Market Overview

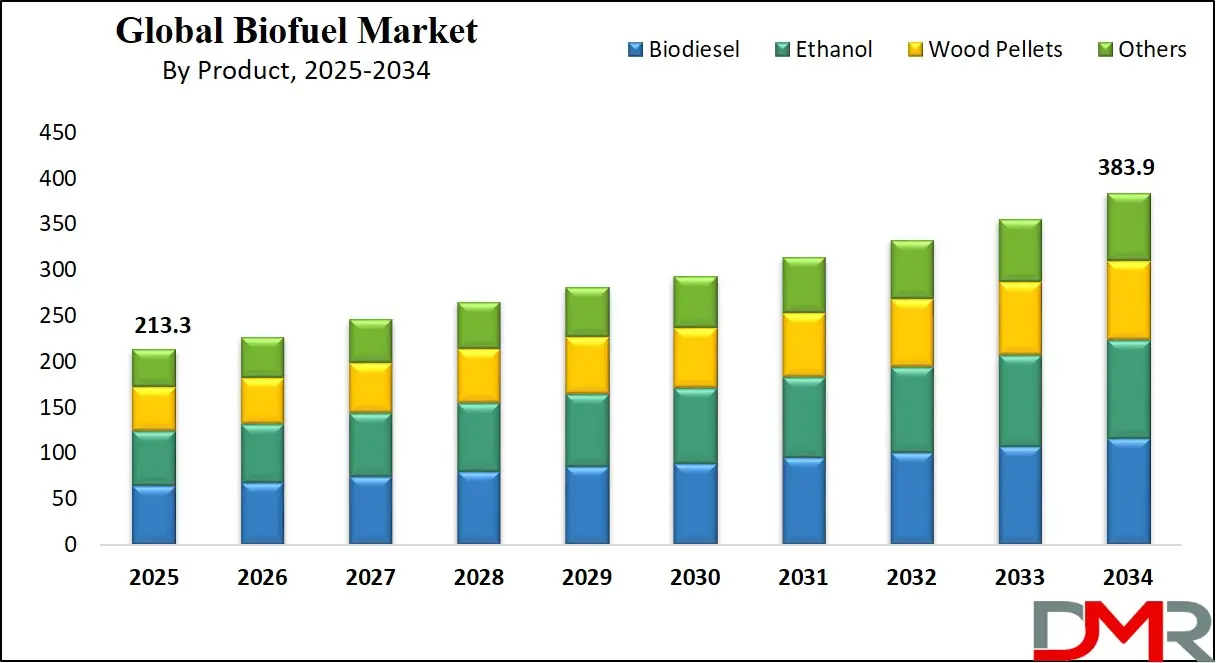

The Global Biofuel Market size is expected to be valued at

USD 213.3 billion in 2025, and it is further anticipated to reach a market value of

USD 383.9 billion by 2034 at a

CAGR of 6.8%.

The global biofuel market refers to an industry dedicated to producing, distributing, and consuming biofuels derived from renewable resources like plant or animal biomass. Blending mandates in countries like the US, Brazil, and the EU have dramatically increased biofuel production and consumption.

Additionally, rising interest in attaining net-zero emissions and transitioning to a low-carbon economy has further spurred investments in biofuel research and infrastructure. Technological advances in production processes have played a vital role in cutting costs while improving efficiency, making biofuels more competitive with conventional fuels.

The global biofuel market plays a critical role in the shift toward renewable energy by leveraging organic and sustainable feedstocks to produce cleaner fuel alternatives. It includes the production of bioethanol from crops like corn and sugarcane, biodiesel from vegetable oils and animal fats, and advanced biofuels from non-food sources like algae and agricultural residues.

The market is shaped by a combination of government mandates, incentives, and technological advancements aimed at reducing greenhouse gas emissions, diversifying energy sources, and enhancing energy security. With applications ranging from road transportation to aviation and power generation, the biofuel market is a key component of global efforts to combat climate change and promote a sustainable energy future.

Current global biofuel markets are marked by dynamic growth and transition as they navigate both challenges and opportunities presented by a sustainable energy future. Biofuel production has seen advances in technology that allow the use of different feedstocks like agricultural residues, algae, and waste materials which help address food security and competition with food crops, which have traditionally been used as raw materials in first-generation biofuel production. Aviation is at the forefront of adopting sustainable fuels, particularly sustainable aviation fuel (SAF), in its efforts to meet stringent environmental goals.

