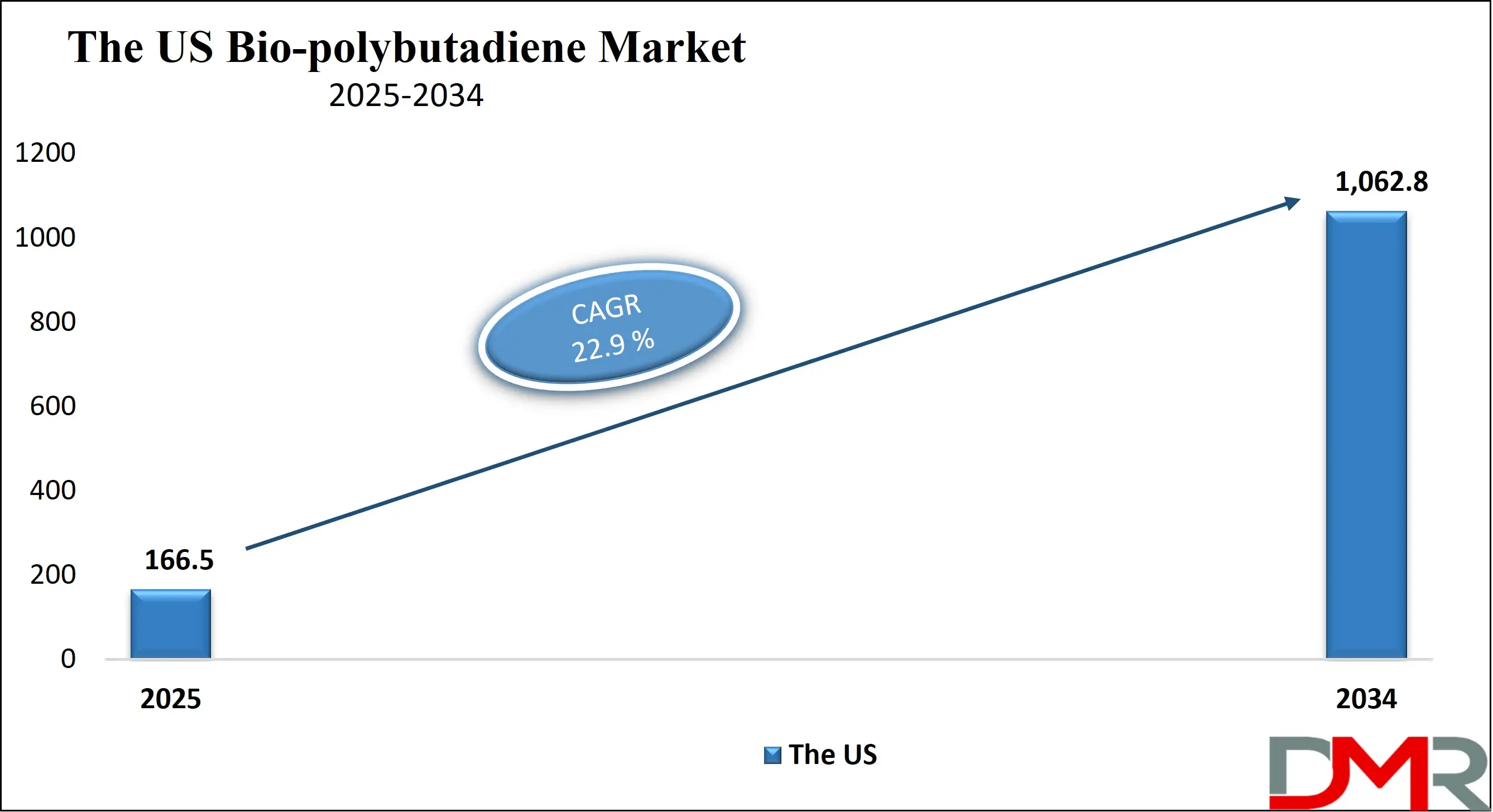

The US Bio-polybutadiene Market is projected to be valued at USD 166.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,062.8 million in 2034 at a CAGR of 22.9%.

