The market size is estimated to be quite considerable and is also likely to grow at a steady growth rate over the forecast period. Blood recovery machines are increasingly being adopted for various surgical procedures, such as cardiac, orthopedic, neurological, and trauma surgeries. The global market is set to gain from the increasing prevalence of chronic diseases requiring surgical interventions, an aging population, and a rise in the number of surgeries across the globe.

New and efficient products are being developed and invented by the key players in the blood recovery machine market. In addition, the adoption of advanced technologies in centrifugal and gravity-based blood recovery systems is further giving a boost to the market.

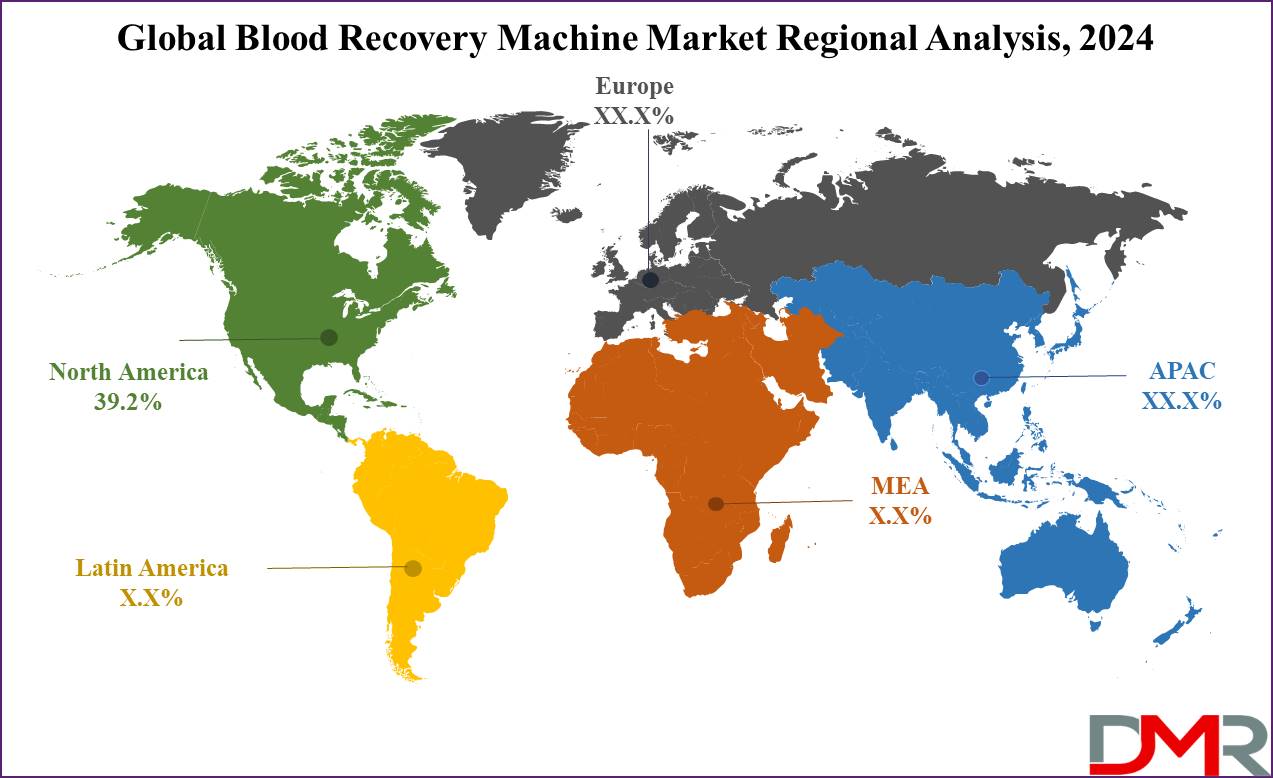

Geographically, North America leads the global blood recovery machine market, owing to a high adoption rate of advanced medical devices and favorable healthcare infrastructure, followed by Europe and the Asia-Pacific region. Thereafter, the market is expected to grow continuously, with advancements continuing and the demand for blood recovery solutions increasing.

Blood recovery machines have seen increasing interest due to an increased demand for efficient transfusion and surgical procedures requiring blood transfusions. These machines play an integral part in collecting lost blood during surgeries, thus decreasing donor requirements while simultaneously decreasing complications related to transfusion-related procedures.

