Market Overview

The

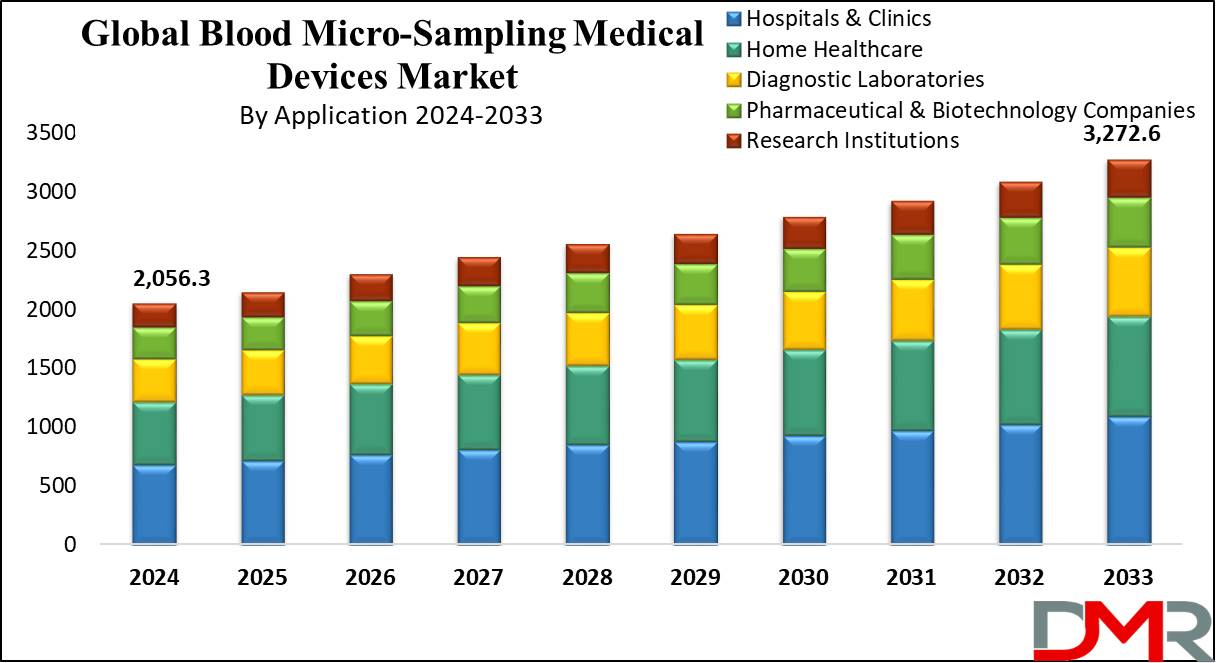

Global Blood Micro-Sampling Medical Devices Market size is expected to reach a

value of USD 2,056.3 million in 2024, and it is further anticipated to reach a market

value of USD 3,272.6 million by 2033 at a

CAGR of 5.3%.

The blood micro-sampling medical device market is gaining momentum, driven by such devices' critical role in the development of secure, quick, and non-invasive access to blood for diagnostic testing. These are designed to collect minimal volumes of blood less than 1 mL which can enable faster analysis and minimize discomfort for the patient. This is brought about by augmenting demand for point-of-care testing, home healthcare, and advancements in the field of personalized medicine. Such factors as an increase in the prevalence of chronic diseases like diabetes and expansion in the growth of services about remote patient monitoring are likely to ensure truly significant growth for the global blood micro-sampling medical devices market in the forthcoming years.

The market growth is further propelled by the increasing focus on patient-oriented healthcare, the advance in new methodology of blood testing, and the growing demand for self-testing devices. Regarding this, companies are developing safety lancets, capillary blood sampling devices, and better collection techniques that may improve safety for the patient and enhance the reliability of the device.

One of the key factors driving the demand for blood micro-sampling medical devices is access to healthcare, especially in emerging markets.

In addition, regulatory support for medical innovations through approvals and guidelines has been a critical factor that influences market dynamics. On the whole, the blood micro-sampling medical devices market will be well-placed for sustained growth on the heels of innovations in medical technology, a rise in healthcare needs, and a movement toward less invasive, patient-friendly diagnostic methodologies.

The growth prospects in the blood micro-sampling medical devices market are strong, particularly during times when access to healthcare is on an upward trend in emerging markets. In various regions across Asia-Pacific, Africa, and Latin America, there has been a growing need for affordable diagnostic solutions that would facilitate better healthcare access and outcomes. The blood micro-sampling medical devices are one of the promising solutions for resource-limited settings, since they are low-cost, and easy to operate, with their operation requiring minimal infrastructure. The role of personalized medicine as a growing global trend finally opens an avenue for these devices to further support frequent and convenient biomarker data that is of utmost importance for personalized therapies.

