Market Overview

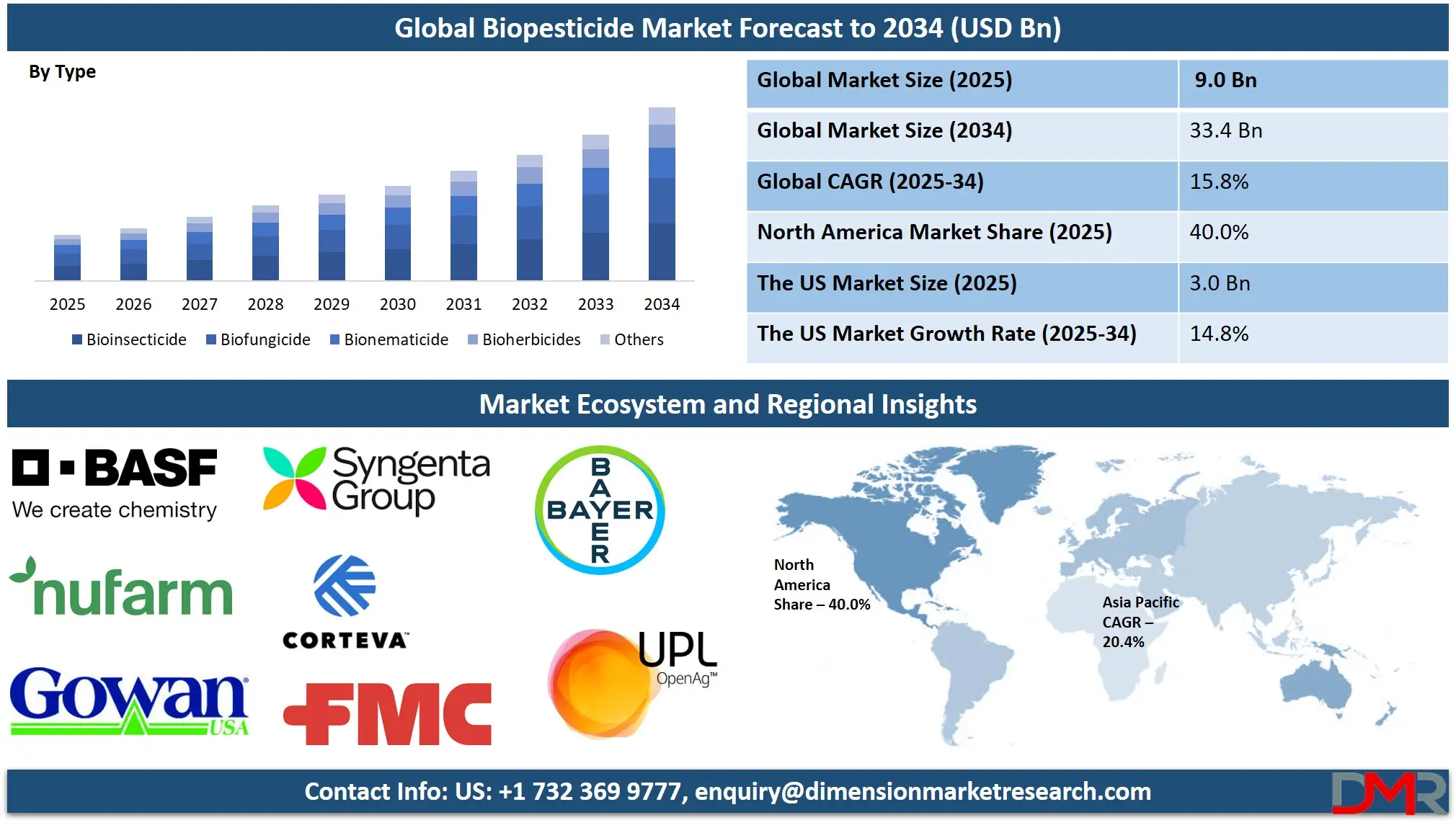

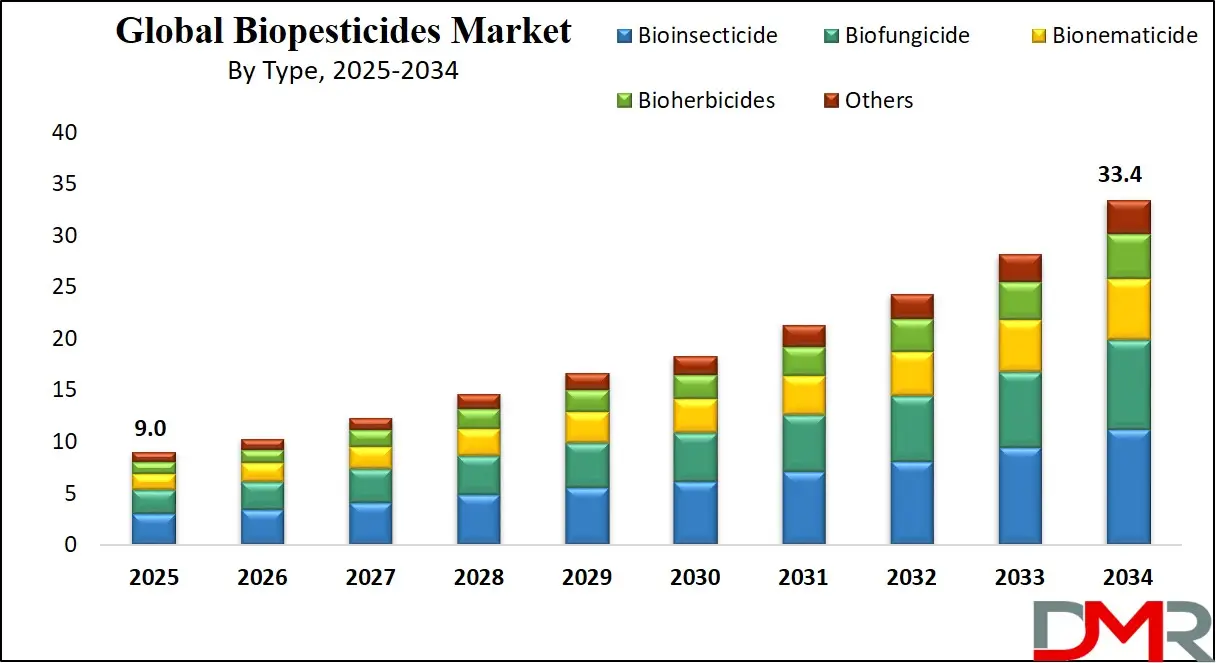

The Global Biopesticides Market is predicted to be valued at

USD 9.0 billion in 2025 and is expected to grow to

USD 33.4 billion by 2034, registering a compound annual growth rate (CAGR) of

15.8% from 2025 to 2034.

Biopesticides are natural or biologically derived substances used to control pests, including insects, weeds, and plant diseases. They are typically derived from organisms such as bacteria, fungi, or plants, or are naturally occurring compounds like insect pheromones or plant extracts. Biopesticides offer an environmentally friendly alternative to chemical pesticides, as they tend to be less toxic to non-target organisms, including humans, animals, and beneficial insects. These products are often used in organic farming and integrated pest management systems. Biopesticides work through various modes of action, such as inhibiting pest growth, repelling pests, or disrupting their reproduction.

The Global biopesticides market evolves rapidly because consumers prioritize environmentally friendly organic products, and there exists mounting concern about synthetic pesticides effects on the environment. The biopesticide market uses escalating amounts of biological pesticides in organic farms, with nanotechnology and encapsulation technologies developing to boost biopesticide performance and stability. They work on upgrading microbial and biochemical formulations to boost the performance of biopesticides, which will make them applicable in multiple agricultural markets. Modern farming depends on biopesticides as these trends continue to develop.

The modernization of agriculture in Asia-Pacific and Latin America and African regions creates multiple growth prospects for biopesticide markets. The adoption of biopesticides continues to rise through government support for sustainable farming as bioplantonice is becoming a prominent part of integrated pest management (IPM) systems. IPM's holistic pest control approach exposes biopesticides to major opportunities that enable their development as essential components in worldwide pest management practices.