Technological advances have revolutionized blood recovery machines, vastly improving their performance, portability and user-friendliness. Advancements like automatic blood separation systems and real-time monitoring features have contributed to improved patient outcomes and greater adoption rates across medical facilities - particularly orthopedic and cardiovascular surgery facilities. This growth trend also aligns with the increasing demand for Operating Room Equipment & Supplies and the integration of

Surgical Robots that enhance precision and automation during complex surgeries.

As more surgeries and trauma cases occur each year, blood recovery machines have become increasingly popular in hospitals and surgical centers alike. They help reduce blood loss while speeding recovery times while decreasing allogeneic blood transfusion requirements which come with additional risks and costs.

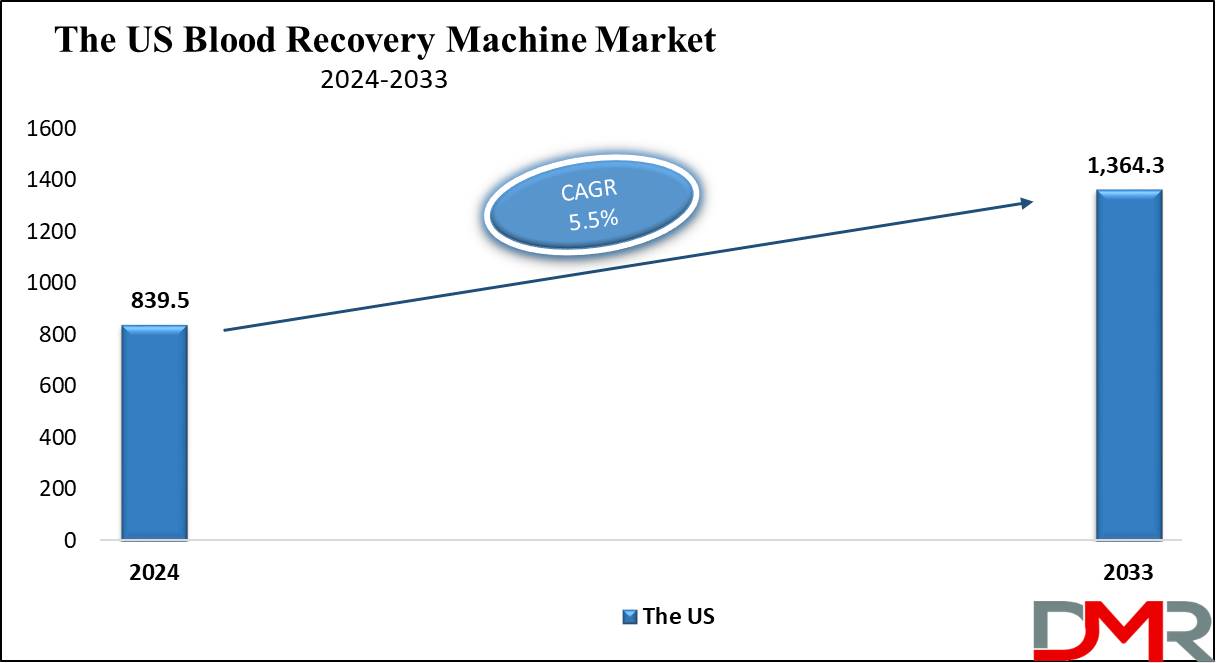

The US Blood Recovery Machine Market

The US

Blood Recovery Machine Market is projected to be

valued at USD 839.5 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 1,364.3 million in 2033 at a

CAGR of 5.5%.

The US blood recovery machine market includes continuous flow system adoptions and integration of advanced filtration. The increasing focus on intraoperative blood loss minimization and better autotransfusion techniques and protocols will continue to drive this market. Hospitals are also adopting

Electrosurgical Generators and Ultrasonic Scalpels to complement these machines, enhancing the safety and precision of surgical procedures.

The rising number of minimally invasive surgeries further supports the demand for advanced blood recovery units. Some of the recent dynamics in the market include strategic alliances and the launch of new products by major market participants, aimed at enhancing the performance and efficiency of machines.

Emphasis on FDA approvals and adherence to strict regulatory standards further enhances the adoption of premium blood recovery machines. Additionally, increasing awareness of the benefits of autologous blood transfusion and pressure for sustainable health practices create significant opportunities.

