Market Overview

The Global

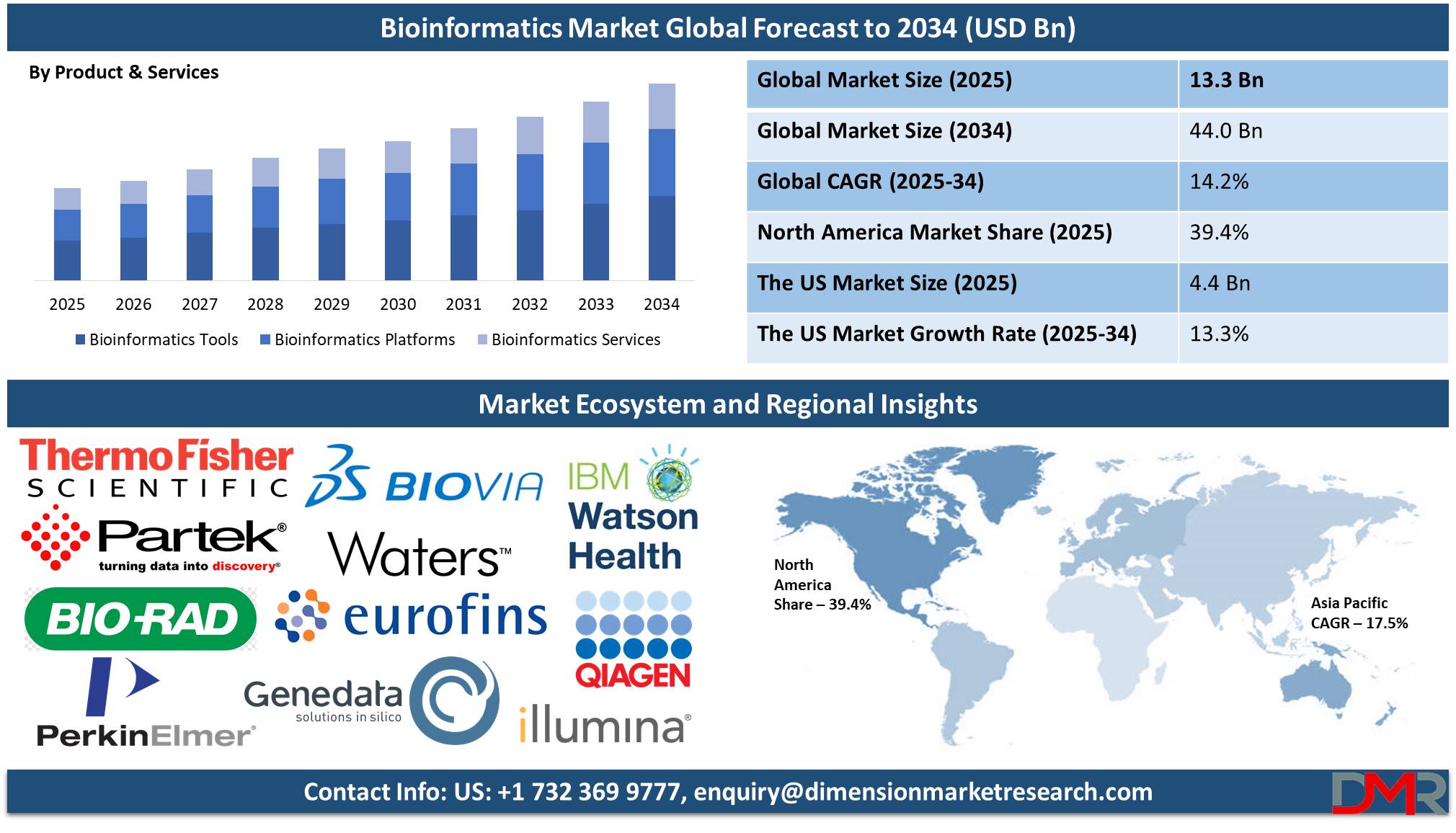

Bioinformatics Market is projected to be valued at

USD 13.3 billion by the end of 2025 and is further to reach a market value of

USD 44.0 billion in 2034 at a

CAGR of 14.2%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The bioinformatics market is witnessing robust growth on the back of advances being made in genomics, proteomics, and drug discovery technologies. It is a highly interdisciplinary field, and its role is indispensable in handling and interpreting the multifaceted biological information that would help further the causes of better healthcare, improved agriculture, and environmental sustainability.