The market encounters hurdles in both production expense and subpar product performance in comparison to synthetic pest management products. Biopesticides need repeated applications since their pest control effectiveness is limited to multiple targets. Manufacturers must deal with longer wait times and elevated expenses because different regions impose delaying product approval processes through their regulatory procedures. Restrictions in biopesticide use primarily affect their adoption across developing countries.

The biopesticides sector will experience growth because consumers demand sustainable farming methods alongside environmentally friendly food items. The future of agricultural pest management looks promising because biopesticide innovations and enabling government regulations will expand their production scale. Technological progress will sustain the market expansion because it drives long-term positive developments.

The Europe Biopesticides Market

The Europe Biopesticides market is projected to be valued at USD 2.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.9 billion in 2034 at a CAGR of 14.5%.

The Europe biopesticide market performs strongly because the regulatory systems encourage sustainable agricultural practices. Biopesticide adoption in the area receives substantial support from the EU Green Deal and its Farm to Fork Strategy. These strategic programs have set the target to decrease synthetic pesticide usage by 50% throughout the next decade to help biopesticide adoption flourish. The countries of Germany, along with France and the Netherlands positioned at the forefront in sustainable farming through active biopesticide integration into their crop protection strategies. The rapid expansion of organic farming throughout Europe, especially in France and Italy, works as a major driver for the rising demand for biopesticides.

The demographics of Europe benefit its biopesticide market through its skilled agricultural labor force and increasing consumer demand for eco-friendly organic food products, thus driving biopesticide consumption. The increase in urban population numbers, including those living in the UK and France, and Germany, tells a tale of mounting environmental concerns about conventional farming approaches that help create demand for sustainable alternatives. Organizational support from key biopesticide industry manufacturers helps the European market thrive. The European commitment to research and development within pest control, alongside its innovative approaches, is projected to strengthen the market position in worldwide biopesticide business operations.

