Market Overview

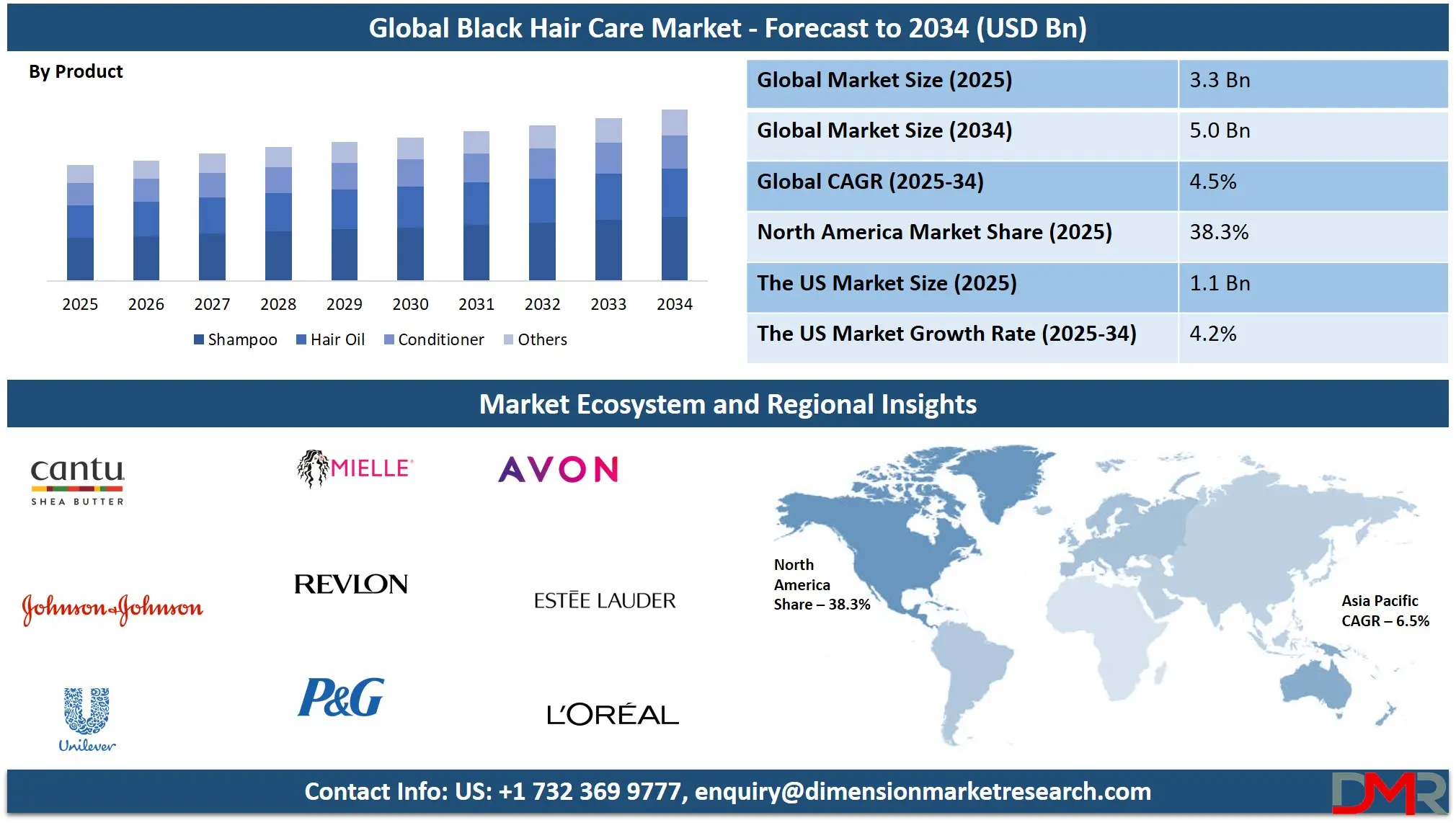

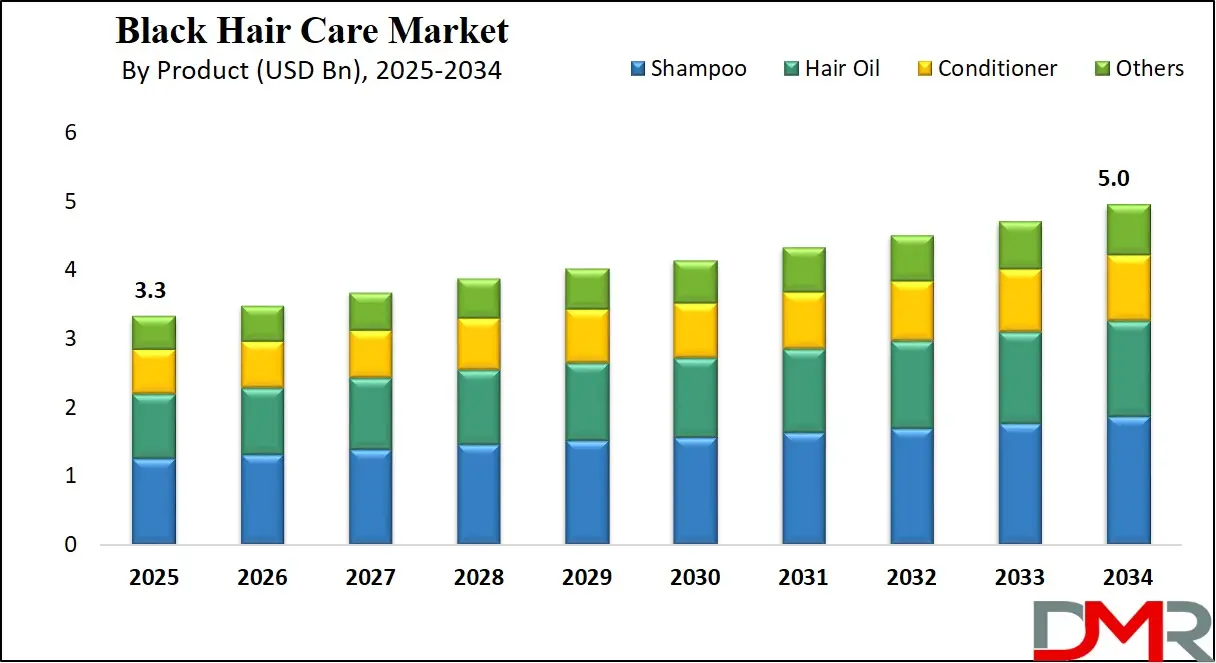

The Global Black Hair Care Market size is projected to reach USD 3.3 billion in 2025 and grow at a compound annual growth rate of 4.5% from there until 2034 to reach a value of USD 5.0 billion.

Black hair care refers to products, services, and practices specifically designed to maintain, style, and protect the hair types commonly found in people of African descent. This includes tightly coiled, kinky, curly, or coarser hair textures. These hair types often require more moisture and gentler handling compared to straighter hair types, leading to unique grooming routines and a wide range of specialized products like oils, conditioners, styling creams, and protective hair accessories.

The demand for Black hair care products has been steadily increasing as more people embrace natural hair and reject harsh chemical treatments. For years, relaxers and straightening products were heavily used due to beauty standards that favored straight hair. However, a strong cultural shift has taken place, especially among younger generations, to wear natural curls, afros, locs, braids, and other textured hairstyles with pride. This change in mindset has increased interest in nourishing, organic, and curl-enhancing hair care products that also align with broader Health and Wellness trends.