Companies and governments alike are investing heavily in infrastructure and partnerships to establish SAF's local production capacities. Companies operating within the energy sector are expanding their portfolios to include biofuels, signaling a strategic shift toward renewable energy sources. Overall, the biofuel market is transforming and trying to balance sustainable development with market demands. With global communities focused on reducing emissions and transitioning to renewable sources of energy such as biofuels, their role will shape the global biofuel landscape.

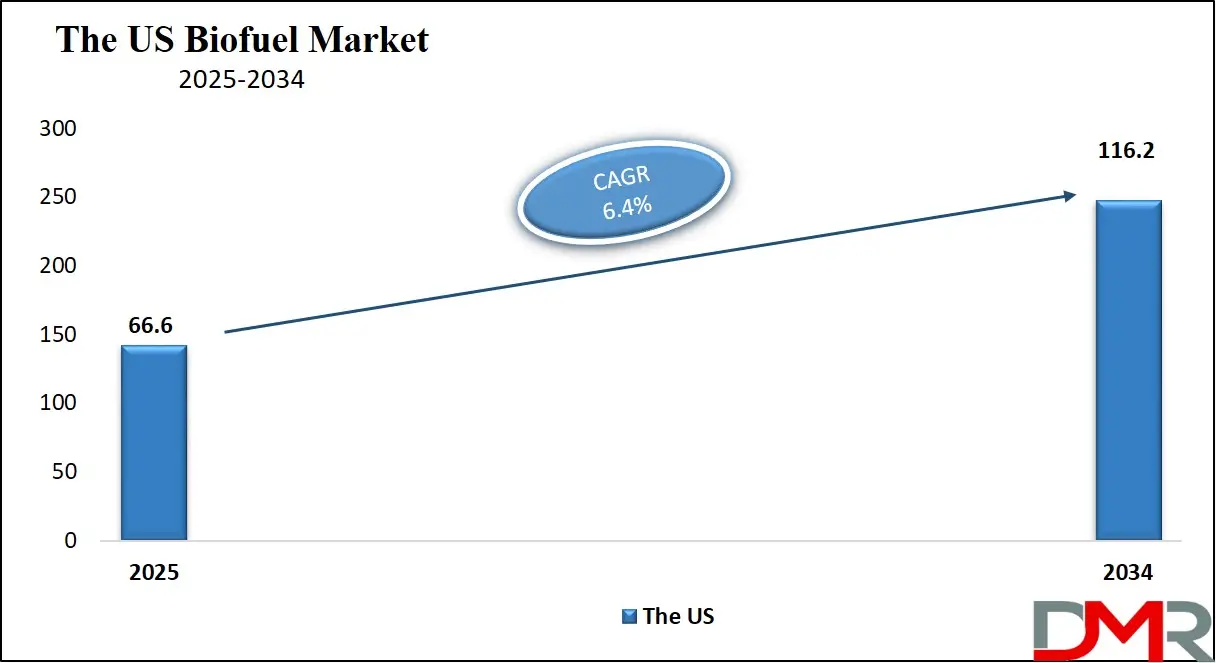

The US Biofuel Market

The US Biofuel Market is projected to be valued at

USD 66.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 116.2 billion in 2034 at a

CAGR of 6.4%.

US biofuel markets have been driven by favorable government policies, technological developments, and concerns over energy independence and environmental sustainability. Canada has long been one of the leading producers and consumers of biofuels such as ethanol and biodiesel, accounting for an impressive portion of total global biofuel production and consumption which subsequently boosts the position of the US in the biofuel market.

The US biodiesel sector is also increasing, with production that has been primarily driven by soybean oil, animal fats, and used cooking oil feedstocks. Biodiesel has taken on an added advantage over regular diesel in transport and heavy vehicle industries.

Despite its continued growth and policy support, the US biofuel market faces several obstacles that limit its success. Another major concern this region faces is feedstock competition. Furthermore, fluctuations in crude oil prices can negatively impact biofuels price competitiveness like when fossil fuel prices decline significantly, which makes it harder for biofuels to maintain their market share.

Global Biofuel Market: Key Takeaways

- Market Value: The global biofuel market size is expected to reach a value of USD 383.9 billion by 2034 from a base value of USD 213.3 billion in 2025 at a CAGR of 6.8%.