The US Biopesticides Market

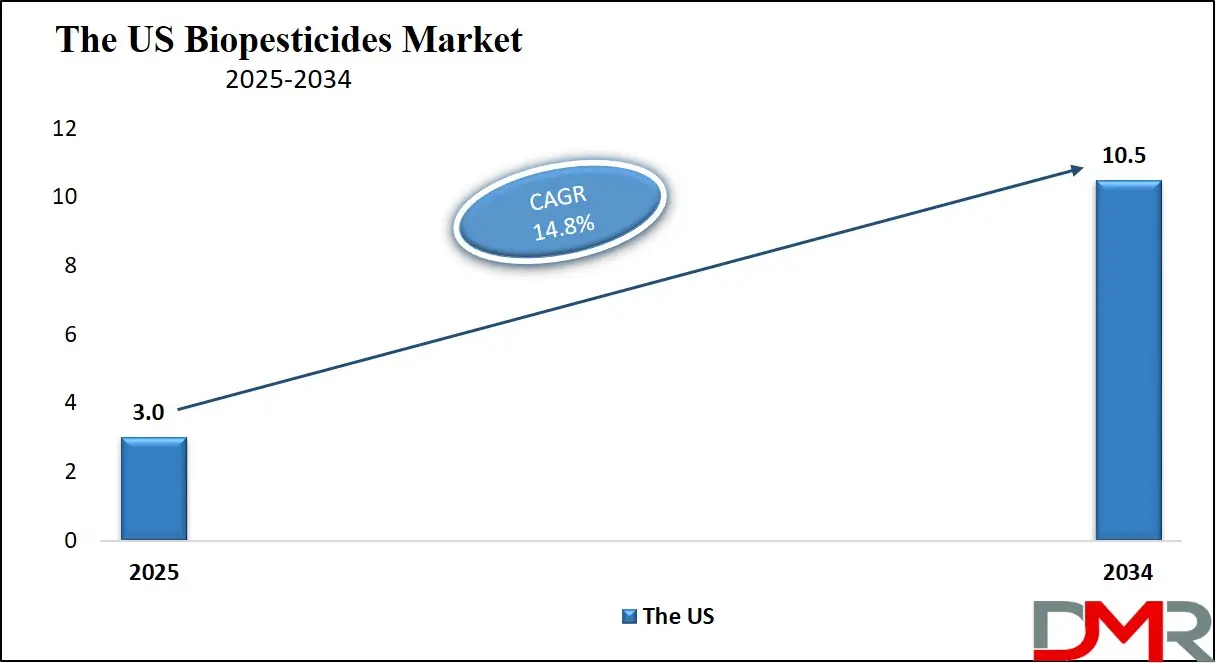

The US Biopesticides market is projected to be valued at USD 3.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.5 billion in 2034 at a CAGR of 14.8%.

The U.S. biopesticides market is one of the largest and most developed globally, driven by stringent environmental regulations and an increasing shift towards sustainable farming practices. With the U.S. being a leader in agricultural production, the demand for biopesticides is growing, particularly in organic farming. This is bolstered by the National Organic Program (NOP), which encourages the use of natural alternatives for pest control. Moreover, U.S. farmers are increasingly adopting Integrated Pest Management (IPM) systems, which integrate biopesticides alongside traditional pest management practices. The EPA's support through approvals and registrations of biopesticides, combined with advanced agricultural technologies, also contributes to the market’s growth.

The U.S. demographic advantage includes a robust agricultural sector, ranging from cereals and oilseeds to fruits and vegetables, where biopesticides are in high demand. With consumer preferences shifting towards safer, residue-free produce, this market has seen significant growth. The market also benefits from a high level of R&D investment in biopesticide formulations, supporting continued innovation and efficacy. Additionally, urbanization and the growing middle class in cities such as New York and California contribute to increasing demand for organic food, further driving the adoption of biopesticides. By 2030, the U.S. is expected to remain a leader in biopesticides, owing to its established agricultural infrastructure and evolving regulatory environment.

The Japan Biopesticides Market

The Japan Biopesticides market is projected to be valued at USD 516.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,480 million in 2034 at a CAGR of 12.4%.

Japan’s biopesticides market is rapidly growing, driven by the country’s commitment to sustainable agriculture and the increasing demand for eco-friendly pest control solutions. Japan has one of the most advanced agricultural sectors in Asia, and the government has been proactive in encouraging sustainable farming practices, including the use of biopesticides. Regulatory bodies like the Japanese Ministry of Agriculture, Forestry, and Fisheries (MAFF) have been instrumental in promoting the use of biopesticides, especially through the Green Food System initiative. This initiative aims to reduce the use of synthetic chemicals in farming, pushing farmers to adopt biopesticides as part of a broader environmental strategy.

Japan’s demographic advantage includes a strong emphasis on food safety and quality, with consumers demanding healthier, residue-free produce. The country's advanced technological infrastructure also supports the development of microbial-based biopesticides, which are increasingly being used to target specific pests in crops such as rice, fruits, and vegetables. With Japan's highly educated agricultural community and a growing awareness of environmental sustainability, there is a strong push for innovative biopesticide formulations.

The market’s aging population and urbanization also play a role in influencing consumer preferences toward organic food and sustainable agriculture. The focus on research and development, alongside the adoption of integrated pest management (IPM) systems, positions Japan as a key player in the biopesticides market in the Asia-Pacific region, contributing to its steady growth.