The U.S. bio-polybutadiene market is primarily driven by the growing demand for eco-friendly and sustainable synthetic rubber alternatives in automotive and industrial applications. Increased consumer preference for low-emission and biodegradable materials supports the transition toward bio-based polymers. Strong governmental emphasis on green manufacturing practices and tax incentives for bio-based product development further stimulate market growth.

Additionally, advancements in bio-refining technologies have made bio-polybutadiene more competitive with petrochemical alternatives. The presence of major tire manufacturers and robust R&D infrastructure also enhances production scalability and innovation, making the U.S. a key player in the adoption of bio-polybutadiene.

One of the significant trends in the U.S. bio-polybutadiene market is the integration of bio-based rubber in high-performance tires to meet sustainability goals without compromising durability. Companies are investing in the development of renewable feedstocks such as biomass and bioethanol-derived butadiene to reduce reliance on fossil fuels. There is also a noticeable increase in partnerships between chemical companies and biotech firms to accelerate product innovation. Furthermore, the trend toward circular economy practices is promoting the use of recyclable and renewable materials, which enhances the appeal of bio-polybutadiene in various end-use sectors including footwear, construction, and electronics.

The Japan Bio-polybutadiene Market

The Japan Bio-polybutadiene Market is projected to be valued at USD 65.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 469.8 million in 2034 at a CAGR of 21.6%.

Japan’s bio-polybutadiene market is primarily driven by its strong focus on sustainable industrial development and energy-efficient technologies. The government’s commitment to reducing greenhouse gas emissions has encouraged chemical manufacturers to transition toward bio-based polymers. Japan’s automotive and electronics sectors, known for their advanced technology integration, are increasingly incorporating sustainable materials into product designs.

The nation’s emphasis on technological innovation, combined with a robust manufacturing ecosystem, provides fertile ground for bio-polybutadiene development. Furthermore, support for biomass-based feedstock utilization in chemical production aligns with national policies aiming at a circular economy and energy security.

In Japan, a significant trend in the bio-polybutadiene market is the use of advanced catalytic and fermentation technologies to produce high-purity bio-based butadiene from non-food biomass sources. The focus on smart materials in next-generation electronics and lightweight automotive parts is expanding the scope of bio-polybutadiene applications. Collaborative research between academia and industry is enhancing innovation and process efficiency. Japanese companies are also investing in overseas joint ventures to secure raw material supply chains and expand their bio-polymer footprint. The drive toward zero-waste production systems and material reuse is shaping the market’s evolution toward long-term sustainability.

The Europe Bio-polybutadiene Market

The Europe Bio-polybutadiene Market is projected to be valued at USD 185.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,538.3 million in 2034 at a CAGR of 25.6%.

In Europe, the bio-polybutadiene market is driven by strict environmental regulations encouraging the reduction of carbon emissions and the adoption of sustainable materials. The EU’s Green Deal and REACH compliance are pushing industries toward bio-based alternatives in rubber manufacturing. Growing demand from the automotive, packaging, and construction sectors for environmentally friendly polymers supports this transition.

Rising public awareness of climate change and sustainable consumer goods also adds pressure on manufacturers to reformulate products using renewable resources. Additionally, government funding and collaborative research programs among EU nations are strengthening technological advancements and the commercialization of bio-based polybutadiene.

A major trend in the Europe bio-polybutadiene market is the rapid adoption of green chemistry and life-cycle analysis tools to ensure minimal environmental impact throughout the product’s lifespan. Companies are focusing on closed-loop production systems and waste-to-resource innovations. The region is witnessing an increase in pilot-scale plants and commercialization of genetically engineered microbes to produce bio-based butadiene efficiently.

Moreover, the push for electrification in the automotive industry is driving innovation in tire manufacturing, where bio-polybutadiene plays a vital role in enhancing fuel efficiency and wear resistance. Strategic collaborations and public-private partnerships are also emerging to scale sustainable production.

Bio-polybutadiene Market: Key Takeaways

- Market Overview: The global bio-polybutadiene market is anticipated to reach a valuation of USD 876.0 million by 2025, with projections suggesting a rise to USD 6,228.6 million by 2034, reflecting a strong compound annual growth rate (CAGR) of 24.4% over the forecast period from 2025 to 2034.

- By Production Method: The segment utilizing conventional petrochemical processes is expected to lead the global bio-polybutadiene market by the end of 2025, capturing around 64.3% of the overall market share.