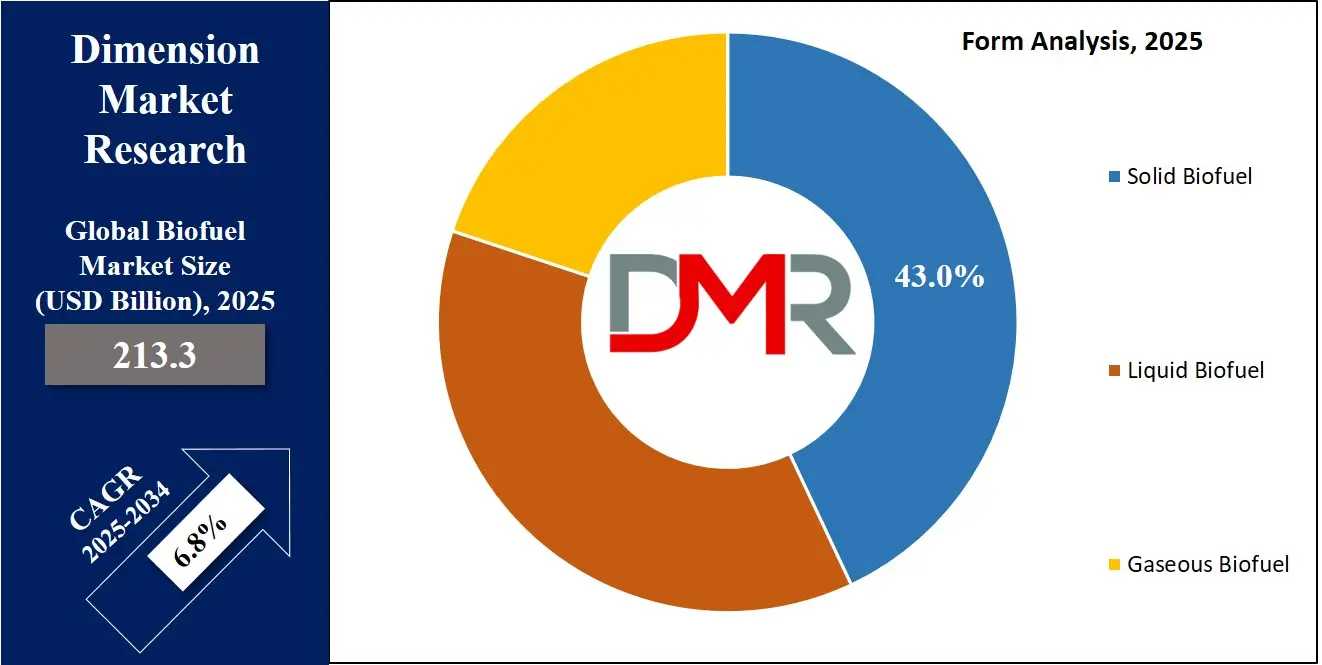

- By Form Segment Analysis: Solid Biofuel is projected to maintain its dominance in the form type segment, capturing 43.0% of the market share in 2025.

- By Product Segment Analysis: Biodiesel is anticipated to capture the global biofuel market with 30.0% of the market share in the product segment by 2025.

- By Application Segment Analysis: Transportation is poised to maintain its dominance in the raw material type segment capturing 70.0% of the total market share in 2025.

- By Feedstock Segment Analysis: Corn is expected to capture the global biofuel market with 63.0% of the market share in the feedstock type segment by 2025.