Biopesticides Market: Key Takeaways

- Market Overview: The global biopesticides market is projected to be valued at USD 9.0 billion in 2025. It is expected to grow significantly to USD 33.4 billion by 2034, registering a CAGR of 15.8% from 2025 to 2034.

- By Region Analysis

- Europe Biopesticides Market is estimated at USD 2.2 billion in 2025 and projected to reach USD 6.9 billion by 2034, growing at a CAGR of 14.5%.

- US Biopesticides Market is expected to be worth USD 3.0 billion in 2025 and grow to USD 10.5 billion by 2034, with a CAGR of 14.8%.

- Japan Biopesticides Market is forecasted at USD 516.0 million in 2025 and is anticipated to increase to USD 1.48 billion by 2034, at a CAGR of 12.4%.

- North America is expected to lead the global biopesticides market, contributing approximately 40.0% of global revenue by 2025.

- By Type Analysis: The bioinsecticide segment is projected to account for around 48.0% of the global biopesticides market by the end of 2025.

- By Source Analysis: The microbial segment is expected to dominate, capturing approximately 78.0% of the total market share in 2025.

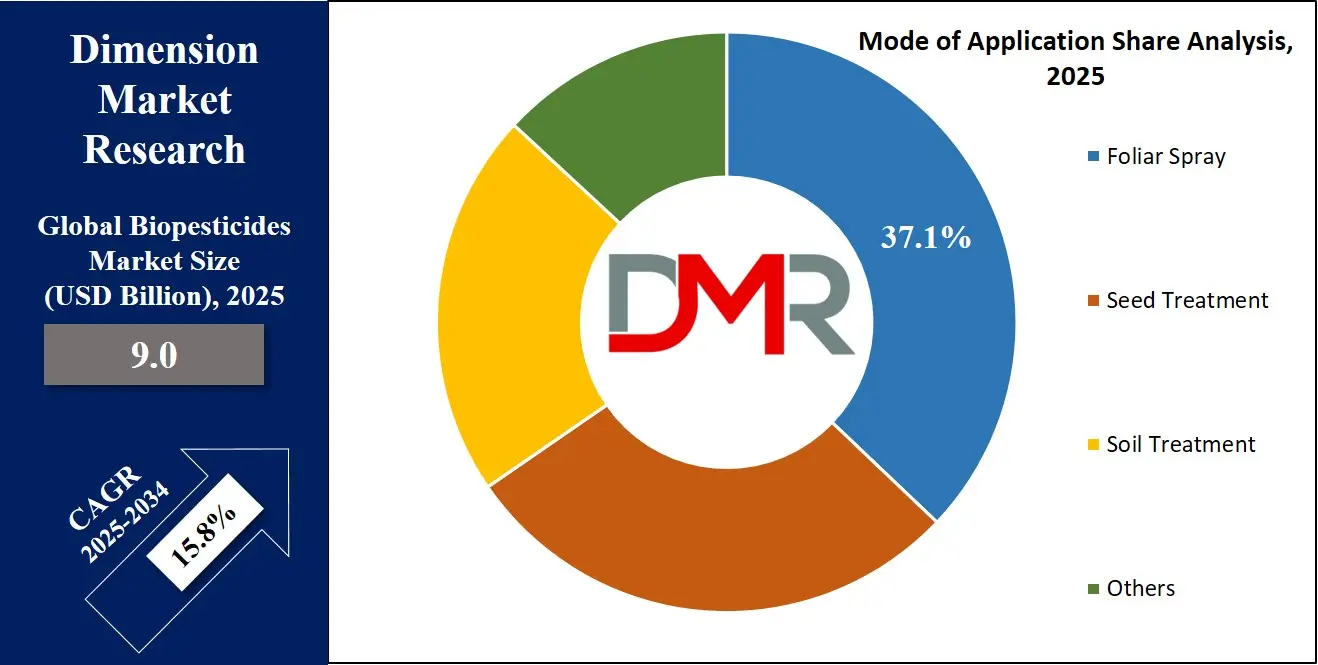

- By Mode of Application Analysis: Foliar spray is anticipated to be the leading application method, holding about 58.0% of the global market share in 2025.

- By Crop Analysis: The fruits and vegetables segment is projected to be the top crop category, comprising around 49.0% of the market share by the end of 2025.

- By Formulation Analysis: The liquid formulation segment is forecasted to dominate the market, representing approximately 68.0% of the total market share in 2025.

Biopesticides Market: Use Cases

- Organic Farming: Biopesticides are essential in organic farming, offering a natural alternative to synthetic pesticides. They help control pests, fungi, and diseases on crops like fruits, vegetables, and grains, ensuring compliance with organic certification standards.

- Integrated Pest Management (IPM): Biopesticides are a key component of Integrated Pest Management (IPM) systems, where they complement other pest control methods. By targeting specific pests, biopesticides help minimize the use of chemical pesticides, reducing environmental damage.

- Agriculture in Developing Regions: In developing regions, biopesticides provide an affordable, eco-friendly alternative to costly chemical pesticides. Smallholder farmers in areas like Africa, Asia, and Latin America benefit from biopesticides to manage pests and diseases in crops such as rice, maize, and cassava.