- By Quality Grade: The standard grade category is set to hold the largest share of the market by 2025, accounting for approximately 58.9% of global demand.

- By Formulation Type: Solid bio-polybutadiene is forecasted to dominate the market landscape by 2025, comprising nearly 66.2% of total consumption.

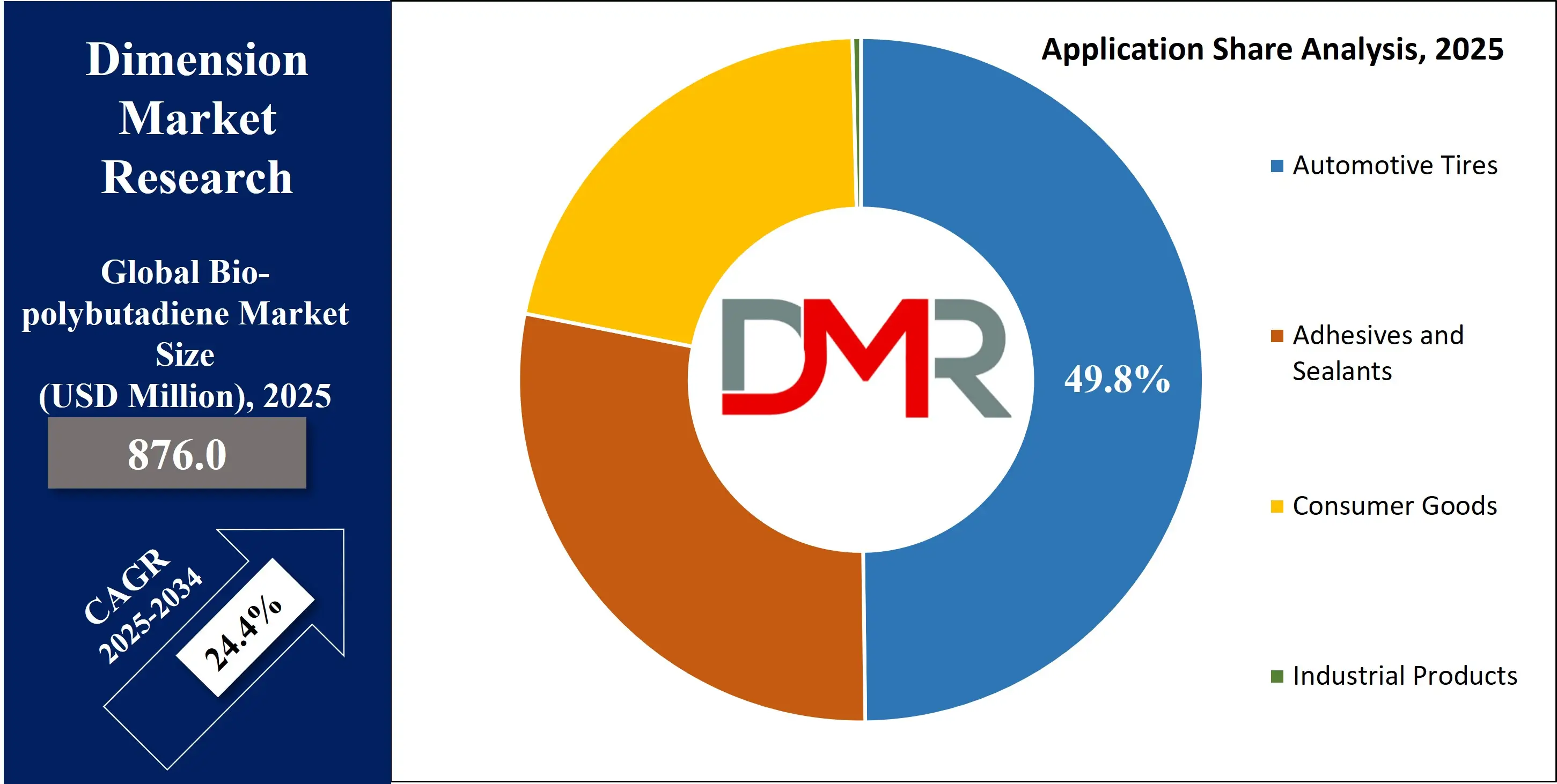

- By Application: The use of bio-polybutadiene in automotive tires is projected to lead all application segments by 2025, with an estimated 49.8% share of the global market.