The US market research report says highly advanced cell-saving machines hold the largest share of the market, supplemented by investment in research and development at a high level. Overall, the US Blood recovery machine market will witness rapid growth driven by technologically advanced devices, more surgeries, and strategic developments within the industry.

Key Takeaways

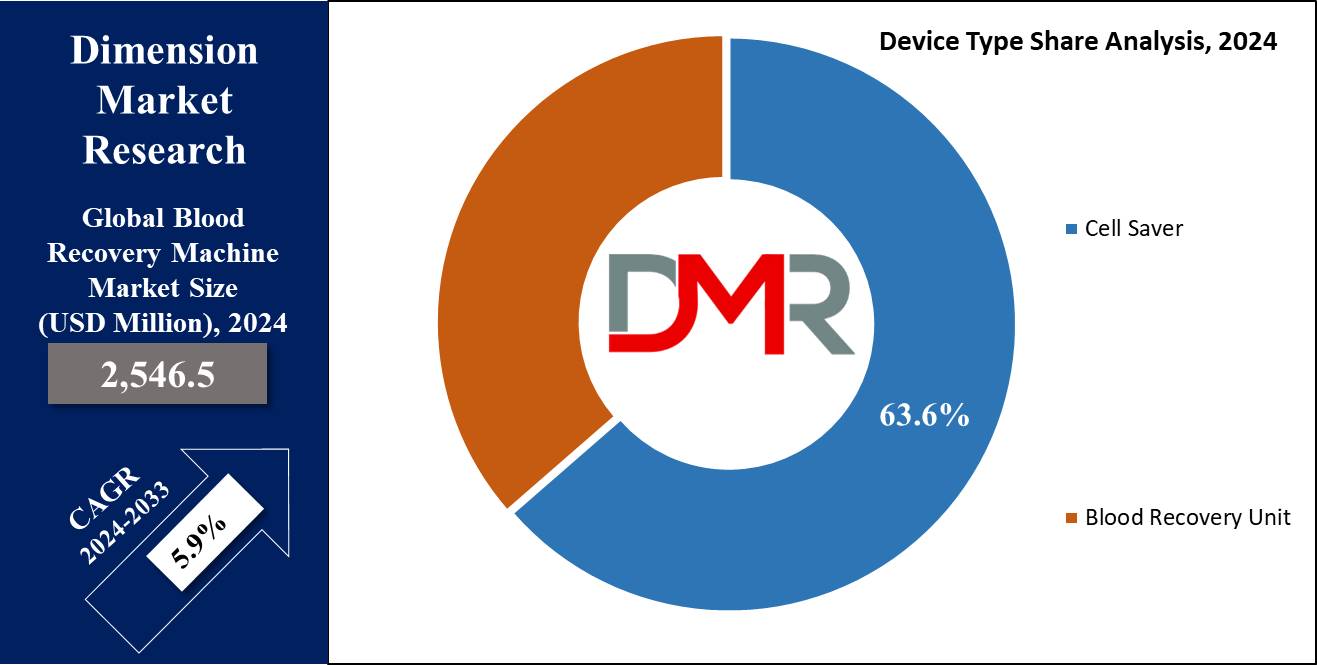

- Global Value: The global blood recovery machine market size is estimated to have a value of USD 2,546.5 million in 2024 and is expected to reach USD 4,277.4 million by the end of 2033.

- The US Market Value: The US Blood Recovery Machine Market is projected to be valued at USD 1,364.3 million in 2033 from the base value of USD 839.5 million in 2024 at a CAGR of 5.5%.

- By Type Segment Analysis: 3000N Type blood recovery machine is projected to dominate this segment as it holds the highest market share in 2024.

- By Device Type Segment Analysis: Cell savers are anticipated to dominate this segment as it hold 63.6% of the market share in 2024.

- By Technology Segment Analysis: Gravity-based blood recovery is projected to dominate this segment as it holds 33.2% of the market share in 2024.

- Regional Analysis: North America is expected to have the largest market share in the Global Blood Recovery Machine Market, with about 39.2% in 2024.

- Global Growth Rate: The market is growing at a CAGR of 5.9 percent over the forecasted period.

Use Cases

- Cardiac Surgery: Cardiac surgeries, like CABG, require blood recovery machines. This is important in reducing the loss of blood and avoiding blood transfusion from donors.