- Greenhouses and Urban Agriculture: Biopesticides are increasingly used in greenhouses and urban agriculture to manage pests without harming beneficial insects or the environment. In these controlled environments, they offer targeted pest control solutions, enhancing crop health.

Biopesticides Market: Stats & Facts

- U.S. Environmental Protection Agency (EPA): Biopesticides represented approximately 15% of the global pesticide market as of 2022, reflecting steady growth due to environmental and health concerns over synthetic chemicals.

- Food and Agriculture Organization (FAO): Biopesticides are increasingly promoted as part of Integrated Pest Management (IPM) strategies, especially in developing countries, due to their low environmental impact.

- United Nations Environment Programme (UNEP): The use of biopesticides can reduce chemical pesticide use by 20 to 30%, contributing significantly to sustainable agriculture.

- European Commission: The European Union has been actively promoting biological alternatives, with over 600 biopesticide products registered across member states by 2023.

- Journal of Agricultural and Food Chemistry: Certain biopesticides, such as Bacillus thuringiensis (Bt), have shown comparable or superior efficacy to conventional pesticides in managing specific crop pests.

- World Bank: Investment in sustainable agriculture, including biopesticides, is part of its broader push toward climate-smart agriculture, especially in Sub-Saharan Africa and Southeast Asia.

- International Centre for Genetic Engineering and Biotechnology (ICGEB): Research shows that microbial biopesticides have a lower risk of pest resistance development, a growing concern in synthetic pesticide use.

- Indian Council of Agricultural Research (ICAR): In India, government subsidies and farmer training programs have helped the biopesticide market grow at double-digit annual rates since 2018.

- World Health Organization (WHO): Biopesticides pose minimal toxicity risks to humans and animals, which makes them a safer alternative in densely populated agricultural zones.

- National Institute of Agricultural Research: Continued R&D in biopesticides is focused on improving shelf life, stability, and field effectiveness, aiming to overcome existing commercial limitations.

Biopesticides Market: Market Dynamic

Driving Factors in the Biopesticides Market

Stringent Regulatory Policies on Chemical PesticidesOne of the key growth drivers for the global biopesticides market is the increasing number of regulatory restrictions placed on the use of chemical pesticides. With growing concerns about environmental contamination, human health risks, and pesticide resistance, governments worldwide are enforcing stricter regulations on synthetic pesticide use. In the European Union, for example, policies like the EU Green Deal and the Farm to Fork Strategy emphasize sustainable agriculture practices and the reduction of chemical pesticide use by 50% by 2030.

Regulatory bodies in North America and Asia are promoting the use of biopesticides as an alternative to traditional chemical options. These regulations not only make biopesticides more appealing but also incentivize farmers to switch to safer, environmentally friendly pest management solutions. As a result, biopesticides are gaining traction in markets that previously relied heavily on chemical pesticides, fueling overall market growth.

Rising Consumer Demand for Residue-Free Produce

The global demand for residue-free produce is another significant driver for the biopesticides market. With consumers becoming more health-conscious and concerned about the long-term effects of pesticide residues on food, there is a noticeable shift toward organic and clean-label products. Biopesticides play a critical role in meeting this demand by providing a safe, effective alternative to traditional pesticides that often leave harmful residues on crops.

This shift is particularly evident in high-value crop sectors such as fruits, vegetables, and herbs, where even trace pesticide residues can be a dealbreaker for consumers. As retailers and food manufacturers cater to this demand, they are increasingly adopting biopesticides to maintain their sustainability credentials and provide consumers with safer food options. The growing preference for organic and residue-free produce is thus driving the market for biopesticides, further pushing the adoption of eco-friendly pest management solutions.

Restraints in the Biopesticides Market

Limited Efficacy Compared to Chemical Pesticides

One of the primary restraints facing the biopesticides market is their limited efficacy compared to chemical pesticides, particularly in terms of rapid action and broad-spectrum control. While biopesticides are effective in controlling certain pests, their performance can vary depending on environmental conditions, pest species, and application methods. In some cases, biopesticides may require multiple applications to achieve the same level of control as chemical alternatives, which can be a challenge for large-scale farmers.

Additionally, the limited shelf life of many biopesticides and the need for specific application timings can further complicate their widespread adoption. Although biopesticides are viewed as safer and more sustainable, these efficacy limitations can hinder their adoption, particularly in regions where high crop yields are critical, and farmers rely on more potent chemical solutions.

High Production and Development Costs

The high production and development costs of biopesticides are another significant barrier to their widespread adoption. Biopesticides often require specialized production processes, such as the cultivation of microorganisms, which can be more expensive than producing synthetic chemicals. Furthermore, biopesticide development involves significant R&D investment, testing, and regulatory approvals, which increases the overall cost of bringing a product to market.

These high costs can limit the accessibility of biopesticides, particularly for smallholder farmers in developing regions who may not have the financial resources to invest in these products. While biopesticides are generally considered cost-effective in the long run due to their environmental benefits and lower application frequency, the initial financial barrier remains a significant restraint, slowing their adoption, especially in price-sensitive markets.