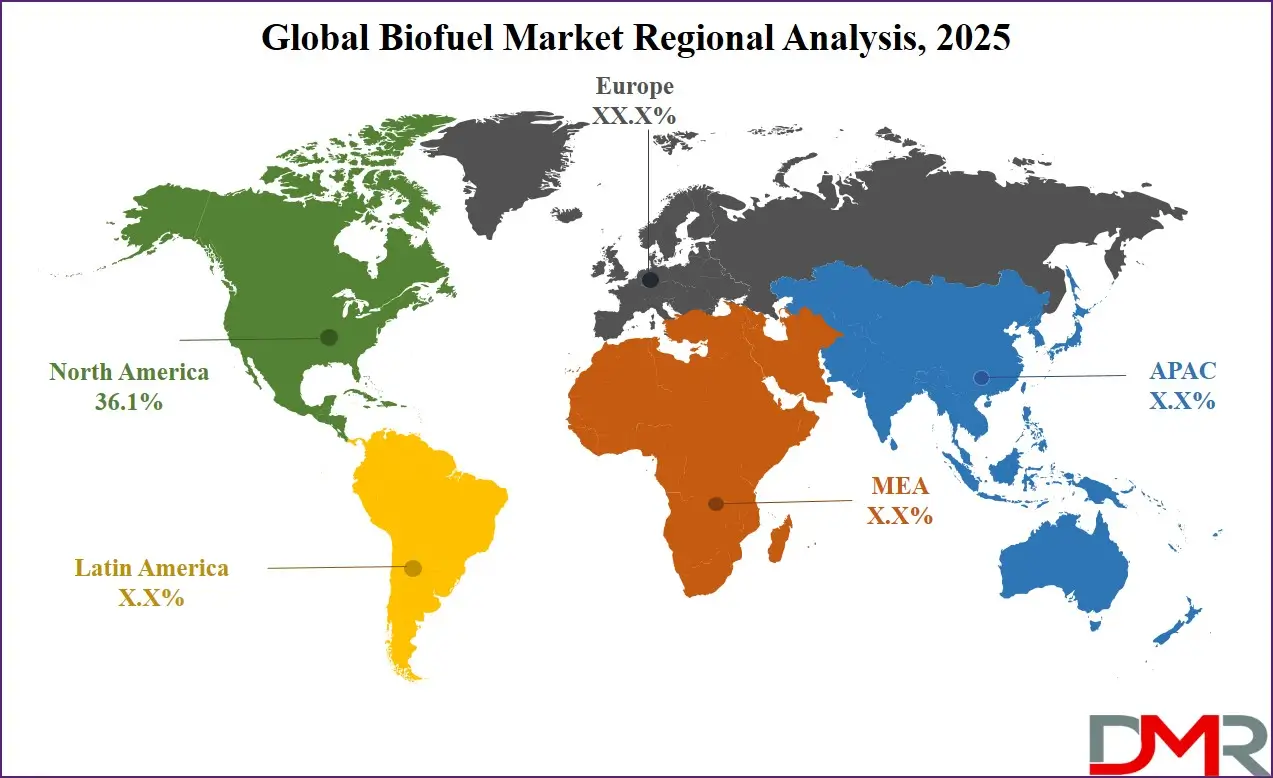

- By Region Analysis: North America is anticipated to lead the global biofuel landscape with 36.1% of total global market revenue and it is further anticipated to maintain its dominance by 2025.

- Key Players: Some major key players in the global biofuel market are Archer Daniels Midland Company, Green Plains Inc., Petrobras, Valero Energy Corp., Alto Ingredients Inc., and Other Key Players.

Global Biofuel Market: Use Cases

- Transportation Fuel: Biofuels are widely used as an alternative to fossil fuels in the transportation sector, helping reduce greenhouse gas emissions and dependence on petroleum. Ethanol, primarily produced from crops like corn and sugarcane, is commonly blended with gasoline to power cars, trucks, and buses.

- Sustainable Aviation Fuel (SAF): The aviation industry is turning to biofuels, specifically sustainable aviation fuel (SAF), as a solution to reduce its carbon footprint. SAF is made from renewable feedstocks like plant oils, algae, and waste materials, and can be used in existing aircraft engines without modification.

- Power Generation: Biofuels play a role in renewable energy generation, particularly in countries seeking to diversify their energy sources. Biomass, which can include wood pellets, agricultural residues, and dedicated energy crops, is used in power plants to produce electricity.

- Decarbonizing Transportation with Biofuels: The transportation sector faces immense pressure to reduce its carbon footprint. Biofuels such as bioethanol, biodiesel, and sustainable aviation fuel (SAF) offer an immediate solution by providing cleaner energy alternatives that work seamlessly with existing infrastructure.

Global Biofuel Market: Stats & Facts

- According to Reuters, India's plans to make more corn-based ethanol has turned Asia's top corn exporter (India) into a net importer for the first time in decades, squeezing local poultry producers and scrambling global supply chains.

- As per the International Energy Agency (IEA), in advanced economies, biofuel demand has increased by 6% or 5,700 million liters between 2022 and 2024, with most of the increase occurring in the United States and Europe.

Market Dynamic

Global Biofuel Market: Driving Factors

Global Biofuel Market: Increasing Demand for Renewable Energy and Sustainability

The global biofuel market has been propelled by rising consumer and government interest in renewable energy sources as they look to safeguard sustainability and environmental protection. This surge in interest arises from climate change concerns, environmental degradation, and the negative repercussions associated with fossil fuel consumption that impact global ecosystems.

