Market Overview

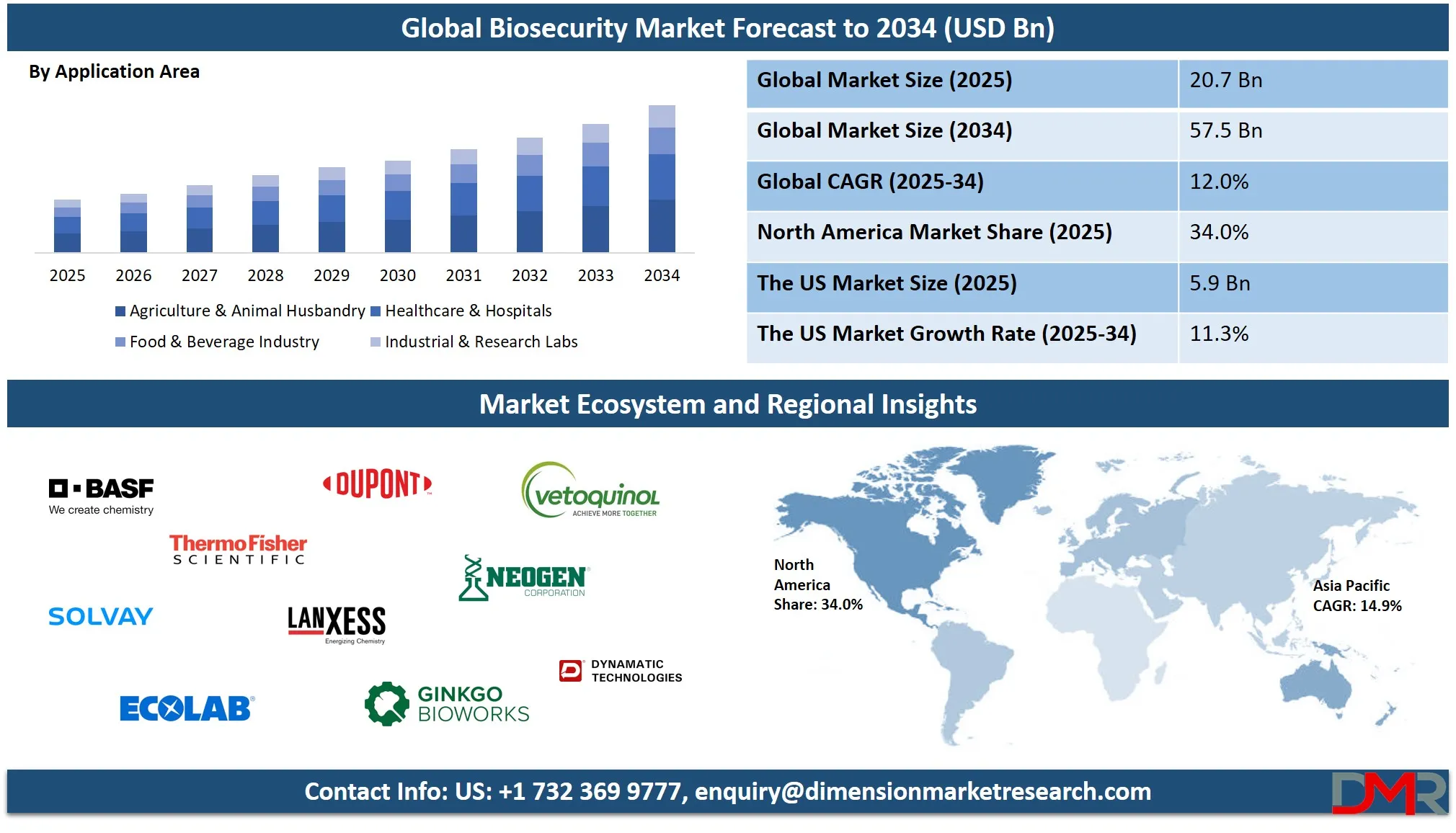

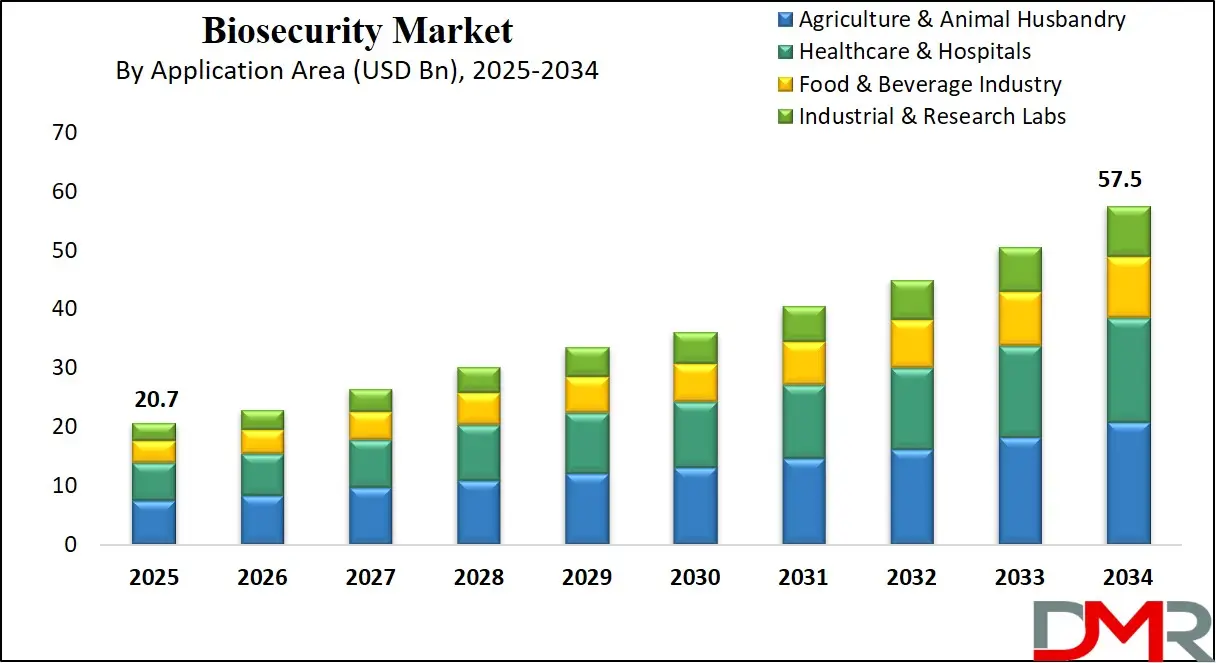

The global biosecurity market is projected to reach USD 20.7 billion in 2025 and is expected to expand to USD 57.5 billion by 2034, registering a CAGR of 12.0% during the forecast period. This growth is driven by rising demand for infection control, agricultural biosecurity, food safety, and advanced disease prevention solutions globally.

Biosecurity refers to a set of practices, policies, and measures designed to protect humans, animals, plants, and the environment from harmful biological threats. It encompasses preventive strategies aimed at reducing the risk of transmission of infectious diseases, controlling the introduction of invasive species, and ensuring safe handling of pathogens, biological materials, and waste. Biosecurity plays a critical role in maintaining public health, safeguarding food production systems, securing laboratory operations, and supporting environmental sustainability by preventing cross-contamination and limiting biological hazards.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global biosecurity market represents a rapidly evolving industry that integrates protective equipment, consumables, diagnostic tools, and specialized services to minimize risks associated with infectious diseases, bioterrorism, agricultural pests, and environmental contamination. Rising concerns over zoonotic outbreaks, stricter government regulations, and the growing demand for infection control in healthcare facilities are fueling the expansion of this market. The growing globalization of trade and movement of people and livestock further drives the need for robust biosecurity solutions to prevent large scale disruptions across industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, the biosecurity market is gaining momentum due to technological advancements such as real time surveillance systems, automated disinfection technologies, and advanced molecular diagnostics that enhance early detection and control of biological threats. With agriculture, healthcare, food processing, and biotechnology sectors adopting comprehensive preventive measures, the market is expected to achieve significant growth. Strategic investments by governments, collaborations between biotech firms and research institutions, and the integration of artificial intelligence and data analytics in monitoring systems are shaping the future landscape of global biosecurity.