Several notable trends have emerged in recent years. Clean beauty and ingredient transparency are now priorities for consumers. Many Black-owned brands focus on sulfate-free, paraben-free, and cruelty-free formulations. There’s also rising demand for multi-use products that support both hair health and styling needs. Protective styles like twists, cornrows, and wigs are more popular than ever, driving demand for styling gels, edge control, and scalp-care products. Social media influencers and natural hair communities have further helped amplify trends and educate consumers.

Cultural movements such as the natural hair movement, “Black Girl Magic,” and broader discussions around racial identity have played key roles in the industry's growth. The fight against discrimination in workplaces and schools over natural hairstyles has even led to legal changes like the CROWN Act in the U.S., which prohibits hair-based discrimination. These developments have brought more attention and legitimacy to the importance of Black hair care solutions.

In recent years, major retailers have responded by expanding shelf space for Black hair care brands, including both legacy names and emerging Black-owned businesses. Large multinational companies have also acquired or partnered with niche brands to gain presence in this space. Meanwhile, independent brands continue to grow through E-Commerce Apparel platforms, community support, and targeted marketing.

Overall, the Black hair care space reflects deep cultural identity, beauty standards, and economic empowerment. It's more than just products—it represents pride, heritage, and a growing recognition of diverse hair needs in the global beauty market.