Key emerging trends to watch in the blood micro-sampling market include the trend toward decentralized healthcare, with an increasing focus on point-of-care and home-based testing. In emerging models of telemedicine and remote patient monitoring, there is a growing interest in devices that would enable reliable testing to be performed at home. This trend is combined with the development of device technologies, including improved lancet designs and user-friendly digital interfaces. This is also being helped with innovations in materials and microfluidics, making devices portable, and with higher accuracy, besides making it much more comfortable for the users.

These create regulatory challenges for the blood micro-sampling market, given that medical authorities like the FDA and EMA set very strict standards for the device. These approval processes mostly take time and prove costly, hence creating a barrier for new entrants and delaying the entry into the marketplace of improved devices. Further, there is a potential risk of errors in readings arising from end-user fault, particularly in a home-based environment, which may lead to adverse patient outcomes and consequently discourage further use. Together with the high costs involved in complying with set regulations, these challenges dampen the growth potential of the market.

Among its many strengths, blood micro-sampling comes out to be convenient and less invasive, with frequent monitoring. Concerning chronic disease management, like diabetes, where patients benefit tremendously by testing their blood frequently without having to visit clinics, such a device would suit them well. The general characteristics of these types of devices are compact size and ease of use, which makes the blood withdrawal procedure much more comfortable in comparison to restricting blood sampling. Adding to their functionality is their compatibility with digital health platforms further extends their utility by allowing data collection and sharing with healthcare providers, thus offering real-time monitoring.

In addition to these advantages, the blood micro-sampling devices also have some weaknesses. User error is one of them; this might yield erroneous test results due to bad sample collection, especially in home tests. A few other issues cannot provide the same degree of precision as lab tests, which limits their use in certain diagnostic analyses. The other weakness may be the fact that advanced micro-sampling devices will indeed have a higher price, which is barrier-prohibitive in the low-resource setting and for patients with no insurance coverage, thus compromising the reach of the market to the so-called "price-sensitive" regions.

It holds great relevance for the over 37 million diabetes patients in the U.S. who require periodic blood sampling for control of their disease state. This, in turn, reflects well on the market demand. Increasing in-home healthcare is expected to propel market growth further. Blood micro-sampling devices revolutionized the collection of blood by allowing small samples to be collected without causing much pain to the patient. Convenience-based micro-sampling, according to research, is preferred by over 60% of patients, against conventional blood drawing.

These devices are now being applied in the areas of remote patient monitoring and management of chronic diseases more frequently without the necessity of visiting clinics. Increased integration of digital platforms means that several micro-sampling devices have applications compatible with smartphone apps; this factor has generally increased their appeal, making them stand out as an indispensable tool in managing modern healthcare.