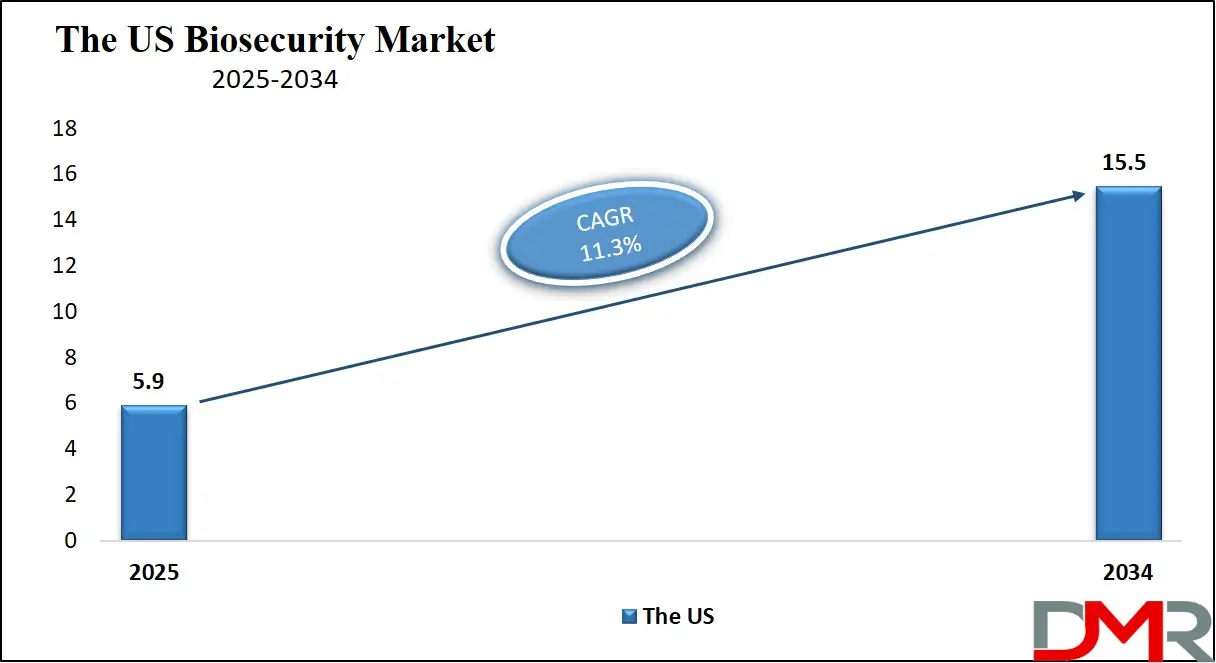

The US Biosecurity Market

The U.S. Biosecurity market size is projected to be valued at USD 5.9 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 15.5 billion in 2034 at a CAGR of 11.3%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US biosecurity market is experiencing strong growth as the country intensifies its efforts to safeguard public health, agriculture, and national security against biological threats. With growing risks of zoonotic diseases, hospital acquired infections, and cross border transmission of pathogens, demand for advanced disinfection systems, protective equipment, diagnostic tools, and monitoring solutions is rising sharply.

Federal initiatives and strict regulatory frameworks from agencies such as the USDA, CDC, and FDA are driving adoption of comprehensive biosecurity measures across healthcare facilities, livestock farms, food processing plants, and research laboratories. The market also benefits from growing investment in biosurveillance technologies, rapid molecular diagnostics, and digital platforms that enhance real time monitoring of infectious diseases.

Additionally, the presence of leading companies in chemicals, life sciences, and biotechnology contributes to innovation in disinfectants, antimicrobial coatings, and integrated facility management services. The US is a global hub for research in biodefense and bioterrorism prevention, fueling demand for advanced containment systems and biohazard waste management.

Expanding healthcare infrastructure, strong emphasis on food safety, and growing R&D in veterinary health further strengthen market prospects. With growing adoption of artificial intelligence, big data, and IoT enabled solutions for predictive analysis and disease prevention, the US biosecurity market is positioned to lead globally, supported by both private sector innovation and government funded programs focused on resilience and preparedness.

Europe Biosecurity Market

The European biosecurity market is projected to reach approximately USD 3.1 billion in 2025, reflecting the region’s strong focus on infection control, agricultural safety, and biodefense initiatives. The market’s growth is supported by stringent regulatory frameworks enforced by the European Food Safety Authority (EFSA) and other national agencies, which require healthcare facilities, research laboratories, and food processing units to implement comprehensive biosecurity measures.

Rising awareness of zoonotic diseases, hospital acquired infections, and contamination risks in the food supply chain is driving demand for advanced disinfection systems, protective equipment, and diagnostic tools across multiple sectors. Furthermore, Europe’s established healthcare infrastructure and presence of leading life sciences companies facilitate the rapid adoption of innovative biosecurity solutions, contributing to the market’s robust size.

Looking ahead, the European biosecurity market is expected to grow at a compound annual growth rate of approximately 8.2% over the forecast period. This growth is fueled by continuous investment in research and development, the integration of digital technologies such as AI and IoT for predictive biosurveillance, and growing collaborations between government agencies and private companies to enhance disease prevention and response strategies.

In agriculture, stricter import-export regulations and heightened focus on livestock health are accelerating adoption of biosecurity practices, while healthcare facilities continue to implement advanced sterilization and monitoring systems to minimize infection risks. With these factors, Europe is poised to remain a key contributor to the global biosecurity market while setting benchmarks for regulatory compliance and technological innovation.

Japan Biosecurity Market

The Japanese biosecurity market is projected to reach approximately USD 1.1 billion in 2025, driven by growing concerns over infectious diseases, food safety, and laboratory containment. The country’s healthcare and agricultural sectors are investing heavily in advanced biosecurity measures, including sterilization systems, personal protective equipment, rapid diagnostic kits, and biosurveillance technologies.

Japan’s densely populated urban centers and intensive livestock farming practices underscore the need for robust infection prevention protocols, while regulatory bodies such as the Ministry of Health, Labour and Welfare (MHLW) and the Ministry of Agriculture, Forestry and Fisheries (MAFF) enforce strict standards for disease control and contamination management. These factors collectively position Japan as a significant regional market within the global biosecurity landscape.

Looking forward, the Japanese biosecurity market is expected to grow at a strong compound annual growth rate of 11.6% over the forecast period, reflecting the rapid adoption of innovative technologies and proactive government initiatives. The market is being further stimulated by investments in smart monitoring systems, AI powered pathogen detection, and automated disinfection solutions across hospitals, research laboratories, and food processing facilities.