- Orthopedic Surgery: In joint replacement surgery, these machines collect and recycle the blood of the patient so that they regularly and continuously provide blood to the patient's body to avoid the risk associated on blood transplantation.

- Trauma Surgery: Blood recovery machines recover and process blood loss quickly during major trauma procedures for immediate autologous transfusion to stabilize the condition of the patient.

- Obstetrics and Gynecology: These devices help recover and re-use the patient's blood in cesarean sections, reducing the patient's dependency on allogeneic blood and contributing to better surgical outcomes.

Market Dynamic

Trends

Technological Advancements

Centrifugal and ultrafiltration-based technologies have revolutionized blood recovery machine markets by improving efficiency and safety during blood processing. These advancements allow machines to more effectively collect and treat blood lost during operations, producing higher-grade washed red blood cells for reinfusion. In addition, hospitals are incorporating Healthcare Analytics and Clinical Chemistry Analyzers to track patient outcomes and streamline surgical workflows for better blood management.

Increased Surgical Procedures

Increasing rates of cardiovascular, orthopedic, and trauma surgeries globally are driving greater demand for blood recovery machines in hospitals and surgical centers. Hospitals and surgical centers increasingly rely on this technology to enhance patient outcomes while decreasing allogeneic blood transfusion requirements; expansion in healthcare infrastructure coupled with an emphasis on patient blood management programs is further driving adoption. As chronic disease prevalence rises among aging populations and leads to an escalating volume of surgical interventions the market for this blood recovery technology will experience exponential expansion.

Growth Drivers

Rising Demand for Autologous Transfusions

The rising preference for autologous blood transfusions over allogeneic ones is one of the primary drivers behind the growth of the global blood recovery machine market. This trend correlates with the wider adoption of Point of Care Diagnostics and In Vitro Diagnostics (IVD) systems that enable faster decision-making in surgical and trauma care environments.

Advancements in Blood Recovery Technology

Ongoing innovations and advancements in blood recovery machine technology are leading to market expansion. Manufacturers are investing heavily in research and development efforts to produce more efficient, user-friendly machines capable of recovering large volumes with minimum processing times - features like automated systems, improved filtration capacities, and portability are making blood recovery machines even more appealing to healthcare providers. Furthermore, technological improvements not only increase market shares for advanced machines but also broaden their applications across numerous surgical specializations.

Growth Opportunities

Expansion into Emerging Markets

Asian and Latin American economies present significant expansion possibilities for blood recovery machine vendors in their respective regions. Rising healthcare infrastructure investments, rising disposable incomes, and awareness of autologous transfusion are driving increased investment into blood recovery technologies and raising their demand. Middle-class populations and chronic disease cases necessitating surgical interventions create an increased need for blood recovery machines; companies can capitalize on this market opportunity by expanding distribution networks and offering cost-effective solutions tailored to these markets.

Integrating Blood Recovery Machines With Digital Health Solutions

Integrating blood recovery machines with digital health technologies such as electronic medical records (EMRs) and surgical planning software provides new growth opportunities. Improved data analytics and real-time monitoring can increase efficiency and effectiveness, leading to advanced patient care outcomes. Furthermore, advances in

machine learning and

artificial intelligence may enable predictive maintenance plans or personalized treatment plans, further fuelling adoption. Collaborating with technology providers on smart blood recovery solutions opens avenues of market expansion.

Restraints

Initial Investment and Maintenance Costs of Blood Recovery Machines

Initial investments and maintenance costs associated with these machines act as major impediments to market growth, particularly in regions with limited resources. The expense involved with purchasing advanced blood recovery technology coupled with servicing requirements often deters healthcare facilities from adopting them; lack of reimbursement policies in some countries further diminishes the market potential for autologous transfusion procedures reducing their market penetration potential.

Manufacturers need to address these barriers by offering more affordable solutions coupled with flexible financing plans to enhance market penetration potential and market potential for autologous transfusion procedures globally.

Compliance with Stringent Requirements

Blood recovery machine manufacturers face challenges meeting stringent regulatory standards and obtaining necessary approvals, creating additional time-to-market delays that restrict product launches across various regions and require extensive investments in quality assurance testing to adhere to rigorous safety and efficacy standards. Compliance is vitally important as regulatory hurdles may impede new players entering the market or slow its overall expansion; having strong quality management systems in place helps mitigate restraints on market growth.