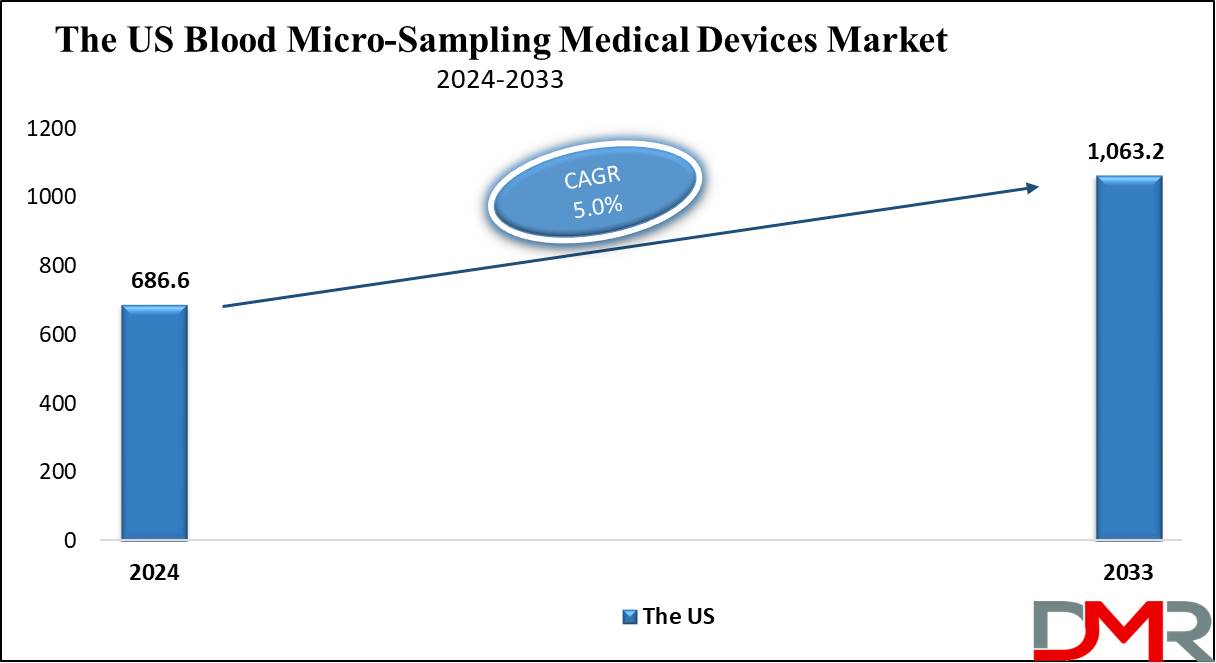

The US Blood Micro-sampling Medical Devices Market

The US Blood Micro-sampling Medical Devices Market is projected to be valued at USD 686.6 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,063.2 million in 2033 at a CAGR of 5.0%.

The major factors for rapid expansion in the U.S. blood micro-sampling medical devices market include growing healthcare awareness and increasing demand for minimally invasive diagnostic tools. The trend markers that can be noted in the U.S. include increased adoption of point-of-care testing due to a greater need for speedier and more efficient diagnostic testing. As diseases like diabetes and cardiovascular diseases continue to plague human life, patients keep hoping for the development of devices that can provide accurate results using only a small amount of blood.

The affordability of blood micro-sampling devices has also been favoring home-based development of care solutions where patients can conduct a self-test. This has been further helped by telemedicine and other digital health solutions that allow healthcare providers to follow up with patients remotely.

Other technology advancement developments include a safer, more reliable lancet, capillary blood sampling device, and micro-sampling kit. Major market leaders currently include BD, Terumo, and Roche; new developments they introduce are for patient safety and allow convenience in blood collection.

The US market is likely to continue growing, considering the aging population, the rising need for diagnostics, and the betterment of medical technologies. Furthermore, the regulatory landscape in the country is welcoming, with agencies like the FDA actively giving their assent to new devices, catalyzing the market's growth and encouraging recent entrants to explore the potential of the blood micro-sampling device.

Key Takeaways

- Global Market Value: The Global Blood Micro-Sampling Medical Devices Market size is estimated to have a value of USD 2,056.3 million in 2024 and is expected to reach USD 3,272.6 million by the end of 2033.

- The US Market Value: The US Blood Micro-sampling Medical Devices Market is projected to be valued at USD 686.6 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,063.2 million in 2033 at a CAGR of 5.0%.