- By End User: The automotive sector is predicted to be the primary end-user industry by the end of 2025, responsible for roughly 51.4% of the total market demand.

- Regional Insights: Asia Pacific is expected to be the dominant regional market, commanding 53.4% of global revenue share by 2025.

Bio-polybutadiene Market: Use Cases

- Tire Manufacturing: Bio-polybutadiene is widely used in tire production due to its high resilience and wear resistance. It enhances fuel efficiency, reduces rolling resistance, and improves grip, making it an eco-friendly alternative to synthetic rubber in green tires for automobiles and light trucks.

- Automotive Parts: Automakers utilize bio-polybutadiene in producing impact-resistant plastic parts, such as bumpers and gaskets. Its flexibility, durability, and eco-friendly properties support sustainable vehicle manufacturing while maintaining high-performance standards in structural and non-structural components.

- Golf Balls: Bio-polybutadiene serves as a core material in golf balls, offering excellent elasticity and energy return. It enhances distance and durability, providing consistent performance, while aligning with growing consumer demand for biodegradable or bio-based sports equipment.

- Footwear Soles: Footwear manufacturers incorporate bio-polybutadiene into shoe soles to achieve superior cushioning, flexibility, and abrasion resistance. The material's renewable origin supports sustainable product development, especially in performance casual and athletic footwear segments.

- Adhesives and Sealants: Bio-polybutadiene is used in industrial adhesives and sealants, where its tackiness and flexibility offer strong bonding performance. It's particularly valuable in automotive and construction applications seeking greener, low-emission materials with consistent adhesion and elasticity.

Bio-polybutadiene Market: Stats & Facts

- PubChem states that bio-polybutadiene has a molecular formula of (C₄H₆)ₙ and a molar mass of approximately 54.09 g/mol per repeating unit, making it lightweight and ideal for elastic applications.

- ScienceDirect reports that high cis-1,4 bio-polybutadiene demonstrates elongation at break exceeding 500%, contributing to its use in flexible and high-impact environments such as tires and conveyor belts.

- Journal of Applied Polymer Science confirms that using neodymium catalysts in bio-polybutadiene synthesis can yield over 97% cis-1,4 structure, improving low-temperature flexibility and abrasion resistance.

- US Department of Energy estimates that switching from petroleum-based to bio-based polybutadiene can cut lifecycle greenhouse gas emissions by up to 50%, depending on the feedstock and processing method.

- Green Chemistry Journal notes that microbial routes for producing butadiene from sugars have achieved conversion efficiencies of more than 80%, showing commercial potential for renewable rubber.

- National Renewable Energy Laboratory found that fermentation of lignocellulosic sugars can yield bio-butadiene with productivities of up to 1.3 grams per liter per hour, a key milestone for industrial feasibility.

- WIPO Patent WO2018111345A1 highlights that bio-polybutadiene produced from renewable butadiene has a glass transition temperature near -100°C, maintaining elasticity in cold-weather applications.

- European Rubber Journal observes that incorporating bio-polybutadiene in tire treads can improve fuel economy by up to 5%, due to enhanced rolling resistance properties.

- Environmental Protection Agency projects that replacing synthetic rubber with bio-based polybutadiene in U.S. tire manufacturing could prevent over 1 million metric tons of CO₂ emissions annually.

- Polymer Database (University of Akron) lists the density of polybutadiene as typically ranging between 0.89 to 0.91 g/cm³, contributing to weight reduction in automotive and aerospace parts.

Bio-polybutadiene Market: Market Dynamics

Driving Factors in the Bio-polybutadiene Market

Rising Demand from the Tire and Automotive Industry

One of the primary driving factors for the bio-polybutadiene market is its increasing application in the tire and automotive industry. As automakers strive for improved fuel efficiency and lower carbon emissions, demand for sustainable raw materials such as bio-based synthetic rubber is surging. Bio-polybutadiene offers superior resilience, wear resistance, and elasticity, making it ideal for manufacturing high-performance tires. With the global shift toward green mobility and electric vehicles, the use of eco-friendly materials like bio-polybutadiene rubber is gaining traction. This trend is further supported by regulatory frameworks promoting low-emission vehicle components and sustainable automotive manufacturing practices.