Research Scope and Analysis

By Type

The 3000N Type Blood Recovery Machine is projected to lead the segment type segment in the global blood recovery machine market due to better performance and versatility in several surgical applications. Well-known for its advanced filtration system and high-efficiency blood processing, the 3000N Type collects and treats blood lost during operations with a high level of efficiency, thus providing high-quality washed red blood cells for autologous transfusion.

Its robust design and reliability make it a preferred choice among hospitals and surgical centers, contributing significantly to its market share. Besides, the comparative ease of use and interfacing with the existing surgeon workflow makes the 3000N Type more acceptable for providers.

Given that it can process large volumes of blood, it reduces the need for multiple transfusions and thus limits the risk associated with the development of various transfusion-related complications. Additionally, it has manufacturer support that is well maintained, including comprehensive maintenance services that ensure the device's constant performance.

This continuous improvement of the machine product portfolio from the 3000N Type is the result of extensive research and development efforts that have been invested in the product so far, keeping it at the leading edge of blood recovery technology.

Its adaptability to various surgical procedures, including cardiac and orthopedic surgeries, further cements its dominance within the market. The combination of efficiency, reliability, and advanced features makes the 3000N Type Blood Recovery Machine the leading choice in the segmentation of the blood recovery machine market, hence its wide adoption across various countries worldwide.

By Device Type

The Cell Saver is projected to dominate this segment as it will hold 63.6% of market share in 2024. The Cell Saver leads the segment of device type in the global blood recovery machine market owing to its essential role in autotransfusion systems and extensive application within surgical settings.

Cell Saver machines are specifically effective in collecting and processing blood that is lost during surgeries to provide a consistent source of washed red blood cells for reinfusion. This efficiency not only enhances patient outcomes but also minimizes the risk of complications related to allogeneic transfusions. These systems are often integrated with Medical Sensors and

Blood Sensors for accurate monitoring of hemoglobin and hematocrit levels during operation.

In addition, there is an enhancement in the process of continuous flow systems and automated processing with the help of Cell Saver devices for recovering blood, further enhancing operational efficiency.

Because they cannot handle large volumes with high precision, performance remains consistent for a wide range of surgical procedures, from cardiac to orthopedic trauma surgeries. Such versatility and reliability make Cell Savers contribute much to dominant shares within the device type segmentation.

Furthermore, Cell Saver technology is based on immense research and development that marks the continuous improvement in machine specifications and product portfolios. The manufacturers are now working on integrating their products with smart technologies, enhancing the user interface for the operation of Cell Savers to be more intuitive and easier. The established market presence and reputation of Cell Saver devices in hospitals proved their worth in surgical outcomes, which further fortifies the position of these devices.

By Technology

Gravity-based blood Recovery systems are projected to dominate the technology segmentation of the global blood recovery machine market as they hold 33.2% of the market share in 2024 The technology segmentation is also dominated because these are simple, low-cost, and easy to operate.

Blood Recovery Systems based on gravity dominate the technology segmentation since such systems are simple, inexpensive, and easy to handle. Systems about this segment apply simple collection systems, depending on gravitational force for collecting and treating blood lost during operatory procedures.

Thus, such systems are highly accessible to a wide range of healthcare facilities, even those with limited resources. With low operational complexity and minimal maintenance requirements, gravity-based systems thus hold a more considerable market share contribution in hospitals and surgical centers.

Besides, gravity-based systems have been a reliably performing counterpart in most instances with no requirement for extensive training or technical support by specialists, which makes them very attractive in emergencies and other high-pressure surgical situations.

Their capability for efficiently collecting and treating blood assures high-quality washed red blood cells to be provided for autologous transfusion, thus improving patient outcomes, and reducing dependency on donor blood. The cost advantages of the gravity-based systems make them favorable options both in developed and emerging markets over their more technologically advanced alternatives.

Consequentially, the simplicity and robustness of gravitational blood recovery systems allow for smooth integration into most types of surgical workflows, which further increases their versatility for a wide range of surgical operations. Manufacturers are also enhancing these systems with advanced filtration options to enhance blood quality and safety, thus further securing their dominance in technology segmentation.

The widespread acceptance and proven efficiency of gravity-based systems in blood loss management during operations will keep them leading in the global blood recovery machine market.