The US Black Hair Care Market

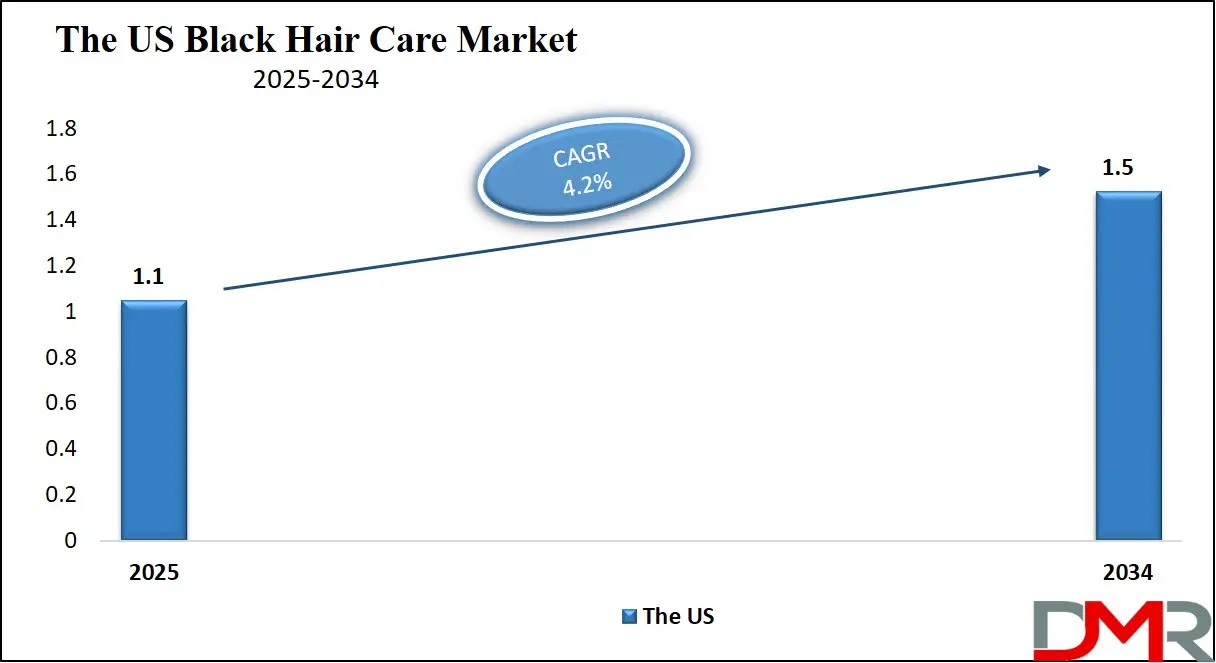

The US Black Hair Care Market size is projected to reach USD 1.1 billion in 2025 at a compound annual growth rate of 4.2% over its forecast period.

The US plays a leading role in the Black hair care market, both as a major consumer base and an innovation hub. It has one of the largest populations of Black consumers, driving strong demand for textured hair products. The US is home to many established and emerging brands that cater specifically to diverse curl patterns and hair needs.

It is also a center for cultural movements like the natural hair revolution, which have shaped global trends. US retailers have increasingly expanded shelf space for inclusive beauty, while social media influencers based in the US help promote new styles and products worldwide. Additionally, US-based legislation, such as the CROWN Act, highlights the importance of protecting natural hair rights and visibility.

Europe Black Hair Care Market

Europe Black Hair Care Market size is projected to reach USD 0.7 billion in 2025 at a compound annual growth rate of 4.0% over its forecast period.

Europe plays a growing but less mature role in the Black hair care market compared to regions like the US. The demand for textured hair products is rising across countries with significant African and Afro-Caribbean populations, such as the UK, France, and the Netherlands. However, access to specialized products has historically been limited, with many consumers relying on imports or niche local stores.

This gap is now being addressed as mainstream European retailers begin to expand their offerings. European consumers are also becoming more vocal about the need for representation and inclusivity in beauty. Additionally, social media and cultural exchange with the US are influencing trends and awareness. As inclusivity improves, Europe presents a promising growth area for Black hair care brands.

Japan Black Hair Care Market

Japan Black Hair Care Market size is projected to reach USD 0.2 billion in 2025 at a compound annual growth rate of 5.5% over its forecast period.

Japan's role in the Black hair care market is still emerging and quite niche. With the majority of Japanese consumers having straight hair, textured-hair products remain scarce in local stores—many Afro-textured hair individuals rely on importing or ordering online. A few specialized salons in Tokyo and other major cities cater to Afro hair, offering services and importing brands like DevaCurl and Shea Moisture. However, prices at those salons can be high, and product availability remains limited. Online platforms like Amazon Japan and iHerb are common sources, often at premium pricing. Overall, Japan offers some access points for Black hair care, but demand remains small, niche, and driven by community effort.

Black Hair Care Market: Key Takeaways

- Market Growth: The Black Hair Care Market size is expected to grow by USD 1.5 billion, at a CAGR of 4.5%, during the forecasted period of 2026 to 2034.

- By Product: The shampoo segment is anticipated to get the majority share of the Black Hair Care Market in 2025.