The growing use of next-generation sequencing technologies and precision medicine initiatives is raising the demand for bioinformatics solutions. These bioinformatics tools empower researchers to make sense of enormous genomic data sets, thus opening ways to breakthroughs in disease diagnosis, treatment personalization, and biomarker discovery. With increasing emphasis by biopharmaceutical companies on the development of biologics, the role of bioinformatics platforms becomes very important in managing and refining workflows for greater data accuracy.

AI and ML, with their increasing integration into bioinformatics, have opened massive avenues for predictive modeling and decision-making. AI-powered tools facilitate the quicker, more accurate interpretation of genomic and proteomic data, hence enhancing R&D efficiency. Also, cloud-based solutions for bioinformatics are increasingly sought on account of scalability and cost. Smaller and mid-sized organizations tend to use these platforms because, through such platforms, advanced analytical access is possible without heavy investments in infrastructure. Growing demand for bioinformatics in agricultural biotechnology also adds to market growth by promoting innovation and application in the development and optimization of crops with viable crop culture and sustainable agriculture methods.

Despite these opportunities, some of the challenges faced by the bioinformatics market include the high cost associated with advanced bioinformatics tools and platforms. Integration of bioinformatics solutions into existing systems in research and clinical settings is complex and thus forms another barrier. Data privacy and strict regulatory compliance also hamper growth. Besides this, a shortage of skilled professionals who can handle bioinformatics tools restricts their wide adoption. To overcome these problems, organizations are now putting more and more emphasis on user-friendly interfaces and training programs to expand their customer base.

The potential for growth for the bioinformatic market is high, with an increase in investment in healthcare and a rise in chronic disease prevalence in the world. This region bounds with untapped opportunities for companies to rise specifically in the Asia-Pacific region along with Latin America. Driven by rises in healthcare infrastructure investments and R&D in biotechnology, various academic collaborations, government support, and industry players can develop innovative ideas and find an ecosystem that is appreciative of bioinformatics knowledge. Additionally, the increased digitization push in Life Sciences is very likely to contribute to speeding up growth with added efficiency and capability for data management.

The US Bioinformatics Market

The US Bioinformatics Market is projected to reach USD 4.4 billion in 2025 at a compound annual growth rate of 13.3% over its forecast period.

The advanced healthcare infrastructure, the significant R&D investments, along the robust biotechnology sector, help the US hold an edge in the global bioinformatics market. By having a large pool of highly qualified people along with leading academic institutions working on bioinformatics R&D, the United States obtains enormous demographic dividends. The market is driven by the increasing adoption of precision medicine and next-generation sequencing technologies, with about 35% of the revenue in bioinformatics coming from the U.S. The integration of AI and big data analytics further strengthens the market, enabling innovations in genomics, proteomics, and transcriptomics.

Supportive government initiatives in the U.S. market, such as funding for genomic research and public-private partnerships for the promotion of biotechnology, are also helping. Many companies, considering it a very good opportunity, are launching innovative bioinformatics solutions in the fields of drug discovery, clinical diagnostics, and agriculture. Extensive cloud-platform adoptions ensure scalability and access to the cloud even for small and mid-scale enterprises, thereby driving growth within the market. With the U.S. being a leader in technological advances and innovation, the growth of the bioinformatics market is very likely to be sustained, hence contributing a great deal to the progress of the global market.