By Number of Channels

The single-channel systems are dominant in the number of channels segmentation of the global blood recovery machine market, because of their highly streamlined design, cost-efficient, and easy-to-operate nature. These systems are configured to process only one channel of blood collection and processing at any given time, making them ideal for most surgical procedures that do not require concurrent processing of multiple blood recoveries.

This simplicity in single-channel systems implies lower manufacturing and maintenance costs; hence, it is very attractive to a wide range of healthcare facilities, from hospitals and clinics to ambulatory surgery centers. Besides, the single-channel systems require minimal volumes of staff training, thus they are easily acceptable in many surgical settings. Their compact and lightweight design easily integrates into the existing setting for surgery hence, they guarantee that machines applied for the recovery of blood do not occupy much space during operations.

The single-channel machines have worked out to be reliable and consistent in the collection and treatment of bloodshed during operations; thus, they have gained a prime choice for effectively managing autologous transfusions. In addition, because single-channel systems are flexible, it is indicated for cardiac, orthopedic, and trauma surgeries, among others, without complicated settings.

The efficiency and functionality of single-channel systems are being improved by the manufacturers through the integration of advanced filtration technologies together with automated processing features; this acts as an efficient tool in further strengthening their market dominance.

Because of the widespread acceptance and proven performance to provide high-quality washed red blood cells for reinfusion, single-channel systems can be expected to enjoy leading positions in the number of channels segmentation of the blood recovery machine market.

By Application

Cardiac surgery has a major share in the application segmentation of the global blood recovery machine market because heart-related surgery is very prevalent and involves manifold complexities that need effective management of blood loss. CABG, heart valve surgery, and aortic surgery are usually characterized by heavy flow of blood; therefore, these kinds of operations require blood recovery machines to collect and treat blood loss during their performance.

This has made cardiac surgeries very critical, which in return gives way to a steady demand for advanced blood recovery technologies, hence driving the dominance of this application segment.

Apart from this, the higher incidence of cardiovascular diseases globally and the aging of the population have increased cardiac surgeries. This creates the demand for successful autologous blood transfusion systems to ensure better patient outcomes while reducing their dependency on blood donations.

Blood recovery machines are needed during operations in order to lower blood loss, hence providing greater chances of reduced risks of complications related to transfusions, which will result in increasing the surgical success rate.

The demand for cardiac surgery with blood recuperation is increasing, and the development of blood recuperation technologies specific to cardiac surgery, such as ultra-efficient filtration systems and centrifugal blood recuperation techniques, are some of the other factors that reinforce the prominence of the application.

Integration of cardiac surgery blood recovery machines in cardiac surgical procedures ensures washed red blood cells are available in optimal amounts so that patients recover more efficiently and are discharged from hospitals earlier.

This is further reinforced by the strategic focus of market players on the development of specialty blood recovery solutions for cardiac surgeries, keeping this segment in the leading slot in the market segmentation of blood recovery machines.

By End User

The end-user segmentation of the global blood recovery machine market is dominated by hospitals, as blood recovery technologies are applied for a wide set of surgical operations. Many of these facilities rely on Automated Hospital Beds and

Hospital Asset Management solutions to ensure seamless integration of blood recovery machines within their critical care infrastructure.

The large volumes of complex and high-risk procedures in hospitals are indicative of the strong demand for appropriate and complicated blood recoveries, which effectively secures the dominance of blood recovery systems in the market.

Apart from that, hospitals have been highly focused on patient safety and quality of care. This is also in line with the benefit offered by blood recovery machines since they can provide a reduction in allogeneic blood transfusions, hence minimizing the number of transfusion-related complications. The implementation of broad-based PBM programs in hospitals typically accelerates the use of blood recovery technologies, encouraging their adoption into routine surgical procedures.

The presence of cardiac, orthopedic, and trauma units, among other dedicated surgical departments, boosts demand for multi-functional and efficient blood recovery machines in hospitals.

Besides that, hospitals are at the forefront of research and development with blood recovery machine manufacturers to develop new and more functional machine product portfolios and specifications. One of the main reasons hospitals continue to be important end customers in driving growth and innovation within the blood recovery machine market is the investment in fully integrated, advanced blood recovery technology.

This leading role in the end-user segmentation of the global blood recovery machine market is strengthened by the comprehensive health services that hospitals provide, along with their commitment to adopting advanced medical technologies.