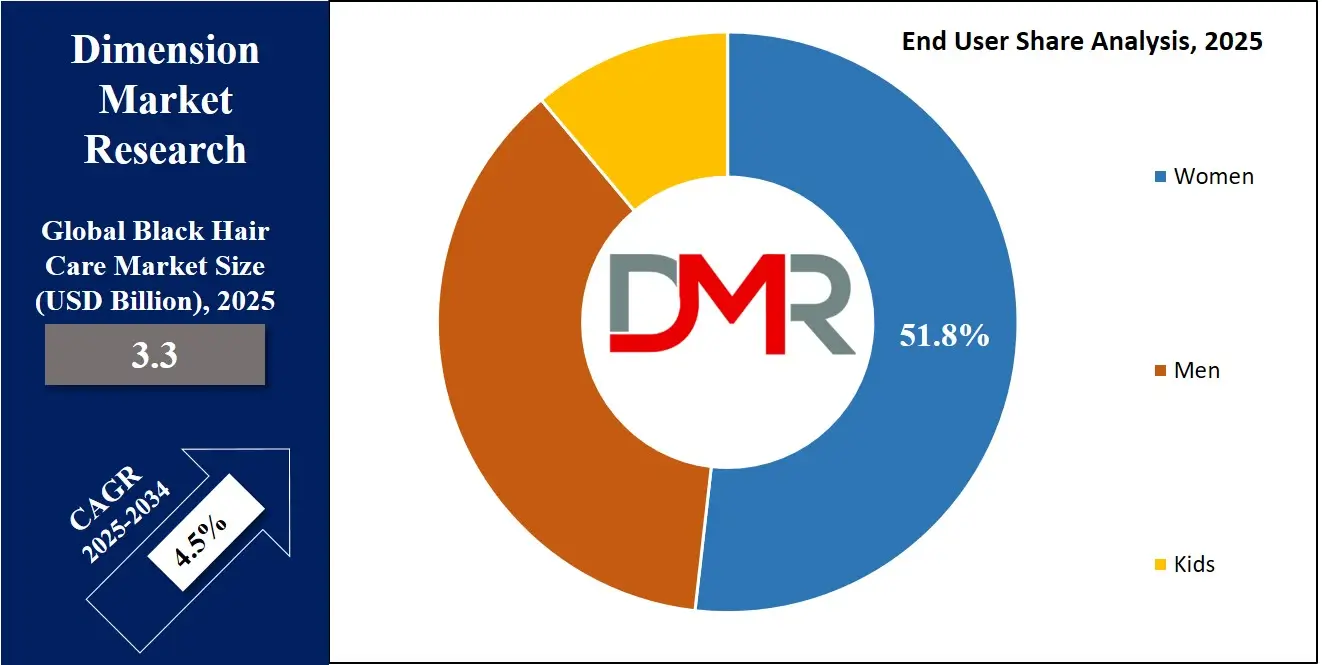

- By End User: The women segment is expected to get the largest revenue share in 2025 in the Black Hair Care Market.