Additionally, Japan’s focus on biodefense preparedness, pandemic response strategies, and export quality control in agriculture is enhancing demand for comprehensive biosecurity solutions. This combination of regulatory support, technological innovation, and heightened awareness of health risks is set to drive sustained growth and strengthen Japan’s contribution to the global biosecurity market.

Global Biosecurity Market: Key Takeaways

- Market Value: The global Biosecurity market size is expected to reach a value of USD 57.5 billion by 2034 from a base value of USD 20.7 billion in 2025 at a CAGR of 12.0%.

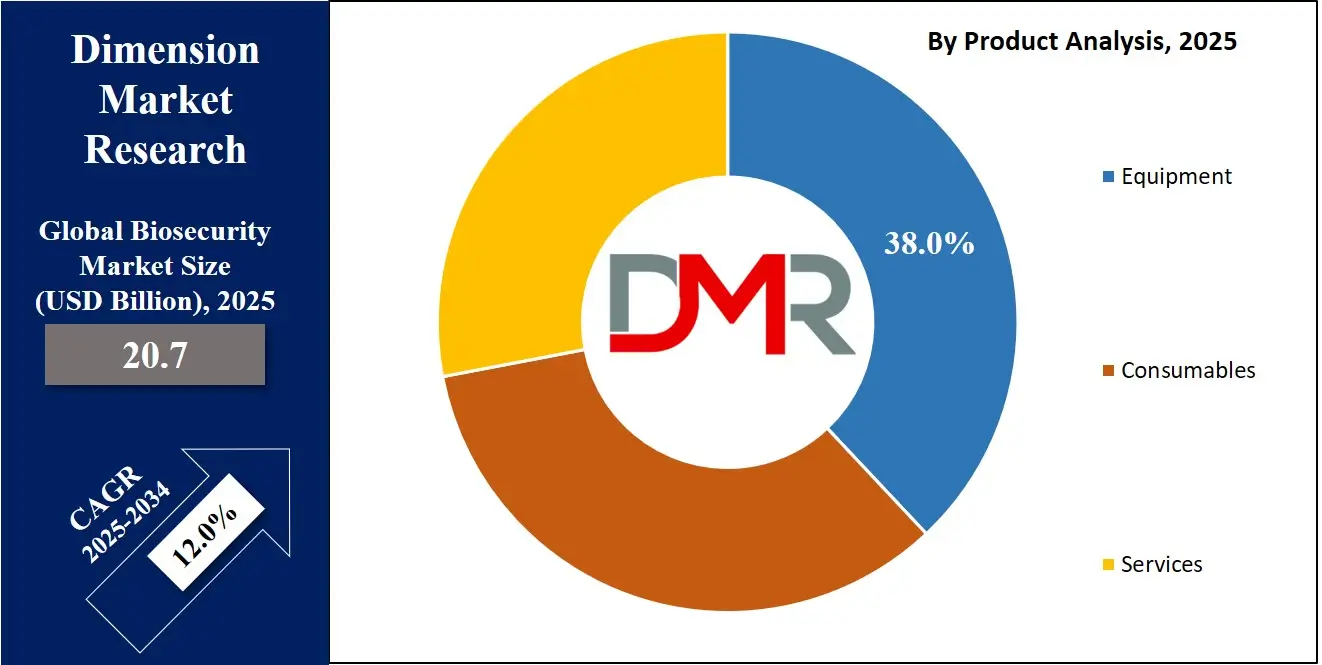

- By Product Analysis: Equipment is anticipated to dominate the product segment, capturing 38.0% of the total market share in 2025.

- By Threat Type Segment Analysis: Infectious Diseases are expected to maintain their dominance in the threat type segment, capturing 44.0% of the total market share in 2025.

- By Application Area Segment Analysis: Agriculture & Animal Husbandry will dominate the application area segment, capturing 36.0% of the market share in 2025.

- By End-User Segment Analysis: Government & Regulatory Bodies will account for the maximum share in the end-user segment, capturing 30.0% of the total market value.

- Regional Analysis: North America is anticipated to lead the global Biosecurity market landscape with 34.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Biosecurity market are BASF SE, Thermo Fisher Scientific Inc., Solvay S.A., Ecolab Inc., DuPont de Nemours Inc., Lanxess AG, Vetoquinol SA, Neogen Corporation, Ginkgo Bioworks Holdings Inc., Dynamatic Technologies Limited, Enviro Tech Chemical Services Inc., and Others.

Global Biosecurity Market: Use Cases

- Disease Prevention in Livestock Farming: Biosecurity solutions play a critical role in livestock and poultry farming by minimizing the spread of infectious diseases such as avian influenza, swine fever, and foot and mouth disease. Farmers adopt disinfection systems, protective equipment, and controlled access protocols to safeguard animal health and maintain food production stability. With rising demand for safe animal protein and global trade in livestock products, biosecurity ensures sustainable farming and reduces economic losses caused by disease outbreaks.