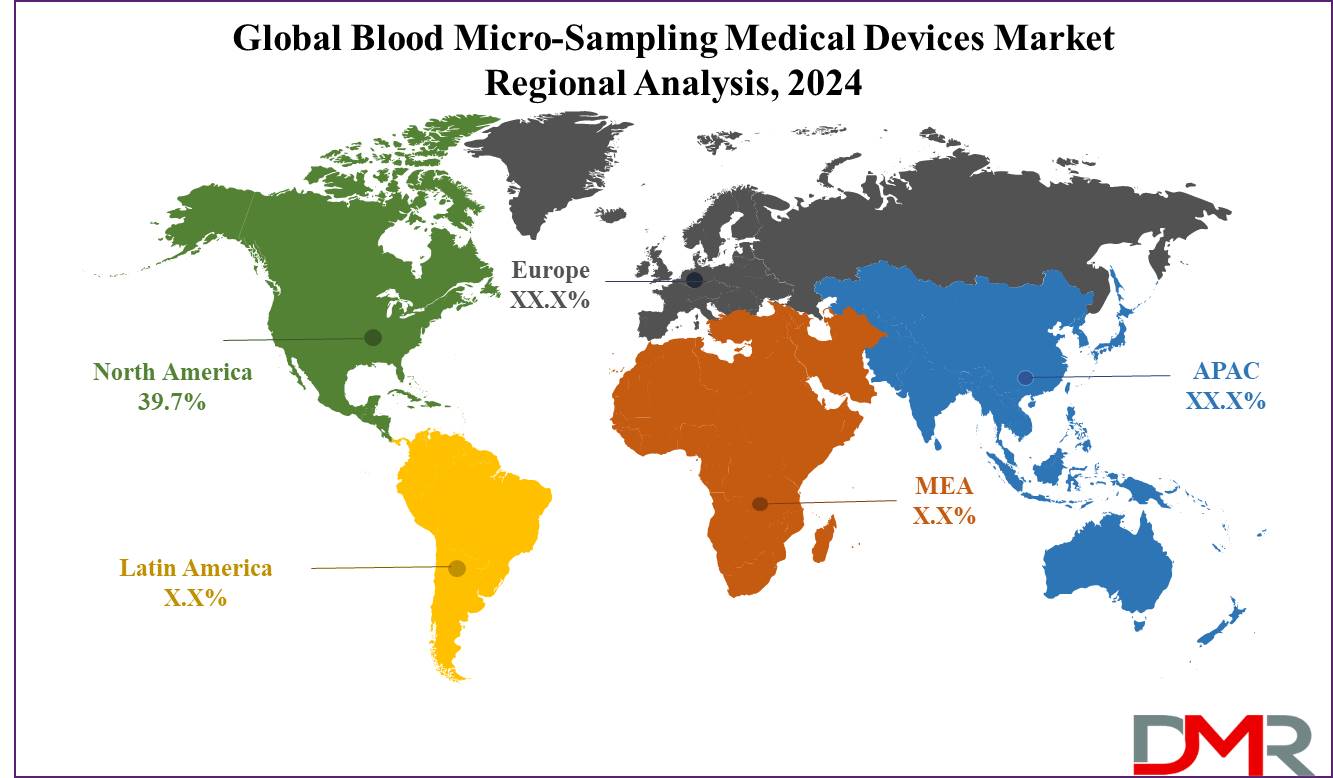

- Regional Analysis: North America is expected to have the largest market share in the Global Blood Micro-Sampling Medical Devices Market with a share of about 39.7% in 2024.

- Key Players: Some of the major key players in the Global Blood Micro-Sampling Medical Devices Market are BD (Becton, Dickinson, and Company), Abbott Laboratories, PerkinElmer, Accriva Diagnostics, Quest Diagnostics, Neoteryx, Tasso Inc., Seventh Sense Biosystems, and many others.

- Global Growth Rate: The market is growing at a CAGR of 5.3 percent over the forecasted period.

Use Cases

- Diabetes Monitoring: A sample of blood microdevices are greatly in practice for monitoring the glucose levels of blood in diabetic patients. These devices sample very minute amounts, which helps the patient to conduct the test at home rather than going to health care facilities frequently.

- Chronic Disease Management: This is in cases where the patients have chronic conditions, such as cardiovascular diseases and kidney diseases, which require frequent blood tests to monitor the condition of their diseases and their response to treatment itself.

- Pediatric Care: Blood micro-sampling devices find their greatest utility in pediatrics. They minimize the pain associated with blood sampling, especially in infants and young children. Safety lancets and capillary blood sampling devices serve to collect the small blood samples continually required for a variety of diagnostic tests.

- At-Home Diagnostics: Growth in home-based diagnostics of a wide range of diseases, including anemia, infectious diseases, and hormonal disorders, has emerged as one of the key factors that add to the growing applications of devices for blood micro sampling.

Market Dynamic

Trends in the Blood Micro-Sampling Medical Devices Market

Increased Adoption of Point-of-Care TestingOne of the major trends that is taking over the market for Blood micro-sampling medical devices is that of point-of-care testing. POC testing is used for quick diagnostics and real-time monitoring at home or in outpatient clinics. Since healthcare is no longer centered around the four cold walls of a hospital, these devices give convenience to patients wherever they are, sometimes with the exclusion of medicinal facilities for chronic conditions like diabetes or heart disease.

This trend is further encouraged by the increasing demand for rapid, actionable results without making patients wait to get the outcomes of lab tests. Devices for self-monitoring of blood glucose and cholesterol find increasing acceptance among diabetic or cardiovascular patients as these can be used every day for monitoring one's health.

Growing Demand for Self-Testing Devices

There is undeniably a need to be seen and met for self-testing devices fueled by rises in telemedicine, remote patient monitoring, and the at-home health movement. With the empowerment of health consumers becoming increasingly evident, there is an uptick in diagnostic tools being delivered to the home. Of all these, blood micro-sampling remains at home.

In particular, for those consumers affected by chronic ill health conditions, such devices provide an avenue for them to monitor their health status between doctor visits. Besides, it is the ease of use promoted by such devices that contributes to the wider preventive healthcare trend when one can identify health problems early and avoid subsequently more invasive treatments.