Supportive Government Regulations and Green Policies

Government initiatives aimed at reducing dependency on fossil fuels and curbing environmental pollution are significantly propelling the bio-polybutadiene market. Policies promoting bio-based chemicals, subsidies for bioplastic adoption, and investments in bio-refineries are fostering the commercial viability of bio-polybutadiene production. Many regions are implementing environmental mandates encouraging the use of renewable feedstocks across the chemical and polymer sectors. The growing acceptance of green chemistry principles and international agreements targeting carbon neutrality further boost market expansion. Bio-polybutadiene's compatibility with sustainable manufacturing and circular economy goals positions it as a strategic solution for reducing environmental impact.

Restraints in the Bio-polybutadiene Market

High Production Costs and Limited Commercialization

Despite its environmental benefits, the high production cost of bio-polybutadiene acts as a major market restraint. Bio-based synthesis methods, especially those involving microbial fermentation or catalytic processes, are still under development and remain expensive compared to conventional petrochemical production. The absence of large-scale infrastructure and limited economies of scale restrict the widespread commercialization of bio-polybutadiene polymers. Moreover, cost-sensitive industries like automotive and footwear manufacturing may be reluctant to shift from established synthetic rubber alternatives without strong economic incentives or regulatory mandates.

Raw Material Supply Chain Challenges

The bio-polybutadiene market faces raw material sourcing limitations due to the dependency on biomass feedstocks like sugarcane, corn, or lignocellulosic material. Fluctuations in agricultural yields, seasonal variations, and land-use competition with food crops create volatility in supply chains. Additionally, issues related to the sustainability and traceability of biomass sources may deter environmentally conscious manufacturers. The inconsistency in biomass availability can affect the stable production of bio-based elastomers, limiting their competitiveness with petroleum-derived polybutadiene rubber in high-volume industrial applications.

Opportunities in the Bio-polybutadiene Market

Expansion in Sustainable Packaging Solutions

With the rising need for biodegradable and compostable packaging materials, bio-polybutadiene presents lucrative opportunities in the sustainable packaging sector. Its flexible nature, barrier properties, and compatibility with bioplastics make it an attractive component for green packaging products. As brands across industries increasingly adopt environmentally friendly packaging to reduce plastic waste and comply with circular economy targets, demand for bio-based rubber compounds is set to grow. Innovations in film extrusion, molding, and coating applications using bio-polybutadiene can further accelerate its market penetration in the eco-packaging domain.

Potential in 3D Printing and Advanced Manufacturing

Emerging applications of bio-polybutadiene in additive manufacturing and 3D printing offer significant market opportunities. The material's elasticity, durability, and low-temperature performance make it suitable for creating flexible, rubber-like prototypes and industrial parts. As 3D printing technologies evolve to support diverse materials, bio-based elastomers like bio-polybutadiene could gain traction in prototyping, custom tooling, and wearables manufacturing. This aligns with the increasing focus on sustainable innovation, especially in aerospace, consumer electronics, and healthcare, where demand for high-performance, eco-friendly materials is expanding rapidly.

Trends in the Bio-polybutadiene Market

Integration with Bio-refinery and Circular Economy Models

A prominent trend shaping the bio-polybutadiene market is its integration into bio-refinery and circular economy frameworks. Companies are investing in closed-loop systems where biomass feedstocks are converted into multiple value-added bio-products, including bio-rubbers. This approach maximizes resource efficiency and minimizes waste. As industries shift toward zero-waste manufacturing and sustainable product design, bio-polybutadiene is gaining recognition as a crucial component of circular bio-economies. Such integration also supports reduced greenhouse gas emissions and enhanced life cycle performance of elastomer-based products.

Technological Advancements in Bio-synthesis Pathways

Rapid innovation in synthetic biology and green chemistry is advancing the bio-synthesis of polybutadiene using microbial and enzymatic processes. Companies are exploring genetically engineered microbes and biocatalysts to enhance yield and scalability of bio-polybutadiene production. These developments aim to replace energy-intensive petrochemical methods with low-carbon, renewable alternatives. Emerging pilot plants and collaborative R&D initiatives are improving process efficiency, opening doors for cost-effective bio-polybutadiene rubber suitable for large-scale applications. This technological momentum is likely to redefine the future landscape of sustainable elastomers.