- Infection Control in Healthcare Facilities: Hospitals and clinical laboratories use advanced biosecurity measures to prevent hospital-acquired infections and cross-contamination. The adoption of sterilization units, personal protective equipment, and rapid diagnostic kits enhances patient safety and staff protection. Biosecurity in healthcare extends to biosafety cabinets, air filtration systems, and waste management, ensuring compliance with CDC and WHO guidelines. Growing focus on pandemic preparedness has further accelerated investments in infection prevention across healthcare infrastructure.

- Food Safety and Processing Industry: Biosecurity practices in the food and beverage sector help prevent microbial contamination during processing, packaging, and distribution. Use of disinfectants, antimicrobial coatings, and automated monitoring systems ensures food quality and extends shelf life. Stringent food safety regulations and consumer demand for hygienic products have driven the integration of biosecurity solutions into production lines, reducing the risks of outbreaks such as Salmonella, Listeria, and E. coli in global food supply chains.

- Biodefense and Research Laboratories: High containment research facilities and biotechnology labs rely on biosecurity systems to control access, manage hazardous materials, and prevent accidental or intentional release of pathogens. Solutions such as biosurveillance platforms, secure waste management, and controlled environment enclosures are vital for biodefense programs. With growing concerns over bioterrorism and global biohazards, governments and research institutions are investing heavily in advanced biosecurity infrastructure to strengthen national security and global preparedness.

Impact of Artificial Intelligence on the Biosecurity Market

Artificial intelligence is transforming the biosecurity market by enabling faster detection, prediction, and response to biological threats across healthcare, agriculture, and food safety. AI powered platforms analyze vast datasets from biosurveillance systems, genomic sequencing, and environmental sensors to identify emerging pathogens and predict outbreak patterns with high accuracy.

In healthcare, AI supports real time infection monitoring and hospital infection control, while in agriculture it assists in tracking livestock health and preventing disease spread. Combined with machine learning and predictive analytics, AI enhances decision making, optimizes resource allocation, and strengthens global preparedness against pandemics, bioterrorism, and environmental biohazards.

Global Biosecurity Market: Stats & Facts

-

Australian Department of Agriculture, Fisheries and Forestry (DAFF)

- Biosecurity Funding (2023–24): Allocated USD 373.4 million for departmental appropriation.

- Biosecurity Funding (2024–25): Allocated USD 377.1 million for departmental appropriation.

- Biosecurity Funding (2025–26): Projected USD 377.8 million for departmental appropriation.

- Cost Recovery (2023–24): Generated USD 379.1 million.

- Cost Recovery (2024–25): Projected USD 417.1 million.

- Cost Recovery (2025–26): Projected USD 420.0 million.

- Total Biosecurity Funding (2023–24): Combined departmental appropriation and cost recovery amounted to USD 752.5 million.

- Total Biosecurity Funding (2024–25): Projected combined funding of USD 794.2 million.

- Total Biosecurity Funding (2025–26): Projected combined funding of USD 797.8 million.

- Diagnostic Activities (2025–26): Full charging for all diagnostic activities to commence.

- Approved Arrangements (2025–26): Proposed new charge for approved arrangements to commence.

-

United States Department of Agriculture (USDA)

- Avian Influenza Response (2025): Allocated USD 500 million for biosecurity upgrades at poultry farms.

- Farmer Relief (2025): Allocated USD 400 million for financial relief to affected farmers.

- Vaccine and Therapeutics (2025): Allocated USD 100 million for development and deployment.

- Regulatory Adjustments (2025): Exploring temporary import options to stabilize the market.

- Egg Price Forecast (2025): Forecasted 41% rise in egg prices due to avian influenza.

- Poultry Losses (2022–2025): Over 166 million birds affected by avian influenza.

- Dairy Herd Losses (2022–2025): Approximately 973 dairy herds impacted.

- Human Cases (2022–2025): Documented human cases and one death due to avian influenza.

- Egg Price Surge (2025): Egg prices reached USD 4.95 per dozen in January 2025.

- USDA Strategy Duration (2025): Full vaccine deployment may take up to two years.

-

UK Government (Biological Security Strategy Implementation Report)

- Strategy Launch (2023): Introduced the 2023 Biological Security Strategy.

- Vision (2030): Aim to be resilient to a spectrum of biological threats.

- Mission (2030): Implement a UK-wide approach to biosecurity.

- Outcome 4 (CO): Regular domestic and international exercising of preparedness and defences.

- Outcome 5 (DSIT): Position the UK as a world leader in responsible innovation.

- Outcome 6 (CPACC): Prevent the development and use of biological weapons.

- Implementation Period: Strategy covers the period from June 2023 to June 2025.

-

Australian Government (Biosecurity Funding and Expenditure Report)

- Sustainable Biosecurity Funding (2023–24): Introduced permanent increases to funding.

- MYEFO 2023–24 and Budget 2024–25: Further increased funding for biosecurity.