Biofuels' popularity can be directly linked to an increased awareness of ecological sustainability. Many nations have set ambitious climate goals in line with international agreements like the Paris Agreement that seeks to limit global warming below 2 Degrees Celsius.

Biofuels have become an integral component of transitioning towards more sustainable energy systems as they are produced from renewable raw materials like crops, waste materials, and algae. In contrast to fossil fuels which take millions of years to form, biofuels restore quickly. Bioethanol is one of the most prevalent biofuels produced from corn and sugarcane crops which is reproduced annually providing a consistent source of renewable supply.

Government Policies and Regulatory Support

One of the key drivers of biofuel sales globally is government support through favorable policies, subsidies, and regulations to encourage renewable energy adoption. Such policies aim to decrease reliance on fossil fuels while decreasing carbon emissions, helping nations meet national and international climate goals while simultaneously prioritizing environmental sustainability and energy security. Government policies mandating biofuel use or providing financial incentives to promote its production and consumption have played an instrumental role in driving market expansion.

Many countries have implemented biofuel blending mandates that require a certain percentage of biofuels to be mixed with conventional gasoline and diesel fuels particularly prevalent in transportation applications where biofuels can replace or reduce fossil fuel usage. One such carbon pricing system in Europe, called the Emissions Trading System (EU ETS), has been instrumental in driving companies towards less polluting alternatives including biofuels as they seek to avoid costly carbon allowances.

Global Biofuel Market: Restraints

High Production Costs and Feedstock Availability

Biofuel producers continue to experience difficulty due to the high production costs associated with biofuel production, especially during its early development stages. Even as the biofuel industry grows steadily, production costs still lag behind conventional fossil fuels compared to biofuels produced from cellulose feedstocks.

Biofuel production requires various feedstocks, including crops such as corn, sugarcane, soybeans, and oilseeds, non-food materials like agricultural waste; algae; and forestry residues as well as any material available from agricultural waste or processing. Their availability plays an essential role in the biofuel cost calculation.

Biofuel crops such as corn and sugarcane can experience fluctuations in agricultural prices due to weather, market demands, crop yields, and yield projections. Changes in crop production can result in shortages or increased costs, negatively affecting biofuel prices.

Technological advances in biofuel production, such as second-generation biofuels derived from non-food feedstocks, hold the promise of reducing production costs in the future. However, their current commercial-scale production requires substantial investment also their high costs also present barriers to their widespread implementation and commercial viability.

Land Use and Food Security Concerns

Another major impediment to global biofuel market growth is competition for land between biofuel production and food crops, raising concerns over food security and environmental sustainability. With rising biofuel demand comes increasing pressure to allot large areas for biofuel feedstocks like corn, soybeans, and sugarcane, which in turn may reduce available land for food production in areas with limited fertile land. Biofuel production using food crops can reduce available land for growing food, leading to rising prices and supply shortages.

This issue is especially impacting the developing countries where food security already poses significant challenges. The competition between biofuel production and food crops remains an obstacle to global biofuel market expansion. Diversion of agricultural land to cultivate feedstock for biofuel production can significantly raise food prices and threaten food security in vulnerable regions.

Global Biofuel Market: Opportunities

Technological Advancements in Biofuel Production

Advanced biofuels that do not rely on food crops are expected to play a crucial role in driving future market expansion of biofuels. These technologies can help biofuel producers overcome some of the primary constraints, including competition with food production and sustainability issues related to land use.

Technological advancements in biofuel production processes such as improved enzymatic breakdown of biomass, more efficient fermentation methods, and integrated biorefinery systems can greatly lower production costs and promote their adoption across global energy markets.

Governments have already recognized the significance of innovation and are investing in research and development to hasten its commercialization. For instance, the U.S. Department of Energy (DOE) has funded several initiatives designed to advance biofuel technologies. Artificial Intelligence (AI) and Machine Learning (ML) technologies are increasingly being applied to optimize biofuel production. AI/ML tools can improve feedstock cultivation, predict crop yields, streamline biofuel production processes, and boost efficiency while simultaneously decreasing costs.