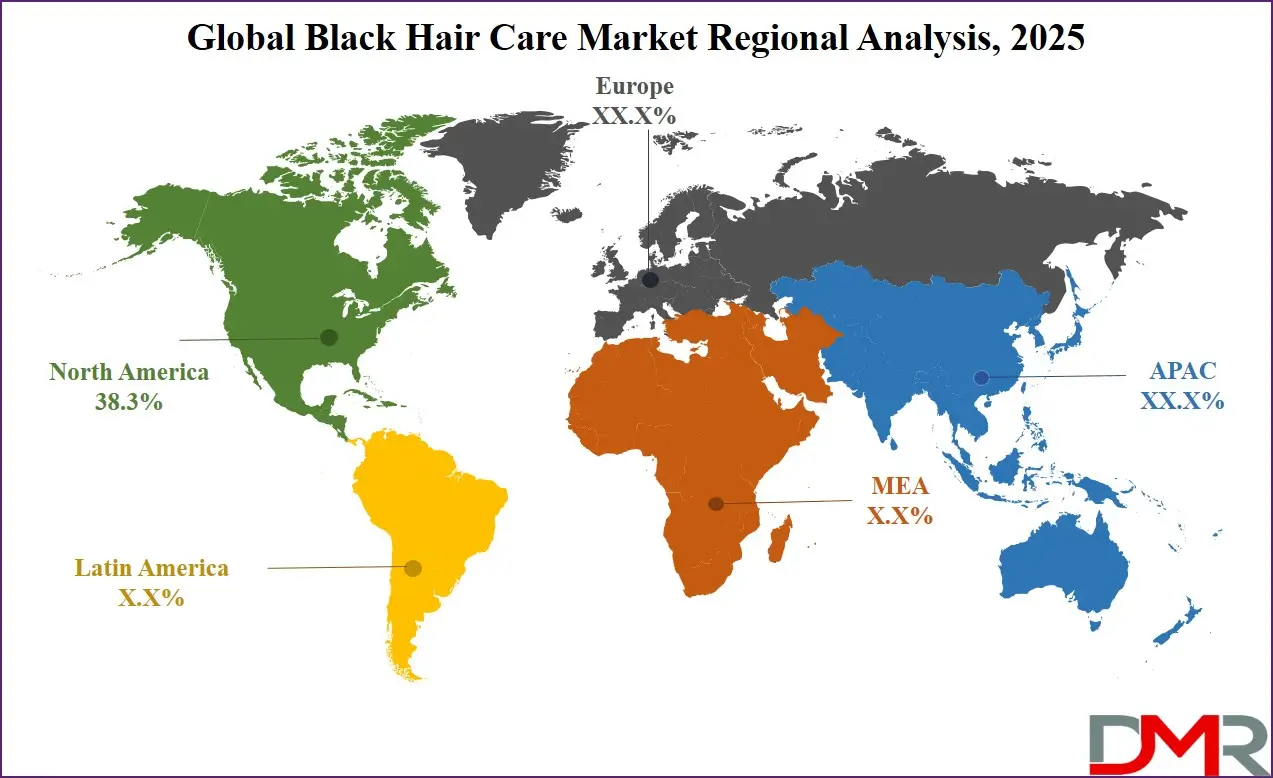

- Regional Insight: North America is expected to hold a 38.3% share of revenue in the Global Black Hair Care Market in 2025.

- Use Cases: Some of the use cases of the Black Hair Care include protective styling support, scalp & hair health treatment, and more.

Black Hair Care Market: Use Cases

- Daily Moisturizing and Maintenance: Many people with textured hair use Black hair care products daily to keep their hair soft, manageable, and hydrated. Leave-in conditioners, oils, and creams are applied to prevent dryness and reduce breakage. This routine helps maintain healthy hair between washes or styling sessions.

- Protective Styling Support: Products like edge control gels, styling butters, and braiding creams are used to support protective styles such as braids, twists, and locs. These styles help protect hair from damage caused by over-manipulation or environmental stress. The products also provide hold, shine, and nourishment during wear.

- Scalp and Hair Health Treatment: Specialized treatments are used to target issues like dandruff, itchiness, or scalp buildup. Oils, serums, and exfoliating scrubs made for textured hair help maintain a healthy scalp environment. These treatments also promote hair growth and strengthen roots. Innovative formulations now incorporate naturally derived ingredients such as Natural Tartaric Acid to enhance scalp health.

- Natural Curl Enhancement and Definition: Curl creams, gels, and mousses are used to define and enhance natural curls, coils, or waves. These products help reduce frizz and improve curl pattern visibility. Many users rely on them for wash-and-go styles or to set curls for special occasions.

Market Dynamic

Driving Factors in the Black Hair Care Market

Rising Cultural Pride and Natural Hair Movement

One of the biggest drivers of growth in the Black hair care market is the rise in cultural pride and acceptance of natural hair. More people are embracing their natural textures and moving away from chemical relaxers and straightening treatments. This shift is not only about beauty but also identity, self-expression, and rejecting outdated beauty norms.

As a result, demand for products that support curly, coily, and kinky hair has surged. Consumers are looking for hydrating, curl-enhancing, and damage-repair products made specifically for their hair type. The popularity of social media movements like #BlackGirlMagic and influencers sharing hair journeys also inspires more people to invest in proper care routines. This rising awareness and pride continue to fuel long-term market expansion.

Expansion of Retail Access and Online Visibility

Another major growth driver is the broader availability of Black hair care products across mainstream retail and digital platforms. Historically, these products were limited to specialty stores, but now they are increasingly found in supermarkets, drugstores, and major beauty retailers. E-commerce has also played a big role by giving small and independent brands global reach through online shops and marketplaces.

Consumers can now easily access product reviews, tutorials, and community feedback, which influences purchasing decisions. Social media has also made it easier for brands to connect directly with customers and tailor offerings to their needs. This wider visibility, both online and offline, is helping the market grow faster and reach new audiences.

Restraints in the Black Hair Care Market

Limited Product Knowledge and Misinformation

A key restraint in the Black hair care market is the lack of accurate product knowledge among consumers. Many people with textured hair still struggle to understand what ingredients and routines work best for their specific curl pattern or scalp condition. Misinformation from social media or unverified sources can lead to poor product choices, which result in damage or dissatisfaction.

Without proper education, consumers may avoid trying new products or fall back on outdated methods. This knowledge gap limits the full adoption of innovative or specialized products. It also poses a challenge for brands that need to invest more in awareness and education campaigns. Until consumers feel more confident and informed, growth will be slowed in some market segments.

High Price Sensitivity and Accessibility Issues

Black hair care products, especially those with natural or high-quality ingredients, can be significantly more expensive than standard hair care options. This creates a barrier for consumers with limited budgets, especially in low-income or rural areas where specialized products may also be hard to find. Price sensitivity often forces people to choose cheaper, less effective alternatives, which can hurt product trust and repeat purchases.