Growth Drivers in the Blood Micro-Sampling Medical Devices Market

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and kidney disorders, increases the demand for blood micro-sampling-enabling devices in healthcare. Most of these conditions highly require frequent monitoring, with the feasibility of their management often relying on the frequency one can carry out blood tests. Therefore, blood micro-sampling devices enable tracking of one's health through a less invasive procedure.

These devices are very important for patients for whom constant monitoring is intended, as they make access to vital biomarkers easy without them returning time and again to healthcare facilities. Their use is increasing, fueling interest in such devices as a growing trend toward preventive care and managing chronic diseases outside conventional clinical settings.

Advancements in Medical Technology

Another important enabler in the use of blood micro-sampling devices is the phenomenal rate at which technology is being contributed to the sector. New material technologies, together with lancet design and blood collection methodologies, have made these devices much safer and more reliable to use. Improvements in safety mechanisms, smaller-sized lancet needles, and easy-to-use user interfaces have added not only to the patient's comfort but also to the accuracy of results.

These support the growing trend of at-home healthcare, as users could expect a greater degree of confidence in the reliability of the results. Besides that, the development of new technologies has continuously improved the ability of such devices to extend tests, that were more difficult and complex without too much effort, thus expanding their functionalities in the home care setting.

Growth Opportunities in the Blood Micro-Sampling Medical Devices Market

Expanding Markets in Developing Regions

The blood micro-sampling market for medical devices seems to hold substantial growth potential in developing regions that are gaining increased access to health care but with a restriction in diagnostic tools. In these regions, the demand is expanding for suitable but efficient and easily operable medical devices that can also be used by healthcare professionals themselves either in a non-hospital environment or directly by the patients themselves.

Blood micro-sampling devices are highly useful in these regions because of their affordability, portability, and ease of operation; therefore, this solution tends to be very attractive for diagnostics when resources are limited. The expansion of healthcare infrastructure in growth markets offers the chance to provide affordable solutions for blood collection capable of serving a wide range of patients, especially in rural and remote areas.

Personalized Medicine

Personalized medicine, developed based on tailored treatment approaches founded on individual genetic profiles and health data, is an exciting new frontier of possibility opening up for blood micro-sampling medical devices. These devices now play a major role in clinical practice, providing substantial support to biomarker monitoring, which consequently plays an important role in the development and implementation of personalized treatment plans.

In turn, this will spur demand for devices that can efficiently collect accurate blood samples for biomarker analysis. Being minimally invasive and easy to use, the blood micro-sampling device is well-positioned to facilitate this trend. It does so by offering healthcare professionals useful data in developing patient-specific treatment options, especially about oncology, genomics, and rare diseases.

Restraints in the Blood Micro-Sampling Medical Devices Market

Regulatory Challenges

There are considerable regulatory challenges to overcome in the regions of the U.S., Europe, and other developed markets for blood micro-sampling devices. Most of these are considered medical devices and usually consist of very lengthy and expensive approval processes. Approval has to be sought from each region separately, each having its various regulations regarding safety, efficacy, and performance standards.

For instance, regulatory clearance is offered in the U.S. Both the FDA and EMA enforce extensive clinical trials and documentation before allowing new devices to reach the market. Thus, innovative blood micro-sampling faces regulatory challenges that may cause delays in entry into the market. In addition, any new entrants or emerging players with fewer resources will be impeded from operating such complex procedures. Hence, longer approval processes may reduce the pace of innovation within this market segment.

User Error and Inaccuracy

An element of user error cannot be eliminated with the advancement of design and user-friendliness in home healthcare. Several blood collection techniques, such as the use or handling of lancets, could lead to inappropriate or unreliable results. Although the design of most blood micro-sampling devices is user-friendly, the absence of skilled supervision may also lead to suboptimal sample collection that affects diagnostic accuracy.

For example, poor specimen collection could result in low sample volumes or even contamination of samples, thus yielding false results. Such issues might prevent the full adoption of these devices by consumers and healthcare providers in medical situations where high-stakes accuracy may be required; frequent user errors could also impact the perception of reliability for these devices.

Research Scope and Analysis

By Type

Safety lancets are projected to dominate the blood micro-sampling medical devices market as they hold the highest market share by the end of 2024. Ease of use, safety features, and facilitation of minimal patient discomfort are some of the factors that have driven dominance in the blood micro-sampling medical device market, brought about by safety lancets. Safety lancets are designed with automatic mechanisms that ensure the concealing of the needle after the action of the device is executed. This prevents needle-stick injury to both the patients and professionals working with these lancets, thus making them apt for self-testing in home care settings and giving a boost to their global acceptance of devices.