Growing Global Focus on Decarbonization and Climate Goals

Biofuel markets stand to benefit greatly from the global trend toward decarbonization and climate goals. As countries strive to cut their carbon emissions and mitigate climate change effects, biofuels have increasingly been recognized as key players in finding solutions to replace fossil fuels. With increasing emphasis placed on decarbonization across transportation, industry, and power generation sectors globally, biofuels may serve as energy sources in moving us toward low-carbon economies.

Governments and regulatory bodies are increasingly adopting policies to encourage biofuel adoption as part of their broader climate action plans. Many countries have set renewable energy targets that include biofuels as an integral component. With their adoption supported by supportive policies and technological developments, biofuels offer a sure path toward meeting global decarbonization targets while simultaneously offering sustainable, renewable energy solutions.

Global Biofuel Market: Trends

Shift Towards Advanced Biofuels and Sustainable Feedstocks

One trend in the global biofuel market is an increased focus on developing and commercializing advanced biofuels specifically second and third-generation options driven by increasing demands for more eco-friendly, cost-effective biofuels that don't compete with food production and are land-use friendly.

Innovations in feedstocks and biofuel production processes have seen significant advancements to make them more cost-efficient and streamlined. This includes improvements in enzyme technology, fermentation processes, and biorefinery systems that allow for the production of various biofuels from different feedstock types.

This trend is projected to accelerate with global decarbonization goals, climate commitments, and the demand for diversifying sources of power increasing their demand for cleaner energy sources that contribute less CO2. As the industry shifts from food-based feedstocks towards eco-friendly solutions that support energy transition initiatives, biofuels have become more relevant as part of an energy transition solution.

Growing Adoption of Biofuels in the Aviation and Shipping Sectors

One significant trend in the global biofuel market is the increasing adoption of biofuels by the aviation and shipping industries. Aviation emissions account for a significant share of transportation, accounting for an increasing portion of total emissions from transportation.

Major airlines and airports globally have begun testing and incorporating SAFs into their operations. Airlines such as KLM, Lufthansa, and British Airways have implemented SAF blends into their flights. Additionally, the aviation industry is working closely with biofuel producers and governments to increase SAF production at cost-competitive levels with traditional jet fuel.

Global aviation organizations such as IATA have set ambitious sustainability goals, including their pledge to achieve net-zero carbon emissions by 2050. Biofuel producers and shipping companies have begun conducting pilot trials of biofuels as marine engine fuels Biofuels made of algae, vegetable oils, and waste materials are being tested as drop-in fuels on existing ships to help reduce sulfur oxide, nitrogen oxide emissions as well as carbon dioxide emissions that contribute to air pollution and climate change.

Global Biofuel Market: Research Scope and Analysis

By Form

Solid Biofuel is projected to maintain its dominance in the form-type segment, capturing 43.0% of the market share in 2025. This is likely due to their wide use in heating homes, powering vehicles, and industrial applications especially in residential heating.

Solid biofuels are made up of renewable sources like wood chips, agricultural residues, and other biomass-derived materials that serve as important renewable energy sources across multiple sectors. This makes solid biofuels an integral component of renewable energy solutions in various fields. There are various factors contributing to solid biofuels' dominance, such as usage by domestic heating households, powering vehicles, and industrial applications.

The increasing adoption of biomass-based energy policies, especially in Europe and North America, coupled with financial incentives for renewable energy projects, has bolstered the production and consumption of solid biofuels. Emerging markets in Asia-Pacific and Latin America are also witnessing significant growth in solid biofuel usage due to their abundant agricultural and forestry resources.

Additionally, advancements in pelletizing technologies and innovations in biomass storage and transportation are expected to further enhance the usability and market penetration of solid biofuels.

Solid biofuels come from organic material like wood agricultural residues or biomass sources which make them an important renewable source in various sectors.

One of the key advantages of solid biofuels is their affordability and accessibility in areas with abundant biomass resources, especially rural and developing nation areas where biomass residues such as crop waste, wood chips, and sawdust from agricultural activities are readily available and easily converted to fuel for cooking and heating needs.

By Product

Biodiesel is anticipated to capture the global biofuel market with 30.0% of the market share in the product segment in 2025. This growth can be attributed to several key factors including increasing demand for cleaner transportation fuels, government policies supporting renewable energy adoption, and biodiesel's ability to reduce greenhouse gas emissions as compared with traditional fossil fuels. Diesel engines account for a substantial portion of vehicles globally and emit harmful pollutants and high levels of carbon emissions.