In addition, smaller or newer brands may struggle with distribution costs, keeping their products out of reach for some customers. Despite growing demand, affordability and access remain significant hurdles that brands must overcome to truly scale in all markets and consumer segments.

Opportunities in the Black Hair Care Market

Innovation in Product Formulation and Personalization

There is a strong opportunity for brands to invest in innovative formulations that cater to the wide variety of hair textures within the Black community. Consumers are increasingly looking for products that are not only natural and free from harsh chemicals but also personalized to their unique hair needs.

Advances in hair science and technology now make it possible to create solutions based on curl type, porosity, and scalp health. Brands that offer customization or detailed product guides stand to gain loyal customers. There’s also growing interest in multi-benefit products that save time and cost. As consumers become more informed and selective, companies that offer innovative, targeted, and easy-to-understand solutions will lead the next wave of market growth.

Expansion into Untapped Global Markets

Another major opportunity lies in expanding Black hair care offerings into underserved international markets. While North America has a more developed landscape, large populations with textured hair in regions like Africa, Latin America, and parts of Europe remain underrepresented. Many of these markets have increasing urban populations, rising disposable income, and growing awareness of natural hair trends.

Local consumers are often eager for products that reflect their needs, but have limited access to quality options. Brands that build culturally relevant, affordable, and region-specific offerings can build strong brand loyalty. Strategic partnerships with regional distributors and e-commerce platforms can help tap into this unmet demand on a global scale.

Trends in the Black Hair Care Market

Scalp-Centric Wellness Takes the Lead

Over the past year, the industry has shifted its focus from just styling hair to caring for the scalp as the foundation of healthy hair. Consumers now prioritize gentle scalp treatments—like detox oils, scrubs, and probiotic-infused formulas—that promote a balanced microbiome and reduce issues such as dandruff and itchiness. This trend is backed by a rising awareness of the scalp’s role in hair growth and vitality. Brands are answering with clean, plant-based ingredients and pre/probiotics designed specifically for textured hair types. As wellness and self-care continue to intersect, scalp care is defining the next wave of holistic hair routines.

Trend Toward Simpler, Time-Smart Routines

A growing number of Natural hair consumers are moving away from intricate, step‑heavy styling routines commonly seen on social media. Instead, they're embracing simpler, user-friendly regimens that still deliver strong results—less frizz, more hydration, and natural curl patterns— without the hassle. This shift reflects a desire for ease, consistency, and scalp-friendly practices. Simplified routines often include a small number of impactful products and protective styling techniques, making hair care more accessible and sustainable for everyday life.

Impact of Artificial Intelligence in Black Hair Care Market

Artificial Intelligence is revolutionizing the Black hair care market by driving personalized solutions that address the unique needs of textured hair. Through AI-powered tools, companies can analyze hair characteristics like texture, density, porosity, and health to recommend tailored products and routines.

This level of personalization helps consumers avoid the traditional trial-and-error process of finding suitable hair care solutions. Several startups are now integrating AI into retail and salon experiences, offering diagnostics through smart devices and applications. These technologies not only improve product accuracy but also enhance the customer experience by ensuring products and regimens are better aligned with individual hair needs.

Beyond personalization, AI is also driving broader market growth by influencing product innovation, accessibility, and representation. There has been a significant increase in product launches specifically formulated for Black hair, as AI tools help brands better understand and cater to diverse hair types. The use of data-driven insights allows companies to design products that are more effective, culturally aware, and inclusive.

AI also enables salons and stylists to offer smarter consultations, boosting client satisfaction and retention. Moreover, many of these innovations are being led by Black entrepreneurs, especially women, who are using technology to fill gaps in the industry and ensure their communities are better served. In this way, AI is not only transforming how Black hair care products are developed and delivered but is also helping build equity and empowerment within the beauty industry.

Research Scope and Analysis

By Product Analysis

Shampoo segment is expected to lead the Black hair care market in 2025 with a projected share of 37.4%, driven by rising demand for sulfate-free, moisturizing, and scalp-friendly formulations. People with textured or curly hair often face dryness and scalp issues, making gentle, hydrating shampoos a key part of their regular hair care routine. Brands are now focusing on clean ingredients, natural oils, and clarifying agents that cater specifically to curly, coily, and kinky hair types.

The growing interest in scalp health and buildup removal has further increased the use of specialized shampoos in wash-day routines. Social media, influencer reviews, and educational content have also encouraged more frequent and informed purchases. As consumers look for safe and nourishing options that maintain hair strength and moisture, the shampoo category remains a foundation for product use, helping drive overall market growth for Black hair care solutions.