The Global Blood Recovery Machine Market Report is segmented on the basis of the following

By Type

- 3000N Type Blood Recovery Machine

- 3000P Type Blood Recovery Machine

- 3000H Type Blood Recovery Machine

- 5000H Type Blood Recovery Machine

By Device Type

- Cell Saver

- Autotransfusion Systems

- Continuous Flow Systems

- Blood Recovery Unit

- Intraoperative Blood Recovery Units

- Postoperative Blood Recovery Units

- Emergency Blood Recovery Units

By Technology

- Gravity Based Blood Recovery

- Simple Collection Systems

- Advanced Filtration Systems

- Centrifugal Blood Recovery

- Continuous Centrifugal Systems

- Batch Centrifugal Systems

- Ultrafiltration-Based Blood Recovery

- Hollow Fiber Membrane Systems

- Flat Sheet Membrane Systems

- Suction-Based Blood Recovery Systems

- Low-Pressure Suction

- High-Pressure Suction

- Aspiration-Based Blood Recovery Systems

By Number of Channels

- Single Channel Systems

- Dual Channel Systems

- Quad Channel Systems

By Application

- Cardiac Surgery

- Coronary Artery Bypass Grafting (CABG)

- Heart Valve Surgery

- Aortic Surgery

- Orthopedic Surgery

- Joint Replacement Surgery

- Spine Surgery

- Fracture Repair

- Obstetrics and Gynecology

- Cesarean Section

- Hysterectomy

- Myomectomy

- Neurological Surgery

- Brain Tumor Surgery

- Spinal Cord Surgery

- Aneurysm Repair

- Oncological Surgery

- Tumor Resection

- Lymph Node Dissection

- Hematological Malignancies

- Trauma Surgery

- Emergency Resuscitation

- Major Trauma Procedures

- Vascular Injury Repair

- Other Applications

By End User

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Blood Banks

Regional Analysis

North America is projected to dominate the global blood recovery machine market as it will hold

39.2% of the market share in 2024. The presence of advanced healthcare infrastructure and very high adoption of innovative Healthcare IT systems, coupled with investments in

Patient Engagement Solutions, contribute toward this regional dominance.

Because key blood recovery machine manufacturing companies have a strong network in these countries, encompassing various hospitals and surgical operating centers, North America dominated the market with a large share contribution. The demand for advanced blood recovery machines is also driven by a focus of the region on improving patient blood management practices and reducing the reliance on allogeneic transfusions.

In addition, the heavy burden of chronic diseases, particularly cardiovascular and orthopedic diseases, contributes to a huge volume of surgeries that demand effective blood loss management. Strict regulatory frameworks, along with supportive reimbursement policies, provide rapid adoption of blood recovery technologies and thereby support the consistent growth of the market in North America. The region also benefits from ongoing technological advancements and product innovations by key players to enhance the performance and reliability of blood recovery machines.

The strong presence of research and consulting firms, along with a large number of clinical trials related to autologous blood transfusion and blood recovery technologies, takes place in North America. Therefore, all these factors put North America in the leading position within the market for blood recovery machines.

Additionally, rising interest in sustainable healthcare management and economical solutions for blood management in North America have started to coincide with the advantages that have been made available from the blood recovery machines, returning once more to the reinforcement of the dominant position for this region.

Along with the overall healthcare ecosystem of North America, with its proactive adoption of advanced medical technologies, the region continues to dominate the global blood recovery machine market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global blood recovery machines market is highly competitive, with impetus arising from the advancements of the latest Medical Disposables and Healthcare Consumables, alongside heightened demand for competent blood management solutions. Key players operating in the market include Medtronic, Haemonetics Corporation, Fresenius SE & Co. KGaA, Terumo Corporation, and LivaNova PLC.

The companies pursue different strategies, like product innovation, strategic partnerships, and mergers and acquisitions, in their effort to maintain market position. A strong product portfolio and broad global reach by Medtronic and Haemonetics position them to lead the market.

A few emerging players also enter the market, while leveraging technological advancements and targeting certain niche segments. Continuous innovation is a characteristic of the market, with various R&D initiatives being engaged by companies for the development of more efficient, user-friendly, and cost-effective blood recovery machines.

Success in this market is pretty reliant on the issue of regulatory approvals and on the ability of manufacturers to provide comprehensive solutions for various surgical procedures. Recently, large players have acquired small firms manufacturing blood recovery machines to embed new technologies into their systems, while simultaneously gaining ground in emerging markets such as Asia-Pacific and Latin America.