Opportunities in the Biopesticides Market

Integration of Biopesticides in Integrated Pest Management (IPM) Systems

The increasing adoption of Integrated Pest Management (IPM) systems across the globe presents another lucrative growth opportunity for the biopesticides market. IPM, which emphasizes a holistic approach to pest control by combining biological, cultural, mechanical, and chemical methods, is gaining popularity among farmers seeking more sustainable solutions. Biopesticides, with their natural origins and low environmental impact, are perfectly suited for inclusion in IPM programs.

Their compatibility with other pest management techniques makes them an attractive option for farmers looking to reduce pesticide usage and protect beneficial organisms in the ecosystem. As awareness of IPM grows and more farmers adopt this comprehensive approach, the demand for biopesticides will likely increase. This integration not only expands the use of biopesticides but also enhances their role in sustainable agriculture, offering a significant growth opportunity in both developed and developing markets.

Trends in the Biopesticides Market

Increasing Adoption of Organic Farming

The growing shift toward organic farming has significantly influenced the biopesticides market. As consumers become more aware of the health and environmental risks associated with synthetic chemicals, the demand for organic products is on the rise. Organic farming practices often emphasize the use of biopesticides to ensure crops remain free of harmful pesticides while adhering to organic standards. This trend is most pronounced in high-value crops like fruits and vegetables, where residue-free produce is crucial.

Governments worldwide are also promoting organic farming through incentives and certifications, which further boosts biopesticide adoption. This shift is not only creating a strong demand for safer pest control solutions but also driving the innovation of more efficient and eco-friendly biopesticides tailored for organic practices. As the organic farming movement gains momentum, biopesticides will play a pivotal role in maintaining crop yields and ensuring product quality without harming the environment.

Technological Advancements in Biopesticide Formulations

There has been a significant increase in the research and development of innovative biopesticide formulations. Companies are continuously working to improve the effectiveness, stability, and shelf life of biopesticides, making them more accessible and reliable for farmers. The integration of advanced technologies like nanotechnology and encapsulation is enhancing the delivery systems of biopesticides, improving their efficiency and performance.

For example, encapsulated biopesticides are designed to release active ingredients in a controlled manner, prolonging their effectiveness and reducing the frequency of applications. Additionally, innovations in microbial-based biopesticides are gaining traction, as they offer a more targeted and sustainable approach to pest control. With ongoing advancements in formulation and application technologies, biopesticides are becoming increasingly viable as an alternative to chemical pesticides, enabling farmers to protect crops more effectively while minimizing environmental impact.

Biopesticides Market: Research Scope and Analysis

By Type Analysis

The bioinsecticide segment will control approximately 48.0% of the global biopesticide market share by the end of 2025. This dominance is due to mounting customer interest in natural insecticide alternatives and their special applications in valuable fruit and vegetable agriculture. Bioinsecticides provide the combination of precise pest control and reduced environmental impact, together with minimal residue, which makes them a top choice for sustainable farmers.

The IPM systems not only welcome bioinsecticides, but this compatibility leads to greater market penetration around the world. The market demands biological alternatives over chemical pesticides due to increasing regulatory controls on chemical pesticides. Bioinsecticides will dominate the biopesticides market during the upcoming years because they demonstrate broad pest-handling efficiency combined with accessible commercial platforms.

The biofungicides segment maintains the runner-up position in the biopesticides market structure with a predicted market share of 28.0%. The market adoption rate rises because fungal diseases continue to increase across vegetables and fruits, and greenhouse crops. Biofungicides originate from bacteria and fungi components in natural sources and possess exceptional properties for pathogen management that protect beneficial microbes while sustaining soil health.

Farmland managers choose biofungicides because of chemical fungicide resistance buildup and the need for chemical-free harvests. Biofungicides demonstrate effectiveness as sustainable alternatives in farming because they have preventive features and support organic cultivation approaches. The market expansion of biofungicides will continue increasing as awareness deepens within both modern and emerging markets.

By Source Analysis

The microbial segment is predicted to dominate the biopesticides market, commanding an estimated 78.0% of the total market share in 2025. Microbial biopesticides, which include bacteria, fungi, and viruses, are widely used due to their effectiveness against a broad spectrum of pests and diseases. Products like Bacillus thuringiensis and Trichoderma have well-established reputations and are approved for use in organic farming, which further enhances their market penetration.

Their strong performance in foliar, seed, and soil applications contributes to widespread adoption. Additionally, microbial biopesticides offer a favorable safety profile, environmental compatibility, and minimal resistance development, making them a top choice in integrated pest management (IPM) systems. With continuous innovation and increasing regulatory support, microbial solutions are expected to lead market growth in the coming years.

The biochemicals segment is the second-dominating source in the biopesticides market, accounting for approximately 22.0% of the global market share. Biochemical biopesticides include plant extracts, pheromones, and natural growth inhibitors that offer targeted, environmentally safe pest and disease control. Their demand is rising due to consumer preference for residue-free crops and increasing pressure to reduce synthetic pesticide use.

Biochemicals are especially useful in precision agriculture and in crops where even minimal chemical residues are unacceptable. While the segment currently holds a smaller share than microbials, it is gaining momentum as farmers and agribusinesses adopt more diversified, integrated pest management practices. Continued R&D and regulatory acceptance are expected to support the expansion of biochemical biopesticides soon.