Bio-polybutadiene Market: Research Scope and Analysis

By Production Method Analysis

The Conventional Petrochemical Processes segment is predicted to dominate the global bio-polybutadiene market by the end of 2025, accounting for approximately 64.3% of the total market share. This dominance is attributed to the well-established supply chains, lower production costs, and compatibility with existing infrastructure. Despite rising awareness of sustainable polymers, conventional synthetic rubber production remains the preferred route due to scalability and raw material availability. The market continues to witness stable demand from tire manufacturers and industrial rubber goods producers who prioritize cost-efficiency and performance consistency. With increasing usage across rubber compounding and molded rubber goods, this production route sustains high traction in the global elastomer landscape.

The Bio-based Synthesis segment is anticipated to record the highest CAGR in the global bio-polybutadiene market by the end of 2025. Growing environmental concerns and demand for eco-friendly synthetic rubbers are accelerating investments in green chemistry innovations. Bio-derived polybutadiene is gaining attention in sustainable materials development, especially in sectors transitioning toward renewable resources. Startups and major players are collaborating to upscale bio-polymer manufacturing, leveraging feedstocks like bio-butadiene sourced from agricultural biomass. Moreover, government incentives and corporate sustainability commitments further support the transition to low-carbon rubber solutions. As industries move toward circular economy models, the adoption of bio-based elastomeric compounds is set to increase substantially.

By Quality Grade Analysis

Standard Grade is forecasted to dominate the global bio-polybutadiene market by the end of 2025, with a market share of approximately 58.9%. This grade is widely used across multiple downstream applications, including automotive tires, polymer modifiers, and mechanical goods, due to its balanced performance-to-cost ratio. Its suitability in general-purpose manufacturing of synthetic rubbers and compatibility with traditional compounding processes make it the first choice for cost-sensitive applications. Additionally, the extensive demand from OEMs and converters for basic formulations sustains its widespread use. The standard grade also supports consistent quality control in high-volume production of thermoplastic elastomers and impact modifiers, reinforcing its commanding position in the market.

The High-performance Grade is expected to register the fastest CAGR in the global bio-polybutadiene market by the end of 2025. This growth is driven by rising demand for durable elastomers in high-stress applications like performance tires, aerospace seals, and precision-molded parts. These premium grades offer enhanced tensile strength, superior abrasion resistance, and low-temperature flexibility. With R&D focusing on advanced material science, the segment is increasingly being adopted in advanced composite rubber production and specialty polymer blends. The shift toward lightweight and fuel-efficient automotive designs also contributes to the uptake of high-spec synthetic rubbers, accelerating the adoption of this advanced grade in critical performance environments.

By Formulation Type Analysis

Solid Bio-polybutadiene is projected to dominate the global market by the end of 2025, holding approximately 66.2% of the total share. Solid formulations are extensively utilized in high-volume rubber processing methods like extrusion and compression molding. These forms are easy to handle, store, and integrate into existing manufacturing lines for tire production, rubber belts, and vibration-damping components. Their stability, lower VOC emissions during processing, and broader application across heavy-duty industrial rubber parts ensure their dominance. Furthermore, solid bio-polybutadiene supports thermal stability and compatibility with reinforcing agents, making it ideal for applications requiring long-term mechanical performance under stress.

Liquid Bio-polybutadiene is expected to grow at the highest CAGR by the end of 2025, driven by its increasing use in adhesives, sealants, and specialty coatings. It enables improved formulation flexibility, better wetting properties, and enhanced dispersion in complex polymer systems. This segment benefits from the demand for low-viscosity elastomers in precision molding and additive manufacturing. In niche applications like encapsulants, reactive diluents, and impact-resistant resin systems, liquid formats are gaining popularity due to their processing efficiency and crosslinking capability. The growing push for eco-friendly sealant technologies in electronics and automotive interiors further stimulates interest in liquid bio-based elastomer formulations.