Some of the prominent players in the Global Blood Recovery Machine Market are

- Medtronic

- Haemonetics Corporation

- Fresenius Medical Care

- LivaNova PLC

- Terumo Corporation

- Stryker Corporation

- Zimmer Biomet

- B. Braun Melsungen AG

- SARSTEDT AG & Co. KG

- Asahi Kasei Medical Co., Ltd.

- Cytosorbents Corporation

- Global Blood Recovery LLC

- Nikkiso Co., Ltd.

- Atrium Medical Corporation

- Other Key Players

Recent Developments

- August 2024: Medtronic Launches Portable Blood Recovery Machine

- Medtronic introduced a new portable blood recovery machine aimed at emergency and ambulatory care settings. This device is designed for rapid deployment in situations where immediate blood recovery is crucial, such as in trauma care or military field operations.

- July 2024: Haemonetics Enhances Cell Saver Machines with Advanced Software

- Haemonetics Corporation rolled out a significant software upgrade for its widely cell cell-saver machines. The update focuses on increasing automation, improving data management, and enhancing the overall user experience.

- June 2024: Terumo Corporation Introduces Compact Intraoperative Blood Salvage Device

- Terumo Corporation expanded its product portfolio by launching a new compact intraoperative blood salvage device. This device is designed to be highly efficient while maintaining ease of use in surgical settings. Its compact design makes it particularly suitable for smaller operating rooms or mobile surgical units.

- May 2024: Fresenius SE & Co. KGaA Acquires Controlling Stake in Blood Recovery Manufacturer

- Fresenius SE & Co. KGaA announced the acquisition of a controlling stake in a prominent blood recovery machine manufacturer. This strategic move is part of Fresenius’ broader plan to expand its portfolio in the blood management and critical care markets.

- April 2024: LivaNova PLC Launches Next-Generation Blood Recovery System

- LivaNova PLC introduced a next-generation blood recovery system that features a redesigned user interface and improved operational efficiency. The new system includes advanced filtration technology, which enhances the quality of recovered blood, making it safer for reinfusion.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 2,546.5 Mn |

| Forecast Value (2033) |

USD 4,277.4 Mn |

| CAGR (2024-2033) |

5.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 839.5 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (3000N Type Blood Recovery Machine, 3000P Type Blood Recovery Machine, 3000H Type Blood Recovery Machine, and 5000H Type Blood Recovery Machine), By Device Type (Cell Saver, and Blood Recovery Unit), By Technology (Gravity Based Blood Recovery, Centrifugal Blood Recovery, Ultrafiltration-Based Blood Recovery, Suction-Based Blood Recovery Systems, and Aspiration-Based Blood Recovery Systems), By Number of Channels (Single Channel Systems, Dual Channel Systems, and Quad Channel Systems), By Application (Cardiac Surgery, Orthopedic Surgery, Obstetrics and Gynecology, Neurological Surgery, Oncological Surgery, Trauma Surgery, and Other Applications), By End User (Hospitals, Ambulatory Surgery Centers, Clinics, and Blood Banks) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Medtronic, Haemonetics Corporation, Fresenius Medical Care, LivaNova PLC, Terumo Corporation, Stryker Corporation, Zimmer Biomet, B. Braun Melsungen AG, SARSTEDT AG & Co. KG, Asahi Kasei Medical Co. Ltd., Cytosorbents Corporation, Global Blood Recovery LLC, Nikkiso Co. Ltd., Atrium Medical Corporation, and Other Key Players/td> |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Blood Recovery Machine Market size is estimated to have a value of USD 2,546.5 million in 2024 and is expected to reach USD 4,277.4 million by the end of 2033.

The US Blood Recovery Machine Market is projected to be valued at USD 839.5 million in 2024. It is expected to witness subsequent growth in the upcoming period, holding USD 1,364.3 million in 2033 at a CAGR of 5.5%.

North America is expected to have the largest market share in the Global Blood Recovery Machine Market, with about 39.2% in 2024.

Some of the major key players in the Global Blood Recovery Machine Market are Medtronic, Haemonetics Corporation, Fresenius Medical Care, and many others.

The market is growing at a CAGR of 5.9 percent over the forecasted period.