By Mode of Application Analysis

The biopesticides market demonstrates foliar spray as its leading segment, where it holds about 58.0% of the total market share in 2025. Foliage application stands as the preferred method because it delivers direct and instant protection to aerial crop parts, including vegetables, fruits, and ornamental plants. This method enables a simple connection to current spraying systems, which makes it affordable and convenient to use for agricultural producers. Through foliar spraying, farmers can quickly absorb the biopesticides and nutrients, which leads to better outcomes while minimizing crop losses.

Increased use of biopesticides within greenhouse and field farming operations has specifically boosted the acceptance of this application technique. Foliar spray will continue to lead the market because of its excellent precision levels and flexibility benefits, alongside wide crop compatibility possibilities.

In the biopesticides market, seed treatment applications represent the second dominant method of application, using estimated data to reach 23% market penetration. Seed treatment protocols apply biopesticides to seeds before planting to protect plants from soilborne pests and diseases from the beginning. Implementing this technique leads to better seed health and powerful root structures, which decreases the dependency on chemical control measures.

The technique proves essential for cereal and oilseed farming because it helps achieve uniform applications at reduced cost. Seed treatment reduces pesticide exposure to the environment and minimizes runoff since it aligns with sustainable farming goals. The seed treatment market will continue to grow as detections of preventive crop protection expand and clean-label food demand rises, which will make seed treatment a mandatory element of worldwide integrated pest and disease control plans.

By Crop Analysis

The biopesticide market shows that the fruits and vegetables segment stands as the leading segment with a predicted 49.0% share of the total market by the end of 2025. The biopesticide market dominance results from high crop value and susceptibility to pests, along with strict residue tests for pesticides. The rising market demand for chemical-free produce in the fresh perishable categories drives biopesticide adoption by consumers.

To satisfy organic requirements and export needs, farmers choose biological management techniques. The short life cycle of vegetable and fruit harvesting, along with repetitive planting schedules, requires regular pest management, thus biopesticides become an effective and environmentally friendly solution. This portion of the biopesticide market will remain prominent because of expanding fruit and vegetable cultivation, along with rising demand for organic farming in developed as well as developing areas.

The biopesticides market shows the cereals segment as its second-largest category based on total market share that reaching 24.0%. Wheat, alongside rice and maize, constitutes a staple crop that practitioners cultivate on a large scale worldwide. Synthetic agrochemical protection of crops has declined because sustainable farming practices and residue-free grain requirements demand increased implementation of biopesticides, particularly through seed treatments and soil care methods.

Rising understandings of soil health, combined with climate-resilient farming approaches, along with recent restrictions regarding chemical pesticide use in cereal farming, have made this segment prosper. Biopesticide use in staple crops receives support from both governments and agricultural agencies as an eco-friendly alternative to manage long-term environmental effects.

By Formulation Analysis

The liquid formulation segment is projected to dominate the biopesticides market, holding an estimated 68.0% of the total market share in 2025. Liquid biopesticides are preferred for their ease of application, compatibility with existing spraying equipment, and uniform coverage. They are especially effective in foliar spray and drip irrigation systems, widely used in fruits, vegetables, and horticultural crops. Liquid formulations also offer better stability, quicker absorption by plants, and easier mixing with other agro-inputs, making them more convenient for large-scale and precision farming.

Moreover, ongoing innovations in encapsulation and shelf-life extension technologies are further enhancing the performance of liquid biopesticides. As demand grows for efficient and ready-to-use biological solutions, the liquid segment is expected to maintain its strong lead across global agricultural markets.

The dry formulation segment is the second-dominating category in the biopesticides market, accounting for approximately 32.0% of the total market share. Dry biopesticides, such as powders, granules, and dusts, are widely used in seed treatment and soil application due to their stability, long shelf life, and ease of storage. They are particularly valued in developing regions where cold-chain logistics may be limited, and farmers prefer cost-effective, durable products.

Dry formulations are also suitable for mechanized seeding systems and can be applied with standard seed coating equipment. Despite their smaller market share compared to liquids, they play a crucial role in crop protection strategies, especially in cereals and oilseeds. Continuous development in formulation technology is expected to support their steady market growth.

The Biopesticides Market Report is segmented on the basis of the following

By Type

- Bioinsecticide

- Biofungicide

- Bionematicide

- Bioherbicides

- Others

By Source

By Formulation

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

By Crop

- Fruits & Vegetables

- Cereals

- Oilseeds

- Others

Regional Analysis

Region with the largest Share

North America is predicted to be the largest share in the biopesticides market, contributing approximately 40.0% of the global revenue by the end of 2025. This dominance is driven by strong regulatory support for sustainable farming, a high adoption rate of organic agriculture, and widespread awareness of environmental and health concerns linked to synthetic pesticides.

The U.S., in particular, leads the region with advanced agricultural infrastructure, significant R&D investments, and favorable policies by agencies like the EPA supporting biopesticide registrations. Additionally, increasing consumer demand for organic and residue-free produce accelerates biopesticide use in fruits, vegetables, and specialty crops. With proactive government initiatives and a well-established commercial distribution network, North America is expected to maintain its leadership position in the global biopesticides market in the near term.