Key Takeaways

- Global Market Value: The Global Bioinformatics Market size is estimated to have a value of USD 13.3 billion in 2025 and is expected to reach USD 44.0 billion by the end of 2034.

- The US Market Value: The US Bioinformatics Market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.6 billion in 2034 at a CAGR of 13.3%.

- Regional Analysis: North America is expected to have the largest market share in the Global Bioinformatics Market with a share of about 39.4% in 2025.

- Key Players: Some of the major key players in the Global Bioinformatics Market are Thermo Fisher Scientific Inc., Illumina, Inc., Qiagen N.V., Agilent Technologies, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., and many others.

- Global Market Growth Rate: The market is growing at a CAGR of 14.2 percent over the forecasted period.

Use Cases

- Precision Medicine Development: It aids in personalized treatment through the identification of biomarkers of diseases by bioinformatics analysis of genomic data that will enhance therapeutic outcomes in cases like cancer.

- Drug Discovery: Accelerates target identification and validation to speed up the process of developing new drugs against complex diseases.

- Agricultural Biotechnology: Genetic engineering to improve crops, which will optimize such traits as drought resistance, pest tolerance, and yield enhancement.

- Environmental Studies: Assists in the analysis of microbial data for monitoring ecosystems, developing biofuels, and addressing various environmental challenges sustainably.

Stats & Facts

- AI in Genomics Summit 2024 (March, Asia): This summit, scheduled for March 2024, is intended to understand the application of machine learning and AI in genomics, with a particular focus on the area of rare diseases. It will unite major researchers in the field of genomics, data scientists, and healthcare professionals who will discuss revolutionary changes that artificial intelligence and machine learning technologies have brought into bioinformatics.

- Illumina's NovaSeq X Series (2024): Illumina's NovaSeq X Series brings about revolutionary improvements in whole-genome sequencing; 50% cost efficiency and speed enables researchers to scale projects for research into cancer genomics, precision medicine, and hereditary disease studies.

- Qiagen's Cloud-Based NGS Platform (2024): Qiagen launched the cloud-based NGS analysis platform, including AI-enabled bioinformatics tools, which facilitate instant collaboration in precision medicine at home, along with personalized choices for treatments of cancer, and many other rare diseases - with scalability of storage along with computing power.

- Genomics & Bioinformatics Summit 2023 (August, U.S.): Hosted by IBM Watson Health, this major event gave a spotlight to the transformative impact artificial intelligence is creating in genomic data analysis, especially within the domains of precision medicine and cancer genomics. The summit featured over 20 keynote speakers from academia, biotechnology companies, and healthcare organizations who discussed how AI-driven bioinformatics tools will be integrated into clinical diagnostics and therapeutic development.

- Thermo Fisher Scientific's Ion AmpliSeq HD System (2023): The Thermo Fisher Ion AmpliSeq HD System uses sophisticated bioinformatics software in extending DNA sequencing, offering the identification of genetic mutations in both oncology and rare genetic disease applications by seamlessly integrating the Ion Torrent Suite.

- Bio-Rad Laboratories' Droplet Digital PCR System (2023): The Droplet Digital PCR system from Bio-Rad can detect extremely rare genetic mutations in real-time, crucial in cancer genomics, personalized medicine, and gene therapy, represented with advanced bioinformatics.

- Bioinformatics Expo 2023 (May, Virtual): Conveying the bioinformatics community together, researchers, and leaders alike, Genedata ran this virtual expo to communicate innovative AI-powered bioinformatics tools. The event shall dive deep into applications in the arena of agricultural genomics, drawing pointers on how AI is at work in accelerating crop improvements and pest resistance research, therefore assuring precise farming. Bioinformatics companies and biotech firms presented the latest advancements in AI-driven software for genomic data analysis, providing demos of their platforms in action.

- Agilent Technologies’ SureSelect XT HS Kit (2023): Agilent SureSelect XT HS Kit is committed to optimizing NGS applications for highly multiplexed genomic analysis, thereby offering better sensitivity in the detection of genetic variation, especially within applications like rare disease diagnostics or cancer genomics. Bioinformatics tools support these kits.