Global Biosecurity Market: Market Dynamics

Global Biosecurity Market: Driving Factors

Rising Prevalence of Infectious Diseases

The growing incidence of zoonotic diseases, pandemics, and antimicrobial resistant pathogens is a key driver of the biosecurity market. Outbreaks such as avian influenza, swine fever, and COVID-19 have highlighted the need for robust infection prevention and biosurveillance systems. This growing threat to public health and food security is accelerating adoption of disinfection technologies, protective equipment, and real time monitoring tools across healthcare, agriculture, and research sectors.

Stringent Regulatory Frameworks and Government Initiatives

Governments globally are implementing strict policies and funding programs to strengthen biosecurity infrastructure. Regulatory bodies such as the USDA, CDC, WHO, and the European Food Safety Authority enforce guidelines on animal health, hospital infection control, and food safety. These frameworks are compelling industries to adopt advanced biosafety cabinets, sterilization systems, and diagnostic tools, creating sustained market demand.

Global Biosecurity Market: Restraints

High Cost of Advanced Biosecurity Solutions

While biosecurity is essential, the adoption of advanced technologies such as automated disinfection systems, molecular diagnostics, and high containment laboratories is restricted by high capital and maintenance costs. Small and medium enterprises in food processing and livestock farming often struggle with affordability, which limits widespread penetration of premium biosecurity products and services.

Lack of Awareness in Developing Economies

In emerging markets, limited knowledge about disease prevention protocols and weak regulatory enforcement hinder effective implementation of biosecurity practices. Insufficient training, inadequate monitoring systems, and poor compliance with international standards reduce adoption rates, particularly in rural agriculture and healthcare facilities with limited resources.

Global Biosecurity Market: Opportunities

Integration of Digital Technologies in Biosecurity

The use of artificial intelligence, IoT sensors, and data analytics in biosecurity monitoring offers significant growth potential. Smart surveillance systems can detect early warning signs of outbreaks, automate facility management, and optimize disinfection protocols. These digital solutions enable cost effective and scalable biosecurity practices across hospitals, farms, and research labs.

Expanding Applications in Food and Agriculture

With growing demand for safe food supply chains and sustainable farming, biosecurity adoption in agriculture and food processing is expected to surge. Preventing contamination in livestock, poultry, aquaculture, and packaged food products ensures consumer safety and supports international trade. Investments in agricultural biosafety and contamination control solutions present a major growth opportunity for global players.

Global Biosecurity Market: Trends

Shift Toward Eco Friendly Biosecurity Solutions

The market is witnessing a transition toward green disinfectants, biodegradable PPE, and sustainable waste management systems. Companies are innovating eco-friendly products that meet regulatory requirements while minimizing environmental impact. This trend aligns with global sustainability goals and supports long term adoption of biosecurity measures.

Increasing Focus on One Health Approach

The adoption of the One Health framework, which integrates human, animal, and environmental health, is shaping biosecurity strategies globally. Governments and organizations are promoting holistic disease prevention programs that address cross species pathogen transmission and ecosystem safety. This trend is fostering collaborations between healthcare, veterinary, and environmental sectors to create unified biosecurity policies.

Global Biosecurity Market: Research Scope and Analysis

By Product Analysis

Equipment is expected to lead the global biosecurity market by product in 2025, accounting for nearly 38.0% of total share, driven by its critical role in maintaining controlled environments and ensuring effective disease prevention. This category includes disinfection and sterilization systems, biosafety cabinets, air filtration units, protective gear, and waste management solutions that are widely used across hospitals, laboratories, livestock farms, and food processing facilities.

The rising focus on infection control, bioterrorism preparedness, and containment of zoonotic diseases has created strong demand for advanced equipment that delivers efficiency, durability, and compliance with international safety standards. Furthermore, growing investment in healthcare infrastructure and research laboratories is reinforcing the dominance of this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Consumables also represent a significant portion of the biosecurity market as they are essential for daily operations in healthcare, agriculture, and industrial applications. This category covers disinfectants, sanitizers, diagnostic kits, reagents, and disposable protective supplies such as masks, gloves, and gowns.

The recurring nature of consumables ensures consistent demand, particularly during outbreaks and routine biosecurity audits. With stricter hygiene protocols and growing awareness of food safety and infection prevention, consumables are becoming indispensable for maintaining high standards of cleanliness and reducing the risk of contamination in diverse industries.

By Threat Type Analysis

Infectious diseases are projected to remain the leading segment in the global biosecurity market by threat type, securing around 44.0% of the total market share in 2025. The dominance of this segment is attributed to the rising prevalence of zoonotic diseases, hospital acquired infections, and pandemic level outbreaks that disrupt public health systems and global supply chains.

Governments, healthcare institutions, and agricultural producers are increasingly prioritizing preventive measures such as biosurveillance systems, disinfection technologies, molecular diagnostics, and vaccination programs to mitigate the risks posed by infectious agents. The growing burden of antimicrobial resistance and the need for rapid detection of pathogens further reinforce the importance of biosecurity strategies focused on infectious disease control across human, animal, and environmental domains.

Bioterrorism and biohazards also represent a critical area of focus in the biosecurity market due to growing concerns about the intentional or accidental release of harmful biological agents. This segment includes preparedness against bioterrorist threats, laboratory safety measures, hazardous waste management, and secure handling of high risk pathogens.