Region with Highest CAGR

Asia-Pacific is projected to experience the highest compound annual growth rate (CAGR) in the biopesticides market during the forecast period. This rapid growth is fueled by increasing awareness among farmers, expanding organic farming practices, and growing restrictions on chemical pesticide use. Countries like India, China, and Vietnam are seeing a shift toward sustainable agriculture, supported by government subsidies, farmer training programs, and rising demand for residue-free food products.

The region’s large agricultural base, combined with the need to improve productivity sustainably, is creating significant demand for cost-effective biopesticide solutions. Moreover, the presence of local manufacturers and emerging startups is making biopesticides more accessible and affordable, further accelerating adoption across diverse crop segments.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the biopesticides market is marked by a mix of established multinational companies and innovative startups, all striving to meet the growing demand for sustainable and eco-friendly crop protection solutions. Leading players in the market include BASF SE, Syngenta AG, Bayer AG, DowDuPont, and Monsanto, which have well-established product portfolios and significant research and development capabilities. These companies have invested heavily in acquiring smaller firms, expanding their biopesticide offerings, and building a strong presence in both developed and emerging markets.

In addition to the large corporations, several regional and specialized players like Novozymes, Biological Products, Certis USA, and Valent BioSciences are also key contributors to market growth, particularly in the microbial-based segment. These companies focus on developing novel biopesticide formulations, offering solutions for specific pest control needs, and gaining popularity in organic farming.

The competitive environment is increasingly driven by R&D innovations aimed at improving the efficacy, shelf-life, and application methods of biopesticides. Additionally, market players are collaborating with government bodies and research institutions to streamline the approval processes for new products and expand the use of biopesticides globally. The rise of digital agriculture tools and integrated pest management solutions is also influencing the competitive dynamics in this rapidly evolving sector.

Some of the prominent players in the Global Biopesticides Market are:

- BASF SE

- Bayer AG

- Syngenta Group

- UPL

- Corteva

- FMC Corporation

- Nufarm

- Sumitomo Chemical Co.

- Gowan Company

- Koppert

- Certis USA L.L.C.

- Bioceres Crop Solutions

- Novonesis Group

- Biobest Group NV

- Lallemand Inc.

- AgriLife

- Kay Bee Bio-Organics Pvt. Ltd.

- Andermatt Group AG

- Gênica

- Seipasa, S.A.

- STK Bio-AG Technologies

- Botano Health

- Other Key Players

Recent Developments

- In May 2024, Bioceres Crop Solutions Corp announced that Brazil's Ministry of Agriculture and Livestock (MAPA) approved three new bio-based insecticidal and nematicidal products. These solutions are derived from inactivated cells of Bioceres’ proprietary Burkholderia platform.

- In May 2024, FMC Corporation entered into a partnership with Optibrium to accelerate the development of innovative crop protection solutions, including biopesticides, by leveraging machine learning and artificial intelligence technologies.

- In April 2024, Bayer signed a strategic agreement with UK-based AlphaBio Control to launch a new biological insecticide. This product, designed for arable crops such as oilseed rape and cereals, will expand Bayer’s sustainable crop protection portfolio.

- In March 2024, BASF announced an investment in a new fermentation facility at its Ludwigshafen site for producing biological and biotech-driven crop protection products. Expected to begin operations in the latter half of 2025, the plant will manufacture biological fungicides and seed treatments, among other products.

- In December 2023, Syngenta launched CERTANO, its first biological product for sugarcane. This microbiological bionematicide also functions as a biofungicide, offering fast and prolonged protection while promoting plant growth.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.0 Bn |

| Forecast Value (2034) |

USD 33.4 Bn |

| CAGR (2025–2034) |

15.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Bioinsecticide, Biofungicide, Bionematicide, Bioherbicides, Others), By Source (Microbials, Biochemicals), By Formulation (Liquid, Dry), By Mode of Application (Foliar Spray, Seed Treatment, Soil Treatment, Others), By Crop (Fruits & Vegetables, Cereals, Oilseeds, Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

BASF SE, Bayer AG, Syngenta Group, UPL, Corteva, FMC Corporation, Nufarm, Sumitomo Chemical Co., Gowan Company, Koppert, Certis USA L.L.C., Bioceres Crop Solutions, Novonesis Group, Biobest Group NV, Lallemand Inc., AgriLife, Kay Bee Bio-Organics Pvt. Ltd., Andermatt Group AG, Gênica, Seipasa, S.A., STK Bio-AG Technologies, Botano Health, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Biopesticides Market size is estimated to have a value of USD 9.0 billion in 2025 and is expected to reach USD 33.4 billion by the end of 2034.

North America is expected to be the largest market share for the Global Biopesticides Market with a share of about 40.0% in 2025.

Some of the major key players in the Global Biopesticides Market are BASF SE, Bayer AG, Syngenta Group and many others.

The market is growing at a CAGR of 15.8 percent over the forecasted period.

The US Biopesticides Market size is estimated to have a value of USD 3.0 billion in 2025 and is expected to reach USD 10.5 billion by the end of 2034.