- International Genomics Conference 2022 (December, Europe): This is being held in Europe in December. Participation had more than 1,000 researchers around the world. It is also dealing with updates on the latest single-cell genomics, transcriptomics, and bioinformatics technologies. The various sessions showed novel updates on new advances within genomic sequencing methodologies, the role of bioinformatics in decoding intricate biological information, and the use of AI in the improvement of genomic analysis.

Market Dynamic

Driving Factors

Rising Demand for Precision MedicineThe increasing global emphasis on personalized health care is a factor that is driving the adoption of bioinformatics tools in precision medicine. By using bioinformatics, researchers study genomic and proteomic data of individual patients, identify biomarkers, and hence tailor treatment accordingly. This leads to increased efficacy of therapy, fewer side effects, and better patient outcomes. Precision medicine programs therefore have considerable activity in oncology, cardiology, and the management of rare diseases that are heavily funded by governments and organizations worldwide.

Advancements in Next-Generation Sequencing (NGS) Technologies

The proliferation of NGS technologies has driven an unprecedented demand for bioinformatics solutions. NGS generates massive volumes of genetic data that need sophisticated tools for storage, analysis, and interpretation. Bioinformatics platforms provide frictionless data processing that allows researchers to uncover insights to drive innovation in genomics, transcriptomics, and metagenomics. These are accelerated by the falling prices of NGS and its use in clinical diagnostics, drug discovery, and agriculture, all of which have increased the application of bioinformatics as a necessary ingredient for contemporary research.

Restraints

High Costs of Advanced Bioinformatics Tools

The high cost of acquiring, implementing, and maintaining advanced bioinformatics tools and platforms is one of the main barriers to its wide diffusion, especially for SMEs and academic institutions. Although cloud-based solutions are easing some of these pains, initial investment in on-premises platforms and special training is still out of the budget for many. These have thus made access to such advanced technologies limited in resource-poor settings.

Complexity and Data Privacy Concerns

This usually means very complicated integrations of the bioinformatic toolchain into already operating systems; such integration typically requires quite a bit of specialist knowledge and considerable time. Also, this amount of sensitive data will involve issues regarding data privacy and security. Especially when working in regions such as Europe with a generally strict law GDPR that requires specific rules and principles to protect personal data companies will need to develop higher levels of compliance. All of the mentioned challenges call for adequate cybersecurity measures and openness towards these policies, possibly slowing projects down and driving operational costs higher.

Opportunities

Emerging Markets in Asia-Pacific and Latin America

The bioinformatics market has emergent growth opportunities in developing geographies like Asia-Pacific and Latin America. The increasing investments in infrastructure, research in biotechnology, and collaborations with academics indicate the demand for bioinformatics solutions. Favorable government policies and a rise in public-private partnerships meet this growing demand for genomics and precision medicine in countries like China, India, and Brazil. Cost advantages of R&D activities are present in these regions, therefore encouraging multinational corporations with reduced operational burdens and market reach.

Applications in Agricultural Biotechnology

Bioinformatics has now taken a leading role in agricultural biotechnology, including supporting genetic research and crop improvement programs. These tools and platforms of analysis for genomic data help scientists develop crops with advanced features of drought resistance, pest tolerance, and enhanced yield. Therefore, due to increased global demand for sustainable food production and climate-resilient crops, the need for bioinformatics solutions is becoming indispensable in agriculture. Collaborations between agricultural companies and bioinformatics firms are driving innovations, opening lucrative opportunities in this sector.

Trends

Adoption of AI and Machine Learning in Bioinformatics

Bioinformatics now covers Artificial Intelligence and Machine Learning in its scope, which is a game-changing point in data analysis and interpretation. AI-based algorithms allow researchers to process large datasets with unparalleled speed and accuracy, allowing predictive modeling and complex simulations. Applications involving ML in genomics are very impactful, covering a wide range of tasks that include genome annotation, variant detection, and gene expression profiling. The insights from these various innovations have finally made drug discovery, diagnostics, and personalized medicine actionable. Further developments will further increase the contribution of artificial intelligence to bioinformatics in enhancing efficiency and fuelling innovation.