Biodiesel produced via transesterification using vegetable oils, animal fats or algae can provide a renewable, biodegradable, and cleaner alternative that significantly lowers harmful emissions such as particulate matter, sulfur dioxide emissions carbon monoxide emission nitrogen oxide emissions, thus improving air quality and public health benefits.

Moreover, advancements in biodiesel production technologies, including second-generation processes that utilize non-food-based feedstocks, are expected to enhance biodiesel's sustainability and expand its market reach.

These innovations help address concerns related to land-use changes and food security, further boosting biodiesel's appeal as a renewable fuel option. The global automotive industry's shift towards cleaner fuels is another significant driver for biodiesel demand. Heavy-duty and commercial vehicles, which rely heavily on diesel, are being highly powered by biodiesel blends to meet emissions compliance and sustainability goals.

Biodiesel's market share can also be increased through its adaptability in terms of mixing with traditional diesel fuel. Biodiesel fuel can be blended to meet specific regional or vehicle type needs with ease, including B5 (5% biodiesel mixed in with 95% petroleum diesel) or B20 (20% biodiesel and 80% petroleum diesel), providing more flexible adoption across regions and vehicle types.

By Application

Transportation is poised to maintain its dominance in the application type segment capturing 70.0% of the total market share in 2025. This is likely due to their heavy reliance on liquid fuels and contributions to global greenhouse gas emissions driving them toward cleaner renewable alternatives like ethanol, biodiesel, and advanced biofuels which help decarbonize transportation while still meeting performance and energy density requirements for vehicles, aviation, and shipping. Biofuels offer a renewable, lower-carbon alternative to fossil fuels that helps lower greenhouse gas emissions while providing energy security.

The dominance of transportation in the biofuel market is also fueled by the growing emphasis on reducing dependency on petroleum-based fuels amid volatile oil prices and concerns about energy security. The road transportation sector, encompassing passenger vehicles, commercial trucks, and buses, accounts for the majority of biofuel consumption due to the compatibility of biofuel blends with existing internal combustion engines.

Biofuels' popularity among transportation users can also be seen as an influence on this sector's growth. With growing awareness of climate change and environmental sustainability, consumers are seeking greener transportation options. This trend can especially be observed in regions with strong environmental consciousness as well as policies supporting renewable energy adoption.

While the transportation segment faces competition from electric vehicles and hydrogen fuel technologies, the global push for diverse clean energy solutions ensures that biofuels remain a vital component of the energy mix.

By Feedstock

Corn is expected to capture 63.0% of the market share in the global biofuel market in the feedstock-type segment in 2025. Corn's dominance can be attributed to its wide availability, high energy yield, and usage in the production of ethanol.

Furthermore, supportive policies, technological advancements, and compatibility with existing agricultural and industrial infrastructure have strengthened corn as a biofuel feedstock source. Corn is used primarily to produce ethanol; a renewable fuel widely blended into gasoline to reduce emissions and improve air quality. Corn starch fermentation results in the creation of ethanol that is later refined for use as either fuel or an additive.

The United States, the largest producer of bioethanol globally, relies heavily on corn as the primary feedstock, contributing significantly to this market share. Policies such as the U.S. Renewable Fuel Standard (RFS) and blending mandates in various countries have incentivized ethanol production, ensuring steady demand for corn as a feedstock. Additionally, countries like Brazil and China are also investing in corn-based ethanol production to meet their renewable energy targets and reduce reliance on fossil fuels.

Corn's availability, cost-effectiveness, and established supply chain infrastructure further solidify its leading position in the feedstock segment. Advances in agricultural practices, including higher-yielding corn varieties and precision farming techniques, have enhanced corn's productivity and sustainability, making it a reliable feedstock choice for biofuel producers.

Corn's versatility as a feedstock also plays a significant role in its market share. Aside from ethanol production, its by-products (such as distillers' grains) can also be utilized as animal feed for use within circular economy models and overall sustainability considerations of biofuel production processes using corn. Utilizing multiple aspects of corn adds both economic viability and appeal as an energy feedstock option.

The Global Biofuel Market Report is segmented on the basis of the following:

By Form

- Solid Biofuel

- Liquid Biofuel

- Gaseous Biofuel

By Product

- Biodiesel

- Ethanol

- Wood Pellets

- Others

By Application

- Transportation

- Aviation

- Energy Generation

- Heating

- Others

By Feedstock

- Corn

- Sugarcane

- Vegetable Oils

- Other

Global Biofuel Market: Regional Analysis

North America is anticipated to lead the global biofuel landscape with

36.1% of total global market revenue in 2025, due to its strong production capacity, favorable policies, abundant feedstock availability, and technological advancement. By prioritizing sustainability and energy security initiatives such as green power projects.