Conditioner segment is showing strong momentum, with significant growth expected over the forecast period due to its essential role in moisturizing and strengthening textured hair. Coily and curly hair types are naturally prone to dryness and breakage, making conditioners a key step in daily and weekly care routines. Deep conditioners, leave-ins, and co-washes have gained popularity for their ability to provide intense hydration, detangle, and reduce frizz.

Consumers are seeking products with ingredients like shea butter, coconut oil, and protein blends to restore moisture and enhance hair manageability. As people become more aware of proper hair maintenance, especially for natural and chemically untreated styles, the demand for high-performance conditioners continues to grow. This segment supports long-term hair health, especially when used alongside protective styling and gentle cleansing routines, making it an important contributor to the expanding Black hair care market.

By Distribution Channel Analysis

Supermarket/hypermarket segment is projected to lead the Black hair care market in 2025 with an estimated share of 41.7%, driven by wide product visibility, accessibility, and consumer trust. These large retail formats offer a variety of textured hair care products, including shampoos, conditioners, oils, and styling creams, all in one place. Their presence in both urban and suburban areas makes it convenient for shoppers to explore and purchase products instantly.

Well-known and new brands benefit from shelf space in these stores, allowing them to reach a broad audience. Promotional offers, product sampling, and in-store guidance also encourage consumers to try new items. With more supermarkets expanding inclusive beauty sections, they continue to play a big role in normalizing and supporting Black hair care needs, especially for everyday buyers looking for trusted, easily available, and affordable solutions under one roof.

Online platform segment is seeing rapid growth and is set to have significant expansion over the forecast period due to its convenience and wide product variety. Many consumers with textured hair prefer online shopping because it gives them access to niche, global, and Black-owned brands that may not be available in local stores. E-commerce platforms also provide detailed reviews, tutorials, and ingredient breakdowns, helping buyers make informed choices.

Personalized product recommendations and subscription models add further appeal. Social media and influencer marketing often drive traffic directly to online shops, boosting visibility and brand loyalty. With rising digital engagement and increased smartphone use, more shoppers are turning to online platforms to find hair care solutions that meet their unique needs. This digital shift is helping brands connect directly with consumers and fuel overall growth in the Black hair care market.

By End User Analysis

Women segment is expected to lead the Black hair care market in 2025 with a projected share of 51.8%, supported by their dominant role in purchasing and using textured hair products. Women with coily, curly, and kinky hair types are often more engaged in detailed hair routines involving moisturizers, deep conditioners, oils, and styling products. They are also more likely to follow beauty trends, seek product education, and experiment with different hair care systems, from natural styles to protective looks like braids and wigs.

Social media communities and influencers often target women, further increasing awareness and product demand. With growing emphasis on clean beauty, self-care, and scalp health, women continue to shape product innovation and brand growth. Their consistent investment in hair maintenance and styling tools makes them a vital force driving both sales and development in the Black hair care industry across global markets.

Further, men segment is experiencing noticeable traction, with significant growth expected over the forecast period due to changing grooming habits and increased interest in textured hair care. More men are now embracing their natural curls, waves, and locs, leading to rising use of products like scalp oils, curl definers, and gentle cleansers. The shift from basic grooming to full hair care routines is encouraging brands to develop male-focused lines that address dryness, breakage, and scalp concerns. Educational content, especially through digital platforms, is helping men understand product use and proper hair maintenance.

The influence of male celebrities, barbers, and content creators is also pushing men toward more personalized and consistent care routines. As awareness grows, the male consumer base for Black hair care continues to expand, offering brands new opportunities to diversify their offerings and reach a broader audience.

The Black Hair Care Market Report is segmented on the basis of the following:

By Product

- Shampoo

- Conditioner

- Hair Oil

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Online Platform

- Retail Stores

By End User

Regional Analysis

Leading Region in the Black Hair Care Market

North America will be leading the Black hair care market in 2025 with an estimated share of 38.3%, driven by strong demand, cultural influence, and high product availability. The region plays a key role in shaping trends and consumer behavior, especially in the United States, where a large Black population drives innovation and product diversity. Growing awareness around textured hair care, natural hair movements, and identity-based beauty choices have made North America a central hub for both legacy and independent Black-owned brands.

Retailers have significantly increased shelf space and visibility for inclusive hair care lines, while social media and celebrity influencers from the region have amplified product reach and education. In addition, the growing support for the CROWN Act and other cultural initiatives have helped normalize natural hair in workplaces and schools, fueling product demand. With continued innovation, community-driven marketing, and a rising preference for clean, customized hair solutions, North America remains a driving force in the global Black hair care market.

Fastest Growing Region in the Black Hair Care Market

Asia Pacific is showing significant growth over the forecast period in the Black hair care market, supported by rising migration, cultural exchange, and increasing demand for textured hair products. Countries like Australia, Japan, and parts of Southeast Asia are witnessing growing awareness about Afro-textured hair needs due to expanding expat populations and online beauty influence.