Expansion of Cloud-Based Bioinformatics Solutions

There is an increasing demand for cloud-based bioinformatics platforms due to their scalability, cost efficiency, and collaboration features. The cloud-based platform provides access to sophisticated bioinformatics tools and datasets with no need for any heavy investments in infrastructure by researchers or organizations. They facilitate real-time collaboration among globally distributed teams that boost productivity and foster innovation. Cloud solutions would especially be helpful for SMEs in competing with large players within the biotechnology sector. It is expected that the adoption of cloud-based bioinformatics will gain pace accordingly with the development of cybersecurity measures and will be one of the cornerstones of the market.

Research Scope and Analysis

By Product & Services

Bioinformatics tools are projected to dominate the global bioinformatics market because they play a crucial role in the analysis and interpretation of data, which acts as the backbone for modern biological research. It aids researchers in performing speedy and accurate analysis of complex data sets, which may include genomic, proteomic, and transcriptomic information. Applications can be supported at various levels, ranging from alignment and molecular modeling to structural bioinformatics and phylogenetic analysis. The applicability across a wide range of fields like genomics, drug discovery, and precision medicine underlines the broad usage of bioinformatics tools.

Continuous improvements in computational algorithms and machine learning further develop the efficiency and capability of bioinformatics tools. Now, massive volumes of data can be processed to find patterns, correlations, and biological insights that were not achievable earlier. The incorporation of AI-powered tools has made such complex tasks as genome annotation and variant analysis more straightforward, thus increasing their demand in academic institutions, pharmaceutical companies, and CROs.

Further, there is a growing orientation toward cloud-based deployment of these bioinformatics tools so that one can use any state-of-the-art technology on his/her browser without large investments in infrastructure. Since accessibility has democratized this market for small and medium-sized enterprises to gain access to, there was also a significant drive toward demand due to friendly interfacing and customization offered in platforms; the innovators thus target segments comprising both naive and advanced end-users.

Their scalability and adaptability to emerging fields like metagenomics and systems biology further ensure their dominance. Since there is an interest in personalized medicine and R&D in biotechnology, bioinformatics tools continue to play a vital role in breakthroughs, hence securing their leading position in the market.

By Application

The genomics segment holds the major share because genomics lays the fundamental framework for understanding structure, function, and evolution in genomes. This increased use of genomics in health studies, agriculture, and environmental studies has amplified the demand for bioinformatics solutions related to this field. Bioinformatics is thus of essence in advancing this science, because research into genomics yields highly complicated and huge data sets that call for sophisticated computational tools for storage, analysis, and interpretation.

The development of NGS has been an enabler, bringing the cost of sequencing down and increasing the scope of genomic research. Bioinformatics platforms enable the analysis of NGS data for GWAS, comparative genomics, and epigenomics. Such insights drive innovation in personalized medicine whereby genomics helps to identify biomarkers in each patient and their genetic predisposition, thus aiding diagnosis and treatment.

Within agriculture, genomics is being used to develop genetically modified crops with better yields, which are resistant to pests and can cope with the climate changes. Similarly, microbial genomics has further developed the understanding of environmental ecosystems and improved biofuel production. These diverse applications give a broad view of the impact brought about by genomics, which depends greatly on bioinformatics tools.

Additionally, billions of dollars have been invested by governments and organizations from different parts of the world in genomics research projects, such as the Human Genome Project and other precision medicine initiatives. Such initiatives have acted as a catalyst for bioinformatics solutions that address genomics. With continuous improvements in sequencing technologies and an ever-widening scope of genomic applications, the dominance of genomics in the bioinformatics market is expected to continue, further driving scientific breakthroughs.