Another strong driving force behind the dominance of safety lancets is the convenience offered by them. Unlike traditional lancets, the depth required in a safety lancet becomes preset and thus ready to be used for an efficient and controlled process of blood samples. Therefore, patients are not required to set the depth of the needle themselves, thereby assuring uniformity and precision in blood sampling with minimal effort. This ease of operation is extremely useful in cases of individuals devoid of ample medical knowledge, such as elderly patients or caretakers.

Moreover, safety lancets are designed to cause minimal pain, hence appearing as an attractive alternative for patients who fear needle pricks or for patients who require frequent blood sampling, such as diabetic patients. Market demand for blood sampling that is painless and fast encourages further growth in the prominence of safety lancets. Regulatory bodies also support their use by approving safety lancet devices. For instance, the FDA approves safety lancet devices, hence further encouraging their market penetration. All factors combined, hence, safety, ease of use, and comfort for patients have positioned safety lancets as the dominant device type in the blood micro-sampling medical device market.

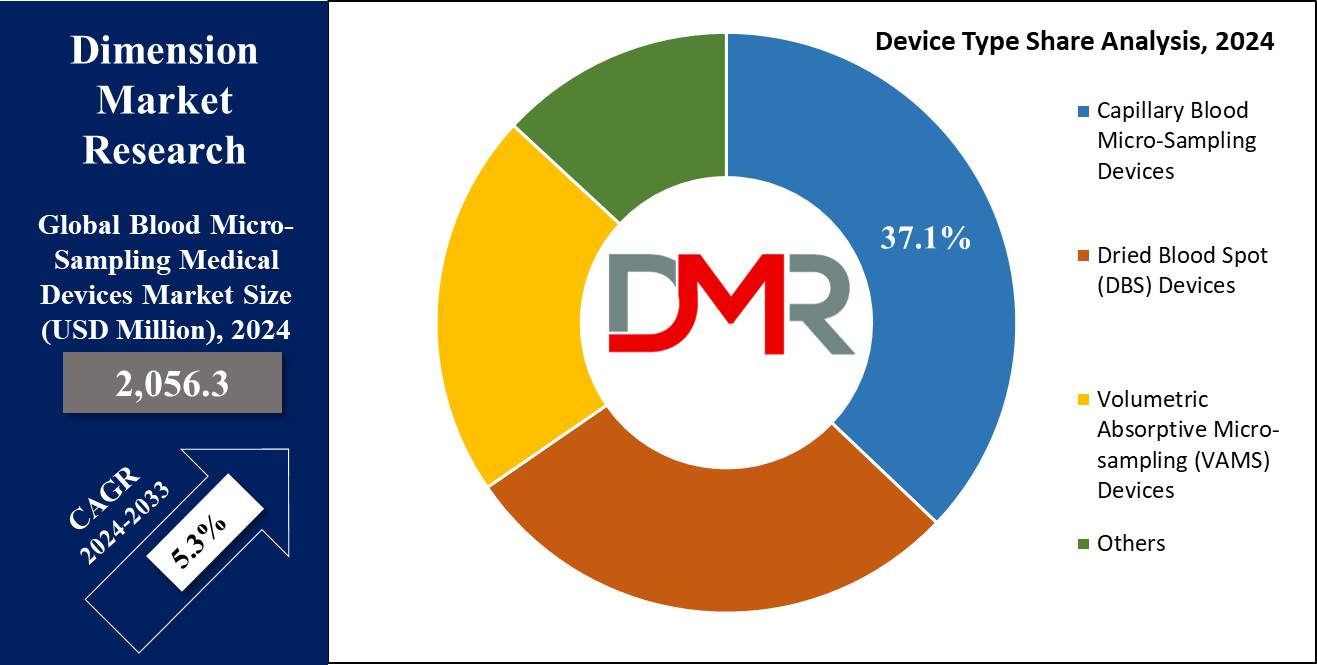

By Device Type

Capillary blood micro-sampling devices are projected to dominate the device type segment in the blood micro-sampling medical devices market as they hold 37.1% of the market share in 2024. Some of the factors that have driven the prevalence of dominance within the blood micro-sampling medical device market brought about by safety lancets include ease of use, safety features, and facilitation of minimal patient discomfort. Safety lancets are designed with automatic mechanisms that ensure the concealing of the needle after the action of the device is executed. This prevents needle-stick injury to both the patients and the professionals working with these lancets, hence making them apt for self-testing in home care settings and thus giving a boost to their global acceptance of devices.