By Application Analysis

Automotive Tires are anticipated to dominate the global bio-polybutadiene market by the end of 2025, capturing an estimated 49.8% market share. Tire manufacturers are increasingly turning to bio-polybutadiene as a sustainable alternative to reduce the carbon footprint of traditional tires while maintaining essential wear resistance and rolling efficiency. This segment benefits from rising global automotive production and increasing consumer demand for green mobility solutions. Bio-based elastomers used in tire treads improve fuel economy and lower environmental impact. Additionally, regulatory frameworks promoting eco-labeling and reduced emissions further support the penetration of bio-derived synthetic rubber in tire manufacturing operations worldwide.

Adhesives and Sealants are expected to witness the highest CAGR in the bio-polybutadiene market by the end of 2025. The increasing demand for flexible, low-VOC bonding materials across the construction, electronics, and packaging sectors is driving this segment’s rapid growth. Bio-polybutadiene offers strong tack, durability, and compatibility with a wide range of substrates, making it ideal for sustainable adhesive formulations. Companies are investing in bio-based sealant technologies to replace petrochemical-based resins, especially in moisture-curing systems and structural bonding applications. As consumers and industries alike shift toward non-toxic and renewable materials, this segment stands out for its eco-conscious innovation potential.

By End User Analysis

The Automotive Industry is forecasted to dominate the global bio-polybutadiene market by the end of 2025, accounting for approximately 51.4% of the total demand. This segment leverages bio-based synthetic rubber for fuel-efficient tires, lightweight interior components, and eco-friendly gaskets. Rising vehicle production, especially electric vehicles (EVs), necessitates advanced elastomeric materials that combine performance with sustainability.

Bio-polybutadiene delivers reduced rolling resistance, low-temperature flexibility, and high resilience—ideal for next-generation automotive systems. Regulatory pressure to lower CO₂ emissions and the shift toward bio-economy-based raw materials further strengthen this segment's dominance, making it integral to the transformation of modern automotive supply chains.

The Healthcare segment is expected to grow with the highest CAGR in the global bio-polybutadiene market by the end of 2025. Rising demand for biocompatible, low-allergenic elastomers in medical devices, surgical gloves, and pharmaceutical packaging fuels this segment’s expansion. Bio-polybutadiene offers low extractables and leachables, excellent flexibility, and high tear strength, making it suitable for sensitive clinical applications. The healthcare industry's shift toward greener materials, in alignment with global sustainability and safety regulations, accelerates adoption. Moreover, the integration of bio-polymers in drug delivery systems and wearable technology enhances performance and patient safety, boosting long-term growth in this high-value end-use market.

The Bio-polybutadiene Market Report is segmented on the basis of the following:

By Production Method

- Bio-based Synthesis

- Conventional Petrochemical Processes

By Quality Grade

- Standard Grade

- High-performance Grade

By Formulation Type

By Application

- Automotive Tires

- Adhesives and Sealants

- Consumer Goods

- Industrial Products

By End User

- Automotive Industry

- Construction Industry

- Consumer Electronics

- Healthcare

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is projected to hold the largest share of the global bio-polybutadiene market, with a revenue share of 53.0% by the end of 2025. The region’s dominance is fueled by the extensive presence of automotive manufacturing hubs, particularly in China, India, Japan, and South Korea. Rapid industrialization, supportive government policies, and the growing demand for sustainable raw materials in the tire and rubber industries further boost market growth.

Additionally, regional investments in green polymer technologies and large-scale production facilities enhance supply capabilities. With a robust base of rubber processors and OEMs, the region benefits from economies of scale and increasing adoption of bio-based alternatives, solidifying Asia Pacific’s leadership in the synthetic elastomer landscape.

Region with Highest CAGR

North America is expected to record the highest CAGR in the global bio-polybutadiene market by the end of 2025. The region's growth is driven by strong regulatory support for sustainable materials, advancements in biopolymer R&D, and a rising shift toward low-emission manufacturing. The U.S. and Canada are witnessing increased demand from the automotive, healthcare, and electronics sectors for eco-friendly elastomer solutions.

Market players are heavily investing in pilot-scale and commercial bio-polymer plants, with collaboration between biotechnology firms and traditional chemical manufacturers. Additionally, the growing consumer preference for green products and corporate ESG commitments further accelerate the adoption of bio-polybutadiene in high-value industrial applications.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global bio-polybutadiene market features a moderately consolidated competitive landscape, with several key players focusing on strategic expansions, partnerships, and sustainable innovation. Leading companies are investing heavily in bio-based elastomer research to diversify their synthetic rubber portfolios and meet growing environmental regulations. Major manufacturers are leveraging renewable feedstocks and advanced fermentation techniques to enhance production efficiency and reduce dependence on petrochemicals.