By End User

Academic institutions and research centers are anticipated to dominate the bioinformatics market, as they are very instrumental in driving both fundamental and applied research in a variety of biological disciplines. Often, they act as hotbeds of innovation in testing new methodologies and applications for bioinformatics in genomics, proteomics, and systems biology. The relative ease of access to public funding and research grants makes advanced bioinformatics tools more accessible, enabling state-of-the-art discoveries in these institutions.

They have been in a position to maintain such commanding positions for various reasons, among them their role in the training of new bioinformaticians. The universities and research centers include multistage groups with biologists, data scientists, and computational experts interacting productively, building synergy. This has translated into considerable contributions in developing open-source bioinformatics tools adopted throughout the scientific world. In contributing, barriers to entry are low for new researchers and organizations that want to start contributing, helping drive the field further ahead.

Additionally, academic institutions represent early adopters of emergent bioinformatics technologies. This becomes very important for the validation of new tools and platforms in setting benchmarks regarding performance and ease of use. Data that arise from academic research usually forms the basis upon which pharmaceutical and biotech industries develop their work, underlining their position in the bioinformatics ecosystem even further.

The rising demand for precision medicine on a global basis, and the ensuing research developments in genomics, bring academic institutions and industry players one step closer to collaboration. This ultimately results in newer applications of bioinformatics and thus demands more investments in the field. As educational institutions define precedent research and can disseminate knowledge, they maintain the leading position in the bioinformatics market.

The Bioinformatics Market Report is segmented on the basis of the following

By Product & Services

- Bioinformatics Tools

- Data Analysis Software

- Sequence Alignment Tools

- Molecular Modelling Tools

- Clinical Data Management Tools

- Bioinformatics Platforms

- Sequence Analysis Platforms

- Structural Analysis Platforms

- Data Integration Platforms

- Bioinformatics Services

- Data Management & Analysis Services

- Cloud-Based Services

- Custom Bioinformatics Solutions

By Application

- Genomics

- Functional Genomics

- Structural Genomics

- Comparative Genomics

- Proteomics

- Protein Identification & Analysis

- Protein Interaction Analysis

- Transcriptomics

- RNA Sequencing

- Gene Expression Analysis

- Drug Discovery and Development

- Target Identification

- Lead Discovery

- ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) Analysis

- Precision Medicine

- Personalized Genomics

- Biomarker Discovery

- Others

By End User

- Academic Institutions and Research Centers

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Healthcare Providers

- Agriculture Organizations

Regional Analysis

North America is projected to lead the bioinformatics market with

39.4% of the market share by the end of 2024. This has resulted in dominance by North America in the bioinformatics market, on the back of the strong presence of its biotechnology and pharmaceutical industries together with a commensurate research infrastructure.

There is a bevy of notable companies that are located within the U.S., offering their services concerning research, commercial application of bioinformatics technology, and Government organizations involved with the genomics field and its translational platform toward personalized medicine. High investments in research and development with considerable participation by various private and public bodies also provide a much-needed boost towards research and improvement of bioinformatics technologies and their applications.

It ensures further reinforcement through the early use of advanced next-generation sequencing (NGS) and AI technologies that create groundbreaking methods of both doing research and generating pharmaceuticals. Due to such circumstances, high demand appeared for bioinformatics analysis using highly sophisticated tools and platforms. Events within North America's regulatory framework are on its side as well for instance, the Precision Medicine Initiative supports making bioinformatics solutions personalized to every particular patient.

Moreover, North America has the most developed pool of human resources in computational biology and data analytics. Academic institutions and industry partnerships spur the development of innovative bioinformatics solutions, while the developed venture capital ecosystem supports startups and innovative projects.