Governments are investing heavily in biodefense infrastructure, high containment research facilities, and advanced monitoring systems to strengthen national security and resilience against potential biological attacks. With the growing geopolitical risks and heightened awareness of biohazards, this segment is witnessing consistent demand for specialized equipment, training, and response protocols to ensure public safety and global stability.

By Application Area Analysis

Agriculture and animal husbandry are expected to dominate the application area segment of the global biosecurity market, accounting for 36.0% of the total share in 2025. This dominance stems from the rising demand for livestock and poultry products, integrated with the growing risks of disease outbreaks such as avian influenza, swine fever, and foot and mouth disease that threaten both food security and international trade.

Farmers and producers are adopting stricter biosecurity protocols, including disinfection systems, protective barriers, controlled farm access, and routine health monitoring to safeguard animal populations. The expansion of aquaculture and dairy farming further amplifies the need for reliable biosecurity practices, as contamination in these areas can lead to large scale economic losses. Supportive government policies, growing awareness among producers, and the globalization of agricultural trade are reinforcing the strong role of this segment in driving market demand.

Healthcare and hospitals also form a vital part of the biosecurity market, as infection control and patient safety are top priorities for medical institutions globally. This segment relies heavily on sterilization systems, personal protective equipment, air filtration units, and rapid diagnostic kits to prevent hospital acquired infections and cross contamination.

The COVID 19 pandemic highlighted the vulnerability of healthcare systems to infectious threats, accelerating the adoption of advanced biosecurity measures across hospitals, clinics, and laboratories. In addition, strict regulatory compliance and continuous investment in hospital infrastructure are ensuring steady demand for biosecurity solutions that enhance operational safety and improve patient outcomes.

By End-User Analysis

Government and regulatory bodies are anticipated to hold the largest share of the end-user segment in the global biosecurity market, capturing 30.0% of the total market value in 2025. Their dominance is driven by large scale investments in national security, public health preparedness, and agricultural protection programs. Agencies such as the CDC, USDA, and WHO establish strict biosecurity guidelines, enforce compliance, and fund infrastructure projects including biosurveillance systems, high containment laboratories, and advanced disinfection technologies.

Governments also play a crucial role in monitoring cross border trade, implementing disease prevention campaigns, and responding to bioterrorism threats, making them central to the demand for biosecurity solutions. With rising global health concerns and growing geopolitical risks, regulatory authorities are expected to maintain strong influence and spending power in this market.

Agricultural producers and farms also represent a significant share of the biosecurity market, as disease prevention in livestock, poultry, and aquaculture is vital for food security and export competitiveness. Farmers are adopting a wide range of biosecurity measures, including protective equipment, sanitation protocols, vaccination programs, and controlled farm access to minimize disease transmission.

The economic impact of outbreaks such as avian influenza or African swine fever has highlighted the importance of preventive practices, encouraging higher adoption among small, medium, and large scale producers. Growing demand for animal protein, integrated with stricter international trade requirements, is ensuring that farms continue to invest in sustainable biosecurity systems that safeguard both productivity and profitability.

The Biosecurity Market Report is segmented on the basis of the following

By Product

- Protective Gear

- Disinfection & Sterilization Systems

- Air Filtration & Ventilation Units

- Fumigation & Waste Disposal Equipment

- Disinfectants & Sanitizers

- Diagnostic Kits & Reagents

- Personal Protective Consumables

- Culture Media & Laboratory Consumables

- Biosecurity Consultancy & Risk Assessment

- Monitoring & Surveillance Services

- Training & Compliance Audits

- Outsourced Facility Management

By Threat Type

- Infectious Diseases

- Bioterrorism & Biohazards

- Invasive Species & Agricultural Pests

- Environmental Contamination

By Application Area

- Agriculture & Animal Husbandry

- Healthcare & Hospitals

- Food & Beverage Industry

- Industrial & Research Labs

By End-User

- Government & Regulatory Bodies

- Agricultural Producers & Farms

- Hospitals & Healthcare Facilities

- Food Processing & Beverage Companies

- Research Institutes & Biotech/Pharma

Global Biosecurity Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global biosecurity market in 2025, accounting for 34.0% of total revenue, supported by strong government initiatives, advanced healthcare infrastructure, and strict regulatory frameworks. The region benefits from significant investments in biosurveillance, hospital infection control, and agricultural biosecurity, driven by agencies such as the CDC, USDA, and FDA.

High awareness of food safety, growing concerns over bioterrorism, and the presence of leading life sciences and biotechnology companies further reinforce North America’s dominance. Additionally, rapid adoption of AI powered monitoring systems and advanced disinfection technologies positions the region as a global hub for innovation in biosecurity solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Asia Pacific is expected to witness significant growth in the global biosecurity market due to rapid industrialization, expanding healthcare infrastructure, and the rising prevalence of infectious diseases across densely populated countries. The region’s large livestock population, growing demand for safe food production, and frequent zoonotic outbreaks are driving the adoption of biosecurity measures in agriculture and animal husbandry.