Another strong driving element in the dominance of safety lancets is mainly the convenience offered by them. As opposed to traditional lancets, the depth required in a safety lancet becomes preset and, therefore, ready to be used for an efficient and controlled process of blood samples. Thus, the patients are not supposed to set the depth of the needle themselves, hence assuring uniformity and precision in blood sampling with the least effort. This ease of use is very helpful in the case of a person who does not have sufficient medical knowledge, such as an aging patient or caretaker.

Also, safety lancets have been designed to be less painful; thus, they come off as a good option for patients who are afraid of needle pricks or for patients with frequent blood sampling, such as diabetic patients. All these factors are painless and fast blood sampling encourages further growth in the prominence of safety lancets. The regulatory bodies support their growth by approving the use of safety lancet devices. For instance, the FDA approves the safety lancet device, hence encouraging further market penetration.

Combining all the factors, therefore, safety, comfort for the patients, and the ease with which these devices are used have ensured that the safety lancet thus remains the dominant device type in the blood micro-sampling medical device market.

By Application

The application segment of blood micro-sampling medical devices is projected to be dominated by hospitals and clinics in 2024 since these are the places responsible for patient care and diagnosis. Both in hospitals and in clinics, the level of dependence on such blood micro-sampling devices would be high for a variety of diagnostic tests, such as blood glucose monitoring, cholesterol checks, and many other hormonal level assessments. Blood micro-sampling devices would be an essential item in such environments where adequate and timely results are of the essence.

These devices come with several advantages to hospitals and clinics. They allow a faster and more efficient way of collecting blood from patients who require frequent testing. For instance, the emergency department has the advantage of fast testing using micro-sampling devices that may not require blood drawing as the original techniques, hence requiring some time and human resources. These devices reduce discomfort in the patient, especially in those situations requiring repeated blood sampling, as in pediatric patients or patients with chronic conditions.

Moreover, the role of hospitals and clinics becomes imperative in addressing problems related to the increasing demand for diagnostic tests. Due to the increasing prevalence of several chronic diseases, along with the drive toward preventive healthcare, there is an immediate need to adopt blood micro-sampling devices that facilitate the timely diagnosis of several diseases. Only then can any form of blood test be carried out efficiently within these healthcare centers. Fast treatment decisions can be made for better patient outcomes.

Their operation is generally quite easy; hence, most blood micro-sampling devices do not need special or particular training. It is this simplicity and efficiency that gives them the leading edge in the application segment, including their usage in hospitals and clinics.

The Blood Micro-Sampling Medical Devices Market Report is segmented on the basis of the following

By Type

- Safety Lancets

- Ordinary Lancets

By Device Type

- Capillary Blood Micro-Sampling Devices

- Dried Blood Spot (DBS) Devices

- Volumetric Absorptive Micro-sampling (VAMS) Devices

- Others

By Application

- Hospitals & Clinics

- Home Healthcare

- Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Research Institutions

Regional Analysis

North America is expected to hold a dominant position in the global blood micro-sampling medical devices market

with 39.7% of the market revenue by the end of 2024. Several factors contribute to North America's leading position in the global blood micro-sampling medical devices market. This is due to the great heights of advancement in healthcare infrastructure, as there is easy access to state-of-the-art medical technologies and associated services throughout this region. The growing demand about decentralized healthcare models, such as point-of-care testing and home-based diagnostics, has built up demand for these central blood micro-sampling devices.

Chronic diseases, such as diabetes, cardiovascular diseases, and obesity, are highly prevalent in the U.S., thus increasing the need for frequent blood testing and monitoring. Such a factor has risen as a strong demand for convenient and minimally invasive blood collection methods among healthcare professionals and patients, including micro-sampling devices. Additionally, strong reimbursement policies in the U.S. regarding home healthcare products act as an added impetus to the usage of such devices.

Moreover, North American firms have always been among the leaders in the research and development of medical technology. Several innovative developments in the field of blood microsampling devices originated in this region. Due to key healthcare players, coupled with encouraging regulatory landscapes and significant R&D investments in healthcare, North America is aptly positioned to continue to lead the market. Further, the dominance of North America is attributed to the increasing focus on personalized medicine, telemedicine, and self-testing. Therefore, the region presents itself as one of the crucial hubs to accelerate the growth of blood micro-sampling medical devices.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market for micro-sampling medical devices for blood is fiercely competitive, with several established and new players. Prominent names in the market include BD, Terumo Corporation, Roche Diagnostics, Abbott Laboratories, and Mylan N.V. These have a strong market share since they have large product portfolios and global reach. These companies offer various micro-sampling devices, which include but are not limited to lancets, capillary blood sampling kits, and blood collection tubes, tailored for various diagnostic purposes.