Other factors that contribute to the growth include an increased regional focus on personalized medicine and its application to oncology and rare diseases. Besides, collaborations between technology providers and healthcare entities to develop cloud-based bioinformatics platforms enhance scalability and accessibility. With continuous developments in genomics, proteomics, and precision medicine, North America is likely to continue to dominate the bioinformatics market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The bioinformatics market is highly competitive, and key players are heavily involved in innovation, strategic partnerships, and acquisitions to maintain their market position. Companies such as Thermo Fisher Scientific, Illumina, and Qiagen have leading positions in the market, offering end-to-end bioinformatics platforms and tools for applications such as genomics and drug discovery.

Agilent Technologies and PerkinElmer have benefited from the integration of bioinformatics solutions into laboratory workflows, while IBM's Watson Health is applying AI in the development of a better interpretation of genomic data. New entrants such as Genedata and DNASTAR are providing solutions to niche areas, infusing healthy competition within the market.

In some cases, bioinformatics companies can be seen joining hands with the pharmaceutical industry in finding quicker routes of drug discovery or providing precision medicine. Increasing investments by entities engaged in research and development and increasing cloud-based platform development further add to the competitiveness quotient. Since growth potential in this industry is considered huge, continued efforts on offering expansion and geographic expansion are assured, both from already established and emerging players.

Some of the prominent players in the global Bioinformatics Market are:

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- Qiagen N.V.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Waters Corporation

- IBM Corporation (Watson Health)

- Dassault Systèmes SE (BIOVIA)

- Eurofins Scientific

- DNASTAR, Inc.

- Partek Incorporated

- Genedata AG

- Other Key Players

Recent Developments

- November 2024: Illumina partnered with an academic consortium to develop AI-driven bioinformatics tools focused on enhancing cancer genomics, aimed at advancing diagnostic precision and treatment personalization.

- September 2024: Qiagen launched a cloud-based next-generation sequencing (NGS) analysis platform designed to streamline workflows and accelerate precision medicine applications for pharmaceutical and clinical research users.

- October 2023: Thermo Fisher Scientific completed a $200 million acquisition of a bioinformatics startup specializing in transcriptomics data analysis to enhance its portfolio for advanced molecular biology research solutions.

- August 2023: IBM Watson Health organized the Genomics & Bioinformatics Summit, highlighting the role of AI in transforming genomic data interpretation and advancing healthcare innovation.

- June 2023: Eurofins Scientific invested $50 million to expand its bioinformatics research and development facilities in the U.S., aiming to bolster capabilities in genomics and proteomics studies.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 13.3 Bn |

| Forecast Value (2033) |

USD 44.0 Bn |

| CAGR (2024-2033) |

14.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 4.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product & Services (Bioinformatics Tools, Bioinformatics Platforms, and Bioinformatics Services) By Application (Genomics, Proteomics, Transcriptomics, Drug Discovery and Development, Precision Medicine, and Others), By End User (Academic Institutions and Research Centers, Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs), Healthcare Providers, and Agriculture Organizations) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Thermo Fisher Scientific Inc., Illumina, Inc., Qiagen N.V., Agilent Technologies, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Waters Corporation, IBM Corporation (Watson Health), Dassault Systèmes SE (BIOVIA), Eurofins Scientific, DNASTAR, Inc., Partek Incorporated, and Genedata AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Bioinformatics Market?

▾ The Global Bioinformatics Market size is estimated to have a value of USD 13.3 billion in 2025 and is expected to reach USD 44.0 billion by the end of 2034.

What is the size of the US Bioinformatics Market?

▾ The US Bioinformatics Market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.6 billion in 2034 at a CAGR of 13.3%.

Which region accounted for the largest Global Bioinformatics Market?

▾ North America is expected to have the largest market share in the Global Bioinformatics Market with a share of about 39.4% in 2025.

Who are the key players in the Global Bioinformatics Market?

▾ Some of the major key players in the Global Bioinformatics Market are Thermo Fisher Scientific Inc., Illumina, Inc., Qiagen N.V., Agilent Technologies, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., and many others.

What is the growth rate in the Global Bioinformatics Market?

▾ The market is growing at a CAGR of 14.2 percent over the forecasted period.