Governments in China, India, and Southeast Asia are strengthening regulations on food safety, hospital infection control, and farm management, while investments in biotechnology and research facilities continue to grow. With rising awareness, technological adoption, and supportive policy frameworks, Asia Pacific is emerging as a key growth engine for the biosecurity industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Biosecurity Market: Competitive Landscape

The global biosecurity market is characterized by a dynamic competitive landscape, featuring a blend of established multinational corporations, specialized biotechnology firms, and innovative startups. Key players such as 3M Company, BASF SE, DuPont de Nemours, Inc., Thermo Fisher Scientific Inc., and Ecolab Inc. lead the market by offering a comprehensive range of products and services across healthcare, agriculture, and industrial sectors. These companies leverage their extensive research and development capabilities, robust distribution networks, and strong brand recognition to maintain a competitive edge.

Additionally, firms like ExoFlare Pty Ltd. are gaining prominence by introducing advanced digital biosecurity solutions, including AI-powered monitoring systems and real-time outbreak tracking platforms, which enhance the effectiveness and efficiency of biosecurity measures. The market is also witnessing increased collaboration between public and private sectors, with government agencies and regulatory bodies playing a pivotal role in shaping industry standards and driving innovation through funding and policy initiatives. This collaborative environment fosters a competitive yet cooperative market dynamic, encouraging continuous advancement in biosecurity technologies and practices.

Some of the prominent players in the global biosecurity market are

- BASF SE

- Thermo Fisher Scientific Inc.

- Solvay S.A.

- Ecolab Inc.

- DuPont de Nemours Inc.

- Lanxess AG

- Vetoquinol SA

- Neogen Corporation

- Ginkgo Bioworks Holdings Inc.

- Dynamatic Technologies Limited

- Enviro Tech Chemical Services Inc.

- Kemin Industries Inc.

- Kersia Group

- ExoFlare Pty Ltd.

- ViroVet NV

- Alfred Becht GmbH

- BioFence Agri Private Limited

- YieldX Technologies

- Narsipur

- Reza Hygiene

- Other Key Players

Global Biosecurity Market: Recent Developments

- May 2025: Merck Animal Health introduced ARMATREX™, a novel biosecurity solution designed to create a long-lasting, invisible barrier against bacteria, fungi, and mold in swine facilities, thereby improving environmental hygiene and disease control.

- March 2025: Allied Universal announced the completion of six acquisitions in 2024, totaling over USD 240 million in annual revenues, thereby broadening its security services portfolio and reinforcing its presence in biosecurity-related sectors.

- January 2025: The U.S. Department of the Interior's Office of Insular Affairs announced USD 2.7 million in funding to enhance biosecurity training and projects in U.S. territories, supporting efforts to improve island and coastal ecosystem resilience.

- September 2024: NOVUS International announced a partnership with Ginkgo Bioworks to develop innovative feed additives aimed at enhancing health and performance consistency in poultry and swine, marking a significant advancement in agricultural biosecurity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 20.7 Bn |

| Forecast Value (2034) |

USD 57.5 Bn |

| CAGR (2025–2034) |

12.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Equipment, Consumables, Services), By Threat Type (Infectious Diseases, Bioterrorism & Biohazards, Invasive Species & Agricultural Pests, Environmental Contamination), By Application Area (Agriculture & Animal Husbandry, Healthcare & Hospitals, Food & Beverage Industry, Industrial & Research Labs), and By End-User (Government & Regulatory Bodies, Agricultural Producers & Farms, Hospitals & Healthcare Facilities, Food Processing & Beverage Companies, Research Institutes & Biotech/Pharma) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Thermo Fisher Scientific Inc., Solvay S.A., Ecolab Inc., DuPont de Nemours Inc., Lanxess AG, Vetoquinol SA, Neogen Corporation, Ginkgo Bioworks Holdings Inc., Dynamatic Technologies Limited, Enviro Tech Chemical Services Inc., and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Biosecurity market?

▾ The global Biosecurity market size is estimated to be worth USD 20.7 billion in 2025 and is expected to reach USD 57.5 billion by the end of 2034.

What is the size of the US Biosecurity market?

▾ The US Biosecurity market is projected to be valued at USD 5.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.5 billion in 2034 at a CAGR of 11.3%.

Which region accounted for the largest global Biosecurity market?

▾ North America is expected to have the largest market share in the global Biosecurity market, with a share of about 34.0% in 2025.

Who are the key players in the global Biosecurity market?

▾ Some of the major key players in the global Biosecurity market are BASF SE, Thermo Fisher Scientific Inc., Solvay S.A., Ecolab Inc., DuPont de Nemours Inc., Lanxess AG, Vetoquinol SA, Neogen Corporation, Ginkgo Bioworks Holdings Inc., Dynamatic Technologies Limited, Enviro Tech Chemical Services Inc., and Others

What is the growth rate of the global Biosecurity market?

▾ The market is growing at a CAGR of 12.0 percent over the forecasted period.