Although product availability has been limited, international brands and e-commerce platforms are filling the gap by offering natural hair products, curl enhancers, and moisturizing treatments. As consumer knowledge improves and inclusive beauty standards gain attention, the region is estimated to experience steady expansion, making Asia Pacific an emerging space for growth in the global Black hair care industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Black hair care market is highly competitive, with a mix of long-standing players, newer independent brands, and emerging startups all fighting for attention. Many smaller brands focus on natural ingredients, cultural authenticity, and community support, which helps them connect with consumers seeking personalized care.

At the same time, big beauty companies are expanding their product lines to better serve textured hair needs, sometimes by acquiring niche brands. Online shopping and social media have given new brands a platform to grow quickly, especially with the help of influencers and tutorials. Retail stores are also giving more space to diverse hair care products. Overall, the market is dynamic, fast-changing, and shaped by both innovation and deep cultural relevance.

Some of the prominent players in the global Black Hair Care are

- Procter & Gamble

- Unilever

- L’Oréal

- Revlon

- Estée Lauder

- Johnson & Johnson

- Avon Products

- Carol’s Daughter

- Mielle Organics

- Cantu Beauty

- Shea Moisture

- Dark & Lovely

- African Pride

- SoftSheen Carson

- Amka Products (Pty) Ltd

- Alodia Hair Care

- Ouidad

- Afrocenchix Ltd.

- Uhuru Naturals LLC

- Pattern Beauty

- Other Key Players

Recent Developments

- In June 2025, MYAVANA, a leader in personalized hair care through technology, announced its partnership with The Beauty Genie®, known for its AI-powered vending solutions for multicultural hair care, which will launch at the 2nd Annual MYAVANA Beauty Tech Summit on June 2025, during Atlanta Tech Week. The partnership aims to revolutionize beauty retail by merging MYAVANA’s data-driven personalization with Beauty Genie’s smart retail tech, making innovative, inclusive solutions more accessible for textured hair consumers through a blend of culture, care, and technology.

- In January 2025, MYAVANA, the innovative AI-driven hair care platform recently valued at USD 50M, has launched its first Certified Stamp for Healthy Hair Care, setting a new benchmark across the hair care industry. This certification highlights safe, high-performing products, personalized services, and beauty tech training for brands, professionals, retailers, and salons. Open to all sectors, MYAVANA Certified status empowers businesses to meet rising demand for personalized, data-driven solutions. The initiative supports MYAVANA’s mission to transform hair care through innovation, community, and smarter, future-ready services.

- In November 2024, CeraVe, the leading dermatologist-recommended skincare brand in the U.S., entered the haircare space with its new Anti-Dandruff Shampoo and Conditioner. This innovative duo targets dandruff at its root by addressing ceramide deficiency, helping eliminate up to 100% of visible flakes while maintaining the scalp’s natural barrier. Designed for mild to moderate dandruff, it soothes the scalp without compromising hair softness or health. CeraVe’s unique approach ensures effective dandruff relief with gentle, dermatologist-backed care.

- In November 2024, CavinKare launched Indica Natural and Nourish Crème Hair Color, marking its entry into the crème hair color market. Priced at INR. 15, the product offers 100% grey coverage and features nourishing ingredients like onion, argan, and coconut oils. Available in Natural Black, Dark Brown, and Burgundy shades, it caters to Indian consumers with a low-dye formula for healthier hair. Actress Trisha Krishnan joins as brand ambassador, reinforcing Indica’s commitment to accessible beauty and innovation in sustainable, hair-friendly coloring solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.3 Bn |

| Forecast Value (2034) |

USD 5.0 Bn |

| CAGR (2025–2034) |

4.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.1 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Shampoo, Conditioner, Hair Oil, and Others), By Distribution Channel (Hypermarket/Supermarket, Online Platform, and Retail Stores), By End User (Men, Women, and Kids) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Procter & Gamble, Unilever, L’Oréal, Revlon, Estée Lauder, Johnson & Johnson, Avon Products, Carol’s Daughter, Mielle Organics, Cantu Beauty, Shea Moisture, Dark & Lovely, African Pride, SoftSheen Carson, Amka Products (Pty) Ltd, Alodia Hair Care, Ouidad, Afrocenchix Ltd., Uhuru Naturals LLC, Pattern Beauty, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Black Hair Care Market size is expected to reach a value of USD 3.3 billion in 2025 and is expected to reach USD 5.0 billion by the end of 2034.

North America is expected to have the largest market share in the Global Black Hair Care Market, with a share of about 38.3% in 2025.

The Black Hair Care Market in the US is expected to reach USD 1.1 billion in 2025.

Some of the major key players in the Global Black Hair Care Market are Procter & Gamble, Unilever, L’Oréal, Revlon, and others

The market is growing at a CAGR of 4.5 percent over the forecasted period.