They work toward product innovation, compliance with regulatory agencies, and strategic partnerships to stay ahead in the market. For example, BD and Terumo have developed advanced safety lancets and capillary sampling devices with improved ease of use and safety features. The other key players in this business, like Roche Diagnostics and Abbott Laboratories, also show initiatives in the development of blood testing technology for the high demand in point-of-care and home diagnostics.

These emerging players are developing cost-effective and user-friendly micro-sampling devices and targeting market share in the developing regions. In addition to that, collaboration with healthcare providers, research organizations, and diagnostic labs is also a very popular strategy among players who intend to strengthen their market positions and earn better market shares.

The competitive landscape is diffused in nature, wherein established players are leveraging their global reach and R&D capabilities, while new entrants are focusing on market disruption with innovative and cost-effective solutions.

Some of the prominent players in the Global Blood Micro-Sampling Medical Devices Market are

- BD (Becton, Dickinson and Company)

- Abbott Laboratories

- PerkinElmer

- Accriva Diagnostics

- Quest Diagnostics

- Neoteryx

- Tasso, Inc.

- Seventh Sense Biosystems

- Trajan Scientific and Medical

- PanoHealth

- Mitra Microsampling

- Capitainer AB

- Sarstedt AG & Co.

- Other Key Players

Recent Developments

- October 2024: Tasso Inc. received FDA clearance for its Tasso+ device, a micro-sampling blood collection tool designed for both clinical and at-home use. The device simplifies blood collection, making it easier for patients to manage their chronic conditions from home.

- September 2024: Abbott Laboratories launched an upgraded version of its FreeStyle Libre glucose monitoring system, integrating more advanced micro-sampling technology to improve accuracy and user comfort for diabetes patients.

- August 2024: Siemens Healthineers expanded its point-of-care diagnostics portfolio, introducing a micro-sampling solution for rapid blood testing, aimed at enhancing remote patient monitoring capabilities, especially in rural areas.

- July 2024: Roche Diagnostics launched a next-generation lancet-based micro-sampling device aimed at improving patient compliance with chronic disease management by offering a less invasive and more comfortable blood collection method.

- June 2024: DarioHealth unveiled a new at-home blood collection device with integrated digital health monitoring, designed to allow patients with diabetes to collect and analyze blood samples without the need for a healthcare provider's assistance.

- May 2024: Thermo Fisher Scientific announced a strategic partnership with a biotech firm to develop a new line of blood micro-sampling devices tailored for genomic testing, expected to boost personalized medicine applications.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,056.3 Mn |

| Forecast Value (2033) |

USD 3,272.6 Mn |

| CAGR (2024-2033) |

5.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 686.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Safety Lancets¸ and Ordinary Lancets), By Device Type (Capillary Blood Micro-Sampling Devices, Dried Blood Spot (DBS) Devices, Volumetric Absorptive Micro-sampling (VAMS) Devices, and Others), By Application (Hospitals & Clinics, Home Healthcare, Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, and Research Institutions) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BD (Becton, Dickinson and Company), Abbott Laboratories, PerkinElmer, Accriva Diagnostics, Quest Diagnostics, Neoteryx, Tasso Inc., Seventh Sense Biosystems, Trajan Scientific and Medical, PanoHealth, Mitra Microsampling, Capitainer AB, Sarstedt AG & Co., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Blood Micro-Sampling Medical Devices Market size is estimated to have a value of USD 2,056.3 million in 2024 and is expected to reach USD 3,272.6 million by the end of 2033.

The US Blood Micro-sampling Medical Devices Market is projected to be valued at USD 686.6 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,063.2 million in 2033 at a CAGR of 5.0%.

North America is expected to have the largest market share in the Global Blood Micro-Sampling Medical Devices Market with a share of about 39.7% in 2024.

Some of the major key players in the Global Blood Micro-Sampling Medical Devices Market are BD (Becton, Dickinson, and Company), Abbott Laboratories, PerkinElmer, Accriva Diagnostics, Quest Diagnostics, Neoteryx, Tasso Inc., Seventh Sense Biosystems, and many others.

The market is growing at a CAGR of 5.3 percent over the forecasted period.