Another key reason behind North America's dominance in the biofuel market lies with the US. As one of the leading producers of both ethanol and biodiesel production, the US boasts an unparalleled position. The Renewable Fuel Standard (RFS) policy has played a key role in mandating their use of gasoline and diesel, creating stable demand that encouraged investments in production facilities and infrastructure.

Although North America's biofuel market remains strong, it does face challenges like fluctuating feedstock prices and competition from renewable energy sources such as solar and wind power issues regarding land use and food security, as well as concerns over land use. However, focusing on innovation, policy support, and advanced biofuel development is expected to overcome these hurdles and maintain its market leadership status.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Biofuel Market: Competitive Landscape

The global biofuel market is highly dynamic, featuring multinational corporations, specialty producers, and regional players all striving to innovate and meet growing consumer demand. Major energy companies such as BP, Shell, TotalEnergies, and Chevron have expanded their portfolios to include biofuels by capitalizing on their extensive global infrastructure and research capabilities. These firms aim to expand the production of renewable diesel, SAFs, and ethanol that aligns with global sustainability goals and stricter carbon reduction mandates.

Strategic collaborations and partnerships add another element to the competitive landscape. Alliances between biofuel producers, feedstock suppliers, end users (such as airlines and auto companies), and end-users have become more prevalent over time, fostering innovation while broadening market reach.

Some of the prominent players in the Global Biofuel Market are:

- Archer Daniels Midland Company

- Green Plains Inc.

- Petrobras

- Valero Energy Corp.

- Alto Ingredients Inc.

- Gevo Butamax Advanced Biofuels LLC

- Wilmar International Ltd.

- Renewable Energy Group, Inc.

- Bunge North America, Inc.

- Royal Dutch Shell Plc

- CropEnergies AG

- Air Liquide

- Scandinavian Biogas Fuels International AB

- Abengoa

- Other Key Players

Recent Developments

- October 2024: U.S. investment firm KKR agreed to acquire a 25% stake in Eni's biofuel unit. This strategic partnership is part of Eni's broader plan to attract co-investors to support its decarbonization initiatives while retaining control over Enilive.

- September 2024: Mining giant Rio Tinto acquired 3,000 hectares of land in the south of Townsville, North Queensland, to launch a biofuels pilot project. The project aims to explore the use of Pongamia seed oil as a renewable diesel feedstock, contributing to the company's efforts to reduce its diesel emissions footprint in Australia.

- August 2024: Swiss commodity trading group Gunvor acquired a 50% stake in Varo Energy's USD 600 million biofuel project at the Port of Rotterdam. This facility is set to convert waste into Sustainable Aviation Fuel (SAF) and biodiesel, aligning with the European Union's increasing mandates for SAF usage in aviation.

- June 2024: BP plans to expand its biofuel operations in Brazil by developing second-generation ethanol and Sustainable Aviation Fuel (SAF). This initiative follows BP's acquisition of full control over its joint venture, BP Bunge Bioenergia, which operates 11 sugarcane processing plants across five Brazilian states.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 213.3 Bn |

| Forecast Value (2034) |

USD 383.9 Bn |

| CAGR (2025-2034) |

6.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 66.6 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form (Solid Biofuel, Liquid Biofuel, and Gaseous Biofuel), By Product (Biodiesel, Ethanol, Wood Pellets, and Others), and By Application (Transportation, Aviation, Energy Generation, Heating, and Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Archer Daniels Midland Company, Green Plains Inc., Petrobras, Valero Energy Corp., Alto Ingredients Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global biofuel market size is estimated to have a value of USD 213.3 billion in 2025 and is expected to reach USD 383.9 billion by the end of 2034.

The US-biofuel market is projected to be valued at USD 66.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 116.2 billion in 2034 at a CAGR of 6.4%.

North America is expected to have the largest market share in the global biofuel market with a share of about 36.1% in 2025.

Some of the major key players in the global biofuel market are Archer Daniels Midland Company, Green Plains Inc., Petrobras, Valero Energy Corp., Alto Ingredients Inc., and many others.

The market is growing at a CAGR of 6.8 percent over the forecasted period.