Top industry participants such as Synthos, Lanxess, Kuraray, and Michelin are actively engaged in scaling up bio-based rubber production to cater to the rising demand from the automotive and industrial sectors. Companies are also integrating bio-polybutadiene into tire treads, adhesives, and sealants to address the sustainability goals of OEMs and end users. Startups and research organizations are entering the market with innovative solutions, particularly in North America and Europe, which further intensifies competition and accelerates technological advancement.

The competitive dynamics are influenced by growing consumer preference for green alternatives, lifecycle performance demands, and supply chain resilience. As the market continues to evolve, players that prioritize low-carbon technologies, circular material integration, and regulatory compliance are expected to gain a competitive edge in the expanding landscape of renewable synthetic rubber materials.

Some of the prominent players in the Global Bio-polybutadiene Market are:

- Kuraray Co., Ltd.

- Arlanxeo

- Synthos S.A.

- Trinseo

- UBE Corporation

- LG Chem

- Versalis S.p.A.

- Reliance Industries Limited

- Zeon Corporation

- Kumho Petrochemical

- SABIC

- Evonik Industries AG

- Mitsubishi Chemical Group

- Bridgestone Corporation

- JSR Corporation

- Asahi Kasei Corporation

- Dow Inc.

- ExxonMobil Chemical

- Lanxess AG

- Sinopec

- Other Key Players

Recent Developments

- In March 2024, Bridgestone received U.S. Department of Energy funding in March to develop a pilot facility converting bioethanol to butadiene. The initiative supports commercialization of renewable synthetic rubber and aligns with growing demand for low-carbon materials in tire and industrial rubber applications.

- In June 2024, Michelin launched new sustainable tires incorporating bio-polybutadiene in June. The product offers improved performance and reduced environmental impact, reinforcing the company’s commitment to achieving fully sustainable tire production by 2050 and advancing circularity in the automotive components manufacturing ecosystem.

- In October 2024, LANXESS introduced a new high-performance bio-polybutadiene grade, offering superior elasticity and abrasion resistance. This innovation supports expanding industrial applications in green coatings and adhesives, and reflects increasing investment in functional biopolymers for automotive and construction industry needs.

- In February 2023, Arlanxeo launched a new 65 ktpa Polybutadiene Rubber (PBR) production facility in Brazil, marking a significant achievement in expanding its footprint across the South American market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 876.0 Mn |

| Forecast Value (2034) |

USD 6,228.6 Mn |

| CAGR (2025–2034) |

24.4% |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Production Method (Bio-based Synthesis, Conventional Petrochemical Processes), By Quality Grade (Standard Grade, High-performance Grade), By Formulation Type (Solid, Liquid), By Application (Automotive Tires, Adhesives and Sealants, Consumer Goods, Industrial Products), By End User (Automotive Industry, Construction Industry, Consumer Electronics, Healthcare, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Kuraray Co., Ltd., Arlanxeo, Synthos S.A., Trinseo, UBE Corporation, LG Chem, Versalis S.p.A., Reliance Industries Limited, Zeon Corporation, Kumho Petrochemical, SABIC, Evonik Industries AG, Mitsubishi Chemical Group, Bridgestone Corporation, JSR Corporation, Asahi Kasei Corporation, Dow Inc., ExxonMobil Chemical, Lanxess AG, Sinopec, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Bio-polybutadiene Market size is estimated to have a value of USD 876.0 million in 2025 and is expected to reach USD 6,228.6 million by the end of 2034.

Asia Pacific is expected to be the largest market share for the Global Bio-polybutadiene Market with a share of about 53.0% in 2025.

Some of the major key players in the Global Bio-polybutadiene Market are Kuraray Co., Ltd., Arlanxeo, Synthos S.A. and many others.

The market is growing at a CAGR of 24.4% over the forecasted period.

The US Bio-polybutadiene Market size is estimated to have a value of USD 166.5 million in 2025 and is expected to reach USD 1,062.8 million by the end of 2034.